Request Demo

Last update 30 Oct 2025

Beta Bionics, Inc.

Startups

250-500

| NASDAQ: BBNX| Startups

250-500

| NASDAQ: BBNX| Last update 30 Oct 2025

Overview

Related

9

Clinical Trials associated with Beta Bionics, Inc.NCT07011147

Primary Care Pragmatic, Real World Experience for Automated Insulin Delivery

The goal of this randomized controlled trial is to compare the efficacy and safety of the iLet Bionic Pancreas (BP) System in adults with insulin-treated diabetes (type 1 diabetes or type 2 diabetes) compared to standard of care when ordered by primary care providers. The main question it aims to answer is:

Can the iLet BP by deployed in primary care settings to adults with insulin-treated diabetes (type 1 diabetes or type 2 diabetes)?

Researchers will compare 13-weeks of iLet BP use to routine care to see if iLet BP use has a greater reduction in HbA1c compared to13-weeks of routine care.

Participants will:

Use the iLet BP for 13-weeks or continue their routine care Be trained to use the study devices or continue their routine care Complete a virtual screening visit, mid-period follow up calls and a final visit Complete baseline CGM collection Complete surveys and fingerstick a1c blood tests Routine care participants will have the option to complete an observational extension phase where they will wear the iLet BP for 13-weeks

Can the iLet BP by deployed in primary care settings to adults with insulin-treated diabetes (type 1 diabetes or type 2 diabetes)?

Researchers will compare 13-weeks of iLet BP use to routine care to see if iLet BP use has a greater reduction in HbA1c compared to13-weeks of routine care.

Participants will:

Use the iLet BP for 13-weeks or continue their routine care Be trained to use the study devices or continue their routine care Complete a virtual screening visit, mid-period follow up calls and a final visit Complete baseline CGM collection Complete surveys and fingerstick a1c blood tests Routine care participants will have the option to complete an observational extension phase where they will wear the iLet BP for 13-weeks

Start Date01 Nov 2025 |

Sponsor / Collaborator |

NCT06449677

A Randomized Trial of the Insulin-only Bionic Pancreas in Cystic Fibrosis Related Diabetes

This multi-center randomized controlled trial (RCT) will compare efficacy and safety endpoints using the insulin-only configuration of the iLet Bionic Pancreas System (BP) versus a control group using their usual care insulin delivery method and continuous glucose monitoring (CGM) during a 13-week study period in individuals ≥14 years old with cystic fibrosis-related diabetes (CFRD). After 13 weeks, participants will continue in a 13-week Extension Phase in which the BP group will continue to use the BP system and the Usual Care group will initiate use of the BP system.

Start Date24 Sep 2024 |

Sponsor / Collaborator |

NCT06891898

iLet Dosing Decision Software Postmarket Surveillance Plan (PS240001): The iLet Experience Study

A one-year, prospective single-arm cohort study to collect safety and effectiveness data on the iLet Dosing Decision Software during real-world use in people 6 years of age or older with type 1 diabetes (T1D) with 12 months follow-up.

Start Date01 May 2024 |

Sponsor / Collaborator  Beta Bionics, Inc. Beta Bionics, Inc. [+1] |

100 Clinical Results associated with Beta Bionics, Inc.

Login to view more data

0 Patents (Medical) associated with Beta Bionics, Inc.

Login to view more data

6

Literatures (Medical) associated with Beta Bionics, Inc.01 Jul 2025·Diabetes Technology & Therapeutics

Early Stages of Automated Insulin Delivery

Review

Author: Dassau, Eyal ; Kudva, Yogish C. ; Fabris, Chiara ; Basu, Ananda ; Buckingham, Bruce A. ; Russell, Steven J. ; Kowalski, Aaron J. ; Renard, Eric ; Klonoff, David C. ; Battelino, Tadej ; Haidar, Ahmad ; DeBoer, Mark D. ; Doyle, Francis J. ; Zisser, Howard ; Weinzimer, Stuart A. ; Breton, Marc D. ; Shah, Viral N. ; Hovorka, Roman ; Phillip, Moshe ; Maahs, David M. ; Steil, Garry M. ; Forlenza, Gregory P. ; Kovatchev, Boris ; Cherñavvsky, Daniel R. ; Levy, Carol J. ; Boughton, Charlotte K. ; Brown, Sue A. ; Ekhlaspour, Laya ; Wadwa, R. Paul

The development of automated insulin delivery systems has seen tremendous improvements from individual components to interoperable system combinations of devices and new drugs besides insulin. The components have become progressively smaller, more accurate, and more user friendly. This article summarizes the history of the artificial pancreas from the earliest concepts to fully functional systems to research into further improvements in the future. The authors include many of the developers of this technology who received research support from the National Institute of Diabetes and Digestive and Kidney Diseases at various stages to develop these systems.

01 Jul 2025·Journal of diabetes science and technology

Early Stages of Automated Insulin Delivery

Review

Author: Dassau, Eyal ; Kudva, Yogish C. ; Fabris, Chiara ; Basu, Ananda ; Buckingham, Bruce A. ; Russell, Steven J. ; Kowalski, Aaron J. ; Renard, Eric ; Klonoff, David C. ; Battelino, Tadej ; Haidar, Ahmad ; DeBoer, Mark D. ; Doyle, Francis J. ; Zisser, Howard ; Weinzimer, Stuart A. ; Breton, Marc D. ; Shah, Viral N. ; Hovorka, Roman ; Phillip, Moshe ; Maahs, David M. ; Steil, Garry M. ; Forlenza, Gregory P. ; Kovatchev, Boris ; Cherñavvsky, Daniel R. ; Levy, Carol J. ; Boughton, Charlotte K. ; Brown, Sue A. ; Ekhlaspour, Laya ; Wadwa, R. Paul

The development of automated insulin delivery systems has seen tremendous improvements from individual components to interoperable system combinations of devices and new drugs besides insulin. The components have become progressively smaller, more accurate, and more user friendly. This article summarizes the history of the artificial pancreas from the earliest concepts to fully functional systems to research into further improvements in the future. The authors include many of the developers of this technology who received research support from the National Institute of Diabetes and Digestive and Kidney Diseases at various stages to develop these systems.

01 Dec 2024·DIABETOLOGIA

Accuracy of continuous glucose monitoring in the hospital setting: an observational study

Article

Author: Larkin, Mary ; Anandakugan, Nillani ; Russell, Steven J ; Zheng, Hui ; O'Connor, Mollie Y ; Bartholomew, Rachel ; Flint, Kristen L ; Sabean, Amy ; Yan, Joyce ; Steiner, Barbara A ; Ashley, Annabelle ; Putman, Melissa S ; Calverley, Melissa ; Greaux, Evelyn

AIMS/HYPOTHESIS:

Continuous glucose monitoring (CGM) improves glycaemic outcomes in the outpatient setting; however, there are limited data regarding CGM accuracy in hospital.

METHODS:

We conducted a prospective, observational study comparing CGM data from blinded Dexcom G6 Pro sensors with reference point of care and laboratory glucose measurements during participants' hospitalisations. Key accuracy metrics included the proportion of CGM values within ±20% of reference glucose values >5.6 mmol/l or within ±1.1 mmol/l of reference glucose values ≤5.6 mmol/l (%20/20), the mean and median absolute relative difference between CGM and reference value (MARD and median ARD, respectively) and Clarke error grid analysis (CEGA). A retrospective calibration scheme was used to determine whether calibration improved sensor accuracy. Multivariable regression models and subgroup analyses were used to determine the impact of clinical characteristics on accuracy assessments.

RESULTS:

A total of 326 adults hospitalised on 19 medical or surgical non-intensive care hospital floors were enrolled, providing 6648 matched glucose pairs. The %20/20 was 59.5%, the MARD was 19.2% and the median ARD was 16.8%. CEGA showed that 98.2% of values were in zone A (clinically accurate) and zone B (benign). Subgroups with lower accuracy metrics included those with severe anaemia, renal dysfunction and oedema. Application of a once-daily morning calibration schedule improved accuracy (MARD 11.4%).

CONCLUSIONS/INTERPRETATION:

The CGM accuracy when used in hospital may be lower than that reported in the outpatient setting, but this may be improved with appropriate patient selection and daily calibration. Further research is needed to understand the role of CGM in inpatient settings.

48

News (Medical) associated with Beta Bionics, Inc.24 Jul 2025

Shoulder Innovations also provides AI-powered surgical planning software, with the FDA-cleared ProVoyance, which translates CT images into 3D bone models. \n The orthopedic implant maker Shoulder Innovations is the latest medtech to plan for a nine-figure IPO, as it looks to scale up its commercial reach. The Grand Rapids, Michigan-based company aims to raise about $100 million by offering 5 million shares on the New York Stock Exchange priced between $19 and $21 apiece. It plans to list under the ticker SI. Shoulder Innovations, founded in 2009, has received FDA green lights for its InSet implant systems for total shoulder joint replacements as well as reverse shoulder procedures, in cases where the rotator cuff is damaged. It also offers artificial intelligence-powered surgical planning software, the FDA-cleared ProVoyance, which translates CT images into 3D bone models. The company says its InSet platform can provide a more secure connection to the bone and reduce the mechanical stresses on the implant as the arm moves, while describing implant loosening as the leading cause of failure in shoulder arthroplasty, where about 250,000 procedures are performed annually in the U.S.In the future, it also plans to develop a revision solution and a fracture-specific system, as well as a line of implants for patients with a sensitivity to metals. In its filed prospectus, Shoulder Innovations reported preliminary financial results of about $21 million in revenue for the first six months of this year, up from $15.4 million for the same period in 2024. The company said it expects its net loss for that time to weigh in at about $24 million, up from last year’s $7.8 million—with the increase primarily due to rising operating losses as it expands its headcount, as well as second-quarter costs tied to changes in the fair value of its preferred stock warrant liability and a series E purchase option exercised in June. For the first quarter of 2025, the company recorded a net loss of $4.6 million, after revenue of $10.1 million.Earlier this week, Shoulder Innovations said it had closed a $40 million convertible notes financing backed by Fidelity Management; in March, the company announced its $40 million series E round, which was led by U.S. Venture Partners and joined by Gilde Healthcare Partners, Gilmartin Capital, Aperture Venture Partners, Arboretum Ventures and Sectoral Asset Management. Earlier this month, the AI coronary artery disease diagnostic developer Heartflow filed for a $100 million Nasdaq IPO after previously plotting a SPAC deal valued at $2.4 billion in 2021, which it abandoned the year after. Before that, the spine surgery devicemaker Carlsmed also aimed to raise more than $100 million.This year has also seen large public offerings from Kestra Medical Technologies, Beta Bionics and Caris Life Sciences, with its $494 million splash.

IPOFinancial Statement

21 Jul 2025

BOSTON--(BUSINESS WIRE)--Omega Funds, a leading international healthcare venture capital firm focused on delivering impactful medicines to patients, today announced the closing of its eighth fund with $647 million in capital commitments. The new fund, Omega Fund VIII, L.P. ("Fund VIII"), was oversubscribed, exceeding its target of $600 million, garnering strong support from both new and existing limited partners. With Fund VIII, the firm will continue to execute its strategy of creating and investing in innovative life sciences companies in the U.S. and Europe that target severe, unmet medical needs.

Since its inception in 2004, Omega Funds has raised $2.5 billion to invest in exceptional entrepreneurs developing innovative products across multiple therapeutic areas, including oncology, immunology, rare diseases, medical devices, and precision medicine.

Fund VIII builds upon the prior success of Omega Funds, resulting in 52 commercialized products being brought to market by Omega portfolio companies. The firm's investments have resulted in 50 exits via M&A, and 47 public listings. Omega’s recent M&A exits and IPOs include SoniVie (acquired by Boston Scientific), Scorpion Therapeutics (acquired by Eli Lilly), Kestra Medical Technologies (NASDAQ: KMTS), Beta Bionics (NASDAQ: BBNX), Upstream Bio (NASDAQ: UPB), Bicara Therapeutics (NASDAQ: BCAX), Morphic Therapeutic (NASDAQ: MORF, acquired by Eli Lilly), EyeBio (acquired by Merck), Imago BioSciences (NASDAQ: IMGO, acquired by Merck), Amunix Pharmaceuticals (acquired by Sanofi), and Chord Therapeutics (acquired by Merck KGaA).

“We are very grateful to our investors for the support and trust, particularly given this exceptionally challenging fundraising environment. By exceeding its target size, Fund VIII is a recognition of our investment strategy and track record of consistent exits across market cycles,” said Otello Stampacchia, Founder and Managing Director of Omega Funds. “We appreciate the partnership from both our longstanding and new limited partners.”

“As with prior funds, Fund VIII will support management teams in the U.S. and Europe through company creation, early venture rounds, and later-stage financings,” said Francesco Draetta, Managing Director of Omega Funds. “We believe our broad investment strategy is well-positioned for navigating this period of macro and policy uncertainty. We look forward to contributing our capital, expertise, and network connectivity in partnering with entrepreneurs, founders, co-investors, and the broader community to transform the standards of care for severe diseases.”

About Omega Funds

Founded in 2004, Omega Funds is a leading international venture capital firm that creates and invests in life sciences companies that target our world's most urgent medical needs. Omega focuses on identifying and supporting companies through value inflection points across the full arc of innovation, from company formation through clinical milestones and commercial adoption. Omega Funds' portfolio companies have brought 52 commercialized products to market in multiple therapeutic areas, including oncology, rare diseases, precision medicine, medical devices, and others. Please visit www.omegafunds.com for additional information.

AcquisitionIPO

21 Jul 2025

Boston and Geneva life sciences investor Omega Funds has rounded up its eighth pool of capital, closing at $647 million, the firm said Monday morning.

The 8th fund is roughly equal in size to Omega’s last batch, which came in at

$650 million in December 2021

. While they’re about the same in scope, Omega had a higher starting goal for its latest: $600 million versus $500 million for the initial

target

of the 7th fund in 2021.

Omega joins a few other longstanding biotech VC firms to have closed a new fund this year, including Aditum Bio, Sofinnova Partners and Deerfield, among others. A few new funds have emerged, as well, like AN Venture Partners and a collaboration between a16z Bio + Health and Eli Lilly.

Within its inner circle, Omega disclosed the final closing at its annual general meeting in May.

“I was incredibly surprised, a number of LPs, and these are very large institutions, came to us and said, ‘You’re probably the only GP commitment we’re doing this year,’” founder and managing director Otello Stampacchia said in an interview. “I was blown away by that statement. There’s a real lack of liquidity out there.”

The new fund arrives on the back of a string of regulatory and financial successes for Omega-backed startups.

Lilly bought two of its portfolio companies in the past 12 months, including Scorpion Therapeutics (and Omega quickly backed its spin-out Antares) and

Morphic Therapeutic

. Last May, Merck bought

EyeBio

, a clinical-stage ophthalmology biotech under Omega’s wings. A few braved the public waters, with Upstream Bio, Bicara Therapeutics and Beta Bionics going public in the past 10 months.

Meanwhile, the FDA’s thumbs up for Nuvation Bio’s

ROS1 cancer medicine

marked the 52nd regulatory approval across Omega’s portfolio, the firm said.

It hasn’t all been roses, though. Aerium Therapeutics, a biotech that had sought to help protect immunocompromised people from Covid-19,

shut down last summer

. Resilience, which sought to shake up the biomanufacturing field, is

winding down multiple facilities

this year.

Omega knows the game, though. It’s weathered the ups and downs and all the oscillations that come with biotech investing. The firm has been around since 2004 and has backed more than 150 companies across therapeutics, diagnostics, medical devices and other tools in life sciences. It backs about two dozen or so companies per fund.

One of the key learnings from those two decades of investing is being “extremely careful about who you syndicate with,” Stampacchia said. Having alignment among investors on the board and strategic direction of each startup is key, he said.

“Another thing that we have been quite unpopular with, I have to say, for the last few years, has been we’ve been trying to tell our companies, if possible, not to go public,” Stampacchia said. “I can tell you that went down like a bag of bricks the first few times we had the conversation with both management teams and other VCs.”

With biotech funding in the doldrums, many companies have had to trim their pipelines and lay off staff. Some have shuttered.

“It’s not very pleasant when you are within one of those companies that perhaps made some extravagant choices in R&D prioritization and so on. It’s never pleasant when you’re inside,” the Omega founder said.

“I went back and read about the Industrial Revolution because every new technology has winners and losers,” he continued. “We’re starting to see this with AI and obviously before that with internet monopolies and all that. But it’s never pleasant when you are within one of those industries who’s being disrupted unless you have the flexibility to adapt. But it’s our job. We are venture capitalists.”

Omega made four investments in the first half of the year, according to a report from William Blair. That includes

Antares Therapeutics

and

Windward Bio

, which emerged in January with $200 million to carry forward an asthma drug candidate from Chinese biotechs.

Helping steer some of Omega’s new investments is AstraZeneca’s former head of R&D, Sir

Mene Pangalos

, who joined the firm last year as a venture partner.

As Omega charts its next bets, it wants to tap into what could become the biggest pharmaceutical market in history: obesity and its many co-morbidities. The firm was

disclosed

as the sole funder of seed-stage Danish biotech Ousia Pharma in May. The company is working on small-molecule neuroplasticity modulators to target the brain’s “appetite control centers,” it said at the time of its unveiling.

“The competitive intensity in some of these areas is very high, so we’re being quite timid or discrete, if you will, just because we want to wrap up some pretty interesting new experiments of which we’ve already seen very good data before we disclose IP and all that,” Stampacchia said of Ousia. “People can leapfrog quite quickly, particularly with small molecules and so on.”

“We’re quite optimistic that Ousia, and probably one or two other things that we’re working on, could address” some of the issues that have arisen with the GLP-1 class, Stampacchia said. That includes dosing compliance, tolerability, lean muscle retention and so on.

AcquisitionDrug Approval

100 Deals associated with Beta Bionics, Inc.

Login to view more data

100 Translational Medicine associated with Beta Bionics, Inc.

Login to view more data

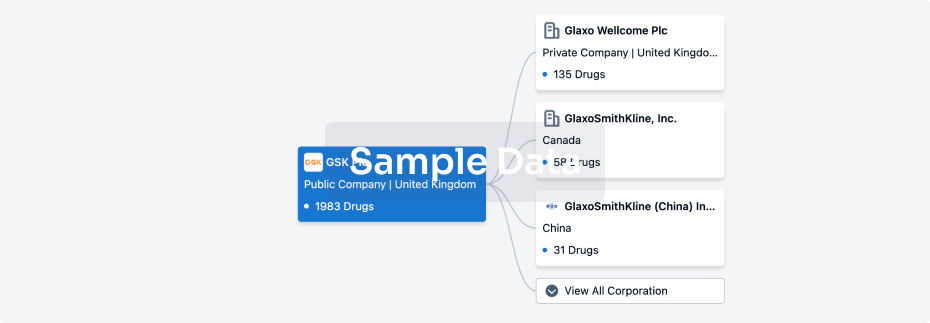

Corporation Tree

Boost your research with our corporation tree data.

login

or

Pipeline

Pipeline Snapshot as of 20 Dec 2025

No data posted

Login to keep update

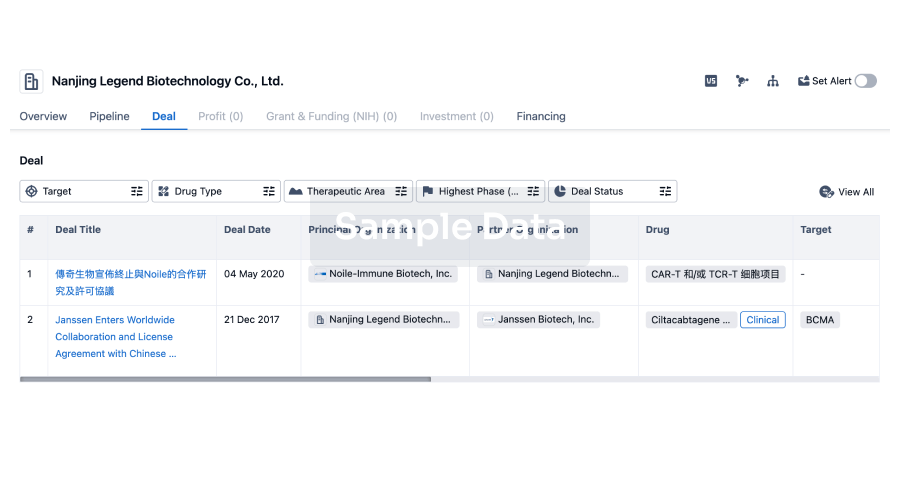

Deal

Boost your decision using our deal data.

login

or

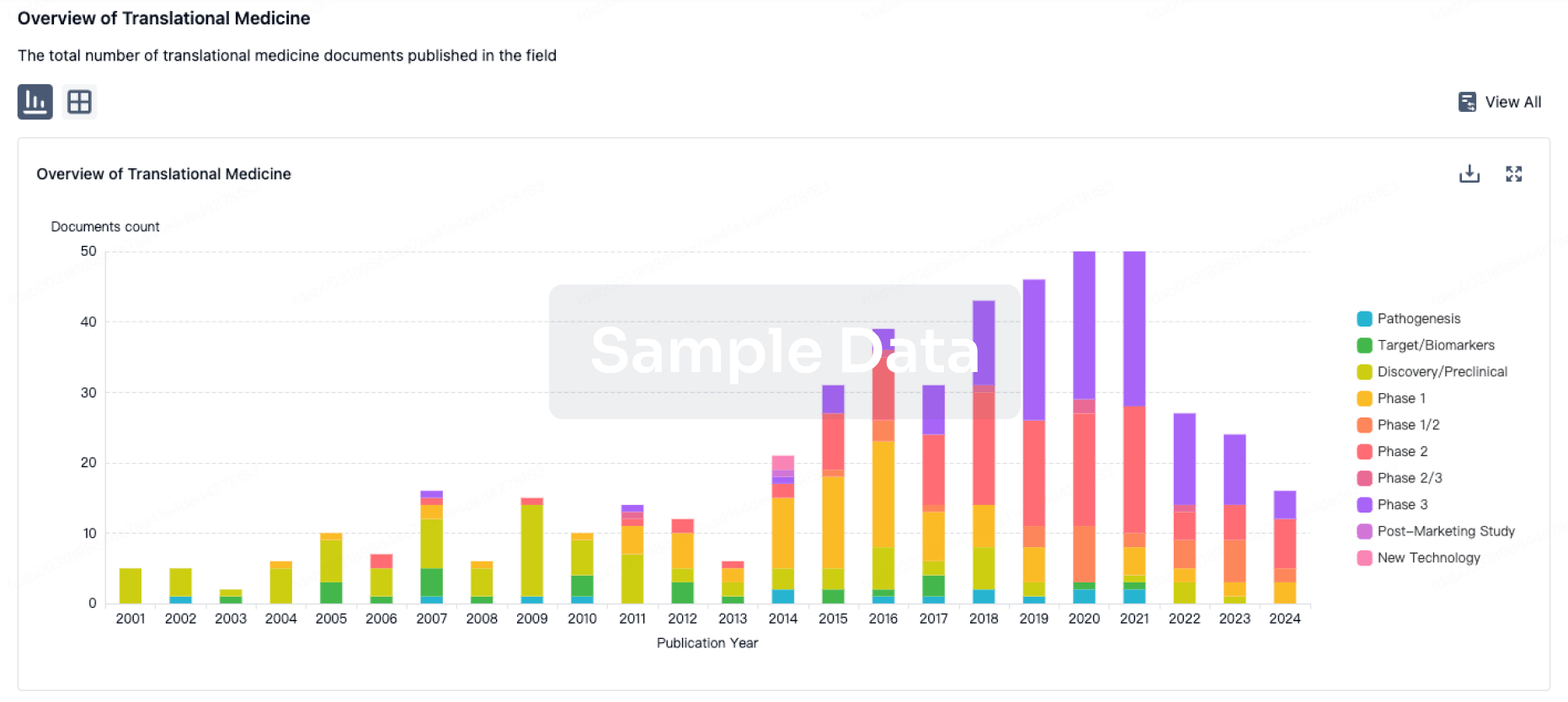

Translational Medicine

Boost your research with our translational medicine data.

login

or

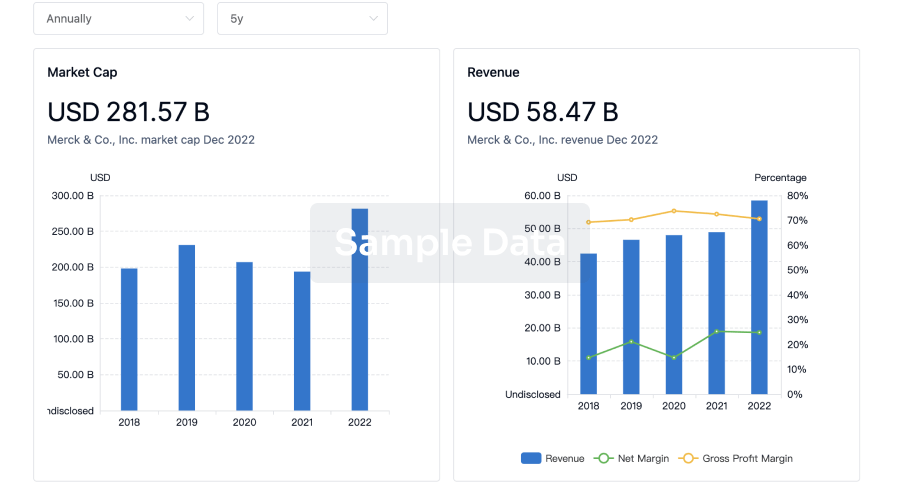

Profit

Explore the financial positions of over 360K organizations with Synapse.

login

or

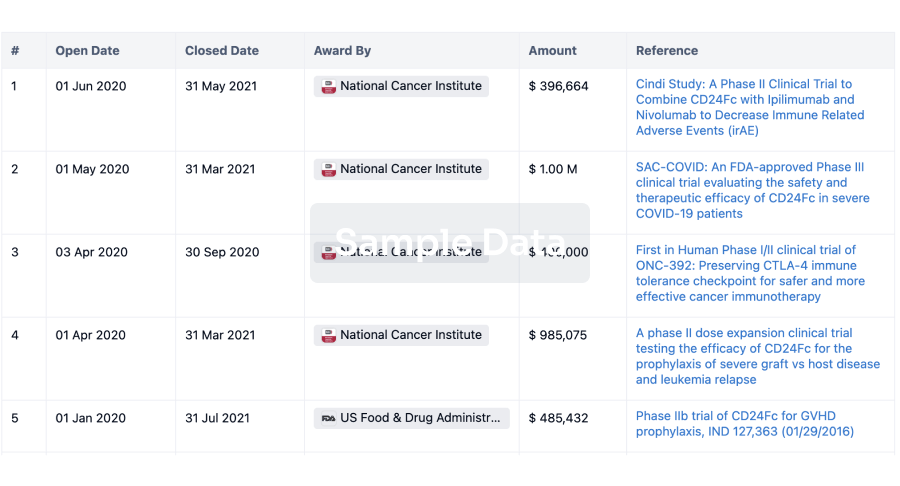

Grant & Funding(NIH)

Access more than 2 million grant and funding information to elevate your research journey.

login

or

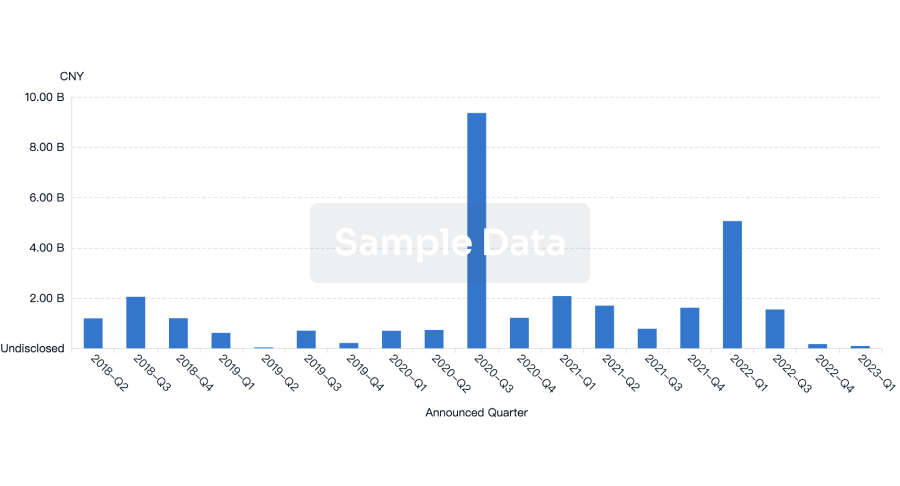

Investment

Gain insights on the latest company investments from start-ups to established corporations.

login

or

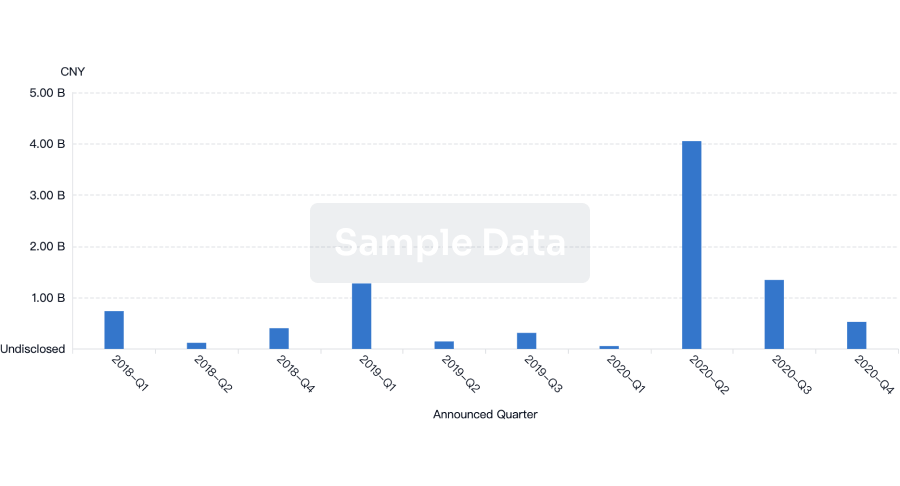

Financing

Unearth financing trends to validate and advance investment opportunities.

login

or

AI Agents Built for Biopharma Breakthroughs

Accelerate discovery. Empower decisions. Transform outcomes.

Get started for free today!

Accelerate Strategic R&D decision making with Synapse, PatSnap’s AI-powered Connected Innovation Intelligence Platform Built for Life Sciences Professionals.

Start your data trial now!

Synapse data is also accessible to external entities via APIs or data packages. Empower better decisions with the latest in pharmaceutical intelligence.

Bio

Bio Sequences Search & Analysis

Sign up for free

Chemical

Chemical Structures Search & Analysis

Sign up for free