Request Demo

Last update 08 May 2025

Encephalitis, St. Louis

Last update 08 May 2025

Basic Info

Synonyms ENCEPHALITIS C, ENCEPHALITIS, SAINT LOUIS, Encephalitis, Saint Louis + [42] |

Introduction A viral encephalitis caused by the St. Louis encephalitis virus (ENCEPHALITIS VIRUS, ST. LOUIS), a FLAVIVIRUS. It is transmitted to humans and other vertebrates primarily by mosquitoes of the genus CULEX. The primary animal vectors are wild birds and the disorder is endemic to the midwestern and southeastern United States. Infections may be limited to an influenza-like illness or present as an ASEPTIC MENINGITIS or ENCEPHALITIS. Clinical manifestations of the encephalitic presentation may include SEIZURES, lethargy, MYOCLONUS, focal neurologic signs, COMA, and DEATH. (From Adams et al., Principles of Neurology, 6th ed, p750) |

Related

2

Drugs associated with Encephalitis, St. LouisTarget- |

Mechanism- |

Active Org.- |

Originator Org. |

Active Indication- |

Inactive Indication |

Drug Highest PhasePending |

First Approval Ctry. / Loc.- |

First Approval Date20 Jan 1800 |

Target- |

Mechanism- |

Active Org.- |

Originator Org. |

Active Indication- |

Inactive Indication |

Drug Highest PhasePending |

First Approval Ctry. / Loc.- |

First Approval Date20 Jan 1800 |

2

Clinical Trials associated with Encephalitis, St. LouisJPRN-UMIN000044234

Effect and adverse effect of direct acting antivirals - Effect and adverse effect of direct acting antivirals

Start Date31 Dec 2017 |

Sponsor / Collaborator- |

JPRN-UMIN000017988

Efficacy and safety of peg-IFN+RBV combined therapy in failure of direct antiviral agents therapy for chronic hepatitis C and liver cirrhosis C - Efficacy and safety of peg-IFN+RBV combined therapy in failure of direct antiviral agents therapy for chronic hepatitis C and liver cirrhosis C

Start Date18 Jun 2015 |

Sponsor / Collaborator- |

100 Clinical Results associated with Encephalitis, St. Louis

Login to view more data

100 Translational Medicine associated with Encephalitis, St. Louis

Login to view more data

0 Patents (Medical) associated with Encephalitis, St. Louis

Login to view more data

627

Literatures (Medical) associated with Encephalitis, St. Louis17 Mar 2025·Journal of Medical Entomology

First record of Culex pipiens (Diptera: Culicidae) in Alberta: expanding distributions and ecotype patterns in a western Canadian province

Article

Author: Mohanaraj, Shahaanaa ; Soghigian, John ; Shaw, Hailey ; Hogaboam, Brittany ; Morinaga, Gen ; Pan, Tiffany ; Seal, Michaela ; Coker, Alexandra ; Jenkins, Michael

10 Feb 2025·The Journal of Infectious Diseases

Arthropod-Borne and Rodent-Borne Infections in Peru From 1990 to 2022

Article

Author: Silva, Maria E ; Chincha, Omayra ; Suarez, Victor ; Russell, Kevin L ; Naquira, Cesar ; Tanchiva, Moises ; Purisaca, Edinson ; Rios, Liliana ; Watts, Douglas M ; Mafaldo, Xiomara ; Campos, Karen ; Rios, Zonia ; Graham, William D ; Saldarriaga, Tatiana ; Herrera, Blgo Victor ; Rengifo, Ana ; Cruz, Cristhopher D ; Astete, Helvio ; Long, Kanya C ; Villanueva, Miguel ; Quintana, Fernando ; Jenkins, Sarah A ; Navarro, Lucy ; Popuche, Dina ; Flores, Guadalupe ; Valderrama, Yadira ; Rossi, Cindi A ; Carrion, Rebeca ; Sihuincha, Moises ; Tamani, Zenith ; Valdivia, Mariela ; Montes, Nadia ; Guevara, Carolina ; Weaver, Scott C ; Aguilar, Yojani ; Travassos da Rosa, Amelia P A ; Grogl, Max ; Gomez, Jorge ; Minaya, Percy ; Sotero, Rosana ; Garcia, Josefina ; Palacios, Ana M ; Custodio, Julio ; Blair, Patrick J ; Vilcaromero, Stalin ; Galvan, Patricia ; Blazes, David L ; Halsey, Eric S ; Aguilar, Patricia V ; Graf, Paul C F ; Jordan, Dr ; Casca, Gisell ; Centeno, Ruth ; Evangelista, Julio ; Carrion, Gladys ; Holguin, Carlos ; Guzman, Hilda ; Mozombite, Johnni ; Reategui, Zoila ; Williams, Maya ; Razuri, Hugo ; Leguia, Mariana ; Garcia, M Paquita ; Castillo Oré, Roger M ; Ocmin, Geraldine ; Ricopa, Sadith ; Kochel, Tadeusz J ; Negrete, Monica ; Rocha, Claudio ; Fernandez, Regina ; Sarmiento, Favio ; Flores, Junnelhy ; Chachi, Zolania ; Pezo, Zenith ; Beingolea, Luis ; Sun, Peifang ; Muñoz, Sandra ; Hontz, Robert D ; Cano, Iliana ; Curico, Leny ; Bausch, Daniel G ; Ramirez, Miguel ; Gutierrez, Noelia ; Tuesta, Sarita ; Ríos, Jane ; Fernandez, Blgo Connie ; Juarez, Diana ; Cabezas, Cesar ; Bazan, Isabel ; Juárez, Edith ; Albujar, Christian ; Tesh, Robert B ; Kocher, Claudine ; Cedano, Luz ; Macedo, Silvia ; Ramirez, Gladys ; Mores, Christopher N ; Chavez, Ana ; Castillo, Elizabeth ; Bautista, Cristian ; Callahan, Johnny ; Pozo, Blgo Edward ; Beltran, Giovana ; Shope, Robert E ; Villaran, Manuel V ; Tejada, Catherine ; Duffoó, Mariangela ; Montes, Augusto ; Marín, Nora ; Ampuero, Julia S ; Chávez, Clara ; Calampa, Carlos ; Montgomery, Joel M ; Cruz, Eva ; Scott, Thomas ; Ramal, Cesar ; Tamani, Rosa ; Block, Karla ; Palermo, Pedro M ; Morrison, Amy C ; Suarez, Luis ; Talledo, Gloria ; Bao, Juan Perez ; Troncos, Gilda ; Pizango, Melita ; Ocaña, Víctor ; Forshey, Brett M ; Zavaleta, Carol ; Rubio, Rubiela ; Cotrina, Karen ; Quispe, Fernando ; Cayetano, Claudia ; Laguna-Torres, V Alberto ; Chuquipiondo, Karina ; Hernandez, Tiffany ; Corahua, Flor ; Chuquirachi, Francis ; Zamora, Jennifher ; Felices, Vidal ; Siles, Crystyan ; Jhonston, Erik ; Mendocilla, Claudia ; Ucañan, Luis E ; Ramos, Julio ; Angulo, Leslye ; Sanchez, Cesar ; Huaman, Alfredo ; Alva-Davalos, Victor ; Valerio, Michel ; Malca, Dante ; Godoy, Nelly ; Wong, Juan F ; Alava, Wieslava ; Sulca, Juan ; Campbell, Wesley R ; Calampa, Nadya ; Cifuentes, Milagros ; Del Rio, Nadia Rocio ; Espinoza, Angelica ; Cabada, Miguel ; Inoñan, Mr Rafael ; Zamalloa, Hernan ; Rivera, Cecilia ; Gotuzzo, Eduardo ; Reátegui, Iris ; Ruiz, Ysabel ; Gribenow, Walter ; Atencio, Teodora ; Espejo, Victoria ; Schilling, Megan ; Garcia, Elsa ; Gonzales, Rina ; Olson, James G ; Caceda, Roxana E ; Rosas, Alicia

13 Jan 2025·Journal of Medical Entomology

Evaluation of the In2care Mosquito Station against Culex quinquefasciatus mosquitoes (Diptera: Culicidae) under semifield conditions

Article

Author: Whitehead, Shelley A ; Schluep, Sierra M ; Romero-Weaver, Ana L ; Ramirez, Daviela ; Kendziorski, Natalie L ; Zimler, Rebecca A ; Bellamy, Shawna K ; Buckner, Eva A

4

News (Medical) associated with Encephalitis, St. Louis06 Sep 2022

BEIJING--(BUSINESS WIRE)-- InnoCare Pharma (HKEX: 09969), a leading biopharmaceutical company for the treatment of cancer and autoimmune diseases, announced today that BTK inhibitor orelabrutinib has been granted priority review for the treatment of relapsed or refractory Marginal Zone Lymphoma (R/R MZL) by the Center for Drug Evaluation (CDE) of the China National Medical Products Administration (NMPA), which accepted the supplemental New Drug Application (sNDA) of orelabrutinib for the treatment of R/R MZL recently.

Dr. Jasmine Cui, Co-founder, Chairwoman and CEO of InnoCare said: "We are so inspired by this excited news. This is the third indication of orelabrutinib granted priority review. There are unmet medical needs for patients with R/R MZL. We hope orelabrutinib can bring better treatment options to benefit patients with R/R MZL.”

The sNDA of Orelabrutinib for the treatment of R/R MZL was accepted by the CDE on August 12. This NDA was submitted based on data from an open multi-center Phase II clinical study to investigate the safety and efficacy of orelabrutinib for the treatment of R/R MZL.

Current treatment options for R/R MZL are quite limited. So far, no BTK inhibitor has ever been approved for treating patients with R/R MZL in China, and hope that orelabrutinib can fill the gap in this therapeutic area.

About Orelabrutinib

Orelabrutinib is a highly selective BTK inhibitor developed by InnoCare for the treatment of cancers and autoimmune diseases.

On Dec. 25 2020, orelabrutinib received conditional approval from the China National Medical Products Administration (NMPA) in two indications: the treatment of patients with relapsed/refractory chronic lymphocytic leukemia (CLL) /small lymphocytic lymphoma (SLL), and the treatment of patients with relapsed/refractory mantle cell lymphoma (MCL). At the end of 2021, orelabrutinib was included into National Reimbursement Drug list to benefit more lymphoma patients.

In addition to the approved indications, multi-center, multi-indication clinical trials are underway in the US and China with orelabrutinib as monotherapy or in combination therapies.

Orelabrutinib was granted as Breakthrough Therapy Designation for the treatment of r/r MCL by U.S. Food and Drug Administration (FDA).

In addition, orelabrutinib is also being evaluated in global phase II studies for the treatment of Multiple Sclerosis (MS), and clinical trials for the treatment of SLE, Primary Immune Thrombocytopenia (ITP) and Neuromyelitis Optica Spectrum Disorder (NMOSD) in China.

About InnoCare

InnoCare is a commercial stage biopharmaceutical company committed to discovering, developing, and commercializing first-in-class and/or best-in-class drugs for the treatment of cancer and autoimmune diseases. We strategically focus on liquid cancer, solid tumors, and autoimmune diseases with high unmet medical needs in China and worldwide. InnoCare has branches in Beijing, Nanjing, Shanghai, Guangzhou, Hong Kong and the United States.

Priority ReviewBreakthrough TherapyFirst in Class

13 Jul 2022

NEW YORK, July 12, 2022 /PRNewswire/ -- People with systemic lupus erythematosus, or SLE, who received a "booster" dose of SARS-CoV-2 vaccine after full vaccination are roughly half as likely to have a subsequent "breakthrough" COVID-19 infection, a new study shows.

The finding, researchers say, should offer reassurance to the more than 200,000 Americans who have SLE, a condition in which the body's immune system mistakenly attacks its own healthy tissues, especially joints and skin. Immune-suppressing drugs, such as steroids, needed to control symptoms of the disease, place them at increased risk of infections, including SARS-CoV-2.

Led by researchers at NYU Grossman School of Medicine, the new study tracked the health of 163 fully vaccinated men and women being treated for SLE at its affiliated hospitals in New York City. The researchers' goal was to see who became infected with the virus over at least six months, given that more than half were taking at least one immune-suppressing medication for their SLE. All had received some combination of the vaccines manufactured by Pfizer, Moderna, or Johnson & Johnson prior to June 2021, but only 125 had received a third or booster dose of vaccine.

Publishing in the journal The Lancet Rheumatology online July 12, the study showed that at the end of the monitoring period (April 24, 2022), 44 vaccinated SLE patients had had breakthrough infections, with two needing hospitalization (but both surviving their infection).

Among those with breakthrough infections, 28 of 125, or 22%, had received a booster, while 16 of 38, or 42%, had not. Notably, according to investigators, the majority of breakthrough infections (42 of 44) occurred after Dec. 2, 2021, when the city detected its first case of the highly contagious omicron variant.

Another key study finding was among 57 of the study participants who agreed to have their blood antibody levels checked, once after full vaccination and again after receiving their booster.

Researchers found that even those on immunosuppression who had not responded to the initial round of vaccination had an immediate rise in antibody levels after the administration of a booster shot. Previous research had shown that these antibody levels were lower among many initially vaccinated patients with rheumatic diseases, including SLE, who were taking immune-suppressing drugs, sparking fears of waning immunity to COVID-19 over time.

However, study results showed those with higher levels of antibodies, needed to block the SARS-Cov-2 "spike" protein and prevent the virus from infecting human cells, were no more protected from breakthrough infection than those with lower spike-protein antibody levels.

Still, researchers say their previous work showed elevated antibody levels in fully vaccinated lupus patients strengthened key measures of long-term immunity, which may help explain the lack of severe disease in those with breakthrough infections.

"Our study results offer people living with systemic lupus erythematosus clinical confirmation that vaccines are highly effective at guarding against severe COVID-19, despite their increased risk of catching the disease," says study co-lead investigator and rheumatologist Amit Saxena, MD, MS.

"COVID-19 vaccine boosters, or third shots, offered an added, doubled layer of protection from breakthrough infection," says Saxena, an assistant professor in the Department of Medicine at NYU Langone Health. "Even in cases of SARS-CoV-2 infection, cases were overwhelmingly mild among SLE patients who were fully vaccinated."

"Our research also shows that most people with systemic lupus erythematosus who are fully vaccinated and boosted mounted good responses despite being on immune suppression," says study co-senior investigator and rheumatologist Peter Izmirly, MD. Izmirly is an associate professor in the Department of Medicine at NYU Langone Health.

However, researchers caution that further monitoring of patients is needed to determine if there is any antibody "cutoff" level below which SLE patients become more vulnerable to SARS-CoV-2 infection.

During the initial wave of the pandemic in spring 2020, NYU Langone hospitalization rates for its SLE patients were more than double those of its patients without the condition, the researchers note, although death rates were the same.

Funding support for the study was provided by grants from the National Institutes of Health (P50AR07059) and Bloomberg Philanthropies COVID-19 Response.

Besides Saxena and Izmirly, other NYU Langone researchers involved in this study are co-lead investigator Alexis Engel, BS; study co-investigators: Brittany Banbury, MD; Ghadeer Hasan, MD; Nicola Fraser, BS; Devyn Zaminski, BS; Mala Masson, BA; Rebecca Haberman, MD; Jose Scher, MD; Gary Ho, MD; Jammie Law, MD; Paula Rackoff, MD; Chung-E Tseng, MD; H. Michael Belmont, MD; Robert Clancy, PhD; and co-senior investigator Jill Buyon, MD.

Saxena has received consulting fees from AstraZeneca, GlaxoSmithKline, Bristol-Myers Squibb, Eli Lilly, and Kezar Life Sciences, manufacturers of drugs used to treat SLE. Izmirly has served on an advisory board sponsored by GlaxoSmithKline and acted as a consultant to Momenta/Janssen. Haberman and Scher have acted as consultants to Janssen, while Scher has also consulted for and/or received research funding from Novartis, Pfizer, Sanofi, UCB, and Abbvie. Clancy and Buyon have acted as consultants to Momenta/Janssen, while Buyon has also consulted for and/or served on data safety monitoring boards for Ventus, Equillium, and GlaxoSmithKline. These arrangements are being managed in accordance with the policies and practices of NYU Langone.

VaccineAntibody

29 Jun 2022

On Monday, Kezar Life Sciences' stock rose 92% after the company announced positive topline results from its Phase II clinical trial investigating the use of zetomipzomib for the treatment of Lupus Nephritis (LN).

Kidney disease is common in people with systemic lupus erythematosus (SLE), an autoimmune disease that can impact any organ system in the body. According to the Lupus Foundation of America, up to 60% of SLE patients will develop LN, one of the most serious complications of the disease in which the immune system attacks the kidneys, causing inflammation that can dysregulate kidney functioning and lead to kidney failure.

Kezar's Phase study included 17 patients who reached the end of the 24-week treatment period in which they received a once-weekly dose of zetomipzomib delivered subcutaneously while being given stable background therapy. At the end of the treatment period, the data readout showed that 11 of the 17 patients achieved an overall response rate, measured as a 50% or greater reduction in urine protein to creatinine ratio, an indicator of kidney disease. Six of the patients achieved a complete response rate of 0.5 urine protein to creatinine ratio, a sign that kidney functioning was climbing back to a normal clinical level.

“The MISSION Phase II topline results show a clinically meaningful overall renal response to zetomipzomib after 6 months, without high-dose induction therapy. Patients in the trial also experienced reductions in extra-renal manifestations of lupus. Zetomipzomib appears to be immunomodulatory, well-tolerated and steroid-sparing – all important attributes for patients with autoimmune disease who are often young and active,” Noreen R. Henig, M.D., chief medical officer at Kezar, said in a statement. “Based on the strength of these results, we plan to continue developing zetomipzomib for patients with lupus nephritis, as well as evaluate development opportunities for systemic lupus erythematosus.”

As part of exploratory analyses, Kezar also reported that patients showed a mean reduction in key SLE disease activity scores and normalization in biomarkers consistent with a reduction in SLE disease activity. Adverse events recorded during the trial were mild-to-moderate and the most common treatment-emergent adverse events included fever, injection site reaction, headache or nausea.

Zetomipzomib is a selective immunoproteasome inhibitor. Preclinical research has shown that the drug’s mechanism is effective at inducing anti-inflammatory responses in animal models without inducing immunosuppression. Immunoproteasomes regulate the normal function of the immune system, and inhibiting them can result in the inhibition of inflammatory cytokine production and immune effector cell activity, pathways that are involved in the autoimmunity response.

There remains a lack of therapies designed specifically to target LN. Currently, the U.S. Food and Drug Administration has approved Benlysta for the treatment of SLE with kidney involvement and Lupkynis specifically for the treatment of LN. Other companies are working to raise this number, including Vera Therapeutics, which is currently developing atacicept for the treatment of LN, with a Phase III trial planned for later this year.

Financing

Analysis

Perform a panoramic analysis of this field.

login

or

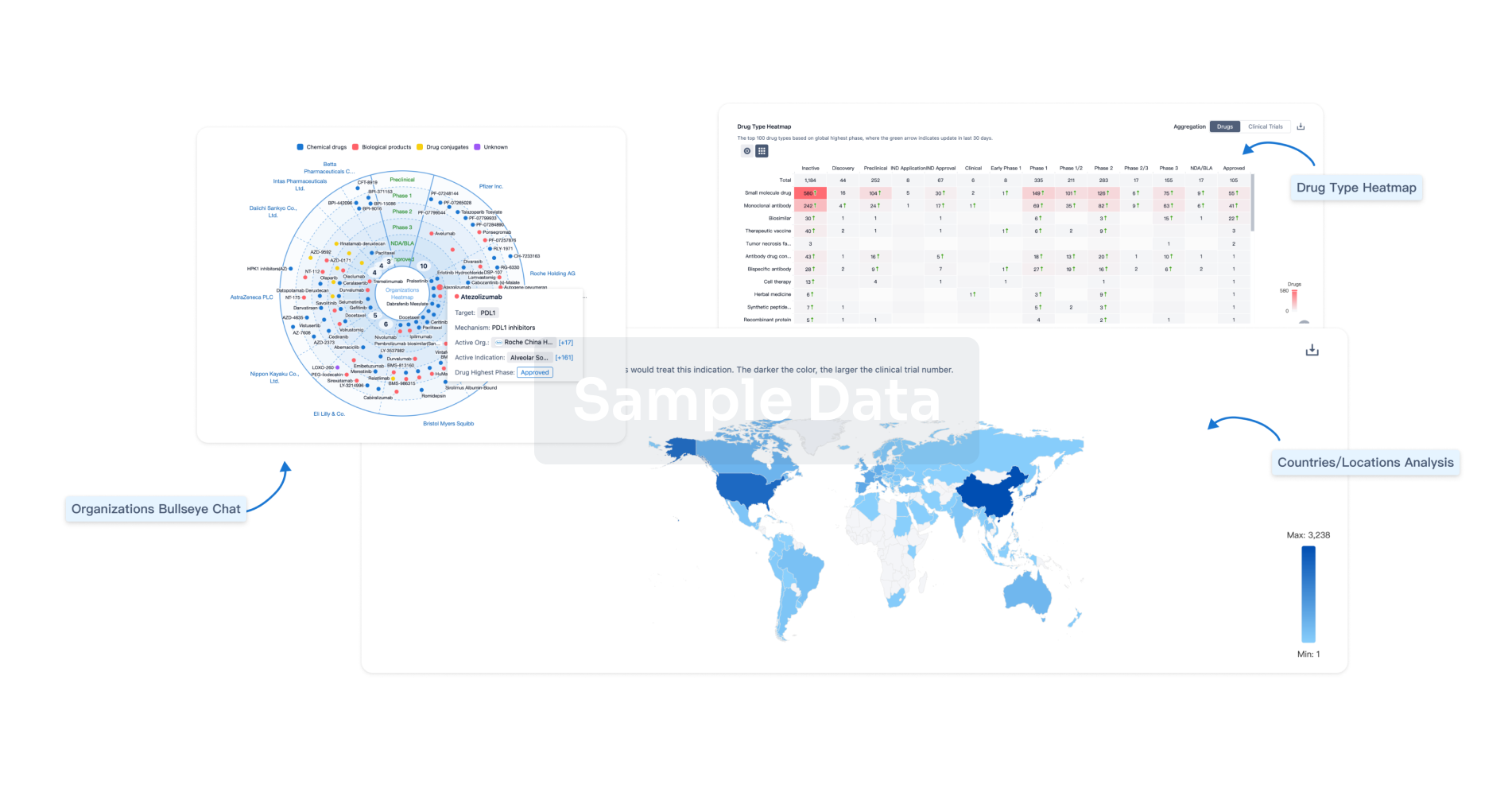

AI Agents Built for Biopharma Breakthroughs

Accelerate discovery. Empower decisions. Transform outcomes.

Get started for free today!

Accelerate Strategic R&D decision making with Synapse, PatSnap’s AI-powered Connected Innovation Intelligence Platform Built for Life Sciences Professionals.

Start your data trial now!

Synapse data is also accessible to external entities via APIs or data packages. Empower better decisions with the latest in pharmaceutical intelligence.

Bio

Bio Sequences Search & Analysis

Sign up for free

Chemical

Chemical Structures Search & Analysis

Sign up for free