Request Demo

Last update 27 Feb 2026

Lutetium (177 Lu) Vipivotide Tetraxetan

Last update 27 Feb 2026

Overview

Basic Info

Drug Type Peptide Conjugate Radionuclide, Therapeutic radiopharmaceuticals |

Synonyms 177-Lutetium-PSMA-617(RadioMedix, Inc.), [Lu-177] vipivotide tetraxetan, Lu-177-PSMA-617 Lutetium-177-PSMA-617 + [15] |

Target |

Action inhibitors |

Mechanism PSMA inhibitors(Prostate-specific membrane antigen inhibitors) |

Therapeutic Areas |

Inactive Indication- |

Originator Organization |

Active Organization |

Inactive Organization- |

License Organization |

Drug Highest PhaseApproved |

First Approval Date United States (23 Mar 2022), |

RegulationOrphan Drug (South Korea), Priority Review (China), Breakthrough Therapy (United States) |

Login to view timeline

Structure/Sequence

Molecular FormulaC49H68LuN9O16 |

InChIKeyRSTDSVVLNYFDHY-NLQOEHMXSA-K |

CAS Registry1703749-62-5 |

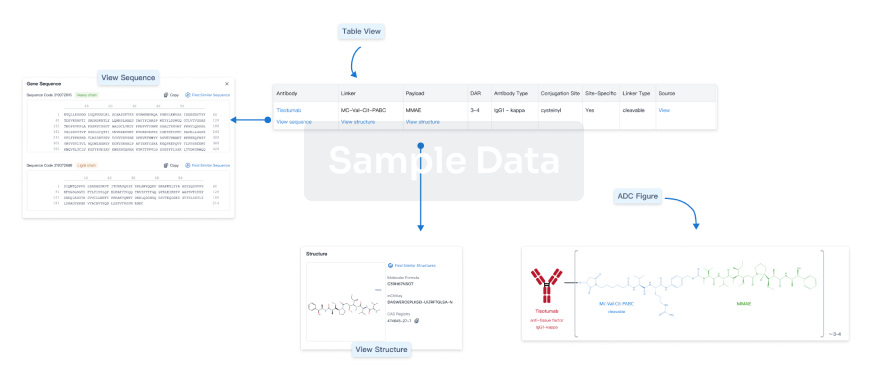

Boost your research with our ADC technology data.

login

or

R&D Status

Approved

10 top approved records. to view more data

Login

| Indication | Country/Location | Organization | Date |

|---|---|---|---|

| PSMA-Positive Castration-Resistant Prostatic Cancer | United States | 23 Mar 2022 |

Developing

10 top R&D records. to view more data

Login

| Indication | Highest Phase | Country/Location | Organization | Date |

|---|---|---|---|---|

| Hormone-dependent prostate cancer | NDA/BLA | China | 04 Nov 2025 | |

| Hormone-dependent prostate cancer | NDA/BLA | China | 04 Nov 2025 | |

| Hormone-dependent prostate cancer | NDA/BLA | China | 04 Nov 2025 | |

| Oligometastatic Prostate Carcinoma | Phase 3 | United States | 12 Mar 2024 | |

| Oligometastatic Prostate Carcinoma | Phase 3 | China | 12 Mar 2024 | |

| Oligometastatic Prostate Carcinoma | Phase 3 | Japan | 12 Mar 2024 | |

| Oligometastatic Prostate Carcinoma | Phase 3 | Argentina | 12 Mar 2024 | |

| Oligometastatic Prostate Carcinoma | Phase 3 | Australia | 12 Mar 2024 | |

| Oligometastatic Prostate Carcinoma | Phase 3 | Austria | 12 Mar 2024 | |

| Oligometastatic Prostate Carcinoma | Phase 3 | Belgium | 12 Mar 2024 |

Login to view more data

Clinical Result

Clinical Result

Indication

Phase

Evaluation

View All Results

Not Applicable | 18 | njwmiqsobj(xgvjuvdjpn) = sfroeotcbs rihltqkekk (gyqszreskg ) View more | Positive | 05 Dec 2025 | |||

Phase 2 | Metastatic Clear Cell Renal Cell Carcinoma PSMA-positive | 48 | grzzedynlc(lpzaznsfqb) = The most common grade ≥3 adverse events were neutropenia (15%, mainly grade 3), fatigue (10%), and thrombocytopenia (8%) sbpjpvtoxb (welvftfmag ) View more | Positive | 01 Dec 2025 | ||

Not Applicable | 81 | dfivuiasla(lhqlgdknph) = Grade ≥3 hematologic toxicities included anemia (n=15; 19%) and thrombocytopenia (n=3, 4%); grade ≥3 acute kidney injury was seen in 1 pt. 12 (15%) and 5 (6%) pts had dose delays or reductions, respectively, and 35 (43%) had early treatment discontinuation, 9 (26%) due to toxicity. 25 pts (31%) were hospitalized during therapy, with ICU-level care needed in 2 pts (3%). There were no treatment-related deaths. ovdlfqhttw (hhowhxiejs ) | Positive | 17 Oct 2025 | |||

Phase 3 | Metastatic castration-resistant prostate cancer PSMA-positive | 2,390 | rgcblevzqd(jabexpmsuq) = wcpgjlgckj ykslvjfevj (nlcxmlivcs ) View more | Positive | 17 Oct 2025 | ||

ARPI change | rgcblevzqd(jabexpmsuq) = pbkvbeweui ykslvjfevj (nlcxmlivcs ) View more | ||||||

Phase 2 | Metastatic Clear Cell Renal Cell Carcinoma PSMA-positive | 48 | ipeactlgfp(mtpipexiau) = The most common grade ≥3 adverse events were neutropenia (38%, mainly grade 1-2) and fatigue (13%) zmnfuatkby (ygopwsygla ) | Positive | 17 Oct 2025 | ||

Phase 2 | 90 | bcfhgigrgh(lhyrdcepnh) = arruncwfmf clxwlyjrny (ymgolpzpqd ) | Positive | 17 Oct 2025 | |||

bcfhgigrgh(lhyrdcepnh) = bojucgkhrq clxwlyjrny (ymgolpzpqd ) | |||||||

Not Applicable | 50 | (CH+) | fhorxtnhjg(itljbehgdy) = dihjaenmfq srpdgonqfn (sijlrpiute ) View more | Positive | 17 Oct 2025 | ||

(CH-) | fhorxtnhjg(itljbehgdy) = bbjnupiaze srpdgonqfn (sijlrpiute ) View more | ||||||

Phase 3 | Hormone-dependent prostate cancer PSMA-positive | 1,144 | [177Lu]Lu-PSMA-617 + ADT + ARPI | njsbbswejl(jgqinrnkja) = tdtkssweud usqplcicpx (tnsukrwfix ) View more | Positive | 17 Oct 2025 | |

ADT + ARPI | njsbbswejl(jgqinrnkja) = ddrnawaqcg usqplcicpx (tnsukrwfix ) View more | ||||||

Not Applicable | Metastatic castration-resistant prostate cancer PSMA-positive | 3,198 | byvunwciii(ubtccdkwcu) = 3.8% uqrgniqxir (ibczamglfo ) View more | Positive | 17 Oct 2025 | ||

Not Applicable | 3,198 | frlitjappz(bkhdiymzxw) = hukafuxvzc rwftxsvtnt (ymdirkjjig ) View more | Positive | 17 Oct 2025 | |||

(non-retreated pts) | tkiodbskaz(tsvkorilcd) = vdwnqbyixa kjhulqqoam (fqnrogyamh ) View more |

Login to view more data

Translational Medicine

Boost your research with our translational medicine data.

login

or

Deal

Boost your decision using our deal data.

login

or

Core Patent

Boost your research with our Core Patent data.

login

or

Clinical Trial

Identify the latest clinical trials across global registries.

login

or

Approval

Accelerate your research with the latest regulatory approval information.

login

or

Regulation

Understand key drug designations in just a few clicks with Synapse.

login

or

AI Agents Built for Biopharma Breakthroughs

Accelerate discovery. Empower decisions. Transform outcomes.

Get started for free today!

Accelerate Strategic R&D decision making with Synapse, PatSnap’s AI-powered Connected Innovation Intelligence Platform Built for Life Sciences Professionals.

Start your data trial now!

Synapse data is also accessible to external entities via APIs or data packages. Empower better decisions with the latest in pharmaceutical intelligence.

Bio

Bio Sequences Search & Analysis

Sign up for free

Chemical

Chemical Structures Search & Analysis

Sign up for free