Request Demo

Last update 29 Aug 2025

Isotechnika, Inc.

Subsidiary Company|Canada

Subsidiary Company|Canada

Last update 29 Aug 2025

Overview

Related

1

Clinical Trials associated with Isotechnika, Inc.EUCTR2006-001352-13-DE

A PHASE III, RANDOMIZED, MULTICENTRE, DOUBLE-BLIND, PLACEBO ANDCYCLOSPORINE CONTROLLED STUDY OF ISA247 IN PLAQUE PSORIASISPATIENTS (ISA05-25) - None available

Start Date27 Sep 2006 |

Sponsor / Collaborator |

100 Clinical Results associated with Isotechnika, Inc.

Login to view more data

0 Patents (Medical) associated with Isotechnika, Inc.

Login to view more data

6

Literatures (Medical) associated with Isotechnika, Inc.01 Nov 2008·Journal of cutaneous medicine and surgeryQ4 · MEDICINE

ISA247: Quality of Life Results from a Phase II, Randomized, Placebo-Controlled Study

Q4 · MEDICINE

Article

Author: Foster, Robert T. ; Yatscoff, Randall W. ; Lynde, Charles ; Gulliver, Wayne ; Barber, Kirk ; Aspeslet, Launa J. ; Lauzon, Gilles ; Gupta, Aditya K. ; Huizinga, Robert B. ; Langley, Richard G.

Background::

Psoriasis is a chronic skin condition that can negatively affect a patient's quality of life (QoL), often hindering social functioning. ISA247, a novel psoriatic agent, has shown clinical efficacy in moderate to severe psoriasis sufferers, but its effect on QoL is currently not reported.

Objective::

The objective of this study was to assess the effect of ISA247 on the QoL in patients with stable, plaque-type psoriasis.

Methods::

A phase II, randomized, double-blind, placebo-controlled, parallel-group, multicenter study assessed the effects of ISA247 doses of 0.5 mg/kg/d ( n = 77) or 1.5 mg/kg/d ( n = 83) compared with placebo ( n = 41) for 12 weeks. QoL was assessed using the Dermatology Life Quality Index (DLQI) and Psoriasis Disability Index (PDI) scales.

Results::

ISA247 treatment (pooled groups) significantly improved QoL scores as assessed by both the DLQI and the PDI compared with those receiving placebo ( p < .05). Treatment with the higher dose of 1.5 mg/kg/d demonstrated a significantly greater response to many of the QoL scales compared with the 0.5 mg/kg/d group ( p < .05).

Conclusions::

ISA247 appears to improve the QoL while also providing effective treatment for chronic, moderate to severe, plaque-type psoriasis.

01 Feb 2002·PHOSPHORUS SULFUR AND SILICON AND THE RELATED ELEMENTS

A Synthetic and Stereochemical Study of 2,6-Diaroyl-3,5-Diaryl-4-Ethyltetrahydro-1,4-Thiazine-1,1-Dioxides

Author: Selvaraj, S. ; Perumal, S. ; Gnanadeepam, M. ; Renuga, S.

Double aza-Michael addition of ethylamine to [R1CH:C(COR2)]2SO2 [R, r1 = Ph, 4-ClC6H4, 4-MeC6H4] gave the previously unknown title compounds I in moderate yields.The decreased yields of I compared to 2,6-diaroyl-3,5-diaryltetrahydro-1,4-thiazine 1,1-dioxides or the corresponding 4-Me derivatives is explained on the basis of the steric size of the nucleophile.The structure and stereochem. of the thianes have been deduced from elemental analyses and spectroscopic data.

01 Feb 2001·The Journal of heart and lung transplantation : the official publication of the International Society for Heart TransplantationQ1 · MEDICINE

ISATX247: a novel calcineurin inhibitor

Q1 · MEDICINE

Article

Author: Foster, R T. ; Kneteman, N M. ; Naicker, S ; Freitag, D G. ; Trepanier, D J. ; Aspeslet, L J. ; Yatscoff, R W. ; Abel, M D.

6

News (Medical) associated with Isotechnika, Inc.21 May 2024

SEOUL, South Korea, May 20, 2024 /PRNewswire/ --

Fellow Aurinia Shareholders,

ILJIN SNT Co., Ltd. and its affiliates (collectively, "ILJIN") is a long-term holder of more than 5% of Aurinia Pharmaceuticals Inc. ("Aurinia" or the "Company") and has been supportive of the Company's mission since 2010 when we invested in the predecessor company, Isotechnika. As one of the largest and longest-standing shareholders, we have had the privilege of supporting the Company through its drug development efforts and subsequent FDA approval of LUPKYNIS. We have also supported the CEO, Mr. Peter Greenleaf, having voted in prior years for his re-election to the Board.

Like other shareholders, we have been greatly shocked and dismayed to see the share price plummet since the Company's announcement on February 15, 2024 of FY 2023 operational results and the unsuccessful conclusion of its 7-month long strategic review process.

The Company recently announced its Q1 2024 operational results. While the Q1 2024 financials showed some improvement, there has been no sign of share price recovery despite the Q1 performance improvement. If anything, the stock performance following the recent earnings report has reinforced the market perception that there remain substantial uncertainties surrounding the Company's new corporate strategy (focused on commercial execution of LUPKYNIS) announced in February. We believe that if we choose to ignore and do not respond to these alarming developments, we may only see our shareholder value further eroding going forward.

In response to these concerning developments, we wrote to management and the Board of the Company in March, and have voiced our concerns and requested changes to the management and also the Board's role as the supervisor of management's performance. However, we only received inadequate responses from the Company reciting its prior statements.

As one of the long-standing shareholders, we now believe it is imperative to demand management's accountability, in order to put the Company back on track. If the Company does not change paths despite the massive losses shareholders have suffered during the past several months, it would only mean that there is no alignment of interests between company management and shareholders, and that it is time to establish a system within the Company to enforce management's accountability.

It is simply not right that while shareholders are suffering major losses, those same executives and Board members responsible for such losses continue to collect hefty amounts of compensation -- including substantial amounts of free RSUs -- from the Company as if nothing had happened. In our view, the only way we can enforce accountability is to make our Board an independent board, and what this means is that the Board composition must be changed, so that the Board may effectively act as a check and balance to Company management.

For these reasons, Mr. Greenleaf should no longer serve on the Board and should only serve as the CEO going forward. As the Company's CEO, Mr. Greenleaf will be able to continue to implement his new corporate strategy (focused on commercial execution) announced in February, while the Board without Mr. Greenleaf's participation will be able to discuss and determine the validity of the new corporate strategy independently and evaluate management's performance objectively.

In addition, given the Company's continued poor performance and its single-minded focus on LUPKYNIS (by foregoing all other growth options such as AUR 200 and AUR 300), it is important and necessary that the Board's size be kept to a bare minimum and no new board member should be allowed until after the Company has showed a clear sign of a turnaround.

In view of the foregoing, ILJIN's intends to vote as follows at the Company's upcoming annual meeting:

As explained above, Peter Greenleaf should no longer serve on the Board and should serve only as the Company's CEO going forward. Although we have previously supported Mr. Greenleaf's board membership, it has become patently clear that his influence over the Board's composition and operation is so significant and prominent that the Board cannot serve its critical role of providing independent oversight of management. While we believe the ultimate responsibility for poor management performance and destruction of shareholder value lies with Mr. Greenleaf, the Board has not and is not willing to hold Mr. Greenleaf accountable for all those management mishaps. ILJIN intends to vote "withhold" on the re-election of Peter Greenleaf to the Board.

In response to its letter to management and the Board in March, ILJIN has received a reply letter from the Board chairman, Daniel Billen. Based on his reply, Mr. Billen appears unable or unwilling to exercise any meaningful oversight over management's performance. So, in our view, Mr. Billen is unqualified to operate the Board as an independent board, and so should no longer serve on the Board. ILJIN intends to vote "withhold" on the re-election of Daniel Billen to the Board.

In September 2023, the Company agreed to add yet another member to an already-excessive Board, and ILJIN believes Dr. Robert Foster should not be elected to a full term on the Board. Given the Company's revised business strategy to focus solely on commercial execution of LUPKYNIS, ILJIN believes Dr. Foster clearly cannot add any new value to the Company's management. ILJIN intends to vote "withhold" on the election of Dr. Robert Foster to the Board.

In light of the dire performance of the Company's share price, the management compensation plan must be rejected. Following a dismal 38.6% say-on-pay vote in 2023, rather than reforming management compensation to align with stockholder interests, the Board has proposed a management compensation plan that is divorced from the Company's performance metrics, and ILJIN believes options and RSUs must not be freely granted regardless of the Company's performance -- particularly when shareholder value is utterly shattered. ILJIN believes the fact that such a management compensation plan is proposed in these dire times shows that the current Board is not performing its fiduciary duties properly and only interested in enriching corporate executives and Board members at the expense of further shareholder dilution. ILJIN intends to vote "against" the advisory resolution on executive compensation and "against" the amendment to the Company's equity incentive plan.

We echo the recent message from other shareholders, such as Lucien Selce, that the Board is severely bloated and excessively compensated. So, we agree that the Board must be downsized, and each shareholder should determine which Board members it will be voting to withhold against at this time to keep the Board to a bare minimum. While we clearly see several additional Board members having no fit for the Company's revised business strategy, we do not believe it is appropriate for us to specify those individual Board members here.

ILJIN believes that the changes above are necessary to strengthen the Board's role as a supervisor of management's performance and to enforce management accountability going forward, and respectfully request other shareholders' support for the changes.

Sincerely,

KH Sung

CEO of ILJIN SNT Co., Ltd.

Media contact: Yoonwha Lee, [email protected]

SOURCE ILJIN SNT Co., Ltd.

Executive ChangeFinancial Statement

22 Feb 2024

WINNIPEG, Manitoba, Feb. 22, 2024 (GLOBE NEWSWIRE) --Kane Biotech Inc. (TSX-V:KNE OTCQB:KNBIF) (the “Company” or “Kane Biotech” or “Kane”) announces that at the special meeting of the shareholders of the Company held on February 20, 2024, Dr. Robert Huizinga was elected as a director of the Company.

Mr. Huizinga has also been appointed by the directors of the Company as Executive Chair of the Company. In this new role in collaboration with Marc Edwards, President and Chief Executive Officer, Dr. Huizinga will devote his time to the development and implementation of strategic initiatives, including strengthening the Company’s partnerships with existing clients and fostering key relationships that lead to new business, including strategic acquisitions. In addition, he will interact with the shareholders and stakeholders of Kane. Dr. Huizinga will also be responsible for managing the business of the board of directors of Kane, ensuring that the functions identified in the charter of directors of the Company are being effectively carried out by the board of directors and its committees.

“I want to thank Philip Renaud and the entire Kane Board for their trust in me. My decision to take on the Executive Chair role at this important time for Kane is fueled by my absolute conviction in the potential of Kane’s portfolio to transform wound and skin care,” said Dr. Huizinga. “I have worked on Nephrology for much of my career and have seen the devastating impact of biofilm on both chronic wounds and long-term catheters. I was fortunate to work with the Kane team on their successful 510(k) clearance of coactiv+™ Antimicrobial Wound Gel from the U.S. Food and Drug Administration (FDA) and look forward to continuing to work with the team.”

Dr. Huizinga is currently the principal of Reformation Consulting Services, and was formerly a co-founder and Executive Vice-President of Aurinia Pharmaceuticals Inc. He led the clinical development and subsequent FDA approval of voclosporin, which had first year sales of $100 million USD. Prior to that, Dr. Huizinga was the Vice President of Clinical Affairs for Isotechnika Inc, and was a clinical investigator at the University of Alberta. Dr. Huizinga holds a PhD in Organizational Leadership, a Masters in Clinical Epidemiology, holds his Nephrology certification and is a member of Sigma Theta Tau. He holds a certificate in leadership from EQUIP Leadership. Dr. Huizinga has been a member of Kane Biotech’s Scientific Advisory Board since 2018.

“I’m excited that the Board accepted my recommendation to add Robert to the Board and to appoint him to the Executive Chair role,” said Marc Edwards, President & Chief Executive Officer. “Robert has been a close ally to Kane since I became President & CEO in 2018 and we look forward to having him be part of the team as we take Kane to the next level.”

The following link includes a video with Marc Edward’s welcoming comments:

About Kane Biotech

Kane Biotech is a biotechnology company engaged in the research, development and commercialization of technologies and products that prevent and remove microbial biofilms. The Company has a portfolio of biotechnologies, intellectual property (80 patents and patents pending, trade secrets and trademarks) and products developed by the Company's own biofilm research expertise and acquired from leading research institutions. StrixNB™, DispersinB®, Aledex™, bluestem™, bluestem®, silkstem™, goldstem™, coactiv+™, coactiv+®, DermaKB™, DermaKB Biofilm™ and revyveTM are trademarks of Kane Biotech Inc. The Company is listed on the TSX Venture Exchange under the symbol "KNE" and on the OTCQB Venture Market under the symbol “KNBIF”.

For more information:

Marc Edwards

Ray Dupuis

Chief Executive Officer

Chief Financial Officer

Kane Biotech Inc.

Kane Biotech Inc.

medwards@kanebiotech.com

rdupuis@kanebiotech.com

Neither TSX Venture Exchange nor its Regulation Services Provider (as that term is defined in policies of the TSX Venture Exchange) accepts responsibility for the adequacy or accuracy of this release.

Caution Regarding Forward-Looking Information

This press release contains certain statements regarding Kane Biotech Inc. that constitute forward-looking information under applicable securities law. These statements reflect management’s current beliefs and are based on information currently available to management. Certain material factors or assumptions are applied in making forward-looking statements, and actual results may differ materially from those expressed or implied in such statements. These risks and uncertainties include, but are not limited to, risks relating to the Company’s: (a) financial condition, including lack of significant revenues to date and reliance on equity and other financing; (b) business, including its early stage of development, government regulation, market acceptance for its products, rapid technological change and dependence on key personnel; (c) intellectual property including the ability of the Company to protect its intellectual property and dependence on its strategic partners; and (d) capital structure, including its lack of dividends on its common shares, volatility of the market price of its common shares and public company costs. Further information about these and other risks and uncertainties can be found in the disclosure documents filed by the Company with applicable securities regulatory authorities, available at . The Company cautions that the foregoing list of factors that may affect future results is not exhaustive.

Executive ChangeDrug Approval

18 Jan 2024

WINNIPEG, Manitoba, Jan. 18, 2024 (GLOBE NEWSWIRE) -- Kane Biotech Inc. (TSX-V:KNE OTCQB:KNBIF) (the “Company”, “Kane” or “Kane Biotech”) announces today that on February 20, 2024, the Company will hold a special meeting of its shareholders (the “Meeting”) to consider the election of Dr. Robert Huizinga as an additional director of the Company. The information circular and other materials with respect to the Meeting will be filed on SEDAR+ by the Company in due course. Dr. Huizinga is currently the principal of Reformation Consulting Services. He was formerly the Executive Vice-President of Aurinia Pharmaceuticals Inc (NASDAQ:AUPH) and led the clinical development of voclosporin which had first year sales of $100 million USD. Prior to that, Dr. Huizinga was the Vice President of Clinical Affairs for Isotechnika Inc, and was a clinical investigator at the University of Alberta. Dr. Huizinga holds a PhD in Organizational Leadership, a Masters in Clinical Epidemiology, holds his Nephrology certification and is a member of Sigma Theta Tau. He holds a certificate in leadership from EQUIP Leadership. Dr. Huizinga has been a member of Kane Biotech’s Scientific Advisory Board since 2018. About Kane Biotech Kane Biotech is a biotechnology company engaged in the research, development and commercialization of technologies and products that prevent and remove microbial biofilms. The Company has a portfolio of biotechnologies, intellectual property (80 patents and patents pending, trade secrets and trademarks) and products developed by the Company's own biofilm research expertise and acquired from leading research institutions. StrixNB™, DispersinB®, Aledex™, bluestem™, bluestem®, silkstem™, goldstem™, coactiv+™, coactiv+®, DermaKB™, DermaKB Biofilm™, and revyve™ are trademarks of Kane Biotech Inc. The Company is listed on the TSX Venture Exchange under the symbol "KNE" and on the OTCQB Venture Market under the symbol “KNBIF”. For more information:

Marc EdwardsRay DupuisNicole SendeyChief Executive OfficerChief Financial OfficerInvestor Relations/PRKane Biotech Inc.Kane Biotech Inc.Kane Biotech Inc.medwards@kanebiotech.comrdupuis@kanebiotech.comnsendey@kanebiotech.com Notes to Editor/References: Neither TSX Venture Exchange nor its Regulation Services Provider (as that term is defined in policies of the TSX Venture Exchange) accepts responsibility for the adequacy or accuracy of this release. Caution Regarding Forward-Looking InformationThis press release contains certain statements regarding Kane Biotech Inc. that constitute forward-looking information under applicable securities law. These statements reflect management’s current beliefs and are based on information currently available to management. Certain material factors or assumptions are applied in making forward-looking statements, and actual results may differ materially from those expressed or implied in such statements. These risks and uncertainties include, but are not limited to, risks relating to the Company’s: (a) financial condition, including lack of significant revenues to date and reliance on equity and other financing; (b) business, including its early stage of development, government regulation, market acceptance for its products, rapid technological change and dependence on key personnel; (c) intellectual property including the ability of the Company to protect its intellectual property and dependence on its strategic partners; and (d) capital structure, including its lack of dividends on its common shares, volatility of the market price of its common shares and public company costs. Further information about these and other risks and uncertainties can be found in the disclosure documents filed by the Company with applicable securities regulatory authorities, available at www.sedarplus.ca. The Company cautions that the foregoing list of factors that may affect future results is not exhaustive.

Executive Change

100 Deals associated with Isotechnika, Inc.

Login to view more data

100 Translational Medicine associated with Isotechnika, Inc.

Login to view more data

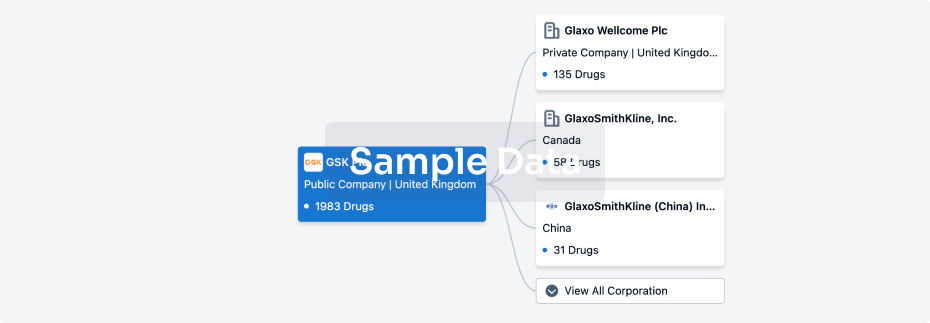

Corporation Tree

Boost your research with our corporation tree data.

login

or

Pipeline

Pipeline Snapshot as of 15 Dec 2025

The statistics for drugs in the Pipeline is the current organization and its subsidiaries are counted as organizations,Early Phase 1 is incorporated into Phase 1, Phase 1/2 is incorporated into phase 2, and phase 2/3 is incorporated into phase 3

Other

1

Login to view more data

Current Projects

| Drug(Targets) | Indications | Global Highest Phase |

|---|---|---|

TAFA-93 ( mTOR ) | Graft Rejection More | Discontinued |

Login to view more data

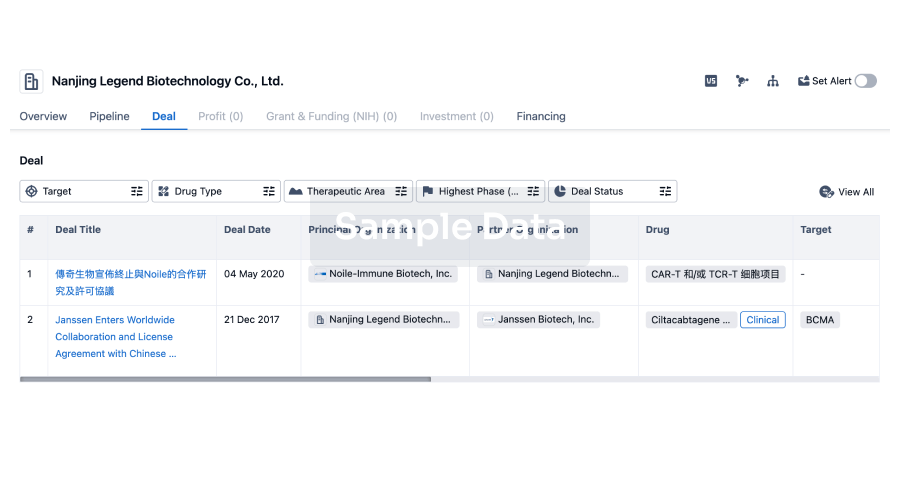

Deal

Boost your decision using our deal data.

login

or

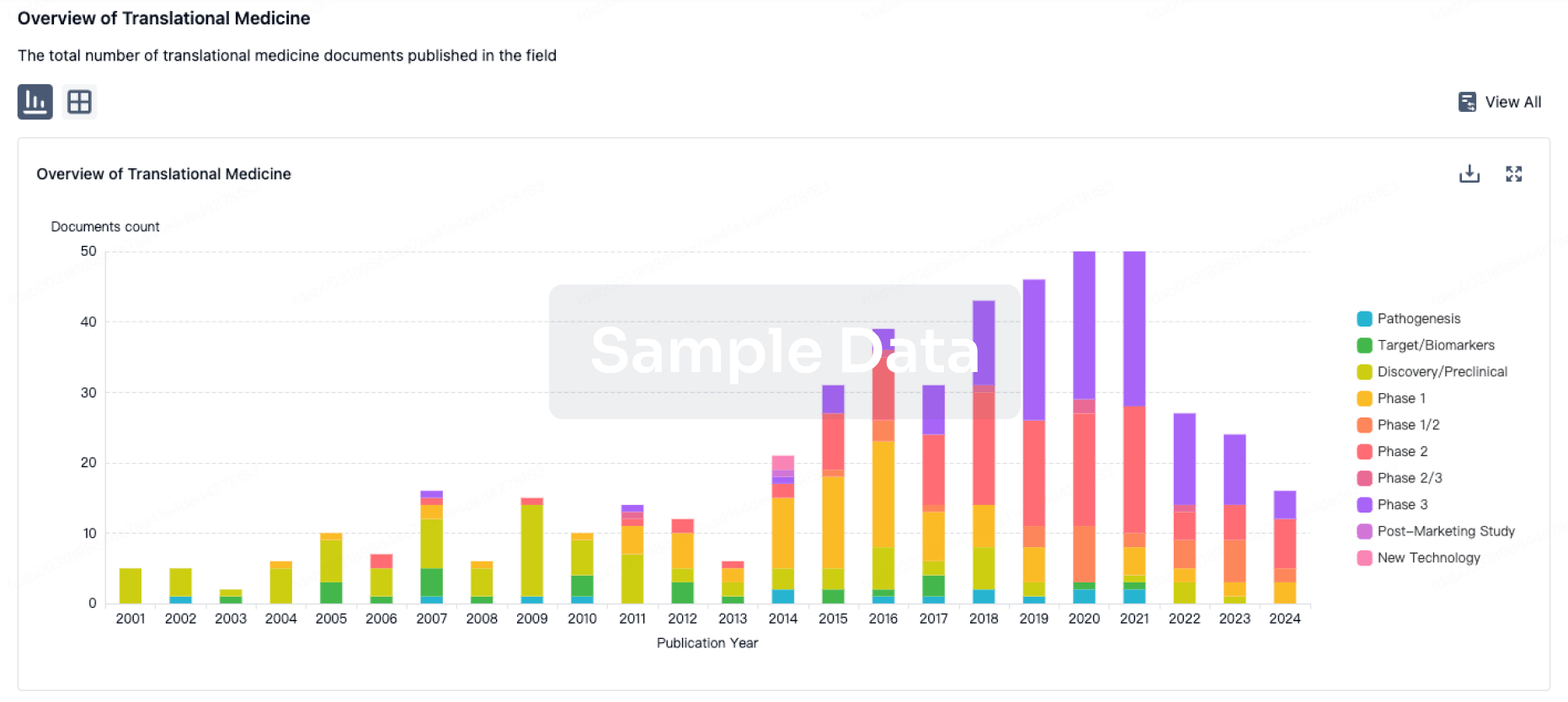

Translational Medicine

Boost your research with our translational medicine data.

login

or

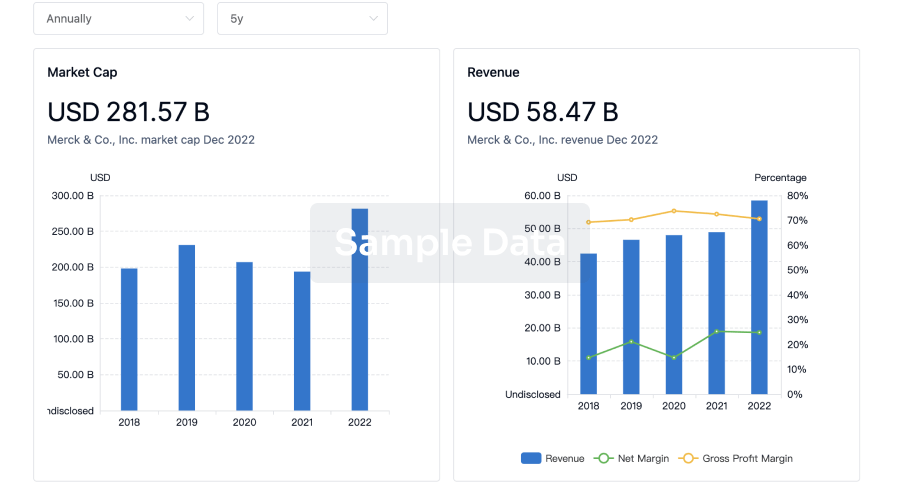

Profit

Explore the financial positions of over 360K organizations with Synapse.

login

or

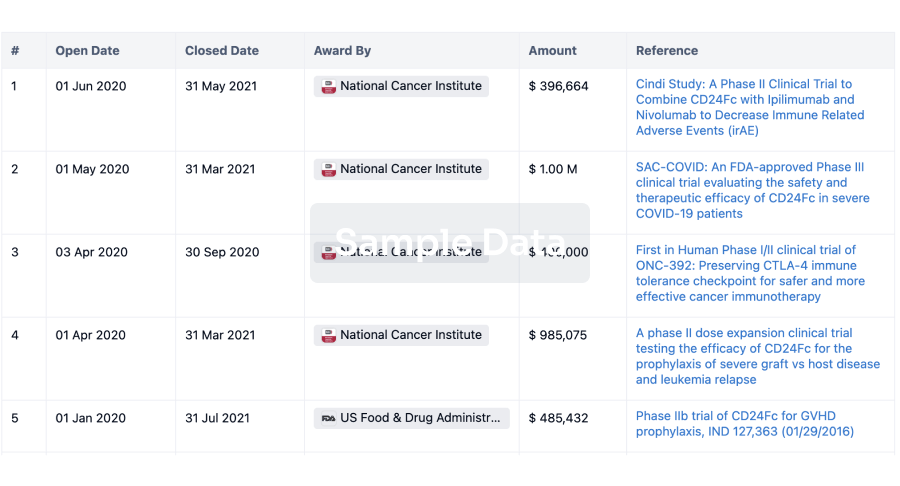

Grant & Funding(NIH)

Access more than 2 million grant and funding information to elevate your research journey.

login

or

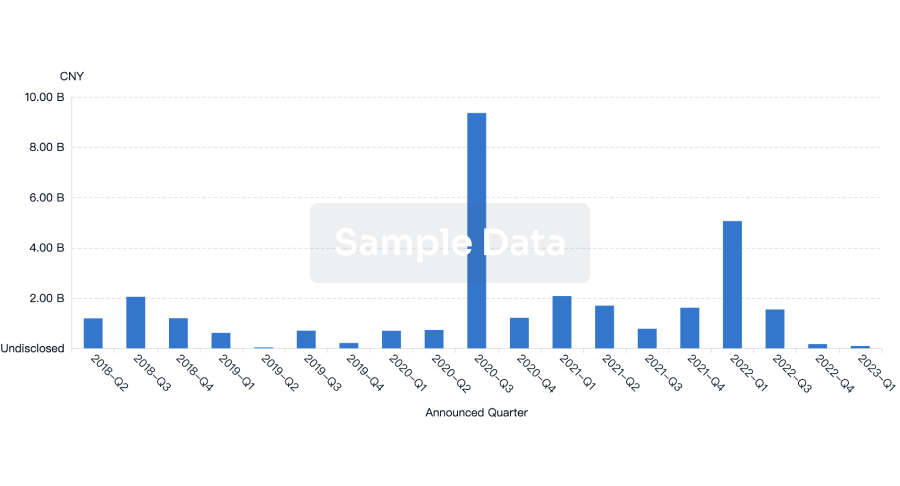

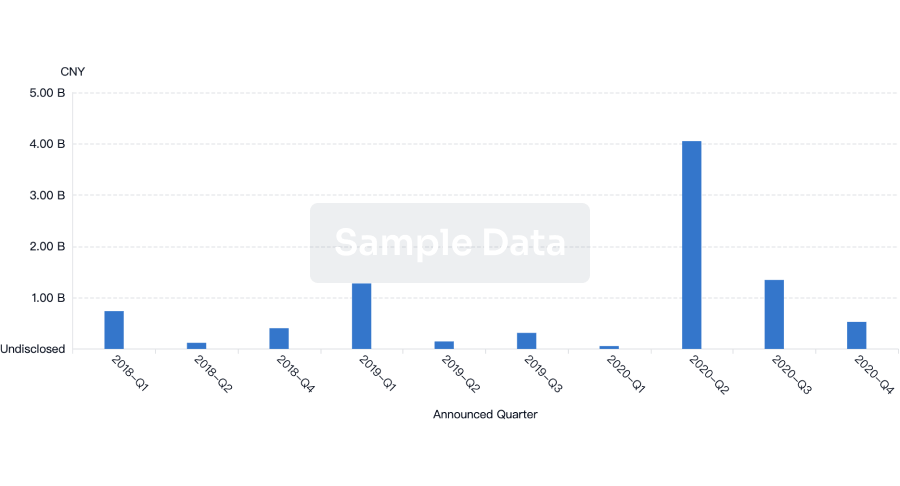

Investment

Gain insights on the latest company investments from start-ups to established corporations.

login

or

Financing

Unearth financing trends to validate and advance investment opportunities.

login

or

AI Agents Built for Biopharma Breakthroughs

Accelerate discovery. Empower decisions. Transform outcomes.

Get started for free today!

Accelerate Strategic R&D decision making with Synapse, PatSnap’s AI-powered Connected Innovation Intelligence Platform Built for Life Sciences Professionals.

Start your data trial now!

Synapse data is also accessible to external entities via APIs or data packages. Empower better decisions with the latest in pharmaceutical intelligence.

Bio

Bio Sequences Search & Analysis

Sign up for free

Chemical

Chemical Structures Search & Analysis

Sign up for free