Request Demo

Last update 07 Nov 2025

uBiome, Inc.

Last update 07 Nov 2025

Overview

Related

3

Clinical Trials associated with uBiome, Inc.NCT04398784

Effect of Whole Blueberry Powder Consumption on Depression: A Randomized, Double-blind, Placebo Controlled, Crossover Study

This pilot study aims to measure the effects of an intervention of 22.5 grams of freeze-dried whole blueberry powder in water drunk daily. Measures are on outcomes of depression, biological markers of inflammation and oxidative stress, and microbial populations in the intestines.

Start Date15 Apr 2019 |

Sponsor / Collaborator |

NCT03582826

Dynamics of the Gut Microbiota in Idiopathic Malodor Production

The purpose of this study is to identify microbial signatures associated with remission and recurrence of idiopathic malodor and PATM conditions.

Start Date16 Jun 2018 |

Sponsor / Collaborator  MEBO Research, Inc. MEBO Research, Inc. [+2] |

NCT04162574

Predicting Binge and Purge Episodes From Passive and Active Apple Watch Data Using a Dynamical Systems Approach

The Binge Eating Genetics Initiative (BEGIN) is an observational study where individuals with binge-eating disorder (BED) or bulimia nervosa (BN) complete assessments about eating disorder history, current disordered eating behavior, and mood. Participants also provide active data on binge eating, purging, nutrition, and cognitions using Recovery Record on the Apple Watch. Passive sensor data are collected via native applications over a 30-day period in 1000 individuals with BED or BN. Investigators will combine longitudinal passive (Apple Watch) and active (Recovery Record) data to predict when patients are at high risk of binge eating or purging. Results will enable the deployment of real-time, in-the-moment, personalized signaling of impending binge or purge episodes that will interrupt automatic behaviors and empower patients to exert control over binge eating and purging by engaging in therapeutic alternatives.

Start Date24 Aug 2017 |

Sponsor / Collaborator |

100 Clinical Results associated with uBiome, Inc.

Login to view more data

0 Patents (Medical) associated with uBiome, Inc.

Login to view more data

10

Literatures (Medical) associated with uBiome, Inc.01 Dec 2019·Poultry scienceQ2 · AGRICULTURAL & FORESTRY SCIENCE

Evaluation of in ovo Bacillus spp. based probiotic administration on horizontal transmission of virulent Escherichia coli in neonatal broiler chickens

Q2 · AGRICULTURAL & FORESTRY SCIENCE

ArticleOA

Author: Adhikari, B ; Hargis, B M ; Vuong, C N ; Arreguin-Nava, M A ; Tellez, G ; Selby, C M ; Graham, B D ; Agnello, M ; Solis-Cruz, B ; Tellez-Isaias, G ; Hernandez-Velasco, X ; Hernandez-Patlan, D ; Latorre, J D

This study evaluated the effect of in ovo Bacillus spp. base probiotic (BBP) administration on hatchability, Gram-negative bacteria (GNB) recovery, performance, and microbiota composition in 2 independent trials using a virulent E. coli seeder challenge model. In each trial, one hundred and eighty 18-day-old embryos were allocated into 1 of 2 groups: Control and treated group (inoculated with 107 BBP). On day 19 of embryogenesis, seeder embryos (n = 18) were inoculated with 4.5 × 104E. coli/mL+272 μg/mL tetracycline and segregated into mesh hatching bags. Twelve chicks per group were euthanized at hatch and at day 7 to evaluate the gastrointestinal composition of total GNB or total aerobic pasteurized bacteria. Also, in trial 2, ceca content from five chickens at day 7 were collected to evaluate microbiota composition. Embryos inoculated with BBP showed a significant (P < 0.05) reduction in the total number of GNB at day-of-hatch (DOH) and day 7. Probiotic treatment increased BW at DOH and day 7, and BW gain (days 0 to 7) when compared with Control chickens. Proteobacteria phylum was significantly reduced, while the Firmicutes was significantly increased by the BBP as compared to the Control (P < 0.05). At family level, Enterobacteriaceae was significantly decreased, while the Lachnospiraceae was significantly elevated in the BBP as compared to the Control group (P < 0.05). The genus Oscillospira was significantly enriched in the BBP group, whereas the unidentified genus of family Enterobacteriaceae in the Control group (P < 0.05). The BBP group increased the bacterial species richness, although there was no significant difference between treatments (P > 0.05). Interestingly, beta diversity showed a significant difference in bacterial community structure between Control and BBP groups (P < 0.05). The results of the present study suggest that in ovo administration of a BBP can reduce the severity of virulent E. coli horizontal transmission and infection of broiler chickens during hatch. The reduction in the severity of the transmission and infection by the BPP might be achieved through alterations of microbiota composition and its community structure.

01 Oct 2018·Molecular and cellular biologyQ3 · BIOLOGY

Analysis and Correction of Inappropriate Image Duplication: the Molecular and Cellular Biology Experience

Q3 · BIOLOGY

Article

Author: Bik, Elisabeth M. ; Fang, Ferric C. ; Kullas, Amy L. ; Davis, Roger J. ; Casadevall, Arturo

We analyzed 960 papers published in Molecular and Cellular Biology (MCB) from 2009 to 2016 and found 59 (6.1%) to contain inappropriately duplicated images. The 59 instances of inappropriate image duplication led to 41 corrections, 5 retractions, and 13 instances in which no action was taken. Our experience suggests that the majority of inappropriate image duplications result from errors during figure preparation that can be remedied by correction. Nevertheless, ∼10% of papers with inappropriate image duplications in MCB were retracted (∼0.5% of total). If this proportion is representative, then as many as 35,000 papers in the literature are candidates for retraction due to inappropriate image duplication. The resolution of inappropriate image duplication concerns after publication required an average of 6 h of journal staff time per published paper. MCB instituted a pilot program to screen images of accepted papers prior to publication that identified 12 manuscripts (14.5% out of 83) with image concerns in 2 months. The screening and correction of papers before publication required an average of 30 min of staff time per problematic paper. Image screening can identify papers with problematic images prior to publication, reduces postpublication problems, and requires less staff time than the correction of problems after publication.

01 Jul 2018·Research in microbiologyQ2 · BIOLOGY

The transcription factor SlyA from Salmonella Typhimurium regulates genes in response to hydrogen peroxide and sodium hypochlorite

Q2 · BIOLOGY

Article

Author: Castro-Nallar, Eduardo ; Castro-Severyn, Juan ; Salinas, César R ; Hidalgo, Alejandro A ; Morales, Eduardo H ; Meneses, Claudio A ; Briones, Alan C ; Baquedano, María S ; Saavedra, Claudia Paz ; Fuentes, Juan A ; Pardo-Esté, Coral ; Cabezas, Carolina E ; Aguirre, Camila

Salmonella Typhimurium is an intracellular pathogen that is capable of generating systemic fever in a murine model. Over the course of the infection, Salmonella faces different kinds of stressors, including harmful reactive oxygen species (ROS). Various defence mechanisms enable Salmonella to successfully complete the infective process in the presence of such stressors. The transcriptional factor SlyA is involved in the oxidative stress response and invasion of murine macrophages. We evaluated the role of SlyA in response to H2O2 and NaOCl and found an increase of slyA expression upon exposure to these toxics. However, the SlyA target genes and the molecular mechanisms by which they influence the infective process are unknown. We hypothesised that SlyA regulates the expression of genes required for ROS resistance, metabolism, or virulence under oxidative stress conditions. Transcriptional profiling in wild type and ΔslyA strains confirmed that SlyA regulates the expression of several genes involved in virulence [sopD (STM14_3550), sopE2 (STM14_2244), hilA (STM14_3475)] and central metabolism [kgtP (STM14_3252), fruK (STM14_2722), glpA (STM14_2819)] in response to H2O2 and NaOCl. These findings were corroborated by functional assay and transcriptional fusion assays using GFP. DNA-protein interaction assays showed that SlyA regulates these genes through direct interaction with their promoter regions.

14

News (Medical) associated with uBiome, Inc.07 Apr 2021

FDA said Tuesday that it will allow the use of the Binx Health IO CT/NG Assay at point-of-care settings, such as in physician offices, community-based clinics, urgent care settings, outpatient healthcare facilities and other patient care settings. The test, which uses female vaginal swabs and male urine specimens, is designed to detect the presence of the bacteria Chlamydia trachomatis and Neisseria gonorrhoeae, which cause the sexually transmitted infections chlamydia and gonorrhea, respectively. The ability to diagnose at a point-of-care setting will help with more quickly and appropriately treating sexually-transmitted infections, expert says.

FDA said it is taking swift action to get more COVID-19 tests for screening asymptomatic people on the market. The agency has authorized several COVID-19-related tests for over-the-counter (OTC) use and some for point-of-care use. The agency says that screening testing, especially with OTC tests, is an important part of the country’s pandemic response as many schools, workplaces,and other entities are setting up testing programs to quickly screen for COVID-19.

And in case you missed our last Medtech in a Minute report...

Vault Health and Everlywell are reaching out to DoorDash in an effort to make FDA-authorized COVID-19 test collection kits more widely available to consumers. The Vault Health COVID-19 Saliva Test Kit and Everlywell COVID-19 Test Home Collection Kit DTC will be available for same-day delivery through the DoorDash marketplace app. The two digital health companies will focus on 12 DashMart locations across the United States, including Baltimore, Chicago, Cleveland, Dallas, Denver, Minneapolis, and Phoenix, with more cities rolling out in the coming months.

The Securities and Exchange Commission has filed litigation against the co-founders of San Francisco, CA-based uBiome, a now-defunct stool-testing company. They are accused of fraudulently raising millions of dollars and duping doctors into ordering unnecessary tests. The company developed and performed laboratory tests that purportedly identified microorganisms in the gut and genitals and assisted in the diagnosis of conditions such as inflammatory bowel disease and sexually transmitted infections.

21 Mar 2021

In a case that smells a lot like Theranos, the founders of San Francisco, CA-based uBiome are facing federal charges for allegedly defrauding investors out of millions of dollars. The company developed and performed laboratory tests that purportedly identified microorganisms in the gut and genitals and assisted in the diagnosis of conditions such as inflammatory bowel disease and sexually transmitted infections.

In 2018, Jessica Richman and Zachary Apte raised about $60 million in a series C round that valued uBiome at nearly $600 million, and enriched Richman and Apte by millions each through the sale of their own uBiome shares during the round. According to the Securities Exchange Commission (SEC) complaint, Richman, who was the CEO of uBiome, and Apte, who was its chief scientific officer, painted a false picture of uBiome as a rapidly growing company with a strong track record of reliable revenue through health insurance reimbursements for its tests. Richman and Apte also had a romatic relationship and married in 2019, the SEC noted.

"Defendants also made numerous misrepresentations that were designed to assure investors that the company’s business model and its tests were widely accepted by health insurance companies and downplay any risks to the company’s revenue," attorneys representing the SEC said in the complaint.

The SEC said uBiome's purported success in generating revenue, however, was a sham, as it depended on "duping doctors" into ordering unnecessary tests and other improper practices. Once their actions were discovered, insurers took back their previous reimbursement payments to uBiome, SEC said.

uBiome employees allegedly raised concerns regarding the company's practices, but Richman and Apte failed to take action to remedy the improper practices. Rather than disclose those practices to investors, they tried to hide it from the company's general counsel, board, and insurers, and told employees to provide insurers with backdated and misleading medical records to substantiate uBiome's prior claims for reimbursement, according to the complaint.

The house of cards collapsed around April 2019 when uBiome's board initiated an internal investigation, following the FBI’s execution of a search warrant at uBiome’s headquarters. "That investigation brought uBiome’s improper billing practices to light and made clear that uBiome’s business model was untenable," according to the complaint.

uBiome suspended its clinical tests business and, in September 2019, ceased operations and filed for bankruptcy protection. The company is currently undergoing Chapter 7 bankruptcy liquidation.

"We allege that Richman and Apte touted uBiome as a successful and fast-growing biotech pioneer while hiding the fact that the company's purported success depended on deceit," Erin Schneider, director of the SEC's San Francisco Regional Office, said in a statement. "Investors are entitled to know the material risks of the companies they are investing in, no matter how transformative those companies claim to be."

The SEC's complaint, filed in federal court in San Francisco, charges Richman and Apte with violating the antifraud provisions of the federal securities laws. The SEC is seeking court orders, including officer and director bars, to prevent Richman and Apte from engaging in future fraud, as well as orders requiring them to disgorge their ill-gotten gains from the violations and pay civil penalties.

In a parallel action, the U.S. Attorney's Office for the Northern District of California announced criminal charges against Richman and Apte.

uBiome's story smells a lot like the Theranos story

Unfortunately for medtech, this is a story that is becoming all too familiar. One company tested people's blood, the other tested people's poop. Both companies have been accused of bilking investors and misleading people regarding the success of their technology.

The well-publicized story of Theranos' failures should have served as a cautionary tale for other medical device and diagnostic companies. The rise and fall of Theranos did not do the industry's reputation any favors, and if Richman and Apte are found guilty of the charges against them, it will be another hit to the industry.

Back in 2016, MD+DI published advice from regulatory consultant David Amor on how to avoid ending up like Theranos. This seems like a good time for a refresher:

19 Mar 2021

uBiome cofounders are in hot water after the SEC charged the pair with healthcare fraud conspiracies.

The company first was founded in 2012 and started with direct-to-consumer microbiome testing.

Now cofounders Zachary Schulz Apte and Jessica Sunshine Richman are being tried for a slew of charges, including conspiracy to commit securities fraud, conspiracy to commit healthcare fraud, money laundering and related offenses connected to alleged schemes to defraud health insurers and providers, according to a Department of Justice release.

The company, which filed for Chapter 11 bankruptcy in 2019, came under investigation by the FBI for its alleged fraudulent insurance billing practices. At the time, the FBI raided the headquarters and required all employees to hand over computers.

The SEC lawsuit claims that uBiome’s developed a clinical version of its microbiome test in order to attract venture dollars. The company landed $60 million in venture funding. The SEC claims these funds were fraudulently raised.

The SEC goes on to allege that after it began marketing this version of the test the company used a number of methods to prompt clinicians to order the tests.

Additionally, the indictment alleges that the cofounders developed and oversaw practices that deceived healthcare providers and insurance companies into ordering tests that were neither valid nor medically necessary.

“uBiome’s purported success in generating revenue, however, was a sham. It depended on duping doctors into ordering unnecessary tests and other improper practices that Richman and Apte directed and which, once discovered, led insurers to claw back their previous reimbursement payments to uBiome,” the court filing reads.

The defendants face seven counts of fraud that could incur up to 90 years in prison.

“Today’s indictment alleges that in their efforts to move fast to drive business and investment capital to their microbiome start up, defendants turned a blind eye to compliance and pursued at all costs a path designed to bring the greatest investment in their company,” Acting U.S. Attorney Hinds said in a statement.

“The indictment alleges defendants bilked insurance providers with fraudulent reimbursement requests, a practice that inevitably would result in higher premiums for us all.

"Further, defendants cashed out on the investment that flowed into the company to benefit themselves. Today’s indictment is a cautionary tale about the importance of robust compliance programs rather than lip service, and the importance of honesty with investors.”

WHY IT MATTERS

These allegations not only put uBiome’s cofounders on trial, but also set an example for all other companies in the space.

“This was the result of a very complex investigation conducted by the FBI and our federal and state partners,” FBI Special Agent in Charge Fair, said in a statement.

“This indictment illustrates that the heavily regulated healthcare industry does not lend itself to a ‘move fast and break things’ approach, but rather to an approach of compliance and accountability.”

THE LARGER TREND

Health tech companies have seen their fair share of legal troubles in the past few years. One of the most notable cases is Theranos. In 2018, Theranos founder Elizabeth Holmes was charged by the SEC with ‘massive fraud.’ She and former Theranos president Ramesh “Sunny” Balwani were charged with raising over $700 million through exaggerated and fraudulent claims.

Recently acquired Outcome Health’s founders also face a number of legal battles. A criminal indictment in the Northern District of Illinois charges former CEO and cofounder Rishi Shah, former President and cofounder Shradha Agarwal, former CFO Brad Purd, and former EVP Ashik Desai, with an alleged $1 billion scheme to defraud clients. Currently, the former executives are awaiting trial.

100 Deals associated with uBiome, Inc.

Login to view more data

100 Translational Medicine associated with uBiome, Inc.

Login to view more data

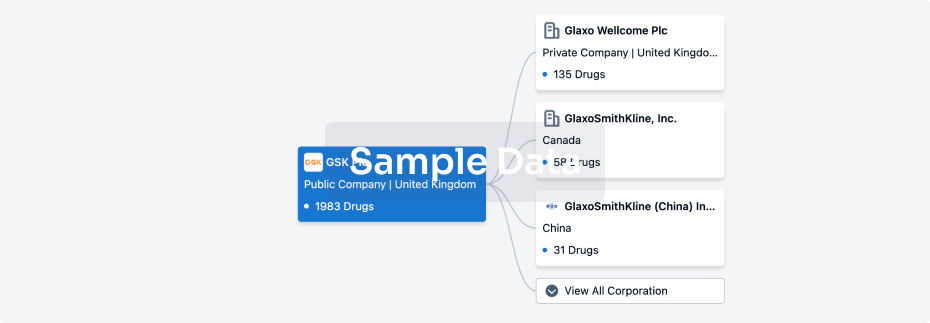

Corporation Tree

Boost your research with our corporation tree data.

login

or

Pipeline

Pipeline Snapshot as of 18 Dec 2025

No data posted

Login to keep update

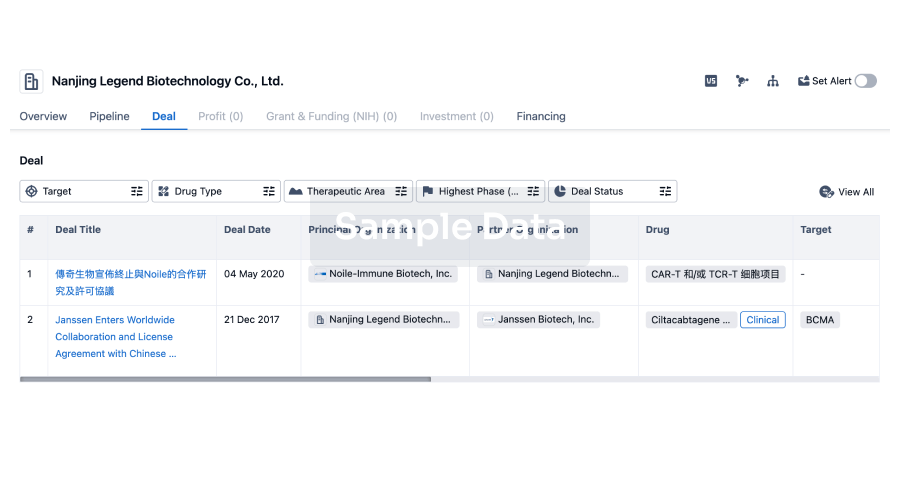

Deal

Boost your decision using our deal data.

login

or

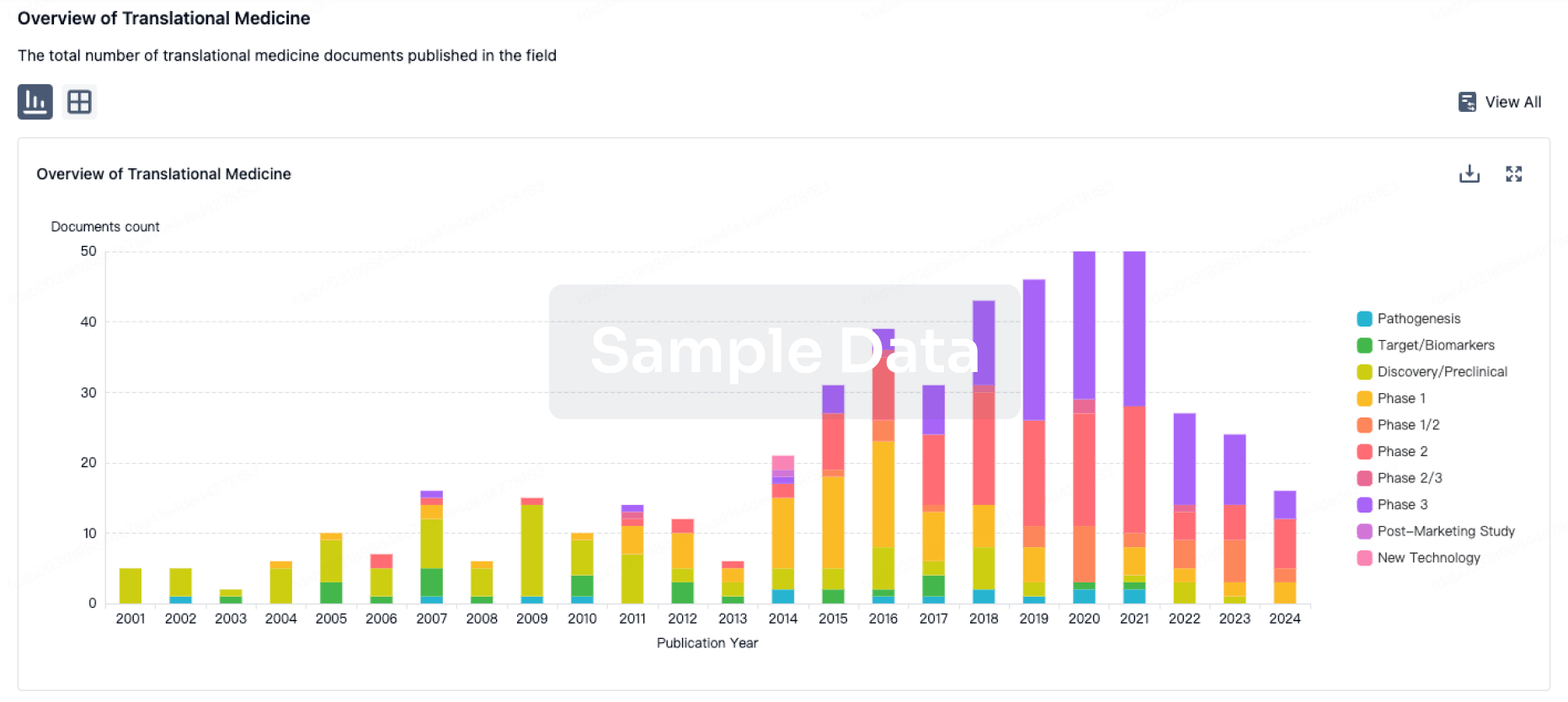

Translational Medicine

Boost your research with our translational medicine data.

login

or

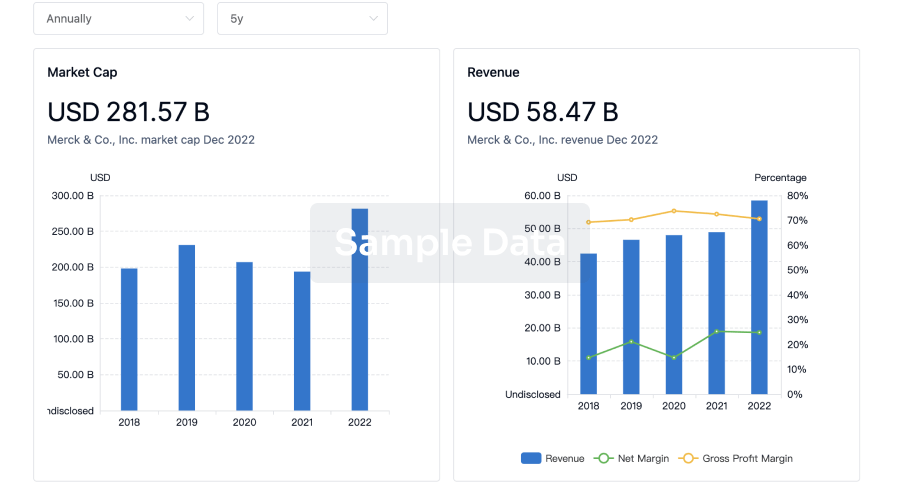

Profit

Explore the financial positions of over 360K organizations with Synapse.

login

or

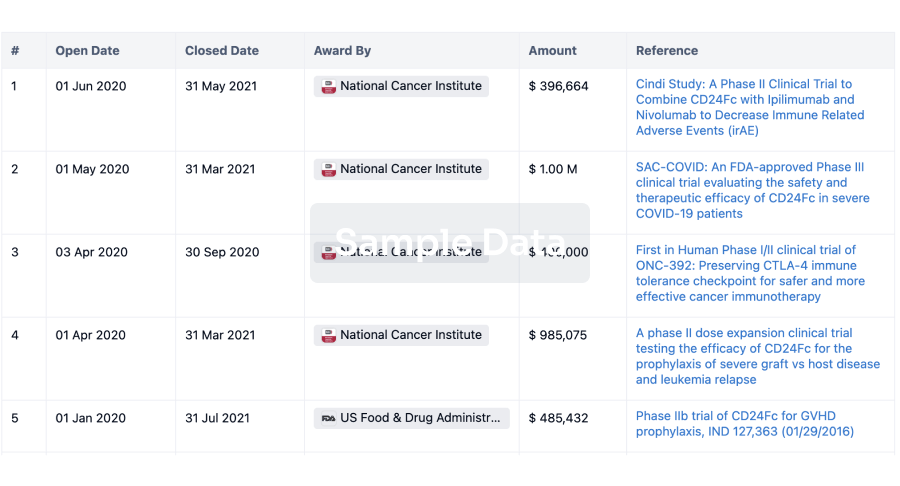

Grant & Funding(NIH)

Access more than 2 million grant and funding information to elevate your research journey.

login

or

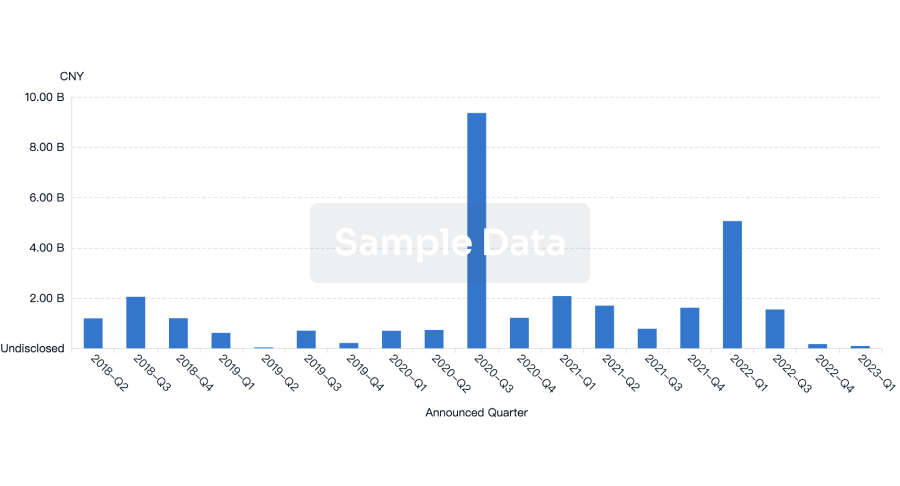

Investment

Gain insights on the latest company investments from start-ups to established corporations.

login

or

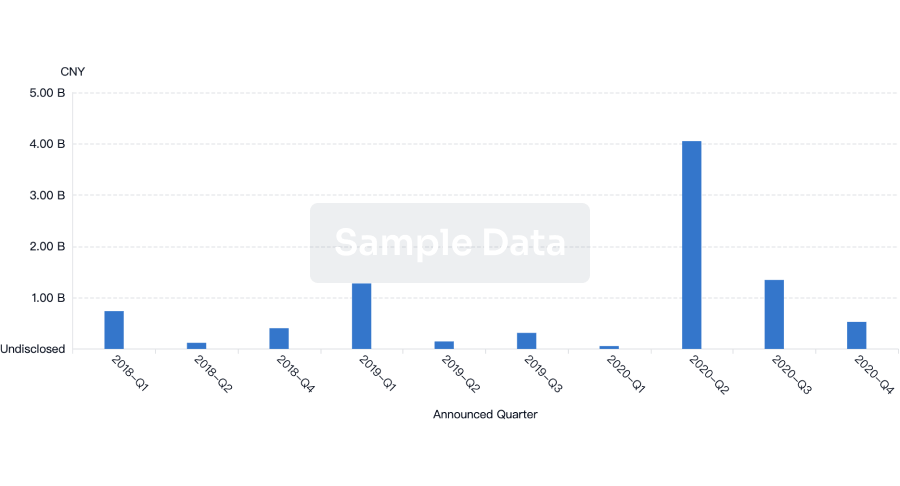

Financing

Unearth financing trends to validate and advance investment opportunities.

login

or

AI Agents Built for Biopharma Breakthroughs

Accelerate discovery. Empower decisions. Transform outcomes.

Get started for free today!

Accelerate Strategic R&D decision making with Synapse, PatSnap’s AI-powered Connected Innovation Intelligence Platform Built for Life Sciences Professionals.

Start your data trial now!

Synapse data is also accessible to external entities via APIs or data packages. Empower better decisions with the latest in pharmaceutical intelligence.

Bio

Bio Sequences Search & Analysis

Sign up for free

Chemical

Chemical Structures Search & Analysis

Sign up for free