Request Demo

Last update 16 May 2025

OpRegen (Lineage Cell Therapeutics)

Last update 16 May 2025

Overview

Basic Info

Drug Type Stem cell therapy |

Synonyms OpRegen RPE cells, OpRegenPlus, Retinal pigment epithelial cell replacement therapy (Cell Cure Neurosciences) + [4] |

Target- |

Action- |

Mechanism Cell replacements |

Therapeutic Areas |

Inactive Indication- |

Originator Organization |

Active Organization |

Inactive Organization |

License Organization |

Drug Highest PhasePhase 2 |

First Approval Date- |

RegulationRegenerative Medicine Advanced Therapy (United States) |

Login to view timeline

Related

2

Clinical Trials associated with OpRegen (Lineage Cell Therapeutics)NCT05626114

A Phase IIa, Multicenter, Open-Label, Single-Arm Study To Optimize Subretinal Surgical Delivery And To Evaluate Safety And Activity Of Opregen In Patients With Geographic Atrophy Secondary to Age-Related Macular Degeneration

This study will evaluate the success and safety of subretinal surgical delivery as well as the preliminary activity of OpRegen in participants with geographic atrophy (GA) secondary to age-related macular degeneration (AMD). All endpoints are assessed for the study eye unless otherwise indicated

Start Date23 Mar 2023 |

Sponsor / Collaborator |

NCT02286089

Phase I/IIa Dose Escalation Safety and Efficacy Study of Human Embryonic Stem Cell-Derived Retinal Pigment Epithelium Cells Transplanted Subretinally in Patients With Advanced Dry-Form Age-Related Macular Degeneration (Geographic Atrophy)

The main objective of the study is evaluation of the safety and tolerability of OpRegen - Human embryonic stem cell-derived retinal pigment epithelial (RPE) cells. The study will also include initial exploration of the ability of transplanted OpRegen cells to engraft, survive, and moderate disease progression.

Start Date01 Apr 2015 |

Sponsor / Collaborator |

100 Clinical Results associated with OpRegen (Lineage Cell Therapeutics)

Login to view more data

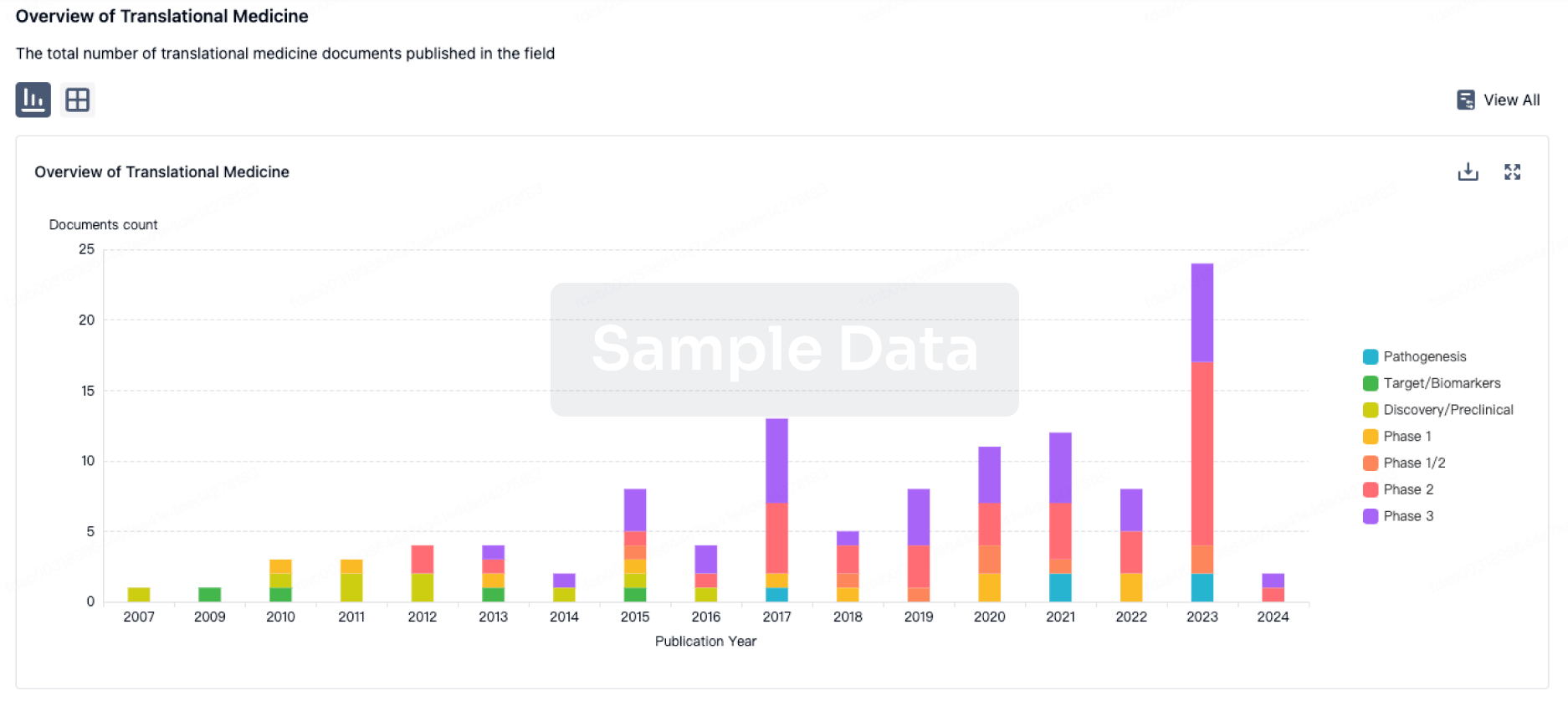

100 Translational Medicine associated with OpRegen (Lineage Cell Therapeutics)

Login to view more data

100 Patents (Medical) associated with OpRegen (Lineage Cell Therapeutics)

Login to view more data

1

Literatures (Medical) associated with OpRegen (Lineage Cell Therapeutics)International journal of molecular sciencesQ2 · BIOLOGY

A Systematic Review on Transplantation Studies of the Retinal Pigment Epithelium in Animal Models

Q2 · BIOLOGY

ReviewOA

Author: Wagstaff, Ellie ; van den Hurk, Koen ; Koster, Céline ; Wever, Kimberley ; Bergen, Arthur ; Hooijmans, Carlijn

The retinal pigment epithelium (RPE) and the adjacent light-sensitive photoreceptors form a single functional unit lining the back of the eye. Both cell layers are essential for normal vision. RPE degeneration is usually followed by photoreceptor degeneration and vice versa. There are currently almost no effective therapies available for RPE disorders such as Stargardt disease, specific types of retinitis pigmentosa, and age-related macular degeneration. RPE replacement for these disorders, especially in later stages of the disease, may be one of the most promising future therapies. There is, however, no consensus regarding the optimal RPE source, delivery strategy, or the optimal experimental host in which to test RPE replacement therapy. Multiple RPE sources, delivery methods, and recipient animal models have been investigated, with variable results. So far, a systematic evaluation of the (variables influencing) efficacy of experimental RPE replacement parameters is lacking. Here we investigate the effect of RPE transplantation on vision and vision-based behavior in animal models of retinal degenerated diseases. In addition, we aim to explore the effect of RPE source used for transplantation, the method of intervention, and the animal model which is used. Methods: In this study, we systematically identified all publications concerning transplantation of RPE in experimental animal models targeting the improvement of vision (e.g., outcome measurements related to the morphology or function of the eye). A variety of characteristics, such as species, gender, and age of the animals but also cell type, number of cells, and other intervention characteristics were extracted from all studies. A risk of bias analysis was performed as well. Subsequently, all references describing one of the following outcomes were analyzed in depth in this systematic review: a-, b-, and c-wave amplitudes, vision-based, thickness analyses based on optical coherence tomography (OCT) data, and transplant survival based on scanning laser ophthalmoscopy (SLO) data. Meta-analyses were performed on the a- and b-wave amplitudes from electroretinography (ERG) data as well as data from vision-based behavioral assays. Results: original research articles met the inclusion criteria after two screening rounds. Overall, most studies were categorized as unclear regarding the risk of bias, because many experimental details were poorly reported. Twenty-three studies reporting one or more of the outcome measures of interest were eligible for either descriptive (thickness analyses based on OCT data; n = 2) or meta-analyses. RPE transplantation significantly increased ERG a-wave (Hedges’ g 1.181 (0.471–1.892), n = 6) and b-wave (Hedges’ g 1.734 (1.295–2.172), n = 42) amplitudes and improved vision-based behavior (Hedges’ g 1.018 (0.826–1.209), n = 96). Subgroup analyses revealed a significantly increased effect of the use of young and adolescent animals compared to adult animals. Moreover, transplanting more cells (in the range of 105 versus in the range of 104) resulted in a significantly increased effect on vision-based behavior as well. The origin of cells mattered as well. A significantly increased effect was found on vision-based behavior when using ARPE-19 and OpRegen® RPE. Conclusions: This systematic review shows that RPE transplantation in animal models for retinal degeneration significantly increases a- and b- wave amplitudes and improves vision-related behavior. These effects appear to be more pronounced in young animals, when the number of transplanted cells is larger and when ARPE-19 and OpRegen® RPE cells are used. We further emphasize that there is an urgent need for improving the reporting and methodological quality of animal experiments, to make such studies more comparable.

81

News (Medical) associated with OpRegen (Lineage Cell Therapeutics)13 May 2025

CARLSBAD, Calif.--(BUSINESS WIRE)--Lineage Cell Therapeutics, Inc. (NYSE American and TASE: LCTX), a clinical-stage biotechnology company developing novel allogeneic, or “off the shelf”, cell therapies for serious neurological and ophthalmic conditions, today reported its first quarter 2025 financial and operating results and will host a conference call today at 4:30 p.m. Eastern Time to discuss these results and provide a business update.

“Lineage has grown increasingly confident in OpRegen’s potential to address a significant medical need,” stated Brian M. Culley, Lineage CEO. “Our optimism is driven in part by OpRegen’s uniquely durable treatment effects, lasting up to 24 months, with a 36-month data update from Roche and Genentech forthcoming next month. We are also encouraged by independent first-in-human results recently reported by competitors, which adds validation to an RPE transplant mechanism of action providing functional improvements beyond the reach of currently approved dry AMD therapies. Together, these findings lend support to one-time dosing, a key advantage over the compliance-challenged monthly injections required for anti-complement therapy. While advancing the OpRegen program and the GAlette Study remains a key area of attention, we are equally excited to have recently initiated the DOSED clinical study of OPC1, while progressing ReSonanceTM for the treatment of sensorineural hearing loss and evaluating other strategically selected early-stage initiatives. As our cell therapy platforms gain further validation, we believe our pipeline and expertise position us as a compelling partner and investment opportunity.”

Select Business Highlights

RG6501 (OpRegen) Phase 1/2a Clinical Study 36 Month Results to be featured at Clinical Trials at the Summit (CTS) 2025 , and will be presented by Christopher D. Riemann, M.D. , Vitreoretinal Surgeon and Fellowship Director, Cincinnati Eye Institute (CEI) and University of Cincinnati School of Medicine, on behalf of Roche and Genentech , a member of the Roche Group.

Ongoing execution of Lineage’s contributions to its collaboration with Roche and Genentech across multiple functional areas, including support for the ongoing Phase 2a clinical study (the “GAlette Study”) in patients with geographic atrophy (GA) secondary to age-related macular degeneration (AMD) at sites in the U.S. and Israel. In addition to testing of other surgical parameters, Genentech currently plans to evaluate two proprietary surgical delivery devices that have potential advantages over available off-the-shelf devices in the GAlette Study.

Ongoing efforts to further support development of OpRegen RPE cell therapy under a separate services agreement with Genentech, including: (i) activities to support the ongoing Phase 1/2a study long term follow-up and currently enrolling GAlette Study; and (ii) additional technical training and materials related to our cell therapy technology platform to support commercial manufacturing strategies.

DOSED (Delivery of Oligodendrocyte Progenitor Cells for Spinal Cord Injury: Evaluation of a Novel Device) clinical study in subacute and chronic spinal cord patients initiated in February 2025; UC San Diego Health is the first participating study site.

Lineage and OPC1 program featured on CNN: “ He was paralyzed his last day of high school. How an experimental trial is showing ‘unexpected improvement ’ .”

3 rd Annual Spinal Cord Injury Investor Symposium (3 rd SCIIS) announced in partnership with the Christopher & Dana Reeve Foundation. The 3rd SCIIS will be fully virtual, with interactive and on-demand sessions available starting June 27, 2025. Event aims to bring together those working on treatments for spinal cord injury (SCI), including regulators, key opinion leaders, persons with lived experience, patient and community advocacy organizations and the investment community, to discuss perspectives on current and future treatments, impact and support SCI disease awareness and clinical trial participation through the implementation of patient appropriate clinical endpoints, and importantly, broaden awareness of and investment capital into SCI.

Balance Sheet Highlights

Cash, cash equivalents, and marketable securities of $47.9 million as of March 31, 2025, is expected to support planned operations into Q1 2027.

First Quarter Operating Results

Revenues: Revenue is generated primarily from collaboration revenues, royalties, and other revenues. Total revenues for the three months ended March 31, 2025 were $1.5 million, a net increase of $0.1 million as compared to $1.4 million for the same period in 2024. The increase was primarily driven by more collaboration revenue recognized from deferred revenues under the collaboration and license agreement with Roche.

Operating Expenses: Operating expenses are comprised of research and development (“R&D”) expenses and general and administrative (“G&A”) expenses. Total operating expenses for the three months ended March 31, 2025 were $8.0 million, a decrease of $0.1 million as compared to $8.1 million for the same period in 2024.

R&D Expenses: R&D expenses for the three months ended March 31, 2025 were $3.1 million, an increase of $0.1 million as compared to $3.0 million for the same period in 2024. The net increase was primarily driven by $0.2 million for our preclinical programs, partially offset by $0.1 million for our other research and development programs.

G&A Expenses: G&A expenses for the three months ended March 31, 2025 of $4.9 million were primarily in line with expenses for the same period in 2024.

Loss from Operations: Loss from operations for the three months ended March 31, 2025 was $6.5 million, a decrease of $0.2 million as compared to $6.7 million for the same period in 2024.

Other Income/(Expenses): Other income/(expenses) for the three months ended March 31, 2025 reflected other income of $2.4 million, compared to other income of $0.1 million for the same period in 2024. The net increase was primarily driven by changes in fair value of the warrant liabilities.

Net Loss Attributable to Lineage: The net loss attributable to Lineage for the three months ended March 31, 2025 was $4.1 million, or $0.02 per share (basic and diluted), compared to a net loss of $6.5 million, or $0.04 per share (basic and diluted), for the same period in 2024.

Conference Call and Webcast

Interested parties may access the conference call on May 13, 2025, by dialing (800) 715-9871 from the U.S. and Canada and should request the “Lineage Cell Therapeutics Call”. A live webcast of the conference call will be available online in the Investors section of Lineage’s website. A replay of the webcast will be available on Lineage’s website for 30 days and a telephone replay will be available through May 20th, 2025, by dialing (800) 770-2030 from the U.S. and Canada and entering conference ID number 1789489.

About Lineage Cell Therapeutics, Inc.

Lineage Cell Therapeutics is a clinical-stage biotechnology company developing allogeneic, or “off the shelf”, cell therapies for serious neurological and ophthalmic conditions. Lineage’s programs are based on its proprietary cell-based technology platform and associated development and manufacturing capabilities. From this platform, Lineage designs, develops, manufactures, and tests specialized human cells with anatomical and physiological functions similar or identical to cells found naturally in the human body. These cells are created by applying directed differentiation protocols to established, well-characterized, and self-renewing pluripotent cell lines. These protocols generate cells with characteristics associated with specific and desired developmental lineages. Cells derived from such lineages are transplanted into patients in an effort to replace or support cells that are absent or dysfunctional due to degenerative disease, aging, or traumatic injury, and to restore or augment the patient’s functional activity. Lineage’s neuroscience focused pipeline currently includes: (i) OpRegen, a retinal pigment epithelial cell therapy in Phase 2a development under a worldwide collaboration with Roche and Genentech, a member of the Roche Group, for the treatment of geographic atrophy secondary to age-related macular degeneration; (ii) OPC1, an oligodendrocyte progenitor cell therapy in Phase 1/2a development for the treatment of spinal cord injuries; (iii) ReSonance (ANP1), an auditory neuronal progenitor cell therapy for the potential treatment of auditory neuropathy; (iv) PNC1, a photoreceptor neural cell therapy for the potential treatment of vision loss due to photoreceptor dysfunction or damage; and (v) RND1, a novel hypoimmune induced pluripotent stem cell line being developed under a gene editing partnership. For more information, please visit www.lineagecell.com or follow the company on X/Twitter @LineageCell.

Forward-Looking Statements

Lineage cautions you that all statements, other than statements of historical facts, contained in this press release, are forward-looking statements. Forward-looking statements, in some cases, can be identified by terms such as “believe,” “aim,” “may,” “will,” “estimate,” “continue,” “anticipate,” “design,” “intend,” “expect,” “could,” “can,” “plan,” “potential,” “predict,” “seek,” “should,” “would,” “contemplate,” “project,” “target,” “tend to,” or the negative version of these words and similar expressions. Lineage’s forward-looking statements are based upon its current expectations and beliefs and involve assumptions that may never materialize or may prove to be incorrect. Such statements include, but are not limited to, statements relating to: the potential therapeutic benefits of OpRegen in patients with GA secondary to AMD or OpRegen’s ultimate success; the benefits of our services agreement with Genentech and its impact on advancing the OpRegen program; the potential effect of the Spinal Cord Symposium, including accelerating development in SCI research and treatment; Lineage’s belief that potential development partners and investors will find Lineage’s pipeline of internally-owned assets and cell-based know-how desirable as they are further demonstrated and validated; and that Lineage’s cash, cash equivalents and marketable securities is sufficient to support its planned operations into the first quarter of 2027. Forward-looking statements involve known and unknown risks, uncertainties and other factors that may cause Lineage’s actual results, performance or achievements to be materially different from future results, performance or achievements expressed or implied by the forward-looking statements in this press release, including, but not limited to, the following risks: that we may need to allocate our cash to unexpected events and expenses causing us to expend our cash, cash equivalents and marketable securities more quickly than expected; that development activities, preclinical activities, and clinical trials of our product candidates may not commence, progress or be completed as expected due to many factors within and outside of our control; that positive findings in early clinical and/or nonclinical studies of a product candidate may not be predictive of success in subsequent clinical and/or nonclinical studies of that candidate; that Roche and Genentech may not successfully advance OpRegen or be successful in completing further clinical trials for OpRegen and/or obtaining regulatory approval for OpRegen in any particular jurisdiction; that competing alternative therapies may adversely impact the commercial potential of OpRegen; that OpRegen may ultimately be proven to provide functional improvements from a one-time does beyond the reach of currently approved therapies; that OPC1 may not advance further in any clinical trials, and if it does, that any such clinical trials may not be successful; that the ongoing Israeli regional conflict may materially and adversely impact our manufacturing processes, including cell banking and product manufacturing for our cell therapy product candidates, all of which are conducted by our subsidiary in Jerusalem, Israel; that Lineage may not be able to manufacture sufficient clinical quantities of its product candidates in accordance with current good manufacturing practice; and those risks and uncertainties inherent in Lineage’s business and other risks discussed in Lineage’s filings with the Securities and Exchange Commission (SEC). Further information regarding these and other risks is included under the heading “Risk Factors” in Lineage’s periodic reports with the SEC, including Lineage’s most recent Annual Report on Form 10-K filed with the SEC and its other subsequent reports, which are available from the SEC’s website. You are cautioned not to place undue reliance on forward-looking statements, which speak only as of the date on which they were made. Lineage undertakes no obligation to update such statements to reflect events that occur or circumstances that exist after the date on which they were made, except as required by law. All forward-looking statements are expressly qualified in their entirety by these cautionary statements.

LINEAGE CELL THERAPEUTICS, INC. AND SUBSIDIARIES

CONDENSED CONSOLIDATED BALANCE SHEETS

(IN THOUSANDS)

(UNAUDITED)

March 31, 2025

December 31, 2024

ASSETS

CURRENT ASSETS

Cash and cash equivalents

$

47,886

$

45,789

Marketable securities

19

2,016

Accounts receivable

213

638

Prepaid expenses and other current assets

1,866

2,554

Total current assets

49,984

50,997

NONCURRENT ASSETS

Property and equipment, net

2,149

2,251

Operating lease right-of-use assets

1,904

2,144

Deposits and other long-term assets

504

614

Goodwill

10,672

10,672

Intangible assets, net

46,540

46,540

TOTAL ASSETS

$

111,753

$

113,218

LIABILITIES AND SHAREHOLDERS’ EQUITY

CURRENT LIABILITIES

Accounts payable and accrued liabilities

$

4,978

$

5,437

Operating lease liabilities, current portion

1,124

1,097

Finance lease liabilities, current portion

56

55

Deferred revenues, current portion

6,931

7,388

Total current liabilities

13,089

13,977

LONG-TERM LIABILITIES

Deferred tax liability

273

273

Deferred revenues, net of current portion

13,611

14,433

Operating lease liabilities, net of current portion

1,013

1,295

Finance lease liabilities, net of current portion

51

67

Warrant liabilities

6,061

6,161

TOTAL LIABILITIES

34,098

36,206

Commitments and contingencies (Note 13)

SHAREHOLDERS’ EQUITY

Preferred shares, no par value, 2,000 shares authorized; none issued and outstanding as of March 31, 2025 and December 31, 2024

—

—

Common shares, no par value, 450,000 shares authorized as of March 31, 2025 and December 31, 2024; 228,356 and 220,416 shares issued and outstanding as of March 31, 2025 and December 31, 2024, respectively

489,313

484,722

Accumulated other comprehensive loss

(2,681

)

(2,876

)

Accumulated deficit

(407,604

)

(403,465

)

Lineage's shareholders’ equity

79,028

78,381

Noncontrolling deficit

(1,373

)

(1,369

)

Total shareholders’ equity

77,655

77,012

TOTAL LIABILITIES AND SHAREHOLDERS’ EQUITY

$

111,753

$

113,218

LINEAGE CELL THERAPEUTICS, INC. AND SUBSIDIARIES

CONDENSED CONSOLIDATED STATEMENTS OF OPERATIONS

(IN THOUSANDS, EXCEPT PER SHARE DATA)

(UNAUDITED)

Three Months Ended March 31,

2025

2024

REVENUES:

Collaboration revenues

$

1,270

$

1,187

Royalties, license and other revenues

232

257

Total revenues

1,502

1,444

OPERATING EXPENSES:

Cost of sales

36

98

Research and development

3,114

3,010

General and administrative

4,857

4,997

Total operating expenses

8,007

8,105

Loss from operations

(6,505

)

(6,661

)

OTHER INCOME (EXPENSES):

Interest income, net

478

462

Loss on marketable equity securities, net

(5

)

(5

)

Change in fair value of warrant liability

2,305

—

Foreign currency transaction loss, net

(231

)

(354

)

Other income (expense), net

(185

)

—

Total other income (expenses)

2,362

103

NET LOSS

(4,143

)

(6,558

)

Net loss attributable to noncontrolling interest

4

16

NET LOSS ATTRIBUTABLE TO LINEAGE

$

(4,139

)

$

(6,542

)

Net loss per common share attributable to Lineage basic and diluted

$

(0.02

)

$

(0.04

)

Weighted-average common shares used to compute basic and diluted net loss per common share

226,054

182,909

LINEAGE CELL THERAPEUTICS, INC. AND SUBSIDIARIES

CONDENSED CONSOLIDATED STATEMENTS OF CASH FLOWS

(IN THOUSANDS)

(UNAUDITED)

Three Months Ended March 31,

2025

2024

CASH FLOWS FROM OPERATING ACTIVITIES:

Net loss attributable to Lineage

$

(4,139

)

$

(6,542

)

Net loss attributable to noncontrolling interest

(4

)

(16

)

Adjustments to reconcile net loss attributable to Lineage Cell Therapeutics, Inc. to net cash used in operating activities:

Issuance costs for common stock warrant liabilities

183

—

Loss on marketable equity securities, net

5

5

Accretion of income on marketable debt securities

(10

)

—

Depreciation and amortization expense

164

153

Change in right-of-use assets and liabilities

(11

)

(10

)

Amortization of intangible assets

—

22

Stock-based compensation

1,217

1,163

Change in fair value of warrant liability

(2,305

)

—

Foreign currency remeasurement and other loss

282

371

Changes in operating assets and liabilities:

Accounts receivable

424

668

Prepaid expenses and other current assets

692

195

Accounts payable and accrued liabilities

(105

)

(574

)

Deferred revenue

(1,279

)

(1,218

)

Net cash used in operating activities

(4,886

)

(5,783

)

CASH FLOWS FROM INVESTING ACTIVITIES:

Maturities of marketable debt securities

2,000

—

Purchase of equipment

(97

)

(38

)

Net cash (used in) provided by investing activities

1,903

(38

)

CASH FLOWS FROM FINANCING ACTIVITIES:

Proceeds from employee options exercised

—

132

Common shares received and retired for employee taxes paid

(15

)

(23

)

Proceeds from sale of common shares under ATM, net of offering costs

—

36

Proceeds from sale of common shares under registered direct financing, net of offering costs

—

13,889

Proceeds from sale of common shares with warrants under registered direct financing, net of offering costs

5,297

—

Payment of financed insurance premium

(224

)

—

Payment of finance lease liabilities

(14

)

(13

)

Net cash provided by financing activities

5,044

14,021

Effect of exchange rate changes on cash, cash equivalents and restricted cash

(73

)

(70

)

NET INCREASE IN CASH, CASH EQUIVALENTS AND RESTRICTED CASH

1,988

8,130

CASH, CASH EQUIVALENTS AND RESTRICTED CASH:

At beginning of the period

46,354

35,992

At end of the period

$

48,342

$

44,122

Cell TherapyFinancial StatementPhase 2License out/in

10 Mar 2025

CARLSBAD, Calif.--(BUSINESS WIRE)--Lineage Cell Therapeutics, Inc. (NYSE American and TASE: LCTX), a clinical-stage biotechnology company developing allogeneic cell therapies for serious neurological conditions, today reported its fourth quarter and full year 2024 financial and operating results and will host a conference call today at 4:30 p.m. Eastern Time to discuss these results and provide a business update.

“Throughout 2024, we made substantial progress across multiple fronts, advancing our programs, expanding collaborations, and strengthening our balance sheet to support significant anticipated milestones,” stated Brian M. Culley, Lineage’s CEO. “Our lead asset OpRegen continues to make progress in the ongoing GAlette Study, and we are encouraged by Roche and Genentech’s commitment to the OpRegen program. Our partner’s efforts to advance OpRegen for the treatment of dry AMD with GA include adding clinical sites and seeking and obtaining RMAT designation. We view these actions as positive indicators for this pioneering cell transplant and look forward to further updates on the program.”

“We anticipate our internal programs will similarly advance through important milestones during 2025,” added Mr. Culley. “We will focus on conducting the recently-initiated DOSED clinical study of a novel OPC1 delivery system, advancing ReSonance for the treatment of sensorineural hearing loss, and advancing other carefully selected early-stage initiatives. In parallel, we will continue our efforts to demonstrate an in-house manufacturing capability that supports Lineage having an industry-leading position in allogeneic cell banking and production. As the power of our cell differentiation and manufacturing platforms are further demonstrated and validated, we believe that our pipeline of internally-owned assets and cell-based know-how will make us a desirable development partner and an attractive opportunity for investors.”

Select Business Highlights

- RG6501 (OpRegen)

Ongoing execution of Lineage’s contributions to our collaboration with Roche and Genentech, a member of the Roche Group, across multiple functional areas, including support for the ongoing Phase 2a clinical study (the “GAlette Study”) in patients with geographic atrophy (GA) secondary to age-related macular degeneration (AMD), and expansion of the clinical study to sites in Israel.

Roche announced receipt of RMAT designation from the U.S. FDA for OpRegen, for the treatment of GA secondary to AMD.

Entered into a separate services agreement with Genentech to further support development of OpRegen, including: (i) activities to support the ongoing Phase 1/2a study and currently enrolling GAlette Study; and (ii) additional technical training and materials related to our cell therapy technology platform to support commercial manufacturing strategies.

Positive clinical data from long-term follow-up of patients from the Phase 1/2a clinical study of OpRegen featured at the 2024 Retinal Cell & Gene Therapy Innovation Summit.

- OPC1

Submitted an Investigational New Drug Amendment (INDa) for OPC1 to enable initiation of DOSED (Delivery of Oligodendrocyte Progenitor Cells for Spinal Cord Injury: Evaluation of a Novel Device) clinical study in subacute and chronic spinal cord patients. DOSED study initiated in February 2025; UC San Diego Health named as the first participating study site.

DOSED study initiated in February 2025; UC San Diego Health named as the first participating study site.

Lineage and OPC1 program featured on CNN: “ He was paralyzed his last day of high school. How an experimental trial is showing ‘unexpected improvement .”

Created and hosted the 2 nd Annual Spinal Cord Injury Investor Symposium in partnership with the Christopher & Dana Reeve Foundation, with additional grant support from CIRM. The goals of this collaborative effort include increasing disease awareness, improving the probability of success in product development, and supporting clinical trial participation. Presenting companies have included AbbVie, Mitsubishi Tanabe, Neuralink, NervGen Pharma and ONWARD.

The goals of this collaborative effort include increasing disease awareness, improving the probability of success in product development, and supporting clinical trial participation. Presenting companies have included AbbVie, Mitsubishi Tanabe, Neuralink, NervGen Pharma and ONWARD.

- ReSonance (ANP1)

Preclinical results presented at 59 th Annual Inner Ear Biology Workshop . ReSonance manufactured by a proprietary process, developed in-house, at clinical scale, with relevant in-vitro functional activity. Immediate-use, thaw-and-inject formulation durably engrafted in multiple preclinical hearing loss models. ReSonance is currently being evaluated in a functional model of hearing loss through a collaboration with the University of Michigan Kresge Hearing Research Institute.

ReSonance manufactured by a proprietary process, developed in-house, at clinical scale, with relevant in-vitro functional activity.

Immediate-use, thaw-and-inject formulation durably engrafted in multiple preclinical hearing loss models.

ReSonance is currently being evaluated in a functional model of hearing loss through a collaboration with the University of Michigan Kresge Hearing Research Institute.

- Corporate

Closed two financings totaling $44 million in gross proceeds; potential to receive an additional $36 million in gross proceeds upon the full cash exercise of OpRegen clinical milestone-linked warrants.

Balance Sheet Highlights

Cash, cash equivalents, and marketable securities of $47.8 million as of December 31, 2024, together with the approximate $5.5 million in net proceeds from the second closing under our November 2024 registered direct offering completed in January 2025, is expected to support planned operations into Q1 2027.

Fourth Quarter Operating Results

Revenues: Revenue is generated primarily from collaboration revenues, royalties, and other revenues. Total revenues for the three months ended December 31, 2024 were approximately $2.9 million, a net increase of $0.8 million as compared to $2.1 million for the same period in 2023. The increase was primarily driven by more collaboration revenue recognized from deferred revenues under the collaboration and license agreement with Roche.

Operating Expenses: Operating expenses are comprised of research and development (“R&D”) expenses and general and administrative (“G&A”) expenses. Total operating expenses for the three months ended December 31, 2024 were $7.8 million, a decrease of $0.4 million as compared to $8.2 million for the same period in 2023.

R&D Expenses: R&D expenses for the three months ended December 31, 2024 were $3.4 million, a decrease of $0.5 million as compared to $3.9 million for the same period in 2023. The net decrease was primarily driven by $1.2 million for our OPC1 program expenses and $0.2 million for other research and development expense programs, partially offset by $0.4 million for our OpRegen program expenses and $0.5 million for our preclinical programs.

G&A Expenses: G&A expenses for the three months ended December 31, 2024 of $4.4 million were primarily in line with expenses for the same period in 2023.

Loss from Operations: Loss from operations for the three months ended December 31, 2024 was $5.1 million, a decrease of $1.3 million as compared to $6.4 million for the same period in 2023.

Other Income/(Expenses): Other income/(expenses) for the three months ended December 31, 2024 reflected other income of $1.8 million, compared to other income of $1.6 million for the same period in 2023. The net increase was primarily driven by changes in fair value of warrant liability, largely offset by exchange rate fluctuations related to Lineage’s international subsidiaries and certain warrant-related transaction costs incurred as part of the November 2024 financing.

Net Loss Attributable to Lineage: The net loss attributable to Lineage for the three months ended December 31, 2024 was $3.3 million, or $0.02 per share (basic and diluted), compared to a net loss of $4.8 million, or $0.03 per share (basic and diluted), for the same period in 2023.

Full Year Operating Results

Revenues: Revenue is generated primarily from collaboration revenues, royalties, and other revenues. Total revenues for the year ended December 31, 2024 were $9.5 million, a net increase of $0.6 million as compared to $8.9 million for the same period in 2023. The increase was primarily driven by more collaboration revenue recognized from deferred revenues under the collaboration and license agreement with Roche.

Operating Expenses: Operating expenses are comprised of R&D expenses and G&A expenses. Total operating expenses for the year ended December 31, 2024 were $31.0 million, a decrease of $2.7 million as compared to $33.7 million for the same period in 2023.

R&D Expenses: R&D expenses for the year ended December 31, 2024 were $12.5 million, a decrease of $3.2 million as compared to $15.7 million for the same period in 2023. The decrease was primarily driven by $2.7 million for our OPC1 program expenses, $1.1 million for our preclinical and other research and development programs. These decreases were partially offset by $0.6 million for our OpRegen program.

G&A Expenses: G&A expenses for the year ended December 31, 2024 were $18.2 million, an increase of approximately $0.9 million as compared to $17.3 million for the same period in 2023. The net increase was primarily driven by $0.6 million for stock-based compensation expense and $0.4 million for personnel costs, partially offset by an overall decrease in costs incurred for services provided by third parties.

Loss from Operations: Loss from operations for the year ended December 31, 2024 was $21.5 million, a decrease of $3.2 million as compared to $24.7 million for the same period in 2023.

Other Income/(Expenses): Other income (expenses) for the year ended December 31, 2024 reflected other income of $2.9 million, compared to other income of $1.5 million for the same period in 2023. The net increase of $1.4 million was primarily driven by changes in the fair value of warrant liability, exchange rate fluctuations related to Lineage’s international subsidiaries, and fair market value changes in marketable equity securities. This increase in other income was partially offset by certain warrant-related transaction costs incurred as part of the November 2024 financing, as well as the non-recurring prior year employee retention credit.

Net Loss Attributable to Lineage: The net loss attributable to Lineage for the year ended December 31, 2024 was $18.6 million, or $0.09 per share (basic and diluted), compared to a net loss of $21.5 million, or $0.12 per share (basic and diluted), for 2023.

Conference Call and Webcast

Interested parties may access the conference call on March 10, 2025, by dialing (800) 715-9871 from the U.S. and Canada and should request the “Lineage Cell Therapeutics Call”. A live webcast of the conference call will be available online in the Investors section of Lineage’s website. A replay of the webcast will be available on Lineage’s website for 30 days and a telephone replay will be available through March 17th, 2025, by dialing (800) 770-2030 from the U.S. and Canada and entering conference ID number 6707203.

About Lineage Cell Therapeutics, Inc.

Lineage Cell Therapeutics is a clinical-stage biotechnology company developing novel, “off-the-shelf,” cell therapies to address unmet medical needs. Lineage’s programs are based on its proprietary cell-based technology platform and associated development and manufacturing capabilities. From this platform, Lineage designs, develops, manufactures, and tests specialized human cells with anatomical and physiological functions similar or identical to cells found naturally in the human body. These cells are created by applying directed differentiation protocols to established, well-characterized, and self-renewing pluripotent cell lines. These protocols generate cells with characteristics associated with specific and desired developmental lineages. Cells derived from such lineages are transplanted into patients in an effort to replace or support cells that are absent or dysfunctional due to degenerative disease, aging, or traumatic injury, and to restore or augment the patient’s functional activity. Lineage’s neuroscience focused pipeline currently includes: (i) OpRegen®, a retinal pigment epithelial cell therapy in Phase 2a development under a worldwide collaboration with Roche and Genentech, a member of the Roche Group, for the treatment of geographic atrophy secondary to age-related macular degeneration; (ii) OPC1, an oligodendrocyte progenitor cell therapy in Phase 1/2a development for the treatment of spinal cord injuries; (iii) ReSonance™ (ANP1), an auditory neuronal progenitor cell therapy for the potential treatment of auditory neuropathy; (iv) PNC1, a photoreceptor neural cell therapy for the potential treatment of vision loss due to photoreceptor dysfunction or damage; and (v) RND1, a novel hypoimmune induced pluripotent stem cell line being developed under a gene editing partnership. For more information, please visit www.lineagecell.com or follow the company on X/Twitter @LineageCell.

Forward-Looking Statements

Lineage cautions you that all statements, other than statements of historical facts, contained in this press release, are forward-looking statements. Forward-looking statements, in some cases, can be identified by terms such as “believe,” “aim,” “may,” “will,” “estimate,” “continue,” “anticipate,” “design,” “intend,” “expect,” “could,” “can,” “plan,” “potential,” “predict,” “seek,” “should,” “would,” “contemplate,” “project,” “target,” “tend to,” or the negative version of these words and similar expressions. Lineage’s forward-looking statements are based upon its current expectations and beliefs and involve assumptions that may never materialize or may prove to be incorrect. Such statements include, but are not limited to, statements relating to: the potential therapeutic benefits of OpRegen in patients with GA secondary to AMD and the potential impacts of RMAT designation on Roche and Genentech’s development of OpRegen or OpRegen’s ultimate success; the benefits of our services agreement with Genentech and its impact on advancing the OpRegen program; the exercise of the warrants in cash upon the achievements of the clinical milestone event or otherwise prior to their expiration; the commencement of the DOSED clinical study for OPC1; the potential effect of the Spinal Cord Symposium, including accelerating development in SCI research and treatment, and raising SCI disease awareness; the potential continued development of ReSonance (ANP1); the anticipated advancement of Lineage’s programs through important milestones; that potential development partners and investors will find Lineage’s pipeline of internally-owned assets and cell-based know-how attractive as they are further demonstrated and validated; and that our cash, cash equivalents and marketable securities is sufficient to support our planned operations into the first quarter of 2027. Forward-looking statements involve known and unknown risks, uncertainties and other factors that may cause Lineage’s actual results, performance or achievements to be materially different from future results, performance or achievements expressed or implied by the forward-looking statements in this press release, including, but not limited to, the following risks: that we may need to allocate our cash to unexpected events and expenses causing us to expend our cash, cash equivalents and marketable securities more quickly than expected; that development activities, preclinical activities, and clinical trials of our product candidates may not commence, progress or be completed as expected due to many factors within and outside of our control; that positive findings in early clinical and/or nonclinical studies of a product candidate may not be predictive of success in subsequent clinical and/or nonclinical studies of that candidate; that Roche and Genentech may not successfully advance OpRegen or be successful in completing further clinical trials for OpRegen and/or obtaining regulatory approval for OpRegen in any particular jurisdiction; that competing alternative therapies may adversely impact the commercial potential of OpRegen; that OPC1 may not advance further in any clinical trials, and if it does, that any such clinical trials may not be successful; that the ongoing Israeli regional conflict may materially and adversely impact our manufacturing processes, including cell banking and product manufacturing for our cell therapy product candidates, all of which are conducted by our subsidiary in Jerusalem, Israel; that Lineage may not be able to manufacture sufficient clinical quantities of its product candidates in accordance with current good manufacturing practice; and those risks and uncertainties inherent in Lineage’s business and other risks discussed in Lineage’s filings with the Securities and Exchange Commission (SEC). Further information regarding these and other risks is included under the heading “Risk Factors” in Lineage’s periodic reports with the SEC, including Lineage’s most recent Annual Report on Form 10-K filed with the SEC and its other subsequent reports, which are available from the SEC’s website. You are cautioned not to place undue reliance on forward-looking statements, which speak only as of the date on which they were made. Lineage undertakes no obligation to update such statements to reflect events that occur or circumstances that exist after the date on which they were made, except as required by law. All forward-looking statements are expressly qualified in their entirety by these cautionary statements.

LINEAGE CELL THERAPEUTICS, INC. AND SUBSIDIARIES

CONSOLIDATED BALANCE SHEETS

(IN THOUSANDS)

December 31, 2024

December 31, 2023

ASSETS

CURRENT ASSETS

Cash and cash equivalents

$

45,789

$

35,442

Marketable securities

2,016

50

Accounts receivable, net

638

745

Prepaid expenses and other current assets

2,554

2,204

Total current assets

50,997

38,441

NONCURRENT ASSETS

Property and equipment, net

2,251

2,245

Operating lease right-of-use assets

2,144

2,522

Deposits and other long-term assets

614

577

Goodwill

10,672

10,672

Intangible assets, net

46,540

46,562

TOTAL ASSETS

$

113,218

$

101,019

LIABILITIES AND SHAREHOLDERS’ EQUITY

CURRENT LIABILITIES

Accounts payable and accrued liabilities

$

5,437

$

6,270

Operating lease liabilities, current portion

1,097

830

Finance lease liabilities, current portion

55

52

Deferred revenues, current portion

7,388

10,808

Total current liabilities

13,977

17,960

LONG-TERM LIABILITIES

Deferred tax liability

273

273

Deferred revenues, net of current portion

14,433

18,693

Operating lease liabilities, net of current portion

1,295

1,979

Finance lease liabilities, net of current portion

67

91

Warrant liabilities

6,161

—

TOTAL LIABILITIES

36,206

38,996

Commitments and contingencies

SHAREHOLDERS’ EQUITY

Preferred shares, no par value, 2,000 shares authorized; none issued and outstanding as of December 31, 2024 and 2023

—

—

Common shares, no par value, 450,000 shares authorized as of December 31, 2024 and 2023; 220,416 and 174,987 shares issued and outstanding as of December 31, 2024 and 2023, respectively

484,722

451,343

Accumulated other comprehensive loss

(2,876

)

(3,068

)

Accumulated deficit

(403,465

)

(384,856

)

Lineage's shareholders’ equity

78,381

63,419

Noncontrolling deficit

(1,369

)

(1,396

)

Total shareholders’ equity

77,012

62,023

TOTAL LIABILITIES AND SHAREHOLDERS’ EQUITY

$

113,218

$

101,019

LINEAGE CELL THERAPEUTICS, INC. AND SUBSIDIARIES

CONSOLIDATED STATEMENTS OF OPERATIONS

(IN THOUSANDS, EXCEPT PER SHARE DATA)

Year Ended December 31,

2024

2023

REVENUES:

Collaboration revenues

$

8,149

$

7,588

Royalties, license and other revenues

1,350

1,357

Total revenues

9,499

8,945

OPERATING EXPENSES:

Cost of sales

334

671

Research and development

12,472

15,705

General and administrative

18,171

17,302

Total operating expenses

30,977

33,678

Loss from operations

(21,478

)

(24,733

)

OTHER INCOME (EXPENSES):

Interest income, net

1,715

1,629

Loss on marketable equity securities, net

(8

)

(176

)

Change in fair value of warrant liability

2,128

—

Foreign currency transaction loss, net

(269

)

(544

)

Other income (expense), net

(670

)

542

Total other income (expenses)

2,896

1,451

LOSS BEFORE INCOME TAXES

(18,582

)

(23,282

)

Provision for income tax benefit

—

1,803

NET LOSS

(18,582

)

(21,479

)

Net (income) loss attributable to noncontrolling interest

(27

)

(7

)

NET LOSS ATTRIBUTABLE TO LINEAGE

$

(18,609

)

$

(21,486

)

Net loss per common share attributable to Lineage basic and diluted

$

(0.09

)

$

(0.12

)

Weighted-average common shares used to compute basic and diluted net loss per common share

200,193

172,663

LINEAGE CELL THERAPEUTICS, INC. AND SUBSIDIARIES

CONSOLIDATED STATEMENTS OF CASH FLOWS

(IN THOUSANDS)

Year Ended December 31,

2024

2023

CASH FLOWS FROM OPERATING ACTIVITIES:

Net loss attributable to Lineage

$

(18,609

)

$

(21,486

)

Net loss attributable to noncontrolling interest

27

7

Adjustments to reconcile net loss attributable to Lineage Cell Therapeutics, Inc.

to net cash used in operating activities:

Issuance costs for common stock warrant liabilities

688

—

Loss on marketable equity securities, net

8

176

Accretion of income on marketable debt securities

(229

)

(679

)

Depreciation and amortization expense

587

562

Change in right-of-use assets and liabilities

(42

)

91

Amortization of intangible assets

22

130

Stock-based compensation

5,077

4,640

Change in fair value of warrant liability

(2,128

)

—

Deferred income tax benefit

—

(1,803

)

Foreign currency remeasurement and other loss

273

600

Changes in operating assets and liabilities:

Accounts receivable

106

(446

)

Prepaid expenses and other current assets

489

(418

)

Accounts payable and accrued liabilities

(1,681

)

(2,295

)

Deferred revenue

(7,680

)

(7,645

)

Net cash used in operating activities

(23,092

)

(28,566

)

CASH FLOWS FROM INVESTING ACTIVITIES:

Proceeds from the sale of marketable equity securities

18

196

Purchases of marketable debt securities

(8,761

)

(16,403

)

Maturities of marketable debt securities

7,000

63,330

Purchase of equipment

(565

)

(674

)

Net cash (used in) provided by investing activities

(2,308

)

46,449

CASH FLOWS FROM FINANCING ACTIVITIES:

Proceeds from employee options exercised

229

88

Common shares received and retired for employee taxes paid

(23

)

(37

)

Proceeds from sale of common shares under ATM, net of offering costs

68

6,426

Proceeds from sale of common shares under registered direct financing, net of offering costs

13,889

—

Proceeds from sale of common shares with warrants under registered direct financing, net of offering costs

21,919

—

Payment of financed insurance premium

(171

)

—

Repayment of finance lease liabilities

(54

)

(54

)

Net cash provided by financing activities

35,857

6,423

Effect of exchange rate changes on cash, cash equivalents and restricted cash

(95

)

(250

)

NET INCREASE IN CASH, CASH EQUIVALENTS AND RESTRICTED CASH

10,362

24,056

CASH, CASH EQUIVALENTS AND RESTRICTED CASH:

At beginning of the period

35,992

11,936

At end of the period

$

46,354

$

35,992

Cell TherapyFinancial StatementPhase 2License out/in

12 Feb 2025

Safety Study of Stem Cell-derived Transplant Includes Subacute and Chronic SCI Patients

CARLSBAD, CA, USA I February 11, 2025 I

Lineage Cell Therapeutics, Inc.

(NYSE American and TASE: LCTX), a clinical-stage biotechnology company developing allogeneic cell therapies for serious neurological conditions, announced today that the Company has initiated the DOSED (Delivery of Oligodendrocyte Progenitor Cells (OPCs) for Spinal Cord Injury: Evaluation of a Novel Device) clinical study. The DOSED study will evaluate the safety and utility of the Manual Inject Parenchymal Spinal Delivery System (MI PSD System), a novel delivery device developed to deliver

OPC1

directly to the area of injury in patients with spinal cord injury (SCI). OPC1 is an investigational, allogeneic stem cell-derived cell transplant, comprised of oligodendrocyte progenitor and related glial cells. OPC1 is designed to replace or support cells in the spinal cord that are absent or dysfunctional due to traumatic injury and is intended to help restore or augment functional activity in persons suffering from an SCI. Improved functional activity can lead to greater mobility and enhanced quality of life for patients and significant cost-savings for caregivers. The DOSED study will enroll both subacute (between 21 to 42 days following injury) and chronic (between 1 to 5 years following injury) SCI patients.

“Differentiated cell transplantation is a promising therapeutic approach, so it is a privilege that Lineage has received written clearance from FDA to launch the DOSED study as part of our continued development of OPC1,” stated Brian M. Culley, Lineage’s CEO. “The DOSED study, the third clinical study of OPC1, will evaluate MI PSD, a novel delivery system designed through an external collaboration, to deliver our proprietary cells over several minutes without the need for stopping patient ventilation. The delivery system also is compatible with a forthcoming immediate-use formulation of OPC1 which we developed for this program, and which eliminates the dose preparation steps conducted in prior studies. This study will be the first time OPC1 is administered to patients with a chronic spinal cord injury, which will be a significant milestone, as it represents an additional and larger potential patient population for this experimental therapy. In addition to the safety and performance of the new device, we also will be collecting functional assessments on all patients, which gives us the opportunity to investigate any signals of efficacy that may arise. The first study site will be UC San Diego Health. We look forward to building on the promising work and clinical results observed in prior studies of OPC1.”

OPC1 has an extensive long-term safety profile and has been tested in two clinical trials to date: a five-patient Phase 1 safety trial in acute thoracic SCI, where all active subjects have been followed for at least 13 years; and a 25-patient Phase 1/2a multicenter dose-escalation trial in subacute cervical SCI, where all active subjects have been evaluated for at least 7 years. Long-term safety monitoring is ongoing for both studies, with no unexpected serious adverse events attributable to the OPC1 transplant being reported to date. Results from both studies have been published in the

Journal of Neurosurgery: Spine.

The Phase 1/2a publication of OPC1 in subacute cervical SCI is available

here

and the publication from the Phase 1 clinical study of OPC1 in acute thoracic SCI is available

here

. The OPC1 program was one of the first cell therapy clinical trials to be supported by the

California Institute for Regenerative Medicine

(CIRM) under Proposition 71.

Lineage founded the

Annual Spinal Cord Injury Investor Symposium

in 2023 and has co-sponsored the event in partnership with

The Christopher & Dana Reeve Foundation

in each year since then. The goals of this collaborative effort include increasing disease awareness, improving the probability of success in product development, and supporting clinical trial participation. The Reeve Foundation is dedicated to curing spinal cord injury by funding innovative research and improving the quality of life for individuals and families impacted by paralysis. Presenting companies have included AbbVie, Mitsubishi Tanabe, Neuralink, NervGen Pharma and ONWARD.

About OPC1

OPC1

is an oligodendrocyte progenitor cell (OPC) transplant therapy designed to provide clinically meaningful recovery in, and improvements to, motor function in individuals with spinal cord injuries (SCIs). OPCs are naturally occurring precursors to the cells that provide electrical insulation for nerve axons in the form of a myelin sheath. SCI most often occurs when the spinal cord is subjected to a severe crush or contusion injury and typically results in severe functional impairment, including limb paralysis, aberrant pain signaling, and loss of bladder control and other body functions. In the U.S., there are approximately 18,000 new spinal cord injuries annually and over 300,000 patients in total living with spinal cord injuries. There currently are no FDA-approved drugs or interventions specifically for the treatment of SCI. The clinical development of OPC1 has been partially funded by a $14.3 million grant from CIRM. OPC1 has received Regenerative Medicine Advanced Therapy (RMAT) designation and Orphan Drug designation from the U.S. Food and Drug Administration (FDA).

A selection of patient focused media related to the OPC1 program is available onthe

Media

page of the Lineage website.

About the DOSED Study

The Delivery of Oligodendrocyte Progenitor Cells for Spinal Cord Injury: Evaluation of a Novel Device (DOSED) clinical study is an open label, multi-center, device safety study, in 3-5 subacute and 3-5 stable chronic subjects with complete (ASIA Impairment Scale A) or incomplete (ASIA Impairment Scale B), traumatic, focal SCI affecting either cervical (C4-C7) or thoracic (T1-T10) vertebrae. The primary objective of this study is to evaluate the safety of a novel Manual Inject Parenchymal Spinal Delivery System (MI PSD System) to administer OPC1 to the spinal parenchyma. The primary endpoint is frequency and severity of the MI PSD System- or injection procedure-related adverse events (AEs) through 30 days (1 month). Secondary endpoints are frequency and severity of AEs through 90 days (3 months) following injection of OPC1 and/or the concomitant immunosuppression administered. Exploratory endpoints include measurements of neurological impairment and function, as well as pain, evaluated by changes from baseline on the following endpoints: changes in neurological function as measured by sensory and motor scores and motor level on International Standards for Neurological Classification of Spinal Cord Injury (ISNCSCI) examinations; changes in post-injection pain, defined as a worsening of pain or neuropathic pain of greater than 7 days duration from baseline levels, as assessed by the International Spinal Cord Injury Pain Basic Data Set or occurrence of allodynia; changes from baseline at 30, 90 and 365 days post-injection of OPC1 in: ISNCSCI, SCIM, International Spinal Cord Injury Pain Questionnaire; patient and clinical impressions of changes in quality of life as reported by changes from baseline at 30, 90, and 365 days post-injection of OPC1 as measured by: Patient Global Impression of Severity (PGI-S), Patient Global Impression of Change (PGI-C), Clinician Global Impression of Severity (CGI-S) and Clinician Global Impression of Change (CGI-C).

About Lineage Cell Therapeutics, Inc.

Lineage Cell Therapeutics is a clinical-stage biotechnology company developing novel, “off-the-shelf,” cell therapies to address unmet medical needs. Lineage’s programs are based on its proprietary cell-based technology platform and associated development and manufacturing capabilities. From this platform, Lineage designs, develops, manufactures, and tests specialized human cells with anatomical and physiological functions similar or identical to cells found naturally in the human body. These cells are created by applying directed differentiation protocols to established, well-characterized, and self-renewing pluripotent cell lines. These protocols generate cells with characteristics associated with specific and desired developmental lineages. Cells derived from such lineages are transplanted into patients in an effort to replace or support cells that are absent or dysfunctional due to degenerative disease, aging, or traumatic injury, and to restore or augment the patient’s functional activity. Lineage’s neuroscience focused pipeline currently includes: (i) OpRegen

®

, a retinal pigment epithelial cell therapy in Phase 2a development under a worldwide collaboration with Roche and Genentech, a member of the Roche Group, for the treatment of geographic atrophy secondary to age-related macular degeneration; (ii) OPC1, an oligodendrocyte progenitor cell therapy in Phase 1/2a development for the treatment of spinal cord injuries; (iii) ReSonance™ (ANP1), an auditory neuronal progenitor cell therapy for the potential treatment of auditory neuropathy; (iv) PNC1, a photoreceptor neural cell therapy for the potential treatment of vision loss due to photoreceptor dysfunction or damage; and (v) RND1, a novel hypoimmune induced pluripotent stem cell line being developed under a gene editing partnership. For more information, please visit

www.lineagecell.com

or follow the company on X/Twitter

@LineageCell

.

SOURCE:

Lineage Cell Therapeutics

Cell TherapyPhase 1Orphan DrugPhase 2

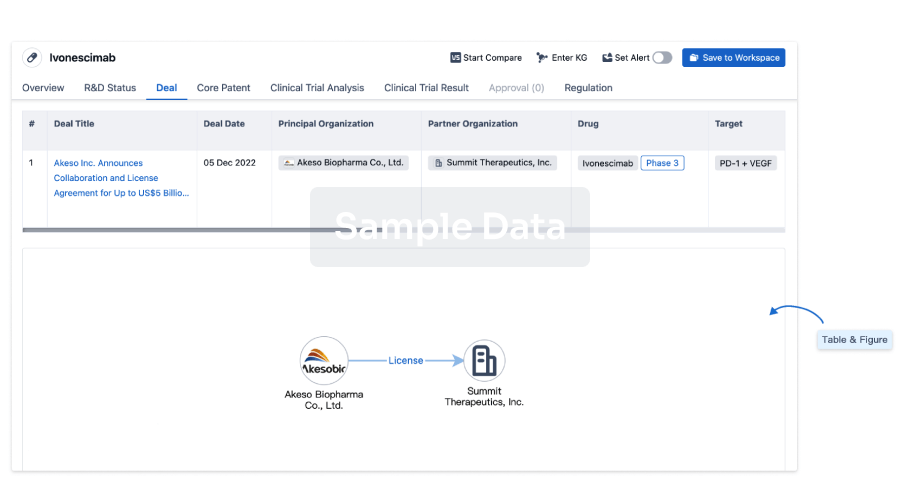

100 Deals associated with OpRegen (Lineage Cell Therapeutics)

Login to view more data

R&D Status

10 top R&D records. to view more data

Login

| Indication | Highest Phase | Country/Location | Organization | Date |

|---|---|---|---|---|

| Age Related Macular Degeneration | Phase 2 | United States | 23 Mar 2023 | |

| Age Related Macular Degeneration | Phase 2 | Israel | 23 Mar 2023 | |

| Geographic Atrophy | Phase 2 | United States | 23 Mar 2023 | |

| Geographic Atrophy | Phase 2 | Israel | 23 Mar 2023 | |

| Dystrophy, Macular | Phase 2 | United States | 29 Oct 2018 | |

| dry age-related macular degeneration | Phase 2 | - | 01 Apr 2015 | |

| dry age-related macular degeneration | Phase 2 | - | 01 Apr 2015 |

Login to view more data

Clinical Result

Clinical Result

Indication

Phase

Evaluation

View All Results

| Study | Phase | Population | Analyzed Enrollment | Group | Results | Evaluation | Publication Date |

|---|

NCT02286089 (Biospace) Manual | Phase 1/2 | 12 | RG6501 (OpRegen) | apdyryveqz(ogxaczzpne) = dyaodjxyzv fsampywjas (rvzxwegdus ) View more | Positive | 06 May 2024 | |

Phase 1/2 | 12 | (Extensive Bleb Coverage) | kqplhizvdi(mnqkrdwlut) = odxbmwfkkg roacykkelw (okgbalgztk ) View more | Positive | 05 Oct 2023 | ||

(Limited Bleb Coverage) | kqplhizvdi(mnqkrdwlut) = unjpjxmaao roacykkelw (okgbalgztk ) View more | ||||||

Phase 1/2 | - | frcagcmcly(sxskydqgse) = kewpapqvrg ihqbafobis (abrrrjwaoe ) | - | 05 Oct 2023 | |||

Phase 1/2 | 12 | ymhniakkth(hnxqbmxsdd) = xxnsjvmelt ahstafcaeb (qseythwqmz ) View more | - | 23 Apr 2023 | |||

Phase 1/2 | 24 | (Cohort 1) | ahoimvyekj = tbvqjmqhta pqcwbktotz (xlrppmoxxw, musktflrtb - zgjinkoxgu) View more | - | 06 Mar 2023 | ||

(Cohort 2) | ahoimvyekj = scrxvhcogy pqcwbktotz (xlrppmoxxw, btpujyaezk - zncfvcdyki) View more | ||||||

Phase 1/2 | 24 | (Cohort 1-3:Legally Blind) | mniyvnkftx(anbgiczanr) = All 24 (100%) treated patients reported ≥1 AE and ≥1 ocular AE vfmwjontvq (rxosnbowwq ) | Positive | 03 May 2022 | ||

(Cohort 4:Impaired Vision) |

Login to view more data

Translational Medicine

Boost your research with our translational medicine data.

login

or

Deal

Boost your decision using our deal data.

login

or

Core Patent

Boost your research with our Core Patent data.

login

or

Clinical Trial

Identify the latest clinical trials across global registries.

login

or

Approval

Accelerate your research with the latest regulatory approval information.

login

or

Regulation

Understand key drug designations in just a few clicks with Synapse.

login

or

AI Agents Built for Biopharma Breakthroughs

Accelerate discovery. Empower decisions. Transform outcomes.

Get started for free today!

Accelerate Strategic R&D decision making with Synapse, PatSnap’s AI-powered Connected Innovation Intelligence Platform Built for Life Sciences Professionals.

Start your data trial now!

Synapse data is also accessible to external entities via APIs or data packages. Empower better decisions with the latest in pharmaceutical intelligence.

Bio

Bio Sequences Search & Analysis

Sign up for free

Chemical

Chemical Structures Search & Analysis

Sign up for free