Request Demo

Last update 08 May 2025

Yuma Regional Medical Center, Inc.

Last update 08 May 2025

Overview

Related

1

Clinical Trials associated with Yuma Regional Medical Center, Inc.NCT00623350

Stroke Team Remote Evaluation Using a Digital Observation Camera Arizona - The Initial Mayo Clinic Experience

Noninvasive prospective multi-center study of an interactive 2-way, wireless or site-independent, audiovisual telemedicine system designed for real-time remote examination of acute stroke symptoms and deficits as a basis for treatment consultation and recommendation.

Study aims (1) to determine the impact of a site-independent, remote, telemedicine consultation system on decision making in the Emergency Department, regarding the decision to treat or not to treat with thrombolytics; (2) to assess the numbers of patients who receive thrombolytics and the time to treatment in patients evaluated by telemedicine versus telephone only; (3) to assess the appropriateness of thrombolytic treatment decisions in telemedicine versus telephone-only consultations; and (4) to assess the completeness of the data collection in telemedicine versus telephone-only consultations.

60 patients in Arizona with acute presentation of stroke symptoms, per bedside practitioner discretion (onset generally less than 12 hours and likely less than 3 hours)

Two arms: Video Camera/Telemedicine (Intervention n = 30) and No Video Camera/Telephone only (Control n = 30)

Study aims (1) to determine the impact of a site-independent, remote, telemedicine consultation system on decision making in the Emergency Department, regarding the decision to treat or not to treat with thrombolytics; (2) to assess the numbers of patients who receive thrombolytics and the time to treatment in patients evaluated by telemedicine versus telephone only; (3) to assess the appropriateness of thrombolytic treatment decisions in telemedicine versus telephone-only consultations; and (4) to assess the completeness of the data collection in telemedicine versus telephone-only consultations.

60 patients in Arizona with acute presentation of stroke symptoms, per bedside practitioner discretion (onset generally less than 12 hours and likely less than 3 hours)

Two arms: Video Camera/Telemedicine (Intervention n = 30) and No Video Camera/Telephone only (Control n = 30)

Start Date01 Dec 2007 |

Sponsor / Collaborator  Mayo Clinic Mayo Clinic [+3] |

100 Clinical Results associated with Yuma Regional Medical Center, Inc.

Login to view more data

0 Patents (Medical) associated with Yuma Regional Medical Center, Inc.

Login to view more data

74

Literatures (Medical) associated with Yuma Regional Medical Center, Inc.01 Oct 2024·Currents in Pharmacy Teaching and Learning

Qualitative analysis of preparation and planning habits of students with low-performance on high-stakes practice examinations (pre-NAPLEX®)

Article

Author: Benken, Scott ; Herrera, Everton ; Mucksavage, Jeffrey ; Shultz, Benjamin ; Belcher, Rachel M

01 Jun 2024·Cardiovascular Revascularization Medicine

MICRA AV implantation after transcatheter aortic valve replacement

Article

Author: Kassab, Kameel ; Patel, Jagat ; Feseha, Habteab ; Kaynak, Evren

01 May 2024·C78. WHAT'S THAT? ATYPICAL AND RARE PRESENTATIONS IN THORACIC ONCOLOGY

An Unusual Presentation of Teratoma

Author: Gogna, M. ; von Haag, D. ; Mikhael, M. ; Gunasekaran, K.

3

News (Medical) associated with Yuma Regional Medical Center, Inc.09 May 2023

YUMA, Ariz.--(

BUSINESS WIRE

)--Northern Arizona University-Yuma will launch a program in fall 2023 to shorten by nearly half the time it takes nursing students to get through their prerequisites. The Compressed Bachelor of Science in Nursing (CBSN) can be completed in 16 months as opposed to 30 months in a traditional program.

A $6.4 million grant from the Arizona Department of Health Services will help pay for scholarships for nursing students in the program. The goal is to get them graduated and practice-ready to help address the state’s critical need for professional nurses.

“Arizona is ranked in the top five states nationwide experiencing severe nursing shortages,” Lillian Smith, dean of NAU’s College of Health and Human Services said. “NAU is positioned to address this critical shortage by increasing access to high-quality accelerated nursing programs which will decrease the time of completion for practice-ready bachelor’s prepared nurses to enter the workforce.”

A

recent survey

by the National Council for State Boards of Nursing found that 100,000 nurses left the profession because of pandemic-related stress and burnout. The U.S. Bureau of Labor Statistics (BLS) estimates that 275,000 nurses will be needed between now and 2030.

“NAU has a rich history of serving rural and underserved communities,” Janina Johnson, executive director of NAU’s School of Nursing said. “The tuition scholarships remove economic barriers for those individuals who may be unable to return to school for financial reasons. With this grant and NAU’s School of Nursing strong track record offering quality nursing education, we can support and graduate more nurses and build the nursing workforce across all Arizona communities.”

About NAU-Yuma

Yuma has been designated as a Branch Campus of Northern Arizona University by the Arizona Board of Regents. Although located several hours south of the main NAU campus, its standards are the same. The purpose is to provide an outstanding undergraduate education strengthened by scholarship, graduate and professional programs, and innovative methods of delivery in Yuma and the surrounding region.

15 Nov 2021

CARLSBAD, Calif., Nov. 15, 2021 (GLOBE NEWSWIRE) -- Palisade Bio, Inc. (Nasdaq: PALI) (“Palisade” or the “Company”), a clinical stage biopharmaceutical company advancing oral therapies that help patients with acute and chronic gastrointestinal (GI) complications, today provides a business update and releases its financial results for the third quarter ended September 30, 2021.

Third Quarter Highlights:

In July 2021, the Company released top line Phase 2 clinical trial results from its development partner, Newsoara, that showed a 1.1-day improvement in GI recovery in patients receiving LB1148 vs placebo.

In July 2021, the Company entered a worldwide exclusive license with the University of California to patent rights covering certain engineered substrates and use in measuring degradative enzymes for disease conditions, including cancer.

In August 2021, Yuma Regional Medical Center made a private investment of $5.2 million to help advance clinical development of LB1148.

Financial Summary:

Research and development expenses increased from $412,000 for the three months ended September 30, 2020, to $624,000 for the three months ended September 30, 2021, primarily attributable to an increase in clinical trial activities as non-essential surgical procedures, which were virtually halted following the onset of the COVID-19 pandemic, have begun to return to pre-pandemic levels resulting in more patients enrolled in our clinical trial. The increase was offset partially by a decrease in share-based compensation expense.

General and administrative expenses increased from $1.4 million for the three months ended September 30, 2020, to $2.4 million for the same period of 2021, primarily related to an increase in other general and administrative expenses associated with operating as a public company, including accounting and legal costs, offset partially by a decrease in share-based compensation expense.

Cash and cash equivalents as of September 30, 2021, was $14.1 million, while outstanding debt was $568,000.

“The positive results from the Phase 2 study demonstrated that LB1148 accelerated return to bowel function in patients undergoing GI surgery compared to placebo. We’re excited about the read outs of these Phase 2 data as they guide us towards a pathway for late-stage protocols,” stated Tom Hallam, Ph.D., President and Chief Executive Officer of Palisade Bio. “Additionally, we are initiating studies based on technology under the UC license to measure blood protease activity in defined patient groups, with the goal of identifying new biomarkers and therapeutic targets to build our pipeline.”

About Palisade Bio, Inc.

Palisade Bio is a clinical stage biopharmaceutical company advancing oral therapies that help patients with acute and chronic gastrointestinal complications stemming from post-operative digestive enzyme damage. Palisade Bio’s innovative lead asset, LB1148, advancing towards Phase 3 is a protease inhibitor with the potential to both reduce abdominal adhesions and help restore bowel function following surgery. Positive data from Phase 2 trials of LB1148 demonstrated safety and tolerability as well as a statistically significant improvement in return to bowel function and decrease in length of stay in ICU and hospital compared to placebo. Palisade Bio believes that its investigational therapies have the potential to address the myriad of health conditions and complications associated with chronic disruption of the gastrointestinal epithelial barrier. For more information, please go to .

Forward Looking Statements

This communication contains “forward-looking” statements, including, without limitation, statements related to expectations regarding Palisade’s plans for future clinical development of LB1148, plans for regulatory approvals of LB1148, and plans for building a pipeline of therapies in the future. Any statements contained in this communication that are not statements of historical fact may be deemed to be forward-looking statements. These forward-looking statements are based upon Palisade’s current expectations. Forward-looking statements involve risks and uncertainties. Palisade’s actual results and the timing of events could differ materially from those anticipated in such forward-looking statements as a result of these risks and uncertainties, which include, without limitation, the Company’s ability to advance its clinical programs and the uncertain and time-consuming regulatory approval process. Additional risks and uncertainties can be found in Palisade Bio’s Quarterly Report on Form 10-Q for the quarter ended September 30, 2021. Palisade expressly disclaims any obligation or undertaking to release publicly any updates or revisions to any forward-looking statements contained herein to reflect any change in Palisade’s expectations with regard thereto or any change in events, conditions or circumstances on which any such statements are based.

Palisade Bio Investor Relations Contact:

Dawn Hofmeister

Manager of Investor and Public Affairs

ir@palisadebio.com

CORE IR

ir@palisadebio.com

Palisade Bio Media Relations Contact:

CORE IR

Jules Abraham

julesa@coreir.com

917-885-7378

Palisade Bio, Inc.

Condensed Consolidated Balance Sheets (Unaudited)

(in thousands, except share and per share amounts)

September 30,

2021

December 31,

2020

ASSETS

Current assets:

Cash and cash equivalents

$

14,104

$

713

Accounts receivable

—

59

Prepaid expenses and other current assets

1,988

124

Total current assets

16,092

896

Restricted cash

26

26

Deferred transaction costs

—

1,817

Right-of-use asset

153

275

Property and equipment, net

3

5

Total assets

$

16,274

$

3,019

LIABILITIES, CONVERTIBLE PREFERRED STOCK AND STOCKHOLDERS' EQUITY (DEFICIT)

Current liabilities:

Accounts payable

$

1,383

$

2,537

Accrued liabilities

722

2,740

Accrued compensation and benefits

89

1,590

Current portion of lease liability

158

168

Current portion of debt

387

578

Current portion of related party debt, net

181

469

Total current liabilities

2,920

8,082

Warrant liability

9,434

1,830

Non-current portion of debt

—

94

Lease liability, net of current portion

—

112

Total liabilities

12,354

10,118

Commitments and contingencies (Note 11)

Series C convertible preferred stock, $0.001 par value; 0 and 33,594,625 shares authorized as of September 30, 2021 and December 31, 2020, respectively; 0 and 11,674,131 shares issued and outstanding at September 30, 2021 and December 31, 2020, respectively; liquidation preference of $10.4 million as of December 31, 2020

—

9,503

Stockholders' equity (deficit):

Series A convertible preferred stock, 7,000,000 shares authorized, $0.01 par value; 200,000 and 0 shares issued and outstanding at September 30, 2021 and December 31, 2020, respectively

2

—

Common stock, $0.01 par value; 300,000,000 and 6,797,500 shares authorized as of September 30, 2021 and December 31, 2020, respectively; 12,929,911 and 2,774,501 shares issued and outstanding at September 30, 2021 and December 31, 2020, respectively

130

28

Additional paid-in capital

99,503

51,396

Accumulated deficit

(95,715

)

(68,026

)

Total stockholders' equity (deficit)

3,920

(16,602

)

Total liabilities, convertible preferred stock and stockholders' equity (deficit)

$

16,274

$

3,019

Palisade Bio, Inc.

Condensed Consolidated Statements of Operations (Unaudited)

(in thousands, except share and per share amounts)

Three Months Ended

September 30,

Nine Months Ended

September 30,

2021

2020

2021

2020

Operating expenses:

Research and development

$

624

$

412

$

1,630

$

2,314

In-process research and development

—

—

30,117

—

General and administrative

2,392

1,404

6,080

3,738

Total operating expenses

3,016

1,816

37,827

6,052

Loss from operations

(3,016

)

(1,816

)

(37,827

)

(6,052

)

Other income (expense):

Gain on forgiveness of PPP loan

—

—

279

—

Loss on issuance of secured debt

—

—

(686

)

—

Gain on change in fair value of warrant liability

12,764

—

17,939

—

Gain on change in fair value of share liability

18

—

91

—

Interest expense

(26

)

(28

)

(2,393

)

(39

)

Other income

20

1

36

13

Loss on issuance of LBS Series 1 Preferred Stock

—

—

(1,881

)

—

Loss on issuance of warrants

(1,673

)

—

(3,247

)

—

Total other income (expense)

11,103

(27

)

10,138

(26

)

Net income (loss)

$

8,087

$

(1,843

)

$

(27,689

)

$

(6,078

)

Earnings (loss) per share:

Basic

$

0.42

$

(0.66

)

$

(3.50

)

$

(2.19

)

Diluted

$

0.42

$

(0.66

)

$

(4.13

)

$

(2.19

)

Weighted average shares used in computing earnings (loss) per share:

Basic

12,100,292

2,774,502

7,902,104

2,774,237

Diluted

12,106,771

2,774,502

7,952,998

2,774,237

Net income (loss) attributable to common shares - basic

$

5,118

$

(1,843

)

$

(27,689

)

$

(6,078

)

Net income (loss) attributable to common shares - diluted

$

5,119

$

(1,843

)

$

(32,808

)

$

(6,078

)

Palisade Bio, Inc.

Condensed Consolidated Statements of Cash Flows (Unaudited)

(in thousands)

Nine Months Ended

September 30,

2021

2020

Net loss

$

(27,689

)

$

(6,078

)

Adjustments to reconcile net loss to net cash used in operating activities:

Depreciation and amortization

2

2

In-process research and development

30,117

—

Noncash transaction costs shared with Seneca

(135

)

—

Noncash lease expense

122

105

Gain on forgiveness of PPP loan

(279

)

—

Accretion of debt discount and non-cash interest expense

2,334

32

Loss on issuance of LBS Series 1 Preferred Stock

1,881

—

Loss on issuance of secured debt

686

—

Loss on issuance of warrants

3,247

—

Change in fair value of warrant liabilities

(17,939

)

—

Change in fair value of share liability

(91

)

—

Stock-based compensation

1,208

1,544

Accrued and unpaid interest

—

7

Other

191

—

Changes in operating assets and liabilities:

Trade and other receivables

84

(53

)

Prepaid and other assets

(1,264

)

24

Accounts payable and accrued liabilities

(2,527

)

1,299

Accrued compensation

(1,544

)

—

Operating lease liabilities

(122

)

(102

)

Net cash used in operating activities

(11,718

)

(3,220

)

Cash flows from investing activities:

Cash acquired in connection with the Merger

3,279

—

Acquisition related costs paid

(3,333

)

—

Purchases of property and equipment

—

(5

)

Net cash used in investing activities

(54

)

(5

)

Cash flows from financing activities:

Payments on debt

(949

)

—

Proceeds from issuance of debt

1,250

379

Proceeds from issuance of LBS Series 1 Preferred Stock

19,900

—

Proceeds from issuance of common stock and warrants

5,209

—

Redemption of warrants

(99

)

—

Payment of debt issuance costs

(148

)

—

Net cash provided by financing activities

25,163

379

Net increase (decrease) in cash, cash equivalents and restricted cash

13,391

(2,846

)

Cash, cash equivalents and restricted cash, beginning of period

739

3,623

Cash, cash equivalents and restricted cash, end of period

$

14,130

$

777

Reconciliation of cash, cash equivalents and restricted cash to the balance sheets:

Cash and cash equivalents

14,104

751

Restricted cash

26

26

Total cash, cash equivalents and restricted cash

$

14,130

$

777

Supplemental disclosure of cash flows:

Interest paid

$

61

$

—

Supplemental disclosures of non-cash investing and financing activities:

Equity issuance costs included in accounts payable

$

67

$

—

Transaction costs shared with Seneca

$

135

$

—

Acquisition costs related to stock issuance

$

1,184

$

—

Issuance of common stock to former Seneca stockholders

$

28,728

$

—

Conversion of LBS Series C Preferred stock into common stock

$

9,503

$

—

Net assets acquired in the Merger

$

2

$

—

Acquisition related vesting of RSU’s assumed in the Merger

$

41

$

—

Acquisition related fair value change in warrant liability assumed in the Merger

$

51

$

—

Financial StatementAcquisitionLicense out/in

06 Sep 2021

More than 700 hospitals and clinics have integrated with Apple’s health records feature. But how many patients are actually using it? Photo credit: Apple

Three years ago, Apple launched a new feature for people to pull in their health records with much fanfare — and some skepticism.

The company made its big debut not long after Microsoft and Google had shuttered their own personal record efforts. Apple brought in healthcare executives who touted the tool, claiming it would be a move toward “patient empowerment,” even as industry analysts were pointing out the limitations of building such a tool on an operating system used by less than half of the U.S. population.

Three years later, the question still looms: Will Apple succeed where its big tech brethren failed? It’s important to note that some believe that both Microsoft and Google’s personal health records efforts failed to scale because they weren’t tied to a particular provider. By contrast, Apple has drummed up 700 hospitals and clinics that have integrated its health records feature with their EHR systems, far beyond the initial 40 at launch. They include blue-chip health systems like Mayo Clinic and Cleveland Clinic.

On top of that, Apple clearly is still investing in the project. At its annual developer conference in June, executives announced plans to roll out a feature this fall that would let patients to share records with their doctor.

All of which sounds promising if people are actually using the Health Records feature to begin with.

Perhaps predictably, Apple declined to say how many people are using the Health Records feature through its Health app. Neither did the company offer an executive or representative to speak on the record for this article. (Representatives did, however, explain the health records feature on background). As a result, MedCity News interviewed others to understand the technology, how many people are using it and in what manner.

Not easy to find

Apple’s health records feature lets people pull in records from their healthcare provider, including allergies, immunizations, vitals and lab results. Photo credit: Apple

Locating Apple’s Health Records feature isn’t exactly intuitive. It’s tucked away in the Health app on users’ iPhones.

From there, people must look up the hospital or clinic where they want to get their records, and remember their username and password for that provider’s patient portal. They have to repeat the same steps with each provider from whom they wish to access records.

This works well from a privacy perspective, as Apple doesn’t touch the health records at all. But the effort involved doesn’t bode well for adoption. While some people might be willing to go through all of these steps, many people can barely remember their login information for their hospital’s patient portal, if they’ve ever used it.

In a 2011 post-mortem of its own health records efforts, Google admitted that while it had won over some tech-savvy patients, caregivers and fitness enthusiasts, it hadn’t found a way to translate that into widespread adoption.

Even with its promises of privacy and enthusiastic fanbase, it’s unclear if Apple has cracked this code. Its health division has seen several recent departures, and Apple is reportedly scaling back a separate wellness app due to lack of engagement, according to Insider.

Provider integration

Though hundreds of health systems, hospitals and clinics have implemented Apple’s Health Records feature so far, providers have a thin grasp on its use.

For this article, MedCity News reached out to 30 health systems, hospitals, physician practices and companies and interviewed the six who agreed to an interview. They are:

University of California San Diego Health in San Diego, California

Hattiesburg Clinic in Hattiesburg, Mississippi

Yuma Regional Medical Center in Yuma, Arizona

ChristianaCare in Newark, Delaware

Gunnison Valley Health in Gunnison, Colorado

Laboratory Corporation of America Holdings in Burlington, North Carolina

A majority of the providers MedCity News spoke with did not have any data on usage, and UC San Diego Health — the only one that did — reported that adoption was low but seeing a little growth.

“What I can share, the numbers we have is fairly low,” said Marc Sylwestrzak, director of information services experience and digital health at UC San Diego Health Sciences, in a phone interview. “In October of last year, we were probably sitting at around 1,100, which is a small number. But, we have seen that [figure] more than double in the last 7 to 8 months…In June we were probably sitting at 2,300 or almost 2,400 unique patients.”

That number is a fraction of the 417,000 patients that UC San Diego Health System provided care for in the past 18 months. Remember also that UC San Diego Health was among the first health systems in the country to test the Health Records feature. If the earliest adopters are seeing such weak adoption of this feature, one can only imagine what the uptake rates are among patients at other systems.

While users have been hard to come by, it appears that at UC San Diego Health, an early survey from 2019 showed that at least those who used it found it valuable. In fact, 90% of users believed it facilitated better health information sharing and understanding of their health.

For providers too — those that chose to integrate the feature with the hospital’s EHR — the process was not a challenge.

“The implementation of Apple Health [Records] in 2018 was a straightforward process [for us] that took a few months,” said Randy Gaboriault, chief digital and information officer, at Newark, Delaware-based ChristianaCare, in an email.

In addition, EMR vendors, like Epic and Cerner, help make it an easy and technically secure process, he added.

Even smaller providers like Gunnison Valley Health in Colorado and Hattiesburg Clinic in Mississippi said the implementation was not difficult as they had guides they could follow.

On the whole, providers believe Apple’s Health app is a boon for patients. They said that it does empower the patient by bringing together information about their health from disparate sources, including from different providers and wearables like Apple Watches. This gives patients access to a wide array of data in real-time.

“It allows patients to have an active role in their healthcare as they are able to monitor certain health metrics and communicate those to their physician without having to make an appointment to see the physician,” said Renee Williams, senior system analyst, at Hattiesburg Clinic, in an email.

The multispecialty clinic, which includes 300 physicians, has received positive anecdotal feedback from patients about Apple’s Health Records feature, Williams said.

Despite a generally positive view of the app and the Health Records feature, providers are not actively promoting its use, leaving patients to either find Apple’s Health Records feature themselves — a challenge given how hidden away it is — or waiting until they ask about it.

Others want to promote their own patient portal instead. That perspective is espoused by Dr. Sarah Kramer, chief medical information officer of Arizona-based Yuma Regional Medical Center. She believes it is more important to have patients use the hospital’s patient portal. The portal allows patients to schedule appointments, message their care team, pay their bills and view clinician notes, none of which is currently possible through Apple’s Health app under which the Health Records feature sits.

“Apple Health [Records] has a lot of promise, but in my mind, it’s really up to Apple to market that,” Kramer said in a phone interview. “Once we have our patients signed up on MyChart, our preference is that they use that.”

Even larger organizations like LabCorp are driving patients to use their app over Apple’s Health app.

“We do a pretty thorough job about letting them know about the LabCorp patient app,” said Lance Berberian, LabCorp’s chief information and technology officer, in a phone interview. “We put less attention on the Apple Health app.”

The LabCorp app also provides more capabilities than Apple’s Health product, including enabling patients to make payments.

App integration is useful in other ways

While usage data is either scant or underwhelming, undermining the “patient empowerment” narrative forwarded by Apple, some providers are finding the data collected through the Health app itself to be useful. This is of increasing importance now as hospitals and health systems push into remote patient monitoring and other at-home services.

For example, UC San Diego Health is conducting a remote patient monitoring program that leverages data from the app. Patients using wearables and devices, like blood pressure monitors and glucometers, record data via the app and then share it with their care team through Apple’s integration with Epic’s MyChart patient portal, UC San Diego Health’s Sylwestrzak said. So far, about 500 patients are participating in the pilot.

“Once the data is received by UCSD…the data is used to cohort patients into a dashboard, alerting a multi-disciplinary care team to follow-up with patients as needed,” he said.

Apple’s Health app supports a large number of data elements, and it is easy to use, he added. The health system is planning to expand the pilot.

Similarly, Hattiesburg Clinic is in the early stages of utilizing Apple’s Health app for home blood pressure readings, glucose monitoring and weight management with a small percentage of patients, the clinic’s Senior System Analyst Williams said.

Technical limitations

It’s difficult to assess how much of a health benefit users derive from the Apple’s Health app. Since it’s built using the FHIR standard, the app is capable of pulling in structured data, but is limited in its ability to pull in unstructured data, such as notes or imaging.

As it’s currently designed, the Health Records feature pulls health information and categorizes it into seven segments, including allergies, vitals, health conditions, immunizations, lab results, medications and procedures. Separately, the Health app also includes information pulled in from wearables, such as users’ heart rate or sleep. Users can view their lab values over a period of time, such as LDL cholesterol, and see if it was in-range.

This could be helpful for people to get a baseline of their health, or share allergy information with a new doctor. But for people managing complex conditions with lots of records, such as cancer, it only scratches the surface.

“Apple is a breadth play — we can only do a little bit but we’ve got to do it for hundreds of millions of people,” said Anil Sethi, Apple’s former director of health records. Sethi has started his own health record startup, Ciitizen, after his sister Tania was diagnosed with metastatic breast cancer and he became keenly aware of the limitations of current records companies. For example, things like pathology reports, imaging, and information on a tumor’s size and grade normally can’t be pulled in through the API.

“Apple uses tech to get whatever the tech will supply through the API. That’s about 8% of all the onco-information that Tania needed,” he said.

Sethi’s new company is taking a different approach, helping a smaller number of people get much more of their data, by requesting it using patients’ right of access under HIPAA and then organizing it in a readable format.

Sethi is not the only one who sees limitations in Apple’s approach.

Ardy Arianpour, who founded a startup that seeks to be the “Mint.com of health records,” said Apple misses some information by only focusing on FHIR data.

“95% of the data out there is non-FHIR,” he said. “It’s not that FHIR is bad. It’s just that FHIR is not special.”

Arianpour’s company — Seqster — built a system to quickly pull patients’ records from multiple facilities using an identifier, such as a driver’s license or social security number.

Yet he credits Apple for shining a light on the issue of personal health records.

“What Apple has done is free advertising for how important this market is,” he said.

While Arianpour and Sethi find Apple’s Health app leaving much to be desired, others believe Apple’s approach is the right one. One app, CommonHealth, is specifically designed to be the Android equivalent of Apple’s Health Records feature. Commons Project co-founder JP Pollak said the company picked this approach because it’s good from a privacy perspective — the data is pulled directly to users’ devices without being processed in the cloud — and it’s the easiest to scale to a large number of people.

“The mechanism of connecting people directly with the institutions that hold their care seems to be the best and most scalable model,” he said, “even if people have to remember their usernames and passwords.”

Future plans

In the long-term, Apple and its peers are betting that expanded access to data, and the ability to share it, will turn these apps from a nice-to-have into a must-have.

This fall, with the release of its new operating system, Apple will roll out a feature for users to share their health data with others, such as a caregiver or doctor. For example, their physician could review trends in exercise and sleep, or if a fall had been detected.

As providers ramp up remote patient monitoring and other at-home services, this data can play a role in clinical outcomes. But leveraging it may not be as simple as it seems.

Pollak, who is working on a similar feature for CommonHealth, said this is a “really thorny issue.”

The challenges range from dealing with the intricacies of embedding that information in an EHR, to figuring out how to make data generated from smartwatches and other sources useful.

“Doctors don’t want to be inundated with data that’s not actionable,” he said.

While the pandemic provided to be a boon to the adoption of digital health, it still remains to be seen what has staying power beyond telemedicine tools. Providers may find Apple’s Health app and other features added on to the Health Records capability enticing, but it remains to be seen if the app’s intended beneficiaries will flock to it: patients.

Correction: This article has been updated to reflect that the ability to pull in data from wearables is part of the Health app, separate from the ability to pull in seven categories of health information from healthcare providers under Apple’s Health Records feature.

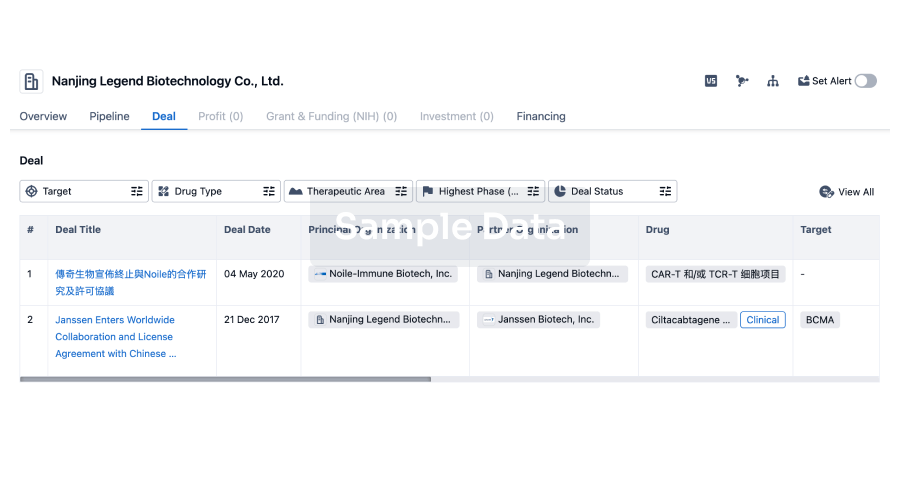

100 Deals associated with Yuma Regional Medical Center, Inc.

Login to view more data

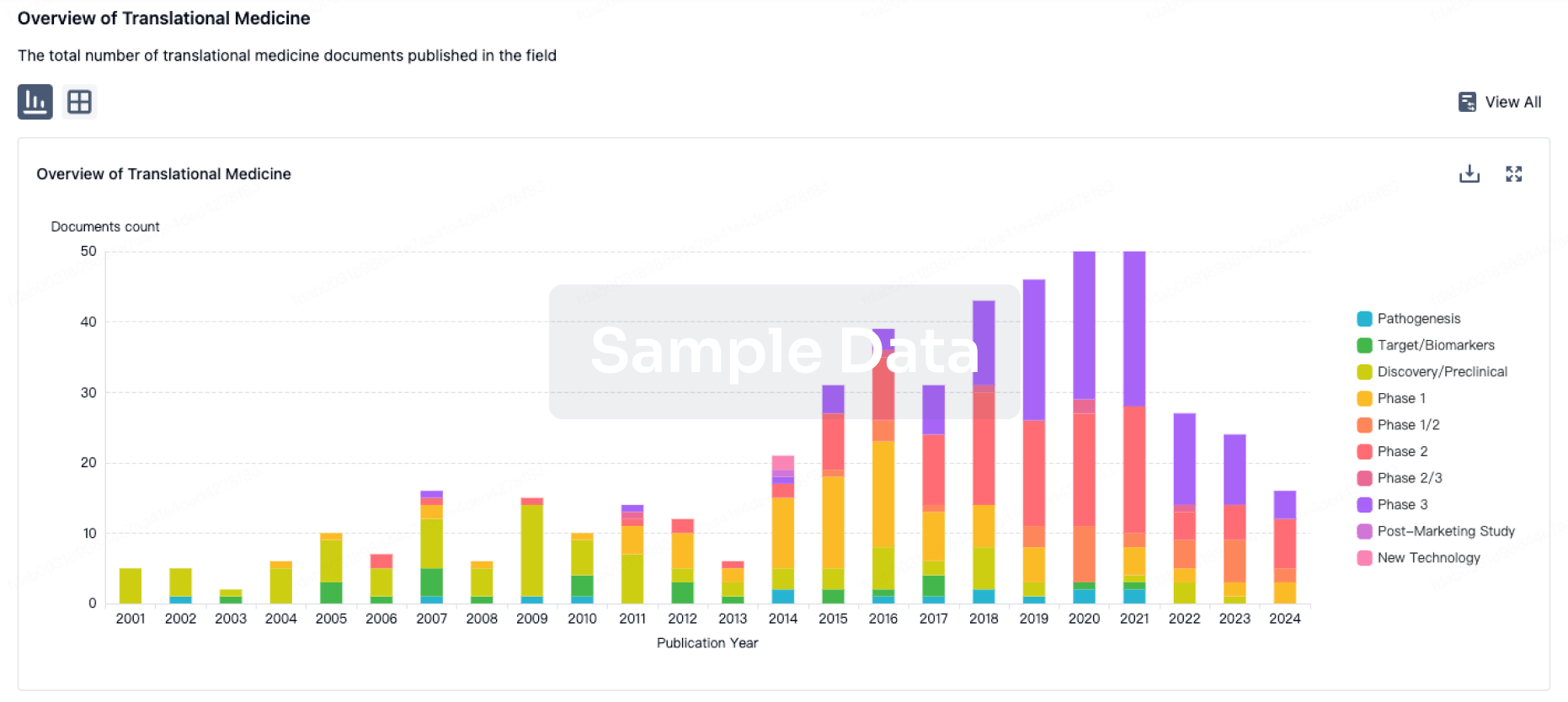

100 Translational Medicine associated with Yuma Regional Medical Center, Inc.

Login to view more data

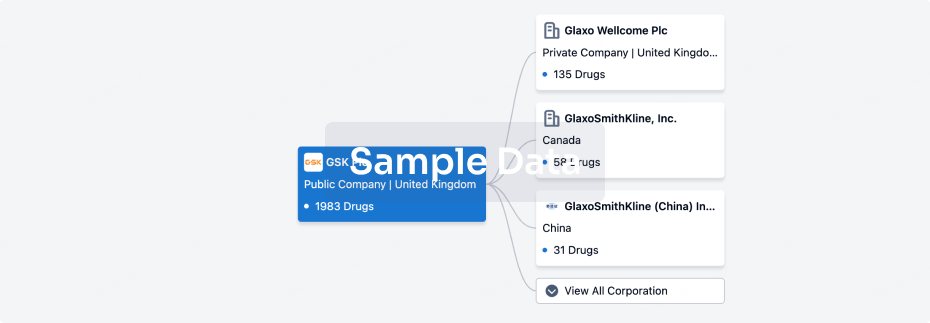

Corporation Tree

Boost your research with our corporation tree data.

login

or

Pipeline

Pipeline Snapshot as of 16 Jul 2025

No data posted

Login to keep update

Deal

Boost your decision using our deal data.

login

or

Translational Medicine

Boost your research with our translational medicine data.

login

or

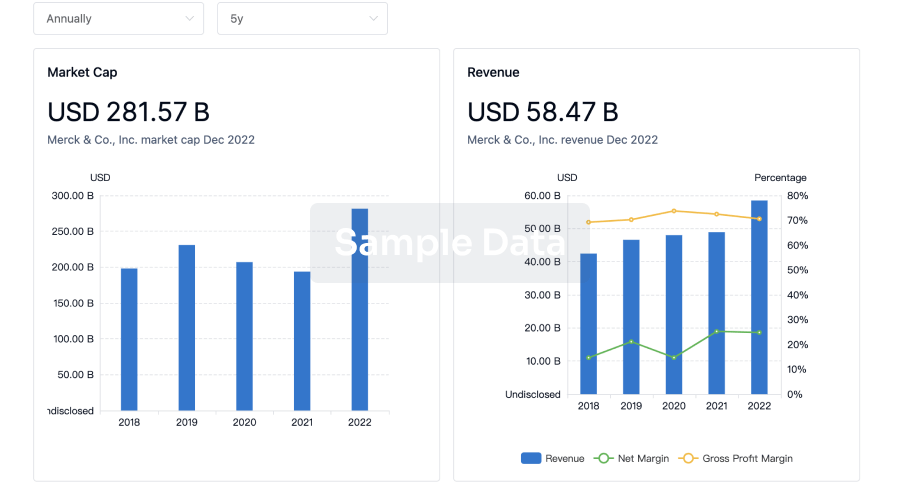

Profit

Explore the financial positions of over 360K organizations with Synapse.

login

or

Grant & Funding(NIH)

Access more than 2 million grant and funding information to elevate your research journey.

login

or

Investment

Gain insights on the latest company investments from start-ups to established corporations.

login

or

Financing

Unearth financing trends to validate and advance investment opportunities.

login

or

AI Agents Built for Biopharma Breakthroughs

Accelerate discovery. Empower decisions. Transform outcomes.

Get started for free today!

Accelerate Strategic R&D decision making with Synapse, PatSnap’s AI-powered Connected Innovation Intelligence Platform Built for Life Sciences Professionals.

Start your data trial now!

Synapse data is also accessible to external entities via APIs or data packages. Empower better decisions with the latest in pharmaceutical intelligence.

Bio

Bio Sequences Search & Analysis

Sign up for free

Chemical

Chemical Structures Search & Analysis

Sign up for free