Request Demo

Last update 08 May 2025

IFM Therapeutics LLC

Last update 08 May 2025

Overview

Tags

Cardiovascular Diseases

Other Diseases

Small molecule drug

Disease domain score

A glimpse into the focused therapeutic areas

No Data

Technology Platform

Most used technologies in drug development

No Data

Targets

Most frequently developed targets

No Data

| Top 5 Drug Type | Count |

|---|---|

| Small molecule drug | 1 |

| Top 5 Target | Count |

|---|---|

| STING(Stimulator of interferon genes) | 1 |

Related

1

Drugs associated with IFM Therapeutics LLCTarget |

Mechanism STING1 inhibitors |

Active Org. |

Originator Org. |

Active Indication |

Inactive Indication- |

Drug Highest PhasePreclinical |

First Approval Ctry. / Loc.- |

First Approval Date- |

1

Clinical Trials associated with IFM Therapeutics LLCNL-OMON49211

A phase 1, double-blind placebo-controlled single and multiple ascending dose study of the safety, tolerability, pharmacokinetics, pharmacodynamics and food effects of IFM-2427 in healthy subjects - IFM 2427 SAD MAD FE study to investigate safety, PK and PD

Start Date27 Feb 2019 |

Sponsor / Collaborator |

100 Clinical Results associated with IFM Therapeutics LLC

Login to view more data

0 Patents (Medical) associated with IFM Therapeutics LLC

Login to view more data

2

Literatures (Medical) associated with IFM Therapeutics LLC10 Apr 2025·Journal of Medicinal Chemistry

Correction to “Discovery of DFV890, a Potent Sulfonimidamide-Containing NLRP3 Inflammasome Inhibitor”

Author: Roush, William R. ; Katz, Jason D. ; Kitanovic, Ana ; El-Kattan, Ayman F. ; Winkler, David G. ; Ghosh, Shomir ; Franchi, Luigi ; Bradley, Sarah ; Dean, Dennis ; Glick, Gary D. ; Byth, Kate F. ; Seidel, H. Martin ; Hinniger, Alexandra ; Dekker, Carien ; Braams, Simona ; Opipari, Anthony W. ; Stutz, Andrea ; Shen, Dong-Ming ; Venkatraman, Shankar ; Lu, Xiaokang ; Stunden, James ; Sanchez, Brian ; Bertheloot, Damien ; Graves, Jonathan D. ; Telling, Alissa ; Olhava, Edward J.

13 Mar 2025·Journal of Medicinal Chemistry

Discovery of DFV890, a Potent Sulfonimidamide-Containing NLRP3 Inflammasome Inhibitor

Article

Author: El-Kattan, Ayman F. ; Lu, Xiaokang ; Hinniger, Alexandra ; Katz, Jason D. ; Ghosh, Shomir ; Bradley, Sarah ; Franchi, Luigi ; Dean, Dennis ; Glick, Gary D. ; Byth, Kate F. ; Venkatraman, Shankar ; Telling, Alissa ; Dekker, Carien ; Braams, Simona ; Stutz, Andrea ; Shen, Dong-Ming ; Bertheloot, Damien ; Roush, William R. ; Sanchez, Brian ; Opipari, Anthony W. ; Seidel, H. Martin ; Kitanovic, Ana ; Winkler, David G. ; Stunden, James ; Olhava, Edward J.

42

News (Medical) associated with IFM Therapeutics LLC21 Jan 2025

Odyssey Therapeutics and Sionna Therapeutics have the sorts of attributes that have enabled biotechs to successfully navigate choppy IPO waters in the recent past.\n Odyssey Therapeutics and Sionna Therapeutics have filed IPO paperwork, swelling the pack of startups that will provide an early look at how receptive public investors could be to biotech listings in 2025.Maze Therapeutics and Metsera filed to list their stocks earlier in January. Like those two companies, Odyssey and Sionna have clinical-phase programs, sizable bank balances and investor syndicates stocked with well-known VCs—the sorts of attributes that have enabled biotechs to successfully navigate choppy IPO waters in the recent past.Sionna is building on the efforts of Sanofi and AbbVie in cystic fibrosis. Greg Hurlbut, Ph.D., and Mark Munson, Ph.D., set up the biotech after working together at Sanofi, and it wasn\'t long before Sionna had licensed compounds designed to stabilize NBD1 from the French pharma for $1.5 million upfront.Multiple companies have studied NBD1, reflecting its key role in CFTR function, but are yet to develop a drug against the target. Pfizer called its results “discouraging,” adding that the binding domain “may not contain the features needed to build high‐affinity interactions.” However, Sionna believes it can hit the target, positioning it to advance treatments for the 90% of cystic fibrosis patients with F508del mutations. Vertex already sells its triple combination therapies Trikafta and Alyftrek for use in patients with F508del mutations. Sionna wants to test its lead NBD1 stabilizer candidate in combination with Trikafta, but it also plans to study the molecule with its own CFTR modulators. The biotech added to its portfolio of CFTR modulators last year by picking up three candidates from AbbVie.Sionna plans to advance a combination of an NBD1 stabilizer and complementary modulator through phase 1 and phase 2a and into phase 2b using the IPO funds. The biotech is yet to pick which molecules to include in the combination. AbbVie could benefit from the choice, with Sionna agreeing to give the Big Pharma up to $360 million in milestones and rights of first negotiation.The IPO filing acknowledges some of the challenges Sionna may face if it runs trials that require people to stop taking standard of care. Sionna said AbbVie terminated part of a phase 2 trial that planned to test a CFTR potentiator and corrector after deeming it “not enrollable due to, among other reasons, the increasing availability of Trikafta.” The biotech licensed the CFTR potentiator and corrector from AbbVie.Meanwhile, Odyssey is seeking funding for autoimmune and inflammatory disease programs, according to its filing. The pipeline is led by a RIPK2 inhibitor that is set to start a phase 2a monotherapy trial for ulcerative colitis this quarter. Odyssey said the IPO funding will enable it to complete the monotherapy trial and generate induction-stage data from a phase 2a trial that will test the candidate in combination with Takeda’s Entyvio. The biotech has struck deals to add to its assets and capabilities, buying Rahko for its machine learning prowess and acquiring IFM Discovery for MDA5 and NLRP1 discovery programs. IFM was a subsidiary of IFM Therapeutics, a biotech founded by Odyssey CEO Gary Glick, Ph.D. Glick previously set up and ran Scorpion Therapeutics, which Eli Lilly is now buying for up to $2.5 billion.Johnson & Johnson and Pfizer have partnerships with Odyssey. J&J paid $6.5 million to jointly discover and optimize small molecules using Odyssey’s artificial intelligence and machine learning capabilities. Pfizer paid $1 million as part of a collaboration intended to identify novel hits using Odyssey’s natural product platform.

IPOAcquisitionPhase 2Phase 1

13 Jan 2025

Eli Lilly has turned to a biotechnology startup for help building its pipeline of cancer drugs, agreeing on Monday to purchase an experimental cancer drug from privately held Scorpion Therapeutics for as much as $2.5 billion.As part of the deal, Scorpion will spin out a new, independent company that will hold its other assets as well as inherit its employees. Lilly will take a minority stake in the new company, which will be owned by Scorpions current shareholders, among them Atlas Venture, Vida Ventures and Omega Funds.Current Scorpion CEO Adam Friedman will lead the new company along with other members of the startups management.The acquisition hands Lilly a medicine, dubbed STX-678, that is aimed at tumors driven to growth by mutations to a gene called PI3Ka. So-called PI3Ka mutations are among the most common drivers of cancer, affecting more than 160,000 people diagnosed each year with breast, gynecological and head and neck cancers in the U.S., according to Scorpion.A handful of medicines already available, like Novartis Piqray and AstraZenecas Truqap, as well as others in clinical development also target PI3Ka mutations.Scorpion has claimed its drug could be more selective and potent than existing PI3Ka inhibitors, which block normal, or wild-type, PI3Ka and as a result are tough to tolerate. Existing drugs also dont readily reach the brain tissue into which many solid tumors spread. Scorpion says its drug might overcome these limitations and has advanced the treatment into a Phase 1/2 trial in multiple tumor types, among them a common form of breast cancer.Scorpion has been collaborating with Pfizer to study STX-678 together with a so-called CDK4 inhibitor. Lilly sells a drug, called Verzenio, that similarly targets CDK4 alongside a related protein.The deal will expand a cancer drug division Lilly has poured considerable resources into as a complement to its lucrative metabolic disease business. Lilly acquired Loxo Oncology in 2019 and, since then, has used deals to buy into other areas of precision oncology such as radiopharmaceuticals and antibody-drug conjugates.Verzenio, which Lilly discovered and developed internally, has become the top-selling drug of its class, though much of Lillys revenue is derived from its diabetes and weight loss treatments. Lilly also has in its pipeline an internally developed PI3Ka inhibitor thats in Phase 1 testing.Lillys deal with Scorpion adds to an upward trend in private biotech M&A. The increase has coincided with a weakening market for initial public offerings, which as forced many mature startups to explore strategic options.Scorpion was co-founded in 2020 by Gary Glick, who helped the company raise nearly $300 million in venture funding before departingin 2021. Prior to Scorpion, Glick led Lycera, which inked a 2015 deal with Celgene, and IFM Therapeutics, which has spun off multiple companies that were acquired by Bristol Myers Squibb and Novartis.Glicks latest company, Odyssey Therapeutics, is developing treatments for inflammatory diseases. '

AcquisitionPhase 1IPO

21 Nov 2024

Through a new deal, Novartis has added a handful of experimental gene therapies to its neuroscience research pipeline.Novartis is betting the gene therapy technologies developed by Kate Therapeutics, a biotechnology startup founded four years ago, can lead to treatments for an array of neuromuscular diseases. The Swiss pharmaceutical giant said Thursday it has acquired Kate, in a transaction that could ultimately be worth as much as $1.1 billion. Novartis did not disclose what it paid upfront, but a source familiar with the deal told BioPharma Dive the sum was substantially greater than Kates Series A round last year.In buying Kate, Novartis now owns a slate of preclinical gene therapies for rare, muscle-eroding diseases. The biotechs two most advanced programs respectively target Duchenne muscular dystrophy and a condition known as X-linked myotubular myopathy. Astellas Pharma, one of the largest drugmakers is Japan, has been partnering on that latter program since Kate officially launched in June of last year.Kate debuted with $51 million from that Series A fundraising round, which was co-led by its founder, Westlake Village Partners, and Versant Ventures. The company claims its technology which stems from research conducted by a team of scientists at the Broad Institute of MIT and Harvard can make gene therapies that are more precise and able to reach parts of the body they normally have trouble hitting, like the heart. Sharif Tabebordbar, who was the main author of that research, went on to co-found Kate and now serves as its chief scientific officer.We have been highly impressed with the rigor and potential of Kates science, and we are confident this acquisition will further enhance our ability to bring forward new therapeutic options for patients living with neuromuscular diseases, said Fiona Marshall, Novartis president of biomedical research, in a statement.Novartis already has experience in neuromuscular gene therapies, having launched Zolgensma, a blockbuster medicine for spinal muscular atrophy. Zolgensma had been given the growth driver moniker not too long ago, but sales of the drug havent been as strong recently. They totaled $1.2 billion in 2023, down 9% under constant currency exchange rates. And they were flat in the third quarter, at $308 million, compared to the same three-month period last year.Sales from Novartis broader neuroscience business were still up 19% in the third quarter, thanks mostly to the multiple sclerosis medication Kesimpta.The Kate acquisition comes almost a year and a half after Novartis agreed to buy DTx Pharma, a startup aiming to use RNA drugmaking technology to treat neurological diseases. The deal, which carried a $500 million upfront payment, handed Novartis a few experimental drugs that had yet to reach human testing.DTx was one in a series of smaller-scale purchases Novartis made over the past couple years. The company snagged the radiopharmaceutical developer Mariana Oncology for $1 billion, the kidney disease drugmaker Chinook Therapeutics for as much as $3.5 billion, and the cancer specialist Morphosys for roughly $2.9 billion.It also scored a portfolio of potential immune system drugs by buying a subsidiary of IFM Therapeutics for $90 million up front.Ned Pagliarulo contributed reportingEditors note: This story has been updated to further characterize the acquisition price Novartis paid for Kate. '

AcquisitionGene Therapy

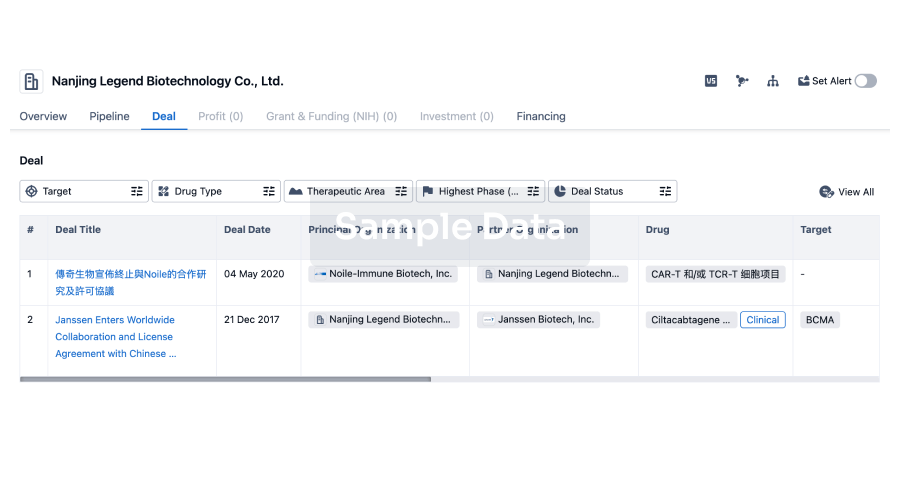

100 Deals associated with IFM Therapeutics LLC

Login to view more data

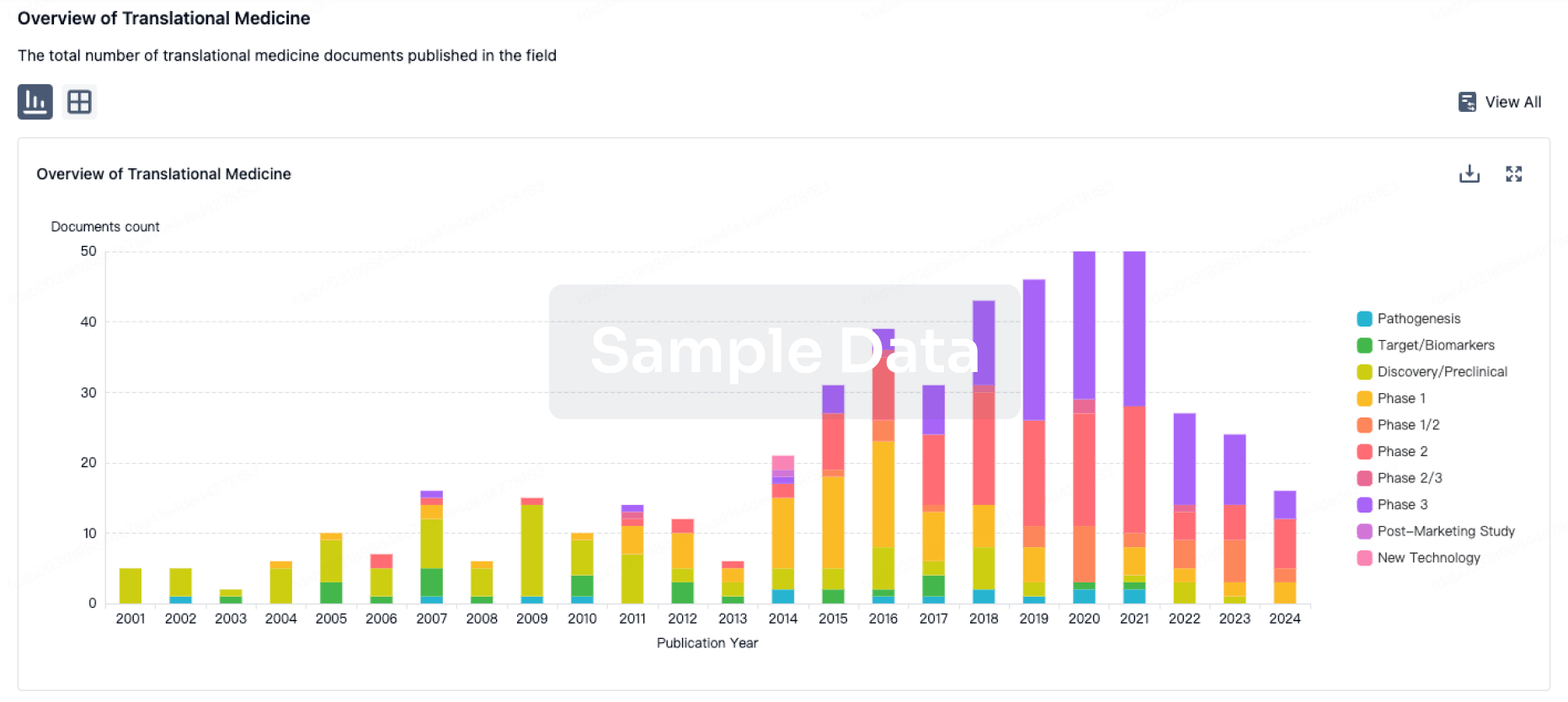

100 Translational Medicine associated with IFM Therapeutics LLC

Login to view more data

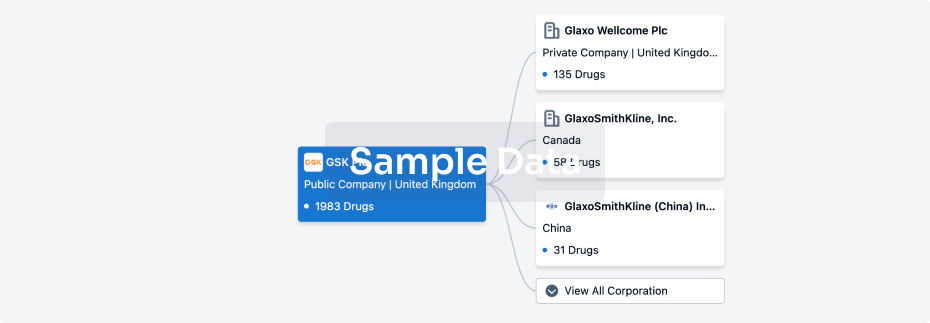

Corporation Tree

Boost your research with our corporation tree data.

login

or

Pipeline

Pipeline Snapshot as of 17 Dec 2025

The statistics for drugs in the Pipeline is the current organization and its subsidiaries are counted as organizations,Early Phase 1 is incorporated into Phase 1, Phase 1/2 is incorporated into phase 2, and phase 2/3 is incorporated into phase 3

Preclinical

1

Login to view more data

Current Projects

| Drug(Targets) | Indications | Global Highest Phase |

|---|---|---|

IFM4490 ( STING ) | STING-associated Vasculopathy With Onset in Infancy More | Preclinical |

Login to view more data

Deal

Boost your decision using our deal data.

login

or

Translational Medicine

Boost your research with our translational medicine data.

login

or

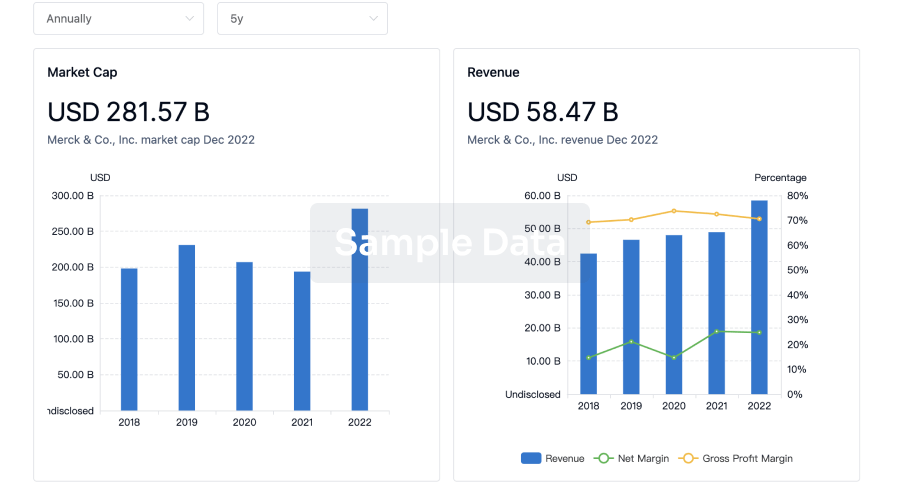

Profit

Explore the financial positions of over 360K organizations with Synapse.

login

or

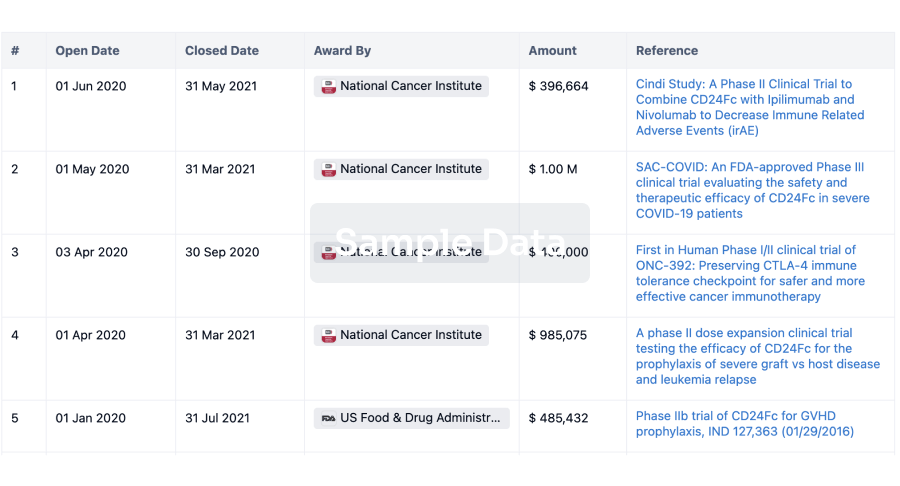

Grant & Funding(NIH)

Access more than 2 million grant and funding information to elevate your research journey.

login

or

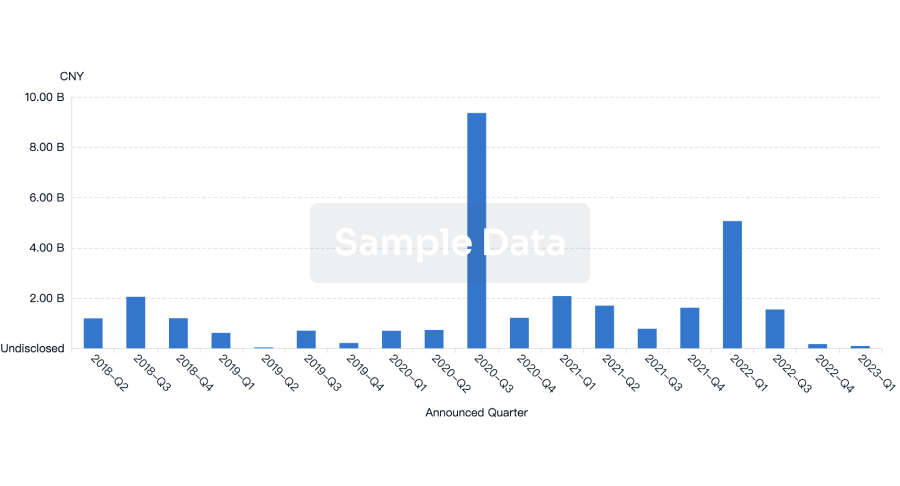

Investment

Gain insights on the latest company investments from start-ups to established corporations.

login

or

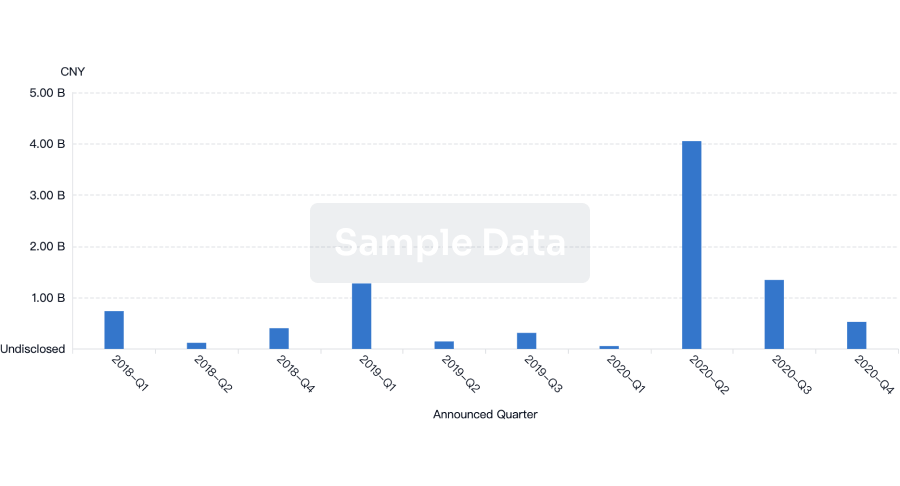

Financing

Unearth financing trends to validate and advance investment opportunities.

login

or

AI Agents Built for Biopharma Breakthroughs

Accelerate discovery. Empower decisions. Transform outcomes.

Get started for free today!

Accelerate Strategic R&D decision making with Synapse, PatSnap’s AI-powered Connected Innovation Intelligence Platform Built for Life Sciences Professionals.

Start your data trial now!

Synapse data is also accessible to external entities via APIs or data packages. Empower better decisions with the latest in pharmaceutical intelligence.

Bio

Bio Sequences Search & Analysis

Sign up for free

Chemical

Chemical Structures Search & Analysis

Sign up for free