Request Demo

Last update 27 Aug 2025

Nodus Oncology Ltd.

Last update 27 Aug 2025

Overview

Basic Info

Introduction Nodus Oncology Ltd. is a British company located in Edinburgh. The firm develops DDR targeting therapies. It was founded in 2020. Ian David Waddell is the current CEO of the firm. Nodus Oncology Ltd. was Founded by Cumulus Oncology, |

Tags

Neoplasms

Skin and Musculoskeletal Diseases

Small molecule drug

Chemical drugs

Disease domain score

A glimpse into the focused therapeutic areas

No Data

Technology Platform

Most used technologies in drug development

No Data

Targets

Most frequently developed targets

No Data

| Disease Domain | Count |

|---|---|

| Neoplasms | 3 |

| Top 5 Drug Type | Count |

|---|---|

| Small molecule drug | 1 |

| Chemical drugs | 1 |

| Unknown | 1 |

Related

3

Drugs associated with Nodus Oncology Ltd.Target |

Mechanism NOD1 antagonists |

Active Org. |

Originator Org. |

Active Indication |

Inactive Indication- |

Drug Highest PhasePreclinical |

First Approval Ctry. / Loc.- |

First Approval Date- |

Target |

Mechanism PARG inhibitors |

Active Org. |

Originator Org. |

Active Indication |

Inactive Indication- |

Drug Highest PhasePreclinical |

First Approval Ctry. / Loc.- |

First Approval Date- |

Target |

Mechanism PARG inhibitors |

Active Org. |

Originator Org. |

Active Indication |

Inactive Indication- |

Drug Highest PhasePreclinical |

First Approval Ctry. / Loc.- |

First Approval Date- |

100 Clinical Results associated with Nodus Oncology Ltd.

Login to view more data

0 Patents (Medical) associated with Nodus Oncology Ltd.

Login to view more data

7

News (Medical) associated with Nodus Oncology Ltd.22 Aug 2024

Aug. 20, 2024 -- Cumulus Oncology, Europe’s first oncology-focused biotech creation company, announces that, in partnership with its collaborator leadXpro (LXP), key milestones have been achieved in their protein structure driven GPR68 drug discovery project. As a result, Cumulus has licensed the small molecule compounds and associated IP created during this collaboration and will continue the programme to lead optimisation and beyond.

In July 2023, Cumulus Oncology and LXP announced a collaboration to develop small molecules against GPR68, an important proton sensing G protein coupled receptor (GPCR), using the latest cutting-edge computational, biophysical and structural biology technologies. Achieving a world first, LXP has solved high-resolution antagonist protein structures of GPR68, rapidly informing compound design. This has enabled the partnership to identify, in under 12 months, a series of potent and selective small molecules for therapeutic intervention in cancer and inflammation, leading to this licensing event. The collaboration will now move to an accelerated drug optimisation phase leveraging these established cutting-edge rational drug design and computational techniques.

LXP will receive a share in revenues from future commercialisation of the project. Further financial details are not disclosed. As the GPR68 programme progresses, Cumulus plans to file for regulatory approval to start clinical development through its Swiss-based portfolio company, GIO Therapeutics, which has been incorporated to develop a portfolio of GPCR targeting assets. The GPR68 programme represents the first programme that will be developed by GIO Therapeutics.

Cumulus Oncology’s CEO Clare Wareing said, “The LeadXpro team are world leading experts in GPCR drug discovery and deciphering membrane protein structures to improve human health. This successful collaboration, and the milestones achieved, have resulted in the licensing agreement between Cumulus and LXP, exemplifying the Cumulus model. Cumulus takes a platform and modality agnostic approach to identifying new targets and assets, seeking out opportunities that have the potential to transform therapeutic options for patients poorly served by existing treatments. When these assets reach key inflection points, they are taken forward in new companies that we create and manage.”

leadXpro’s Co-founder, CEO, and Chairman of the Board, Michael Hennig added, “We’re delighted to have achieved this major drug development milestone working with Cumulus Oncology. Clare and her team share our passion for structure-based drug discovery. Together we have achieved fantastic success with our medicinal, computational chemistry, biophysics and structural biology input in a short span of time. We are looking forward to continuing the collaboration on this therapeutically important proton sensing GPCR. This continues to be a very positive relationship and shows us to be the partner of choice for structure-based drug design of novel membrane protein targets.”

Cumulus Oncology is Europe’s first biotech company creation factory dedicated to the development of novel therapeutics. It sources novel oncology assets from academic institutes, commercial drug discovery groups, and biopharmaceutical companies as well as its own internal asset search engine. An early focus on molecularly selected patient sub-groups is a key aspect of the business model. The company incorporates the use of artificial intelligence (AI) and machine learning (ML) platforms into its decision-making process to prioritize targets and assets and build patient sub-group hypotheses.

Cumulus currently has two spinout companies under management; Nodus Oncology, a DDR portfolio company where the lead asset is a PARG inhibitor program with a positive data package, and GIO Therapeutics AG which was launched in 2024, with a focus on developing therapeutics targeting GPCRs for oncology and inflammation.

Cumulus contributes both early-stage capital and oncology drug development expertise and manages each spinout company to achieve key development milestones and value inflection points. The Cumulus team has extensive drug discovery and development expertise with a collective track record in successful drug approvals over the last 20 years.

leadXpro AG is a biotechnology company specialized in structure-based drug discovery for membrane proteins. Membrane proteins are the most promising targets for drug discovery, yet also the most challenging. To unlock these targets, we bring together specialized knowledge in protein science, pioneering technologies in structural biology and expertise in ligand design and characterization. leadXpro’s research covers a range of membrane proteins, including GPCRs, ion channels, transporters, and enzymes. leadXpro acts as a research partner for a growing number of pharmaceutical, biotechnology and academic partners.

Proton-sensing G protein-coupled receptors are transmembrane receptors which sit in the outer membrane of cells. They sense changes in the acidity of the environment outside the cell and transmit this information into the cell with instructions on how to adapt. This naturally beneficial and adaptive response can go awry and/or be hijacked by cancerous or diseased cells to enable them to survive in a low pH (acidic) environment. Such receptors are an underexploited target class.

The content above comes from the network. if any infringement, please contact us to modify.

License out/inPROTACs

10 Jun 2024

EDINBURGH, Scotland, June 10, 2024 (GLOBE NEWSWIRE) -- Cumulus Oncology, Europe’s first oncology-focused biotech company creation factory, announces the appointment of Catherine Lewis La Torre to its Board of Directors. Catherine brings over thirty years of investment expertise, specialising in private equity, private debt, growth equity and venture capital. As former Chief Executive of British Business Investments, British Patient Capital, and the British Business Bank, Catherine played a pivotal role in the evolution of these organisations to support innovative companies in the UK, including in the life sciences sector. Over the course of her career, Catherine has designed and implemented ambitious private capital investment strategies, operated at partner level within various European private equity firms, collaborated with the most senior representative of the UK Government to roll out large scale loan guarantee and equity investment programs, and provided advice to global institutional investors on their private capital strategies. Clare Wareing, CEO of Cumulus Oncology said, “We’re delighted to welcome Catherine to our Board. Her extensive experience in private equity and venture capital will be invaluable as we continue to scale our company and embark on our Series A financing to support our mission to create innovative oncology-focused companies.” Catherine’s appointment comes at a pivotal time for Cumulus following the close of their £9m raise earlier this year. The company continues to scale its operations with the appointment of new team members and the initiation of additional collaborations around targets and assets. The incorporation of a high integrity data sciences strategy to drive novel target identification and build key patient sub-group intel further enhances the Cumulus business model. The allocation of early-stage capital and expertise applied to asset curation and de-risking are key differentiators for the company. Catherine Lewis La Torre, newly appointed Board Director at Cumulus Oncology said, “I am honoured to join the Board of Directors at Cumulus. Its resource efficient approach to creating companies is timely as investors seek more capital efficient ways to grow innovative companies and deliver milestones. I look forward to working with the Board and the executive team to further the company’s mission of bringing novel oncology therapeutics to market with the overarching goal of improving patient outcomes.” About Cumulus Oncology Cumulus Oncology is Europe’s first biotech company creation factory dedicated to the oncology therapeutic area. It sources novel oncology assets from academic institutes, commercial drug discovery groups, and biopharmaceutical companies. An early focus on molecularly selected patient sub-groups is a key aspect of the business model. The company incorporates the use of artificial intelligence (AI) and machine learning (ML) platforms into its decision-making process to prioritize targets and assets and build patient sub-group hypotheses. Cumulus currently has 2 spinout companies under management; Nodus Oncology a DDR portfolio company where the lead asset is a PARG inhibitor program with a positive data package, and GIO Therapeutics AG which was launched earlier this year, with a focus on developing therapeutics targeting GPCRs for oncology and inflammation. Cumulus contributes both early-stage capital and oncology drug development expertise and manages each spinout company to achieve key development milestones and value inflection points. The founding team at Cumulus consists of successful life science entrepreneurs, scientists, and a range of oncology drug development and pharma sector business professionals who have collectively taken 18 oncology assets to successful drug approval. Follow the company on LinkedIn and see the website for more information. Media Inquiries Cumulus Oncology Clare Wareing, Cumulus CEO cwareing@cumulusoncology.com Scius Communications

Katja Stout Tel: +44 7789 435 990 katja@sciuscommunications.com Daniel Gooch Tel: +44 7747 875 479 daniel@sciuscommunications.com

Executive ChangeAcquisition

08 Jan 2024

Cumulus Oncology raises £9m in seed financing Eos Advisory-led round includes new corporate investor the Scottish National Investment Bank Proceeds from the financing will be used to support Cumulus Oncology’s future growth plans, expand its portfolio and accelerate the development of new cancer treatments from discovery towards clinical Proof of Concept Edinburgh, Scotland, 08 January 2024 – Cumulus Oncology (“Cumulus” or “the Company”), which operates Europe’s first oncology biotech creation business model, today announces the successful raise of £9 million in seed financing. The funding round was led by existing investor Eos Advisory (“Eos”) and includes a new corporate investor, the Scottish National Investment Bank (“the Bank”). Cumulus, headquartered in Edinburgh, operates using a unique 'hub and spoke' model as a company creation studio with Cumulus acting as the creator of high value spin-out companies. Focusing on new areas of biology where strong scientific validation exists, Cumulus is leading the development of a new wave of therapeutic options for cancer patients. The model enables Cumulus to leverage its deep expertise and successful track record in new drug approvals in the oncology area, keeping pace with scientific innovations and spreading the risk associated with therapeutic development. Cumulus will utilise the new funding to expand its existing portfolio of companies, focusing on de-risking science and prioritising the strongest programmes, scientifically and commercially. The first company established by Cumulus, Nodus Oncology, is actively engaged in two innovative oncology drug discovery programmes in the area of DNA damage response (DDR). A second company, currently in stealth mode, is set to be unveiled in early 2024. Further projects are poised to read out on important data points, which will form the basis of at least a third new company creation in the next 12 months. The Cumulus business model is based on two key strategies: the inclusion of molecularly selected patient sub-groups throughout all stages of drug discovery and development, and the utilisation of advanced technologies, such as artificial intelligence (“AI”) and machine learning (“ML”) platforms. These platform technologies will be embedded into Cumulus’s decision-making process to prioritise targets, assets and the relevant patient population to focus on. The AI/ML strategy will involve collaborations with key players in the oncology field. Clare Wareing, Founder and Chief Executive Officer of Cumulus Oncology said: “This funding round marks an important milestone for Cumulus, as oncology remains a critical area of scientific innovation and unmet medical need. At Cumulus, we're not only innovating at the scientific level but also offering a uniquely differentiated process for decision-making and prioritisation in drug discovery and development. The business model enables only the strongest science to be translated from discovery into clinical trials. Our portfolio approach aims to enhance the ultimate success rate in cancer therapy development, which currently remains unacceptably low. It also provides an alternative approach to the de-risking of early-stage oncology investment. We are grateful for the support from Eos and the Scottish National Investment Bank enabling us to continue investing in our existing companies and expand our portfolio of new biotechs, advancing our mission to develop the next generation of cancer therapies.” Paul Callaghan, Investment Director at the Scottish National Investment Bank, said: “Cumulus, aided by an extremely experienced and capable team, is innovating not only in the science, but in the entire process of how drugs are moved from discovery to later stage clinical trials. We are really pleased to be helping them achieve their ambitions and shine a spotlight on Scotland’s drug discovery capabilities.” Andrew McNeil, Managing Partner of Eos, added: “The Cumulus approach is one that supports the development of a range of cancer treatments, this inherently reduces risk by not placing reliance on one therapeutic candidate. We see this as a really exciting and novel business model, with a team who have the track record of having brought 17 new cancer drugs to market throughout their careers. Eos has been proud to support Cumulus since its inception.” -END- For media enquiries: ICR Consilium: T: +44 (0)20 3709 5700 / E: cumulus@consilium-comms.comMary-Jane Elliott / Lindsey Neville / Davide Salvi About Cumulus Oncology From securing pre-seed investment in 2020, Cumulus has continued to develop a capitally efficient business model. The company sources novel oncology assets from academic institutes, commercial drug discovery groups and biopharmaceutical companies. The Cumulus scientific and commercial team members identify novel targets for drug discovery programmes which the company funds, supports and collaborates on. Following rigorous due diligence and market assessment activities, negotiations on deal terms and in-depth feasibility on the investment case, selected assets are spun out into newly created companies. An early focus on molecularly selected patient sub-groups, is a key aspect of the business model. The company incorporates the use of artificial intelligence (AI) and machine learning (ML) platforms into its decision making process to prioritise targets and assets Cumulus contributes both early-stage capital and oncology drug development expertise and manages each spinout company to achieve key development milestones and value inflections. The companies created by Cumulus represent valuable investment opportunities for VCs that focus on the biotech sector. These VCs are important partners for Cumulus when the spinout companies reach key inflection points. The founding team at Cumulus consists of successful life science entrepreneurs, scientists and a range of oncology drug development and pharma sector business professionals. For more information, please visit: https://www.cumulusoncology.com/ About Scottish National Investment Bank The Scottish National Investment Bank is Scotland’s first development investment bank, wholly owned by the Scottish Ministers on behalf of the people of Scotland. The Bank is an impact investor, focussed on delivering both commercial returns and mission impacts with its investments. The Bank is a PLC and operationally independent from government. The Bank invests in business and projects connected to Scotland to deliver long term, patient debt or equity investment where the private market is failing to provide the support businesses and projects require to grow. The Bank’s missions are: Supporting Scotland’s transition to net zeroBuilding communities and promoting equalityHarnessing innovation to enable our people to flourish The Scottish Government has committed to capitalising the Bank with £2bn in its first 10 years. Over time as the Bank’s initial investments are repaid, the Bank will reinvest those funds in businesses and projects creating a perpetual investment fund to support the Scottish economy in the long term. The Bank was established in November 2020 About Eos Eos is a hands-on, early-stage and growth investor in science and technology innovations that seek to address societal and environmental issues. With deep roots in Scotland and a global approach, Eos was founded in St Andrews in 2014. The 4 impact areas Eos focuses on are 1) Disease Diagnosis, Prevention and Treatment, 2) Food and Water security, 3) Energy Security, Climate Change and Pollution and 4) Improvement and Sustainability of Industrial Processes.

100 Deals associated with Nodus Oncology Ltd.

Login to view more data

100 Translational Medicine associated with Nodus Oncology Ltd.

Login to view more data

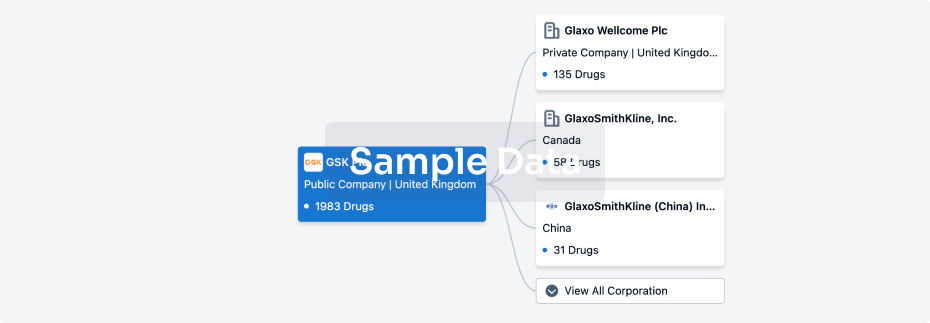

Corporation Tree

Boost your research with our corporation tree data.

login

or

Pipeline

Pipeline Snapshot as of 16 Dec 2025

The statistics for drugs in the Pipeline is the current organization and its subsidiaries are counted as organizations,Early Phase 1 is incorporated into Phase 1, Phase 1/2 is incorporated into phase 2, and phase 2/3 is incorporated into phase 3

Preclinical

3

Login to view more data

Current Projects

| Drug(Targets) | Indications | Global Highest Phase |

|---|---|---|

NOD1 inhibitor(Nodus Oncology) ( NOD1 ) | Neoplasms More | Preclinical |

NOD-2 ( PARG ) | Neoplasms More | Preclinical |

NODX-010 ( PARG ) | Breast Cancer More | Preclinical |

Login to view more data

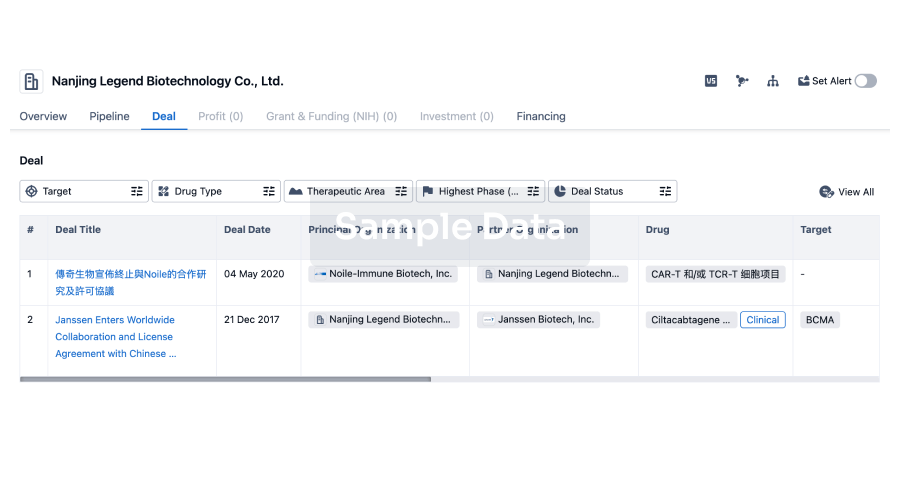

Deal

Boost your decision using our deal data.

login

or

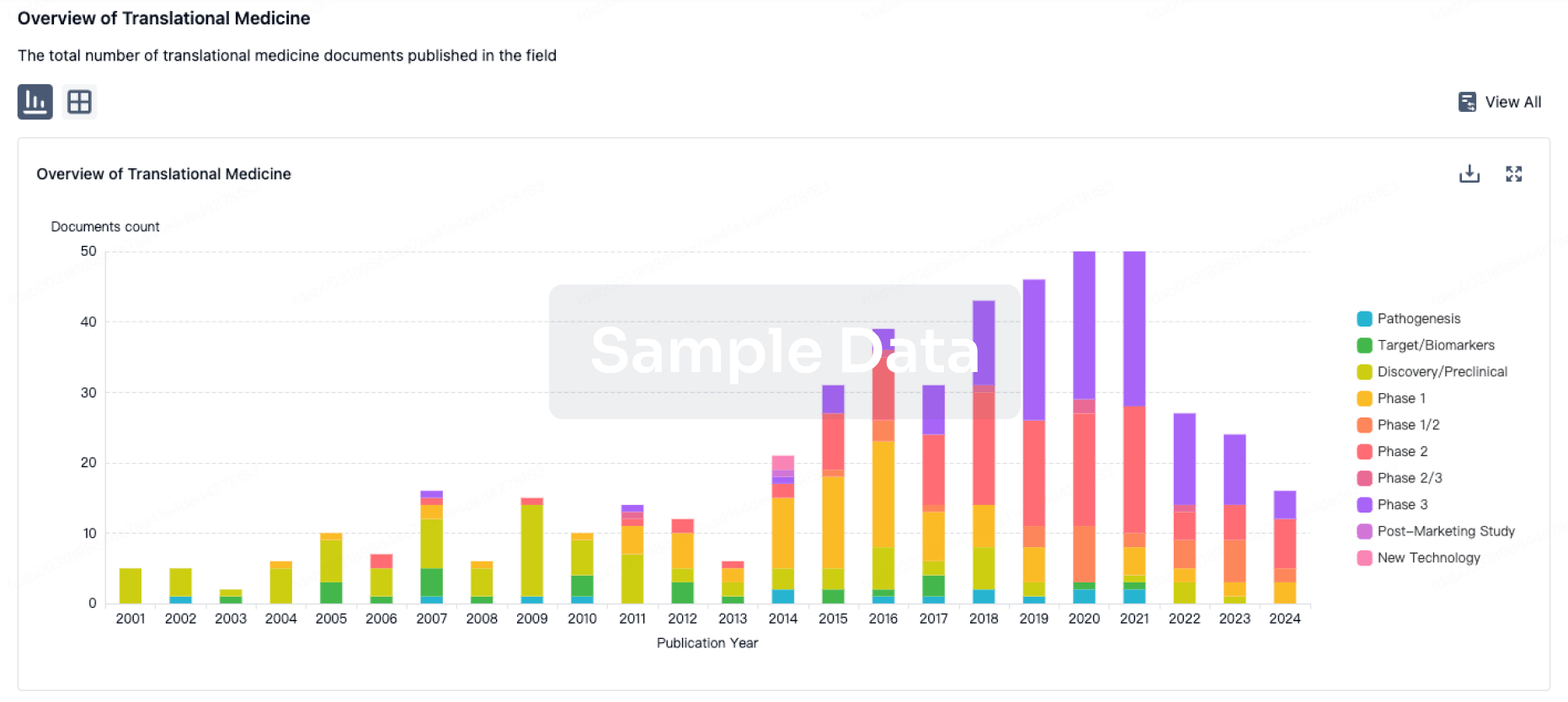

Translational Medicine

Boost your research with our translational medicine data.

login

or

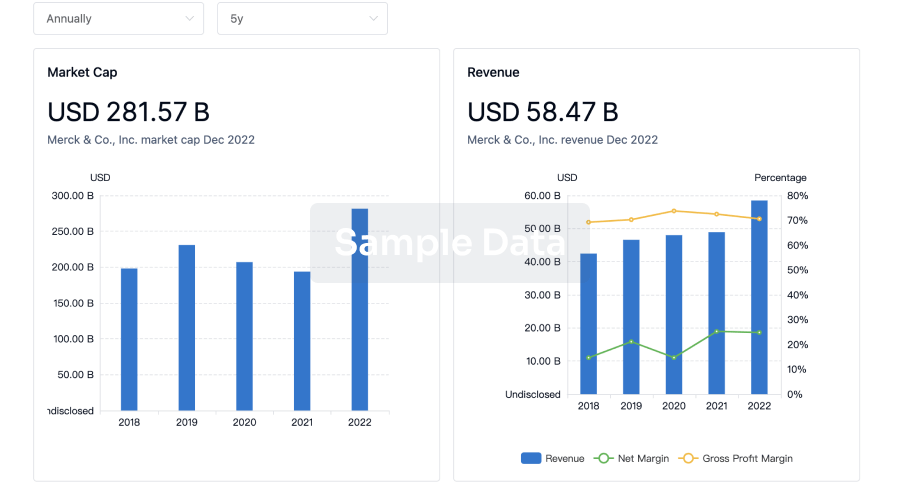

Profit

Explore the financial positions of over 360K organizations with Synapse.

login

or

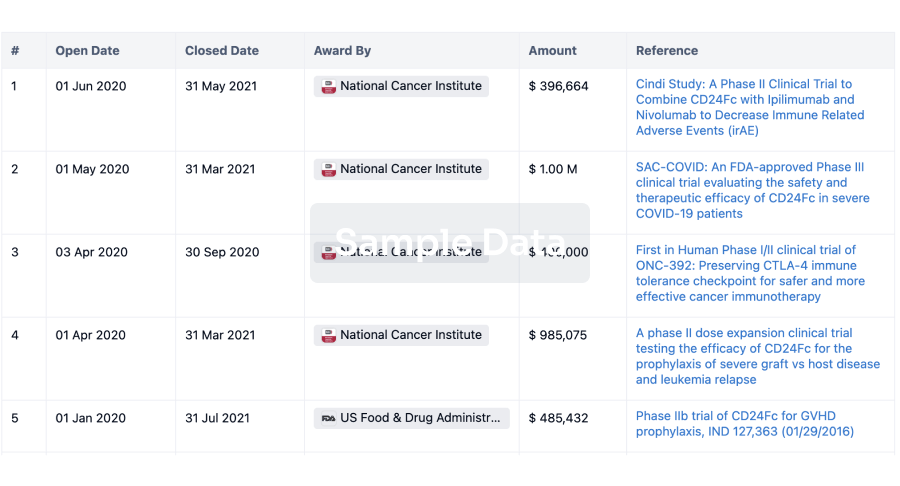

Grant & Funding(NIH)

Access more than 2 million grant and funding information to elevate your research journey.

login

or

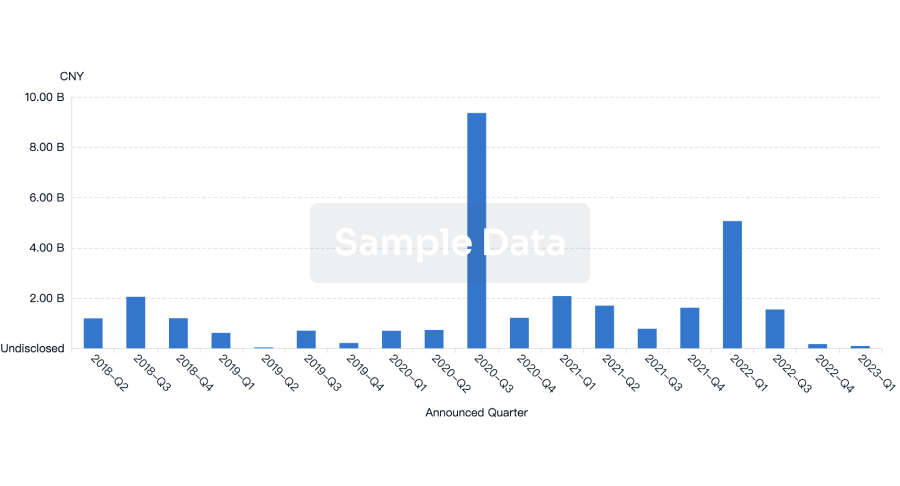

Investment

Gain insights on the latest company investments from start-ups to established corporations.

login

or

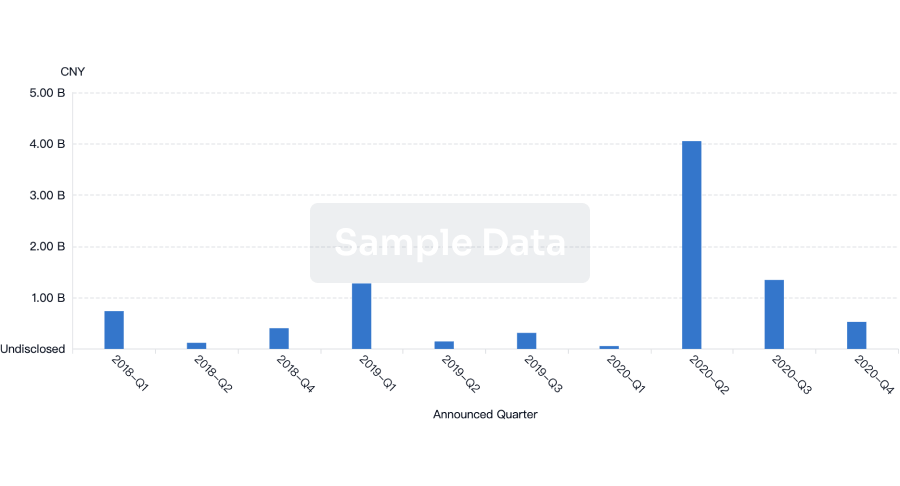

Financing

Unearth financing trends to validate and advance investment opportunities.

login

or

AI Agents Built for Biopharma Breakthroughs

Accelerate discovery. Empower decisions. Transform outcomes.

Get started for free today!

Accelerate Strategic R&D decision making with Synapse, PatSnap’s AI-powered Connected Innovation Intelligence Platform Built for Life Sciences Professionals.

Start your data trial now!

Synapse data is also accessible to external entities via APIs or data packages. Empower better decisions with the latest in pharmaceutical intelligence.

Bio

Bio Sequences Search & Analysis

Sign up for free

Chemical

Chemical Structures Search & Analysis

Sign up for free