Request Demo

Last update 08 May 2025

Bioventus LLC

Public Company | Subsidiary Company|2012|North Carolina, United States|

250-500

| NASDAQ: BVS| Public Company | Subsidiary Company|2012|North Carolina, United States|

250-500

| NASDAQ: BVS| Last update 08 May 2025

Overview

Related

1

Drugs associated with Bioventus LLCTarget- |

Mechanism Cell replacements |

Active Org.- |

Originator Org. |

Active Indication- |

Inactive Indication |

Drug Highest PhasePending |

First Approval Ctry. / Loc.- |

First Approval Date- |

27

Clinical Trials associated with Bioventus LLCNCT05644639

StimRouter Genicular NeuromoduLation for Chronic KnEe OsteoArthritic Pain Management

The goal of this study is to evaluate the use of StimRouter Neuromodulation System (StimRouter) in adult subjects with an established diagnosis of primary femorotibial osteoarthritis in the target knee (Kellgren-Lawrence ≥1) who have surgical contraindications to undergo a knee joint arthroplasty procedure. The main questions it aims to answer are:

1. To assess the effect of the StimRouter Neuromodulation System to manage joint pain in patients with symptomatic OA of the knee who are surgically contraindicated to undergo a knee joint arthroplasty

2. To assess the effect of StimRouter on joint stiffness, function and patient quality of life

Participants will have StimRouter leads implanted then clinic visits will be scheduled for follow-up at Week 2, Month 3 and Month 6 (End of Study (EOS) or Early Termination (ET)).

1. To assess the effect of the StimRouter Neuromodulation System to manage joint pain in patients with symptomatic OA of the knee who are surgically contraindicated to undergo a knee joint arthroplasty

2. To assess the effect of StimRouter on joint stiffness, function and patient quality of life

Participants will have StimRouter leads implanted then clinic visits will be scheduled for follow-up at Week 2, Month 3 and Month 6 (End of Study (EOS) or Early Termination (ET)).

Start Date18 Oct 2022 |

Sponsor / Collaborator |

NCT05405374

A Prospective, Randomized, Intra-Patient Controlled, Multi-Center Clinical Investigation Evaluating OSTEOAMP SELECT Fibers Versus Infuse Bone Graft as Autograft Substitute in Lumbar Fusion Procedures

The objective of this clinical study is to compare OSTEOAMP SELECT Fibers to Infuse Bone Graft, in terms of effectiveness and safety, when used as a bone graft substitute in in skeletally mature patients qualified for 2-lumbar interbody fusion (LIF) by means of an intra-patient control model.

Start Date06 May 2022 |

Sponsor / Collaborator |

NCT05100225

A Multiple Arm, Multicenter, Prospective, Randomized, Double-Blind, Placebo-Controlled, Parallel-Arm, Phase 2 Study of Intra-Articular Administration of an Allogeneic Human Placental Tissue Particulate (PTP-001) for the Treatment of Knee Osteoarthritis

Evaluation of safety, tolerability and efficacy of a single intra-articular (IA) injection of PTP-001, an allogeneic placental tissue particulate, in individuals with knee osteoarthritis (OA).

Start Date30 Sep 2021 |

Sponsor / Collaborator  Bioventus LLC Bioventus LLC [+1] |

100 Clinical Results associated with Bioventus LLC

Login to view more data

0 Patents (Medical) associated with Bioventus LLC

Login to view more data

22

Literatures (Medical) associated with Bioventus LLC18 Aug 2021·Journal of Bone and Joint SurgeryQ2 · MEDICINE

A BMP/Activin A Chimera Induces Posterolateral Spine Fusion in Nonhuman Primates at Lower Concentrations Than BMP-2

Q2 · MEDICINE

Article

Author: Fredricks, Douglas C ; Seeherman, Howard J ; Wilson, Christopher G ; Morales, Pablo R ; Wozney, John M ; Vanderploeg, Eric J ; Brown, Christopher T

01 Dec 2020·Seminars in Arthritis and RheumatismQ2 · MEDICINE

A comparison of 4-year total medical care costs, adverse outcomes, and opioid/prescription analgesic use for 3 knee osteoarthritis pain treatments: Intra-articular hyaluronic acid, intra-articular corticosteroids, and knee arthroplasty

Q2 · MEDICINE

Article

Author: Mackowiak, John ; Dasa, Vinod ; Jones, John T

01 May 2019·The Journal of Foot and Ankle SurgeryQ4 · MEDICINE

Nonanimal Hyaluronic Acid for the Treatment of Ankle Osteoarthritis: AProspective, Single-Arm Cohort Study

Q4 · MEDICINE

Article

Author: Nacht, Jeff ; Harrison, Andrew ; Younger, Alastair S E ; Wing, Kevin ; Veljkovic, Andrea ; Penner, Murray ; Wang, Zhe ; Wester, Tawana

63

News (Medical) associated with Bioventus LLC11 Mar 2025

Accelerated fourth quarter sales growth to 13.5%Fourth quarter gross margin expanded 310 bps and adjusted gross margin* expanded 230 bpsFourth quarter cash from operations of $19.3 million increased 86.3%Provides full-year 2025 financial guidance reflecting continued above market revenue growth and continued operating margin expansion DURHAM, N.C., March 11, 2025 (GLOBE NEWSWIRE) -- Bioventus Inc. (Nasdaq: BVS) (“Bioventus” or the “Company”), a global leader in innovations for active healing, today announced fourth quarter and full-year financial results for the year ended December 31, 2024, and provided its financial guidance for full-year 2025. “Our Bioventus team delivered strong results in the fourth quarter to conclude a very successful and transformational year for our company,” said Rob Claypoole, Bioventus President and Chief Executive Officer. “Looking forward, we believe we are well positioned to build on this positive momentum, driving above-market revenue growth with a multitude of diverse growth drivers, while enhancing profitability and accelerating cash flow to create significant shareholder value.” Fourth Quarter 2024 Financial Results For the fourth quarter, worldwide revenue totaled $153.6 million, an increase of 13.5% compared to the prior year, driven by double-digit growth in Pain Treatments and Surgical Solutions. Net loss from continuing operations was $0.3 million, compared to net loss from continuing operations of $7.7 million in the prior-year period. Adjusted EBITDA* from continuing operations of $28.3 million advanced 28.3% from $22.0 million last year due to strong revenue growth and adjusted gross margin expansion. There was no loss per share of Class A common stock from continuing operations compared to a loss of $0.10 per share last year. Non-GAAP earnings per share from continuing operations* was $0.15 per share, compared to income of $0.07 per share in the prior year. Full-Year 2024 Financial Results Bioventus’ full-year 2024 worldwide revenue totaled $573.3 million, an increase of 11.9% compared to the prior year. On an organic* basis, revenue increased 14.4%, driven by double-digit growth in Pain Treatments and Surgical Solutions. Full-year 2024 net loss from continuing operations was $43.8 million, compared to net loss from continuing operations of $121.2 million in the prior year. Adjusted EBITDA from continuing operations* of $108.9 million advanced 22.5% from $88.9 million last year due to strong revenue growth and adjusted gross margin expansion. Loss per share of Class A common stock from continuing operations was $0.52 per share, compared to a loss of $1.54 per share last year. Non-GAAP earnings per share from continuing operations* was $0.49 per share, compared to $0.02 per share in the prior year.

Revenue By Business The following tables represent net sales by geographic region and by business, for the three and twelve months of 2024 and 2023, respectively: Three Months Ended Change as Reported Constant Currency* Change December 31, 2024 December 31, 2023 $ % %U.S.

Pain Treatments$62,799 $52,926 $9,873 18.7% 18.7%Surgical Solutions(a) 46,431 39,757 6,674 16.8% 16.8%Restorative Therapies(a) 25,980 26,125 (145) (0.6%) (0.6%)Total U.S. net sales 135,210 118,808 16,402 13.8% 13.8%International

Pain Treatments 6,414 6,218 196 3.2% 2.8%Surgical Solutions(a) 7,293 5,936 1,357 22.9% 23.0%Restorative Therapies(a) 4,725 4,461 264 5.9% 5.5%Total International net sales 18,432 16,615 1,817 10.9% 10.7%Total net sales$153,642 $135,423 $18,219 13.5% 13.4% (a) Sales from the SonicOne product were reclassified from Restorative Therapies to Surgical Solutions on a prospective and retrospective basis during the first quarter of 2024 as SonicOne's ability to remove devitalized or necrotic tissue and fiber deposits more closely aligns with Surgical Solutions' soft tissue management. SonicOne revenue reclassified for the three months ended December 31, 2023 totaled $1,539 and $85 for the U.S. and International reporting segments, respectively.

Year Ended Change as Reported Constant Currency* Change December 31, 2024 December 31, 2023 $ % %U.S.

Pain Treatments$234,936 $197,954 $36,982 18.7% 18.7%Surgical Solutions(a) 167,706 141,888 25,818 18.2% 18.2%Restorative Therapies(a) 104,167 110,018 (5,851) (5.3%) (5.3%)Total U.S. net sales 506,809 449,860 56,949 12.7% 12.7%International

Pain Treatments 26,353 22,847 3,506 15.3% 15.4%Surgical Solutions(a) 21,549 19,715 1,834 9.3% 9.5%Restorative Therapies(a) 18,569 19,923 (1,354) (6.8%) (6.5%)Total International net sales 66,471 62,485 3,986 6.4% 6.6%Total net sales$573,280 $512,345 $60,935 11.9% 11.9% (a) Sales from the SonicOne product were reclassified from Restorative Therapies to Surgical Solutions on a prospective and retrospective basis during the first quarter of 2024 as SonicOne's ability to remove devitalized or necrotic tissue and fiber deposits more closely aligns with Surgical Solutions' soft tissue management. SonicOne revenue reclassified for the year ended December 31, 2023 totaled $6,833 and $299 for the U.S. and International reporting segments, respectively. Recent Business Highlights Bioventus continues to advance its strategic priorities with key achievements, including the following: Delivered five consecutive quarters of double-digit revenue growth in Pain Treatments and Surgical Solutions, which contributed to a 28.3% increase in Adjusted EBITDA* in the fourth quarterDivested the Advanced Rehabilitation Business in the fourth quarter, receiving $24.7 million in proceeds at closingStrengthened the balance sheet and improved liquidity by reducing long-term debt by $48.3 million in the fourth quarter 2025 Financial Guidance Bioventus introduced its financial guidance for full-year 2025. The Company expects: Net sales of $560 million to $570 million. This reflects organic* growth of approximately 6.1% to 8.0% when including the impact of the Company's divestiture of its Advanced Rehabilitation Business, which generated revenue of $45.4 million in 2024.Adjusted EBITDA* of $112 million to $116 million, reflecting 100 basis points in Adjusted EBITDA Margin* growth compared to the 2024 Adjusted EBITDA* Margin of 19.0% when using the low end of the 2025 revenue and Adjusted EBITDA* guidance.Non-GAAP EPS* of $0.64 to $0.68, reflecting an increase of 30.6% to 38.8%. The Company does not provide U.S. GAAP financial measures, other than net sales, on a forward-looking basis, because the Company is unable to predict with reasonable certainty the impact and timing of acquisition and divestiture related expenses, accounting fair-value adjustments, and certain other reconciling items without unreasonable efforts. These items are uncertain, depend on various factors, and could be material to the Company’s results computed in accordance with U.S. GAAP. *See below under “Use of Non-GAAP Financial Measures” for more details. About Bioventus Bioventus delivers clinically proven, cost-effective products that help people heal quickly and safely. Its mission is to make a difference by helping patients resume and enjoy active lives. The Innovations for Active Healing from Bioventus include offerings for Pain Treatments, Surgical Solutions and Restorative Therapies. Built on a commitment to high quality standards, evidence-based medicine and strong ethical behavior, Bioventus is a trusted partner for physicians worldwide. For more information, visit www.bioventus.com and follow the Company on LinkedIn and Twitter. Bioventus and the Bioventus logo are registered trademarks of Bioventus LLC.

Fourth Quarter 2024 Earnings Conference Call: Management will host a conference call to discuss the Company’s financial results and provide a business update, with a question and answer session, at 8:30 a.m. Eastern Time on March 11, 2025. Those who would like to participate may dial 1-833-636-0497 (domestic and international) and refer to Bioventus Inc. A live webcast of the call and any accompanying materials will also be provided on the investor relations section of the Company's website at https://ir.bioventus.com/. The webcast will be archived on the Company’s website at https://ir.bioventus.com/ and available for replay until March 10, 2026. Legal Notice Regarding Forward-Looking Statements This press release contains forward-looking statements within the meaning of Section 27A of the Securities Act of 1933, as amended, and Section 21E of the Securities Exchange Act of 1934, as amended. All statements contained in this press release that do not relate to matters of historical fact should be considered forward-looking statements, including, without limitation, statements concerning our future financial results and liquidity; the impact of our recently divested Advanced Rehabilitation Business on our financial condition and operations; our business strategy, position and operations; and expected sales trends, opportunities, market position and growth. In some cases, you can identify forward-looking statements by terminology such as “aim,” “anticipate,” “assume,” “believe,” “contemplate,” “continue,” “could,” “due,” “estimate,” “expect,” “goal,” “intend,” “may,” “objective,” “plan,” “predict,” “potential,” “positioned,” “seek,” “should,” “target,” “will,” “would” and other similar expressions that are predictions of or indicate future events and future trends, or the negative of these terms or other comparable terminology, although not all forward-looking statements contain these words. Forward-looking statements are inherently subject to risks and uncertainties, some of which cannot be predicted or quantified. Important factors that may cause actual results to differ materially from current expectations include, among other things: we might not realize some or all of the benefits expected to result from the recently completed divestiture of our Advanced Rehabilitation Business; if we fail to properly manage growth or scale our business processes, systems, or data management, our business could suffer; our ability to maintain our competitive position depends on our ability to attract, retain and motivate our senior management team and other highly qualified personnel necessary to execute our strategic plans; we may face issues with respect to the supply of our products or their components due to product quality and regulatory compliance issues, including increased costs, disruptions of supply, shortages, contamination or mislabeling; we might not meet certain of our debt covenants under our Credit and Guaranty Agreement and might be required to repay our indebtedness on an accelerated basis; there are restrictions on operations and other costs associated with our indebtedness; we might require additional capital to fund our current financial obligations and support business growth; failure to establish and maintain effective financial controls could adversely affect our business and stock price; we might not be able to complete acquisitions or successfully integrate new businesses, products or technologies in a cost-effective and non-disruptive manner; our cash is maintained at financial institutions, often in balance that exceed federally insured limits; we have been subject to securities class action litigation and may be subject to similar or other litigation, including shareholder litigation, in the future, which will require significant management time and attention, result in significant legal expenses or costs not covered by our insurers, and may result in unfavorable outcomes; we are highly dependent on a limited number of products; our long-term growth may be limited by our inability to develop, acquire and commercialize new products, line extensions or expanded indications; demand for our existing portfolio of products and any new products, line extensions or expanded indications depends on the continued and future acceptance of our products by physicians, patients, third-party payers and others in the medical community; the proposed down classification of non-invasive bone growth stimulators, including our EXOGEN system, by the U.S. Food and Drug Administration (“FDA”) could increase future competition for bone growth stimulators and otherwise adversely affect the Company’s sales of EXOGEN; failure to achieve and maintain adequate levels of coverage and/or reimbursement for our products or future products, the procedures using our products; pricing pressure and other competitive factors; we may be unable to successfully commercialize newly developed or acquired products or therapies in the United States; governments outside the United States might not provide coverage or reimbursement of our products; we compete and may compete in the future against other companies, some of which have longer operating histories, more established products or greater resources than we do; if our HA products are reclassified from medical devices to drugs in the United States by the FDA, it could negatively impact our ability to market these products and may require that we conduct costly additional clinical studies to support current or future indications for use of those products; our failure to properly manage our growth or scale our business processes, systems, or data management; risks related to product liability claims; fluctuations in demand for our products; issues relating to the supply of our products or their components due to product quality and regulatory compliance issues, including increased costs, disruptions of supply, shortages, contamination or mislabeling; our reliance on a limited number of third-party manufacturers to manufacture certain of our products; security breaches, unauthorized access to or disclosure of information, cyberattacks, or other incidents or the perception that confidential information in our or our vendors’ or service providers’ possession or control is not secure; failure of key information technology and communications systems, process or sites; economic, political (including international tariffs), regulatory and other risks related to international sales, manufacturing and operations; unstable political or economic conditions; failure to maintain contractual relationships; failure to comply with extensive governmental regulation relevant to us and our products; we may be subject to enforcement action if we engage in improper claims submission practices and resulting audits or denials of our claims by government agencies could reduce our net sales or profits; the FDA regulatory process is expensive, time-consuming and uncertain, and the failure to obtain and maintain required regulatory clearances and approvals could prevent us from commercializing our products; if clinical studies of our future product candidates do not produce results necessary to support regulatory clearance or approval in the United States or elsewhere, we will be unable to expand the indications for or commercialize these products; legislative or regulatory reforms; if our facilities are damaged or become inoperable, we will be unable to continue to research, develop and manufacture certain of our products; risks related to intellectual property matters; the dilution of our Class A common stockholders upon an exchange of the outstanding common membership interests in Bioventus LLC could adversely affect the market price of our Class A common stock and the resale of such shares could cause the market price of our Class A common stock to fall; and other the other risks identified in our Annual Report on Form 10-K for the year ended December 31, 2024, as such factors may be updated from time to time in Bioventus’ other filings with the SEC which are accessible on the SEC’s website at www.sec.gov and the Investor Relations page of Bioventus’ website at https://ir.bioventus.com. Except to the extent required by law, the Company undertakes no obligation to update or review any estimate, projection, or forward-looking statement. Actual results may differ materially from those set forth in the forward-looking statements.

BIOVENTUS INC.Consolidated balance sheetsAs of December 31, 2024 and December 31, 2023(Amounts in thousands, except share amounts) (unaudited) December 31, 2024 December 31, 2023Assets Current assets: Cash and cash equivalents$41,582 $36,964 Accounts receivable, net 127,393 122,789 Inventory 92,475 91,333 Prepaid and other current assets 14,160 16,913 Total current assets 275,610 267,999 Property and equipment, net 27,012 36,605 Goodwill 7,462 7,462 Intangible assets, net 404,729 482,350 Operating lease assets 6,506 13,353 Deferred tax assets 4,745 — Investment and other assets 1,892 3,141 Total assets$727,956 $810,910 Liabilities and Stockholders’ Equity Current liabilities: Accounts payable$23,690 $23,038 Accrued liabilities 135,879 119,795 Current portion of long-term debt 27,339 27,848 Current portion of contingent consideration 19,573 — Other current liabilities 3,917 4,816 Total current liabilities 210,398 175,497 Long-term debt, less current portion 308,288 366,998 Deferred income taxes 564 1,213 Contingent consideration — 18,150 Other long-term liabilities 23,102 27,934 Total liabilities 542,352 589,792 Stockholders’ Equity: Preferred stock, $0.001 par value, 10,000,000 shares authorized, 0 shares issued Class A common stock, $0.001 par value, 250,000,000 shares authorized as of December 31, 2024 and December 31, 2023, 65,758,341 and 63,267,436 shares issued and outstanding as of December 31, 2024 and December 31, 2023, respectively 66 63 Class B common stock, $0.001 par value, 50,000,000 shares authorized, 15,786,737 shares issued and outstanding as of December 31, 2024 and December 31, 2023 16 16 Additional paid-in capital 505,509 494,254 Accumulated deficit (355,078) (321,536)Accumulated other comprehensive (loss) income (2,573) 794 Total stockholders’ equity attributable to Bioventus Inc. 147,940 173,591 Noncontrolling interest 37,664 47,527 Total stockholders’ equity 185,604 221,118 Total liabilities and stockholders’ equity$727,956 $810,910

BIOVENTUS INC.Consolidated statements of operations and comprehensive loss(Amounts in thousands, except share and per share data) (unaudited) Three Months Ended(1) Year Ended December 31, 2024 December 31, 2023 December 31, 2024 December 31, 2023Net sales$153,642 $135,423 $573,280 $512,345 Cost of sales (including depreciation and amortization of $10,630and $10,357, $41,882, $48,503 respectively) 50,986 49,122 185,054 184,152 Gross profit 102,656 86,301 388,226 328,193 Selling, general and administrative expense 86,613 78,357 340,894 303,879 Research and development expense 3,246 3,262 13,639 13,446 Restructuring costs (52) (71) (52) 840 Change in fair value of contingent consideration 345 290 1,423 719 Depreciation and amortization 1,768 2,102 7,652 8,842 Impairment of assets 2,456 — 36,357 78,615 Loss on disposals 292 1,196 292 3,577 Operating income (loss) 7,988 1,165 (11,979) (81,725)Interest expense, net 8,997 10,280 38,792 40,676 Other income (1,241) (709) (1,645) (1,290)Other expense 7,756 9,571 37,147 39,386 Income (loss) before income taxes 232 (8,406) (49,126) (121,111)Income tax expense (benefit), net 550 (750) (5,293) 85 Net loss from continuing operations (318) (7,656) (43,833) (121,196)Loss from discontinued operations, net of tax — — — (74,429)Net loss (318) (7,656) (43,833) (195,625)Loss attributable to noncontrolling interest - continuing operations 162 1,560 10,291 24,458 Loss attributable to noncontrolling interest - discontinued operations — — — 14,937 Net loss attributable to Bioventus Inc.$(156) $(6,096) $(33,542) $(156,230)

Loss per share of Class A common stock from:

Continuing operations, basic and diluted$— $(0.10) $(0.52) $(1.54)Discontinued operations, basic and diluted — — — (0.95)Loss per share of Class A common stock$— $(0.10) $(0.52) $(2.49)

Weighted-average shares of Class A common stock outstanding basic and diluted 65,451,881 63,101,172 64,547,474 62,647,554

(1) The three months ended December 31, 2024 and 2023 covered the periods beginning September 28, 2024 and September 30, 2023, respectively. BIOVENTUS INC.Consolidated condensed statements of cash flows(Amounts in thousands) (unaudited) Three Months Ended(1) Year Ended December 31, 2024 December 31, 2023 December 31, 2024 December 31, 2023Operating activities:

Net loss$(318) $(7,656) $(43,833) $(195,625)Less: Loss from discontinued operations, net of tax — — — (74,429)Loss from continuing operations (318) (7,656) (43,833) (121,196)Adjustments to reconcile net loss to net cash from operating activities:

Depreciation and amortization 12,405 12,465 49,555 57,365 Equity-based compensation 1,731 1,775 10,058 2,722 Change in fair value of contingent consideration 345 290 1,423 719 Impairments of assets 2,456 — 36,357 78,615 Deferred income taxes 3,215 1,163 (5,394) (2,377)Loss on disposals 292 1,196 292 3,577 Unrealized (gain) loss on foreign currency fluctuations (126) (732) (259) 665 Other, net 1,430 (102) 2,376 604 Changes in working capital (2,108) 1,975 (11,780) (3,181)Net cash from operating activities - continuing operations 19,322 10,374 38,795 17,513 Net cash from operating activities - discontinued operations — — — (2,169)Net cash from operating activities 19,322 10,374 38,795 15,344 Investing activities:

Proceeds from sale of a business 24,678 (222) 24,678 34,675 Purchase of property and equipment (574) (369) (1,006) (7,362)Investments and acquisition of distribution rights — — (709) — Net cash from investing activities - continuing operations 24,104 (591) 22,963 27,313 Net cash from investing activities - discontinued operations — — — (11,506)Net cash from investing activities 24,104 (591) 22,963 15,807 Financing activities:

Proceeds from issuance of Class A and B common stock 1,103 158 2,442 778 Receipt of deferred consideration 4,500 — 4,500 — Borrowing on revolver — — — 64,000 Payment on revolver (15,000) — (15,000) (49,000)Debt financing costs — — (1,180) (3,661)Payments on long-term debt (33,264) — (44,584) (38,264)Other, net (194) (172) (758) (506)Net cash from financing activities (42,855) (14) (54,580) (26,653)Effect of exchange rate changes on cash (2,063) 368 (2,560) 629 Net change in cash and cash equivalents (1,492) 10,137 4,618 5,127 Cash and cash equivalents at the beginning of the period 43,074 26,827 36,964 31,837 Cash and cash equivalents at end of the period$41,582 $36,964 $41,582 $36,964 (1) The three months ended December 31, 2024 and 2023 covered the periods beginning September 28, 2024 and September 30, 2023, respectively.

Use of Non-GAAP Financial Measures Organic Revenue Growth The Company defines the term “organic revenue” as revenue in the stated period excluding the impact from business acquisitions and divestitures. The Company uses the related term “organic revenue growth” or "organic growth" to refer to the financial performance metric of comparing the stated period's organic revenue with the comparable reported revenue of the corresponding period in the prior year. The Company believes that these non-GAAP financial measures, when taken together with GAAP financial measures, allow the Company and its investors to better measure the Company’s performance and evaluate long-term performance trends. Organic revenue growth also facilitates easier comparisons of the Company’s performance with prior and future periods and relative comparisons to its peers. The Company excludes the effect of acquisitions and divestitures because these activities can have a significant impact on the Company's reported results, which the Company believes makes comparisons of long-term performance trends difficult for management and investors. Adjusted EBITDA, Non-GAAP Gross Profit, Non-GAAP Gross Margin, Non-GAAP Operating Income, Non-GAAP Operating Expenses, Non-GAAP R&D, Non-GAAP Operating Margin, Non-GAAP Net Income, and Non-GAAP Earnings per share of Class A Common Stock We present Adjusted EBITDA, Non-GAAP Gross Profit, Non-GAAP (or Adjusted) Gross Margin, Non-GAAP Operating Income, Non-GAAP Operating Expenses, Non-GAAP R&D, Non-GAAP Operating Margin, Non-GAAP Net Income, and Non-GAAP Earnings per share of Class A common stock, all non-GAAP financial measures, to supplement our GAAP financial reporting because we believe these measures are useful indicators of our operating performance. We define Adjusted EBITDA as net loss from continuing operations before depreciation and amortization, provision of income taxes and interest expense, net, adjusted for the impact of certain cash, non-cash and other items that we do not consider in our evaluation of ongoing operating performance. These items include acquisition and divestiture related costs, certain shareholder litigation costs, impairment of assets, restructuring and succession charges, equity-based compensation expense, financial restructuring costs and other items. See the table below for a reconciliation of net loss from continuing operations to Adjusted EBITDA. Our management uses Adjusted EBITDA principally as a measure of our operating performance and believes that Adjusted EBITDA is useful to our investors because it is frequently used by securities analysts, investors and other interested parties in their evaluation of the operating performance of companies in industries similar to ours. Our management also uses Adjusted EBITDA for planning purposes, including the preparation of our annual operating budget and financial projections. Our management uses Non-GAAP Gross Profit, Non-GAAP Gross Margin, Non-GAAP Operating Income, Non-GAAP Operating Expense, Non-GAAP Operating Margin and Non-GAAP Net Income principally as measures of our operating performance and believes that these non-GAAP financial measures are useful to better understand the long term performance of our core business and to facilitate comparison of our results to those of peer companies. Our management also uses these non-GAAP financial measures for planning purposes, including the preparation of our annual operating budget and financial projections. We define Non-GAAP Gross Profit as gross profit, adjusted for the impact of certain cash, non-cash and other items that we do not consider in our evaluation of ongoing operating performance. These items include depreciation and amortization included in the cost of goods sold and acquisition and divestiture related costs in the cost of goods sold. We define Non-GAAP Gross Margin as Non-GAAP Gross Profit divided by net sales. See the table below for a reconciliation of gross profit and gross margin to Non-GAAP Gross Profit and Non-GAAP Gross Margin. We define Non-GAAP Operating Income as operating income, adjusted for the impact of certain cash, non-cash and other items that we do not consider in our evaluation of ongoing operating performance. These items include depreciation and amortization, acquisition and divestiture related costs, certain shareholder litigation costs, impairment of assets, restructuring and succession charges, financial restructuring costs and other items. Non-GAAP Operating Margin is defined as Non-GAAP Operating Income divided by net sales. See the table below for a reconciliation of operating income (loss) and operating margin to Non-GAAP Operating Income and Non-GAAP Operating Margin. We define Non-GAAP Operating Expenses as operating expenses, adjusted to exclude certain cash, non-cash and other items that we do not consider in our evaluation of ongoing operating performance. These items include depreciation and amortization, acquisition and divestiture related costs, certain shareholder litigation costs, impairment of assets, restructuring and succession charges, financial restructuring costs and other items. See the table below for a reconciliation of operating expenses to Non-GAAP Operating Expenses. We define Non-GAAP R&D as research and development, adjusted to exclude certain cash, non-cash and other items that we do not consider in our evaluation of ongoing operating performance. These items include depreciation and amortization, acquisition and divestiture related costs, restructuring and succession charges, and other items. See the table below for a reconciliation of operating expenses to Non-GAAP R&D. We define Non-GAAP Net Income from continuing operations as Net Income from continuing operations, adjusted for the impact of certain cash, non-cash and other items that we do not consider in our evaluation of ongoing operating performance. These items include depreciation and amortization, acquisition and divestiture related costs, certain shareholder litigation costs, restructuring and succession charges, impairment of assets, financial restructuring costs, other items and the tax effect of adjusting items. See the table below for a reconciliation of Net loss from continuing operations to Non-GAAP Net Income from continuing operations. We define Non-GAAP Earnings per Class A share as Earnings per Class A share, adjusted for the impact of certain cash, non-cash and other items that we do not consider in our evaluation of ongoing operating performance. These items include depreciation and amortization, acquisition and divestiture related costs, certain shareholder litigation costs, restructuring and succession charges, impairment of assets, financial restructuring costs, other items and the tax effect of adjusting items divided by weighted average number of shares of Class A common stock outstanding during the period. See the table below for a reconciliation of loss per Class A share to Non-GAAP Earnings per Class A share. Net Sales, International Net Sales Growth and Constant Currency Basis Net Sales, International Net Sales Growth and Constant Currency Basis are non-GAAP measures, which are calculated by translating current and prior year results at the same foreign currency exchange rate. Constant currency can be presented for numerous GAAP measures, but is most commonly used by management to facilitate the comparison sales in foreign currencies to prior periods and analyze net sales performance without the impact of changes in foreign currency exchange rates. Prior Period Recast for Discontinued Operations On February 27, 2023, the Company ceased to control CartiHeal for accounting purposes, and therefore, deconsolidated CartiHeal effective February 27, 2023. CartiHeal was part of the Company’s international reporting segment. The Company treated the deconsolidation of CartiHeal as a discontinued operation. Refer to Note 4. Acquisitions and divestitures and Note 15. Discontinued operations in the Company's Form 10-K for the period ended December 31, 2024, filed on March 11, 2025, for further details regarding the deconsolidation of CartiHeal. Limitations of the Usefulness of Non-GAAP Measures Non-GAAP financial measures have limitations as an analytical tool and should not be considered in isolation or as a substitute for, or as superior to, the financial information prepared and presented in accordance with GAAP. These measures might exclude certain normal recurring expenses. Therefore, these measures may not provide a complete understanding of the Company's performance and should be reviewed in conjunction with the GAAP financial measures. Additionally, other companies might define their non-GAAP financial measures differently than we do. Investors are encouraged to review the reconciliation of the non-GAAP measures provided in this press release, including in the tables below, to their most directly comparable GAAP measures. Additionally, the Company does not provide U.S. GAAP financial measures on a forward-looking basis because the Company is unable to predict with reasonable certainty the impact and timing of acquisition and divestiture related expenses, accounting fair-value adjustments and certain other reconciling items without unreasonable efforts. These items are uncertain, depend on various factors, and could be material to the Company’s results computed in accordance with U.S. GAAP. Reconciliation of Net Loss from Continuing Operations to Adjusted EBITDA (unaudited) Three Months Ended Years Ended($, thousands)December 31, 2024 December 31, 2023 December 31, 2024 December 31, 2023Net loss from continuing operations$(318) $(7,656) $(43,833) $(121,196)Interest expense, net 8,997 10,280 38,792 40,676 Income tax expense (benefit), net 550 (750) (5,293) 85 Depreciation and amortization(a) 12,405 12,465 49,555 57,365 Acquisition and related costs(b) 345 1,647 1,339 5,694 Shareholder litigation costs(c) 82 — 13,802 — Restructuring and succession charges(d) (124) 1,420 (57) 2,331 Equity-based compensation(e) 1,731 1,775 10,058 2,722 Financial restructuring costs(f) — 226 351 7,291 Impairment of assets(g) 2,456 — 36,357 78,615 Loss on disposal of a business(h) 292 222 292 1,539 Other items(i) 1,834 2,389 7,519 13,740 Adjusted EBITDA$28,250 $22,018 $108,882 $88,862 (a) Includes for the three months ended December 31, 2024 and December 31, 2023 and the years ended December 31, 2024 and December 31, 2023, respectively, depreciation and amortization of $10.6 million, $10.4 million, $41.9 million and $48.5 million in cost of sales and $1.8 million, $2.1 million, $7.7 million and $8.9 million in operating expenses presented in the consolidated statements of operations and comprehensive loss. (b) Includes acquisition and integration costs related to completed acquisitions and changes in fair value of contingent consideration. (c) Costs incurred as a result of certain shareholder litigation unrelated to our ongoing operations. (d) Costs incurred were the result of adopting restructuring plans to reduce headcount, contract termination, reorganize management structure and consolidate certain facilities. (e) Includes compensation expense resulting from awards granted under our equity-based compensation plans. The year ended December 31, 2024 includes increased award activity as a result of certain annual employee bonuses granted in the form of equity awards. The year ended December 31, 2023 includes the reversal of $3.8 million in equity-based compensation expenses related to the transition of our executive leadership. (f) Financial restructuring costs include advisory fees and debt amendment related costs. (g) Activity in 2024 includes: (i) a non-cash impairment charge of $33.9 million for intangible assets solely attributable to our Advanced Rehabilitation Business due to the decision to divest the business and (ii) a non-cash impairment charge of $2.5 million for rented right of use assets involving exited office and warehouse spaces. Activity in 2023 relates to the non-cash impairment charge attributable to our divested Wound Business. (h) Represents the loss on the disposal of the Advanced Rehabilitation and Wound Businesses for the years ended December 31, 2024 and 2023, respectively. (i) Other items primarily include charges associated with strategic transactions, such as potential acquisitions or divestitures and a transformative project to redesign systems and information processing. Other items for the three months ended December 31, 2024 mostly consisted of divestiture costs related to the Company's Advanced Rehabilitation Business. Other items for the three months ended December 31, 2023 primarily consisted of $1.3 million in transformative project costs and $0.6 million in strategic transaction costs. During the year ended December 31, 2024, other items primarily consisted of the following: (i) divestiture costs related to the Company’s Advanced Rehabilitation Business, including transactional fees, totaled $4.7 million; (ii) transformative project costs of $1.7 million; and (iii) strategic transaction costs of $0.4 million. During the year ended December 31, 2023, other items mostly consisted of the following: (i) strategic transaction costs of $4.8 million, including divestiture costs of $1.1 million related to Advanced Rehabilitation; (ii) transformative project costs of $4.5 million; (iii) transition and severance costs of $2.8 million; and (iv) $1.0 million in costs related to the discontinuance of MOTYS. Reconciliation of Other Reported GAAP Measures to Non-GAAP Measures Three Months Ended December 31, 2024Gross Profit Operating Expenses(a) R&D Operating Income Net Loss Continuing Operations EPS from Continuing Operations(k)Reported GAAP measure$102,656 $91,422 $3,246 $7,988 $(318) $— Reported GAAP margin 66.8%

5.2% Depreciation and amortization(b) 10,630 1,768 7 12,405 12,405 0.15 Acquisition and related costs(c) — 345 — 345 345 — Shareholder litigation costs(d) — 82 — 82 82 — Restructuring and succession charges(e) — (124) — (124) (124) — Impairment of assets(f) — 2,456 — 2,456 2,456 0.03 Loss on disposal of a business(h) — 292 — 292 292 — Other items(i) — 2,646 86 2,732 1,834 0.02 Tax effect of adjusting items(j) — — — — (4,355) (0.05)Non-GAAP measure$113,286 $83,957 $3,153 $26,176 $12,617 $0.15 Non-GAAP margin 73.7%

17.0%

Non-GAAP Gross Margin Non-GAAP Operating Expenses Non-GAAP R&D Non-GAAP Operating Income Non-GAAP Net Income Continuing Operations Adjusted EPS Continuing Operations

Three Months Ended December 31, 2023Gross Profit Operating Expenses(a) R&D Operating Income Net Loss Continuing Operations EPS from Continuing Operations(k)Reported GAAP measure$86,301 $81,874 $3,262 $1,165 $(7,656) $(0.10)Reported GAAP margin 63.7%

0.9% Depreciation and amortization(b) 10,357 2,102 6 12,465 12,465 0.16 Acquisition and related costs(c) — 1,647 — 1,647 1,647 0.02 Restructuring and succession charges(e) — 1,420 — 1,420 1,420 0.02 Financial restructuring costs(g) — 226 — 226 226 — Loss on disposal of a business(h) — 222 — 222 222 — Other items(i) — 2,500 (111) 2,389 2,389 0.03 Tax effect of adjusting items(j) — — — — (4,611) (0.06)Non-GAAP measure$96,658 $73,757 $3,367 $19,534 $6,102 $0.07 Non-GAAP margin 71.4%

14.4%

Non-GAAP Gross Margin Non-GAAP Operating Expenses Non-GAAP R&D Non-GAAP Operating Income Non-GAAP Net Income Continuing Operations Adjusted EPS Continuing Operations

Year Ended December 31, 2024Gross Profit Operating Expenses(a) R&D Operating Loss Net Loss Continuing Operations EPS from Continuing Operations(k)Reported GAAP measure$388,226 $386,566 $13,639 $(11,979) $(43,833) $(0.52)Reported GAAP margin 67.7%

(2.1%) Depreciation and amortization(b) 41,882 7,652 21 49,555 49,555 0.62 Acquisition and related costs(c) — 1,339 — 1,339 1,339 0.02 Shareholder litigation costs(d) — 13,802 — 13,802 13,802 0.17 Restructuring and succession charges(e) — (57) — (57) (57) — Impairment of assets(f) — 36,357 — 36,357 36,357 0.45 Financial restructuring costs(g) — 351 — 351 351 — Loss on disposal of a business(h) — 292 — 292 292 — Other items(i) — 7,894 514 8,408 7,519 0.09 Tax effect of adjusting items(j) — — — — (27,620) (0.34)Non-GAAP measure$430,108 $318,936 $13,104 $98,068 $37,705 $0.49 Non-GAAP margin 75.0%

17.1%

Non-GAAP Gross Margin Non-GAAP Operating Expenses Non-GAAP R&D Non-GAAP Operating Income Non-GAAP Net Income Continuing Operations Adjusted EPS Continuing Operations

Year Ended December 31, 2023Gross Profit Operating Expenses(a) R&D Operating Loss Net Loss Continuing Operations EPS from Continuing Operations(k)Reported GAAP measure$328,193 $396,472 $13,446 $(81,725) $(121,196) $(1.54)Reported GAAP margin 64.1%

(16.0%) Depreciation and amortization(b) 48,503 8,842 20 57,365 57,365 0.73 Acquisition and related costs(c) — 5,694 — 5,694 5,694 0.07 Restructuring and succession charges(e) — 2,331 — 2,331 2,331 0.03 Impairment of assets(f) — 78,615 — 78,615 78,615 1.00 Financial restructuring costs(g) — 7,291 — 7,291 7,291 0.09 Loss on disposal of a business(h) — 1,539 — 1,539 1,539 0.02 Other items(i) — 8,761 1,175 9,936 9,936 0.13 Tax effect of adjusting items(j) — — — — (36,401) (0.51)Non-GAAP measure$376,696 $283,399 $12,251 $81,046 $5,174 $0.02 Non-GAAP margin 73.5%

15.8%

Non-GAAP Gross Margin Non-GAAP Operating Expenses Non-GAAP R&D Non-GAAP Operating Income Non-GAAP Net Income Continuing Operations Adjusted EPS Continuing Operations (a) The "Reported GAAP Measure" under the "Operating Expenses" column is a sum of all GAAP operating expense line items, excluding research and development. (b) Includes for the three months ended December 31, 2024 and 2023 and the years ended December 31, 2024 and 2023, respectively, depreciation and amortization of $10.6 million, $10.4 million, $41.9 million and $48.5 million in cost of sales and $1.8 million, $2.1 million, $7.7 million and $8.9 million in operating expenses presented in the consolidated statements of operations and comprehensive loss. (c) Includes acquisition and integration costs related to completed acquisitions and changes in fair value of contingent consideration. (d) Costs incurred as a result of certain shareholder litigation unrelated to our ongoing operations. (e) Costs incurred were the result of adopting restructuring plans to reduce headcount, contract termination, reorganize management structure and consolidate certain facilities. (f) Activity in 2024 includes: (i) a non-cash impairment charge of $33.9 million for intangible assets solely attributable to our Advanced Rehabilitation Business due to the decision to divest the business and (ii) a non-cash impairment charge of $2.5 million for rented right of use assets involving exited office and warehouse spaces. Activity in 2023 relates to the non-cash impairment charge attributable to our divested Wound Business. (g) Financial restructuring costs include advisory fees and debt amendment related costs. (h) Represents the loss on the disposal for the Advanced Rehabilitation and Wound Businesses for the year ended December 31, 2024 and 2023, respectively. (i) Other items primarily include charges associated with strategic transactions, such as potential acquisitions or divestitures and a transformative project to redesign systems and information processing. Other items for the three months December 31, 2024 mostly consisted of divestiture costs related to the Company's Advanced Rehabilitation Business. Other items for the three months ended December 31, 2023 primarily consisted of $1.3 million in transformative project costs and $0.6 million in strategic transaction costs. During the year ended December 31, 2024, other items primarily consisted of the following: (i) divestiture costs related to the Company’s Advanced Rehabilitation Business, including transactional fees, totaling $4.7 million; (ii) transformative project costs of $1.7 million; and (iii) strategic transaction costs of $0.4 million. During the year ended December 31, 2023, other items mainly consisted of the following: (i) strategic transaction costs totaling $4.8 million, including divestiture costs of $1.1 million related to Advanced Rehabilitation; (ii) transformative project costs of $4.5 million; (iii) transition and severance costs of $2.8 million; and (iv) $1.0 million in costs related to the discontinuance of MOTYS. Other items also includes a reversal of $3.8 million in equity-based compensation expenses related to the transition of our executive leadership. (j) The three months ended and year ended December 31, 2024 includes a tax impact of $0.7 million and $8.7 million, respectively, related to the impairment of assets. The year ended December 31, 2023 includes a $15.3 million tax impact related to the impairment of assets. An estimated tax impact for the remaining adjustments to Non-GAAP Net Income was calculated by applying a rate of 25.1% to those adjustments for the year ended December 31, 2024 and 2023. (k) Adjustments are pro-rated to exclude the weighted average non-controlling interest ownership of 19.4% and 20.0%, respectively, for the years ended December 31, 2024 and 2023. Investor Inquiries and Media:Dave CrawfordBioventusinvestor.relations@bioventus.com

Financial Statement

07 Jan 2025

DURHAM, N.C., Jan. 07, 2025 (GLOBE NEWSWIRE) -- Bioventus Inc. (Nasdaq: BVS), a global leader in innovations for active healing, today announced that Rob Claypoole, chief executive officer, will present at the 43rd Annual J.P. Morgan Healthcare Conference on Wednesday, January 15, 2025, at 10:30 a.m. PT (1:30 p.m. ET). The live webcast of the presentation, including Q&A, may be accessed on the Investors section of the Bioventus website and will be available until February 15, 2025. About BioventusBioventus delivers clinically proven, cost-effective products that help people heal quickly and safely. Its mission is to make a difference by helping patients resume and enjoy active lives. The Innovations for Active Healing from Bioventus include offerings for Pain Treatments, Restorative Therapies and Surgical Solutions. Built on a commitment to high quality standards, evidence-based medicine and strong ethical behavior, Bioventus is a trusted partner for physicians worldwide. For more information, visit www.bioventus.com, and follow the Company on LinkedIn and Twitter. Bioventus and the Bioventus logo are registered trademarks of Bioventus LLC. Investor and Media Inquiries:Dave Crawford919-474-6787dave.crawford@bioventus.com

29 Oct 2024

DURHAM, N.C., Oct. 29, 2024 (GLOBE NEWSWIRE) -- Bioventus Inc. (Nasdaq: BVS) (“Bioventus” or the “Company”), a global leader in innovations for active healing, today announced that it will report financial results for the third quarter of fiscal year 2024 before the market opens on Tuesday, November 5, 2024. The Company’s management will host a conference call at 8:30 a.m. Eastern Time that same day to discuss the results and provide a business update. To participate in the conference call, dial 1-833-636-0497 and refer to the Bioventus Inc. Conference Call. A live webcast of the call and accompanying materials will also be provided on the “Investor Relations” section of the Company's website at https://ir.bioventus.com/. The webcast will be archived at the same site and available for replay until November 4, 2025. About BioventusBioventus delivers clinically proven, cost-effective products that help people heal quickly and safely. Its mission is to make a difference by helping patients resume and enjoy active lives. The Innovations for Active Healing from Bioventus include offerings for Pain Treatments, Restorative Therapies and Surgical Solutions. Built on a commitment to high quality standards, evidence-based medicine and strong ethical behavior, Bioventus is a trusted partner for physicians worldwide. For more information, visit www.bioventus.com and follow the Company on LinkedIn and Twitter. Bioventus and the Bioventus logo are registered trademarks of Bioventus LLC. Investor and Media Inquiries:Dave Crawford919-474-6787Dave.Crawford@bioventus.com

Financial Statement

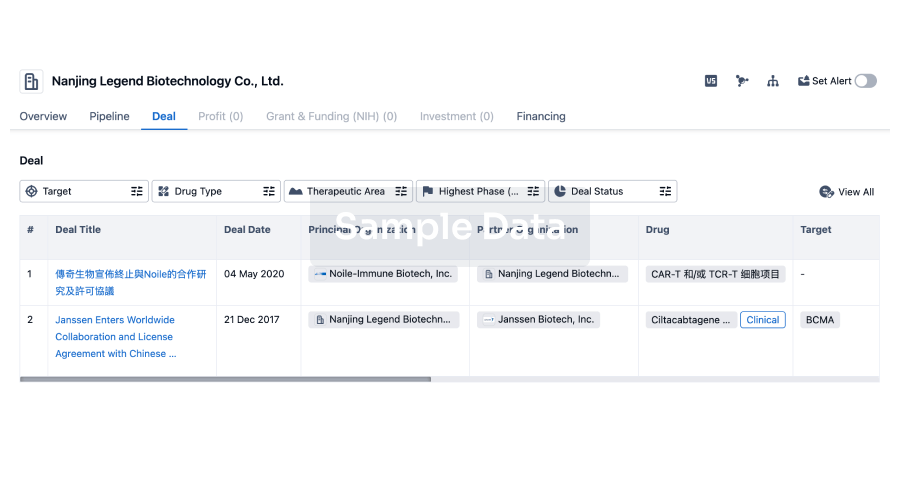

100 Deals associated with Bioventus LLC

Login to view more data

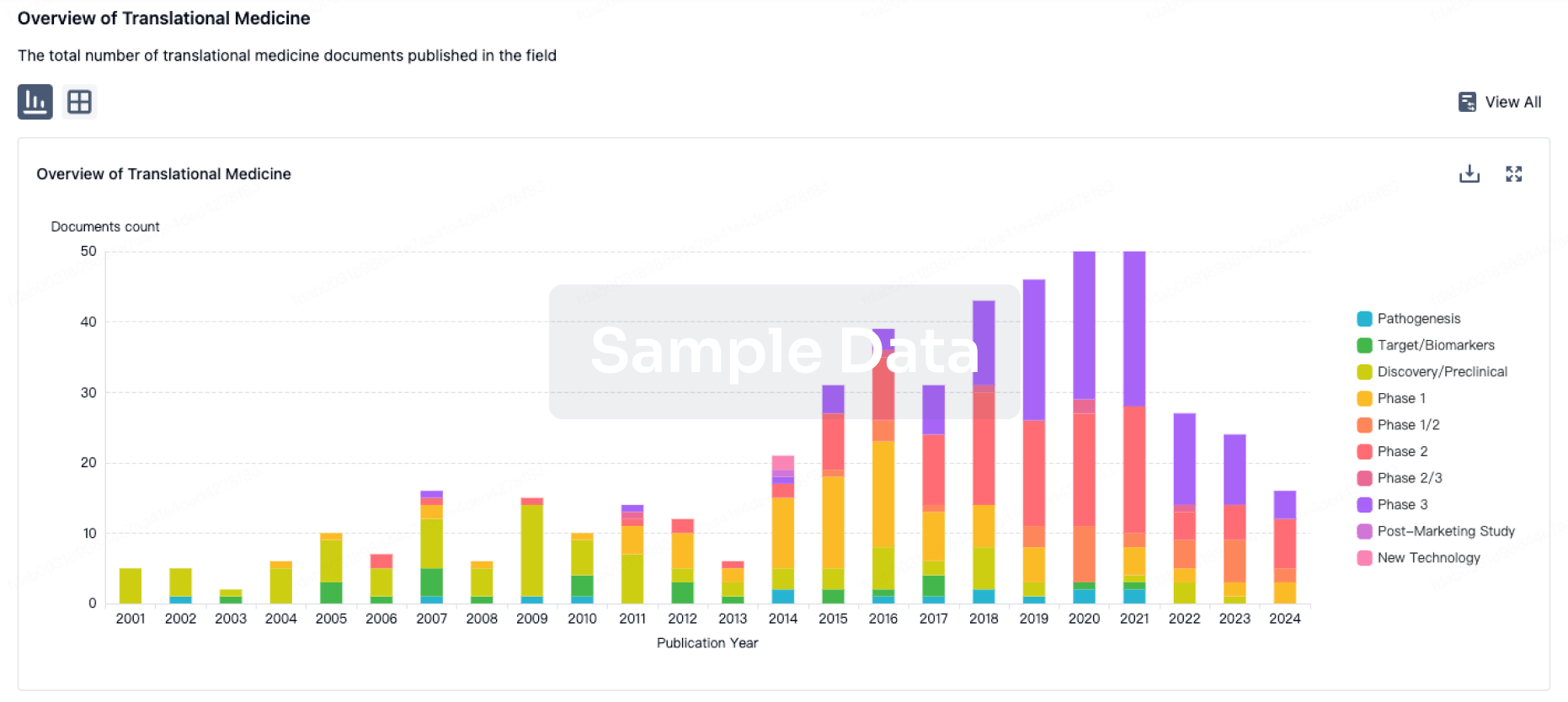

100 Translational Medicine associated with Bioventus LLC

Login to view more data

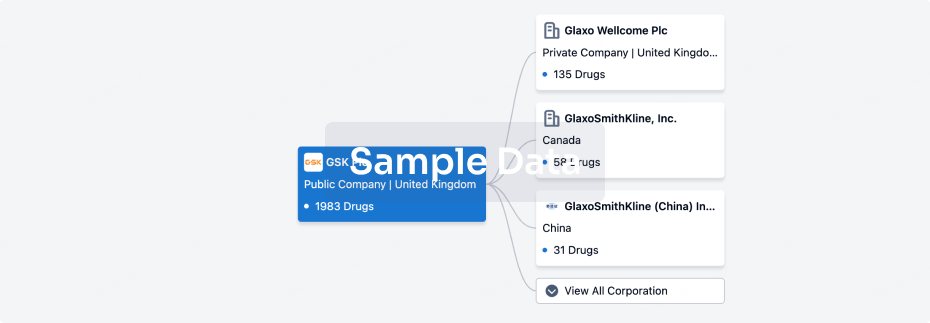

Corporation Tree

Boost your research with our corporation tree data.

login

or

Pipeline

Pipeline Snapshot as of 20 Jul 2025

The statistics for drugs in the Pipeline is the current organization and its subsidiaries are counted as organizations,Early Phase 1 is incorporated into Phase 1, Phase 1/2 is incorporated into phase 2, and phase 2/3 is incorporated into phase 3

Other

1

Login to view more data

Current Projects

| Drug(Targets) | Indications | Global Highest Phase |

|---|---|---|

PTP-001 | Osteoarthritis, Knee More | Pending |

Login to view more data

Deal

Boost your decision using our deal data.

login

or

Translational Medicine

Boost your research with our translational medicine data.

login

or

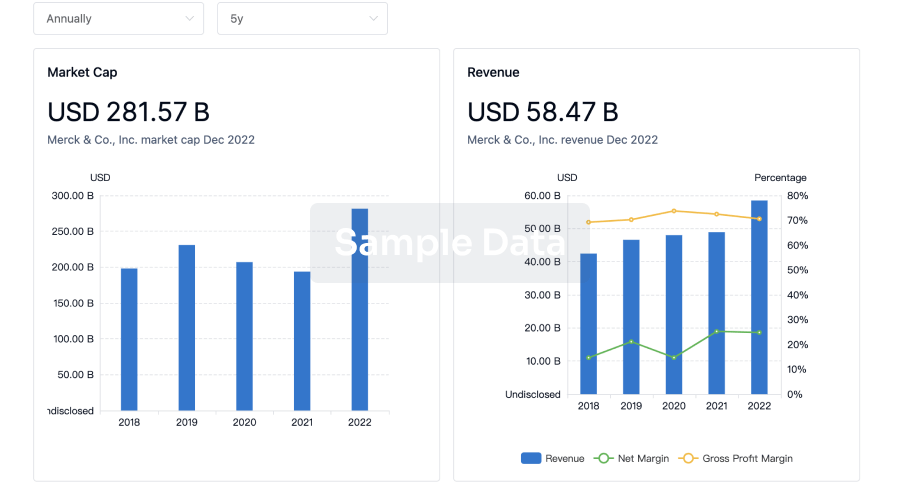

Profit

Explore the financial positions of over 360K organizations with Synapse.

login

or

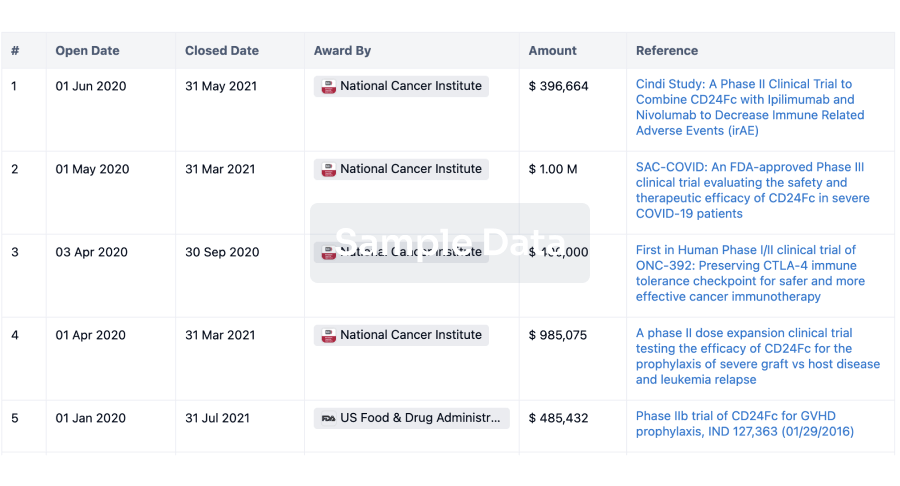

Grant & Funding(NIH)

Access more than 2 million grant and funding information to elevate your research journey.

login

or

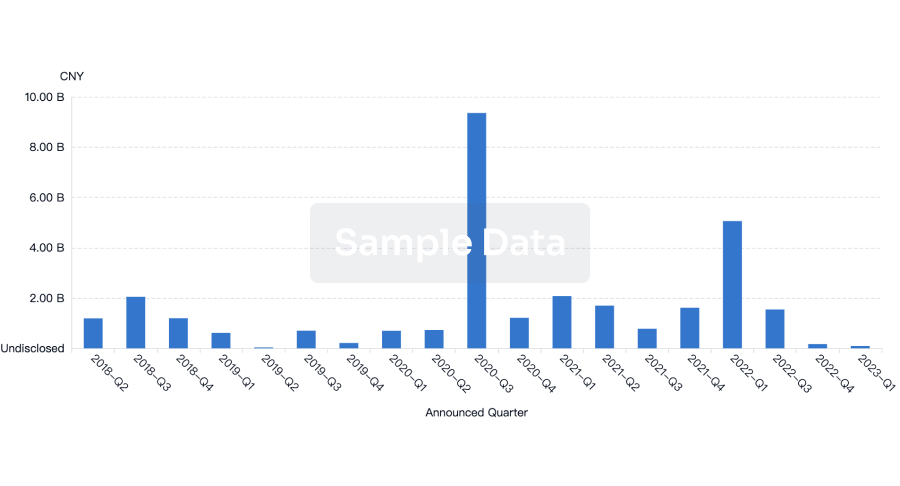

Investment

Gain insights on the latest company investments from start-ups to established corporations.

login

or

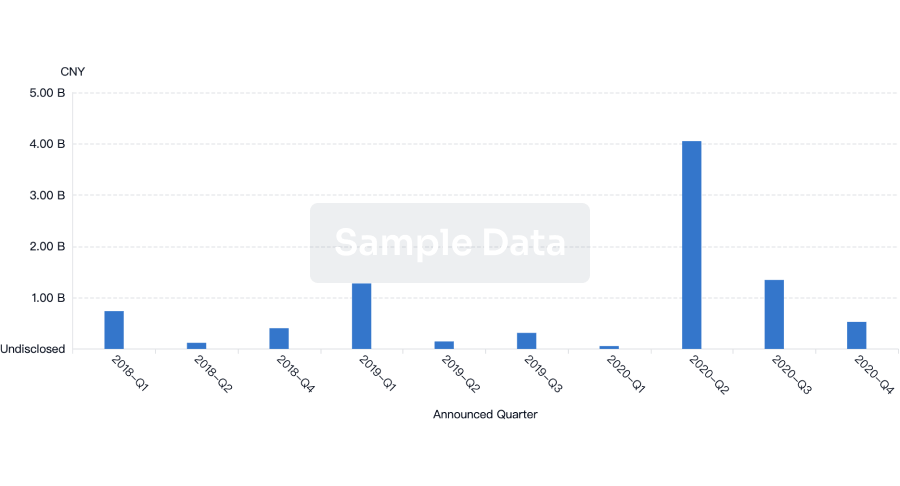

Financing

Unearth financing trends to validate and advance investment opportunities.

login

or

AI Agents Built for Biopharma Breakthroughs

Accelerate discovery. Empower decisions. Transform outcomes.

Get started for free today!

Accelerate Strategic R&D decision making with Synapse, PatSnap’s AI-powered Connected Innovation Intelligence Platform Built for Life Sciences Professionals.

Start your data trial now!

Synapse data is also accessible to external entities via APIs or data packages. Empower better decisions with the latest in pharmaceutical intelligence.

Bio

Bio Sequences Search & Analysis

Sign up for free

Chemical

Chemical Structures Search & Analysis

Sign up for free