Increasing FDA Approvals for New Sleep Apnea Devices. The Popularity of Upper Airway Stimulation Devices & Non-CPAP Devices Changing Market Scenario. More than USD 4 billion Opportunities for Vendors - Arizton

11 Jan 2023

Acquisition

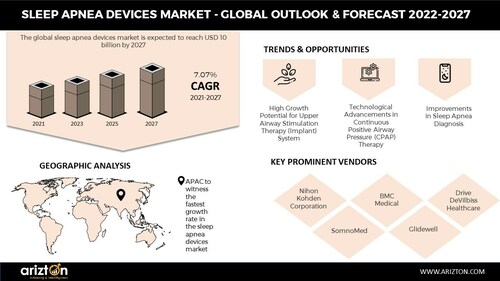

CHICAGO, Jan. 11, 2023 /PRNewswire/ -- According to Arizton's latest research report, the sleep apnea devices market will grow at a CAGR of 7.07% during 2021-2027. The global sleep apnea patient pool is expected to grow due to rising obesity rates. Also, due to the increasing elderly population, the current trend of adopting sleep apnea devices is being explored by both existing and new upcoming players.

Continue Reading

Preview

Source: PRNewswire

Sleep Apnea Devices Market

The sleep apnea device is fully implantable and does not require a mask or tube. This makes these devices easy to use and gives patients a comfortable feeling. This has significantly increased the use of sleep apnea implants to treat many sleep disorders, including central and obstructive sleep apnea. This scenario indicates that the global sleep apnea implants market will likely exhibit an upward revenue trajectory.

Upper airway stimulation is the most recent treatment option for those with sleep apnea. UAS devices are implanted using a minimally invasive procedure to treat sleep apnea by stimulating the muscles that control the tongue to prevent it from collapsing into the airway.

Sleep Apnea Devices Market Report Scope

Click Here to Download the Free Sample Report

Growing Popularity of Non-CPAP Devices for Sleep Apnea Treatment.

With increasing CPAP device noncompliance, patients are recommended to use oral OSA devices such as mandibular advancement devices, tongue retaining devices, implants, etc. These non-CPAP devices are showing emerging growth in the sleep apnea devices market. The Non-CPAP device is growing at a double-digit growth rate in the global sleep apnea market.

Implants are emerging non-CPAP devices, which will grow fast during the forecast period due to raised awareness concerning the adverse effects of untreated sleep apnea. The leading player in sleep apnea implants, Inspire Medical offers an inspired therapy known for implant therapy. Inspire Therapy, AIRLIFT, and resmed System are some of the popular devices present in the global market for sleep apnea implants.

Recent Advancements in the Global Sleep Apnea Devices Market

In April 2022, Fisher & Paykel Healthcare announced the launch of the F&P Evora Full in the US, a compact full-face mask for OSA.

In June 2021, Oventus Medical signed a partnership agreement with Aeroflow Healthcare to bring Oventus' OSA treatment solutions, including O2Vent Optima, directly to consumers through US sleep clinics.

In August 2021, ResMed launched a new PAP device in the US sleep apnea devices market to help hundreds of millions of people with sleep apnea.

In February 2021, Oventus Medical launched 02Vent Optima, a customizable oral appliance therapy device that offers an alternative to CPAP therapy through GoPAPfree in the US.

In December 2021, ZOLL Medical Corporation, a subsidiary of Asahi Kasei that manufactures medical devices and related software solutions, announced the acquisition of Itamar Medical Ltd., a medical device and digital health company that provides home testing services.

Key Company Profiles

Drive DeVilbiss Healthcare

Koninklijke Philips N.V

MEDITAS

Tomed

ApneaMed

Nyxoah

Somnowell

Horizon Prime

Breas Medical

Market Segmentation

Product:

Therapeutic Devices

Facial Interfaces

Diagnostics Devices

Age Group:

Between 41 & 60 Years

61 Years & Above

Below 40 Years

Gender:

Males

Females

End-User:

Sleep Clinics/Labs

Home Healthcare Settings

Hospitals

Others

Geography

North America

The US

Canada

Europe

Germany

France

Italy

Spain

The UK

APAC

China

Japan

India

South Korea

Australia

Latin America

Brazil

Mexico

Argentina

Middle East & Africa

South Africa

Saudi Arabia

Turkey

Click Here to Download the Free Sample Report

Check Out Some of the Top-Selling Related Research Reports:

Anti-Snoring Devices Market - The global anti-snoring devices market is estimated to reach USD 1.81 billion by 2027.

U.S. Sleep Disorder Clinics Market – The U.S. sleep disorder clinics market is expected to reach USD 7.44 billion by 2027.

Mental Wellness Market - The global mental wellness market is expected to reach USD 200.42 billion by 2027.

Sleep Market - The global sleep market will reach USD 137.16 billion by 2026, growing at a CAGR of 6.11% during the forecast period.

Table of Content

1 RESEARCH METHODOLOGY

2 RESEARCH OBJECTIVES

3 RESEARCH PROCESS

4 SCOPE & COVERAGE

4.1 MARKET DEFINITION

4.1.1 INCLUSIONS

4.1.2 EXCLUSIONS

4.1.3 MARKET ESTIMATION CAVEATS

4.2 BASE YEAR

4.3 SCOPE OF THE STUDY

4.3.1 MARKET SEGMENTATION BY GEOGRAPHY

5 REPORT ASSUMPTIONS & CAVEATS

5.1 KEY CAVEATS

5.2 CURRENCY CONVERSION

5.3 MARKET DERIVATION

6 MARKET AT A GLANCE

7 PREMIUM INSIGHTS

7.1 MARKET OVERVIEW

7.1.1 MARKET DYNAMICS

7.1.2 MARKET SEGMENTATION

7.1.3 VENDOR ANALYSIS

7.1.4 RECENT ADVANCES

8 INTRODUCTION

8.1 OVERVIEW

8.1.1 RISK FACTORS

8.1.2 DIAGNOSIS OF SLEEP APNEA

8.1.3 TREATMENT FOR SLEEP APNEA

9 MARKET OPPORTUNITIES & TRENDS

9.1 IMPLEMENTATION OF AI IN SLEEP APNEA TREATMENTS

9.2 GROWING DEMAND AND ADVANCES IN HOME SLEEP APNEA TESTS (HSATS)

9.3 GROWING ADOPTION OF TELEMEDICINE, MHEALTH IN SLEEP APNEA TREATMENT

9.4 GROWING POPULARITY OF NON-CPAP DEVICES FOR SLEEP APNEA TREATMENT

10 MARKET GROWTH ENABLERS

10.1 IMPROVEMENTS IN SLEEP APNEA DIAGNOSIS

10.2 TECHNOLOGICAL ADVANCES IN CPAP THERAPY

10.3 INCREASING TARGET PATIENT POPULATION

10.4 HIGH GROWTH POTENTIAL FOR UPPER AIRWAY STIMULATION THERAPY (IMPLANT) SYSTEM

11 MARKET RESTRAINTS

11.1 PRESENCE OF NUMEROUS UNDIAGNOSED PATIENTS

11.2 HIGH COST OF SLEEP APNEA DEVICES

11.3 AVAILABILITY OF SURGICAL OPTION TO TREAT SLEEP APNEA

11.4 LACK OF PATIENT ADHERENCE TO CPAP DEVICE

12 MARKET LANDSCAPE

12.1 MARKET OVERVIEW

12.2 MARKET SIZE & FORECAST

12.2.1 INSIGHTS BY GEOGRAPHY SEGMENTATION

12.2.2 INSIGHTS BY PRODUCT SEGMENTATION

12.2.3 INSIGHTS BY AGE GROUP SEGMENTATION

12.2.4 INSIGHTS BY GENDER SEGMENTATION

12.2.5 INSIGHTS BY END-USER SEGMENTATION

12.3 FIVE FORCES ANALYSIS

12.3.1 THREAT OF NEW ENTRANTS

12.3.2 BARGAINING POWER OF SUPPLIERS

12.3.3 BARGAINING POWER OF BUYERS

12.3.4 THREAT OF SUBSTITUTES

12.3.5 COMPETITIVE RIVALRY

13 PRODUCT

13.1 MARKET SNAPSHOT & GROWTH ENGINE

13.2 MARKET OVERVIEW

13.3 THERAPEUTIC DEVICES

13.3.1 MARKET OVERVIEW

13.3.2 MARKET SIZE & FORECAST

13.3.3 MARKET BY GEOGRAPHY

13.4 FACIAL INTERFACES

13.4.1 MARKET OVERVIEW

13.4.2 MARKET SIZE & FORECAST

13.4.3 MARKET BY GEOGRAPHY

13.5 DIAGNOSTICS DEVICES

13.5.1 MARKET OVERVIEW

13.5.2 MARKET SIZE & FORECAST

13.5.3 MARKET BY GEOGRAPHY

14 AGE GROUP

14.1 MARKET SNAPSHOT & GROWTH ENGINE

14.2 MARKET OVERVIEW

14.3 BETWEEN 41 & 60 YEARS

14.3.1 MARKET OVERVIEW

14.3.2 MARKET SIZE & FORECAST

14.3.3 MARKET BY GEOGRAPHY

14.4 61 YEARS & ABOVE

14.4.1 MARKET OVERVIEW

14.4.2 MARKET SIZE & FORECAST

14.4.3 MARKET BY GEOGRAPHY

14.5 BELOW 40 YEARS

14.5.1 MARKET OVERVIEW

14.5.2 MARKET SIZE & FORECAST

14.5.3 MARKET BY GEOGRAPHY

15 GENDER

15.1 MARKET SNAPSHOT & GROWTH ENGINE

15.2 MARKET OVERVIEW

15.3 MALES

15.3.1 MARKET OVERVIEW

15.3.2 MARKET SIZE & FORECAST

15.3.3 MARKET BY GEOGRAPHY

15.4 FEMALES

15.4.1 MARKET OVERVIEW

15.4.2 MARKET SIZE & FORECAST

15.4.3 MARKET BY GEOGRAPHY

16 END-USER

16.1 MARKET SNAPSHOT & GROWTH ENGINE

16.2 MARKET OVERVIEW

16.3 SLEEP CLINICS/LABS

16.3.1 MARKET OVERVIEW

16.3.2 MARKET SIZE & FORECAST

16.3.3 MARKET BY GEOGRAPHY

16.4 HOME HEALTHCARE SETTINGS

16.4.1 MARKET OVERVIEW

16.4.2 MARKET SIZE & FORECAST

16.4.3 MARKET BY GEOGRAPHY

16.5 HOSPITALS

16.5.1 MARKET OVERVIEW

16.5.2 MARKET SIZE & FORECAST

16.5.3 MARKET BY GEOGRAPHY

16.6 OTHERS

16.6.1 MARKET OVERVIEW

16.6.2 MARKET SIZE & FORECAST

16.6.3 MARKET BY GEOGRAPHY

17 GEOGRAPHY

17.1 MARKET SNAPSHOT & GROWTH ENGINE

17.2 GEOGRAPHIC OVERVIEW

18 NORTH AMERICA

18.1 MARKET OVERVIEW

18.2 MARKET SIZE & FORECAST

18.2.1 NORTH AMERICA: PRODUCT SEGMENTATION

18.2.2 NORTH AMERICA: AGE GROUP SEGMENTATION

18.2.3 NORTH AMERICA: GENDER SEGMENTATION

18.2.4 NORTH AMERICA: END USER SEGMENTATION

18.3 KEY COUNTRIES

18.3.1 US: MARKET SIZE & FORECAST

18.3.2 CANADA: MARKET SIZE & FORECAST

19 EUROPE

19.1 MARKET OVERVIEW

19.2 MARKET SIZE & FORECAST

19.2.1 EUROPE: PRODUCT SEGMENTATION

19.2.2 EUROPE: AGE GROUP SEGMENTATION

19.2.3 EUROPE: GENDER SEGMENTATION

19.2.4 EUROPE: END USER SEGMENTATION

19.3 KEY COUNTRIES

19.3.1 GERMANY: MARKET SIZE & FORECAST

19.3.2 FRANCE: MARKET SIZE & FORECAST

19.3.3 UK: MARKET SIZE & FORECAST

19.3.4 ITALY: MARKET SIZE & FORECAST

19.3.5 SPAIN: MARKET SIZE & FORECAST

20 APAC

20.1 MARKET OVERVIEW

20.2 MARKET SIZE & FORECAST

20.2.1 APAC: PRODUCT SEGMENTATION

20.2.2 APAC: AGE GROUP SEGMENTATION

20.2.3 APAC: GENDER SEGMENTATION

20.2.4 APAC: END USER SEGMENTATION

20.3 KEY COUNTRIES

20.3.1 CHINA: MARKET SIZE & FORECAST

20.3.2 JAPAN: MARKET SIZE & FORECAST

20.3.3 INDIA: MARKET SIZE & FORECAST

20.3.4 SOUTH KOREA: MARKET SIZE & FORECAST

20.3.5 AUSTRALIA: MARKET SIZE & FORECAST

21 LATIN AMERICA

21.1 MARKET OVERVIEW

21.2 MARKET SIZE & FORECAST

21.2.1 LATIN AMERICA: PRODUCT SEGMENTATION

21.2.2 LATIN AMERICA: AGE GROUP SEGMENTATION

21.2.3 LATIN AMERICA: GENDER SEGMENTATION

21.2.4 LATIN AMERICA: END USER SEGMENTATION

21.3 KEY COUNTRIES

21.3.1 BRAZIL: MARKET SIZE & FORECAST

21.3.2 MEXICO: MARKET SIZE & FORECAST

21.3.3 ARGENTINA: MARKET SIZE & FORECAST

22 MIDDLE EAST & AFRICA

22.1 MARKET OVERVIEW

22.2 MARKET SIZE & FORECAST

22.2.1 MIDDLE EAST & AFRICA: PRODUCT SEGMENTATION

22.2.2 MIDDLE EAST & AFRICA: AGE GROUP SEGMENTATION

22.2.3 MIDDLE EAST & AFRICA: GENDER SEGMENTATION

22.2.4 MIDDLE EAST & AFRICA: END USER SEGMENTATION

22.3 KEY COUNTRIES

22.3.1 TURKEY: MARKET SIZE & FORECAST

22.3.2 SAUDI ARABIA: MARKET SIZE & FORECAST

22.3.3 SOUTH AFRICA: MARKET SIZE & FORECAST

23 COMPETITIVE LANDSCAPE

23.1 COMPETITION OVERVIEW

23.2 MARKET SHARE ANALYSIS

24 KEY COMPANY PROFILES

24.1 NIHON KOHDEN CORPORATION

24.1.1 BUSINESS OVERVIEW

24.1.2 NIHON KOHDEN CORPORATION IN SLEEP APNEA MARKET

24.1.3 PRODUCT OFFERINGS

24.1.4 KEY STRATEGIES

24.1.5 KEY STRENGTHS

24.1.6 KEY OPPORTUNITIES

24.2 BMC MEDICAL

24.3 DRIVE DEVILBISS HEALTHCARE

24.4 SOMNOMED

24.5 GLIDEWELL

24.6 RESMED

24.7 KONINKLIJKE PHILIPS N.V

24.8 FISHER & PAYKEL HEALTHCARE

24.9 COMPUMEDICS LIMITED

24.10 INSPIRE MEDICAL SYSTEMS

24.11 NATUS MEDICAL

24.12 ITAMAR MEDICAL

25 OTHER PROMINENT VENDORS

25.1 APEX MEDICAL

25.1.1 BUSINESS OVERVIEW

25.1.2 PRODUCT OFFERINGS

25.2 CADWELL INDUSTRIES

25.3 SOMNOMEDICS

25.4 CLEVELAND MEDICAL DEVICES

25.5 PROSOMNUS SLEEP TECHNOLOGIES

25.6 MEDITAS

25.7 WHITE DENTAL HEALTHCARE

25.8 OVENTUS

25.9 TOMED

25.10 SIGNIFIER MEDICAL TECHNOLOGIES

25.11 APNEAMED

25.12 NYXOAH

25.13 VIVOS THERAPEUTICS

25.14 SOMNOWELL

25.15 REMSLEEP HOLDINGS

25.16 SIESTA MEDICAL

25.17 HORIZON PRIME

25.18 NOX MEDICAL

25.19 ONERA HEALTH

25.20 LIVANOVA

25.21 ZOLL MEDICAL

25.22 BRAEBON MEDICAL

25.23 INVACARE

25.24 BREAS MEDICAL

26 REPORT SUMMARY

26.1 KEY TAKEAWAYS

26.2 STRATEGIC RECOMMENDATIONS.

27 QUANTITATIVE SUMMARY

27.1 MARKET BY PRODUCT

27.1.1 NORTH AMERICA: PRODUCT SEGMENTATION

27.1.2 EUROPE: PRODUCT SEGMENTATION

27.1.3 APAC: PRODUCT SEGMENTATION

27.1.4 LATIN AMERICA: PRODUCT SEGMENTATION

27.1.5 MIDDLE EAST & AFRICA: PRODUCT SEGMENTATION

27.2 MARKET BY AGE GROUP

27.2.1 NORTH AMERICA: AGE GROUP SEGMENTATION

27.2.2 EUROPE: AGE GROUP SEGMENTATION

27.2.3 APAC: AGE GROUP SEGMENTATION

27.2.4 LATIN AMERICA: AGE GROUP SEGMENTATION

27.2.5 MIDDLE EAST & AFRICA: AGE GROUP SEGMENTATION

27.3 MARKET BY GENDER

27.3.1 NORTH AMERICA: GENDER SEGMENTATION

27.3.2 EUROPE: GENDER SEGMENTATION

27.3.3 APAC: GENDER SEGMENTATION

27.3.4 LATIN AMERICA: GENDER SEGMENTATION

27.3.5 MIDDLE EAST & AFRICA: GENDER SEGMENTATION

27.4 MARKET BY END USER

27.4.1 NORTH AMERICA: END USER SEGMENTATION

27.4.2 EUROPE: END USER SEGMENTATION

27.4.3 APAC: END USER SEGMENTATION

27.4.4 LATIN AMERICA: END USER SEGMENTATION

27.4.5 MIDDLE EAST & AFRICA: END USER SEGMENTATION

27.5 MARKET BY GEOGRAPHY

27.5.1 THERAPEUTIC DEVICES: GEOGRAPHY SEGMENTATION

27.5.2 FACIAL INTERFACES: GEOGRAPHY SEGMENTATION

27.5.3 DIAGNOSTICS DEVICE: GEOGRAPHY SEGMENTATION

27.5.4 BETWEEN 41 & 60 YEARS: GEOGRAPHY SEGMENTATION

27.5.5 61 YEARS & ABOVE: GEOGRAPHY SEGMENTATION

27.5.6 BELOW 40 YEARS: GEOGRAPHY SEGMENTATION

27.5.7 MALES: GEOGRAPHY SEGMENTATION

27.5.8 FEMALES: GEOGRAPHY SEGMENTATION

27.5.9 SLEEP CLINICS/LABS: GEOGRAPHY SEGMENTATION

27.5.10 HOME HEALTHCARE SETTINGS: GEOGRAPHY SEGMENTATION

27.5.11 HOSPITALS: GEOGRAPHY SEGMENTATION

27.5.12 OTHERS: GEOGRAPHY SEGMENTATION

28 APPENDIX

28.1 ABBREVIATIONS

About

Us

:

Arizton Advisory and Intelligence is an innovative and quality-driven firm that offers cutting-edge research solutions to clients worldwide. We excel in providing comprehensive market intelligence reports and advisory and consulting services.

We offer comprehensive market research reports on consumer goods & retail technology, automotive and mobility, smart tech, healthcare, life sciences, industrial machinery, chemicals, materials, I.T. and media, logistics, and packaging. These reports contain detailed industry analysis, market size, share, growth drivers, and trend forecasts.

Arizton comprises a team of exuberant and well-experienced analysts who have mastered generating incisive reports. Our specialist analysts possess exemplary skills in market research. We train our team in advanced research practices, techniques, and ethics to outperform in fabricating impregnable research reports.

Click Here to Contact Us

Call: +1-312-235-2040

+1 302 469 0707

Mail: [email protected]

Photo: https://mma.prnewswire.com/media/1981640/Sleep_Apnea_Devices_Market.jpg

Logo: https://mma.prnewswire.com/media/818553/Arizton_Logo.jpg

SOURCE Arizton Advisory & Intelligence

For more details,please visit the original website

The content of the article does not represent any opinions of Synapse and its affiliated companies. If there is any copyright infringement or error, please contact us, and we will deal with it within 24 hours.

Organizations

Indications

Targets

-Drugs

-Hot reports

Get started for free today!

Accelerate Strategic R&D decision making with Synapse, PatSnap’s AI-powered Connected Innovation Intelligence Platform Built for Life Sciences Professionals.

Start your data trial now!

Synapse data is also accessible to external entities via APIs or data packages. Leverages most recent intelligence information, enabling fullest potential.