Request Demo

Last update 29 Aug 2025

Aronora, Inc.

Last update 29 Aug 2025

Overview

Tags

Cardiovascular Diseases

Monoclonal antibody

Disease domain score

A glimpse into the focused therapeutic areas

No Data

Technology Platform

Most used technologies in drug development

No Data

Targets

Most frequently developed targets

No Data

| Top 5 Drug Type | Count |

|---|---|

| Monoclonal antibody | 1 |

| Top 5 Target | Count |

|---|---|

| F11(Coagulation factor XI) | 1 |

Related

1

Drugs associated with Aronora, Inc.Target |

Mechanism factor XIa inhibitors |

Active Org. |

Originator Org. |

Active Indication |

Inactive Indication- |

Drug Highest PhasePhase 1 |

First Approval Ctry. / Loc.- |

First Approval Date- |

4

Clinical Trials associated with Aronora, Inc.NCT03963895

A Phase 2, Randomized, Double-Blind, Placebo-Controlled Study to Assess the Safety and Efficacy of a Single Dose of E-WE Thrombin, Administered During a Regular Hemodialysis Procedure, in Patients With End-Stage Renal Disease on Chronic Hemodialysis

This study evaluates the safety and efficacy of AB002 (E-WE thrombin) in patients with end stage renal disease on chronic hemodialysis. Two dose levels will be evaluated in two cohorts. Within each cohort the patients will be randomized to receive either AB002 (E-WE thrombin) or placebo (at a ratio of 2:1 active: placebo).

Start Date03 Jul 2019 |

Sponsor / Collaborator  Aronora, Inc. Aronora, Inc. [+1] |

NCT03612856

A Phase 2, Randomized, Double-Blind, Placebo-Controlled Study of the Safety and Efficacy/Potency of a Single Dose of Xisomab 3G3, Administered at the Beginning of a Regular Hemodialysis Procedure, in Patients With End-Stage Renal Disease on Chronic Hemodialysis

This study evaluates the safety and efficacy of AB023 (xisomab 3G3) in patients with end stage renal disease on chronic hemodialysis. Two dose levels will be evaluated in two cohorts. Within each cohort the patients will be randomized to receive either AB023 (xisomab 3G3) or placebo (at a ratio of 2:1 active: placebo).

Start Date29 Oct 2018 |

Sponsor / Collaborator |

NCT03453060

A Phase 1, Single Ascending Dose, Randomized, Double-Blind, Placebo-Controlled Study to Evaluate the Safety, Tolerability, and Pharmacodynamics of E-WE Thrombin as an Intravenous Bolus in Healthy Adult Subjects

The purpose of this study is to assess the safety, tolerability and pharmacodynamics of a single iv dose of E-WE Thrombin in healthy adult subjects.

Start Date30 May 2018 |

Sponsor / Collaborator |

100 Clinical Results associated with Aronora, Inc.

Login to view more data

0 Patents (Medical) associated with Aronora, Inc.

Login to view more data

39

Literatures (Medical) associated with Aronora, Inc.01 May 2025·Research and Practice in Thrombosis and Haemostasis

The factor XIa antibody osocimab strongly inhibits clotting in extracorporeal circuits with human blood and in baboons

Article

Author: Schwameis, Michael ; Tucker, Erik I ; Schranz, Sabine ; Buchmüller, Anja ; Jilma, Bernd ; Kovacevic, Katarina D ; Watschinger, Bruno ; Gruber, András ; Stoiber, Martin ; Wallisch, Michael ; Wolf, Christopher ; Samaha, Eslam

Background:

Effective anticoagulant approaches in extracorporeal circuits with little impact on hemostasis are still an unmet medical need. Targeted inhibition of activated factor (F)XI might represent an attractive alternative or addition to conventional anticoagulation.

Objectives:

We aimed to evaluate the additional antithrombotic effect of the monoclonal anti-FXIa antibody osocimab in in vitro and in vivo models of extracorporeal circulation.

Methods:

This study compared the additional antithrombotic effect of a novel monoclonal antibody, osocimab (anti-FXIa), with that of low-molecular-weight heparin in 3 in vitro models of extracorporeal blood circulation (hemodialysis [HD], left ventricular assist devices [LVADs], and extracorporeal membrane oxygenation [ECMO]). Whole blood donated by healthy volunteers was spiked with enoxaparin ± osocimab and circulated for several hours in extracorporeal circuits. The primary endpoint was time to filter clotting. Furthermore, we performed in vivo ECMO perfusion studies in baboons using unfractionated heparin and osocimab.

Results:

Of 40 subjects screened, 34 (50% male; mean age, 32 years [±9 SD]) were enrolled in the study. The addition of osocimab significantly prolonged the time to filter clotting from 120 minutes (IQR, 105-150) to 180 minutes (IQR, 180-180; n = 10) in HD circuits, from 127 minutes (IQR, 38-210) to 180 minutes (IQR, 69-240; n = 12) in ECMO circuits, and from 36 minutes (IQR, 18-59) to 113 minutes (IQR, 51-120; n = 12) in LVAD circuits. Furthermore, it preserved fibrinogen concentrations (HD: 227 mg/dL vs 170 mg/dL; LVADs: 229 mg/dL vs 50 mg/dL; ECMO: 221 mg/dL vs 170 mg/dL) and platelet aggregation and prolonged clotting times in thromboelastometry. In baboons, osocimab significantly reduced the oxygenator's platelet deposition and terminal fibrin content.

Conclusion:

Osocimab effectively inhibited clotting due to extracorporeal circulation.

31 Dec 2024·Platelets

Role of platelet count in a murine stasis model of deep vein thrombosis

Article

Author: Mathews, Rick ; Le-Cook, Anh ; Nguyen, Khanh P ; Loftis, Jennifer M ; Lorentz, Christina U ; Woltjer, Randall L ; Kaempf, Andy ; Hinds, Monica T ; Revenko, Alexey ; Setthavongsack, Naly

Platelets are core components of thrombi but their effect on thrombus burden during deep vein thrombosis (DVT) has not been fully characterized. We examined the role of thrombopoietin-altered platelet count on thrombus burden in a murine stasis model of DVT. To modulate platelet count compared to baseline, CD1 mice were pretreated with thrombopoietin antisense oligonucleotide (THPO-ASO, 56% decrease), thrombopoietin mimetic (TPO-mimetic, 36% increase), or saline (within 1%). Thrombi and vein walls were examined on postoperative days (POD) 3 and 7. Thrombus weights on POD 3 were not different between treatment groups (p = .84). The mean thrombus weights on POD 7 were significantly increased in the TPO-mimetic cohort compared to the THPO-ASO (p = .005) and the saline (p = .012) cohorts. Histological grading at POD 3 revealed a significantly increased smooth muscle cell presence in the thrombi and CD31 positive channeling in the vein wall of the TPO-mimetic cohort compared to the saline and THPO-ASO cohorts (p < .05). No differences were observed in histology on POD 7. Thrombopoietin-induced increased platelet count increased thrombus weight on POD 7 indicating platelet count may regulate thrombus burden during early resolution of venous thrombi in this murine stasis model of DVT.

24 Oct 2024·BLOOD

Coagulation factor XI regulates endothelial cell permeability and barrier function in vitro and in vivo

Article

Author: Pang, Jiaqing ; Gailani, David ; Lorentz, Christina U. ; Melrose, Alexander R. ; McCarty, Owen J. T. ; Shatzel, Joseph J. ; Keshari, Ravi S. ; Puy, Cristina ; Tucker, Erik I. ; Vu, Helen H. ; Moellmer, Samantha A. ; Lupu, Florea

Abstract:

Loss of endothelial barrier function contributes to the pathophysiology of many inflammatory diseases. Coagulation factor XI (FXI) plays a regulatory role in inflammation. Although activation of FXI increases vascular permeability in vivo, the mechanism by which FXI or its activated form FXIa disrupts endothelial barrier function is unknown. We investigated the role of FXIa in human umbilical vein endothelial cell (HUVEC) or human aortic endothelial cell (HAEC) permeability. The expression patterns of vascular endothelial (VE)-cadherin and other proteins of interest were examined by western blot or immunofluorescence. Endothelial cell permeability was analyzed by Transwell assay. We demonstrate that FXIa increases endothelial cell permeability by inducing cleavage of the VE-cadherin extracellular domain, releasing a soluble fragment. The activation of a disintegrin and metalloproteinase 10 (ADAM10) mediates the FXIa-dependent cleavage of VE-cadherin, because adding an ADAM10 inhibitor prevented the cleavage of VE-cadherin induced by FXIa. The binding of FXIa with plasminogen activator inhibitor 1 and very low–density lipoprotein receptor on HUVEC or HAEC surfaces activates vascular endothelial growth receptor factor 2 (VEGFR2). The activation of VEGFR2 triggers the mitogen-activated protein kinase (MAPK) signaling pathway and promotes the expression of active ADAM10 on the cell surface. In a pilot experiment using an established baboon model of sepsis, the inhibition of FXI activation significantly decreased the levels of soluble VE-cadherin to preserve barrier function. This study reveals a novel pathway by which FXIa regulates vascular permeability. The effect of FXIa on barrier function may be another way by which FXIa contributes to the development of inflammatory diseases.

5

News (Medical) associated with Aronora, Inc.13 Aug 2025

Business development: Purchased mezagitamab royalty and milestone rights held by BioInvent International and will secure royalty economic interests in two early-stage partnered assets through XOMA Royalty’s recently announced acquisition of LAVA Therapeutics. Company acquisitions: Announced XOMA Royalty’s acquisitions of Turnstone Biologics, LAVA Therapeutics, and HilleVax; acted as structuring agent and provided financing for XenoTherapeutics’ acquisition of ESSA Pharma; completed the sale of Kinnate pipeline assets and distributed upfront proceeds to Kinnate contingent value right (CVR) holders. Key Pipeline advancements: Rezolute completed enrollment in Phase 3 sunRIZE study of ersodetug in patients with congenital hyperinsulinism; the Marketing Authorization Application (MAA) for Day One Biopharmaceuticals and Ipsen’s tovorafenib was accepted for review by the European Marketing Authority (EMA), resulting in a $4 million milestone payment to XOMA Royalty; Zevra Therapeutics submitted an MAA with EMA seeking marketing approval for arimoclomol as a treatment for Niemann-Pick Type C. Cash receipts: In the first half of 2025, XOMA Royalty received $29.6 million in royalties and milestones from its partners, including $11.7 million during the second quarter. EMERYVILLE, Calif., Aug. 13, 2025 (GLOBE NEWSWIRE) -- XOMA Royalty Corporation (NASDAQ: XOMA), the biotech royalty aggregator, reported its 2025 second quarter and year to date financial results and highlighted recent actions that have the potential to deliver shareholder value. “We continue to add to our diversified portfolio of both early- and late-stage assets through disciplined capital deployment and creative financial structures,” stated Owen Hughes, Chief Executive Officer of XOMA Royalty. “Recently approved drugs are addressing key unmet patient needs, which is driving increased royalty receipts, and we await data from several key Phase 3 assets over the coming quarters.” Royalty and Milestone Acquisitions CompanyAsset and Transaction DetailBioInventXOMA Royalty deployed $20 million to purchase the future mezagitamab royalty and milestone interests held by BioInvent and will pay an additional $10 million as the asset achieves a certain regulatory milestone. With its existing entitlement, plus the newly acquired economics from BioInvent, XOMA Royalty will be entitled to milestones of up to $16.25 million from Takeda and mid-single digit royalties on future mezagitamab commercial sales.LAVA TherapeuticsXOMA Royalty will secure an economic interest in two partnered assets through the Company’s recently announced acquisition of LAVA. The partnered assets are PF-08046052, which is being developed by Pfizer, and JNJ-89853413, which is being developed by Johnson & Johnson. Company Acquisitions CompanyTransaction DetailsTurnstone BiologicsXOMA Royalty and Turnstone Biologics entered into a definitive merger agreement, whereby XOMA Royalty will acquire Turnstone for $0.34 in cash per share of Turnstone common stock plus one non-transferable contingent value right (CVR). The transaction closed on August 11.HilleVaxXOMA Royalty and HilleVax have entered into a definitive merger agreement, whereby XOMA Royalty will acquire HilleVax for $1.95 per share upon closing. HilleVax stockholders also will receive a CVR that entitles them to receive certain potential payments following the closing of a pro rata portion of any remaining HilleVax cash in excess of $102.95 million; certain savings realized related to HilleVax’ office lease obligations, and should XOMA Royalty sell or out license the HilleVax norovirus programs within two years after the acquisition closes, 90% of any net proceeds received within five years by XOMA Royalty. The acquisition is expected to be completed in September.LAVA TherapeuticsXOMA Royalty and LAVA Therapeutics have entered into a definitive merger agreement, whereby XOMA Royalty will acquire LAVA for between $1.16 and $1.24 in cash per share of LAVA common stock plus one non-transferable CVR representing the right to receive 75% of the net proceeds related to LAVA’s two partnered assets and 75% of any proceeds related to the sale or out license of LAVA’s unpartnered programs. The acquisition is expected to close in the fourth quarter of 2025.XenoTherapeutics Acquisition of ESSA PharmaXOMA Royalty acted as structuring agent and is providing short-term financing for XenoTherapeutics’ acquisition of ESSA Pharma.KinnateXOMA Royalty sold the remaining Kinnate pipeline assets for a total of up to $270 million in upfront and milestone payments, plus royalties on commercial sales at rates ranging from low-single digits to mid-teens. In July, the Kinnate CVRs holders received their 85% share of the modest upfront payments. Pipeline Partner Updates through August 8, 2025 PartnerEventRezoluteIn May, the company announced the U.S. Food and Drug Administration (FDA) granted Breakthrough Therapy Designation (BTD) to its investigational therapy, ersodetug, for the treatment of hypoglycemia caused by tumor HI.1 In May, Rezolute announced the completion of enrollment in the Phase 3 sunRIZE study. Topline data are anticipated in December of 2025.2As a result of Rezolute completing enrollment in the study, XOMA Royalty received a $5 million milestone payment.TakedaThe first patient was dosed in Takeda’s Phase 3 clinical trial investigating mezagitamab as a treatment for adults with chronic primary immune thrombocytopenia (ITP). This achievement resulted in XOMA Royalty receiving a $3.0 million milestone payment, net, during the second quarter.Day One BiopharmaceuticalsIpsen, Day One’s partner outside of the U.S., announced its Marketing Authorization Application (MAA) for tovorafenib as a treatment for pediatric low-grade glioma (pLGG) had been accepted for review by the European Medicines Agency (EMA)3.Zevra TherapeuticsOn July 28, Zevra announced it had submitted an MAA to EMA for the evaluation of arimoclomol for the treatment of Niemann-Pick Disease Type C (NPC)4.Gossamer BioOn June 16, Gossamer announced it had completed enrollment in the ongoing Phase 3 PROSERA Study that is evaluating seralutinib in Functional Class II and III pulmonary atrial hypertension (PAH) patients5. Topline results continue to be anticipated in February 20266.Daré BiosciencesAnnounced positive interim safety and efficacy results from its ongoing Phase 3 clinical trial evaluating the contraceptive effectiveness, safety, and acceptability of Ovaprene®, an investigational monthly, hormone-free intravaginal contraceptive.7 Anticipated 2025 Partner Events of Note PartnerEventRezoluteTopline data from sunRIZE Phase 3 clinical trial, which is investigating ersodetug in infants and children with congenital hyperinsulinism (cHI). Topline data are expected in December 20252. First patient dosed in the Phase 3 registrational study for ersodetug for the treatment of hypoglycemia due to tumor hyperinsulinism8.TakedaFirst patient dosed in Takeda’s Phase 3 clinical trial investigating mezagitamab as a treatment for adults with IgA Nephropathy.Gossamer BioActivates first clinical sites for the global, registrational Phase 3 SERANATA Study examining seralutinib in patients with pulmonary hypertension associated with interstitial lung disease (PH-ILD) in the fourth quarter5.Daré BioscienceMakes Sildenafil Cream, 3.6% available commercially via prescription in the fourth quarter of 2025 as a compounded drug under Section 503B of the Federal Food, Drug, and Cosmetic Act.9 Commencement of one of two registrational Phase 3 clinical trials investigating Sildenafil Cream, 3.6%, for the treatment of female sexual arousal disorder10. Second Quarter and Year to Date 2025 Financial Results Tom Burns, Chief Financial Officer of XOMA Royalty, commented, “In the first six months of 2025, we have received $29.6 million in cash from partners, of which $16.0 million were royalty payments related to commercial sales and $13.6 million in milestone payments and fees. In the second quarter, we received $11.7 million in cash, $2.6 million from our partners’ commercial sales and $9.0 million from milestones and fees. Our partners’ product marketing activities continue to be well executed and as new commercial opportunities within our portfolio emerge, our line of sight to becoming cash flow positive on a consistent basis exclusively from the cash payments received from royalties grows clearer. With this outlook, we deployed $1.8 million to repurchase 81,682 shares of our common stock in the second quarter, bringing the total number of shares repurchased in 2025 to over 107,500 shares.” Income and Revenue: Income and revenue for the three and six months ended June 30, 2025, were $13.1 million and $29.0 million, respectively, as compared with $11.1 million and $12.6 million for the corresponding periods of 2024. The increase in both periods presented was primarily driven by increased income related to VABYSMO and OJEMDA. Research and Development (R&D) Expenses: R&D expenses for the three and six months ended June 30, 2025, were $0.1 million and $1.4 million, respectively, compared with $1.2 million for each of the corresponding periods of 2024. The R&D expenses in the first quarter of 2025 and the three- and six-month periods of 2024 were related to the clinical trial costs incurred subsequent to XOMA Royalty’s acquisition of Kinnate in April 2024 related to KIN-3248 and the associated wind-down activities. General and Administrative (G&A) Expenses: G&A expenses for the three and six months ended June 30, 2025, were $7.8 million and $15.9 million, respectively, as compared with $11.0 million and $19.5 million for the corresponding periods of 2024. The decrease in the second quarter of 2025 compared to the second quarter of 2024 was primarily due to the $3.6 million in exit packages paid to Kinnate senior leadership in the second quarter of 2024. In 2025, XOMA Royalty’s G&A expenses included non-cash stock-based compensation expenses during the three and six months ended June 30, 2025, of $1.6 million and $3.6 million, respectively, as compared to $2.7 million and $5.5 million for the corresponding periods of 2024. The 2024 periods reflect non-cash stock-based compensation related to the appointment of Mr. Hughes to full-time Chief Executive Officer and issuance of performance stock units. Credit Losses on Purchased Receivables: In the second quarter of 2024, XOMA Royalty recorded a one-time, non-cash credit loss on purchased receivables of $9.0 million and a corresponding reduction of royalty receivables of $9.0 million associated with the Aronora assets. To date there have been no credit losses in 2025. Amortization of Intangible Assets: Amortization of intangible assets relates to the IP acquired in the Company’s acquisitions of Pulmokine in November 2024 and the mezagitamab economics from the BioInvent transaction in May 2025. Amortization of non-cash intangible assets were $0.7 million and $1.2 million for the three and six months ended June 30, 2025. Gain on Acquisition of Kinnate: In the second quarter of 2024, XOMA Royalty recorded a $19.3 million gain on the acquisition of Kinnate due to the fair value of net assets that exceeded total purchase consideration. Interest Expense: For the three and six months ended June 30, 2025, interest expense was $3.2 million and $6.7 million, respectively, as compared with $3.4 million and $7.0 million for the corresponding periods of 2024. Interest expense relates to the Blue Owl Loan established in December 2023. Other Income, net: For the three and six months ended June 30, 2025, other income, net was $7.8 million and $7.7 million, respectively, as compared with $2.1 million and $4.0 million for the corresponding periods of 2024. The increases for the periods presented were primarily driven by increases in the fair value of XOMA Royalty’s investments in equity securities. Net Income: XOMA Royalty reported net income of $9.2 million and $11.6 million for the three and six months ended June 30, 2025, as compared to $16.0 and $7.4 million in the corresponding periods of 2025. Cash Position: On June 30, 2025, XOMA Royalty had cash and cash equivalents of $78.5 million (including $3.4 million in restricted cash), compared with cash and cash equivalents of $106.4 million (including $4.8 million in restricted cash) on December 31, 2024. In the second quarter of 2025, XOMA Royalty received $11.7 million in cash receipts including $2.6 million in royalties and commercial payments and $9.0 million in milestones and fees. During the second quarter of 2025, XOMA Royalty deployed $20 million to acquire additional economics in mezagitamab, repurchased approximately 81,700 shares of XOMA Royalty common stock for a cost of $1.8 million, and paid $1.4 million in dividends on the XOMA Royalty Perpetual Preferred stocks. In the first six months of 2025, XOMA Royalty received $29.6 million in cash receipts, including $16.0 million in royalties and commercial payments and $13.6 million in milestone payments and fees. During the first half of 2025, XOMA Royalty deployed $25.0 million to acquire additional assets for its royalty and milestone portfolio, repurchased approximately 107,500 shares of its common stock for a cost of $2.4 million, and paid $2.7 million in dividends on the XOMA Royalty Perpetual Preferred stocks. About XOMA Royalty CorporationXOMA Royalty is a biotechnology royalty aggregator playing a distinctive role in helping biotech companies achieve their goal of improving human health. XOMA Royalty acquires the potential future economics associated with pre-commercial and commercial therapeutic candidates that have been licensed to pharmaceutical or biotechnology companies. When XOMA Royalty acquires the future economics, the seller receives non-dilutive, non-recourse funding they can use to advance their internal drug candidate(s) or for general corporate purposes. The Company has an extensive and growing portfolio of assets (asset defined as the right to receive potential future economics associated with the advancement of an underlying therapeutic candidate). For more information about the Company and its portfolio, please visit www.xoma.com or follow XOMA Royalty Corporation on LinkedIn. Forward-Looking Statements/Explanatory NotesCertain statements contained in this press release are forward-looking statements within the meaning of Section 27A of the Securities Act of 1933 and Section 21E of the Securities Exchange Act of 1934, including statements regarding the timing and amount of potential commercial payments to XOMA Royalty and other developments related to VABYSMO® (faricimab-svoa), OJEMDA™ (tovorafenib), MIPLYFFA™ (arimoclomol), XACIATO™ (clindamycin phosphate) vaginal gel 2%, IXINITY® [coagulation factor IX (recombinant)], DSUVIA® (sufentanil sublingual tablet), and Sildenafil Cream, 3.6%; the potential occurrences of the events listed under “Anticipated 2025 Events of Note”; the anticipated timings of regulatory filings and approvals related to assets in XOMA Royalty’s portfolio; and the potential of XOMA Royalty’s portfolio of partnered programs and licensed technologies generating substantial milestone and royalty proceeds over time. In some cases, you can identify such forward-looking statements by terminology such as “anticipate,” “intend,” “believe,” “estimate,” “plan,” “seek,” “project,” “expect,” “may,” “will”, “would,” “could” or “should,” the negative of these terms or similar expressions. These forward-looking statements are not a guarantee of XOMA Royalty’s performance, and you should not place undue reliance on such statements. These statements are based on assumptions that may not prove accurate, and actual results could differ materially from those anticipated due to certain risks inherent in the biotechnology industry, including those related to the fact that our product candidates subject to out-license agreements are still being developed, and our licensees may require substantial funds to continue development which may not be available; we do not know whether there will be, or will continue to be, a viable market for the products in which we have an ownership or royalty interest; and if the therapeutic product candidates to which we have a royalty interest do not receive regulatory approval, our third-party licensees will not be able to market them. Other potential risks to XOMA Royalty meeting these expectations are described in more detail in XOMA Royalty's most recent filing on Form 10-Q and in other filings with the Securities and Exchange Commission. Consider such risks carefully when considering XOMA Royalty's prospects. Any forward-looking statement in this press release represents XOMA Royalty's beliefs and assumptions only as of the date of this press release and should not be relied upon as representing its views as of any subsequent date. XOMA Royalty disclaims any obligation to update any forward-looking statement, except as required by applicable law. EXPLANATORY NOTE: Any references to “portfolio” in this press release refer strictly to milestone and/or royalty rights associated with a basket of drug products in development. Any references to “assets” in this press release refer strictly to milestone and/or royalty rights associated with individual drug products in development. As of the date of this press release, the commercial assets in XOMA Royalty’s milestone and royalty portfolio are VABYSMO® (faricimab-svoa), OJEMDA™ (tovorafenib), MIPLYFFA™ (arimoclomol), XACIATO™ (clindamycin phosphate) vaginal gel 2%, IXINITY® [coagulation factor IX (recombinant)], and DSUVIA® (sufentanil sublingual tablet). All other assets in the milestone and royalty portfolio are investigational compounds. Efficacy and safety have not been established. There is no guarantee that any of the investigational compounds will become commercially available. 1 https://ir.rezolutebio.com/news/detail/354/rezolute-receives-breakthrough-therapy-designation-from-fda-for-ersodetug-in-the-treatment-of-hypoglycemia-due-to-tumor-hyperinsulinism2 https://ir.rezolutebio.com/news/detail/356/rezolute-announces-completion-of-enrollment-in-the-phase-3-sunrize-study-of-ersodetug-in-patients-with-congenital-hyperinsulinism3 https://www.ipsen.com/press-releases/ipsen-delivers-strong-sales-in-the-first-quarter-2025-and-confirms-its-full-year-guidance-3062256/4 https://investors.zevra.com/news-releases/news-release-details/zevra-therapeutics-submits-marketing-authorization-application5 https://ir.gossamerbio.com/news-releases/news-release-details/gossamer-bio-announces-completion-enrollment-registrational6 https://ir.gossamerbio.com/news-releases/news-release-details/gossamer-bio-announces-second-quarter-2025-financial-results-and7 https://ir.darebioscience.com/news-releases/news-release-details/positive-interim-phase-3-results-highlight-potential-ovaprener8 https://ir.rezolutebio.com/news/detail/337/rezolute-announces-fda-clearance-of-ind-application-for-phase-3-registrational-study-of-rz358-for-treatment-of-hypoglycemia-due-to-tumor-hyperinsulinism9 https://ir.darebioscience.com/news-releases/news-release-details/dare-bioscience-and-rosy-wellness-announce-strategic10 https://ir.darebioscience.com/news-releases/news-release-details/dare-bioscience-announces-phase-3-plans-sildenafil-cream-36 XOMA CORPORATIONCONDENSED CONSOLIDATED STATEMENTS OF OPERATIONS(unaudited)(in thousands, except share and per share amounts)

Three Months Ended June, Six Month Ended June 30, 2025 2024 2025 2024 Income and Revenues:

Income from purchased receivables under the EIR method$6,007 $4,562 $12,077 $4,562 Income from purchased receivables under the cost recovery method 1,743 870 7,268 870 Revenue from contracts with customers 5,025 5,025 9,025 6,025 Revenue recognized under units-of-revenue method 354 629 671 1,119 Total income and revenues 13,129 11,086 29,041 12,576

Operating expenses:

Research and development 69 1,161 1,362 1,194 General and administrative 7,802 11,004 15,948 19,465 Credit losses on purchased receivables - 9,000 - 9,000 Amortization of intangible assets 655 - 1,199 - Total operating expenses 8,526 21,165 18,509 29,659

Income (Loss) from operations 4,603 (10,079) 10,532 (17,083)

Other income (expense)

Gain on the acquisition of Kinnate - 19,316 - 19,316 Change in fair value of embedded derivative related to RPA - 8,100 - 8,100 Interest expense (3,236) (3,402) (6,703) (6,953)Other income, net 7,824 2,050 7,729 4,010 Net income$9,191 $15,985 $11,558 $7,390 Net income available to common stockholders, basic$5,522 $10,224 $6,225 $3,253 Basic net income per share available to common stockholders$0.46 $0.88 $0.52 $0.28 Weighted average shares used in computing basic net income per share available to common stockholders 12,007 11,643 11,988 11,611

Net income available to common stockholders, diluted$7,823 $14,617 $8,822 $4,654 Diluted net income per share available to common stockholders$0.44 $0.84 $0.50 $0.27 Weighted average shares used in computing diluted net income per share available to common stockholders 17,761 17,321 17,777 17,263

XOMA CORPORATIONCONDENSED CONSOLIDATED BALANCE SHEETS(unaudited)(in thousands, except share and per share amounts)

June 30, December 31, 2025 2024 ASSETS Current assets: Cash and cash equivalents$75,060 $101,654 Short-term restricted cash 80 1,330 Investment in equity securities 8,801 3,529 Trade and other receivables, net 1,817 1,839 Short-term royalty and commercial payment receivables under the EIR method 17,960 14,763 Short-term royalty and commercial payment receivables under the cost recovery method 700 413 Prepaid expenses and other current assets 507 2,076 Total current assets 104,925 125,604

Long-term restricted cash 3,345 3,432 Property and equipment, net 26 32 Operating lease right-of-use assets 288 319 Long-term royalty and commercial payment receivables under the EIR method 4,775 4,970 Long-term royalty and commercial payment receivables under the cost recovery method 58,937 55,936 Exarafenib milestone asset (Note 4) 3,402 3,214 Investment in warrants 609 - Intangible assets, net 45,434 25,909 Other assets - long term 1,715 1,861 Total assets$223,456 $221,277

LIABILITIES, CONVERTIBLE PREFERRED STOCK AND STOCKHOLDERS’ EQUITY Current liabilities: Accounts payable$1,138 $1,053 Accrued and other liabilities 5,411 5,752 Contingent consideration under RPAs, AAAs, and CPPAs - 3,000 Operating lease liabilities 472 446 Unearned revenue recognized under units-of-revenue method 1,434 1,361 Preferred stock dividend accrual 1,368 1,368 Current portion of long-term debt 11,672 11,394 Total current liabilities 21,495 24,374

Unearned revenue recognized under units-of-revenue method – long-term 3,666 4,410 Exarafenib milestone contingent consideration 3,402 3,214 Long-term operating lease liabilities 238 483 Long-term debt 102,201 106,875 Total liabilities 131,002 139,356

Convertible preferred stock, $0.05 par value, 5,003 shares authorized, issued and outstanding as of June 30, 2025 and December 31, 2024 20,019 20,019

Stockholders’ equity: 8.625% Series A cumulative, perpetual preferred stock, $0.05 par value, 984,000 shares authorized, issued and outstanding as of June 30, 2025 and December 31, 2024 49 49 8.375% Series B cumulative, perpetual preferred stock, $0.05 par value, 3,600 shares authorized, 1,600 shares issued and outstanding as of June 30, 2025 and December 31, 2024 — — Common stock, $0.0075 par value, 277,333,332 shares authorized, 12,062,466 and 11,952,377 shares issued and outstanding as of June 30, 2025 and December 31, 2024, respectively 90 90 Additional paid-in capital 1,300,066 1,298,747 Accumulated other comprehensive income 122 73 Accumulated deficit (1,227,892) (1,237,057)Total stockholders’ equity 72,435 61,902 Total liabilities, convertible preferred stock and stockholders’ equity$223,456 $221,277

XOMA CORPORATIONCONDENSED CONSOLIDATED STATEMENTS OF CASH FLOWS (unaudited)(in thousands)

Six Months Ended June 30, 2025 2024 Cash flows from operating activities:

Net income$11,558 $7,390 Adjustments to reconcile net income to net cash provided by (used in) operating activities:

Adjustment for income from EIR method purchased receivables (3,935) (4,562)Stock-based compensation expense 3,588 5,546 Credit losses on purchased receivables — 9,000 Gain on the acquisition of Kinnate — (19,316)Common stock contribution to 401(k) 141 118 Amortization of intangible assets 1,199 — Depreciation 6 5 Accretion of long-term debt discount and debt issuance costs 749 508 Non-cash lease expense 31 29 Change in fair value of equity securities (5,173) (535)Change in fair value of available-for-sale debt securities classified as cash equivalents 49 — Change in fair value of derivatives (5) — Changes in assets and liabilities:

Trade and other receivables, net 22 478 Prepaid expenses and other assets 1,715 (603)Accounts payable and accrued liabilities (387) 921 Operating lease liabilities (219) (82)Unearned revenue recognized under units-of-revenue method (671) (1,117)Net cash provided by (used in) operating activities 8,668 (2,220)

Cash flows from investing activities:

Net cash acquired in Kinnate acquisition — 18,926 Payments of consideration under RPAs, AAAs, and CPPAs (8,000) (37,000)Receipts under RPAs, AAAs, and CPPAs 2,039 16,741 Payment for BioInvent contract-based intangible asset (20,614) — Purchase of property and equipment — (17)Purchase of equity securities (99) — Net cash used in investing activities (26,674) (1,350)

Cash flows from financing activities:

Principal payments – debt (5,065) (3,616)Debt issuance costs and loan fees paid in connection with long-term debt (80) (661)Payment of preferred stock dividends (2,736) (2,736)Repurchases of common stock (2,370) (13)Proceeds from exercise of options and other share-based compensation 896 2,353 Taxes paid related to net share settlement of equity awards (570) (1,387)Net cash used in financing activities (9,925) (6,060)

Net decrease in cash, cash equivalents and restricted cash (27,931) (9,630)Cash, cash equivalents and restricted cash at the beginning of the period 106,416 159,550 Cash, cash equivalents and restricted cash at the end of the period$78,485 $149,920

Supplemental Cash Flow Information:

Cash paid for interest$6,078 $3,780 Cash paid for taxes$277 $— Non-cash investing and financing activities:

Estimated fair value of the Exarafenib milestone asset$— $2,922 Estimated fair value of the Exarafenib milestone contingent consideration$— $2,922 Right-of-use assets obtained in exchange for operating lease liabilities in Kinnate acquisition$— $824 Relative fair value basis reduction of rights-of-use assets in Kinnate acquisition$— $(824)Accrual of contingent consideration under the Affitech CPPA$— $3,000 Preferred stock dividend accrual$1,368 $1,368 Excise tax accrual due to stock repurchases$24 $— Transaction costs in connection with BioInvent IP acquisition included in accounts payable$111 $—

Investor contact:Media contact:Juliane SnowdenKathy VincentXOMA Royalty CorporationKV Consulting & Management+1-646-438-9754kathy@kathyvincent.com juliane.snowden@xoma.com

Phase 3Financial StatementBreakthrough TherapyAcquisitionNDA

12 Oct 2023

Aronora is Revolutionizing Blood Clot Treatment with Groundbreaking Innovations

PORTLAND, OR / ACCESSWIRE / October 12, 2023 / Aronora, Inc., a clinical-stage biotech poised to revolutionize blood clot treatment and prevention, today announced it has closed an investment from NYBC Ventures, a venture fund established by New York Blood Center. The funding will support team expansion, manufacturing, and regulatory activities as Aronora prepares for late-stage clinical development of their lead investigational products E-WE thrombin (AB002) and Gruticibart (AB023). Both drug candidates have completed phase 2a clinical trials, with compelling top-line data.

Blood clots, the leading global cause of death, have long been a challenge for medical research, and treatments have lagged behind many other diseases. Unfortunately, all currently available blood thinners and clot busters can cause severe bleeding complications.

In a remarkable breakthrough, Aronora's founders, Dr. Andras Gruber and Dr. Erik Tucker, have demonstrated that it is possible to target harmful blood clots (thrombosis) without increasing the risk of bleeding. Their pioneering work led to the filing of the first patents on coagulation factor XI inhibition, giving rise to Aronora's innovative antibody, Gruticibart. This achievement marked the creation of an entirely new class of anti-factor XI blood thinners that are ready to transform the landscape of thrombosis treatment.

Aronora's pipeline also includes a groundbreaking clot-buster, E-WE thrombin, marking the first substantial advancement in this field in nearly four decades.

Dr. Erik Tucker, Aronora's CEO, shared his journey, stating, "As a graduate student, I found our therapies worked better than currently available FDA-approved drugs, and had no bleeding issues. Now, a decade later, Aronora is primed to deliver a new generation of safer blood-thinning and clot-busting treatments."

NYBC Ventures' Managing Director, Meg Wood, added, "Aronora is a trailblazing company at the forefront in developing a new generation of safer blood-thinning and clot-dissolving medications. Aronora's transformative work will revolutionize the way we approach blood clot treatment, offering hope for millions of individuals worldwide." Ms. Wood will serve as a member on Aronora's Board of Directors.

Contact Information

Norah Verbout

Director of Strategic Partnerships

info@aronorabio.com

(503) 530-6842

SOURCE: Aronora, Inc.

View source version on accesswire.com:

Phase 2

29 Aug 2022

Companies like Sana Biotechnology, Umoja Biopharma and Sonoma Biotherapeutics are heeding the call from the Tacoma mountains, making the BioForest region of Washington and Oregon a lucrative landing ground for biotech innovators. And if the rumors are to be believed, there could soon be a major player moving in.

Seattle, in particular, is a bastion for one of biopharma’s hottest spaces – cell and gene therapy.

“You have a big focus on cell and gene therapies because you have the Hutch, which is really where the first cell therapy was developed,” Andy Scharenberg, M.D., co-founder and CEO of Seattle-based Umoja told BioSpace. Scharenberg was referring to the storied Fred Hutchinson Cancer Research Center where bone marrow transplant pioneer Dr. E. Donnall Thomas discovered the potential for the human immune system to eliminate cancer.

Along with Umoja, Sana and Affini-T Therapeutics, both based in Seattle, are continuing this work. Umoja’s approach aims to re-engineer a patient’s immune system in vivo to attack and destroy both hematologic and solid organ-based tumors. Sana is a cell and gene therapy hybrid with a cloaking technology that works to overcome the immune barriers of allogeneic cells. Affini-T, launched by researchers at the Hutch, is pioneering engineered TCR T cell therapies with synthetic biology and gene editing enhancements to target oncogenic driver mutations.

Meanwhile, in December 2021, Seattle-based Tune Therapeutics announced its entrance into the sizzling epigenome editing space. This emerging field also consists of Omega Therapeutics and the brand new Epic Bio.

While Seattle gets the most attention, just to the south, Oregon is home to Sparrow Pharmaceuticals, NemaMetrix and Aronora, along with a host of scientific tools manufacturers including Araceli Biosciences and Grace Bio-Labs.

An Elite Talent Pool

BioForest-based companies are able to draw elite scientific talent from the Hutch as well as the University of Washington where Affini-T scientific co-founder Phil Greenberg maintains a teaching position. The Oregon State University’s Center for Genome Research and Biocomputing offers another plentiful talent pool.

With established companies like Seagen in the region, there is also an ecosystem to provide management talent, Scharenberg said, noting that “building a biotech requires good management.”

Those factors, along with a relative affordability edge over the principle Biotech Bay and Genetown hubs have made Seattle a great place to build new biotechs, he said. “You're seeing that with an increasing amount of startup activity, and also the continued capacity to grow those into at least the mid-cap range.”

Seagen, Scharenberg said, is “an example of a biotech that's completely homegrown - just an absolutely fantastic success - and has spawned a ton of expertise in how you grow and operate a pharmaceutical company at every stage. People have spun out of that to all over the Seattle area.”

BioForest is also just that, a forest, and that appeals to the current generation of biotech talent, Scharenberg said.

“There is an increasing interest in doing things in the outdoors and Seattle is amazing for that. There's probably nowhere else in the country where you can drive an hour or go backcountry skiing and feel like you're practically in the wilderness.” He added that the COVID-19 pandemic has possibly added to this sentiment.

These factors clearly spoke to Sonoma. The cell therapy company, which is focused on curing autoimmune and inflammatory disease, recently announced plans to build an 83,000-square-foot operations facility in Seattle. The site will be primarily dedicated to the research, development and manufacturing of novel regulatory T cell (Treg) therapies. Sonoma’s first target is rheumatoid arthritis, for which it is conducting IND-enabling studies.

Heidi Hagen, chief technical officer at Sonoma, told BioSpace the company expects to hire for more than 100 positions across the Seattle area.

“Seattle has an established legacy of delivering many firsts in the field of cell therapy for oncology, and Sonoma Bio is leveraging these insights to deliver the next wave of innovation – Treg cell therapies for autoimmune and inflammatory diseases,” she said. Hagen added that Sonoma “considered proximity to transportation infrastructure, talent, technology and [its] current operations” when exploring prime locations for the center.

Hagen noted that the first active cell immunotherapy, Dendreon Pharmaceuticals’ Provenge, for prostate cancer, was developed and approved in the Seattle area. This accomplishment led to Juno Therapeutics, which was formed by former Dendreon executives and then acquired by Celgene (now BMS) for $9 billion. Juno raised a $176 million Series A in 2014, one of the largest early-stage biotech financing rounds at the time.

The Intersection of High-Tech and Biotech

The high concentration of companies like Amazon and Microsoft in the region “provides an opportunity for integration of digital technology and medical science,” Hagen noted. “It is at this intersection of high-tech and biotech that new genetic innovations and streamlined means of medical diagnoses and product manufacturing can be achieved.”

Sana President and CEO Steve Harr, M.D. told BioSpace the critical mass of talent, large companies, emerging companies, infrastructure, capital and high-quality cities in the BioForest region are converging to “make Seattle a leader in important emerging areas such as cell therapy, antibody-drug conjugates and complex manufacturing.”

Harr honed in on complex manufacturing in cell therapy, which he said “has emerged as a core strength and differentiator of the region that is both growing and looks sustainable.

“This talent, combined with a mix of large and emerging companies, has given the area the critical mass to be a sustainable life sciences hub,” Harr continued. Seattle’s strong foundation in cell and gene therapy and oncology is what drew Sana to the area, he said.

The Future

Historically, Seattle’s successful biotechs have been acquired at the small- or mid-cap range, Scharenberg noted, adding that he anticipates “we're going to see more and more successful biotechs that turn into operating companies, a little bit like Seagen.

“What we’ll hopefully continue to do is see companies like [Seagen] start from scratch, grow into the small- to mid-cap stage, but also eventually be successful and hang around and grow into successful commercial biotechs that gradually move into the large biotech category,” he said.

Ultimately, “When you have an ecosystem that can be anchored by one or two companies that are bigger like that, and then a smattering in the middle and a really active startup situation, that for me is a really healthy ecosystem,” Scharenberg concluded.

According to Harr, BioForest is right on the cusp.

“I am optimistic that the Seattle area has reached a critical mass that provides the momentum for inevitable success,” he shared. “That said, winners attract and grow the talent base and will remain critical to the region’s success.”

Of course, with Merck’s potential acquisition of Seagen on the horizon – the deal has reportedly been stalled by a disagreement over price – the region’s star could rise even higher. Only time will tell.

Featured Jobs on BioSpace

Gene TherapyAntibodyCell TherapyImmunotherapyADC

100 Deals associated with Aronora, Inc.

Login to view more data

100 Translational Medicine associated with Aronora, Inc.

Login to view more data

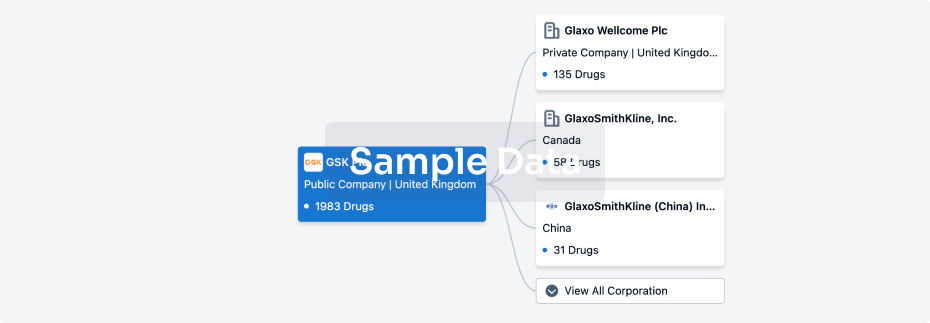

Corporation Tree

Boost your research with our corporation tree data.

login

or

Pipeline

Pipeline Snapshot as of 20 Dec 2025

The statistics for drugs in the Pipeline is the current organization and its subsidiaries are counted as organizations,Early Phase 1 is incorporated into Phase 1, Phase 1/2 is incorporated into phase 2, and phase 2/3 is incorporated into phase 3

Phase 1

1

4

Other

Login to view more data

Current Projects

| Drug(Targets) | Indications | Global Highest Phase |

|---|---|---|

BAY-1831865 ( F11 ) | Thrombosis More | Phase 1 |

Xisomab 3G3(Oregon Health & Science University) ( F11 ) | Nervous System Diseases More | Pending |

AB-062 ( TBXA2R ) | Cardiovascular Diseases More | Pending |

E WE thrombin(Aronora, Inc.) ( protein C ) | Kidney Failure, Chronic More | Pending |

AB-054 ( F12 ) | Thrombosis More | Pending |

Login to view more data

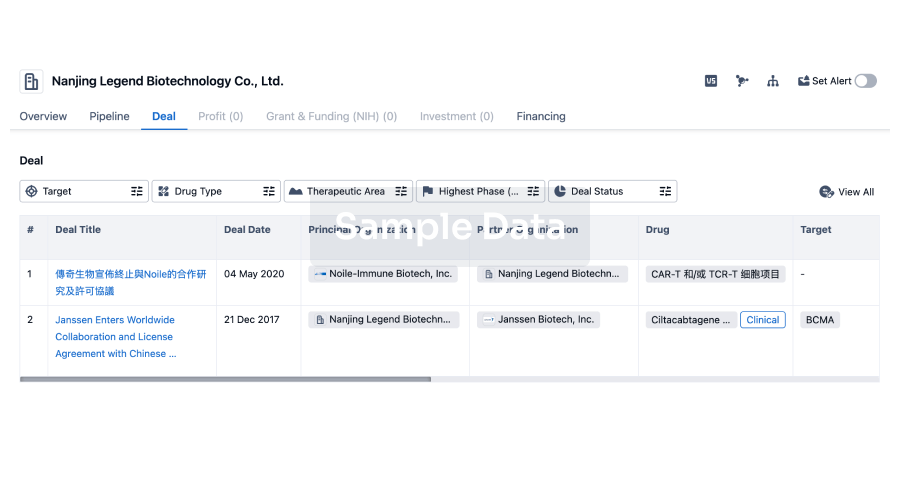

Deal

Boost your decision using our deal data.

login

or

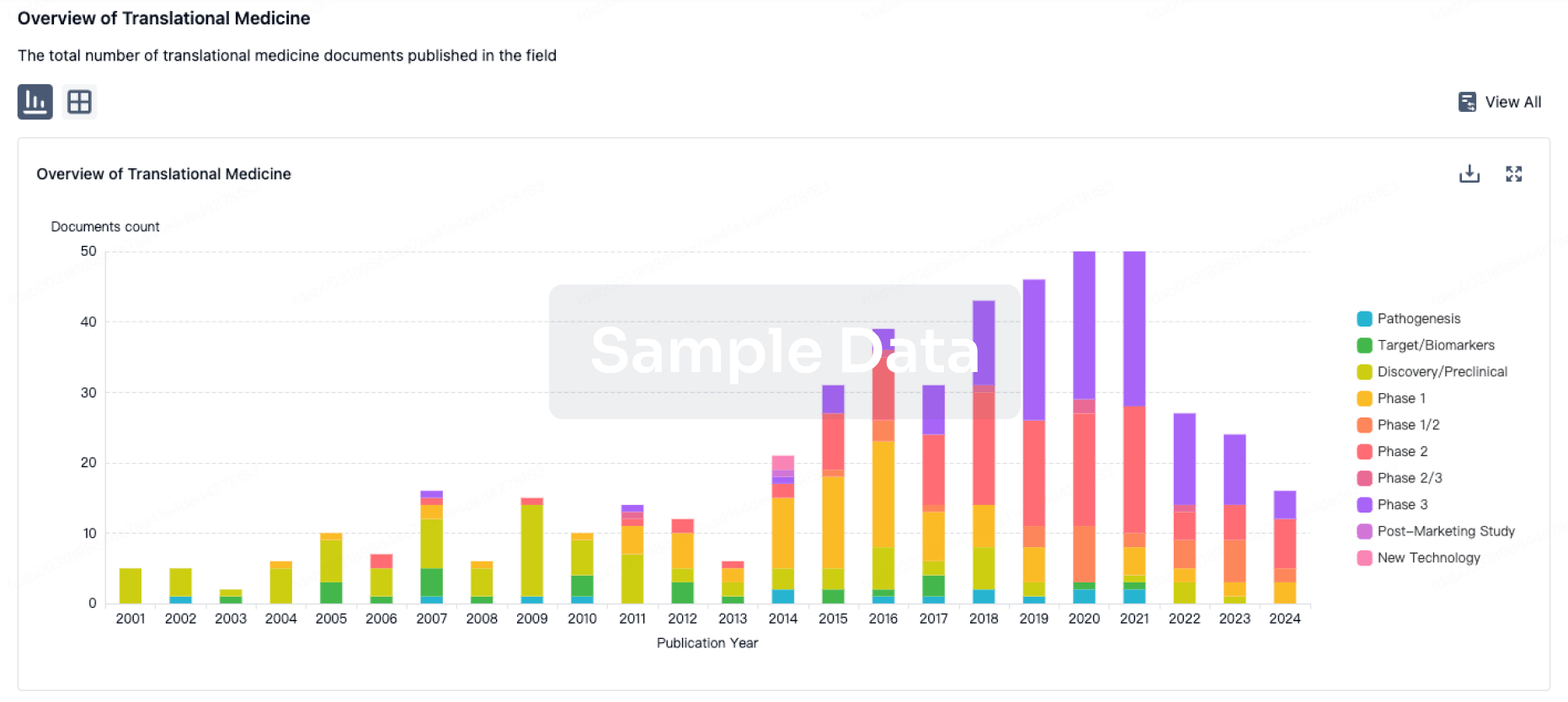

Translational Medicine

Boost your research with our translational medicine data.

login

or

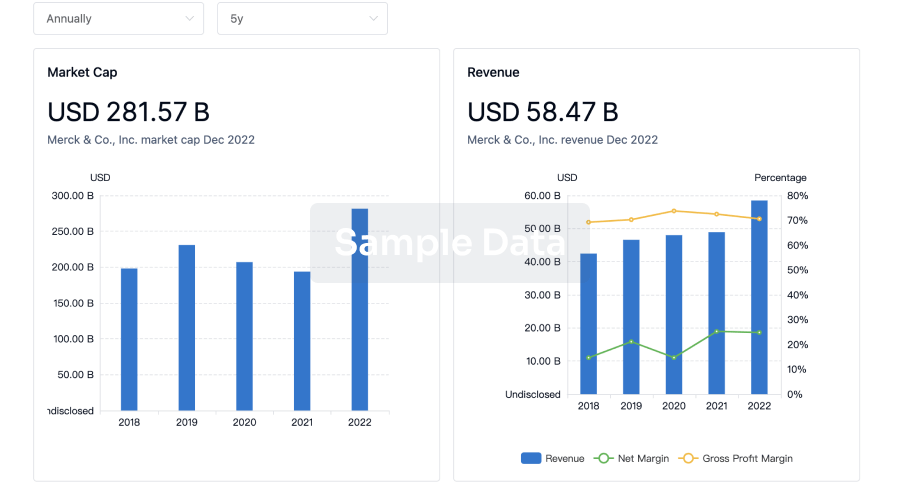

Profit

Explore the financial positions of over 360K organizations with Synapse.

login

or

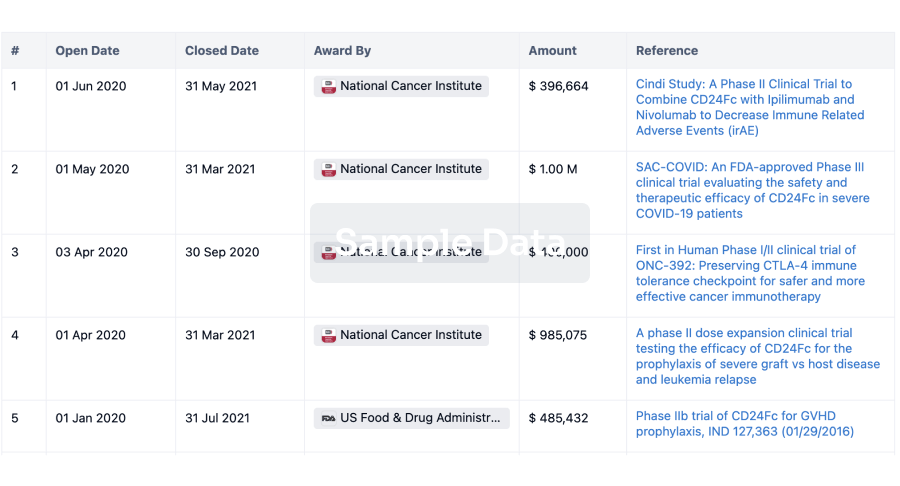

Grant & Funding(NIH)

Access more than 2 million grant and funding information to elevate your research journey.

login

or

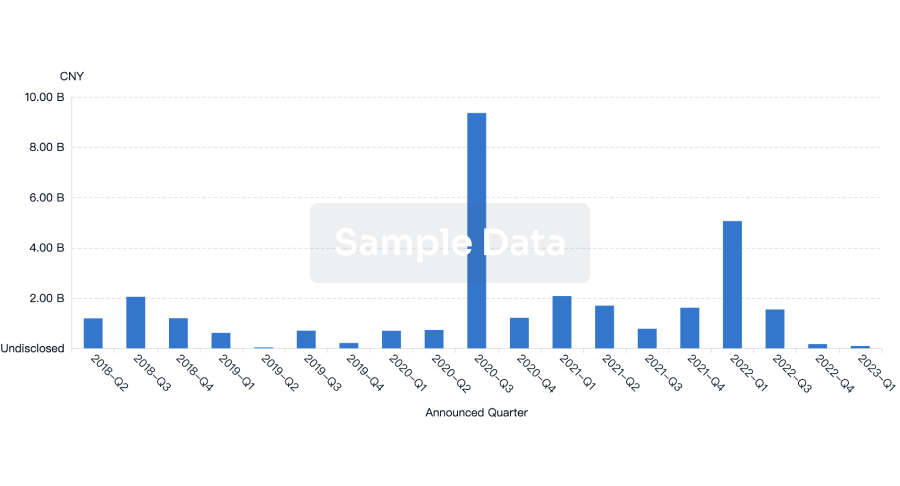

Investment

Gain insights on the latest company investments from start-ups to established corporations.

login

or

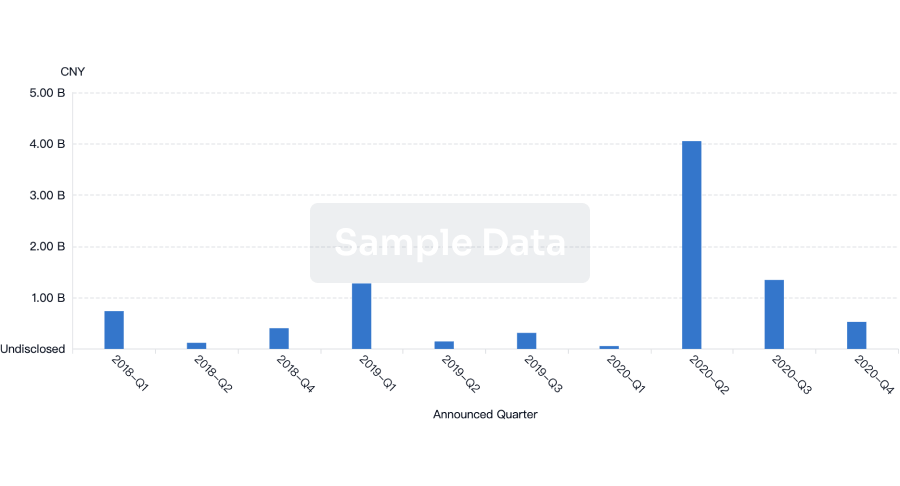

Financing

Unearth financing trends to validate and advance investment opportunities.

login

or

AI Agents Built for Biopharma Breakthroughs

Accelerate discovery. Empower decisions. Transform outcomes.

Get started for free today!

Accelerate Strategic R&D decision making with Synapse, PatSnap’s AI-powered Connected Innovation Intelligence Platform Built for Life Sciences Professionals.

Start your data trial now!

Synapse data is also accessible to external entities via APIs or data packages. Empower better decisions with the latest in pharmaceutical intelligence.

Bio

Bio Sequences Search & Analysis

Sign up for free

Chemical

Chemical Structures Search & Analysis

Sign up for free