Request Demo

Last update 01 Apr 2025

Restoration Robotics, Inc.

Public Company | Subsidiary Company|

2002|

California, United States

| 100-250

| NASDAQ: HAIR| Public Company | Subsidiary Company|

2002|

California, United States

| 100-250

| NASDAQ: HAIR| Last update 01 Apr 2025

Overview

Related

2

Clinical Trials associated with Restoration Robotics, Inc.NCT02914587

Computer-Assisted Hair Implantation Using ARTAS System VS Manual Implantation Technique Hair Restoration Study

To investigate and compare the safety and effectiveness of the ARTAS™ System to manual hair follicle implantation method following a nine month period of post-procedure evaluation.

Start Date01 Aug 2016 |

Sponsor / Collaborator |

NCT00926211

Safety and Efficacy of Computer-Assisted vs. Manual Hair Follicle Harvest: A Comparative Hair Count Study

The objective of this clinical study is to investigate and compare the safety and efficacy of the Restoration Robotics Computer-Assisted Harvesting System to the manual hair follicle harvesting method following a nine-month period of post-procedural evaluation.

Start Date01 Jun 2009 |

Sponsor / Collaborator |

100 Clinical Results associated with Restoration Robotics, Inc.

Login to view more data

0 Patents (Medical) associated with Restoration Robotics, Inc.

Login to view more data

1

Literatures (Medical) associated with Restoration Robotics, Inc.01 Jan 2013·Acta neurochirurgica. Supplement

The Birth of Human Stereotactic Surgery

Article

Author: Gildenberg, Philip L

Stereotactic surgery began with the Horsley-Clarke apparatus which has been used in animal research since 1908. In 1947, Spiegel and Wycis introduced stereotactic surgery in human patients. Their initial choice of target involved the extrapyramidal system, which Russell Meyers had recently performed with craniotomy and manual lesions that might alleviate symptoms of movement disorders, albeit with significant morbidity and mortality, a problem not seen with stereotactic surgery.

2

News (Medical) associated with Restoration Robotics, Inc.19 Jan 2024

TORONTO, Jan. 19, 2024 (GLOBE NEWSWIRE) -- Venus Concept, Inc. (“Venus Concept” or the “Company”) (NASDAQ: VERO), a global medical aesthetic technology leader, announced today that it has issued new secured convertible notes to EW Healthcare Partners, L.P. and one of its affiliates (“EW Healthcare”) in an aggregate principal amount of $2.0 million. The convertible notes have a maturity date of December 9, 2025 and an annual interest rate of 90-day Adjusted SOFR + 8.5% that is payable in kind on a quarterly basis. The notes are convertible at any time into shares of common stock of the Company (“Common Stock”) at an initial conversion price of $1.251 per share, subject to adjustment. The convertible notes include a mandatory redemption provision for part or all of the notes upon the Company or Venus Concept USA Inc. receiving payments in connection with employee retention credits, and the occurrence of certain specified events.

“I want to thank EW Healthcare for their valuable partnership and support of the Company over many years,” said Rajiv De Silva, Chief Executive Officer of Venus Concept. “While our fourth quarter 2023 revenue results were softer-than-expected due to the impact of restructuring activities related to improving profitability in our international markets and the difficult financing environment for customers in all markets including the US, we are pleased to deliver on our primary objective for 2023 - to reduce our cash used in operations by approximately 50% year-over-year. This new debt financing provides Venus Concept with additional liquidity to support ongoing operations and execution of our near-to-intermediate term strategic turnaround objectives.”

Additional information regarding the convertible notes will be set forth in a Current Report on Form 8-K, which the Company expects to the Securities and Exchange Commission (“SEC”) today.

The offer and sale of the foregoing securities are being made in a transaction not involving a public offering and have not been registered under the Securities Act of 1933, as amended (the “1933 Act”), or applicable state securities laws. The securities may not be offered or sold in the United States absent registration or pursuant to an exemption from the registration requirements of the Securities Act and applicable state securities laws. The Company has agreed to registration statement covering the resale of the Common Stock issuable upon conversion of the notes.

This press release does not constitute an offer to sell or the solicitation of an offer to buy the securities in the described offering, nor shall there be any offer, solicitation or sale of the securities in any jurisdiction in which such offer, solicitation or sale would be unlawful prior to registration or qualification under the securities laws of any such jurisdiction.

Cautionary Statement Regarding Forward-Looking Statements

This communication contains “forward-looking” statements within the meaning of Section 27A of the 1933 Act and Section 21E of the Securities Exchange Act of 1934, as amended, including, without limitation, statements about the Company’s financial condition, and other statements containing the words “expect,” “intend,” “may,” “will,” and similar expressions, constitute forward-looking statements within the meaning of The Private Securities Litigation Reform Act of 1995. These forward-looking statements are based on current expectations, estimates, forecasts, and projections about the Company’s business and the industry in which it operates and management’s beliefs and assumptions and are not guarantees of future performance or developments and involve known and unknown risks, uncertainties, and other factors that are in some cases beyond the Company’s control. Factors that could materially affect the Company’s business operations and financial performance and condition include, but are not limited to, those risks and uncertainties described under Part I Item 1A—“Risk Factors” in the Company’s most recent Annual Report on Form 10-K, Part II Item 1A—“Risk Factors” in the Company’s most recent Form 10-Q and in other documents the Company may the SEC. You are urged to consider these factors carefully in evaluating the forward-looking statements and are cautioned not to place undue reliance on the forward-looking statements. The forward-looking statements are based on information available to the Company as of the date hereof. Unless required by law, the Company does not intend to publicly update or revise any forward-looking statements to reflect new information or future events or otherwise.

About Venus Concept

Venus Concept is an innovative global medical aesthetic technology leader with a broad product portfolio of minimally invasive and non-invasive medical aesthetic and hair restoration technologies and reach in over 60 countries and 14 direct markets. Venus Concept’s product portfolio consists of aesthetic device platforms, including Venus Versa, Venus Legacy, Venus Velocity, Venus Fiore, Venus Viva, Venus Glow, Venus Bliss, Venus BlissMAX, Venus Epileve, Venus Viva MD and AI.ME. Venus Concept’s hair restoration systems include NeoGraft® and the ARTAS iX® Robotic Hair Restoration system. Venus Concept has been backed by leading healthcare industry growth equity investors including EW Healthcare Partners (formerly Essex Woodlands), HealthQuest Capital, Longitude Capital Management, Aperture Venture Partners, and Masters Special Situations.

Investor Relations Contact:

ICR Westwicke on behalf of Venus Concept:

Mike Piccinino, CFA

VenusConceptIR@westwicke.com

30 Mar 2023

Record full-year 2022 total revenue of EUR 55.1 million ($58.0 million) increased 25.1% over full-year 2021

Full-year HIFU revenue was EUR 15.6 million (USD 16.4 million), an increase of 57.7% as compared to EUR 9.9 million (USD 11.7 million) for the full-year 2021

Record Q4 2022 total revenue of EUR 15.7 million ($16.2 million) versus EUR 14.0 million ($15.9 million) for Q4 2021

Ended the year with a strong cash position of EUR 63.1 million ($67.5 million) as of December 31, 2022

Ryan Rhodes to succeed Marc Oczachowski as Chief Executive Officer of the Company, effective May 1, 2023

Company to host conference call and webcast today, March 30th, at 8:30 a.m. ET

LYON, France, March 30, 2023 -- EDAP TMS SA (Nasdaq: EDAP) (the “Company”), a global leader in robotic energy-based therapies, announced today unaudited financial results for the fourth quarter and full-year 2022 and announced a change in its leadership, effective May 1, 2023.

In line with EDAP’s Global Group Strategy, and its focus on expansion in the United States and rest of world markets, the Board of Directors has decided to embark on a new era of leadership for the Company. The Board has therefore unanimously appointed Ryan Rhodes Chief Executive Officer of EDAP TMS effective May 1, 2023 to lead, strengthen and accelerate the Company’s development. Marc Oczachowski will continue to serve as Chairman of the Board of the Company.

Mr. Rhodes has over 30 years of leadership experience in market development in the medical device industry, including 20 years dedicated to medical robotics. Prior to joining EDAP, he served as Chief Executive Officer of Restoration Robotics, where he led the company to a successful merger with Venus Concept Inc. in 2019. He also held leadership positions at Intuitive Surgical, and Ethicon Inc., a Johnson & Johnson Company.

Marc Oczachowski, EDAP's Chairman and Chief Executive Officer, said: “In 2022, EDAP delivered another strong year of financial and operational performance, achieving record revenue and more than doubling worldwide Focal One sales compared to 2021. With EDAP experiencing strong positive HIFU momentum, particularly in the U.S., we have now reached a key inflection point to make this transition and to further accelerate our global expansion. I have enjoyed working with Ryan for almost two years. His leadership and knowledge of the industry, combined with his acute understanding of global commercial market development, are excellent assets for EDAP. I have complete confidence in Ryan’s ability to continue to accelerate the growth and development of the Company in support of its ongoing strategic objectives.”

Ryan Rhodes, Chief Executive Officer of EDAP US, stated, “During the fourth quarter, we achieved a record of nine Focal One transactions in the U.S., reflecting the growing appreciation for the clinical value of Focal One by both large academic healthcare institutions as well as local community hospitals. 2022 was a critical year in the adoption of Focal One robotic HIFU and the growth of this therapeutic option as part of the comprehensive management of prostate cancer. The number of U.S. sites selecting Focal One doubled over the previous year, and we saw positive momentum in the advancement of U.S. society guidelines with focal ablation. Our team and capacity have grown to be well positioned to drive even greater clinical and market expansion in 2023.”

Ryan Rhodes added: "I am very pleased to be appointed Chief Executive Officer of the EDAP TMS group, and I am grateful to both Marc and the EDAP Board for their continued confidence in my abilities. I am excited to lead EDAP’s global strategy to a new era of growth as we continue to build and expand our winning organization across the U.S. and international markets.”

Full-Year 2022 Results

Total revenue for the full year 2022 was EUR 55.1 million ($58.0 million), representing an increase of 25.1% over full-year 2021 total revenue of EUR 44.1 million ($51.9 million).

Total revenue in the HIFU business for the full year 2022 was EUR 15.6 million (USD 16.4 million), an increase of 57.7% as compared to EUR 9.9 million (USD 11.7 million) for the full year 2021.

Total revenue in the LITHO business for the full year 2022 was EUR 11.6 million (USD 12.2 million), an increase of 5.0% from EUR 11.0 million (USD 13.0 million) for the full year 2021.

Total revenue in the Distribution business for the full year 2022 was EUR 27.9 million (USD 29.4 million), a 20.6% increase compared to EUR 23.1 million (USD 27.3 million) for the full year 2021.

Gross profit for the twelve months ended December 31, 2022, was EUR 24.2 million (USD 25.4 million), compared to EUR 18.4 million (USD 21.7 million) for the year-ago period. Gross profit margin on net sales was 43.9% for the twelve months ended December 31, 2022, compared to 41.8% for the comparable period in 2021. The increase in gross profit year-over-year was due to higher sales effect on fixed costs, particularly in the HIFU business.

Operating expenses were EUR 28.5 million (USD 29.90 million) for the twelve months ended December 31, 2022, compared to EUR 20.0 million (USD 23.6 million) for the same period in 2021.

Operating loss for the twelve months ended December 31, 2022, was EUR 4.3 million (USD 4.5 million), compared to an operating loss of EUR 1.6 million (USD 1.9 million) for the twelve months ended December 31, 2021.

Net loss for the twelve months ended December 31, 2022, was EUR 2.9 million (USD 3.1 million), or EUR (0.09) per diluted share, as compared to net income of EUR 0.7 million (USD 0.8 million), or EUR 0.02 per diluted share in the year-ago period.

As of December 31, 2022, the company held cash, cash equivalents and short-term investments of EUR 63.1 million ($67.5 million), as compared to EUR 47.2 million (USD 53.4 million) as of December 31, 2021.

Fourth Quarter 2022 Results

Total revenue for the fourth quarter 2022 was EUR 15.7 million (USD 16.2 million), a 12.8% increase as compared to total revenue of EUR 14.0 million (USD 15.9 million) for the same period in 2021.

Total revenue in the HIFU business for the fourth quarter 2022 was EUR 5.4 million (USD 5.5 million), an increase of 27.9% as compared to EUR 4.2 million (USD 4.8 million) for the fourth quarter of 2021.

Total revenue in the LITHO business for the fourth quarter 2022 was EUR 3.6 million (USD 3.7 million), an increase of 7.5% as compared to EUR 3.3 million (USD 3.8 million) for the fourth quarter of 2021.

Total revenue in the Distribution business for the fourth quarter 2022 was EUR 6.7 million (USD 7.0 million), a 5.0% increase compared to EUR 6.4 million (USD 7.3 million) for the fourth quarter of 2021.

Gross profit for the fourth quarter 2022 was EUR 7.2 million (USD 7.4 million), compared to EUR 6.2 million (USD 7.1 million) for the year-ago period. Gross profit margin on net sales was 45.9% in the fourth quarter of 2022, compared to 44.5% in the year-ago period. The increase in gross profit year-over-year was driven by the higher sales effect on fixed costs.

Operating expenses were EUR 8.8 million (USD 9.1 million) for the fourth quarter of 2022, compared to EUR 5.8 million (USD 6.5 million) for the same period in 2021.

Operating loss for the fourth quarter of 2022 was EUR 1.6 million (USD 1.6 million), compared to an operating profit of EUR 0.5 million (USD 0.5 million) in the fourth quarter of 2021.

Net loss for the fourth quarter of 2022 was EUR 5.1 million (USD 5.3 million), or EUR (0.14) per diluted share, as compared to net income of EUR 1.4 million (USD 1.6 million), or EUR 0.04 per diluted share in the year-ago period.

Conference Call

An accompanying conference call and webcast will be conducted by management to review the results. The call will be held at 8:30 a.m. ET today, March 30th, 2023. Please refer to the information below for conference call dial-in information and webcast registration.

Conference Call & Webcast

Thursday, March 30th, 2023 @ 8:30 a.m. ET

Domestic: 877-451-6152

International: 201-389-0879

Passcode: 13736071

Webcast link: Here

Following the live call, a replay will be available on the Company's website, under "Investors Information."

About EDAP TMS SA

A recognized leader in the global therapeutic ultrasound market, EDAP TMS develops, manufactures, promotes and distributes worldwide minimally invasive medical devices for various pathologies using ultrasound technology. By combining the latest technologies in imaging and treatment modalities in its complete range of Robotic HIFU devices, EDAP TMS introduced the Focal One® in Europe and in the U.S. as an answer to all requirements for ideal prostate tissue ablation. With the addition of the ExactVu™ Micro-Ultrasound device, EDAP TMS is now the only company offering a complete solution from diagnostics to focal treatment of Prostate Cancer. EDAP TMS also produces and distributes other medical equipment including the Sonolith® i-move lithotripter and lasers for the treatment of urinary tract stones using extra-corporeal shockwave lithotripsy (ESWL). For more information on the Company, please visit and us.hifu-prostate.com and

Forward-Looking Statements

In addition to historical information, this press release contains forward-looking statements within the meaning of applicable federal securities laws, including Section 27A of the U.S. Securities Act of 1933 (the “Securities Act”) or Section 21E of the U.S. Securities Exchange Act of 1934, which may be identified by words such as “believe,” “can,” “contemplate,” “could,” “plan,” “intend,” “is designed to,” “may,” “might,” “potential,” “objective,” “target,” “project,” “predict,” “forecast,” “ambition,” “guideline,” “should,” “will,” “estimate,” “expect” and “anticipate,” or the negative of these and similar expressions, which reflect our views about future events and financial performance. Such statements are based on management's current expectations and are subject to a number of risks and uncertainties, including matters not yet known to us or not currently considered material by us, and there can be no assurance that anticipated events will occur or that the objectives set out will actually be achieved. Important factors that could cause actual results to differ materially from the results anticipated in the forward-looking statements include, among others, the clinical status and market acceptance of our HIFU devices and the continued market potential for our lithotripsy and distribution divisions, as well as risks associated with the current worldwide inflationary environment, the uncertain worldwide economic, political and financial environment, geopolitical instability, climate change and pandemics like the COVID 19 pandemic, or other public health crises, and their related impact on our business operations, including their impacts across our businesses or demand for our devices and services.

Other factors that may cause such a difference may also include, but are not limited to, those described in the Company's filings with the Securities and Exchange Commission and in particular, in the sections "Cautionary Statement on Forward-Looking Information" and "Risk Factors" in the Company's Annual Report on Form 20-F.

Forward-looking statements speak only as of the date they are made. Other than required by law, we do not undertake any obligation to update them in light of new information or future developments. These forward-looking statements are based upon information, assumptions and estimates available to us as of the date of this press release, and while we believe such information forms a reasonable basis for such statements, such information may be limited or incomplete.

Company Contact

Blandine Confort

Investor Relations / Legal Affairs

EDAP TMS SA

+33 4 72 15 31 50

bconfort@edap-tms.com

Investor Contact

John Fraunces

LifeSci Advisors, LLC

917-355-2395

jfraunces@lifesciadvisors.com

EDAP TMS S.A.

UNAUDITED CONDENSED CONSOLIDATED STATEMENTS OF OPERATIONS

(Amounts in thousands of Euros and U.S. Dollars, except per share data)

Three Months Ended:

Three Months Ended:

December 31,

December 31,

December 31,

December 31,

2022

2021

2022

2021

Euros

Euros

$US

$US

Sales of medical equipment

11,493

9,864

11,840

11,231

Net Sales of RPP and Leases

1,441

1,387

1,484

1,579

Sales of spare parts, supplies and Services

2,784

2,720

2,868

3,097

TOTAL NET SALES

15,718

13,971

16,192

15,907

Other revenues

—

1

—

2

TOTAL REVENUES

15,718

13,973

16,192

15,909

Cost of sales

(8,500)

(7,762)

(8,756)

(8,837)

GROSS PROFIT

7,218

6,211

7,436

7,072

Research & development expenses

(1,304)

(562)

(1,344)

(640)

S, G & A expenses

(7,484)

(5,188)

(7,709)

(5,907)

Total operating expenses

(8,788)

(5,750)

(9,053)

(6,547)

OPERATING PROFIT (LOSS)

(1,570)

461

(1,617)

525

Interest (expense) income, net

297

23

306

26

Currency exchange gains (loss), net

(4,075)

786

(4,198)

895

INCOME (LOSS) BEFORE TAXES AND MINORITY INTEREST

(5,348)

1,270

(5,509)

1,446

Income tax (expense) credit

217

95

224

108

NET INCOME (LOSS)

(5,130)

1,365

(5,285)

1,554

Earning per share – Basic

(0.14)

0.04

(0.14)

0.05

Average number of shares used in computation of EPS

36,863,623

33,466,136

36,863,623

33,466,136

Earning per share – Diluted

(0.14)

0.04

(0.14)

0.05

Average number of shares used in computation of EPS for positive net income

36,863,623

33,641,317

36,863,623

33,641,317

NOTE: Translated for convenience of the reader to U.S. dollars at the 2022 average three months’ noon buying rate of 1 Euro = 1.0302 USD, and 2021 average three months noon buying rate of 1 Euro = 1.1386 USD

EDAP TMS S.A.

UNAUDITED CONDENSED CONSOLIDATED STATEMENTS OF OPERATIONS

(Amounts in thousands of Euros and U.S. Dollars, except per share data)

Year Ended:

Year Ended:

December 31,

December 31,

December 31,

December 31,

2022

2021

2022

2021

Euros

Euros

$US

$US

Sales of medical equipment

38,462

29,040

40,456

34,229

Net Sales of RPP and Leases

5,617

4,968

5,908

5,856

Sales of spare parts, supplies and Services

11,030

10,052

11,602

11,848

TOTAL NET SALES

55,108

44,060

57,966

51,932

Other revenues

—

6

—

7

TOTAL REVENUES

55,108

44,065

57,966

51,939

Cost of sales

(30,916)

(25,643)

(32,519)

(30,225)

GROSS PROFIT

24,193

18,422

25,447

21,714

Research & development expenses

(4,920)

(3,402)

(5,175)

(4,010)

S, G & A expenses

(23,530)

(16,633)

(24,751)

(19,605)

Total operating expenses

(28,450)

(20,034)

(29,925)

(23,614)

OPERATING PROFIT (LOSS)

(4,257)

(1,612)

(4,478)

(1,900)

Interest (expense) income, net

235

145

248

171

Currency exchange gains (loss), net

1,926

2,360

2,025

2,781

INCOME (LOSS) BEFORE TAXES AND MINORITY INTEREST

(2,096)

893

(2,205)

1,052

Income tax (expense) credit

(837)

(193)

(880)

(227)

NET INCOME (LOSS)

(2,933)

700

(3,085)

825

Earning per share – Basic

(0.09)

0.02

(0.09)

0.03

Average number of shares used in computation of EPS

34,392,598

32,129,047

34,392,598

32,129,047

Earning per share – Diluted

(0.09)

0.02

(0.09)

0.03

Average number of shares used in computation of EPS for positive net income

34,392,598

32,422,871

34,392,598

32,422,871

NOTE: Translated for convenience of the reader to U.S. dollars at the 2022 average twelve months’ noon buying rate of 1 Euro = 1.0519 USD, and 2021 average twelve months noon buying rate of 1 Euro = 1.1787 USD

EDAP TMS S.A.

UNAUDITED CONSOLIDATED BALANCE SHEETS HIGHLIGHTS

(Amounts in thousands of Euros and U.S. Dollars)

December 31,

December 31,

December 31,

December 31,

2022

2021

2022

2021

Euros

Euros

$US

$US

Cash, cash equivalents and short-term treasury investments

63,136

47,183

67,539

53,405

Account receivables, net

14,943

12,118

15,985

13,716

Inventory

11,780

7,499

12,601

8,487

Other current assets

660

581

706

658

TOTAL CURRENT ASSETS

90,518

67,382

96,832

76,267

Property, plant and equipment, net

5,984

5,173

6,401

5,855

Goodwill

2,412

2,412

2,580

2,730

Other non-current assets

2,210

2,260

2,364

2,558

TOTAL ASSETS

101,123

77,226

108,177

87,409

Accounts payable & other accrued liabilities

13,087

10,786

14,000

12,208

Deferred revenues, current portion

4,050

3,408

4,333

3,857

Short term borrowing

1,846

1,914

1,975

2,167

Other current liabilities

2,725

1,843

2,916

2,086

TOTAL CURRENT LIABILITIES

21,708

17,951

23,223

20,318

Obligations under operating and finance leases non-current

1,222

1,318

1,308

1,492

Long term debt, non-current

3,587

4,930

3,837

5,580

Deferred revenues, non-current

264

440

282

498

Other long term liabilities

2,710

2,534

2,899

2,868

TOTAL LIABILITIES

29,492

27,172

31,549

30,755

TOTAL SHAREHOLDERS’EQUITY

71,632

50,054

76,628

56,655

TOTAL LIABILITIES & SHAREHOLDERS’ EQUITY

101,123

77,226

108,177

87,409

NOTE: Translated for convenience of the reader to U.S. dollars at the noon buying rate of 1 Euro = 1.0697 USD, on December 31, 2022 and at the noon buying rate of 1 Euro = 1.1319 USD, on December 31, 2021.

EDAP TMS S.A.

UNAUDITED CONSOLIDATED STATEMENTS OF CASH FLOWS

(Amounts in thousands of Euros)

Year Ended

Twelve Months Ended

Year Ended

Twelve Months Ended

December 31,

December 31,

December 31,

December 31,

2022

2021

2022

2021

(Euros)

(Euros)

($US)

($US)

NET INCOME (LOSS)

(2,933)

700

(3,085)

825

Adjustments to reconcile net income (loss) to net cash generated by (used in) operating activities(1)

4,225

3,225

4,444

3,801

OPERATING CASH FLOW

1,292

3,925

1,359

4,626

Increase/Decrease in operating assets and liabilities

(4,316)

520

(4,539)

613

NET CASH GENERATED BY (USED IN) OPERATING ACTIVITIES

(3,024)

4,445

(3,180)

5,239

Short term investments

—

—

—

—

Additions to capitalized assets produced by the company and other capital expenditures

(2,378)

(1,638)

(2,501)

(1,931)

NET CASH GENERATED BY (USED IN) INVESTING ACTIVITIES

(2,378)

(1,638)

(2,501)

(1,931)

NET CASH GENERATED BY (USED IN) FINANCING ACTIVITIES

21,741

20,266

22,869

23,887

NET EFFECT OF EXCHANGE RATE CHANGES ON CASH AND CASH EQUIVALENTS

(388)

(585)

(3,053)

(3,992)

NET INCREASE (DECREASE) IN CASH AND CASH EQUIVALENTS

15,952

22,488

14,134

23,204

(1) including share based compensation expenses for 2,103 thousand of Euros for theyear ended December 31,2022 and 1,900 thousand of Euros for the full year endedDecember 31, 2021.

NOTE: Translated for convenience of the reader to U.S. dollars at the 2022 average twelve months’ noon buying rate of 1 Euro = 1.0519 USD, and 2021 average twelve months noon buying rate of 1 Euro = 1.1787 USD

EDAP TMS S.A.

UNAUDITED CONDENSED STATEMENTS OF OPERATIONS BY DIVISION

twelvemonths endedDecember 31, 2022

(Amounts in thousands of Euros)

HIFU

ESWL

Distribution

Reconciling

Total After

Division

Division

Division

Items

Consolidation

Sales of goods

9,437

4,880

24,145

—

38,462

Sales of RPPs & Leases

4,287

1,058

272

—

5,617

Sales of spare parts & services

1,909

5,630

3,491

—

11,030

TOTAL NET SALES

15,634

11,568

27,907

—

55,108

Other revenues

—

—

—

—

—

TOTAL REVENUES

15,634

11,568

27,907

—

55,108

GROSS PROFIT (% of Net Sales)

8,846

56.6

%

4,836

41.8

%

10,511

37.7

%

—

24,193

43.9

%

Research & Development

(3,525)

(950)

(444)

—

(4,920)

Total SG&A plus depreciation

(10,214)

(2,964)

(8,099)

(2,254)

(23,530)

OPERATING PROFIT (LOSS)

(4,894)

922

1,968

(2,254)

(4,257)

Attachment

2023 - 03 - 30 -- EDAP FY2022 Strategy - FINAL2

Financial StatementExecutive Change

100 Deals associated with Restoration Robotics, Inc.

Login to view more data

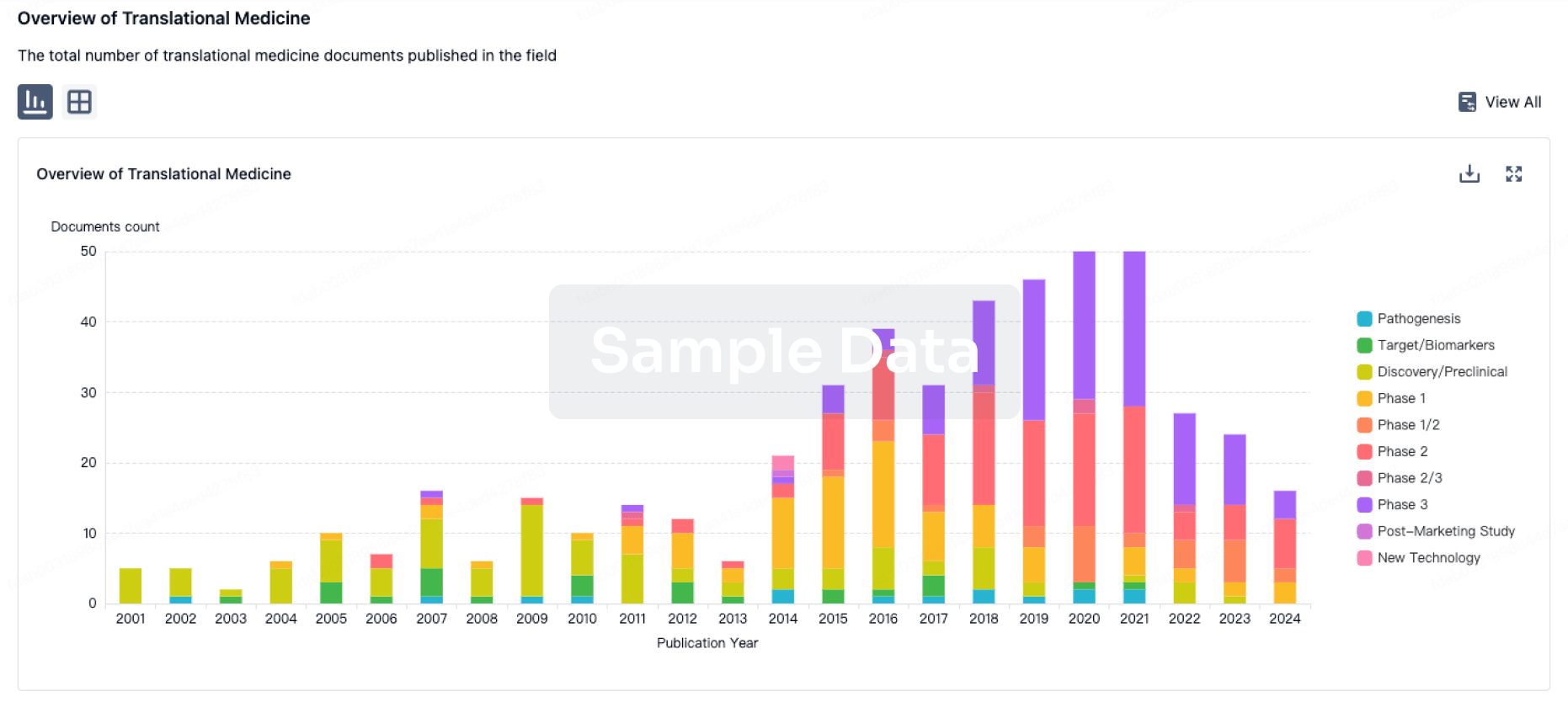

100 Translational Medicine associated with Restoration Robotics, Inc.

Login to view more data

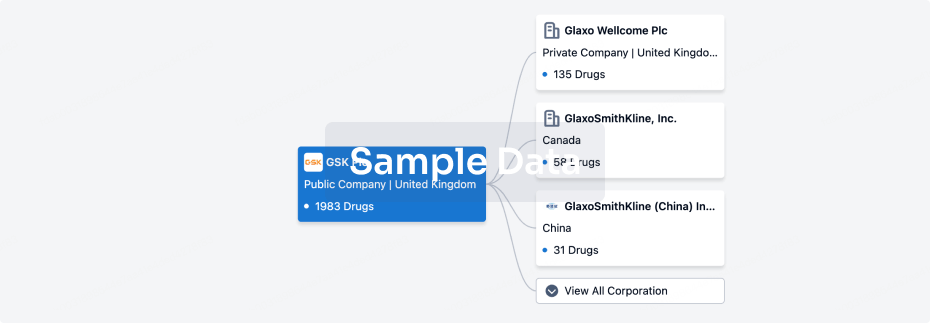

Corporation Tree

Boost your research with our corporation tree data.

login

or

Pipeline

Pipeline Snapshot as of 29 Apr 2025

No data posted

Login to keep update

Deal

Boost your decision using our deal data.

login

or

Translational Medicine

Boost your research with our translational medicine data.

login

or

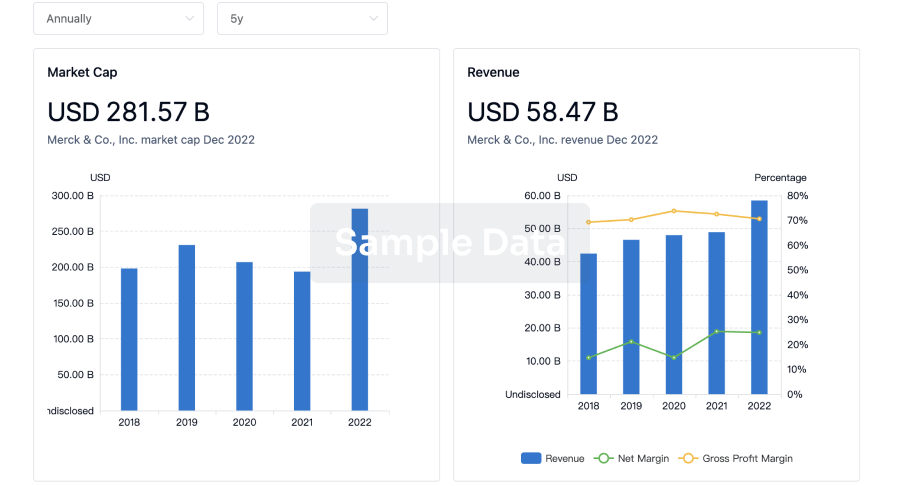

Profit

Explore the financial positions of over 360K organizations with Synapse.

login

or

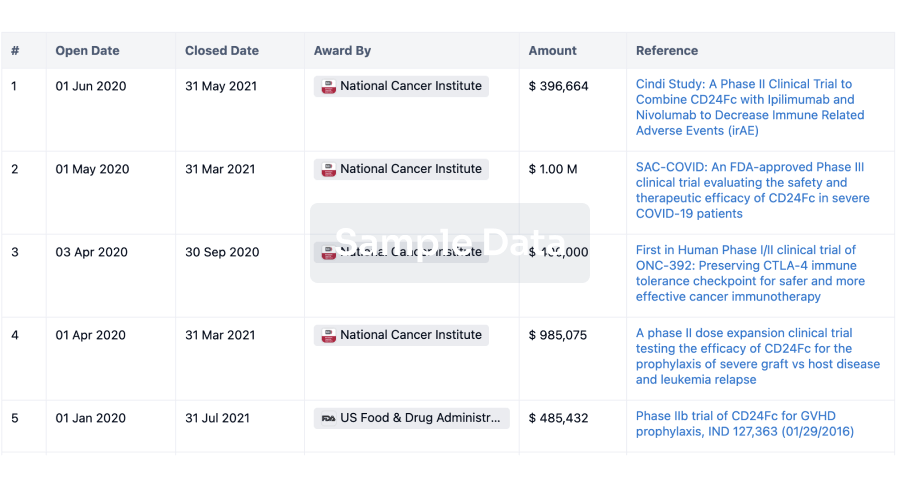

Grant & Funding(NIH)

Access more than 2 million grant and funding information to elevate your research journey.

login

or

Investment

Gain insights on the latest company investments from start-ups to established corporations.

login

or

Financing

Unearth financing trends to validate and advance investment opportunities.

login

or

Chat with Hiro

Get started for free today!

Accelerate Strategic R&D decision making with Synapse, PatSnap’s AI-powered Connected Innovation Intelligence Platform Built for Life Sciences Professionals.

Start your data trial now!

Synapse data is also accessible to external entities via APIs or data packages. Empower better decisions with the latest in pharmaceutical intelligence.

Bio

Bio Sequences Search & Analysis

Sign up for free

Chemical

Chemical Structures Search & Analysis

Sign up for free