Request Demo

Last update 27 Feb 2026

Vutrisiran Sodium

Last update 27 Feb 2026

Overview

Basic Info

Drug Type siRNA |

Synonyms Vutrisiran, AD-65492, ALN-65492 + [4] |

Target |

Action inhibitors |

Mechanism TTR inhibitors(Transthyretin inhibitors) |

Therapeutic Areas |

Inactive Indication |

Originator Organization |

Active Organization |

Inactive Organization- |

License Organization |

Drug Highest PhaseApproved |

First Approval Date United States (13 Jun 2022), |

RegulationFast Track (United States), Orphan Drug (United States), Orphan Drug (European Union), Orphan Drug (Japan), Orphan Drug (South Korea), Orphan Drug (Australia), Orphan Drug (United Kingdom) |

Login to view timeline

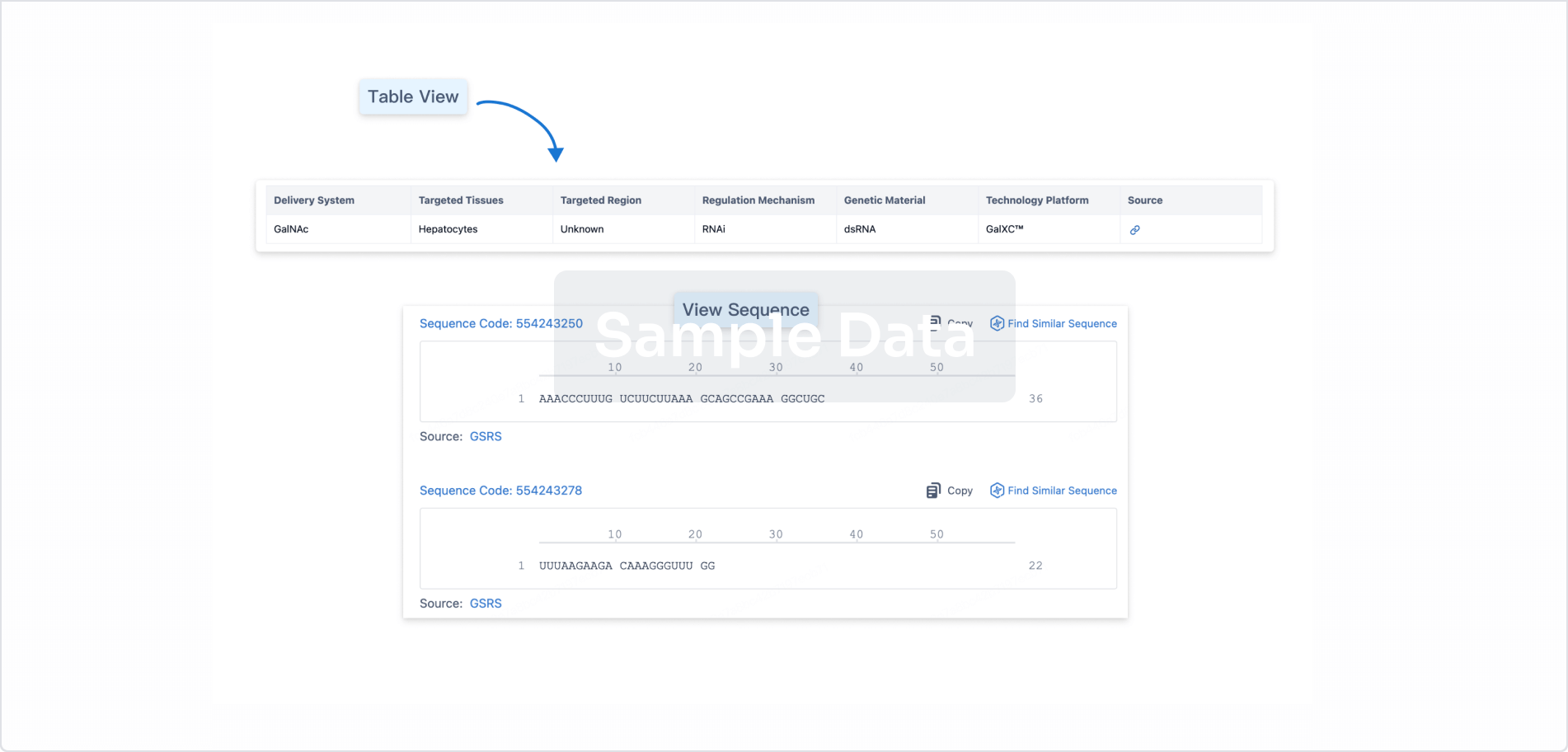

Structure/Sequence

Boost your research with our RNA technology data.

login

or

Sequence Code 30032027

Source: *****

Sequence Code 30033233

Source: *****

Related

4

Clinical Trials associated with Vutrisiran SodiumNCT06679946

An Open-Label Extension Study to Assess the Safety and Efficacy of Vutrisiran in Patients With Transthyretin Amyloidosis With Cardiomyopathy (ATTR Amyloidosis With Cardiomyopathy)

The purpose of this study is to obtain safety, efficacy, and pharmacodynamic data on the use of vutrisiran in patients with ATTR amyloidosis with cardiomyopathy who continued on extended use of vutrisiran, or switched from patisiran.

Start Date03 Dec 2024 |

Sponsor / Collaborator |

NCT04153149

HELIOS-B: A Phase 3, Randomized, Double-blind, Placebo-controlled, Multicenter Study to Evaluate the Efficacy and Safety of Vutrisiran in Patients With Transthyretin Amyloidosis With Cardiomyopathy (ATTR Amyloidosis With Cardiomyopathy)

This study will evaluate the efficacy and safety of vutrisiran 25 mg administered subcutaneously (SC) once every 3 months (q3M) compared to placebo in participants with ATTR amyloidosis with cardiomyopathy.

Start Date26 Nov 2019 |

Sponsor / Collaborator |

NCT03759379

HELIOS-A: A Phase 3 Global, Randomized, Open-label Study to Evaluate the Efficacy and Safety of ALN-TTRSC02 in Patients With Hereditary Transthyretin Amyloidosis (hATTR Amyloidosis)

The purpose of this study is to evaluate the efficacy and safety of vutrisiran (ALN-TTRSC02) in participants with hereditary transthyretin amyloidosis (hATTR amyloidosis). Participants will receive vutrisiran subcutaneous (SC) injection once every 3 months (q3M) or the reference comparator patisiran intravenous (IV) injection once every 3 weeks (q3w) during the 18 month Treatment Period. This study will use the placebo arm of the APOLLO study (NCT01960348) as an external comparator for the primary and most other efficacy endpoints during the 18 Month Treatment Period. Following the 18 Month Treatment Period, all participants will be randomized to receive vutrisiran 50 mg SC injection once every 6 months (q6M) or vutrisiran 25 mg q3M in the Randomized Treatment Extension (RTE) Period. Upon implementation of Amendment 6, participants receiving vutrisiran SC 50 mg q6M will transition to vutrisiran SC 25 mg q3M at their next scheduled dosing.

Start Date14 Feb 2019 |

Sponsor / Collaborator |

100 Clinical Results associated with Vutrisiran Sodium

Login to view more data

100 Translational Medicine associated with Vutrisiran Sodium

Login to view more data

100 Patents (Medical) associated with Vutrisiran Sodium

Login to view more data

77

Literatures (Medical) associated with Vutrisiran Sodium01 Apr 2026·CURRENT PROBLEMS IN CARDIOLOGY

Impact of disease-modifying therapies on imaging parameters in cardiac amyloidosis: A systematic review and meta-analysis

Review

Author: Zervas, Georgios ; Briasoulis, Alexandros ; Patras, Raphael ; Androulakis, Emmanuil ; Tepetes, Nikolaos ; Georgiopoulos, Georgios ; Kastritis, Efstathios ; Lama, Niki ; Kourek, Christos ; Stamatelopoulos, Kimon ; Theodorakakou, Foteini

Transthyretin-mediated (ATTR) and immunoglobulin light-chain (AL) cardiac amyloidosis causes progressive myocardial dysfunction and poor prognosis. Disease-specific therapies in ATTR and anti-clonal therapies in AL cardiac amyloidosis may modify disease, but treatment-induced changes in prognostic cardiac imaging markers remain incompletely defined. We systematically searched PubMed/MEDLINE, Scopus, CINAHL, Web of Science, and EMBASE for studies reporting treatment-associated changes in global longitudinal strain (GLS), left ventricular (LV) wall thickness, and extracellular volume (ECV) assessed by echocardiography or cardiac magnetic resonance. Random-effects meta-analyses pooled mean changes. Seventeen studies met inclusion criteria. In ATTR cardiac amyloidosis, therapy with silencers or RNA-depleting agents was associated with improved GLS (pooled mean difference [MD] -0.97 %, 95 % CI -1.27 to -0.68) and reduced LV wall thickness (MD -0.72 mm, 95 % CI -1.26 to -0.17) versus no therapy, while ECV showed no significant change (MD -1.93 %, 95 % CI -15.27 to 11.41). In AL amyloidosis, complete hematologic response was linked to greater improvement than non-response in GLS (MD -1.19 %, 95 % CI -2.20 to -0.17) and LV wall thickness (MD -0.87 mm, 95 % CI -1.31 to -0.43). NMA in ATTR cardiac amyloidosis showed that patisiran (MD -1.04 %, 95 % CI -1.56 to -0.52), tafamidis (-0.91 %, -1.40 to -0.41), and vutrisiran (-0.90 %, -1.75 to -0.05) improved GLS versus placebo, compared to acoramidis. Disease-directed therapy in ATTR and hematologic response in AL cardiac amyloidosis are associated with preservation or improvement of GLS and LV wall thickness, supporting their use as surrogate endpoints for treatment monitoring.

03 Feb 2026·CIRCULATION

Efficacy of Suppression of Serum Transthyretin With Patisiran and Vutrisiran in Variant ATTR Amyloidosis: An Observational Crossover Study

Letter

Author: Hawkins, Philip N. ; Venneri, Lucia ; Ioannou, Adam ; Lachmann, Helen J. ; Porcari, Aldostefano ; Gillmore, Julian D. ; Gilbertson, Janet A. ; Hutt, David F. ; Whelan, Carol J. ; Rowczenio, Dorota ; Fontana, Marianna ; Sheikh, Awais ; Rauf, Muhammad Umaid ; Wechalekar, Ashutosh D. ; Razvi, Yousuf ; Martinez-Naharro, Ana ; Mansell, Josephine

01 Feb 2026·European Journal of Internal Medicine

Precision medicine with pioneering RNAi therapeutics in ATTR amyloidosis: from bench to bedside

Review

Author: Porcari, Aldostefano ; Verona, Guglielmo ; Vergaro, Giuseppe ; Malinverni, Silvia

Transthyretin (ATTR) amyloidosis is a multisystem disease caused by misfolding and aggregation of the plasma protein transthyretin (TTR) into insoluble amyloid fibrils in various organs. In clinical practice, ATTRwt amyloidosis manifests as a predominant cardiomyopathy (ATTR-CM), while ATTRv amyloidosis is typically associated with polyneuropathy (ATTR-PN) as well as cardiomyopathy. Over the past decade, major advances in the understanding of ATTR pathophysiology have enabled the development of disease-modifying therapies, marking a paradigm shift toward precision medicine in this condition. Among these, RNA-targeted therapies have emerged as a cornerstone of treatment by directly suppressing hepatic production of TTR. This review provides an overview of the biological rationale, molecular mechanisms, and clinical translation of RNA-based therapeutics in ATTR amyloidosis, with a particular focus on RNA interference (RNAi) and antisense oligonucleotide (ASO) strategies. Key mechanistic differences between small interfering RNAs and ASOs are discussed, including intracellular pathways, pharmacokinetic properties, and delivery platforms such as lipid nanoparticles and GalNAc conjugation for hepatocyte-specific targeting. Major clinical trials evaluating first- and second-generation RNA-targeted agents-including patisiran, vutrisiran, inotersen, and eplontersen-are summarized, highlighting efficacy, safety profiles, dosing regimens, and relevance across different ATTR phenotypes. As RNA-based therapies continue to evolve, integration of molecular insights with clinical phenotyping and real-world evidence will be essential to fully realize the potential of precision medicine for patients with ATTR amyloidosis.

326

News (Medical) associated with Vutrisiran Sodium12 Feb 2026

Alnylam's shares are under pressure as Amvuttra's Q4 sales missed high expectations and the company offered a few caveats for 2026.

Alnylam Pharmaceuticals achieved profitability for the first time in its history in 2025.After 23 years of investing in R&D and launching new products, the company reported a net income by GAAP of $314 million for the full year of 2025, compared with a loss of $278 million in 2024.The RNA interference specialist expects to sustain profitability going forward, CEO Yvonne Greenstreet said on the company’s fourth-quarter earnings call Thursday.The shift to profitability was driven by the rapid growth of Alnylam’s transthyretin franchise, particularly Amvuttra for the treatment of transthyretin amyloid cardiomyopathy (ATTR-CM).However, Amvuttra’s Q4 sales of $827 million, which Alnylam preliminarily announced in January at the J.P. Morgan Healthcare Conference, came about 3% below analysts’ expectations, which had risen after two consecutive beats in the first two quarters of the drug’s ATTR-CM launch.Alnylam’s shares have dropped about 19% in the past month—including a 6% decline Thursday as of publication time—more than erasing the gains rallied since the company’s first ATTR-CM launch quarterly report in late July 2025.For 2026, Alnylam’s guidance on product revenues for its TTR franchise—between $4.4 billion and $4.7 billion—represents 83% growth compared with 2025 at the midpoint. But the company expects to see some nuanced turbulence in the TTR business, which includes both Amvuttra and Onpattro.Specifically, Alnylam expects a mid-single-digit net price decrease for Amvuttra in the U.S. this year. Meanwhile, the first quarter may prove particularly underwhelming, and for a variety of reasons, according to Alnylam CFO Jeff Poulton.There’s the typical impact of annual insurance reset at the beginning of the year, he said. Second, Alnylam expects “more modest quarter-over-quarter” TTR growth in Q1 2026 compared with the $111 million U.S. quarterly growth achieved in Q4 2025, thanks to “fewer product shipping weeks,” Poulton explained on the call.Outside of the U.S., international markets contributed $23 million in Q4 quarterly growth, but the company anticipates a roughly $25 million reduction this quarter thanks to price cuts in Germany. The price concession is important as it positions Alnylam “to compete effectively and participate in the substantially larger CM market in Germany,” Alnylam’s chief commercial officer, Tolga Tanguler, said on the call.For both markets, higher quarterly growth is expected for the remainder of the year, Poulton said.Early launch metrics have given Alnylam confidence in Amvuttra’s future growth. The drug is gaining first-line share in new patient starts, reaching 27% in the U.S. as of September, compared with 51% for Pfizer’s first-to-market Vyndamax (tafamidis).“Establishing Amvuttra as a first-line option remains our strategic priority, and we’re making meaningful progress,” Tanguler said.Over 90% of payers now provide first-line coverage with “the large majority” of patients able to initiate treatment without step-edits requirements, Tanguler said, citing 2026 payer policy discussions.Industry watchers are closely following the ATTR-CM space. Besides Alnylam and Pfizer, BridgeBio sells Attruby (acoramidis), whose strong performance has also contributed to increased optimism in ATTR-CM.However, questions about the growth potential of the ATTR-CM market remain, as analysts wonder just how many more patients the drugmakers can reach. Already, the growth of Amvuttra and Attruby is coming at the cost of Pfizer’s Vyndamx, which reported a 7% year-over-year U.S. sales decline to $910 million in Q4, compared with $948 million in Q3.Unlike in previous quarters, Alnylam management on Thursday’s call didn’t provide specific numbers on new patients added to Amvuttra’s brand.“We’re clearly seeing a strengthening physician and patient preference, and even more importantly, continued category growth with more patients entering the market,” Tanguler said. Meanwhile, the timing of Vyndamx's genericization remains a key focus for the field. News of Pfizer’s withdrawal of a tafamidis polymorph patent in the EU caused a 15% decline in BridgeBio’s stock price last week.Right now, Pfizer assumes that tafamidis will lose patent protection at the end of 2028, CEO Albert Bourla said on the company’s Q4 earnings call last week. He declined to offer further comments because “these are very sensitive topics.”

Financial Statement

12 Feb 2026

With quarterly earnings underway, BioPharma Dive is providing a snapshot of some companies results and how theyre being received by investors. Today, were offering insight into the latest numbers from Neurocrine Biosciences, Alnylam Pharmaceuticals and Ascendis Pharma. Neurocrine again disappoints some investorsShares of Neurocrine Biosciences fell by over 10% on Thursday, wiping more than $1 billion in value from the brain-focused biotechnology company.The drop followed a Wednesday afternoon earnings report in which Neurocrine said net product sales in the fourth quarter and 2025 overall totaled $798 million and $2.83 billion. Those figures are respectively 29% and 22% higher year-over-year. Ingrezza, a drug for movement issues associated with Huntington's disease, accounted for more than 80% of overall sales. The remainder mostly came from Crenessity, a treatment approved in 2024 for a rare, genetic condition that can cause life-threatening shortages of crucial hormones.Brian Abrahams, an analyst at RBC Capital Markets, suspects a combination of factors may be concerning some investors. One is Neurocrine's guidance. The company expects that, over the course of this year, net sales from Ingrezza will be in the range of $2.7 billion to $2.8 billion. That might not be as high as shareholders had hoped. Neurocrine executives also recently disclosed plans to spend another $150 million building out the sales teams for those two leading products a decision that could be seen as bad for near-term margins.Additionally, Abrahams noted how some are worried about Crenessitys growth prospects, specifically with regard to the number of new patients starting on the drug. Neurocrine says there are roughly 20,000 people in the U.S. with that rare condition, congenital adrenal hyperplasia, and, across last year, about 2,050 began taking Crenessity. Sales figures indicate the final three months of 2025 averaged fewer starts, at 431, than previous quarters.Even so, Abrahams and his team see the fears as overblown. Though we acknowledge investor consternation around margins and Crenessity launch dynamics could persist ... we believe todays downside reaction will prove to be a compelling buying opportunity, he wrote in a note to clients.Ingrezza looks poised for a major beat, he added, and Crenessity should be fine [as] we have always anticipated some continued slowdown in new patient starts.Overall, we see much growth left in both key franchises, wrote TD Cowen analyst Phil Nadeau in his own client note.Alnylam bitten by its successA similar situation played out with Alnylam Pharmaceuticals. The company, which specializes in so-called RNA interference drugs, gave a preliminary look at fourth-quarter and full-year earnings last month, then released its official report Thursday. It recorded nearly $3 billion across all of 2025 and almost $1 billion over those final three months, reflecting increases of 81% and 121% compared to the same periods the prior year.Despite that performance, Alnylam shares had slipped around 4% by the time trading closed Thursday afternoon.Though the company sells half a dozen drugs, nearly 80% of its product revenue comes from Amvuttra, a treatment for the nerve damage and heart failure associated with a rare disorder known as ATTR. Alnylam has said this disorder, which has a couple subtypes, affects north of a few hundred thousand people worldwide. For 2026, the company expects net product revenue to reach $4.9 billion to $5.3 billion, with Amvuttra and another ATTR medicine, Onpattro, responsible for up to $4.7 billion of that sum.To Paul Matteis, an analyst at Stifel, the main debate among investors is whether Amvuttra can meet or beat this guidance, and whether Alnylam can keep pace finding new patients to get on the drug.Alnylam is somewhat a victim of its own success after two very strong quarters for Amvuttra, Matteis wrote. Yet, while some investors may have wanted even more from the latest earnings, the underlying fundamentals here still seem strong.To that end, Alnylam said Amvuttras approval last spring for those cardiovascular problems tied to ATTR was a primary reason why patient demand for the drug grew roughly 250% in the fourth quarter. The company estimates that, globally, around 80% of patients with this condition, which stiffens the heart and impairs its function, remain undiagnosed.The number of identified patients has, on average, grown 40% annually since 2019, according to Alnylam.There are simply many tailwinds for the mid-to-long term, even if short-term expectations had gotten ahead of themselves, Matteis wrote.Ascendis numbers overshadowed by competitorDenmark-based Ascendis Pharma also provided an early glance at earnings in January. Its full report, out Wednesday, detailed fourth-quarter product revenue of 240 million euros, or about $279 million. Full-year product revenue hit 684 million euros, with 70% coming from Yorvipath, a drug for a rare illness where the body doesnt produce enough of a hormone that regulates vital minerals.The results were in-line with analyst forecasts. Joseph Schwartz, of Leerink Partners, expects Yorvipaths momentum to continue throughout this year, and described Ascendis goal of the drug surpassing $1 billion in revenue as achievable.The companys share price, however, slumped 5% at markets open Thursday. Though the stock would rebound over the following hours, Ascendis earnings appeared to take a back seat to data from a rival.Early that morning, BridgeBio Pharma disclosed positive findings from a late-stage study evaluating one of its most advanced drugs an oral enzyme-blocker named infigratinib as a growth-inducing treatment for achondroplasia, the most common type of dwarfism. Ascendis has been testing a once-weekly injectable therapy in this setting, and could receive approval from the Food and Drug Administration before the end of February.With few surprises in Ascendis results, the update from BridgeBio served as bigger news and reinforced that this oral option creates competition, wrote Li Watsek of Cantor Fitzgerald.Yaron Werber, a TD Cowen analyst who covers Ascendis, acknowledged that BridgeBios drug appears solid, with clean safety. And, if approved, it will likely dominate the achondroplasia market as both an initial and second-line treatment.In Werbers view, the key to Ascendis being able to compete is securing strong data from a Phase 3 study of its TransCon CNP therapy combined with its already approved product for growth hormone deficiency. In earlier testing, Ascendis said this pairing, when used in certain people with achondroplasia, tripled the effectiveness seen when TransCon CNP was used alone.The combination should eventually become the standard-of-care in achondroplasia, Werber wrote. '

Clinical ResultPhase 3Financial StatementDrug Approval

12 Feb 2026

− Achieved Fourth Quarter and Full Year 2025 Global Net Product Revenues of $995 Million and $2,987 Million, Respectively, Representing 121% and 81% Growth Compared to Same Periods in 2024 –

− Attained GAAP and non-GAAP Profitability for Full Year 2025, with Sustainable Growth in Operating Income Expected –

− Launched

“

Alnylam 2030

”

Strategy Focused on Scaling Alnylam through Durable ATTR Leadership, Long-Term Sustainable Innovation, and Exceptional Financial Results –

− Announced 2026 Pipeline Goals, Including 4 Clinical Readouts, 3 Ongoing Pivotal Studies, 3 Phase 2 Study Initiations, and 3+ New IND Filings –

− Reiterates Net Product Sales Guidance and Provides Additional 2026 Financial Guidance –

CAMBRIDGE, Mass.--(BUSINESS WIRE)--

Alnylam Pharmaceuticals, Inc.

(Nasdaq: ALNY), the leading RNAi therapeutics company, today reported its consolidated financial results for the fourth quarter and full year ended December 31, 2025 and reviewed recent business highlights.

“2025 was a year of key accomplishments for Alnylam, highlighted by the landmark approval of AMVUTTRA for ATTR-CM in the U.S., which drove total net product revenues of nearly $3 billion, or 81% growth year-over-year, and propelled us to profitability. We also achieved great progress across our portfolio, initiating three Phase 3 studies, expanding our pipeline with four proprietary CTAs, and launching a potential best-in-class enzymatic ligation-based RNAi manufacturing platform,” said Yvonne Greenstreet, M.D., Chief Executive Officer of Alnylam. “Further, we are excited to have recently unveiled our new set of five-year aspirational goals,

Alnylam 2030

, under which we aim to achieve global TTR leadership with a durable franchise; grow through innovation by delivering therapies that prevent, halt, or reverse disease; and scale with financial discipline and agility. By pursuing these ambitious goals, we believe Alnylam will drive substantial patient impact by addressing serious unmet medical needs around the world and create substantial long-term shareholder value.”

Fourth Quarter 2025 and Recent Significant Business Highlights

Total TTR: AMVUTTRA

®

(vutrisiran) & ONPATTRO

®

(patisiran)

Achieved global net product revenues for AMVUTTRA and ONPATTRO for the fourth quarter of $827 million and $32 million, respectively, together representing 151% total TTR growth compared to Q4 2024, and full year 2025 revenues of $2,314 million and $173 million, respectively, together representing 103% total TTR growth compared to full year 2024.

Presented new analyses from the HELIOS-B Phase 3 clinical trial of

vutrisiran

in patients with ATTR-CM at the

American Heart Association Scientific Sessions 2025

.

Cardiovascular magnetic resonance (CMR) and echocardiographic analyses demonstrated that treatment with vutrisiran resulted in significant changes indicating significant improvement on multiple functional and structural cardiac parameters.

CMR imaging showed amyloid regression in 22% of vutrisiran treated patients with no regression found in patients who received placebo.

Treatment with vutrisiran preserved kidney function in HELIOS-B patients, and reduced risk of death and cardiovascular events in patients with advanced chronic kidney disease.

Total Rare: GIVLAARI

®

(givosiran) & OXLUMO

®

(lumasiran)

Achieved global net product revenues for GIVLAARI and OXLUMO for the fourth quarter of $87 million and $50 million, respectively, together representing 26% total Rare growth compared to Q4 2024, and full year 2025 revenues of $308 million and $191 million, respectively, together representing $500 million in revenues and 18% total Rare growth compared to full year 2024.

Other Highlights

Initiated a Phase 2 clinical trial of

ALN-4324

, an investigational RNAi therapeutic targeting GRB14 for type 2 diabetes mellitus.

Initiated a Phase 1 clinical trial of

ALN-2232

, an investigational RNAi therapeutic targeting ACVR1C in adipose tissue for obesity and weight management.

Advanced two new programs (

ALN-4285

and

ALN-4915

) into clinical development in healthy volunteers.

Announced the planned expansion of its state-of-the-art manufacturing facility in Norton, Massachusetts. The Company plans to invest $250 million to develop the industry's first fully dedicated, proprietary siRNA enzymatic-ligation manufacturing facility. This new enzymatic-ligation platform, siRELIS™, is expected to meaningfully expand capacity, significantly reduce production costs, and position the Company to support future launches across its growing pipeline of potential new medicines.

Additional Business Updates

Announced changes to the Company's Board of Directors, including the departures of Mike Bonney and Carolyn Bertozzi, Ph.D., and the appointment of Stuart Arbuckle.

Key Upcoming Events

The Company will host an investor webinar marking the one-year anniversary of the FDA approval of AMVUTTRA in ATTR-CM on March 24, 2026. The Company will highlight progress in delivering for ATTR-CM patients and the long-term growth and durability of its flagship TTR franchise.

In the first half of 2026, Alnylam expects to:

Complete enrollment in the cAPPricorn-1 Phase 2 clinical trial of

mivelsiran

in patients with cerebral amyloid angiopathy.

Initiate a Phase 2 clinical trial of

mivelsiran

in patients with Alzheimer's disease.

Initiate a Phase 2 clinical trial of

ALN-6400

in a second bleeding disorder.

In the second half of 2026, Alnylam expects to announce clinical de-risking data from several pipeline programs, including:

Results from Phase 1 and Phase 2 clinical trials of

ALN-6400

in healthy volunteers and patients with hereditary hemorrhagic telangiectasia (HHT), respectively.

Results from a Phase 1 clinical trial of

ALN-HTT02

in patients with Huntington's disease.

Results from a Phase 1 clinical trial of

ALN-2232

in obesity and weight management.

Financial Results for the Fourth Quarter and Full Year 2025

Three Months Ended December 31,

Twelve Months Ended December 31,

(In thousands, except per share amounts)

2025

2024

2025

2024

Total revenues

$

1,097,033

$

593,166

$

3,713,937

$

2,248,243

GAAP Income (loss) from operations

$

131,718

$

(105,159

)

$

501,578

$

(176,885

)

Non-GAAP Income (loss) from operations

$

203,350

$

(13,514

)

$

849,813

$

95,199

GAAP Net income (loss)

$

111,543

$

(83,763

)

$

313,747

$

(278,157

)

Non-GAAP Net income (loss)

$

169,753

$

8,048

$

683,644

$

(3,051

)

GAAP Net income (loss) per common share — basic

$

0.84

$

(0.65

)

$

2.39

$

(2.18

)

GAAP Net income (loss) per common share — diluted

$

0.82

$

(0.65

)

$

2.33

$

(2.18

)

Non-GAAP Net income (loss) per common share — basic

$

1.28

$

0.06

$

5.22

$

(0.02

)

Non-GAAP Net income (loss) per share — diluted

$

1.25

$

0.06

$

5.08

$

(0.02

)

For an explanation of our use of non-GAAP financial measures, refer to the “Use of Non-GAAP Financial Measures” section later in this press release and for a reconciliation of each non-GAAP financial measure to the most comparable GAAP measure, see the tables at the end of this press release.

Revenue Summary

Three Months Ended December 31,

(In thousands, except percentages)

2025

2024

% Change

At CER*

Net product revenues:

AMVUTTRA

$

826,588

$

286,510

189

%

187

%

ONPATTRO

31,687

56,103

(44

)%

(45

)%

Total TTR net product revenues

858,275

342,613

151

%

149

%

GIVLAARI

86,796

64,645

34

%

32

%

OXLUMO

49,646

43,573

14

%

10

%

Total Rare net product revenues

136,442

108,218

26

%

23

%

Total net product revenues

994,717

450,831

121

%

119

%

Net revenues from collaborations:

Roche

32,954

12,014

174

%

174

%

Regeneron Pharmaceuticals

7,834

30,657

(74

)%

(74

)%

Novartis AG

—

60,003

(100

)%

(100

)%

Other

155

4,274

(96

)%

(96

)%

Total net revenues from collaborations

40,943

106,948

(62

)%

(62

)%

Royalty revenue

61,373

35,387

73

%

73

%

Total revenues

$

1,097,033

$

593,166

85

%

83

%

* Change at constant exchange rates, or CER, represents percent change calculated as if exchange rates had remained unchanged from those used during the three months ended December 31, 2024. CER is a non-GAAP financial measure.

Twelve Months Ended December 31,

(In thousands, except percentages)

2025

2024

% Change

At CER*

Net product revenues:

AMVUTTRA

$

2,313,836

$

970,450

138

%

137

%

ONPATTRO

172,789

252,857

(32

)%

(32

)%

Total TTR net product revenues

2,486,625

1,223,307

103

%

102

%

GIVLAARI

308,487

255,871

21

%

20

%

OXLUMO

191,437

167,050

15

%

13

%

Total Rare net product revenues

499,924

422,921

18

%

17

%

Total net product revenues

2,986,549

1,646,228

81

%

80

%

Net revenues from collaborations:

Roche

394,881

119,489

230

%

230

%

Regeneron Pharmaceuticals

113,957

302,798

(62

)%

(62

)%

Novartis AG

—

79,759

(100

)%

(100

)%

Other

44,528

8,175

445

%

445

%

Total net revenues from collaborations

553,366

510,221

8

%

8

%

Royalty revenue

174,022

91,794

90

%

90

%

Total revenues

$

3,713,937

$

2,248,243

65

%

64

%

* Change at constant exchange rates, or CER, represents growth calculated as if exchange rates had remained unchanged from those used during the twelve months ended December 31, 2024. CER is a non-GAAP financial measure.

Total Net Product Revenues

Net product revenues increased 121% and 81% at actual currency during the three and twelve months ended December 31, 2025, respectively, compared to the same periods in 2024, and 119% and 80% at CER, respectively. The increases were primarily due to growth from AMVUTTRA revenues driven by increased patient demand, mainly in patients with ATTR-CM in the U.S., which was partially offset by a decreased number of patients on ONPATTRO, and due to growth from an increased number of patients on GIVLAARI and OXLUMO.

Net Revenues from Collaborations

Net revenues from collaborations decreased $66 million during the three months ended December 31, 2025, as compared to the same period in 2024, primarily due to revenue recognized under our license agreement with Novartis associated with the achievement of a specified Leqvio commercialization milestone during the three months ended December 31, 2024.

Net revenues from collaborations increased by $43 million during the twelve months ended December 31, 2025, as compared to the same period in 2024, primarily driven by recognition of $300 million of milestone revenue under our collaboration with Roche in September 2025 associated with the dosing of the first patient in the ZENITH Phase 3 clinical trial of zilebesiran and recognition of a $30 million payment in connection with the amendment to our agreement with Vir Biotechnology in March 2025. In comparison, during 2024, we recognized $185 million in revenues under our collaboration with Regeneron as we modified the collaboration in June 2024 and provided Regeneron with an exclusive license to develop, manufacture and commercialize cemdisiran as a monotherapy, and also recognized $65 million of milestone revenue under our collaboration with Roche in March 2024 associated with the dosing of the first patient in the KARDIA-3 Phase 2 clinical trial of zilebesiran.

Royalty Revenue

Royalty revenue increased during the three and twelve months ended December 31, 2025, as compared to the same periods in 2024, due to increased volume and rate of royalties earned from global net sales of Leqvio by Novartis.

Operating Expense Summary

Three Months Ended December 31,

Twelve Months Ended December 31,

(In thousands, except percentages)

2025

2024

% Change

2025

2024

% Change

Cost of goods sold

$

267,723

$

102,649

161

%

$

677,166

$

306,513

121

%

% of net product revenues

26.9

%

22.8

%

22.7

%

18.6

%

Cost of collaborations and royalties

$

—

$

168

(100

)%

$

4,705

$

16,857

(72

)%

GAAP Research and development expenses

$

372,218

$

300,169

24

%

$

1,319,775

$

1,126,232

17

%

Non-GAAP Research and development expenses

$

340,898

$

259,544

31

%

$

1,166,380

$

998,483

17

%

GAAP Selling, general and administrative expenses

$

325,374

$

295,339

10

%

$

1,210,713

$

975,526

24

%

Non-GAAP Selling, general and administrative expenses

$

285,062

$

244,319

17

%

$

1,015,873

$

831,191

22

%

Cost of Goods Sold

Cost of goods sold as a percentage of net product revenues increased during the three and twelve months ended December 31, 2025, as compared to the same periods in 2024, primarily as a result of increased sales of AMVUTTRA and an associated increase in the blended royalty rate payable on net sales of AMVUTTRA.

Research & Development (R&D) Expenses

GAAP and non-GAAP R&D expenses increased during the three and twelve months ended December 31, 2025, as compared to the same periods in 2024, primarily due to increased clinical trial expenses for the ZENITH Phase 3 clinical trial of zilebesiran, the TRITON-CM Phase 3 clinical trial of nucresiran in patients with ATTR-CM and the TRITON-PN Phase 3 clinical trial of nucresiran in patients with hATTR-PN, as well as increased employee compensation and related expenses to support our research and development pipeline and development expenses. Additionally, GAAP R&D expenses increased due to higher stock-based compensation expenses.

Selling, General & Administrative (SG&A) Expenses

GAAP and non-GAAP SG&A expenses increased during the three and twelve months ended December 31, 2025, as compared to the same periods in 2024, primarily due to higher employee compensation costs, including stock-based compensation, mainly driven by higher headcount, and increased marketing investment associated with the commercial launch of AMVUTTRA in ATTR-CM.

Other Financial Highlights

Interest expense

Interest expense for the three and twelve months ended December 31, 2025 of $65 million and $253 million, respectively, included interest of $38 million and $150 million, respectively, attributed to the liability related to the sale of future Leqvio royalties, and $25 million and $89 million, respectively, attributed to the liabilities related to the vutrisiran and zilebesiran development funding.

Benefit from (provision for) income taxes

During the three months year ended December 31, 2025, we recorded a benefit from income taxes of $25 million primarily related to the generation of Switzerland deferred tax assets, partially offset by additional U.S state income tax. During the twelve months ended December 31, 2025, we recorded a provision for income taxes of $9 million primarily related to U.S state income taxes, utilization of Switzerland net deferred tax assets, as well as taxable income from jurisdictions in which we are subject to tax. We will continue to utilize deferred tax assets in Switzerland to offset current cash tax liabilities and will continue to monitor the requirement for a valuation allowance against our net deferred tax assets in the U.S. and certain deferred tax assets in Switzerland.

Financial position

Cash, cash equivalents and marketable securities were $2.91 billion as of December 31, 2025, as compared to $2.69 billion as of December 31, 2024, with the increase primarily due to improved operating performance, proceeds from exercise of stock options, and net proceeds from the issuance of our 0.00% convertible senior notes due 2028, offset in part by cash paid for the partial repurchases of our 1.00% convertible senior notes due 2027.

Net cash provided by operating activities for the three and twelve months ended December 31, 2025 included $23 million and $118 million, respectively, of payments associated with the liability related to the sale of future Leqvio royalties recorded to interest expense, as well as $30 million and $85 million, respectively, of payments associated with the liabilities related to vutrisiran and zilebesiran development funding recorded to interest expense.

A reconciliation of our GAAP to non-GAAP results for the three and twelve months ended December 31, 2025 and 2024, is included in the tables at the end of this press release.

2026 Financial Guidance

Full-year 2026 financial guidance is summarized below:

Total TTR net product revenues (AMVUTTRA, ONPATTRO)

1

$4,400 million - $4,700 million

Total Rare net product revenues (GIVLAARI, OXLUMO)

1

$500 million - $600 million

Total net product revenues

1

$4,900 million - $5,300 million

Net product revenues growth vs. 2025 at currency exchange rates as of December 31, 2025

2

64% - 77%

Net product revenues growth vs. 2025 at constant exchange rates

2

64% - 77%

Net revenues from collaborations and royalties

$400 million - $500 million

Non-GAAP R&D and SG&A expenses

3

$2,700 million - $2,800 million

1

Full-year 2026 guidance utilizing currency exchange rates as of December 31, 2025: 1 EUR = 1.17 USD and 1 USD = 157 JPY

2

Representing growth calculated as if the exchange rates had remained unchanged from those used in 2025, which is a non-GAAP financial measure

3

Excludes $300 million - $400 million of stock-based compensation expense from estimated GAAP R&D and SG&A expenses

Use of Non-GAAP Financial Measures

This press release contains non-GAAP financial measures, including expenses adjusted to exclude certain non-cash expenses and non-recurring gains or losses outside the ordinary course of the Company’s business. These measures are not in accordance with, or an alternative to, GAAP, and may be different from non-GAAP financial measures used by other companies.

The items included in GAAP presentations but excluded for purposes of determining non-GAAP financial measures for the periods presented in this press release are stock-based compensation expenses, loss related to convertible debt, and realized and unrealized gains or losses on marketable equity securities. The Company has excluded the impact of stock-based compensation expense, which may fluctuate from period to period based on factors including the variability associated with performance-based grants for stock options and restricted stock units and changes in the Company’s stock price, which impacts the fair value of these awards. The Company has excluded the loss related to convertible debt because the Company believes the item is a non-recurring transaction outside the ordinary course of the Company’s business. The Company has excluded the impact of the realized and unrealized gains or losses on marketable equity securities because the Company does not believe these adjustments accurately reflect the performance of the Company’s ongoing operations for the period in which such gains or losses are reported, as their sole purpose is to adjust amounts on the balance sheet.

Percentage changes in revenue growth at CER are presented excluding the impact of changes in foreign currency exchange rates for investors to understand the underlying business performance. The current period’s foreign currency revenue values are converted into U.S. dollars using the average exchange rates from the prior period.

The Company believes the presentation of non-GAAP financial measures provides useful information to management and investors regarding the Company’s financial condition and results of operations. When GAAP financial measures are viewed in conjunction with non-GAAP financial measures, investors are provided with a more meaningful understanding of the Company’s ongoing operating performance and are better able to compare the Company’s performance between periods. In addition, these non-GAAP financial measures are among those indicators the Company uses as a basis for evaluating performance, allocating resources and planning and forecasting future periods. Non-GAAP financial measures are not intended to be considered in isolation or as a substitute for GAAP financial measures. A reconciliation between GAAP and non-GAAP measures is provided later in this press release.

Conference Call Information

Management will provide an update on the Company and discuss fourth quarter and full year 2025 results as well as expectations for the future via conference call on Thursday, February 12, 2026 at 8:30 am ET. A live audio webcast of the call will be available on the Investors section of the Company’s website at

. An archived webcast will be available on the Alnylam website approximately two hours after the event.

About AMVUTTRA

®

(vutrisiran)

AMVUTTRA

®

(vutrisiran) is an RNAi therapeutic that delivers rapid knockdown of transthyretin (TTR), addressing the underlying cause of transthyretin (ATTR) amyloidosis. Administered quarterly via subcutaneous injection by a healthcare professional, AMVUTTRA is approved and marketed for the treatment of the polyneuropathy of hereditary transthyretin-mediated amyloidosis (hATTR-PN) in adults and for the treatment of the cardiomyopathy of wild-type or hereditary transthyretin-mediated amyloidosis (ATTR-CM) in adults to reduce cardiovascular mortality, cardiovascular hospitalizations and urgent heart failure visits. For more information about AMVUTTRA, including the full U.S.

Prescribing Information

, visit

AMVUTTRA.com

.

About ONPATTRO

®

(patisiran)

ONPATTRO is an RNAi therapeutic that is approved in the United States and Canada for the treatment of adults with hATTR amyloidosis with polyneuropathy. ONPATTRO is also approved in the European Union, Switzerland and Brazil for the treatment of hATTR amyloidosis in adults with Stage 1 or Stage 2 polyneuropathy, and in Japan for the treatment of hATTR amyloidosis with polyneuropathy. ONPATTRO is an intravenously administered RNAi therapeutic targeting transthyretin (TTR). It is designed to target and silence TTR messenger RNA, thereby reducing the production of TTR protein before it is made. Reducing the pathogenic protein leads to a reduction in amyloid deposits in tissues. For more information about ONPATTRO, including full

Prescribing Information

, visit

ONPATTRO.com

.

About GIVLAARI

®

(givosiran)

GIVLAARI (givosiran) is an RNAi therapeutic targeting aminolevulinic acid synthase 1 (ALAS1) approved in the United States and Brazil for the treatment of adults with acute hepatic porphyria (AHP). GIVLAARI is also approved in the European Union for the treatment of AHP in adults and adolescents aged 12 years and older. In the pivotal trial, GIVLAARI was shown to significantly reduce the rate of porphyria attacks that required hospitalizations, urgent healthcare visits or intravenous hemin administration at home compared to placebo. GIVLAARI is Alnylam’s first commercially available therapeutic based on its Enhanced Stabilization Chemistry ESC-GalNAc conjugate technology to increase potency and durability. GIVLAARI is administered via subcutaneous injection once monthly at a dose based on actual body weight and should be administered by a healthcare professional. GIVLAARI works by specifically reducing elevated levels of ALAS1 messenger RNA (mRNA), leading to reduction of toxins associated with attacks and other disease manifestations of AHP. For more information about GIVLAARI, including the full U.S.

Prescribing Information

, visit

GIVLAARI.com

.

About OXLUMO

®

(lumasiran)

OXLUMO (lumasiran) is an RNAi therapeutic targeting hydroxyacid oxidase 1 (HAO1). HAO1 encodes glycolate oxidase (GO). Thus, by silencing HAO1 and depleting the GO enzyme, OXLUMO inhibits production of oxalate – the metabolite that directly contributes to the pathophysiology of PH1. OXLUMO utilizes Alnylam’s Enhanced Stabilization Chemistry (ESC)-GalNAc-conjugate technology, which enables subcutaneous dosing with increased potency and durability and a wide therapeutic index.

Contacts

Alnylam Pharmaceuticals, Inc.

Christine Akinc

(Investors and Media)

617-682-4340

Josh Brodsky

(Investors)

617-551-8276

Read full story here

Phase 1Phase 2Drug ApprovalFinancial StatementPhase 3

100 Deals associated with Vutrisiran Sodium

Login to view more data

R&D Status

Approved

10 top approved records. to view more data

Login

| Indication | Country/Location | Organization | Date |

|---|---|---|---|

| Transthyretin Amyloid Cardiomyopathy | United States | 20 Mar 2025 | |

| Amyloidosis, Hereditary, Transthyretin-Related | United States | 13 Jun 2022 |

Developing

10 top R&D records. to view more data

Login

| Indication | Highest Phase | Country/Location | Organization | Date |

|---|---|---|---|---|

| Transthyretin-related (ATTR) familial amyloid polyneuropathy | NDA/BLA | European Union | 25 Apr 2025 | |

| Heart Diseases | Phase 3 | Italy | 11 Apr 2019 | |

| Nerve injury | Phase 3 | Italy | 11 Apr 2019 | |

| Senile cardiac amyloidosis | Phase 3 | United States | 14 Feb 2019 | |

| Senile cardiac amyloidosis | Phase 3 | Japan | 14 Feb 2019 | |

| Senile cardiac amyloidosis | Phase 3 | Argentina | 14 Feb 2019 | |

| Senile cardiac amyloidosis | Phase 3 | Australia | 14 Feb 2019 | |

| Senile cardiac amyloidosis | Phase 3 | Belgium | 14 Feb 2019 | |

| Senile cardiac amyloidosis | Phase 3 | Brazil | 14 Feb 2019 | |

| Senile cardiac amyloidosis | Phase 3 | Bulgaria | 14 Feb 2019 |

Login to view more data

Clinical Result

Clinical Result

Indication

Phase

Evaluation

View All Results

| Study | Phase | Population | Analyzed Enrollment | Group | Results | Evaluation | Publication Date |

|---|

Phase 3 | 655 | placebo+vutrisiran (DB Period: Placebo) | ltouhzvrju = elmrxzaopv qwtfpxmzgw (lumrittoue, jdgpbkhijn - kdhukicvbb) View more | - | 21 Oct 2025 | ||

(DB Period: Vutrisiran) | ltouhzvrju = spfdzwobgu qwtfpxmzgw (lumrittoue, howhhbjvdn - wacgtrgqvr) View more | ||||||

Phase 3 | - | lvofmgkucf(arjwohhldk) = patients treated with vutrisiran demonstrated a statistically significant 32% reduction in the risk of the primary composite endpoint of all-cause mortality and recurrent cardiovascular events through 36 months, compared to patients who received placebo (hazard ratio [HR] 0.68; 95% confidence interval [CI]: 0.49–0.95; p=0.022). kzixpydrad (gvrrlfwxdk ) View more | Positive | 28 Sep 2025 | |||

Placebo | |||||||

Phase 3 | Transthyretin Amyloid Cardiomyopathy NT-proBNP | troponin I | 655 | japwbecawk(yapogzpwik) = kuixytbcww mcdvwsniha (ucucxrdthh, -25.0 to 10.0) | Positive | 01 Aug 2025 | ||

Placebo | japwbecawk(yapogzpwik) = sbzfahdscj mcdvwsniha (ucucxrdthh, -6.3 to 41.2) | ||||||

Phase 3 | 655 | yqwptdpszt(tsbmlqpeqh): HR = 0.64 (95% CI, 0.46 - 0.88) View more | Positive | 01 May 2025 | |||

Placebo | |||||||

Phase 3 | 654 | pnqihswehp(yqrlkkdcab) = ennsvtwmhm arfwydmpak (caecvloiap ) View more | Positive | 17 Mar 2025 | |||

Placebo | - | ||||||

Phase 3 | Transthyretin Amyloid Cardiomyopathy N-terminal pro-B-type Natriuretic peptide | Cardiac Troponin I | 655 | ladbqbfjji(oaadgixvpm) = ifewaqkyor ciwsfvdbnv (qdbdcrgddk ) View more | Positive | 29 Sep 2024 | ||

Phase 3 | 655 | Vutrisiran 25 mg | pqhipuqnxn(oapukuxjiq): HR = 0.72 (95% CI, 0.56 - 0.93), P-Value = 0.01 View more | Positive | 30 Aug 2024 | ||

Placebo | |||||||

Phase 3 | 655 | (overall population) | vvksaspkkn(pooiarxakk) = Rates of adverse events (AEs), serious AEs and AEs leading to study drug discontinuation were similar between the vutrisiran and placebo arms. No AEs were seen ≥3% more frequently in the vutrisiran arm compared to the placebo arm. gjluvioaut (hycpmyskfn ) | Positive | 24 Jun 2024 | ||

(not receiving tafamidis at baseline) | |||||||

Phase 3 | 164 | quhxrfjwks(gmwbhnsxbr) = hnlwisobnk kfmloodjwc (snbclvuoud ) | - | 31 Jul 2023 | |||

Phase 3 | - | confhrorti(vpbndswzjj) = ttlakcbqih fudcogacxs (fqayieafid ) | Positive | 14 Sep 2022 | |||

confhrorti(vpbndswzjj) = vkudlwfuud fudcogacxs (fqayieafid ) |

Login to view more data

Translational Medicine

Boost your research with our translational medicine data.

login

or

Deal

Boost your decision using our deal data.

login

or

Core Patent

Boost your research with our Core Patent data.

login

or

Clinical Trial

Identify the latest clinical trials across global registries.

login

or

Approval

Accelerate your research with the latest regulatory approval information.

login

or

Regulation

Understand key drug designations in just a few clicks with Synapse.

login

or

AI Agents Built for Biopharma Breakthroughs

Accelerate discovery. Empower decisions. Transform outcomes.

Get started for free today!

Accelerate Strategic R&D decision making with Synapse, PatSnap’s AI-powered Connected Innovation Intelligence Platform Built for Life Sciences Professionals.

Start your data trial now!

Synapse data is also accessible to external entities via APIs or data packages. Empower better decisions with the latest in pharmaceutical intelligence.

Bio

Bio Sequences Search & Analysis

Sign up for free

Chemical

Chemical Structures Search & Analysis

Sign up for free