The newest healthcare blank-check company has arrived, coming from the CEO of a company that is attempting to shake up the digital pharmaceutical space.

The SPAC known as Aesther Healthcare Acquisition

filed

for its initial offering late Monday, putting down $100 million as its raise estimate. Led by Suren Ajjarapu, chief executive of online drug marketplace TRxADE Health, the SPAC is targeting pharmaceuticals, medtech and healthcare IT.

Per the S-1, Ajjarapu currently controls all shares of the SPAC, but once it prices he will only own 20%.

Ajjarapu got his company started back in 2010 with the goal of giving pharmacies more power in selling their prescription drugs. Based out of Land o’ Lakes, FL, TRxADE boasts of price competition with e-commerce giants like Amazon and eBay, claiming it has dozens of drug wholesalers that allow members to save tens of thousands of dollars.

Much of the SPAC’s team is made up of Ajjarapu’s colleagues at TRxADE and other companies in which he serves as a board member. The TRxADE CFO is also joining as the SPAC’s finances head, and Ajjarapu has crossed paths with two other board members.

In addition to TRxADE, Ajjarapu has worked with several companies in the natural gas biofuels industries.

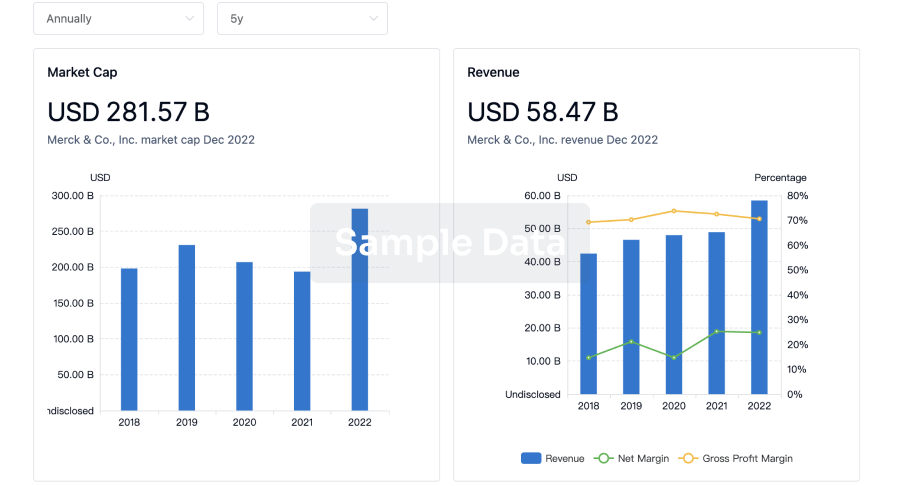

Within the S-1, the SPAC offers few details other than the typical boilerplate language about looking for a company with a “strong competitive position.” Ajjarapu outlined a plan to focus on companies with a market cap between $250 million and $1 billion, but qualified that statement — as is usual — saying the SPAC could go in any direction.

SPAC filings have slowed down since the beginning of the year, but mergers are beginning to pick up. Just yesterday, the weight management company Gelesis

announced

the latest reverse merger in its $476 million heel turn to the New York Stock Exchange.

Another biotech IPO

has priced

, this time coming from Miramar, FL-based HCW Biologics.

Hopping onto Nasdaq at the low end of its range, HCW hit the exchange at $8 per share and completing a $56 million raise. The biotech is aiming to research the connection between chronic inflammation and aging, coining the buzzy phase “inflammaging” to describe its targets.

In its initial S-1 a few weeks ago, HCW listed plans for four clinical trials to be up and running by the end of the year for its candidate in relapsed/refractory acute myeloid leukemia. But the new S-1 updated for the pricing has no mention of this program, and it is no longer listed on the company’s website either. Two of those four trials had already been ongoing, and it’s unclear whether they are still running.

Instead, the IPO will now largely center around a pipeline program for pancreatic cancer and solid tumors, with goals to submit an IND for a Phase Ib/II trial for the former as an adjunct to chemo. About $6.4 million will be funneled to this program, the S-1 said.

The biggest portion of the IPO, about $19 million, will go to “salaries and benefits for all employees.”

CEO Hing Wong will take home most of the IPO prize, as he will own 42.6% of shares once the IPO is completed, according to the S-1. Medmira Capital’s bet also pays off, as the firm owns the second-biggest share at 10.5%.