Request Demo

Last update 18 Oct 2025

PCSK9 inhibitor (AstraZeneca)

Last update 18 Oct 2025

Overview

Basic Info

Drug Type Small molecule drug |

Synonyms- |

Target |

Action inhibitors |

Mechanism PCSK9 inhibitors(Proprotein convertase subtilisin kexin type 9 inhibitors) |

Therapeutic Areas |

Active Indication- |

Inactive Indication |

Originator Organization |

Active Organization- |

Inactive Organization |

License Organization |

Drug Highest PhasePendingPreclinical |

First Approval Date- |

Regulation- |

Related

100 Clinical Results associated with PCSK9 inhibitor (AstraZeneca)

Login to view more data

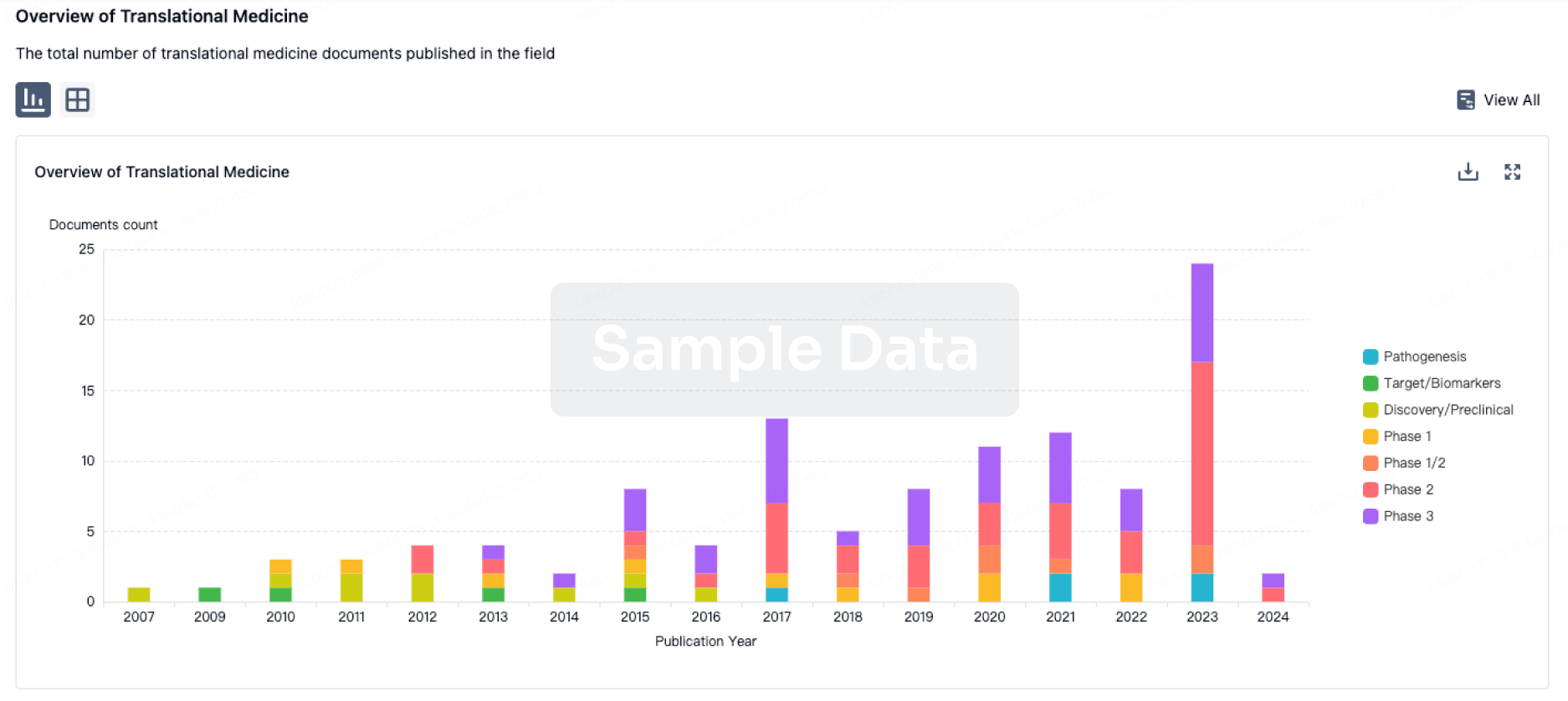

100 Translational Medicine associated with PCSK9 inhibitor (AstraZeneca)

Login to view more data

100 Patents (Medical) associated with PCSK9 inhibitor (AstraZeneca)

Login to view more data

10

Literatures (Medical) associated with PCSK9 inhibitor (AstraZeneca)01 Jun 2025·NEOPLASIA

L-methionine promotes CD8+ T cells killing hepatocellular carcinoma by inhibiting NR1I2/PCSK9 signaling

Article

Author: Zhou, Huyue ; Hu, Changpeng ; Yin, Yue ; Zhang, Rong ; Yuan, Chengsha ; Liu, Yafeng ; Li, Guobing ; Liu, Wuyi ; Lai, Wenjing

BACKGROUND:

Liver cancer has consistently high incidence and mortality rates among malignant tumors. PCSK9, a target for hypercholesterolemia therapy, has recently been identified as an inhibitor of anti-tumor immunity, and targeting PCSK9 effectively inhibits tumor progression. However, small molecule inhibitors are lacking due to its flat protein structure.

METHODS:

PCSK9 transcription inhibitor screening was conducted using a PCSK9 promoter-driven td-Tomato plasmid. Quantitative real-time PCR and immunoblotting were employed to assess the effect of L-methionine on PCSK9 expression in HCC cell lines. Co-culture experiments were performed to evaluate the impact of L-methionine on CD8+ T cell-mediated killing of liver cancer cells. RNA sequencing, CUT&Tag, gene editing, and luciferase reporter assays were utilized to identify the transcription factor regulating PCSK9. Additionally, liver cancer xenograft and spontaneous liver cancer mouse models were used to evaluate the anti-cancer efficacy of L-methionine.

RESULTS:

Our study identified L-methionine, an essential amino acid, as a transcriptional inhibitor of PCSK9. The optimal dose of L-methionine to inhibit PCSK9 expression and enhance CD8+ T cell-mediated killing of liver cancer cells in vitro is 50 μM. Furthermore, intraperitoneal injection of 5 mg/kg/day of L-methionine significantly inhibited tumor growth in both liver cancer xenograft and spontaneous liver cancer mouse models. Mechanistically, we identified NR1I2 as a key transcription factor for PCSK9 and their crucial binding site was TGCACCCTGACAC. L-methionine inhibits PCSK9 transcription by downregulating NR1I2.

CONCLUSIONS:

This work demonstrates that L-methionine promotes CD8+ T cell-mediated killing of hepatocellular carcinoma by inhibiting NR1I2/PCSK9 signaling. Our study introduces a novel and convenient approach to inhibit PCSK9 and provides a theoretical basis for the rational supplementation of L-methionine in liver cancer patients.

03 Jun 2024·European journal of preventive cardiology

Genetically proxied low-density lipoprotein cholesterol lowering via PCSK9-inhibitor drug targets and risk of congenital malformations

Article

Author: de Marvao, Antonio ; Ng, Fu Siong ; Reddy, Rohin K ; Slob, Eric A W ; Hill, Phoebe ; Ardissino, Maddalena ; Honigberg, Michael C ; Williamson, Catherine ; Morley, Alec P ; Schuermans, Art

Abstract:

Aims:

Current guidelines advise against the use of lipid-lowering drugs during pregnancy. This is based only on previous observational evidence demonstrating an association between statin use and congenital malformations, which is increasingly controversial. In the absence of clinical trial data, we aimed to use drug-target Mendelian randomization to model the potential impact of fetal LDL-lowering, overall and through PCSK9 drug targets, on congenital malformations.

Methods and results:

Instrumental variants influencing LDL levels overall and through PCSK9-inhibitor drug targets were extracted from genome-wide association study (GWAS) summary data for LDL on 1 320 016 individuals. Instrumental variants influencing circulating PCSK9 levels (pQTLs) and liver PCSK9 gene expression levels (eQTLs) were extracted, respectively, from a GWAS on 10 186 individuals and from the genotype-tissue expression project. Gene-outcome association data was extracted from the 7th release of GWAS summary data on the FinnGen cohort (n = 342 499) for eight categories of congenital malformations affecting multiple systems. Genetically proxied LDL-lowering through PCSK9 was associated with higher odds of malformations affecting multiple systems [OR 2.70, 95% confidence interval (CI) 1.30–5.63, P = 0.018], the skin (OR 2.23, 95% CI 1.33–3.75, P = 0.007), and the vertebral, anorectal, cardiovascular, tracheo-esophageal, renal, and limb association (VACTERL) (OR 1.51, 95% CI 1.16–1.96, P = 0.007). An association was also found with obstructive defects of the renal pelvis and ureter, but this association was suggestive of horizontal pleiotropy. Lower PCSK9 pQTLs were associated with the same congenital malformations.

Conclusion:

These data provide genetic evidence supporting current manufacturer advice to avoid the use of PCSK9 inhibitors during pregnancy.

01 Jun 2023·Cell biochemistry and biophysics

PCSK9 Inhibition Regulates Infarction-Induced Cardiac Myofibroblast Transdifferentiation via Notch1 Signaling.

Article

Author: Ji, Jian ; Lin, Dawei ; Wu, Chen ; Wang, Yaosheng ; Jiang, Yiweng ; Jiang, Feng

Increasing evidence suggests that PCSK9 inhibition protects cardiomyocytes against ischemia-reperfusion injury after myocardial infarction. However, it is not clear whether PCSK9 inhibitor (PCSK9i) affects cardiac fibroblasts (CFs) activation after MI. In this study we used SBC-115076, an antagonist of PCSK9, to investigate the role of PCSK9i in the conversion of CFs to cardiac myofibroblasts (CMFs) after MI and provided a basic for its clinical application in cardiac fibrosis after MI. In vivo study, PCSK9i was injected into mice 4 days after MI. Cardiac function and degree of fibrosis were evaluated by echocardiographic and tissue staining after treatment. Western blot showed that PCSK9i treatment decreases expression of α-SMA, collagen and increases expression of Notch1 in border infarct area. Vitro studies showed that PCSK9i decreased the degree of fibrosis, migration, and collagen fiber deposition in CFs. Confocal microscopy imaging also showed that hypoxia contributes to the formation of α-SMA stress filaments, and PCSK9i alleviated this state. Moreover, overexpression of Notch1 further suppress the activation of CFs under hypoxia. These results revealed that SBC-115076 ameliorates cardiac fibrosis and ventricular dysfunction post-myocardial infarction through inhibition of the differentiation of cardiac fibroblasts to myofibroblasts via Notch1/Hes1 signaling.

2

News (Medical) associated with PCSK9 inhibitor (AstraZeneca)08 Oct 2025

THOUSAND OAKS, Calif. —

In 2023, Dave Reese walked out of a Silicon Valley meeting and made a career-changing call.

Reese was working as the head of R&D at Amgen. He rang up his CEO Bob Bradway and, effectively, pitched the idea of firing himself, giving a simple explanation: Everything in biotech was about to change, and Reese wanted to lead that transformation for Amgen.

Over 20 years at Amgen, Reese had long envisioned a convergence of biotech and tech. The AI boom accelerated his belief that the time had come, spurring him to pitch the new role of chief technology officer. In doing so, he’s reorganized large chunks of the 28,000-employee biopharma to capitalize.

“It’s the hinge moment,” Reese recalled telling Bradway. “There’s no question.”

Last month, Reese and other Amgen scientific leaders gave

Endpoints News

an exclusive look at how the AI strategy is playing out. The reality, Reese says, is there will be no Eureka moment that changes everything. Instead, Amgen’s labs are undergoing a continuous, radical transformation, putting AI models at the heart of more and more of the process of finding and developing drugs. Those efforts, they say, are starting to deliver.

Computation in drug R&D isn’t new. For decades, drug developers have simulated and generated molecules on the computer with technologies named like QSAR or molecular dynamics. But, in Reese’s view, AI is a “step change” difference, similar to how the telegraph was getting incrementally better until the telephone arrived and “obviated the need for that.”

“We’re at a sort of telephone moment,” Reese said in an interview at Thousand Oaks, dressed in a gray blazer and blue-striped shirt on an unseasonably hot September day.

And while most of today’s gains are making things faster and cheaper, Reese said that alone is not the ultimate goal.

“The efficiency play is important, but that’s not the prize,” Reese said. “The prize is getting undruggable targets even earlier in the process. The prize is understanding disease biology that we don’t yet understand, where we don’t even have a target or we don’t have tractable ways of going at a disease.”

Yaron Werber, a TD Cowen analyst who started covering Amgen in 2006, credited Reese’s decision to leave the R&D head position as a key boost to the changes of making AI work inside Amgen. Reese brings as deep a familiarity as imaginable in what pharma R&D is about.

“That’s fairly unique, because AI usually is driven by informatics people and computer scientists who don’t really speak biology,” Werber said in an interview. “There’s usually a bit of a cultural clash, potentially, so developing that in partnership, organically, is very powerful.”

A lab inside the uncreatively named Building 29 is home to a research team embodying a lot of Reese’s desired changes.

At the center of protein processing platform lab — known inside Amgen as the P3 Lab — is a robotic arm that whizzes around, grasping a plate and moving it to one of six plexiglass-covered workstations arranged in a surrounding hexagon.

“This is a future version of me,” Marissa Mock, director of generative biology at Amgen, said, staring at the robot. “Marissa 2.0,” she called it.

In the early 2010s at Amgen, Mock did much of the robot’s work by hand, running tests to observe various qualities and activities of proteins. There’s nothing extraordinarily special about the robotic arm itself, which has become a commonplace feature in any modern lab. When Endpoints visited, the lab scientists booted up a demo that puts it in a frenzied, near-constant state of motion. When reporters aren’t watching, it typically moves every half hour or so, moving plates full of proteins onto the next step in whatever lab test it’s running at the moment.

The lab’s main charge is turning initial hit candidates into more optimized drug programs that are ready for the next preclinical stages. The robotized system runs over two dozen types of lab tests in characterizing these proteins, studying their qualities and activities.

Viscosity is one of those characteristics. Too thick, and it can’t be pushed through a syringe. Too thin, and it may require more injections to get enough of the protein delivered as a drug.

Traditionally, Amgen’s scientists would manufacture a few hundred milligrams of any protein of interest to assess viscosity. Today, Amgen runs an algorithm predicting viscosity from the sequence of a protein, before it’s ever made in the lab. If the prediction is not promising, it’s not made.

“We now do it every day on every molecule,” said Alan Russell, head of R&D technology and innovation at Amgen. “There are literally 20 or 30 other predictive models that we use to correct all of the therapeutic molecular attributes that could cause a problem.”

Russell, formerly a Carnegie Mellon University professor, joined Amgen five years ago and has seen every aspect of large-molecule discovery change over that timespan. AI models are playing a leading role.

“We’re not at a tipping point,” Russell said of AI’s impact. “We’ve tipped. We’ve tipped years ago.”

All the proteins made in the P3 Lab first go through AI models from computational biologists Marti Head and Chris Langmead, who work closely with the P3 Lab after both joining Amgen in 2022. Mock recalled that the previous digital chemistry team operated differently: more aloof and acting “almost like service providers,” she said.

Now, the teams frequently meet and share a language spanning life and computer sciences. The computational team often has batches of proteins made, where they expect some will be terrible performers. But models benefit from negative results too, not just successes.

Human scientists still make the final calls on which proteins are made. But AI models — like the viscosity-predicting one — are informing those decisions. Amgen hasn’t published or shared specifics on most of these internal models, but the strategy shows the next frontiers for AI in biology and drug hunting that extend well past the initial triumph of Google DeepMind’s AlphaFold in predicting protein structures.

“If you map 15 to 20 of these, you start to knock them down in

in silico

design,” Reese said. “All of a sudden, you’re in a new world. It’s not a big bang moment, but it’s the accretion of these over time, but then you look back and say, ‘This is completely different.’”

Amgen is already an outlier by its sheer existence as an independent, self-sustaining biotech. It started in Thousand Oaks, roughly an hour’s drive northwest of downtown Los Angeles, over four decades ago. At the time, it went by the name Applied Molecular Genetics and had a handful of scientists in a 3,000-square-foot space wedged between an evangelical church and a Rolls-Royce detailer.

Since then, Amgen has built dozens of buildings on roughly 100 acres here, ranging from R&D to sales to manufacturing. It is one of three drugmakers on the Dow Jones Industrial Average, alongside Merck and Johnson & Johnson.

But despite being one of the original big biotechs, it also may not be the first place that comes to mind when someone thinks of the AI revolution in the industry.

Startups like

Isomorphic Labs

and

Xaira Therapeutics

have raised hundreds of millions to advance Nobel Prize-winning AI breakthroughs in biology. Roche’s Genentech has put Aviv Regev, a computational biologist and

a leader of the lab-in-the-loop strategy

, in charge of early R&D. Some of these leaders, like Isomorphic’s Demis Hassabis, are even trying to build their companies without the traditional wet labs — an even more radical bet on AI’s future capabilities than Amgen is currently making.

Many know Amgen for its feats in the courtroom and around the deal-negotiating table. There’s a sticky — if unfair — description that has followed the company around: a law firm with a biotech business on the side. Werber called it a “grossly outdated” viewpoint. Still, the reputation comes from Amgen’s lawyers being a formidable crew that has argued before the Supreme Court, battled the IRS and FTC in court, and has defended its biggest moneymakers from generic threats over the years.

And despite its biotech origins, Amgen has often turned to pharma’s playbook of multibillion-dollar acquisitions to find its next legs of growth. It bought

Onyx Pharmaceuticals

for $10.4 billion in 2013,

the psoriasis drug Otezla

for $13.4 billion in 2019, and

Horizon Pharmaceuticals

for $27.8 billion in 2023.

Those three deals, alone, are roughly equal to Amgen’s R&D spending over the entire last decade.

All of that can leave its internal science overlooked. Its labs, though, have developed major first-in-class, or nearly first-in-class, medicines, including the PCSK9 inhibitor Repatha in 2015, the CGRP migraine drug Aimovig in 2018, the first KRAS-targeting cancer therapy Lumakras in 2021, and a DLL3-targeted bispecific cancer drug Imdelltra in 2024.

Amgen has also maintained its investment in deCODE Genetics, a once-bankrupt Icelandic startup it bought for $415 million back in 2012. DeCODE specializes in sequencing entire human genomes, rather than just the protein-making parts of the genetic code. Amgen has now built an on-site Nvidia supercomputer in Iceland to find patterns hidden in that data.

Efforts like deCODE convinced Howard Chang to leave a longtime spot on Stanford’s faculty and become Amgen’s chief scientific officer earlier this year. Chang, a leader in genetics research, envisions a future of “smart medicines with programmable outcomes.” In an interview, he described these medicines almost like automobile designs, with a combination of modular and boutique parts being used to build a drug.

MariTide, which has captivated investors for the past year, is putting these ideas to the test. The drug is a bispecific peptide-antibody conjugate that both blocks a hormone called GIP while activating GLP-1. Other drugmakers are testing candidates that turn on GIP, instead.

Cowen’s Werber said the conventional thinking has been that GIP antagonism could weaken bones. The deCODE database

suggested bone health isn’t an issue

, Werber said, and the early data looks to support that viewpoint.

“Amgen bucked the conventional wisdom based on the deCODE genetics data in hundreds of thousands of women, and so far, that database has been proven to be correct,” Werber said.

Cowen’s Werber called that innovation record impressive. But he also said Amgen has limited itself by capping its R&D spending over the years to boost profitability and margins. The “artificial cap really hurt them,” he said, especially in maintaining early leads in competitive, crowded areas like cancer.

But Reese’s AI push is part of a new surge in R&D spending underway at Amgen. R&D expenses are forecasted to exceed $7 billion in 2025, an all-time high in Amgen’s history and a 20% increase from last year, which was already a 25% jump from 2023. Large-scale trials for its obesity drug MariTide and heart treatment olpasiran are key drivers of the budget, but Bradway also called out spending on technological advancements like AI, as well, on its most recent earnings call.

Those bets will need to deliver, as the drugmaker and its $158 billion market value face one of the industry’s most severe patent cliffs.

A Morgan Stanley analysis

found two-thirds of today’s revenues at Amgen are potentially at risk from patent expiries by the end of 2030. Supercomputers and robot-powered labs cost money. Reinvention has to deliver tangible results in replacing those sales, while overcoming the challenges of bureaucracy and cultural inertia found in every large corporation.

So, is AI just the latest shiny object that large drugmakers are trying to latch onto as a savior? Or is this technology actually starting to deliver the revolutionary impacts that its backers have long promised?

Reese is searching for answers in the research lab and beyond. Instead of running hundreds of pilot projects “that seem really cool but never scale and never go anywhere,” he said he’s focused Amgen on a few big AI bets in areas like molecular engineering, clinical trials and manufacturing.

He’s equally eager to talk about AI built into its new Ohio manufacturing plant, where cameras and algorithms now inspect lines of drug product instead of humans, who would take 30 to 40 minutes to clear each and every line. That doesn’t lead to flashy predictions about AI curing disease, but it does tackle the real-world inefficiencies that have long weighed on pharma’s productivity.

“That half-hour savings translates into many, many days of additional production over the course of the year,” Reese said. “It’s not sexy. It’s never going to get a headline in the

New York Times

.

”

But unsexy stories of viscosity predictions, manufacturing inspections, and

faster trial enrollment

add up to what Reese has bet his career on: a future of drug companies looking like hybrids of technology and data companies with biotechs.

“You then have brought the hinge moment to life at the enterprise level,” he said. “That’s the end goal, and I think it’s now inevitable. The only question is who’s going to get there.”

And as with any new technology riding the hype cycle, there are some early reality checks on generative AI’s impact on business.

A recent MIT study

drew headlines by finding 95% of AI projects didn’t deliver businesses a return on investment. Reese said he pays no mind to such reports.

“You’re running a marathon, and you’re a quarter-mile in, and someone’s declaring the outcome of the race,” Reese said of the MIT study, adding he pays “absolutely no interest” to these types of studies and resulting articles. “It’s just silly.”

And then Reese leaned forward, across the table with a widening grin.

“I hope our competitors are deeply skeptical,” he said.

Acquisition

26 Dec 2023

PCSK9, also known as Neural Apoptosis-Regulated Convertase 1 (NARC1), is the ninth major member of the proprotein convertase family, primarily derived from human liver cells, and is also expressed in the small intestine, renal interstitial cells, and neurons. The PCSK9 protein is composed of a signal peptide (containing 30 amino acids), a pro-domain (122 amino acids), a catalytic domain (299 amino acids), and a cysteine- and histidine-rich C-terminal domain (279 amino acids). To date, two genetic variants of PCSK9 have been identified: gain-of-function mutations and loss-of-function mutations. PCSK9 gain-of-function mutations are associated with familial hypercholesterolemia and cardiovascular diseases; conversely, individuals with loss-of-function mutations have lower levels of LDL-C and a reduced incidence of cardiovascular diseases. Click the image below to embark on a journey of PCSK9 discovery!

Most LDL particles are cleared through LDL receptors (LDL-R) on the surface of hepatocyte membranes. After LDL binds to LDL-R, the complex is internalized through endocytosis. Due to the decrease in pH, the LDL-R complex dissociates, releasing LDL-R back to the cell membrane surface to capture LDL particles again, further reducing plasma LDL levels. LDL particles are then degraded within lysosomes. If PCSK9 is present, an LDL and LDL-R-PCSK9 complex is formed, which is co-degraded within the lysosomes, including the LDL-R. This reduces the recirculation of LDL-R, decreases the clearance of LDL particles, and thereby increases plasma LDL levels.

PCSK9 inhibitors lower circulating LDL-C levels by blocking the degradation of LDL-R by PCSK9. According to their mechanism of action, they can be classified into three types: (1) Antisense oligonucleotides (ASO) or siRNA: These inhibit PCSK9 synthesis through gene silencing. (2) Monoclonal antibodies or mimetic antibody proteins: They directly inhibit the interaction between PCSK9 protein and LDL-R. (3) Peptides targeting the catalytic site of PCSK9: Such peptides can bind to and induce a conformational change in the catalytic site of PCSK9 protein, thereby affecting its interaction with LDL-R. (4) Small molecule inhibitors: Since the interaction interface between PCSK9 protein and LDL-R is relatively large and small molecules have limited contact area, the development of such drugs poses certain challenges.

PCSK9 inhibitors have displayed significant potential in the pharmaceutical market, primarily due to their use in treating hypercholesterolemia and cardiovascular diseases; as a breakthrough therapeutic approach, PCSK9 inhibitors are anticipated to continue their growth in the coming years, further enhancing the quality of life for patients.

Key Drug: InclisiranInclisiran (ALN-PCSsc), developed by Novartis, is a long-acting therapeutic agent that inhibits the synthesis of PCSK9 through RNA interference (RNAi) and requires only two subcutaneous injections per year. It was approved for marketing in December 2020. As the first siRNA drug targeting PCSK9, inclisiran features a specially designed GalNAc delivery system that first specifically binds to N-acetylgalactosamine (GalNAc) and the asialoglycoprotein receptor (ASGPR) on the surface of liver cell membranes, facilitating its entry into hepatocytes. Once inside the liver cells, inclisiran associates with the RNA-induced silencing complex (RISC) and, guided by the antisense strand, binds to the mRNA encoding PCSK9 protein, thereby inhibiting the production of PCSK9 protein.

On November 18, 2022, the Marketing Authorization Application (MAA) for Novartis's inclisiran injection was accepted by the National Medical Products Administration (NMPA) of China. In a prospective, non-interventional cohort study, the effectiveness of inclisiran in treating adults with primary hypercholesterolemia or mixed dyslipidemia was assessed. The results showed that out of 34 patients, 28 (82.4%) had their LDL-C levels measured on day 90±14 after the first injection of inclisiran, with an average reduction in LDL-C levels of 40.2% from baseline. Regarding safety, Chinese patients tolerated inclisiran well, with no adverse events leading to discontinuation of the drug or serious adverse events related to inclisiran reported.

AstraZeneca: AZD8233AZD8233 (ION449) is an antisense oligonucleotide (ASO) drug developed using the Ionis Ligand-Conjugated Antisense (LICA) technology platform. It functions by reducing the production of PCSK9 in the liver, thus lowering the levels of plasma LDL-C (low-density lipoprotein cholesterol) and consequently decreasing the risk of cardiovascular diseases.

In April 2022, AstraZeneca released phase 2b clinical trial data for the subcutaneous injection of AZD8233 in treating hypercholesterolemia. The results demonstrated that a once-monthly dose of AZD8233 reduced patients' PCSK9 levels by 89% and LDL-C levels by 73%, achieving the primary endpoint of the trial. AstraZeneca indicated that this candidate drug achieved a greater reduction compared to the key trials for Praluent (alirocumab) from Sanofi/Regeneron, where alirocumab lowered LDL-C by approximately 50%.

How to obtain the latest development progress of PCSK9 inhibitors?In the Synapse database, you can keep abreast of the latest research and development advances of PCSK9 inhibitors anywhere and anytime, daily or weekly, through the "Set Alert" function. Click on the image below to embark on a brand new journey of drug discovery!

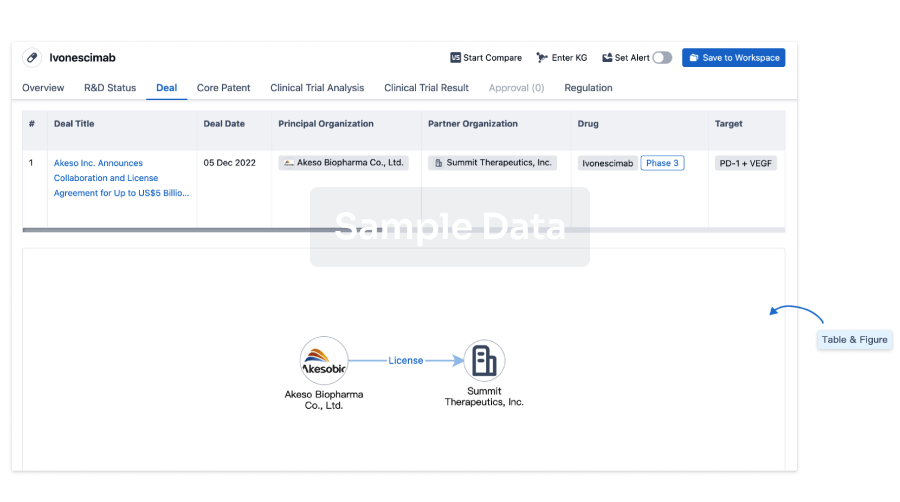

100 Deals associated with PCSK9 inhibitor (AstraZeneca)

Login to view more data

R&D Status

10 top R&D records. to view more data

Login

| Indication | Highest Phase | Country/Location | Organization | Date |

|---|---|---|---|---|

| Cardiovascular Diseases | Preclinical | United Kingdom | 17 Sep 2020 | |

| Hypercholesterolemia | Preclinical | United Kingdom | 17 Sep 2020 |

Login to view more data

Clinical Result

Clinical Result

Indication

Phase

Evaluation

View All Results

| Study | Phase | Population | Analyzed Enrollment | Group | Results | Evaluation | Publication Date |

|---|

No Data | |||||||

Login to view more data

Translational Medicine

Boost your research with our translational medicine data.

login

or

Deal

Boost your decision using our deal data.

login

or

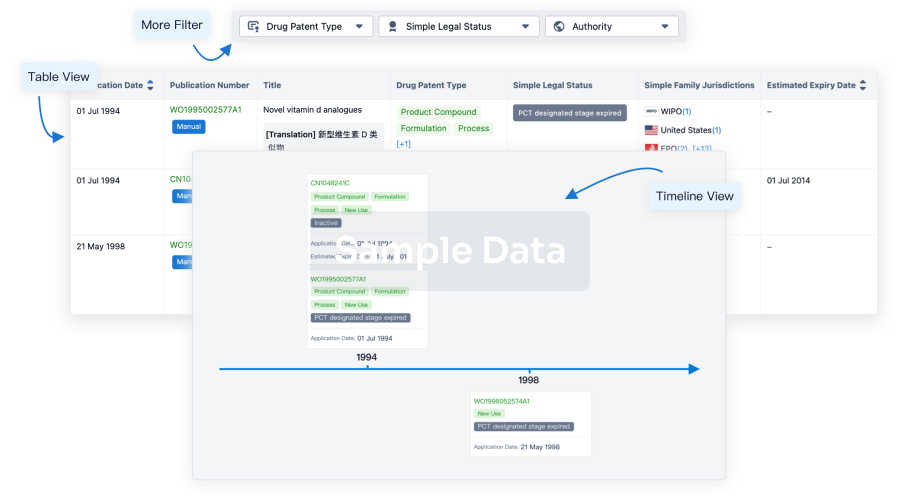

Core Patent

Boost your research with our Core Patent data.

login

or

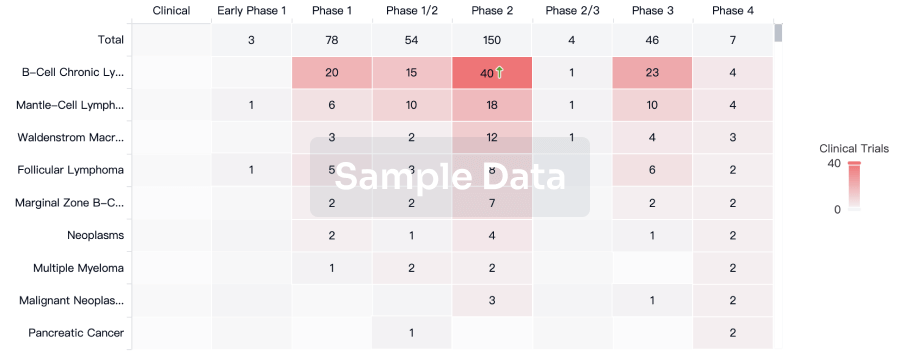

Clinical Trial

Identify the latest clinical trials across global registries.

login

or

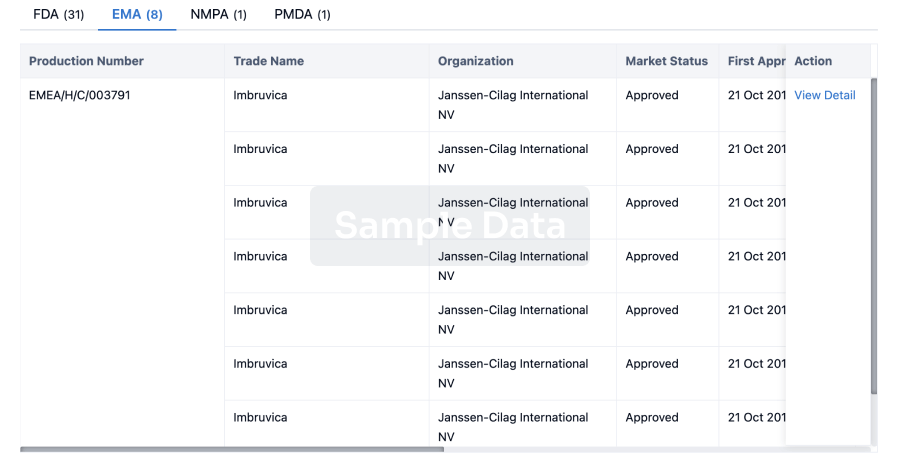

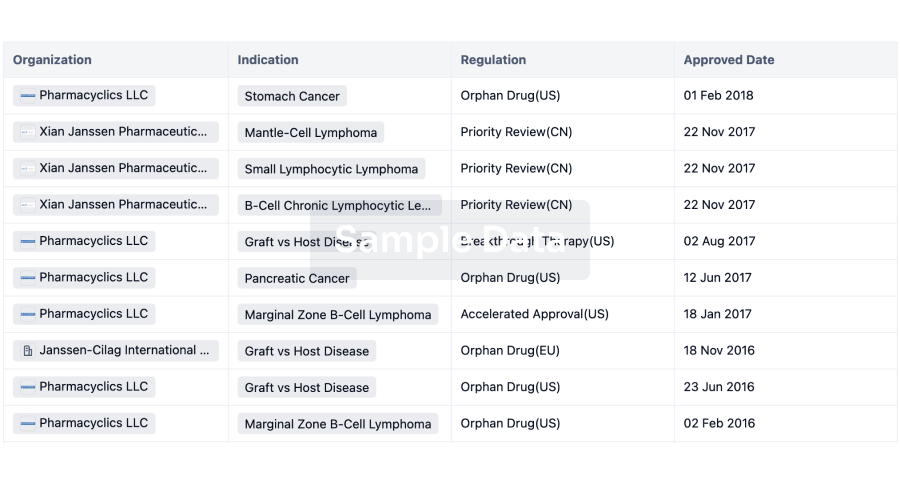

Approval

Accelerate your research with the latest regulatory approval information.

login

or

Regulation

Understand key drug designations in just a few clicks with Synapse.

login

or

AI Agents Built for Biopharma Breakthroughs

Accelerate discovery. Empower decisions. Transform outcomes.

Get started for free today!

Accelerate Strategic R&D decision making with Synapse, PatSnap’s AI-powered Connected Innovation Intelligence Platform Built for Life Sciences Professionals.

Start your data trial now!

Synapse data is also accessible to external entities via APIs or data packages. Empower better decisions with the latest in pharmaceutical intelligence.

Bio

Bio Sequences Search & Analysis

Sign up for free

Chemical

Chemical Structures Search & Analysis

Sign up for free