Request Demo

Last update 08 May 2025

Mariana Oncology, Inc.

Last update 08 May 2025

Overview

Tags

Respiratory Diseases

Neoplasms

Therapeutic radiopharmaceuticals

Peptide Conjugate Radionuclide

Disease domain score

A glimpse into the focused therapeutic areas

No Data

Technology Platform

Most used technologies in drug development

No Data

Targets

Most frequently developed targets

No Data

| Disease Domain | Count |

|---|---|

| Neoplasms | 1 |

| Top 5 Drug Type | Count |

|---|---|

| Therapeutic radiopharmaceuticals | 1 |

| Peptide Conjugate Radionuclide | 1 |

| Top 5 Target | Count |

|---|---|

| DLL3(Delta-like protein 3) | 1 |

Related

1

Drugs associated with Mariana Oncology, Inc.Target |

Mechanism DLL3 inhibitors |

Active Org. |

Originator Org. |

Active Indication |

Inactive Indication- |

Drug Highest PhasePreclinical |

First Approval Ctry. / Loc.- |

First Approval Date- |

100 Clinical Results associated with Mariana Oncology, Inc.

Login to view more data

0 Patents (Medical) associated with Mariana Oncology, Inc.

Login to view more data

82

News (Medical) associated with Mariana Oncology, Inc.31 Mar 2025

iStock,

Love Employee

While Novartis and Bayer got there first, AstraZeneca, Bristol Myers Squibb and Eli Lilly are all vying to bring their radiopharmaceutical assets to a market projected to be worth over $13 billion by 2033.

When the FDA

approved

a small and peculiar eight-amino acid peptide therapy in 2018, it also signed off on a field that today provides a precise and personalized approach to treating cancer.

Novartis’ Lutathera belongs to a class called radiopharmaceuticals, which combines a radioactive substance and a biological agent into one therapeutic molecule.

Lutathera carries lutetium-177, a beta-emitting isotope of lutetium that releases high-energy radiation as it degrades, in turn damaging a cancer cell’s DNA and ultimately leading to its death. Meanwhile, the drug’s eight-residue backbone allows it to specifically home in on subtype 2 somatostatin receptors, proteins typically highly expressed on specific types of cancer cells.

This specific structure gives Lutathera—and radiotherapies more broadly—their characteristic precision. Radiopharmaceutical drugs “can generally shrink tumors effectively without causing much side effects,” Andrew Tsai, an analyst at Jefferies, told

BioSpace

in an email.

The use of radioisotopes gives this modality its marked efficacy, Tsai continued, adding that these treatments might also lead to a more durable, longer-lasting therapy. “Lethality of radiation on cancer is robust, and there is no resistance mechanism to the modality,” he explained.

Of course, the use of radioactive agents, no matter how targeted, is still bound to cause some toxicity. According to Tsai, radiotherapies can lead to the accumulation of radiation in various organs, which “could limit the dosing potential” of the modality. There is also a limit to how precise radiopharmaceuticals can get, and they still sometimes lead to unintended off-target side effects such as dry mouth and alopecia.

On a more practical level, supply constraints also pose a roadblock to radiopharmaceuticals. “Having access to radioisotope[s] has been rate limiting in many instances even for clinical trials,” Tsai said. Another barrier, he continued, is that the practice has yet to penetrate sufficiently into current medical practice; both patients and physicians remain uninformed or uncomfortable about the tech, and there is a need to improve their awareness.

Here,

BioSpace

looks at the current state of radiopharmaceuticals through five leading players—Novartis, AstraZeneca, Bristol Myers Squibb, Eli Lilly and Bayer—including their strategic moves and key upcoming milestones in a space

projected to be worth

more than $13 billion by 2033.

Novartis Seeks to Maintain Radiopharma Leadership

Radiopharma assets: Lutathera, Pluvicto

Novartis

is the clear frontrunner in the radiopharmaceutical race.

The Swiss drugmaker already has two commercial products on the market: Lutathera, indicated for gastroenteropancreatic neuroendocrine tumors (GEP-NETs), and Pluvicto, for metastatic castration-resistant prostate cancer (mCRPC).

Compared with its competitors, Novartis has also fleshed out “industry-leading radioligand research and production sites” globally, Geoff Towle, vice president of the company’s radioligand therapy solid tumor strategy, told

BioSpace

in an email.

Despite enjoying a comfortable lead, Novartis continues to strengthen its radiopharma portfolio. In May 2024, the company paid

$1 billion

to acquire Mariana Oncology and its promising pipeline, anchored by MC-339, an actinium-based therapy being studied in small cell lung cancer (SCLC).

Novartis also recently launched two pivotal trials for the next-generation radiotherapy AAA817, which is under development for prostate cancer, Towle shared. Like Pluvicto, AAA817 targets the prostate-specific membrane antigen (PSMA) but instead carries an actinium-based payload, which could deliver

higher potency

.

Aside from building out the pipeline, Novartis is also seeking to expand the indications for its current products.

Pluvicto, for instance, is currently under review by the FDA for use in earlier-stage mCRPC, with a regulatory verdict expected in the

first half of 2025

, Towle said. This approval, if granted, would allow the use of Pluvicto ahead of chemotherapy and would highlight the “potential for radioligand therapy to become an established pillar of cancer care,” he added.

These strategic moves, according to Towle, place the company in a strong position to “realize the $10 billion business potential of our candidates in clinical trials or pre-clinical trials,” and bring radioligand therapies beyond prostate and neuroendocrine tumors to other areas of high unmet patient need, including breast and lung cancer.

AstraZeneca Zeroes in on Radioconjugates

Radiopharma assets: FPI-2265, AZD2068

AstraZeneca

bought entry into the radiopharma market in March 2024, with the up to $2.4 billion

acquisition

of Fusion Pharmaceuticals.

Despite being a relative newcomer to the space, AstraZeneca has set its sights high. In a

company presentation

last month, the pharma announced that radioconjugates are expected to be a strong driver of its business by 2030 and beyond.

“Our aim is to build a substantial radioconjugate portfolio to offer treatment options for patients with a broad range of tumor types,” Puja Sapra, AstraZeneca’s senior vice president for biologics engineering and oncology target discovery, told

BioSpace

in an email. In particular, the pharma envisions that radioconjugates will complement existing radiation therapy and help reach other cancer types that have been difficult to treat.

AstraZeneca’s radiopharma pipeline is anchored by FPI-2265—the centerpiece of the Fusion acquisition—which consists of a small molecule drug that targets PSMA and carries an actinium-225 radioisotope that can inflict irreparable damage to cancer cells.

FPI-2265 is being assessed in the Phase II AlphaBreak study in patients with PSMA-positive mCRPC, with a readout expected in the second half of 2025, according to Sapra.

AstraZeneca is also working on AZD2068, another radioconjugate from Fusion, designed to target cells expressing the EGFR and cMET markers. The asset is currently in a Phase I study for advanced solid tumors. Findings are

expected

in 2026 at the earliest, according to the pharma’s latest pipeline document.

Aside from its pipeline, AstraZeneca is also working on “molecular imaging and computation pathology,” which according to Sapra would “enhance the delivery and monitoring” of radioconjugates. The end goal, she continued, is to “deliver the right treatment to the right patient.”

BMS Leads the Way in Actinium-Based Radiotherapies

Radiopharma assets: RYZ-101, RYZ-801

A few months ahead of AstraZeneca,

Bristol Myers Squibb

made a major radiopharma play in December 2023 with the acquisition of

RayzeBio

and its actinium-225-based platform for $4.1 billion.

“RayzeBio is pioneering the use of Actinium-225,” which is an alpha-emitting radioisotope, Ben Hickey, the company’s president under BMS, told

BioSpace

in an email. “We believe alpha-emitting isotopes represent the next generation of therapeutic radionucleotides due to their higher potency as compared to beta-emitting isotopes.” Novartis’ Lutathera and Pluvicto carry beta-emitting lutetium-177.

With the RayzeBio acquisition, BMS gained ownership of the biotech’s lead asset RYZ-101, which targets somatostatin receptor type 2, a protein commonly expressed on certain solid tumors. BMS is running three clinical trials for RYZ-101: A Phase III study for GEP-NETs and Phase I studies in unresectable metastatic breast cancer and extensive-stage SCLC.

The SCLC study will

read out later this year

, while pivotal data for GEP-NETs are expected in 2026, according to Hickey. “If successful, we believe RYZ101 could be the first [actinium-255-based radiopharmaceutical therapy] approved In the U.S.”

BMS is also advancing

RYZ-801

, which consists of a proprietary peptide bound to an actinium-225 radioactive payload. RYZ-801, which targets the GPC3 protein, entered the clinic late last year for hepatocellular carcinoma, with enrollment currently ongoing, according to Hickey.

Aside from these two clinical assets, the acquisition of RayzeBio gave BMS what Hickey called an “IND-generating engine” that can produce “several therapeutic candidates in the coming years.” BMS currently has several preclinical programs ongoing, he said.

Beyond beefing up its radiopharma pipeline, BMS is also building up manufacturing capabilities. Hickey said the pharma’s facility in Indianapolis “is now fully operational” and can contribute to clinical supply, while BMS works to ramp up the site to support commercial-scale operations.

Eli Lilly Enters Radiopharma Space With Dealmaking Flurry

Radiopharma asset: PNT2001 and PNT2002

Ahead of both BMS and AstraZeneca, Lilly entered the radiopharma arena in October 2023 with $1.4 billion to

acquire

Point Biopharma—a transaction that

formally closed

in December that year.

Less than a year later, in May 2024, Lilly doubled down on radiopharma with an

agreement

with Aktis Oncology worth up to $1.1 billion. The deal gave Lilly access to the biotech’s proprietary discovery engine to develop novel radiotherapeutic assets against certain cancer targets.

But Lilly wasn’t done. In July 2024, the company entered into another

strategic alliance

, this time with Radionetics Oncology, for $140 million upfront. The partners will work on radiotherapies targeting small-molecule G-protein coupled receptors for the treatment of various solid tumors. Under the deal, Lilly also has the exclusive right to acquire Radionetics for $1 billion.

From the Point acquisition, Lilly gained ownership of the biotech’s lead asset PNT2002, a PSMA-targeted lutetium-177-based therapy being proposed for patients with mCRPC whose disease has progressed after hormonal treatment.

A

Phase III readout

in December 2023 for PNT2002 was

disappointing

: The asset reduced the risk of death or disease progression by 29% versus androgen receptor blockage—an effect that met statistical significance but fell below what analysts had hoped for. Regulatory filings for PNT2002 are “pending,” according to Jefferies’ Tsai.

Lilly has other radiopharma bets in the clinic, including PNT2001, which targets the PSMA protein and carries a 225-actinium radioisotope payload. The asset is currently in

Phase I development

for prostate cancer. According to a Feb. 7 Jefferies note, Lilly also has a preclinical radiopharma candidate that uses 225-actinium. Another, PNT2003, delivers lutetium-177 and targets the somatostatin receptor to address GEP-NETs.

Bayer Builds Radiopharma Pipeline Beyond Xofigo

Radiopharma assets: Xofigo, 225Ac-Pelgifatamab, 225Ac-PSMA-Trillium

Aside from Novartis, the only other company on this list with an FDA-approved radiopharma asset is Bayer.

Xofigo

, a radium-223 dichloride radioactive drug, was cleared by the FDA in 2013 for the treatment of castration-resistant prostate cancer with symptomatic bone metastases and with no known visceral metastatic disease. Unlike Novartis’ Lutathera and Pluvicto, however, Xofigo does not include a targeting moiety. Instead, the drug takes advantage of radium’s chemistry, which allows it to bind to bone minerals, in turn helping localize the drug to sites of high bone turnover. Xofigo’s market performance has been underwhelming, peaking at

€408 million in 2017

. Bayer

did not report

specific sales for Xofigo last year.

But the pharma is attempting to carve out a space in today’s radiopharma space, inking a strategic collaboration with Bicycle Therapeutics in May 2023. For $45 million upfront and up to $1.7 billion in milestones, Bayer gained access to Bicycle’s proprietary peptides, which it will use to develop targeted radiotherapies for several undisclosed cancer targets.

As per its

pipeline page

, Bayer has at least two clinical-stage radiopharmaceutical therapies in development: 225Ac-Pelgifatamab and 225Ac-PSMA-Trillium, both actinium-based candidates in early-stage studies for advanced prostate cancer.

Phase 3Clinical ResultPhase 1Drug ApprovalAcquisition

11 Feb 2025

Novartis is wagering more than $3 billion that a startup it helped launch six years ago has developed a better blood thinner than whats now available.The Swiss drugmaker on Tuesday announced a deal to acquire Anthos Therapeutics, a Boston-based startup it formed with Blackstone Life Sciences in 2019. Novartis will pay $925 million upfront, and could pay up to $2.15 billion more should the drug at the center of the deal hit certain regulatory and sales milestones. The deal should close in the first half of 2025.Through the acquisition, Novartis will regain a blood-thinning drug, called abelacimab, thats currently in late-stage testing. Novartis originally discovered the compound, but in 2019 licensed it to Anthos, a startup Blackstone Life Sciences launched with $250 million. That deal gave Novartis a minority stake in Anthos, which went on to advance the drug into Phase 3 testing.Abelacimab is a new type of anticoagulant called a Factor XI inhibitor. Its designed to be safer than existing blood thinners like Xarelto and Eliquis, which earn their makers billions of dollars in sales each year. But they also carry bleeding risks that can make treatment challenging. Abelacimab, as well as other Factor XI blockers in development by Bristol Myers Squibb and Regeneron, are thought to stop clotting while sidestepping some of those issues.Testing has yielded inconsistent results, though. Bayer dialed back development of a Factor XI drug after it failed a Phase 3 trial in 2023. Bristol Myers candidate was moved into late-stage trials despite mixed findings in earlier testing. Factor XI blockers have not shown a meaningfully better clinical profile to date than Eliquis or Xarelto in head-to-head Phase 3 trials, RBC Capital Markets analyst Brian Abrahams wrote in December.Generic versions of Eliquis could arrive in 2026, too, raising the commercial bar for alternative therapies to succeed.Still, Anthos acquisition offers another validation for the Factor XI mechanism and its large market potential in the anticoagulant space, Abrahams wrote after the deals announcement Tuesday.Anthos showed a glimpse of that potential in November 2023, when it presented results showing abelacimab was safer than Xarelto in a large, mid-stage trial. Three late-stage studies are ongoing in people at risk of serious clots who have either atrial fibrillation or cancer-associated blood clotting. Anthos has said study results could come next year.We are proud that this medicine originated at Novartis and have been impressed with the Anthos Therapeutics teams expertise and dedication and with the great progress they have made on the program, said David Soergel, head of Novartis cardiovascular, renal and metabolism development unit, in a statement. Now is the right time to bring abelacimab back into the Novartis CRM pipeline.The acquisition is Novartis first of 2025. It adds to a series of startup buyouts inked by Novartis in recent years, including of DTx Pharma, Mariana Oncology, Calypso Biotech and IFM Due. Beyond Novartis, industry dealmaking of late has focused more heavily on privately held companies. '

AcquisitionPhase 3Drug ApprovalClinical Result

03 Feb 2025

The new funding will help to expand AdvanCell’s manufacturing capacity. Credit: sesame via Getty Images.

AdvanCell, an Australia-based radiopharmaceutical company, has raised $112m as investor interest in the radiopharma sector continues in 2025.

The funding round was co-led by SV Health Investors, Sanofi Ventures, Abingworth, and SymBiosis, with additional participation from Morningside, Tenmile, and Brandon Capital.

AdvanCell has been developing targeted alpha therapies (TATs) as an alternative to the beta particle-based radiopharmaceuticals commonly used by drug developers. The company focuses on a lead-212 (Pb-212)-based candidate ADVC001, an alpha-emitting radioisotope that offers potential advantages in targeting and destroying cancer cells while limiting damage to surrounding healthy tissue. Pb-212 has a short half-life, which can reduce long-term radiation exposure.

AdvanCell is currently enrolling patients for the highest dose cohort of its TheraPb Phase I/II dose escalation clinical trial (NCT05720130), evaluating the safety and efficacy of ADVC001in metastatic prostate cancer.

The Sydney-headquartered company previously raised $18m in a Series B round in August 2022. The latest investment comes as demand for radiopharmaceuticals continues to grow while the sector faces logistical and regulatory challenges. Radiopharmaceuticals require specialised infrastructure, strict regulatory compliance, and just-in-time delivery due to their short shelf lives. AdvanCell said that the new funding will help to expand its manufacturing capacity and accelerate the development of its Pb-212-based candidates.

The radiopharmaceutical industry has seen increased investment and consolidation in recent years. Major pharmaceutical companies have entered the space through acquisitions, aiming to expand their radioligand therapy pipelines. In February 2024,

Bristol Myers Squibb

made

a $4.2bn acquisition

of RayzeBio to strengthen its radiopharmaceutical capabilities. A few months later, In May 2024,

Novartis

acquired Mariana Oncology

for $1.75bn, adding MC-339, a radioligand therapy candidate, to its portfolio. Prior to the deals in 2024, Eli Lilly had announced the acquisition of POINT Biopharma for $1.4bn.

Prior to the Eli Lilly deal, POINT Biopharma had partnered with AdvanCell to support the clinical development and commercialisation of Pb-212-based radioligands. Other companies, including Orano Med, are also

developing therapies using Pb-212

, with Orano conducting multiple clinical studies on its lead-212-based drug candidates.

Industry consolidation has also extended to contract development and manufacturing organisations (CDMOs). Last week,

Lantheus

announced plans to acquire

clinical stage radiopharma CDMO Evergreen Theragnostics for an upfront payment of $250m, with the potential for an additional $752.5m in milestone payments.

Another Australia-based radiopharma specialist Telix made headlines in 2024 after it

withdrew a proposed US listing

on Nasdaq. But it later acquired

RLS Radiopharmacies

to expand its US presence in Q3 2024. More recently at the 2025 JP Morgan Healthcare Conference, Telix’s CEO said the company had a

55% year-on-year revenue increase

last year.

AcquisitionRadiation TherapyClinical Study

100 Deals associated with Mariana Oncology, Inc.

Login to view more data

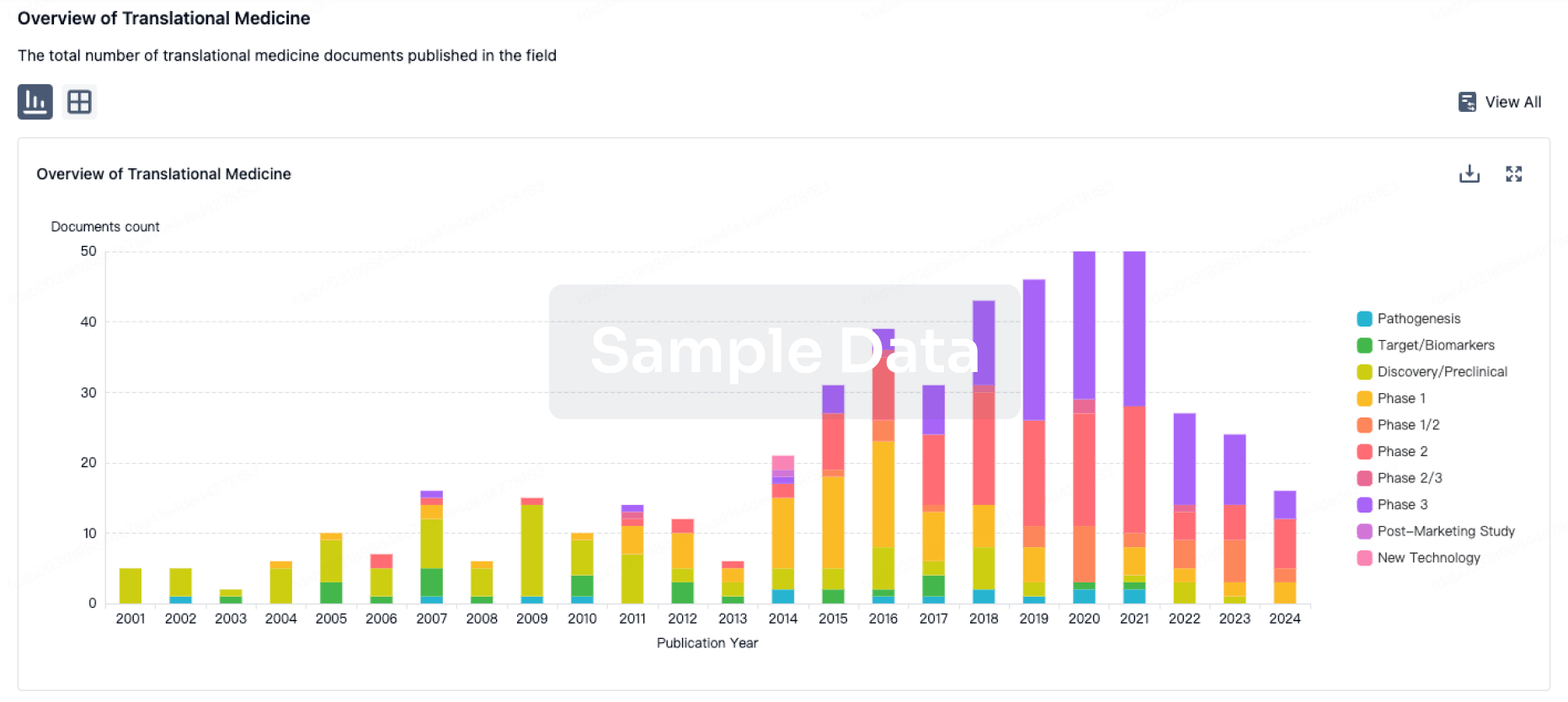

100 Translational Medicine associated with Mariana Oncology, Inc.

Login to view more data

Corporation Tree

Boost your research with our corporation tree data.

login

or

Pipeline

Pipeline Snapshot as of 20 Dec 2025

The statistics for drugs in the Pipeline is the current organization and its subsidiaries are counted as organizations,Early Phase 1 is incorporated into Phase 1, Phase 1/2 is incorporated into phase 2, and phase 2/3 is incorporated into phase 3

Preclinical

1

Login to view more data

Current Projects

| Drug(Targets) | Indications | Global Highest Phase |

|---|---|---|

MC-339 ( DLL3 ) | Small Cell Lung Cancer More | Preclinical |

Login to view more data

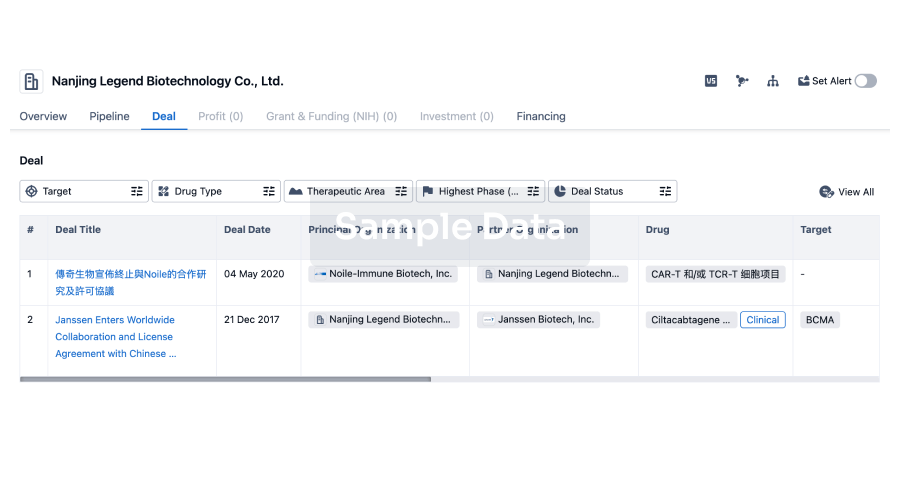

Deal

Boost your decision using our deal data.

login

or

Translational Medicine

Boost your research with our translational medicine data.

login

or

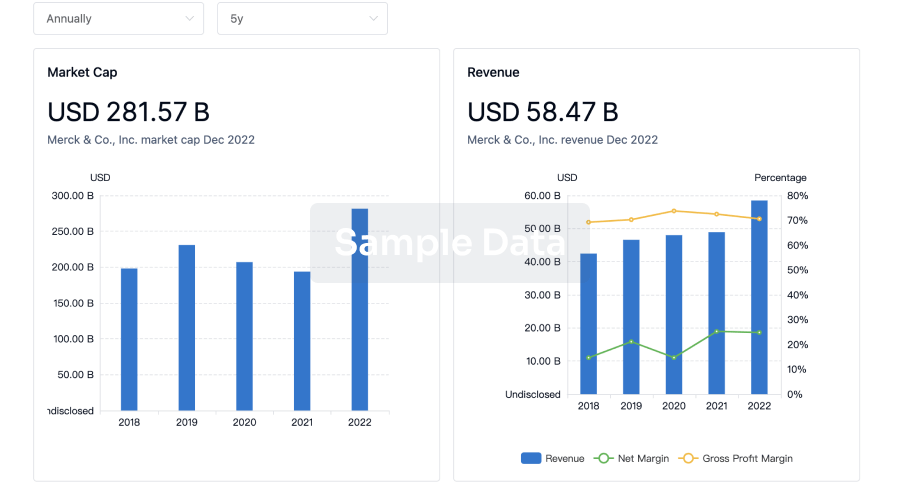

Profit

Explore the financial positions of over 360K organizations with Synapse.

login

or

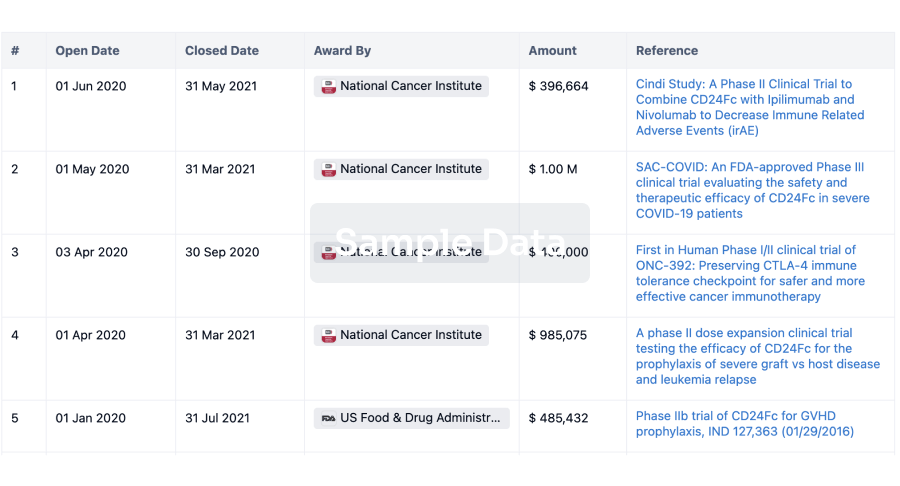

Grant & Funding(NIH)

Access more than 2 million grant and funding information to elevate your research journey.

login

or

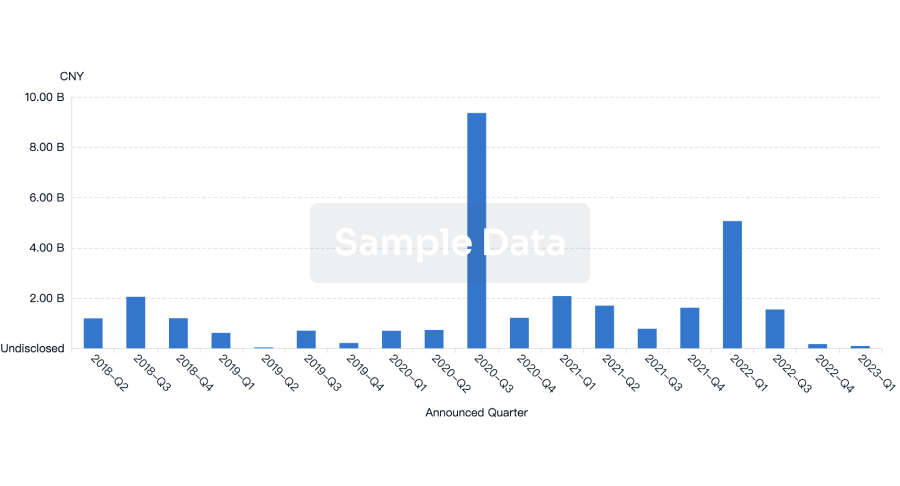

Investment

Gain insights on the latest company investments from start-ups to established corporations.

login

or

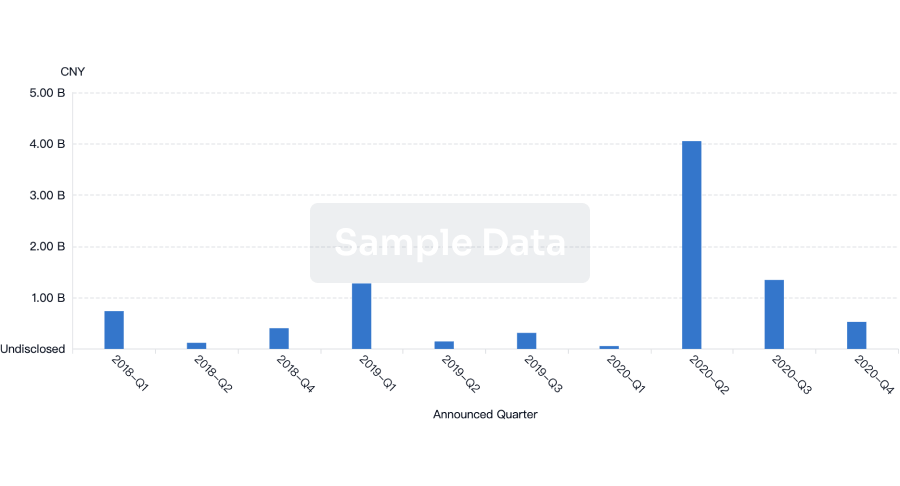

Financing

Unearth financing trends to validate and advance investment opportunities.

login

or

AI Agents Built for Biopharma Breakthroughs

Accelerate discovery. Empower decisions. Transform outcomes.

Get started for free today!

Accelerate Strategic R&D decision making with Synapse, PatSnap’s AI-powered Connected Innovation Intelligence Platform Built for Life Sciences Professionals.

Start your data trial now!

Synapse data is also accessible to external entities via APIs or data packages. Empower better decisions with the latest in pharmaceutical intelligence.

Bio

Bio Sequences Search & Analysis

Sign up for free

Chemical

Chemical Structures Search & Analysis

Sign up for free