Sanofi is likely to increase its M&A this year since it has more cash in its pockets, as the French pharma also monitors China as a possible source of new drug innovation, CFO François Roger said during a media call Thursday morning.

“We have always been very active in the M&A space. We may be a bit more in the near future due to the fact that we have a strong balance sheet,” Roger said.

In a separate media call, CEO Paul Hudson said Sanofi would likely target preclinical and Phase 1 assets because it already has a robust late-stage pipeline. Roger added Sanofi would prefer to focus on assets worth between €2 billion and €5 billion.

It’s been more than a year since Hudson announced Sanofi’s

strategic shift

to become a pure-play biopharma company. Now, Roger said that it is going to receive a significant amount of cash following its

plans to relinquish

the controlling stake in its consumer health unit Opella. This deal could close in the second quarter at the earliest.

That transaction is estimated to be worth in the high single-digits in billions of euros, which means Sanofi can move “relatively quickly” on potential new deals, Roger said. Further, Sanofi’s debt position is “relatively low,” which would allow it to make such deals, he said.

Because Sanofi is established in autoimmune disease, it could add more dermatology, respiratory, gastroenterology or rheumatology candidates into its pipeline, Hudson said: “That allows us to bring breakthrough science at a low marginal cost once it’s launched, because we have the people in place to do the job properly, and we have an incredible reputation.”

The rare disease space is also attractive. In retrospect, Hudson said he would’ve liked to add more such assets to its portfolio in the past few years since the company has the capability, and this would offer the unit more breakthroughs on top of what’s being done internally. Sanofi is also interested in vaccines and neurology, he added.

Sanofi will remain open-minded about other disease areas but it won’t be as efficient. “It takes a lot to push yourself in an area where you have no expertise,” Hudson said.

Nonetheless, Roger said the company “doesn’t feel any pressure to go crazy on M&A” and would be “very disciplined.” He said it would “reward its shareholders first” with plans announced Thursday for a

share buyback program

this year worth €5 billion.

As for China, Sanofi views the country as not only a source of revenue (it is the company’s second largest market), but also as a key source of innovation. Roger pointed out that more than 20% of new molecular entities come from China, so “this is not something that we can neglect.”

One key decision Sanofi will have to make if it is to invest in China is whether such deals would be focused on the Chinese market alone or have utility outside the country as well, Roger said. In December, the company

announced

it is spending about €1 billion for a new insulin facility in Beijing for the Chinese market and neighboring countries.

Elsewhere, Sanofi said that Beyfortus has reached blockbuster status, with €1.7 billion in sales in its first year in the market. The infant RSV antibody, which it co-developed with AstraZeneca, had

steady growth

in the past quarters after having to

address supply issues

early last year.

While there is more growth to be had in 2025 by entering new geographies and increasing uptake rates, Roger said the rise in Beyfortus revenue this year might “not be to the same extent” as last year. Merck’s own antibody challenger in RSV could enter the market in 2025. Roger noted that Sanofi “welcomes competition,” but also pointed to

the key differences

between the two assets.

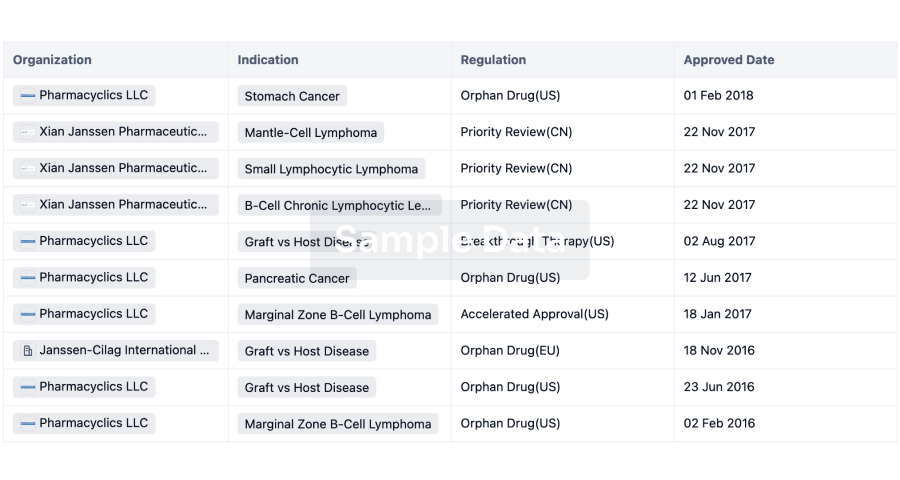

The drugmaker also said Thursday that it axed four programs, including a Phase 3 study of its BTK inhibitor tolebrutinib in relapsing multiple sclerosis. Sanofi obtained the drug in 2020 as part of its

$3.7 billion

acquisition of Principia Biopharma and it’s still being advanced for

other forms of MS

.

Other assets on the chopping block included a Phase 1 candidate called pegenzileukin that targets IL-2 for cancer and a T cell engager dubbed SAR444200 in early development for solid tumors. Sanofi also discontinued SAR445611, a monoclonal antibody that was in Phase 1 development for inflammation.

Additional reporting by Ayisha Sharma.