Request Demo

Last update 02 Mar 2026

Denosumab-bnht

Last update 02 Mar 2026

Overview

Basic Info

Drug Type Biosimilar, Monoclonal antibody |

Synonyms Denosumab Biosimilar (Fresenius Kabi Pharmaceuticals Holding LLC), 地舒单抗生物类似药(Fresenius Kabi Pharmaceuticals Holding LLC), FKS518 + [2] |

Target |

Action inhibitors |

Mechanism RANKL inhibitors(Tumor necrosis factor ligand superfamily member 11 inhibitors) |

Therapeutic Areas |

Active Indication |

Inactive Indication- |

Originator Organization |

Active Organization |

Inactive Organization |

License Organization- |

Drug Highest PhaseApproved |

First Approval Date United States (25 Mar 2025), |

Regulation- |

Login to view timeline

Structure/Sequence

Sequence Code 94568L

The sequence is quoted from: *****

Sequence Code 143522H

The sequence is quoted from: *****

External Link

| KEGG | Wiki | ATC | Drug Bank |

|---|---|---|---|

| - | - | - |

R&D Status

10 top approved records. to view more data

Login

| Indication | Country/Location | Organization | Date |

|---|---|---|---|

| Osteoporotic Fractures | European Union | 18 Jul 2025 | |

| Osteoporotic Fractures | Iceland | 18 Jul 2025 | |

| Osteoporotic Fractures | Liechtenstein | 18 Jul 2025 | |

| Osteoporotic Fractures | Norway | 18 Jul 2025 | |

| Bone Cancer | European Union | 17 Jul 2025 | |

| Bone Cancer | Iceland | 17 Jul 2025 | |

| Bone Cancer | Liechtenstein | 17 Jul 2025 | |

| Bone Cancer | Norway | 17 Jul 2025 | |

| Bone Diseases | United States | 25 Mar 2025 | |

| Fractures, Bone | United States | 25 Mar 2025 | |

| Giant Cell Tumor of Bone | United States | 25 Mar 2025 | |

| Glucocorticoid-induced osteoporosis | United States | 25 Mar 2025 | |

| Humoral Hypercalcemia of Malignancy | United States | 25 Mar 2025 | |

| Multiple Myeloma | United States | 25 Mar 2025 | |

| Osteoporosis | United States | 25 Mar 2025 | |

| Osteoporosis, Postmenopausal | United States | 25 Mar 2025 | |

| Solid tumor | United States | 25 Mar 2025 |

Login to view more data

Clinical Result

Clinical Result

Indication

Phase

Evaluation

View All Results

Literature Manual | Not Applicable | - | 213 | prvkqfhwja(wjyekkmvsq) = cidoffseja stwyheeibq (ifwchwlznp ) View more | Positive | 29 May 2024 | |

prvkqfhwja(wjyekkmvsq) = lsdyvjnmtw stwyheeibq (ifwchwlznp ) View more |

Login to view more data

Translational Medicine

Boost your research with our translational medicine data.

login

or

Deal

Boost your decision using our deal data.

login

or

Core Patent

Boost your research with our Core Patent data.

login

or

Clinical Trial

Identify the latest clinical trials across global registries.

login

or

Approval

Accelerate your research with the latest regulatory approval information.

login

or

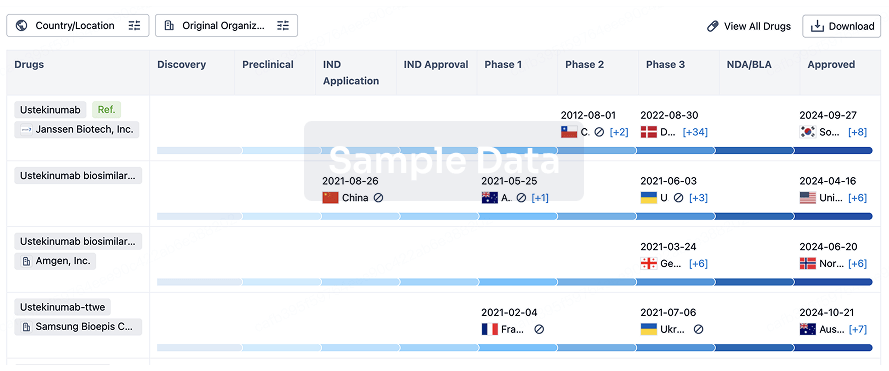

Biosimilar

Competitive landscape of biosimilars in different countries/locations. Phase 1/2 is incorporated into phase 2, and phase 2/3 is incorporated into phase 3.

login

or

Regulation

Understand key drug designations in just a few clicks with Synapse.

login

or

AI Agents Built for Biopharma Breakthroughs

Accelerate discovery. Empower decisions. Transform outcomes.

Get started for free today!

Accelerate Strategic R&D decision making with Synapse, PatSnap’s AI-powered Connected Innovation Intelligence Platform Built for Life Sciences Professionals.

Start your data trial now!

Synapse data is also accessible to external entities via APIs or data packages. Empower better decisions with the latest in pharmaceutical intelligence.

Bio

Bio Sequences Search & Analysis

Sign up for free

Chemical

Chemical Structures Search & Analysis

Sign up for free