Request Demo

Last update 03 Feb 2026

ios H2

Last update 03 Feb 2026

Overview

Basic Info

Drug Type Protein drugs |

Synonyms ios-H2, IOS-1002 |

Action inhibitors |

Mechanism KIR3DL1 inhibitors(killer cell immunoglobulin like receptor, three Ig domains and long cytoplasmic tail 1 inhibitors), LILRB1 inhibitors(Leukocyte immunoglobulin-like receptor B1 inhibitors), LILRB2 inhibitors(Leukocyte immunoglobulin-like receptor subfamily B member 2 inhibitors) |

Therapeutic Areas |

Active Indication |

Inactive Indication |

Originator Organization |

Active Organization |

Inactive Organization- |

License Organization |

Drug Highest PhasePreclinical |

First Approval Date- |

Regulation- |

Login to view timeline

Related

1

Clinical Trials associated with ios H2NCT05763004

A Phase 1a/1b, First-in-human, Open-label, Non-randomized, Multicenter, Dose Escalation and Cohort Expansion Study to Evaluate the Safety, Tolerability, Efficacy, Immunogenicity, Pharmacokinetics, and Pharmacodynamics of IOS 1002 Administered Alone and in Combination with Pembrolizumab, a PD-1 Monoclonal Antibody in Advanced Solid Tumors

The goal of this clinical trial is to learn about IOS-1002 in patients with solid tumors.

The main questions it aims to answer are:

* To determine the safety and tolerability of various doses of IOS-1002 administered alone and/or in combination with KEYTRUDA® (pembrolizumab) in a single dose escalation scheme

* To determine the safety, tolerability and efficacy of a selected dose of IOS-1002 administered every 2 weeks alone and in combination with a PD-1 Antibody

The study will be conducted in 3 parts:

* Part A (Phase 1a, monotherapy and combination therapy dose escalation): IOS-1002 alone and IOS-1002 plus PD-1 mAb in patients with advanced solid tumors

* Part B (Phase 1b, monotherapy cohort expansion): IOS-1002 alone in patients with advanced solid tumors

* Part C (Phase 1b, combination therapy cohort expansion): IOS-1002 plus PD-1 mAb in patients with advanced solid tumors.

The main questions it aims to answer are:

* To determine the safety and tolerability of various doses of IOS-1002 administered alone and/or in combination with KEYTRUDA® (pembrolizumab) in a single dose escalation scheme

* To determine the safety, tolerability and efficacy of a selected dose of IOS-1002 administered every 2 weeks alone and in combination with a PD-1 Antibody

The study will be conducted in 3 parts:

* Part A (Phase 1a, monotherapy and combination therapy dose escalation): IOS-1002 alone and IOS-1002 plus PD-1 mAb in patients with advanced solid tumors

* Part B (Phase 1b, monotherapy cohort expansion): IOS-1002 alone in patients with advanced solid tumors

* Part C (Phase 1b, combination therapy cohort expansion): IOS-1002 plus PD-1 mAb in patients with advanced solid tumors.

Start Date15 Mar 2023 |

Sponsor / Collaborator |

100 Clinical Results associated with ios H2

Login to view more data

100 Translational Medicine associated with ios H2

Login to view more data

100 Patents (Medical) associated with ios H2

Login to view more data

3

Literatures (Medical) associated with ios H201 Jan 2022·Nutricion hospitalaria

Anti-diabetic effects of Inonotus obliquus extract in high fat diet combined streptozotocin-induced type 2 diabetic mice

Article

Author: Chen, Shanshan ; Lang, Hui ; Li, Haojie ; Liu, Yuan ; Li, Yongchun ; Ma, Yuanye ; Wu, Jie ; He, Yingxin ; Zhou, Min ; Guo, Erfeng

Introduction:

Introduction: type 2 diabetes (T2DM) is a complex disease affected by lifestyle and genetic factors. Although the drugs currently used to treat T2DM have certain curative effects, they still have some adverse side effects. Therefore, it is urgent to find new effective drugs with few side effects to cure T2DM. Objective: to study the role of Inonotus obliquus (IO) in diabetic model mice. Methods: we used high-fat diet (HFD) combined with streptozocin (STZ) to establish a diabetic mouse model. Mice were divided into non-high-fat diet group (ND), diabetes model group (HFD + STZ) and IO-treated diabetes model group (IO). The mice in the IO group were orally treated with IO (150 mg/kg) at 10 ml/kg for five weeks. Body weight, glucose level, food intake and water consumption, glucose tolerance and insulin tolerance were evaluated in all mice. The pathological sections of liver, kidney and pancreas were observed by hematoxylin-eosin staining. Results: after IO administration, the blood glucose level, water consumption, low-density lipoprotein (LDL) and triacylglycerol (TG) levels of mice decreased. Compared with the HFD + STZ group, the number of normal islet β cells increased and focal necrosis of the liver was significantly reduced in the IO administration group. Conclusions: IO reduced the levels of blood glucose, restored body weight, and enhanced insulin sensitivity along with insulin tolerance and glucose tolerance in diabetic mice. Additionally, IO also reversed HFD and STZ-induced organ injury.

Clinical and experimental rheumatologyQ3 · MEDICINE

Survival and safety of infliximab bio-original and infliximab biosimilar (CT-P13) in usual rheumatology care.

Q3 · MEDICINE

Article

Author: Paalanen, Kirsi ; Kokko, Arto ; Asikainen, Juha ; Borodina, Jelena ; Sokka, Tuulikki ; Hannonen, Pekka ; Nikiphorou, Elena ; Rannio, Tuomas

OBJECTIVES:

Reports to-date indicate similarity between infliximab biosimilar (IB) and infliximab bio-original (IO) in clinical efficacy and safety. This study examines the survival of IB and IO using routinely collected data over a 2-year period.

METHODS:

Routinely collected clinical data inputted directly in an electronic database at a large rheumatology centre were analysed. Adult patients taking IO or IB for any rheumatological diagnosis were included. Kaplan-Meier survival analyses were used to examine IB and IO survival, with a sub-group analysis among those starting infliximab from 2008 onwards.

RESULTS:

Out of 395 patients analysed, 53% (n=209) were female; the majority had rheumatoid arthritis (31%) followed by spondyloarthritis (28%). Ninety-nine patients had IB as the first infliximab drug. Patients who started on IB vs. IO as their first infliximab product, had better survival over the first 2 years (log rank=0.001). Discontinuation due to inefficacy was much commoner in IO versus IB users (18 vs. 5%). In patients switching from IO to IB, drug survival was better versus those receiving IB as the first infliximab drug (log rank=0.073).

CONCLUSIONS:

IB was well-tolerated and comparable to IO, with no additional safety signals identified. The results suggest superior survival of IB over IO over the first 2 years.

Cancers

IOS-1002, a Stabilized HLA-B57 Open Format, Exerts Potent Anti-Tumor Activity

Article

Author: Ebersbach, Hilmar ; Kumar, Anil ; Coats, Steve ; Woods, Richard ; Gualandi, Marco ; Marroquin Belaunzaran, Osiris ; Renner, Christoph ; Rafiei, Anahita ; Brunner, Kathrin ; Yang, Chia-Lung ; Sigrist, John

HLA-B27 and HLA-B57 are associated with autoimmunity and long-term viral control and protection against HIV and HCV infection; however, their role in cancer immunity remains unknown. HLA class I molecules interact with innate checkpoint receptors of the LILRA, LILRB and KIR families present in diverse sets of immune cells. Here, we demonstrate that an open format (peptide free conformation) and expression- and stability-optimized HLA-B57-B2m-IgG4_Fc fusion protein (IOS-1002) binds to human leukocyte immunoglobulin-like receptor B1 and B2 (LILRB1 and LILRB2) and to killer immunoglobulin-like receptor 3DL1 (KIR3DL1). In addition, we show that the IgG4 Fc backbone is required for engagement to Fcγ receptors and potent activation of macrophage phagocytosis. IOS-1002 blocks the immunosuppressive ITIM and SHP1/2 phosphatase signaling cascade, reduces the expression of immunosuppressive M2-like polarization markers of macrophages and differentiation of monocytes to myeloid-derived suppressor cells, enhances tumor cell phagocytosis in vitro and potentiates activation of T and NK cells. Lastly, IOS-1002 demonstrates efficacy in an ex vivo patient-derived tumor sample tumoroid model. IOS-1002 is a first-in-class multi-target and multi-functional human-derived HLA molecule that activates anti-tumor immunity and is currently under clinical evaluation.

4

News (Medical) associated with ios H223 Sep 2024

Pharmaceutical licensing collaboration1.Novo Nordisk Collaborates to Develop RNA Editing Drugs in a $530 Million Deal

On September 16, Korro Bio has entered into a collaboration with Novo Nordisk to develop RNA editing candidates targeting two undisclosed targets, which could be used to treat diseases such as obesity, diabetes, and cardiovascular conditions. Under the agreement, Novo Nordisk will pay $530 million in upfront and milestone payments, in addition to tiered royalties and research funding for the two projects. Korro Bio will be responsible for preclinical development of the projects, after which Novo Nordisk can opt to proceed with clinical testing.

Korro Bio stated that its OPERA platform uses oligonucleotides to "leverage natural processes within the human body" by modifying mRNA to regulate protein function. Since this technology does not alter DNA, its RNA editing method is precise and tunable, with the potential for increased specificity and long-term tolerability.

2.MaxCyte Partners with Kamau to Develop Gene Therapy for Genetic Diseases

On September 16, MaxCyte has entered into a partnership with Kamau Therapeutics, granting Kamau non-exclusive research, clinical, and commercial rights to MaxCyte’s Flow Electroporation technology and ExPERT platform to support the development of Kamau’s novel gene correction technology using homology-directed repair (HDR). MaxCyte is entitled to annual license fees and revenue associated with the project.

Kamau is a next-generation gene correction company, leveraging HDR editing technology based on the first-generation CRISPR-Cas9 system, which not only cuts DNA but also provides a template for DNA repair. MaxCyte's ExPERT instrument portfolio offers next-generation electroporation technology, facilitating complex and scalable cell engineering.

3.AbbVie Partners with Ripple Therapeutics in a $300 Million-Plus Glaucoma Therapy Deal

On September 17, Ripple Therapeutics announced a collaboration and licensing agreement with AbbVie to develop the next-generation glaucoma treatment, RTC-620. Under the agreement, Ripple will lead preclinical development of RTC-620, while AbbVie will handle its clinical and commercialization activities once the option is exercised. Ripple will receive $21.8 million upfront and could earn up to $290 million in option and milestone payments, along with tiered royalties on net sales.

RTC-620 is a biodegradable, sustained-release anterior chamber implant designed for repeat administration to reduce intraocular pressure in patients with open-angle glaucoma or ocular hypertension. Ripple’s innovative drug delivery platform allows for controlled drug release without the use of polymers or excipients.

4.Nippon Shinyaku Secures $1.5 Billion Distribution Rights for New DMD Drug

On September 17, Nippon Shinyaku and Capricor Therapeutics announced the signing of a letter of intent to engage in exclusive negotiations over the distribution rights for CAP-1002 (Deramiocel) in Europe for the treatment of Duchenne muscular dystrophy (DMD). Under the agreement, Capricor will receive a $15 million equity investment and a $20 million upfront payment upon the signing of the final agreement. The deal also includes potential milestone payments up to $715 million, with double-digit royalties on product revenue, bringing the total potential deal value to approximately $1.5 billion.

CAP-1002 is an exosome-based cell therapy composed of human allogeneic cardiosphere-derived cells (CDCs) and is intended for the treatment of various forms of DMD, regardless of the genetic mutation type. A Phase 2 trial conducted in the U.S., HOPE-2, showed that the therapy improved upper limb and heart function in advanced DMD patients. CAP-1002 is currently undergoing a Phase 3 study, HOPE-3, across several hospitals in the U.S.

5.Vectura Fertin Pharma Sells Subsidiary for Nearly £300 Million

On September 17, Philip Morris International's subsidiary, Vectura Fertin Pharma, announced the sale of its subsidiary Vectura to Molex Asia Holdings. As part of the deal, a master service agreement (MSA) has been established to develop Vectura Fertin Pharma's proprietary inhalation therapy pipeline. The sale includes £150 million in upfront cash consideration, with potential deferred payments of up to £148 million.

Vectura specializes in the design and formulation of inhaled drug delivery devices. After the sale, Vectura will be operated under Molex’s Phillips Medisize division, enhancing the latter’s capability to offer a broader range of inhalation combination drug devices and solutions to pharmaceutical customers.

6.Axcelead DDP Collaborates with Eli Lilly to Develop Multiple Drugs

On September 18, Axcelead DDP announced a strategic research and collaboration agreement with Eli Lilly on multiple drug discovery projects. Axcelead DDP, leveraging its comprehensive drug discovery capabilities and innovative technologies (including artificial intelligence), is committed to advancing innovation in drug discovery. Under the agreement, Axcelead DDP will receive upfront payments and will be eligible for additional milestone payments based on the progress of each drug discovery project.

7.Organon Acquires Dermavant for $1.2 Billion

On September 18, Organon and Dermavant Sciences announced a definitive agreement under which Organon will acquire Dermavant, including its innovative therapy Vtama (tapinarof) cream. Dermavant Sciences is a biopharmaceutical company specializing in immunodermatology. Under the agreement, Organon will pay $175 million in upfront payments, $75 million in milestone payments, and up to $950 million in commercial milestone payments. Vtama cream is a non-steroidal, once-daily topical treatment that reduces inflammation and restores the skin barrier by activating aryl hydrocarbon receptors in the skin. The product was approved by the U.S. FDA in May 2022 for the treatment of adults with mild, moderate, and severe plaque psoriasis. The FDA is also reviewing a supplemental new drug application (sNDA) for the drug as a potential treatment for atopic dermatitis in adults and children aged two years and older.

8.Aosairui Biomedical and Puli Pharmaceutical Sign Collaboration Agreement

On September 19, Aosairui Biomedical and Puli Pharmaceutical announced the signing of a collaboration agreement for the research and development of iron-based nano MRI contrast agents at the IND stage. This agreement builds on the progress Puli Pharmaceutical has made with its novel polydopamine micelle-based MRI contrast agent and the early-stage research and candidate compound (PCC) identification for tumor theranostics. Following the signing, the company will continue to develop the candidate compounds and pursue IND applications in compliance with regulatory requirements in both China and the United States.

9.Novo Nordisk Invests $600 Million in Extrahepatic LNP Delivery Technology

On September 19, NanoVation Therapeutics announced a collaboration with Novo Nordisk aimed at developing innovative gene therapies to treat cardiometabolic diseases and rare diseases. Under the agreement, NanoVation will receive research funding and is eligible to receive up to approximately $600 million in upfront and potential milestone payments over the course of the multi-year collaboration. Novo Nordisk will gain exclusive global rights to NanoVation’s LNP technology for two major projects, with the potential to expand to five additional targets for cardiometabolic and rare diseases.

NanoVation boasts a broad and expanding library of innovative lipids and LNP components and has developed a proprietary long-circulating lipid nanoparticle (lcLNP) RNA delivery technology. In preclinical studies, this technology has demonstrated higher efficacy, safety, and stability than traditional delivery systems, enabling the delivery of nucleic acids to various cell types beyond the liver.

Pharmaceutical Financing Events1.Nura Bio Raises Over $140 Million in Series A Funding

On September 17, Nura Bio announced the completion of more than $140 million in Series A financing. This includes an initial $73 million announced in 2020, with an additional $68 million raised in this round. The funding was led by founding investor The Column Group, with participation from Samsara BioCapital, Euclidean Capital, and Sanofi Ventures.

Nura Bio is developing neuroprotective small-molecule therapies to treat debilitating neurodegenerative diseases. The lead asset in its small molecule pipeline, NB-4746, is a brain-penetrant SARM1 inhibitor that has demonstrated the ability to prevent axon degeneration and provide neuroprotection in preclinical models of various neurological injuries and diseases. Nura Bio plans to initiate a Phase 1b/2 trial of this product by 2025.

2.Nuvalent Completes $575 Million Follow-On Offering

On September 18, Nuvalent announced the completion of a large public offering of common stock, raising approximately $575 million in gross proceeds after deducting underwriting discounts, commissions, and other offering expenses.

Nuvalent focuses on creating precise targeted therapies for cancer patients, aiming to overcome the limitations of existing treatments targeting clinically validated kinase targets. The company is advancing multiple small-molecule drug candidates, including those targeting ROS1-positive, ALK-positive, and HER2-mutant non-small cell lung cancer, as well as several early-stage research programs in drug discovery.

3.Brenus Pharma Completes $25 Million Series A Funding

On September 18, Brenus Pharma announced the completion of a $25 million Series A funding round, led by the investment fund Angelor, with participation from UI Investissement, Fonds Régional Avenir Industrie, and others.

The proceeds from this financing will be used to fully fund the first-in-human proof-of-concept study for the STC-1010 cancer vaccine, which is being developed as a first-line treatment for metastatic colorectal cancer. The product is also planned to be expanded to other types of gastrointestinal tumors, such as pancreatic and liver cancers. Additionally, Brenus Pharma aims to accelerate the development of its product pipeline for other solid tumor indications, particularly its second candidate, STC-1020.

4.Syntax Bio Raises $15 Million

On September 18, Syntax Bio was founded with support from Astellas Venture Management and Illumina Ventures, raising $15 million. Other investors include DCVCBio, Civilization Ventures, EGB Capital, and Portal Innovations.

Syntax Bio focuses on leveraging its novel Cellgorithm platform technology to generate therapeutic cells from stem cells. This platform simulates human developmental processes at the epigenetic level, using a modified CRISPR system to regulate endogenous genes in an automated and time-controlled manner. By accelerating cell differentiation, this technology significantly reduces the time required to produce high-value cell types, addressing long-standing challenges in stem cell-derived therapies.

5.GC Therapeutics Raises $75 Million in Funding

On September 19, GC Therapeutics (GCTx) announced its emergence from stealth mode, having raised $65 million in Series A funding led by Cormorant Asset Management, bringing total funding to $75 million. Other investors include Mubadala Capital, Andreessen Horowitz (a16z) Bio + Health, and others.

GCTx is focused on developing first-in-class and best-in-class off-the-shelf cell therapies for the treatment of gastrointestinal, neurological, and immune diseases. Its TFome platform for induced pluripotent stem cell (iPSC) programming was invented and developed by a team of renowned scientists, overcoming the complexities of development and scaling associated with cell therapies.

6.ImmunOs Raises $11 Million in Series C Funding

On September 19, ImmunOs Therapeutics announced the completion of an $11 million Series C financing round. The round was led by Gimv, Pfizer Ventures, Mission BioCapital, and BioMed Partners, with support from new investor Double Point Ventures and other existing investors.

ImmunOs is currently using its immune modulation platform based on human leukocyte antigen (HLA) to develop first-in-class drugs for cancer and autoimmune diseases. The financing will further support ongoing clinical trials for its lead program, IOS-1002, aiming to complete the Phase 1a dose-escalation trial. IOS-1002 is a checkpoint inhibitor targeting LILRB1 (ILT2), LILRB2 (ILT4), and KIR3DL1, being developed for the treatment of advanced solid tumors.

For more information on the progress of pharmaceutical funding transactions, please consult the Synapse database.

19 Sep 2023

Former Novartis Executive Director brings significant expertise in manufacturing, operations, and technical development

Schlieren (Zurich Area), Switzerland, and Gaithersburg, MD, USA – September 19, 2023 – ImmunOs Therapeutics AG, a biopharmaceutical company leveraging its HLA-based technology platform to develop first-in-class therapeutics for the treatment of cancer and inflammatory diseases, today announced the appointment of Dr. Constanze Guenther as Senior Vice President, CMC and Technical Development.

Dr. Guenther joins ImmunOs from Novartis Pharma, where she most recently served as Global Portfolio Head Cell Therapy focusing on the successful transition of cell therapy programs from research to commercialization. In this role, she headed a team of technical project leads responsible for all CMC aspects of these programs. Previously at Novartis, Dr. Guenther led a team of more than 300 associates as Site Head of the main European site for manufacturing of Kymriah, the first FDA approved cell therapy. Prior to joining Novartis, she was Laboratory Head of Process Development and Analytics at Cytos Biotechnology, where she led a team of scientists and engineers responsible for process development and production of clinical material for various product candidates. Dr. Guenther received an executive MBA from HSG (St. Gallen, Switzerland), and holds a PhD in protein biotechnology and a diploma in biology, both from the University of Halle, Germany.

"We warmly welcome Constanze to ImmunOs. We are excited to have her join the team and lead our CMC and technical development efforts to develop and manufacture novel protein- and antibody-based therapies," said Steve Coats, PhD, Chief Development Officer at ImmunOs. "Constanze brings an outstanding track record in the development and manufacturing of innovative biologics. Her breadth and depth of expertise in technical development, manufacturing and operations will be important for advancing our first-in-class pipeline of multi-functional immunotherapies to and through clinical development."

"I believe that ImmunOs´ expertise in pioneering HLA-based therapeutics focusing on both oncology and immunology, led by IOS-1002, ImmunOs´ lead clinical candidate in oncology, is at the forefront of current research," said Dr. Constanze Guenther, Senior Vice President, CMC and Technical Development at ImmunOs. "I am excited to use my expertise in the development and manufacturing of a broad range of novel biologics to help advance the Company´s pipeline of innovative HLA-based therapies, which are designed to address both the adaptive and innate immune systems."

###

About ImmunOs Therapeutics AG

ImmunOs Therapeutics AG leverages its HLA-based technology platform to develop first-in-class therapeutics for the treatment of cancer and inflammatory diseases. The Company has identified specific HLA molecules known to activate the immune system and is utilizing these HLA molecules as the backbone of novel therapies capable of stimulating both the innate and the adaptive immune systems of cancer patients to eliminate tumor cells. ImmunOs’ lead program is a multi-functional fusion protein that blocks specific LILRB (leukocyte immunoglobulin-like) and KIR (killer cell immunoglobulin-like) receptors and activates anti-tumor responses. ImmunOs is also developing antibodies to block the activation of specific HLA protein molecules associated with inflammatory diseases. The Company is supported by leading international investors including Samsara BioCapital, Lightspeed Venture Partners, Gimv, Pfizer Ventures, BioMed Partners, Schroder Adveq, Mission BioCapital, GL Capital, PEAK6, and Fiscus. ImmunOs is located in Schlieren, Switzerland, and Gaithersburg, MD, USA.

For more information, please visit

ImmunOs Therapeutics AG

Wagistrasse 18

8952 Schlieren (Zurich Area), Switzerland

info@immunostherapeutics.com

Media Inquiries

akampion

Dr. Ludger Wess / Ines-Regina Buth

Managing Partners

info@akampion.com

Tel. +49 40 88 16 59 64 /Tel. +49 30 23 63 27 68

ImmunotherapyExecutive ChangeCell TherapyDrug Approval

08 Jun 2022

Funding this week went mostly to companies with sophisticated tech platforms. Financing rounds will support platforms for tumor-targeting antibodies, genome-scale nucleic acid imaging and no-code bioinformatics for scientists to store and visualize data.

Coya Therapeutics

Coya Therapeutics, a clinical-stage biotechnology company utilizing cell-based therapy for neurodegenerative and autoimmune diseases, just announced it has raised approximately $10.3 million from institutional and accredited investors. This brings the company's total funding to date to over $20 million.

This financing paves the way for clinical development across several of Coya’s therapeutic programs, including COYA 101, an autologous Treg cell therapy for amyotrophic lateral sclerosis (ALS); COYA 201, an autologous Treg-derived exosome therapeutic for ALS; COYA 202, an allogenic Treg-derived exosome therapy for frontal temporal dementia; and a novel biologic program for investigational new drug (IND) submissions for ALS, frontal temporal dementia and Alzheimer’s disease.

ImmunOs Therapeutics

Switzerland-based ImmunOs Therapeutics closed an oversubscribed Series B financing round with $74 million. The round was led by new investors Samsara BioCapital, Lightspeed Venture Partners and Gimv, joined by new investors Mission BioCapital, GL Capital, PEAK6 Strategic Capital and Fiscus Financial, as well as existing investors Pfizer Ventures, BioMed Partners, and Schroder Adveq.

The funding will propel ImmunOs’ clinical development of its lead program, IOS-1002, a first-in-class, multi-functional agent that targets components of the immune system, as well as several other immunotherapy treatments for solid and liquid tumors. The funding will also support ImmunOs’ new U.S. subsidiary to expand its international reach and execute U.S. clinical trials.

PineTree Therapeutics

PineTree Therapeutics, a pre-clinical stage biotech company that pioneers disruptive therapies in oncology and immuno-oncology, closed a Series A1 round of funding worth $23.5 million. Investors included InterVest, SK Securities, DSC Investment, J Curve Investment, Samho Green Investment and SJ Investment Partners.

With the money, PineTree will advance its oncology and viral disease platforms, including its Tumor Associated Essential Receptor Targeting AntiBody (TAER-TAB) platform, which targets and degrades drug-resistant and difficult-to-treat receptors on types of tumors and types of immune and disease cells.

National Resilience

Complex medicine biomanufacturing company National Resilience raised $625 million in a Series D financing. That amount is on top of a previously unannounced $600 million Series C financing the company completed in August 2021.

“These new funds will help support our next phase of growth, as we continue to innovate biomanufacturing across all our modalities, expand our footprint to serve customers, sign strategic collaborations and support the developers of a new generation of complex medicines,” Rahul Singhvi, Sc.D., CEO of Resilience, said.

The funding will also help Resilience advance its R&D efforts, including stable cell lines for viral vector production and continuous manufacturing for biologics.

Vizgen

Cambridge, Massachusetts-based Vizgen closed a Series C financing, bringing in $85.2 million. The financing was led by Blue Water Life Science Advisors and ARCH Venture Partners and included support from Sofina, Northpond Ventures, Tao Capital Partners, Novalis LifeSciences, David Walt and others.

Vizgen, which visualizes single-cell spatial genomics information, will use the funds to advance drug discovery and improve insight into tissue-scale basic research and translational medicine. The funding will also hone the company’s Merscope platform, which enables massively multiplexed, genome-scale nucleic acid imaging with high accuracy and detection efficiency at subcellular resolution.

LatchBio

In a Series A round of financing, San Francisco-based LatchBio raised $28 million for its modern data analysis stack. The funding was co-led by Coatue and Lux Capital with participation from Hummingbird Ventures, Caffeinated Capital, and existing investors Haystack and Fifty Years.

With the money, LatchBio will continue its work on its cloud-based platform, which offers no-code bioinformatics for scientists to store and visualize data. The platform helps solve computational and logistical challenges for researchers with its biocomputing workflows, which can speed up discovery and translational research.

Vernal Biosciences

Vernal Biosciences completed a $21 million financing with the goal of fully integrating its mRNA manufacturing solutions. The financing, led by Ampersand Capital Partners and Dynamk Capital with participation from Alloy Therapeutics, ATUM and Charles River Laboratories, Inc., will support Vernal’s goal of bringing design sequences, plasmid template and RNA manufacturing, release testing of drug products and other mRNA and LNP-mRNA manufacturing services all under a single contract.

AntibodyFirst in ClassCell TherapyImmunotherapyCollaborate

100 Deals associated with ios H2

Login to view more data

R&D Status

10 top R&D records. to view more data

Login

| Indication | Highest Phase | Country/Location | Organization | Date |

|---|---|---|---|---|

| Advanced Malignant Solid Neoplasm | Phase 1 | Australia | 15 Mar 2023 | |

| Hematologic Neoplasms | Preclinical | Switzerland | - |

Login to view more data

Clinical Result

Clinical Result

Indication

Phase

Evaluation

View All Results

| Study | Phase | Population | Analyzed Enrollment | Group | Results | Evaluation | Publication Date |

|---|

Phase 1 | 28 | zuvxiqzklj(vjmhbkxtqk) = 32 adverse events related to the treatment with 3 grade 3 events were reported. pjsmoshxjo (sfllfaurjg ) View more | Positive | 17 Oct 2025 | |||

Login to view more data

Translational Medicine

Boost your research with our translational medicine data.

login

or

Deal

Boost your decision using our deal data.

login

or

Core Patent

Boost your research with our Core Patent data.

login

or

Clinical Trial

Identify the latest clinical trials across global registries.

login

or

Approval

Accelerate your research with the latest regulatory approval information.

login

or

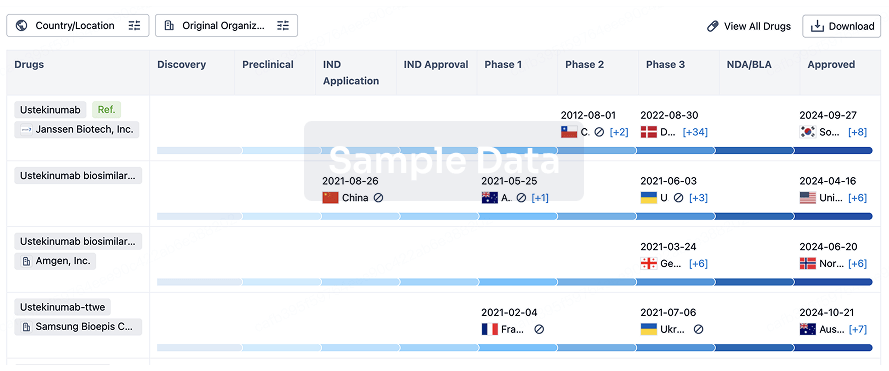

Biosimilar

Competitive landscape of biosimilars in different countries/locations. Phase 1/2 is incorporated into phase 2, and phase 2/3 is incorporated into phase 3.

login

or

Regulation

Understand key drug designations in just a few clicks with Synapse.

login

or

AI Agents Built for Biopharma Breakthroughs

Accelerate discovery. Empower decisions. Transform outcomes.

Get started for free today!

Accelerate Strategic R&D decision making with Synapse, PatSnap’s AI-powered Connected Innovation Intelligence Platform Built for Life Sciences Professionals.

Start your data trial now!

Synapse data is also accessible to external entities via APIs or data packages. Empower better decisions with the latest in pharmaceutical intelligence.

Bio

Bio Sequences Search & Analysis

Sign up for free

Chemical

Chemical Structures Search & Analysis

Sign up for free