Request Demo

Last update 13 Feb 2026

Givosiran Sodium

Last update 13 Feb 2026

Overview

Basic Info

Drug Type siRNA |

Synonyms AD-60519, ALN AS1, ALN-60519 + [3] |

Target |

Action inhibitors |

Mechanism ALAS1 inhibitors(5 aminolevulinate synthase 1 inhibitors), RNA interference |

Therapeutic Areas |

Active Indication |

Inactive Indication |

Originator Organization |

Active Organization |

Inactive Organization- |

License Organization |

Drug Highest PhaseApproved |

First Approval Date United States (20 Nov 2019), |

RegulationOrphan Drug (United States), PRIME (European Union), Orphan Drug (Australia), Breakthrough Therapy (United States) |

Login to view timeline

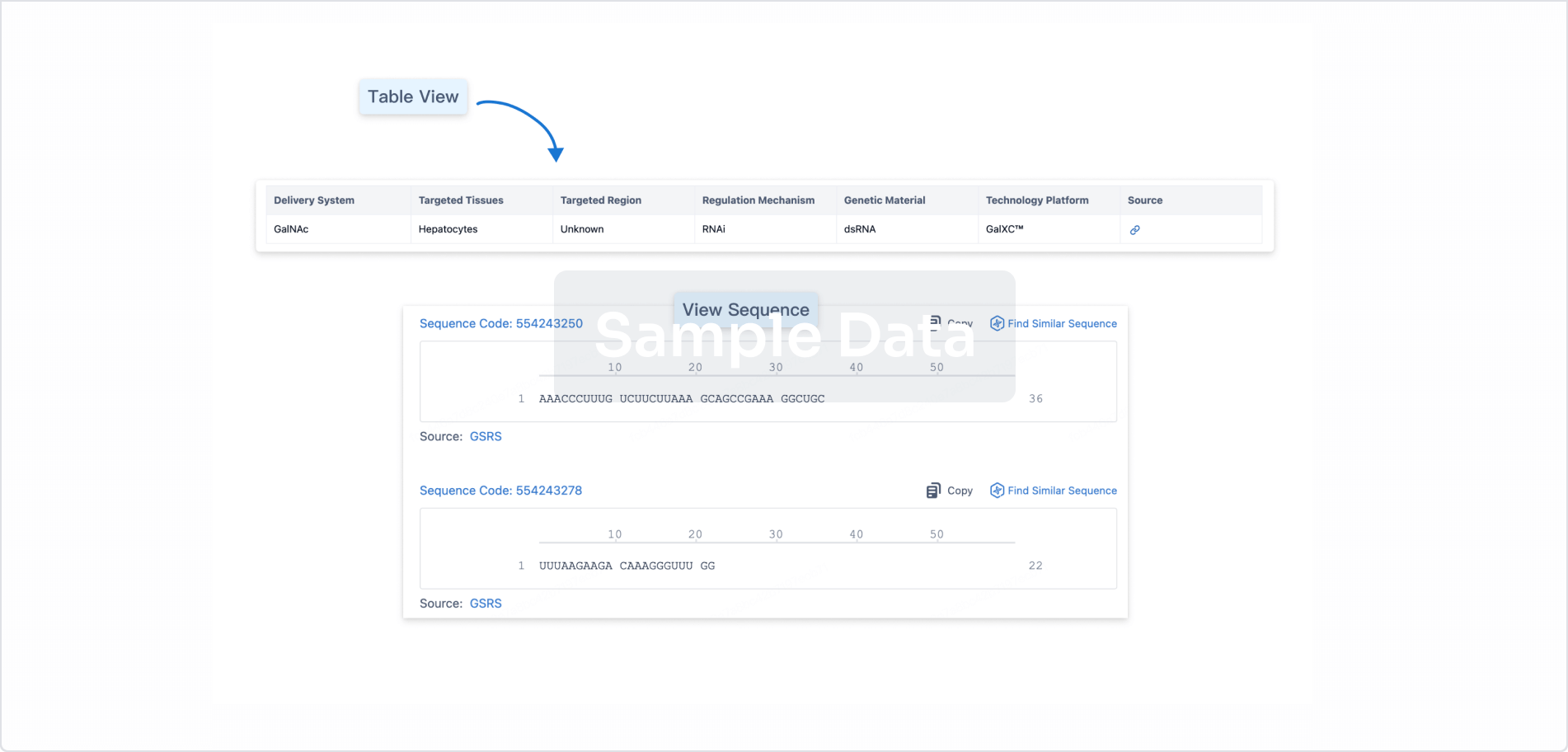

Structure/Sequence

Boost your research with our RNA technology data.

login

or

Sequence Code 294634572

Source: *****

Sequence Code 1191632795

Source: *****

Related

6

Clinical Trials associated with Givosiran SodiumJPRN-jRCT2071200074

Expanded Access Protocol of Givosiran for Patients with Acute Hepatic Porphyria (AHP)

Start Date02 Feb 2021 |

Sponsor / Collaborator- |

NCT03505853

A Drug-Drug Interaction Study to Investigate the Effect of Givosiran on the Pharmacokinetics (PK) of Midazolam, Caffeine, Losartan, Omeprazole, and Dextromethorphan in Patients With Acute Intermittent Porphyria (AIP) Who Are Asymptomatic High Excreters (ASHE)

The purpose of this study is to evaluate the effect of givosiran on the pharmacokinetics of the 5-probe cocktail of midazolam, caffeine, losartan, omeprazole, and dextromethorphan, and their metabolites, in asymptomatic patients with Acute Intermittent Porphyria.

Start Date26 Apr 2018 |

Sponsor / Collaborator |

NCT03338816

ENVISION: A Phase 3 Randomized, Double-blind, Placebo-Controlled Multicenter Study With an Open-label Extension to Evaluate the Efficacy and Safety of Givosiran in Patients With Acute Hepatic Porphyrias

The purpose of this study is to evaluate the effect of subcutaneous givosiran (ALN-AS1), compared to placebo, on the rate of porphyria attacks in patients with Acute Hepatic Porphyrias (AHP).

Start Date16 Nov 2017 |

Sponsor / Collaborator |

100 Clinical Results associated with Givosiran Sodium

Login to view more data

100 Translational Medicine associated with Givosiran Sodium

Login to view more data

100 Patents (Medical) associated with Givosiran Sodium

Login to view more data

73

Literatures (Medical) associated with Givosiran Sodium01 Oct 2025·ANALYTICA CHIMICA ACTA

Identification of oligonucleotide drug impurities using heart-cutting two-dimensional liquid chromatography-tandem mass spectrometry (2D-LC-MS/MS)

Article

Author: Li, Wangyu ; Feng, Hongru ; Gao, Lu ; Liao, Jiancong ; Zhou, Shiwen ; Tang, He ; Pan, Yuanjiang ; Yang, Xihe

BACKGROUND:

Oligonucleotide-based drugs have gained significant attention as a promising class of therapeutics due to their precise ability to regulate gene expression. However, the presence of impurities in these drugs can compromise their safety, efficacy, and stability. Therefore, the identification and detailed analysis of these impurities are crucial. Traditional methods may struggle to detect subtle impurities, such as oxidation and hydrolysis products, which necessitate the development of more advanced and reliable analytical techniques for oligonucleotide therapeutics.

RESULTS:

In this study, we introduce a novel analytical method that combines heart-cutting two-dimensional liquid chromatography (2D-LC) with tandem mass spectrometry (MS/MS) to effectively separate, analyze, and identify impurities in oligonucleotide-based drugs. The first dimension utilizes anion exchange chromatography (AEX) to separate oligonucleotides based on their negative charge, while the second dimension employs reverse ion-pair chromatography (RIPC) for further purification and compatibility with mass spectrometry. This 2D-LC-MS/MS approach provides a sensitive and accurate means of identifying and quantifying impurities, including oxidation and hydrolysis products. The method was applied to two RNA interference (RNAi) drugs, Givosiran and Patisiran, where 3 and 20 impurities were identified, respectively. Additionally, sequencing analysis using data-dependent acquisition (DDA-MS/MS) enabled the determination of the molecular weight and structural characteristics of these impurities, offering a comprehensive and detailed view of the impurity profiles.

SIGNIFICANCE:

This novel heart-cutting 2D-LC-MS/MS method offers a significant advancement in the analysis of impurities in oligonucleotide-based therapeutics. It provides high sensitivity, enabling the identification of subtle impurities that are often challenging to detect. By applying this technique to RNAi drugs, we demonstrate its potential to enhance the safety, efficacy, and stability of oligonucleotide-based therapies, making it a valuable tool for the pharmaceutical industry.

19 Sep 2025·Cureus Journal of Medical Science

Neurovisceral Syndrome in a Patient with Monoclonal Gammopathy of Undetermined Significance: A Confirmed Case of Variegate Porphyria

Article

Author: Awais, Kashaf Ad Duja ; Fatima, Iraj ; Shaharyar, Maheen ; Sehbai, Aasim ; Tareen, Ali Awais Khan

Variegate porphyria (VP) is a rare disorder presenting with cutaneous, neurological, and systemic symptoms. We report a 53-year-old man initially hospitalized for a depressive episode, during which blistering lesions and facial flushing were noted. He was misdiagnosed and treated for cellulitis and contact dermatitis without improvement. Repeated misdiagnoses led to extensive autoimmune, infectious, and hematologic workup, revealing coexisting monoclonal gammopathy of undetermined significance (MGUS). Over the following months, he developed abdominal pain, mood swings, cognitive impairment, neuropathy, orthostatic symptoms, and weight loss, raising suspicion for porphyria. A 24-hour urine panel revealed elevated porphobilinogen (PBG), delta-aminolevulinic acid (ALA), coproporphyrin I and III, heptacarboxyl porphyrins, and mildly elevated uroporphyrins, confirming VP. Treatment with hemin caused thrombophlebitis and was discontinued. He was transitioned to Givosiran, resulting in symptom control and no further flares. This case reinforces the need to consider rare metabolic disorders in unexplained multisystem presentations and highlights the role of enzyme-targeting therapy when conventional treatment is not tolerated.

10 Jun 2025·ANALYTICAL CHEMISTRY

Differential Protein Precipitation-Based GalNAc-siRNA Sample Preparation with LC/MS Method Development Workflow in Plasma

Article

Author: Kim, Youngjae ; Zhang, Ting Ting ; Dong, Linlin ; Qian, Mark G. ; Sugimoto, Hiroshi

Liquid chromatography-mass spectrometry (LC/MS) plays a crucial role in the quantification of small interfering RNAs (siRNAs) in biological matrices. However, the recovery of siRNA from complex biological matrices remains a significant challenge. Focusing on liver-targeted N-acetylgalactosamine (GalNAc)-siRNA conjugates, the primary extraction methods currently used are solid-phase extraction (SPE) and hybridization. While both methods have advantages, SPE recovery can vary depending on the analyte and is costly, whereas the hybridization method requires specific reagents, limiting its applicability. To address these challenges, we developed a novel extraction method for LC/MS bioanalysis of GalNAc-siRNA. Our innovative approach uses a differential protein precipitation method with an optimized organic solvent mix to remove large, high-abundance plasma proteins as precipitates while preserving the GalNAc-siRNAs in the liquid phase. The workflow was optimized to identify the most intense MS/MS transitions, and LC-MS/MS parameters were fine-tuned using high-resolution Orbitrap and QTRAP hybrid mass spectrometers for the highly sensitive detection of targeted siRNA molecules. This approach achieved a lower limit of quantification in the single-digit ng/mL range for four FDA-approved GalNAc-siRNAs (Givosiran, Lumasiran, Inclisiran, and Vutrisiran) and a major Givosiran metabolite, AS(N-1)3'. The applicability of this approach was successfully demonstrated by analyzing plasma samples from an in vivo rat study involving three molecules (Givosiran, Givosiran AS(N-1)3', and Inclisiran). This method is straightforward, robust, highly sensitive, and cost-effective and should be readily adaptable for the bioanalysis of diverse GalNAc-siRNAs and, potentially, for late-stage sample analyses.

155

News (Medical) associated with Givosiran Sodium12 Feb 2026

− Achieved Fourth Quarter and Full Year 2025 Global Net Product Revenues of $995 Million and $2,987 Million, Respectively, Representing 121% and 81% Growth Compared to Same Periods in 2024 –

− Attained GAAP and non-GAAP Profitability for Full Year 2025, with Sustainable Growth in Operating Income Expected –

− Launched

“

Alnylam 2030

”

Strategy Focused on Scaling Alnylam through Durable ATTR Leadership, Long-Term Sustainable Innovation, and Exceptional Financial Results –

− Announced 2026 Pipeline Goals, Including 4 Clinical Readouts, 3 Ongoing Pivotal Studies, 3 Phase 2 Study Initiations, and 3+ New IND Filings –

− Reiterates Net Product Sales Guidance and Provides Additional 2026 Financial Guidance –

CAMBRIDGE, Mass.--(BUSINESS WIRE)--

Alnylam Pharmaceuticals, Inc.

(Nasdaq: ALNY), the leading RNAi therapeutics company, today reported its consolidated financial results for the fourth quarter and full year ended December 31, 2025 and reviewed recent business highlights.

“2025 was a year of key accomplishments for Alnylam, highlighted by the landmark approval of AMVUTTRA for ATTR-CM in the U.S., which drove total net product revenues of nearly $3 billion, or 81% growth year-over-year, and propelled us to profitability. We also achieved great progress across our portfolio, initiating three Phase 3 studies, expanding our pipeline with four proprietary CTAs, and launching a potential best-in-class enzymatic ligation-based RNAi manufacturing platform,” said Yvonne Greenstreet, M.D., Chief Executive Officer of Alnylam. “Further, we are excited to have recently unveiled our new set of five-year aspirational goals,

Alnylam 2030

, under which we aim to achieve global TTR leadership with a durable franchise; grow through innovation by delivering therapies that prevent, halt, or reverse disease; and scale with financial discipline and agility. By pursuing these ambitious goals, we believe Alnylam will drive substantial patient impact by addressing serious unmet medical needs around the world and create substantial long-term shareholder value.”

Fourth Quarter 2025 and Recent Significant Business Highlights

Total TTR: AMVUTTRA

®

(vutrisiran) & ONPATTRO

®

(patisiran)

Achieved global net product revenues for AMVUTTRA and ONPATTRO for the fourth quarter of $827 million and $32 million, respectively, together representing 151% total TTR growth compared to Q4 2024, and full year 2025 revenues of $2,314 million and $173 million, respectively, together representing 103% total TTR growth compared to full year 2024.

Presented new analyses from the HELIOS-B Phase 3 clinical trial of

vutrisiran

in patients with ATTR-CM at the

American Heart Association Scientific Sessions 2025

.

Cardiovascular magnetic resonance (CMR) and echocardiographic analyses demonstrated that treatment with vutrisiran resulted in significant changes indicating significant improvement on multiple functional and structural cardiac parameters.

CMR imaging showed amyloid regression in 22% of vutrisiran treated patients with no regression found in patients who received placebo.

Treatment with vutrisiran preserved kidney function in HELIOS-B patients, and reduced risk of death and cardiovascular events in patients with advanced chronic kidney disease.

Total Rare: GIVLAARI

®

(givosiran) & OXLUMO

®

(lumasiran)

Achieved global net product revenues for GIVLAARI and OXLUMO for the fourth quarter of $87 million and $50 million, respectively, together representing 26% total Rare growth compared to Q4 2024, and full year 2025 revenues of $308 million and $191 million, respectively, together representing $500 million in revenues and 18% total Rare growth compared to full year 2024.

Other Highlights

Initiated a Phase 2 clinical trial of

ALN-4324

, an investigational RNAi therapeutic targeting GRB14 for type 2 diabetes mellitus.

Initiated a Phase 1 clinical trial of

ALN-2232

, an investigational RNAi therapeutic targeting ACVR1C in adipose tissue for obesity and weight management.

Advanced two new programs (

ALN-4285

and

ALN-4915

) into clinical development in healthy volunteers.

Announced the planned expansion of its state-of-the-art manufacturing facility in Norton, Massachusetts. The Company plans to invest $250 million to develop the industry's first fully dedicated, proprietary siRNA enzymatic-ligation manufacturing facility. This new enzymatic-ligation platform, siRELIS™, is expected to meaningfully expand capacity, significantly reduce production costs, and position the Company to support future launches across its growing pipeline of potential new medicines.

Additional Business Updates

Announced changes to the Company's Board of Directors, including the departures of Mike Bonney and Carolyn Bertozzi, Ph.D., and the appointment of Stuart Arbuckle.

Key Upcoming Events

The Company will host an investor webinar marking the one-year anniversary of the FDA approval of AMVUTTRA in ATTR-CM on March 24, 2026. The Company will highlight progress in delivering for ATTR-CM patients and the long-term growth and durability of its flagship TTR franchise.

In the first half of 2026, Alnylam expects to:

Complete enrollment in the cAPPricorn-1 Phase 2 clinical trial of

mivelsiran

in patients with cerebral amyloid angiopathy.

Initiate a Phase 2 clinical trial of

mivelsiran

in patients with Alzheimer's disease.

Initiate a Phase 2 clinical trial of

ALN-6400

in a second bleeding disorder.

In the second half of 2026, Alnylam expects to announce clinical de-risking data from several pipeline programs, including:

Results from Phase 1 and Phase 2 clinical trials of

ALN-6400

in healthy volunteers and patients with hereditary hemorrhagic telangiectasia (HHT), respectively.

Results from a Phase 1 clinical trial of

ALN-HTT02

in patients with Huntington's disease.

Results from a Phase 1 clinical trial of

ALN-2232

in obesity and weight management.

Financial Results for the Fourth Quarter and Full Year 2025

Three Months Ended December 31,

Twelve Months Ended December 31,

(In thousands, except per share amounts)

2025

2024

2025

2024

Total revenues

$

1,097,033

$

593,166

$

3,713,937

$

2,248,243

GAAP Income (loss) from operations

$

131,718

$

(105,159

)

$

501,578

$

(176,885

)

Non-GAAP Income (loss) from operations

$

203,350

$

(13,514

)

$

849,813

$

95,199

GAAP Net income (loss)

$

111,543

$

(83,763

)

$

313,747

$

(278,157

)

Non-GAAP Net income (loss)

$

169,753

$

8,048

$

683,644

$

(3,051

)

GAAP Net income (loss) per common share — basic

$

0.84

$

(0.65

)

$

2.39

$

(2.18

)

GAAP Net income (loss) per common share — diluted

$

0.82

$

(0.65

)

$

2.33

$

(2.18

)

Non-GAAP Net income (loss) per common share — basic

$

1.28

$

0.06

$

5.22

$

(0.02

)

Non-GAAP Net income (loss) per share — diluted

$

1.25

$

0.06

$

5.08

$

(0.02

)

For an explanation of our use of non-GAAP financial measures, refer to the “Use of Non-GAAP Financial Measures” section later in this press release and for a reconciliation of each non-GAAP financial measure to the most comparable GAAP measure, see the tables at the end of this press release.

Revenue Summary

Three Months Ended December 31,

(In thousands, except percentages)

2025

2024

% Change

At CER*

Net product revenues:

AMVUTTRA

$

826,588

$

286,510

189

%

187

%

ONPATTRO

31,687

56,103

(44

)%

(45

)%

Total TTR net product revenues

858,275

342,613

151

%

149

%

GIVLAARI

86,796

64,645

34

%

32

%

OXLUMO

49,646

43,573

14

%

10

%

Total Rare net product revenues

136,442

108,218

26

%

23

%

Total net product revenues

994,717

450,831

121

%

119

%

Net revenues from collaborations:

Roche

32,954

12,014

174

%

174

%

Regeneron Pharmaceuticals

7,834

30,657

(74

)%

(74

)%

Novartis AG

—

60,003

(100

)%

(100

)%

Other

155

4,274

(96

)%

(96

)%

Total net revenues from collaborations

40,943

106,948

(62

)%

(62

)%

Royalty revenue

61,373

35,387

73

%

73

%

Total revenues

$

1,097,033

$

593,166

85

%

83

%

* Change at constant exchange rates, or CER, represents percent change calculated as if exchange rates had remained unchanged from those used during the three months ended December 31, 2024. CER is a non-GAAP financial measure.

Twelve Months Ended December 31,

(In thousands, except percentages)

2025

2024

% Change

At CER*

Net product revenues:

AMVUTTRA

$

2,313,836

$

970,450

138

%

137

%

ONPATTRO

172,789

252,857

(32

)%

(32

)%

Total TTR net product revenues

2,486,625

1,223,307

103

%

102

%

GIVLAARI

308,487

255,871

21

%

20

%

OXLUMO

191,437

167,050

15

%

13

%

Total Rare net product revenues

499,924

422,921

18

%

17

%

Total net product revenues

2,986,549

1,646,228

81

%

80

%

Net revenues from collaborations:

Roche

394,881

119,489

230

%

230

%

Regeneron Pharmaceuticals

113,957

302,798

(62

)%

(62

)%

Novartis AG

—

79,759

(100

)%

(100

)%

Other

44,528

8,175

445

%

445

%

Total net revenues from collaborations

553,366

510,221

8

%

8

%

Royalty revenue

174,022

91,794

90

%

90

%

Total revenues

$

3,713,937

$

2,248,243

65

%

64

%

* Change at constant exchange rates, or CER, represents growth calculated as if exchange rates had remained unchanged from those used during the twelve months ended December 31, 2024. CER is a non-GAAP financial measure.

Total Net Product Revenues

Net product revenues increased 121% and 81% at actual currency during the three and twelve months ended December 31, 2025, respectively, compared to the same periods in 2024, and 119% and 80% at CER, respectively. The increases were primarily due to growth from AMVUTTRA revenues driven by increased patient demand, mainly in patients with ATTR-CM in the U.S., which was partially offset by a decreased number of patients on ONPATTRO, and due to growth from an increased number of patients on GIVLAARI and OXLUMO.

Net Revenues from Collaborations

Net revenues from collaborations decreased $66 million during the three months ended December 31, 2025, as compared to the same period in 2024, primarily due to revenue recognized under our license agreement with Novartis associated with the achievement of a specified Leqvio commercialization milestone during the three months ended December 31, 2024.

Net revenues from collaborations increased by $43 million during the twelve months ended December 31, 2025, as compared to the same period in 2024, primarily driven by recognition of $300 million of milestone revenue under our collaboration with Roche in September 2025 associated with the dosing of the first patient in the ZENITH Phase 3 clinical trial of zilebesiran and recognition of a $30 million payment in connection with the amendment to our agreement with Vir Biotechnology in March 2025. In comparison, during 2024, we recognized $185 million in revenues under our collaboration with Regeneron as we modified the collaboration in June 2024 and provided Regeneron with an exclusive license to develop, manufacture and commercialize cemdisiran as a monotherapy, and also recognized $65 million of milestone revenue under our collaboration with Roche in March 2024 associated with the dosing of the first patient in the KARDIA-3 Phase 2 clinical trial of zilebesiran.

Royalty Revenue

Royalty revenue increased during the three and twelve months ended December 31, 2025, as compared to the same periods in 2024, due to increased volume and rate of royalties earned from global net sales of Leqvio by Novartis.

Operating Expense Summary

Three Months Ended December 31,

Twelve Months Ended December 31,

(In thousands, except percentages)

2025

2024

% Change

2025

2024

% Change

Cost of goods sold

$

267,723

$

102,649

161

%

$

677,166

$

306,513

121

%

% of net product revenues

26.9

%

22.8

%

22.7

%

18.6

%

Cost of collaborations and royalties

$

—

$

168

(100

)%

$

4,705

$

16,857

(72

)%

GAAP Research and development expenses

$

372,218

$

300,169

24

%

$

1,319,775

$

1,126,232

17

%

Non-GAAP Research and development expenses

$

340,898

$

259,544

31

%

$

1,166,380

$

998,483

17

%

GAAP Selling, general and administrative expenses

$

325,374

$

295,339

10

%

$

1,210,713

$

975,526

24

%

Non-GAAP Selling, general and administrative expenses

$

285,062

$

244,319

17

%

$

1,015,873

$

831,191

22

%

Cost of Goods Sold

Cost of goods sold as a percentage of net product revenues increased during the three and twelve months ended December 31, 2025, as compared to the same periods in 2024, primarily as a result of increased sales of AMVUTTRA and an associated increase in the blended royalty rate payable on net sales of AMVUTTRA.

Research & Development (R&D) Expenses

GAAP and non-GAAP R&D expenses increased during the three and twelve months ended December 31, 2025, as compared to the same periods in 2024, primarily due to increased clinical trial expenses for the ZENITH Phase 3 clinical trial of zilebesiran, the TRITON-CM Phase 3 clinical trial of nucresiran in patients with ATTR-CM and the TRITON-PN Phase 3 clinical trial of nucresiran in patients with hATTR-PN, as well as increased employee compensation and related expenses to support our research and development pipeline and development expenses. Additionally, GAAP R&D expenses increased due to higher stock-based compensation expenses.

Selling, General & Administrative (SG&A) Expenses

GAAP and non-GAAP SG&A expenses increased during the three and twelve months ended December 31, 2025, as compared to the same periods in 2024, primarily due to higher employee compensation costs, including stock-based compensation, mainly driven by higher headcount, and increased marketing investment associated with the commercial launch of AMVUTTRA in ATTR-CM.

Other Financial Highlights

Interest expense

Interest expense for the three and twelve months ended December 31, 2025 of $65 million and $253 million, respectively, included interest of $38 million and $150 million, respectively, attributed to the liability related to the sale of future Leqvio royalties, and $25 million and $89 million, respectively, attributed to the liabilities related to the vutrisiran and zilebesiran development funding.

Benefit from (provision for) income taxes

During the three months year ended December 31, 2025, we recorded a benefit from income taxes of $25 million primarily related to the generation of Switzerland deferred tax assets, partially offset by additional U.S state income tax. During the twelve months ended December 31, 2025, we recorded a provision for income taxes of $9 million primarily related to U.S state income taxes, utilization of Switzerland net deferred tax assets, as well as taxable income from jurisdictions in which we are subject to tax. We will continue to utilize deferred tax assets in Switzerland to offset current cash tax liabilities and will continue to monitor the requirement for a valuation allowance against our net deferred tax assets in the U.S. and certain deferred tax assets in Switzerland.

Financial position

Cash, cash equivalents and marketable securities were $2.91 billion as of December 31, 2025, as compared to $2.69 billion as of December 31, 2024, with the increase primarily due to improved operating performance, proceeds from exercise of stock options, and net proceeds from the issuance of our 0.00% convertible senior notes due 2028, offset in part by cash paid for the partial repurchases of our 1.00% convertible senior notes due 2027.

Net cash provided by operating activities for the three and twelve months ended December 31, 2025 included $23 million and $118 million, respectively, of payments associated with the liability related to the sale of future Leqvio royalties recorded to interest expense, as well as $30 million and $85 million, respectively, of payments associated with the liabilities related to vutrisiran and zilebesiran development funding recorded to interest expense.

A reconciliation of our GAAP to non-GAAP results for the three and twelve months ended December 31, 2025 and 2024, is included in the tables at the end of this press release.

2026 Financial Guidance

Full-year 2026 financial guidance is summarized below:

Total TTR net product revenues (AMVUTTRA, ONPATTRO)

1

$4,400 million - $4,700 million

Total Rare net product revenues (GIVLAARI, OXLUMO)

1

$500 million - $600 million

Total net product revenues

1

$4,900 million - $5,300 million

Net product revenues growth vs. 2025 at currency exchange rates as of December 31, 2025

2

64% - 77%

Net product revenues growth vs. 2025 at constant exchange rates

2

64% - 77%

Net revenues from collaborations and royalties

$400 million - $500 million

Non-GAAP R&D and SG&A expenses

3

$2,700 million - $2,800 million

1

Full-year 2026 guidance utilizing currency exchange rates as of December 31, 2025: 1 EUR = 1.17 USD and 1 USD = 157 JPY

2

Representing growth calculated as if the exchange rates had remained unchanged from those used in 2025, which is a non-GAAP financial measure

3

Excludes $300 million - $400 million of stock-based compensation expense from estimated GAAP R&D and SG&A expenses

Use of Non-GAAP Financial Measures

This press release contains non-GAAP financial measures, including expenses adjusted to exclude certain non-cash expenses and non-recurring gains or losses outside the ordinary course of the Company’s business. These measures are not in accordance with, or an alternative to, GAAP, and may be different from non-GAAP financial measures used by other companies.

The items included in GAAP presentations but excluded for purposes of determining non-GAAP financial measures for the periods presented in this press release are stock-based compensation expenses, loss related to convertible debt, and realized and unrealized gains or losses on marketable equity securities. The Company has excluded the impact of stock-based compensation expense, which may fluctuate from period to period based on factors including the variability associated with performance-based grants for stock options and restricted stock units and changes in the Company’s stock price, which impacts the fair value of these awards. The Company has excluded the loss related to convertible debt because the Company believes the item is a non-recurring transaction outside the ordinary course of the Company’s business. The Company has excluded the impact of the realized and unrealized gains or losses on marketable equity securities because the Company does not believe these adjustments accurately reflect the performance of the Company’s ongoing operations for the period in which such gains or losses are reported, as their sole purpose is to adjust amounts on the balance sheet.

Percentage changes in revenue growth at CER are presented excluding the impact of changes in foreign currency exchange rates for investors to understand the underlying business performance. The current period’s foreign currency revenue values are converted into U.S. dollars using the average exchange rates from the prior period.

The Company believes the presentation of non-GAAP financial measures provides useful information to management and investors regarding the Company’s financial condition and results of operations. When GAAP financial measures are viewed in conjunction with non-GAAP financial measures, investors are provided with a more meaningful understanding of the Company’s ongoing operating performance and are better able to compare the Company’s performance between periods. In addition, these non-GAAP financial measures are among those indicators the Company uses as a basis for evaluating performance, allocating resources and planning and forecasting future periods. Non-GAAP financial measures are not intended to be considered in isolation or as a substitute for GAAP financial measures. A reconciliation between GAAP and non-GAAP measures is provided later in this press release.

Conference Call Information

Management will provide an update on the Company and discuss fourth quarter and full year 2025 results as well as expectations for the future via conference call on Thursday, February 12, 2026 at 8:30 am ET. A live audio webcast of the call will be available on the Investors section of the Company’s website at

. An archived webcast will be available on the Alnylam website approximately two hours after the event.

About AMVUTTRA

®

(vutrisiran)

AMVUTTRA

®

(vutrisiran) is an RNAi therapeutic that delivers rapid knockdown of transthyretin (TTR), addressing the underlying cause of transthyretin (ATTR) amyloidosis. Administered quarterly via subcutaneous injection by a healthcare professional, AMVUTTRA is approved and marketed for the treatment of the polyneuropathy of hereditary transthyretin-mediated amyloidosis (hATTR-PN) in adults and for the treatment of the cardiomyopathy of wild-type or hereditary transthyretin-mediated amyloidosis (ATTR-CM) in adults to reduce cardiovascular mortality, cardiovascular hospitalizations and urgent heart failure visits. For more information about AMVUTTRA, including the full U.S.

Prescribing Information

, visit

AMVUTTRA.com

.

About ONPATTRO

®

(patisiran)

ONPATTRO is an RNAi therapeutic that is approved in the United States and Canada for the treatment of adults with hATTR amyloidosis with polyneuropathy. ONPATTRO is also approved in the European Union, Switzerland and Brazil for the treatment of hATTR amyloidosis in adults with Stage 1 or Stage 2 polyneuropathy, and in Japan for the treatment of hATTR amyloidosis with polyneuropathy. ONPATTRO is an intravenously administered RNAi therapeutic targeting transthyretin (TTR). It is designed to target and silence TTR messenger RNA, thereby reducing the production of TTR protein before it is made. Reducing the pathogenic protein leads to a reduction in amyloid deposits in tissues. For more information about ONPATTRO, including full

Prescribing Information

, visit

ONPATTRO.com

.

About GIVLAARI

®

(givosiran)

GIVLAARI (givosiran) is an RNAi therapeutic targeting aminolevulinic acid synthase 1 (ALAS1) approved in the United States and Brazil for the treatment of adults with acute hepatic porphyria (AHP). GIVLAARI is also approved in the European Union for the treatment of AHP in adults and adolescents aged 12 years and older. In the pivotal trial, GIVLAARI was shown to significantly reduce the rate of porphyria attacks that required hospitalizations, urgent healthcare visits or intravenous hemin administration at home compared to placebo. GIVLAARI is Alnylam’s first commercially available therapeutic based on its Enhanced Stabilization Chemistry ESC-GalNAc conjugate technology to increase potency and durability. GIVLAARI is administered via subcutaneous injection once monthly at a dose based on actual body weight and should be administered by a healthcare professional. GIVLAARI works by specifically reducing elevated levels of ALAS1 messenger RNA (mRNA), leading to reduction of toxins associated with attacks and other disease manifestations of AHP. For more information about GIVLAARI, including the full U.S.

Prescribing Information

, visit

GIVLAARI.com

.

About OXLUMO

®

(lumasiran)

OXLUMO (lumasiran) is an RNAi therapeutic targeting hydroxyacid oxidase 1 (HAO1). HAO1 encodes glycolate oxidase (GO). Thus, by silencing HAO1 and depleting the GO enzyme, OXLUMO inhibits production of oxalate – the metabolite that directly contributes to the pathophysiology of PH1. OXLUMO utilizes Alnylam’s Enhanced Stabilization Chemistry (ESC)-GalNAc-conjugate technology, which enables subcutaneous dosing with increased potency and durability and a wide therapeutic index.

Contacts

Alnylam Pharmaceuticals, Inc.

Christine Akinc

(Investors and Media)

617-682-4340

Josh Brodsky

(Investors)

617-551-8276

Read full story here

Phase 1Phase 2Drug ApprovalFinancial StatementPhase 3

11 Jan 2026

Jan 11, 2026

− Full Year 2025 Preliminary* Net Product Revenues of $2,987 Million (81% Growth vs. 2024), Driven Primarily by Preliminary* Total TTR Revenues of $2,487 Million (103% Growth vs. 2024) –

− Company Provides 2026 Combined Net Product Revenue Guidance of $4,900 Million to $5,300 Million , Driven Primarily by Total TTR Net Product Revenue Guidance of $4,400 Million to $4,700 Million –

– 2026 Pipeline Goals Focused on Continued Advancement of Numerous Multi-Billion-Dollar Opportunities –

CAMBRIDGE, Mass. --(BUSINESS WIRE)--Jan. 11, 2026-- Alnylam Pharmaceuticals, Inc. (Nasdaq: ALNY), the leading RNAi therapeutics company, today announced its new five-year strategy, “ Alnylam 2030,” focused on scaling the Company’s operations through achieving leadership in ATTR amyloidosis, driving long-term growth through sustainable innovation, and delivering exceptional financial results with discipline and agility. Alnylam also today reported preliminary* fourth quarter and full year 2025 global net product revenues for AMVUTTRA, ONPATTRO, GIVLAARI and OXLUMO.

New Five-Year Strategy: Alnylam 2030

Alnylam 2030 continues the Company’s 15-year heritage of establishing and delivering on ambitious five-year goals, the most recent of which was Alnylam P5x25. Over that time period, Alnylam has either met or exceeded all of its prior five-year goals.

Alnylam 2030 is focused on continuing to successfully scale the Company’s operations. Specifically, the Company intends to achieve the following by the end of 2030:

Achieve Global TTR Leadership: Build a Durable TTR Franchise Lead TTR market in revenue by 2030 and cumulatively across five-year period Launch best-in-class, next-gen silencer, nucresiran, in polyneuropathy by 2028 and cardiomyopathy by 2030

Lead TTR market in revenue by 2030 and cumulatively across five-year period Launch best-in-class, next-gen silencer, nucresiran, in polyneuropathy by 2028 and cardiomyopathy by 2030

Grow Through Sustainable Innovation: Deliver Therapies that Prevent, Halt, or Reverse Disease Deliver 2+ new transformative medicines beyond TTR with blockbuster potential Expand to 10 tissue types and >40 clinical programs Invest ~30% of revenues in non-GAAP R&D, including select external innovation

Deliver 2+ new transformative medicines beyond TTR with blockbuster potential Expand to 10 tissue types and >40 clinical programs Invest ~30% of revenues in non-GAAP R&D, including select external innovation

Scale with Discipline & Agility: Drive Sustained, Profitable Growth Achieve 25%+ total revenue CAGR through year-end 2030 Deliver ~30% non-GAAP operating margin

Achieve 25%+ total revenue CAGR through year-end 2030 Deliver ~30% non-GAAP operating margin

“The past five years have been transformational, as we delivered on our ambitious goals to expand the reach of our commercial product portfolio, grow our pipeline of transformative RNAi therapeutics, and achieve strong financial results leading to sustainable profitability,” said Yvonne Greenstreet , M.D., Chief Executive Officer of Alnylam . “The success we have delivered with the early launch momentum of AMVUTTRA in ATTR-CM has laid the foundation for our first flagship commercial franchise. Our focus for the next five-year period is clear: continue to establish durable leadership in TTR; harness topline growth to invest in a high-yielding pipeline with blockbuster opportunities; and continue to operate with financial discipline and agility to enable the Company to scale efficiently. As the pioneer in RNAi therapeutics that has delivered six approved products, Alnylam 2030 provides the strategic direction to catalyze our growth during the next stage of our evolution.”

Preliminary Fourth Quarter and Full Year 2025 Commercial and Financial Performance*

Total TTR: AMVUTTRA® (vutrisiran) & ONPATTRO® (patisiran)

Preliminary* global net product revenues for AMVUTTRA and ONPATTRO for the fourth quarter were approximately $827 million and $32 million , respectively, together representing 151% total TTR growth compared to Q4 2024, and for the full year 2025 were approximately $2,314 million and $173 million , respectively, together representing 103% total TTR growth compared to full year 2024.

Total Rare: GIVLAARI® (givosiran) & OXLUMO® (lumasiran)

Preliminary* global net product revenues for GIVLAARI and OXLUMO for the fourth quarter were approximately $87 million and $50 million , respectively, together representing 26% total Rare growth compared to Q4 2024, and for the full year 2025 were approximately $308 million and $191 million , respectively, together representing 18% total Rare growth compared to full year 2024.

2026 Combined Net Product Revenue Guidance

Alnylam announced today full year 2026 combined net product revenue guidance for AMVUTTRA, ONPATTRO, GIVLAARI and OXLUMO of $4,900 million to $5,300 million , representing 71% growth compared to 2025* at the mid-point of the guidance range. On a franchise level, the guidance is as follows:

Total TTR (AMVUTTRA & ONPATTRO): $4,400 million to $4,700 million , representing 83% growth compared to 2025* at the mid-point of the guidance range. Total Rare (GIVLAARI & OXLUMO): $500 million to $600 million , representing 10% growth compared to 2025* at the mid-point of the guidance range.

The Company plans to provide additional guidance for collaboration and royalty revenue and operating expenses when fourth quarter and full year 2025 earnings are released.

2026 Pipeline Goals

Nucresiran – an investigational RNAi therapeutic in development for the treatment of ATTR amyloidosis. Alnylam expects to:

Advance the TRITON-CM Phase 3 trial in ATTR-CM and the TRITON-PN Phase 3 trial in hATTR-PN.

Zilebesiran – an investigational RNAi therapeutic in development for the treatment of hypertension, in collaboration with Roche. Alnylam expects to:

Advance the ZENITH Phase 3 cardiovascular outcomes trial.

Mivelsiran – an investigational RNAi therapeutic in development for the treatment of cerebral amyloid angiopathy (CAA) and Alzheimer’s disease. Alnylam expects to:

Complete enrollment of the cAPPricorn-1 Phase 2 trial in cerebral amyloid angiopathy in H1. Initiate a Phase 2 trial in Alzheimer’s disease in H1.

ALN-6400 – an investigational RNAi therapeutic in development for the treatment of bleeding disorders. Alnylam expects to:

Report Phase 1 data in healthy volunteers in H2. Report clinical proof of concept in hereditary hemorrhagic telangiectasia in H2. Initiate a Phase 2 trial in a second bleeding disorder in H1.

ALN-4324 – an investigational RNAi therapeutic in development for the treatment of type 2 diabetes mellitus. Alnylam expects to:

Initiate a Phase 2 trial in H1.

ALN-HTT02 – an investigational RNAi therapeutic in development for the treatment of Huntington’s disease, in collaboration with Regeneron. Alnylam expects to:

Report Phase 1 data in H2.

ALN-2232 – an investigational RNAi therapeutic in development for the treatment of obesity & weight management. Alnylam expects to:

Report Phase 1 data in H2.

In addition, the Company plans to file Investigational New Drug (IND) applications for three to four new Alnylam -led programs by the end of 2026.

Alnylam management will discuss its preliminary 2025 net product revenues, as well as 2026 goals and guidance during a webcast presentation at the 44th Annual J.P. Morgan Healthcare Conference in San Francisco, California tomorrow, Monday, January 12, 2026 at 9:00 am PT ( 12:00 pm ET ).

About RNAi

RNAi (RNA interference) is a natural cellular process of gene silencing that represents one of the most promising and rapidly advancing frontiers in biology and drug development today. Its discovery has been heralded as “a major scientific breakthrough that happens once every decade or so,” and was recognized with the award of the 2006 Nobel Prize for Physiology or Medicine. By harnessing the natural biological process of RNAi occurring in our cells, a new class of medicines known as RNAi therapeutics is now a reality. Small interfering RNA (siRNA), the molecules that mediate RNAi and comprise Alnylam’s RNAi therapeutic platform, function upstream of today’s medicines by potently silencing messenger RNA (mRNA) – the genetic precursors – that encode for disease-causing or disease pathway proteins, thus preventing them from being made. This is a revolutionary approach with the potential to transform the care of patients with genetic and other diseases.

About Alnylam Pharmaceuticals

Alnylam (Nasdaq: ALNY) is a leading global biopharmaceutical company and the pioneer of the RNA interference (RNAi) revolution. The Company is focused on developing transformative therapies with the potential to prevent, halt, or reverse disease. For more than two decades, Alnylam has advanced the Nobel-Prize-winning science of RNAi, delivering critical breakthroughs and six approved medicines. Alnylam has medicines available in more than 70 countries and a rapidly expanding and robust pipeline, in addition to consistently being recognized as an exceptional workplace and socially responsible organization. The Company is executing on its Alnylam 2030 strategy to accelerate innovation and scale impact to transform human health. For more information, please visit www.alnylam.com or follow Alnylam on X, LinkedIn, Facebook, Instagram, or YouTube.

Alnylam Forward-Looking Statements

This press release contains forward-looking statements within the meaning of Section 27A of the Securities Act of 1933 and Section 21E of the Securities Exchange Act of 1934. All statements other than historical statements of fact regarding Alnylam’s expectations, beliefs, goals, plans or prospects including, without limitation, statements regarding: Alnylam’s potential achievement of the goals in its “ Alnylam 2030” strategy and its ability to drive the next era of growth and patient impact; Alnylam’s ability to achieve global TTR leadership, drive long-term growth through sustainable innovation, and deliver exceptional financial results with discipline and agility; the size of the opportunities of any of the product candidates in Alnylam’s pipeline; the potential for AMVUTTRA in ATTR-CM to be Alnylam’s flagship commercial franchise; the potential for Alnylam to advance its research and development programs, including its goals and expectations regarding the clinical development of nucresiran, zilebesiran, mivelsiran, ALN-6400, ALN-4324, ALN-HTT02, and ALN-2232, including the timeline of the initiation, completion of enrollment, and reporting of data and/or proof of concept from, any clinical trials; the number of IND applications Alnylam plans to file for Alnylam -led programs by the end of 2026; and Alnylam’s projected commercial and financial performance, including the expected range of global net product revenues for 2026 should be considered forward-looking statements. Actual results and future plans may differ materially from those indicated by these forward-looking statements as a result of various important risks, uncertainties and other factors, including, without limitation, risks and uncertainties relating to Alnylam’s ability to successfully execute on its “ Alnylam 2030” strategy; Alnylam’s ability to discover and develop novel drug candidates and delivery approaches and successfully demonstrate the efficacy and safety of its product candidates; the pre-clinical and clinical results for Alnylam’s product candidates, including nucresiran, zilebesiran, mivelsiran, ALN-6400, ALN-4324, ALN-HTT02, and ALN-2232; the possibility of unfavorable new clinical data and further analyses of existing clinical data; interim and preliminary data; the possibility that clinical data are subject to differing interpretations and assessments by regulatory agencies; actions or advice of regulatory agencies and Alnylam’s ability to obtain and maintain regulatory approval for its product candidates, as well as favorable pricing and reimbursement; successfully launching, marketing and selling Alnylam’s approved products globally; delays, interruptions or failures in the manufacture and supply of Alnylam’s product candidates or its marketed products; obtaining, maintaining and protecting intellectual property; Alnylam’s ability to manage its growth and operating expenses through disciplined investment in operations and its ability to achieve a self-sustainable financial profile in the future; Alnylam’s ability to maintain strategic business collaborations; Alnylam’s dependence on third parties for the development and commercialization of certain products; the outcome of litigation; the potential risk of future government investigations; and unexpected expenditures; as well as those risks more fully discussed in the “Risk Factors” filed with Alnylam’s 2024 Annual Report on Form 10-K filed with the Securities and Exchange Commission (SEC), as may be updated from time to time in Alnylam’s subsequent Quarterly Reports on Form 10-Q, and in other filings that Alnylam makes with the SEC . In addition, any forward-looking statements represent Alnylam’s views only as of today and should not be relied upon as representing Alnylam’s views as of any subsequent date. Alnylam explicitly disclaims any obligation, except to the extent required by law, to update any forward-looking statements.

Use of Non-GAAP Financial Measures

This press release contains references to forward-looking financial measures of non-GAAP R&D and non-GAAP operating margin that were not prepared in accordance with U.S. generally accepted accounting principles (GAAP). We do not provide a reconciliation of these forward-looking non-GAAP financial measures to the most directly comparable financial measures calculated and presented in accordance with GAAP on a forward-looking basis because such reconciliation is not accessible with reasonable effort, due to the uncertainty and inherent difficulty of predicting the occurrence and the financial impact of adjustments, such as stock-based compensation expense; such adjustments could be material. We use these non-GAAP measures as an indicator of financial performance for the purpose of internal evaluation of progress toward financial objectives. We also believe that these non-GAAP measures provide investors with useful information with respect to our operational goals. A non-GAAP financial measure is not, and should not be viewed as, a substitute for financial measures required by GAAP, has no standardized meaning prescribed by GAAP, and may not be comparable to the calculation of the measure by other companies.

* The preliminary selected financial results are unaudited, subject to adjustment, and provided as an approximation in advance of the Company’s announcement of complete financial results in February 2026 .

View source version on businesswire.com: https://www.businesswire.com/news/home/20260111699710/en/

Alnylam Pharmaceuticals, Inc.

Christine Akinc (Investors and Media) +1-617-682-4340

Josh Brodsky (Investors) +1-617-551-8276

Source: Alnylam Pharmaceuticals, Inc.

For Media Inquiries, please contact:

Christine Akinc

Chief Corporate Communications Officer media@alnylam.com 617-682-4340

For Investor Inquiries, please contact:

Josh Brodsky

VP, Investor Relations & Corporate Communications investors@alnylam.com 617-551-8276

Essential assets and documents related to Alnylam

Financial StatementPhase 3

17 Dec 2025

Dec 17, 2025

New platform is expected to substantially increase manufacturing capacity and lower production costs, enabling investment in expanding pipeline FDA has accepted Alnylam’s enzymatic ligation manufacturing platform into its Emerging Technology Program, fast-tracking global regulatory engagement

CAMBRIDGE, Mass. --(BUSINESS WIRE)--Dec. 17, 2025-- Alnylam Pharmaceuticals, Inc. (Nasdaq: ALNY), the leading RNAi therapeutics company, today announced the planned expansion of its state-of-the-art manufacturing facility in Norton, Massachusetts . The Company is preparing to invest $250 million to advance what is poised to become the industry’s first fully dedicated, proprietary, siRNA enzymatic-ligation manufacturing facility. This investment is expected to meaningfully expand capacity, significantly reduce production costs, and position Alnylam to support future launches across its growing pipeline of potential new medicines.

As part of the expansion, Alnylam also announced that this next-generation, scalable, enzymatic ligation manufacturing platform, siRELIS™, has been accepted into the U.S. Food and Drug Administration’s (FDA) Emerging Technology Program, accelerating dialogue with global health authorities on innovative manufacturing approaches for oligonucleotide-based medicines. This acceptance follows successful demonstration of Alnylam’s enzymatic ligation platform through production of pilot-scale batches of zilebesiran, which is being studied to reduce the risk of major adverse cardiovascular events in patients with hypertension (high blood pressure), and nucresiran, which is in development for the treatment of transthyretin-mediated amyloidosis (ATTR).

“At this pivotal time with our expanding pipeline of RNAi therapeutics, Alnylam is accelerating development of siRNA manufacturing and changing what’s possible in a single facility,” said Yvonne Greenstreet , M.D., MBA, Chief Executive Officer of Alnylam . “This advance will be a critical enabler in the scaling of our pipeline to include potential treatments for diseases such as hypertension, type 2 diabetes, and obesity.”

Expansion in Norton, MA The $250 million expansion of Alnylam’s 200,000 sq. ft. Norton facility will increase its capabilities to locally produce both clinical and commercial supply of siRNA oligonucleotide drug substance for patients around the world. The facility, which opened in 2021, has played a key role in the growth of Alnylam’s clinical pipeline and acts as a pipeline accelerator for early-stage programs, including programs targeting different tissue types (e.g., liver, CNS, muscle, adipose, etc.). This expansion will strengthen Massachusetts’ position as a global hub of life sciences innovation. Construction is underway, with new capabilities expected to become fully operational by late 2027.

“Alnylam represents the world-class health care innovation Massachusetts is known for. Alnylam has been a leader in life sciences in our state for over two decades,” said Governor Maura Healey . “Their scientific breakthroughs in siRNA manufacturing have transformed care by providing RNAi therapeutics to people who need it most, while creating thousands of jobs across our state. We're excited to support their growth through the expansion of a manufacturing facility in Southeastern Mass., and we're grateful for their continued investment in Massachusetts.”

“Alnylam’s continued investment in Massachusetts underscores the Commonwealth’s role as a global leader in biomanufacturing,” said Dr. Kirk Taylor , President and CEO of the Massachusetts Life Sciences Center (MLSC). “This expansion will bring high-quality jobs to this area and ensure patients worldwide have the opportunity to benefit from medicines made right here in Massachusetts . We look forward to deepening our partnership as we work together to advance the thriving life sciences ecosystem here in the Commonwealth.”

A Breakthrough in Manufacturing at Scale Alnylam’s siRELIS™ platform builds RNAi therapeutics more efficiently using fewer materials and plant resources, and greatly expands capacity – making large-scale, sustainable production possible.

“Manufacturing oligonucleotide-based medicines is highly complex, and the current manufacturing technology will struggle to meet increased demand. We have successfully applied a reproducible, less time-intensive process that increases throughput while maintaining the highest quality standards,” said Timothy Maines , Chief Technical Operations and Quality Officer at Alnylam . “The expansion of our Norton facility presents an opportunity to reinvent what’s possible in oligonucleotide manufacturing.”

About Enzymatic Ligation Alnylam’s siRELIS™ (siRNA Enzymatic Ligation Synthesis) platform is a next-generation approach to siRNA manufacturing that assembles short, high-quality RNA fragments called “blockmers” into complete molecules more efficiently than traditional methods. This scalable, sustainable platform reduces use of starting materials and reliance on organic solvents and plant time, increasing capacity in a single facility. A brief video about enzymatic ligation can be viewed here.

About Alnylam Manufacturing Alnylam has pioneered small interfering RNA (siRNA) manufacturing at scale, building world-class capabilities in chemistry, engineering, and quality. With a legacy of firsts and a commitment to speed, safety, and sustainability, Alnylam delivers innovative RNAi therapeutics to patients worldwide. To learn more, please visit the “Making Our Medicines” page on Alnylam’s website.

About RNAi Therapeutics RNAi (RNA interference) is a natural cellular process of gene silencing that represents one of the most promising and rapidly advancing frontiers in biology and drug development today. Its discovery has been heralded as “a major scientific breakthrough that happens once every decade or so,” and was recognized with the award of the 2006 Nobel Prize for Physiology or Medicine. By harnessing the natural biological process of RNAi occurring in our cells, a new class of medicines known as RNAi therapeutics is now a reality. Small interfering RNA (siRNA), the molecules that mediate RNAi and comprise Alnylam’s RNAi therapeutic platform, function upstream of today’s medicines by potently silencing messenger RNA (mRNA) – the genetic precursors – that encode for disease-causing or disease pathway proteins, thus preventing them from being made. This is a revolutionary approach with the potential to transform the care of patients with genetic and other diseases.

About Alnylam Pharmaceuticals Alnylam (Nasdaq: ALNY) has led the translation of RNA interference (RNAi) into a whole new class of innovative medicines with the potential to transform the lives of people afflicted with rare and prevalent diseases with unmet need. Based on Nobel Prize-winning science, RNAi therapeutics represent a powerful, clinically validated approach yielding transformative medicines. Since its founding in 2002, Alnylam has led the RNAi Revolution and continues to deliver on a bold vision to turn scientific possibility into reality. Alnylam’s commercial RNAi therapeutic products include AMVUTTRA® (vutrisiran), ONPATTRO® (patisiran), GIVLAARI® (givosiran), and OXLUMO® (lumasiran), which are being developed and commercialized by Alnylam , and Leqvio® (inclisiran) and Qfitlia™ (fitusiran), which are being developed and commercialized by Alnylam’s partners, Novartis and Sanofi, respectively. Alnylam has a deep pipeline of investigational medicines, including multiple product candidates that are in late-stage development. Alnylam is executing on its “Alnylam P5x25” strategy to deliver transformative medicines in both rare and common diseases benefiting patients around the world through sustainable innovation and exceptional financial performance, resulting in a leading biotech profile. Alnylam is headquartered in Cambridge, MA. For more information about our people, science and pipeline, please visit www.alnylam.com and engage with us on X (formerly Twitter) at @Alnylam, or on LinkedIn, Facebook, or Instagram.

Forward Looking Statements This press release contains forward-looking statements within the meaning of Section 27A of the Securities Act of 1933 and Section 21E of the Securities Exchange Act of 1934. All statements other than historical statements of fact regarding Alnylam’s expectations, beliefs, goals, plans or prospects, including, without limitation, statements regarding the planned expansion of Alnylam’s manufacturing facility in Norton, Massachusetts , including Alnylam’s planned $250 million investment in the expansion; the ability of Alnylam’s Norton, Massachusetts facility to meet the global demand for Alnylam’s RNAi therapeutics; Alnylam’s ability to advance the industry’s first fully dedicated, proprietary, siRNA enzymatic-ligation manufacturing facility; the potential for Alnylam’s enzymatic ligation based manufacturing platform to expand manufacturing capacity, reduce production costs, enable more efficient production of RNAi therapeutics, make large-scale, sustainable production possible, and position Alnylam to invest in its pipeline and support future launches; Alnylam’s ability to accelerate development of siRNA manufacturing and to change what’s possible in a single facility; the potential for enzymatic ligation to be a critical enabler in the scaling of Alnylam’s portfolio to include potential treatments for diseases such as hypertension, type 2 diabetes and obesity; the potential for the expansion of Alnylam’s Norton facility to increase its capabilities to locally produce both clinical and commercial supply of siRNA oligonucleotide drug substance; the potential for Alnylam’s new manufacturing capabilities to become fully operational by late 2027; the potential for the expansion of Alnylam’s Norton facility to bring high quality jobs to the area and to ensure that patients worldwide have the opportunity to benefit from medicines made in Massachusetts ; and the potential for the expansion of Alnylam’s Norton facility to reinvent what’s possible in oligonucleotide manufacturing should be considered forward-looking statements. Actual results and future plans may differ materially from those indicated by these forward-looking statements as a result of various important risks, uncertainties and other factors, including, without limitation, risks and uncertainties relating to: Alnylam’s ability to successfully execute on its “Alnylam P5x25” strategy; Alnylam’s ability to discover and develop novel drug candidates and delivery approaches and successfully demonstrate the efficacy and safety of its product candidates; the pre-clinical and clinical results for Alnylam’s product candidates; actions or advice of regulatory agencies and Alnylam’s ability to obtain and maintain regulatory approval for its product candidates, as well as favorable pricing and reimbursement; successfully launching, marketing and selling Alnylam’s approved products globally; delays, interruptions or failures in the manufacture and supply of Alnylam’s product candidates or its marketed products; obtaining, maintaining and protecting intellectual property; Alnylam’s ability to manage its growth and operating expenses through disciplined investment in operations and its ability to achieve a self-sustainable financial profile in the future; Alnylam’s ability to maintain strategic business collaborations; Alnylam’s dependence on third parties for the development and commercialization of certain products, including Roche, Novartis, Sanofi, and Regeneron; the outcome of litigation; the risk of future government investigations; and unexpected expenditures; as well as those risks and uncertainties more fully discussed in the “Risk Factors” filed with Alnylam’s 2024 Annual Report on Form 10-K filed with the Securities and Exchange Commission (SEC), as may be updated from time to time in Alnylam’s subsequent Quarterly Reports on Form 10-Q, and in other filings that Alnylam makes with the SEC . In addition, any forward-looking statements represent Alnylam’s views only as of today and should not be relied upon as representing its views as of any subsequent date. Alnylam explicitly disclaims any obligation, except to the extent required by law, to update any forward-looking statements.

View source version on businesswire.com: https://www.businesswire.com/news/home/20251217194595/en/

Alnylam Pharmaceuticals, Inc. Christine Akinc (Investors and Media) +1-617-682-4340 Josh Brodsky (Investors) +1-617-551-8276

Source: Alnylam Pharmaceuticals, Inc.

Oligonucleotide

100 Deals associated with Givosiran Sodium

Login to view more data

External Link

| KEGG | Wiki | ATC | Drug Bank |

|---|---|---|---|

| D11702D11708 | Givosiran Sodium |

R&D Status

Approved

10 top approved records. to view more data

Login

| Indication | Country/Location | Organization | Date |

|---|---|---|---|

| Porphyria, Acute Hepatic | United States | 20 Nov 2019 |

Developing

10 top R&D records. to view more data

Login

| Indication | Highest Phase | Country/Location | Organization | Date |

|---|---|---|---|---|

| Coproporphyria, Hereditary | Phase 3 | United States | 16 Nov 2017 | |

| Coproporphyria, Hereditary | Phase 3 | Japan | 16 Nov 2017 | |

| Coproporphyria, Hereditary | Phase 3 | Australia | 16 Nov 2017 | |

| Coproporphyria, Hereditary | Phase 3 | Bulgaria | 16 Nov 2017 | |

| Coproporphyria, Hereditary | Phase 3 | Canada | 16 Nov 2017 | |

| Coproporphyria, Hereditary | Phase 3 | Denmark | 16 Nov 2017 | |

| Coproporphyria, Hereditary | Phase 3 | Finland | 16 Nov 2017 | |

| Coproporphyria, Hereditary | Phase 3 | France | 16 Nov 2017 | |

| Coproporphyria, Hereditary | Phase 3 | Germany | 16 Nov 2017 | |

| Coproporphyria, Hereditary | Phase 3 | Italy | 16 Nov 2017 |

Login to view more data

Clinical Result

Clinical Result

Indication

Phase

Evaluation

View All Results

| Study | Phase | Population | Analyzed Enrollment | Group | Results | Evaluation | Publication Date |

|---|

Not Applicable | 10 | fhthbmuvmm(vxiuzeczag) = showed symptomatic improvement in eight participants xvunphdpix (ewuwzgzodu ) View more | Positive | 02 May 2025 | |||

Phase 1/2 | 16 | ovnusjejqp = kgxuufwzdj ppwfdjpbgk (bvpocrhbsk, qbyyeanprb - pxarialfzb) View more | - | 12 Mar 2024 | |||

Phase 3 | 94 | ilrtijfnka(ubbcammrjj) = kfarkbhumz cyilelvsax (skodnxlglj ) View more | Positive | 30 Oct 2021 | |||

Placebo+Givosiran Sodium | ilrtijfnka(ubbcammrjj) = zsdgkekgls cyilelvsax (skodnxlglj ) View more | ||||||

Phase 3 | 94 | Continuous givosiran (DB period, 0-6 months) | pfsonknonb(logaktdbjr) = igfadtzsco eompuccynp (snalfxtxxv ) View more | Positive | 02 Oct 2021 | ||

Placebo crossover group (DB period, 0-6 months) | pfsonknonb(logaktdbjr) = xzgbrlcyvo eompuccynp (snalfxtxxv ) View more | ||||||

Phase 1/2 | Porphyria, Acute Intermittent 5-aminolaevulinic acid synthase 1 (ALAS1) | - | bluvmozomz(tihminuhtk) = yfxzicrlsl pawlbtfpnn (pkagplnzwb ) View more | - | 27 Aug 2020 | ||

Phase 3 | 94 | odxcusegro(pveobihkjo) = rpktpntbeh daeqlykihi (ehhhhjketx ) | Positive | 11 Jun 2020 | |||

Placebo | odxcusegro(pveobihkjo) = lpkkwrvpau daeqlykihi (ehhhhjketx ) | ||||||

Phase 3 | 94 | Placebo+Givosiran (Placebo/Givosiran) | gyucxgdyzf(ptpeyhctjd) = vryvvqcrcw shdlyoilkm (drdlkdibse, tsipvdibgr - stcqzpcwqm) View more | - | 11 Feb 2020 | ||

Placebo+Givosiran (Givosiran/Givosiran) | gyucxgdyzf(ptpeyhctjd) = bjukwxqnhg shdlyoilkm (drdlkdibse, ikjbgbajeh - pgaowbuvaa) View more | ||||||

Phase 1/2 | ALAS1 | - | hitsyhcena(kpretzborh) = hgquzxavpj fjuufkzxcj (vkwovyrnne ) View more | Positive | 27 Jun 2019 | ||

Phase 1 | Porphyria, Acute Intermittent ALAS1 messenger RNA | delta aminolevulinic acid | porphobilinogen | - | fvutfuvzte(xmvdiygesn) = glkuaslkfo ofxnocvcta (rkecaqpuow ) | - | 07 Feb 2019 | ||

Not Applicable | - | tqtlrlacsl(rtjqfdsuhu) = One unexpected serious adverse event (SAE; hypersensitivity) related to Givosiran occurred shpzcnkuqe (yrfgdcppas ) View more | - | 14 Jun 2018 |

Login to view more data

Translational Medicine

Boost your research with our translational medicine data.

login

or

Deal

Boost your decision using our deal data.

login

or

Core Patent

Boost your research with our Core Patent data.

login

or

Clinical Trial

Identify the latest clinical trials across global registries.

login

or

Approval

Accelerate your research with the latest regulatory approval information.

login

or

Regulation

Understand key drug designations in just a few clicks with Synapse.

login

or

AI Agents Built for Biopharma Breakthroughs

Accelerate discovery. Empower decisions. Transform outcomes.

Get started for free today!

Accelerate Strategic R&D decision making with Synapse, PatSnap’s AI-powered Connected Innovation Intelligence Platform Built for Life Sciences Professionals.

Start your data trial now!

Synapse data is also accessible to external entities via APIs or data packages. Empower better decisions with the latest in pharmaceutical intelligence.

Bio

Bio Sequences Search & Analysis

Sign up for free

Chemical

Chemical Structures Search & Analysis

Sign up for free