Request Demo

Last update 08 May 2025

Chk1 x Chk2

Last update 08 May 2025

Related

5

Drugs associated with Chk1 x Chk2Target |

Mechanism Chk1 inhibitors [+1] |

Active Org. |

Originator Org. |

Active Indication |

Inactive Indication |

Drug Highest PhasePhase 2 |

First Approval Ctry. / Loc.- |

First Approval Date20 Jan 1800 |

Target |

Mechanism Chk1 inhibitors [+1] |

Active Org.- |

Originator Org. |

Active Indication- |

Inactive Indication |

Drug Highest PhaseDiscontinued |

First Approval Ctry. / Loc.- |

First Approval Date20 Jan 1800 |

Target |

Mechanism Chk1 inhibitors [+1] |

Active Org.- |

Originator Org. |

Active Indication- |

Inactive Indication |

Drug Highest PhaseDiscontinued |

First Approval Ctry. / Loc.- |

First Approval Date20 Jan 1800 |

27

Clinical Trials associated with Chk1 x Chk2NCT06597565

A Phase II Study of ACR-368 and Low Dose Gemcitabine Combination Therapy in Patients With Recurrent and/or Metastatic Head and Neck Squamous Cell Carcinoma

The purpose of the study is to determine the activity and safety of ACR-368 (prexasertib) in combination with gemcitabine in participants with Head and Neck Squamous Cell Carcinoma (HNSCC). Participants will receive the study drugs ACR-368 and a low dose of gemcitabine once every 2 weeks in 4-week cycles and will continue on treatment unless the disease deteriorates.

Start Date25 Sep 2024 |

Sponsor / Collaborator |

NCT05548296

A Phase 1b/2 Basket Study of ACR-368 as Monotherapy and in Combination With Gemcitabine in Adult Subjects With Platinum-Resistant Ovarian Carcinoma, Endometrial Adenocarcinoma, and Urothelial Carcinoma Based on Acrivon OncoSignature® Status

This is an open label Phase 1b/2 study to evaluate the efficacy and safety of ACR-368 as monotherapy or in combination with ultralow dose gemcitabine in participants with platinum-resistant ovarian carcinoma, endometrial adenocarcinoma, and urothelial carcinoma based on Acrivon's OncoSignature® test status.

Start Date29 Aug 2022 |

Sponsor / Collaborator Acrivon AB [+1] |

100 Clinical Results associated with Chk1 x Chk2

Login to view more data

100 Translational Medicine associated with Chk1 x Chk2

Login to view more data

0 Patents (Medical) associated with Chk1 x Chk2

Login to view more data

998

Literatures (Medical) associated with Chk1 x Chk201 Aug 2025·Colloids and Surfaces B: Biointerfaces

Synthetic selenomelanin nanoparticles radio-sensitize non-melanocytic lung cancer (A549) cells by promoting G2/M arrest

Article

Author: Das, Ram Pada ; Aishwarya, J ; Kunwar, Amit ; Barik, Atanu

01 May 2025·Bioorganic Chemistry

Discovery of 4-(2-(methylamino)thiazol-5-yl)pyrimidin-2-amine derivatives as novel cyclin-dependent kinase 12 (CDK12) inhibitors for the treatment of esophageal squamous cell carcinoma

Article

Author: Cao, Yin ; Zhang, Yuxiang ; Wang, Xiumin ; Wang, Di ; Yang, Ziying ; Chen, Simian ; He, Yaohui ; He, Fengming ; Qiu, Yingkun ; Ao, Mingtao ; Huang, Mengxian ; Wu, Zhen ; Fang, Meijuan ; Zhao, Xinwei ; Huang, Sen ; Chen, Shutong

01 Jan 2025·Journal of Medical Virology

ATM/ATR‐Mediated DNA Damage Response Facilitates SARS‐CoV‐2 Spike Protein‐Induced Syncytium Formation

Article

Author: Liu, Yang ; Zhou, Haitao ; Wang, Qin ; Wei, Tingting ; Zhao, Xiaotong ; Wu, Yanjin ; Hou, Yujia ; Meng, Jiahui

9

News (Medical) associated with Chk1 x Chk227 Mar 2025

Generative Phosphoproteomics AP3 platform designed to enable streamlined, rational drug discovery, with proprietary, proteome-wide SAR delivering desirable pathway effects

R&D event highlighted positive ACR-368 endometrial cancer data in OncoSignature-positive (BM+) patients with heavily pretreated aggressive tumors, and who had all progressed on prior anti-PD-1 and chemotherapy, with 35% confirmed overall response rate (cORR), which is >2-fold higher than last prior line of therapy (15%)

In the BM+ patients who had relapsed after prior anti-PD-1 and chemotherapy, the cORR was 50% with the median duration of response (mDOR) not yet reached (>10 months), while in BM+ patients who were refractory to their last prior line of therapy, the cORR was 33% and mDOR was ~3.4 months

Endometrial cancer prioritized given limited treatment options and compelling commercial opportunity; represents first potential regulatory approval opportunity for ACR-368

Phase 1 trial of ACR-2316 ahead of schedule with enrollment in first three dose-escalation cohorts completed; initial clinical activity with tumor shrinkage already observed at dose level three

Cash runway extended into 2027

WATERTOWN, Mass., March 27, 2025 (GLOBE NEWSWIRE) -- Acrivon Therapeutics, Inc. (“Acrivon” or “Acrivon Therapeutics”) (Nasdaq: ACRV), a clinical stage precision medicine company utilizing its Acrivon Predictive Precision Proteomics (AP3) platform for the discovery, design, and development of drug candidates through a mechanistic match to patients whose disease is predicted sensitive to the specific treatment, today reported financial results for the fourth quarter and full year ended December 31, 2024 and reviewed recent business highlights.

“We continue executing our highly differentiated Generative Phosphoproteomics AP3-enabled strategy, delivering rapid progress towards key milestones across all programs, including our clinical assets, ACR-368 and ACR-2316,” said Peter Blume-Jensen, M.D., Ph.D., chief executive officer, president, and founder of Acrivon. “We previously identified endometrial cancer as a sensitive tumor type with our AP3 platform prior to clinical entry. At our recent R&D event, we shared positive data for ACR-368 in patients with stage III/IV endometrial cancer who had all progressed after prior anti-PD-1 and chemotherapy. Despite patients presenting with large, heavily pretreated tumors (including 65% treated with prior pembrolizumab and lenvatinib) with aggressive histopathologies (75% serous or carcinosarcomas), pMMR, and p53 mutations, we observed strong anti-tumor activity, both among refractory and relapsed patients. Interestingly, amongst the patients that had relapsed after their last prior line, we observed 50% cORR and mDOR (not yet reached) of greater than 10 months, and 33% cORR in refractory patients who did not respond at all to their last prior line of therapy. In our ACR-2316 Phase 1 trial, we have completed enrollment in the first three dose-escalation cohorts, and have observed approximate dose proportionality, target engagement, and initial clinical activity with significant tumor shrinkage already at dose level three. Finally, we continue to expand the actionable capabilities of our Generative Phosphoproteomics AP3 platform to enable us to optimize therapeutic compounds for desired pathway effects, which drives our streamlined drug discovery, design and development.”

Program Updates Presented at Corporate R&D Event on March 25, 2025

Reviewed continued expansion of the differentiated capabilities of the Generative Phosphoproteomics AP3 platform, highlighting the growing suite of powerful, internally-developed tools, including the AP3 Interactome, the AP3 Kinase Substrate Relationship Predictor, the AP3 Data Portal and the AP3 Chatbot. Together, these proprietary tools have enabled the company to go beyond the limitations of traditional drug discovery to rapidly design and advance innovative agents into clinical development. Presented data (from February 25, 2025) from the ongoing Phase 2b registrational-intent trial of ACR-368 that included 20 BM+ endometrial cancer patients treated with ACR-368 monotherapy and 38 BM- patients treated with ACR-368 plus ultra-low dose gemcitabine (LDG) that were efficacy-evaluable by RECIST (2 BM- had treatment discontinued without scan) All BM+ patients had progressed after prior platinum-based chemotherapy and prior anti-PD-1, and the median and mean prior lines of therapy for these patients were 2 and 2.6, respectively. A majority of these BM+ patients were refractory to the last prior line of therapy, with aggressive, generally heavily pre-treated tumors: 12 had refractory disease (best overall response of PD in last prior line of therapy), 6 had relapsed disease, and 2 were unknown. Among the 20 BM+ patients, 15 were either serous or carcinosarcomas, 13 were pMMR (2 deficient DNA mismatch repair, 5 not tested), and 11 had p53 mutations (3 wild-type; 6 unknown) The ACR-368 OncoSignature assay accurately identified patients whose tumors are sensitive to ACR-368, with 80% of BM+ patients demonstrating tumor shrinkage. Among all 20 BM+ patients, the cORR was 35%, more than double than in the prior line of therapy, and the disease control rate (DCR) was 80%. In patients that had relapsed after the prior line of therapy (N=6), the cORR was 50%, mDOR was not yet reached (>10 months), and DCR was 100%. In the 12 patients with tumors refractory to last prior line of therapy (ORR = 0%), significant clinical activity was observed with a cORR of 33% and DCR of 75%. In BM- patients treated with the ACR-368 + LDG combination, cORR was ~13%, which is comparable to the best overall response rate in the last prior line of therapy (median = 3), which was 17%. The totality of the preclinical and observed clinical data support significant LDG sensitization to ACR-368 in BM- patients. The company expects that a similar sensitization would occur in BM+ patients, which could be explored in a future all-comer study of ACR-368 + LDG. Several case studies were presented with imaging showing clinically significant, powerful tumor shrinkage in endometrial cancer patients treated with ACR-368 Given encouraging, maturing data in endometrial cancer, combined with limited treatment options for second-line therapy (standard of care ORR of 10-12% and mPFS of ~3 months, based on estimates from key opinion leaders and derived from control arms of past Phase 2 trials), and potential market opportunity, the company is prioritizing endometrial cancer, reallocating all clinical resources to ACR-368 in endometrial cancer and ACR-2316 Due to increased competition and a smaller market opportunity, the company set a high internal clinical bar for ovarian cancer, which preliminary data suggests is unlikely to be met Bladder cancer is also being deprioritized due to lower than preclinically predicted BM+ rate, leading to enrollment challenges Continued dosing of patients with a certain advanced solid tumors in the ongoing Phase 1 monotherapy clinical trial of ACR-2316 (initiated 2 quarters ahead of original timelines). ACR-2316 was uniquely designed by AP3 to overcome the limitations of current WEE1 and PKMYT1 inhibitors, for superior therapeutic index, and for potent single-agent activity. Dose levels 1 and 2 were cleared without safety concerns or dose-limiting toxicities (DLTs) by the safety review committee; dose level 3 is fully enrolled and the safety observation period is anticipated to be completed by April 1 Encouraging early observations include: evidence of approximate dose proportionality, based on pharmacokinetic analyses of the first two DLs; drug target engagement, identified using the company’s mass spectrometry-based AP3 profiling capabilities; and initial clinical activity in a DL3 patient, with significant decrease in size of metastatic lesions throughout the chest, abdomen and pelvis. This patient (who had received 3 prior lines of therapy including chemotherapy and anti-PD-1) remains on therapy. Using AP3-based Indication Finding and AP3-based analyses of in-house and publicly available data, the company is enrolling selected, high unmet need solid tumor types predicted sensitive to ACR-2316 in the clinical trial

All BM+ patients had progressed after prior platinum-based chemotherapy and prior anti-PD-1, and the median and mean prior lines of therapy for these patients were 2 and 2.6, respectively. A majority of these BM+ patients were refractory to the last prior line of therapy, with aggressive, generally heavily pre-treated tumors: 12 had refractory disease (best overall response of PD in last prior line of therapy), 6 had relapsed disease, and 2 were unknown. Among the 20 BM+ patients, 15 were either serous or carcinosarcomas, 13 were pMMR (2 deficient DNA mismatch repair, 5 not tested), and 11 had p53 mutations (3 wild-type; 6 unknown) The ACR-368 OncoSignature assay accurately identified patients whose tumors are sensitive to ACR-368, with 80% of BM+ patients demonstrating tumor shrinkage. Among all 20 BM+ patients, the cORR was 35%, more than double than in the prior line of therapy, and the disease control rate (DCR) was 80%. In patients that had relapsed after the prior line of therapy (N=6), the cORR was 50%, mDOR was not yet reached (>10 months), and DCR was 100%. In the 12 patients with tumors refractory to last prior line of therapy (ORR = 0%), significant clinical activity was observed with a cORR of 33% and DCR of 75%. In BM- patients treated with the ACR-368 + LDG combination, cORR was ~13%, which is comparable to the best overall response rate in the last prior line of therapy (median = 3), which was 17%. The totality of the preclinical and observed clinical data support significant LDG sensitization to ACR-368 in BM- patients. The company expects that a similar sensitization would occur in BM+ patients, which could be explored in a future all-comer study of ACR-368 + LDG. Several case studies were presented with imaging showing clinically significant, powerful tumor shrinkage in endometrial cancer patients treated with ACR-368 Given encouraging, maturing data in endometrial cancer, combined with limited treatment options for second-line therapy (standard of care ORR of 10-12% and mPFS of ~3 months, based on estimates from key opinion leaders and derived from control arms of past Phase 2 trials), and potential market opportunity, the company is prioritizing endometrial cancer, reallocating all clinical resources to ACR-368 in endometrial cancer and ACR-2316 Due to increased competition and a smaller market opportunity, the company set a high internal clinical bar for ovarian cancer, which preliminary data suggests is unlikely to be met Bladder cancer is also being deprioritized due to lower than preclinically predicted BM+ rate, leading to enrollment challenges

Due to increased competition and a smaller market opportunity, the company set a high internal clinical bar for ovarian cancer, which preliminary data suggests is unlikely to be met Bladder cancer is also being deprioritized due to lower than preclinically predicted BM+ rate, leading to enrollment challenges

Dose levels 1 and 2 were cleared without safety concerns or dose-limiting toxicities (DLTs) by the safety review committee; dose level 3 is fully enrolled and the safety observation period is anticipated to be completed by April 1 Encouraging early observations include: evidence of approximate dose proportionality, based on pharmacokinetic analyses of the first two DLs; drug target engagement, identified using the company’s mass spectrometry-based AP3 profiling capabilities; and initial clinical activity in a DL3 patient, with significant decrease in size of metastatic lesions throughout the chest, abdomen and pelvis. This patient (who had received 3 prior lines of therapy including chemotherapy and anti-PD-1) remains on therapy. Using AP3-based Indication Finding and AP3-based analyses of in-house and publicly available data, the company is enrolling selected, high unmet need solid tumor types predicted sensitive to ACR-2316 in the clinical trial

Anticipated Upcoming Milestones

Provide update on registrational intent trial and confirmatory trial design for ACR-368 Report initial clinical data from the Phase 1 clinical study of ACR-2316 in the second half of 2025 Advance a new potential first-in-class cell cycle drug discovery program for an undisclosed target towards development candidate nomination in 2025

Fourth Quarter and Full Year 2024 Financial Results

Net loss for the quarter and full year ended December 31, 2024 was $22.8 million and $80.6 million, respectively. This compares to a net loss of $19.3 million and $60.4 million, respectively for the same periods in 2023.

Research and development expenses were $18.6 million for the quarter ended December 31, 2024, and $64.0 million for the full year 2024, compared to $15.5 million and $46.0 million, respectively, for the same periods in 2023. The difference was primarily due to the continued development of ACR-368 - which included the progression of the ongoing clinical trial and the achievement of milestones for the companion diagnostic, the initiation of the ACR-2316 clinical trial in the third quarter of 2024, and increased personnel to support development activities.

General and administrative expenses were $6.3 million for the quarter ended December 31, 2024, and $25.2 million for the full year 2024, compared to $5.6 million and $21.1 million, respectively, for the same periods in 2023. The difference was primarily due to increased personnel costs, inclusive of non-cash stock compensation expense.

As of December 31, 2024, the company had cash, cash equivalents and investments of $184.6 million, which is expected to fund operating expenses and capital expenditure requirements into 2027.

About Acrivon Therapeutics Acrivon is a clinical stage biopharmaceutical company discovering and developing precision oncology medicines for patients whose tumors are predicted to be sensitive to each specific medicine by utilizing its proprietary Generative Phosphoproteomics platform, Acrivon Predictive Precision Proteomics, or AP3. The AP3 platform is engineered to measure compound-specific effects on the entire tumor cell protein signaling network and drug-induced resistance mechanisms in an unbiased manner yielding terabytes of high resolution proprietary quantitative data for pathway-based drug design, indication finding, and response prediction. These distinctive capabilities enable AP3’s direct application for streamlined rational drug discovery for monotherapy activity, the identification of rational drug combinations, and the creation of drug-specific proprietary OncoSignature companion diagnostics that are used to identify the patients most likely to benefit from Acrivon’s drug candidates. Acrivon is currently advancing its lead candidate, ACR-368 (also known as prexasertib), a selective small molecule inhibitor targeting CHK1 and CHK2 in a potentially registrational Phase 2 trial, focusing on endometrial cancer. The company has received Fast Track designation from the Food and Drug Administration, or FDA, for the investigation of ACR-368 as monotherapy based on OncoSignature-predicted sensitivity in patients with endometrial cancer. Acrivon’s ACR-368 OncoSignature test, which has not yet obtained regulatory approval, has been extensively evaluated in preclinical studies, including in two separate, blinded, prospectively-designed studies on pretreatment tumor biopsies collected from past third-party Phase 2 trials in patients with ovarian cancer treated with ACR-368. The FDA has granted Breakthrough Device designations for the ACR-368 OncoSignature assay for the identification of patients with endometrial cancer who may benefit from ACR-368 treatment.

In addition to ACR-368, Acrivon is also leveraging its proprietary AP3 precision medicine platform for developing its co-crystallography-driven, internally discovered pipeline programs. These include ACR-2316, the company’s second clinical stage asset, a novel, potent, selective WEE1/PKMYT1 inhibitor designed for superior single-agent activity through strong activation of not only CDK1 and CDK2, but also of PLK1 to drive pro-apoptotic cell death, as demonstrated in preclinical studies against benchmark inhibitors. In addition, the company has a preclinical cell cycle program with an undisclosed target.

Acrivon has developed its AP3 Interactome, a proprietary, computational analytics platform driven by Generative Phosphoproteomics machine learning for integrated comprehensive analyses across all large, in-house AP3 phosphoproteomic drug profiling data sets to advance its in-house research programs.

Forward-Looking Statements This press release includes certain disclosures that contain “forward-looking statements” within the meaning of the Private Securities Litigation Reform Act of 1995 about us and our industry that involve substantial risks and uncertainties. All statements other than statements of historical facts contained in this press release, including statements regarding our future results of operations or financial condition, preclinical and clinical results, business strategy and plans and objectives of management for future operations, are forward-looking statements. In some cases, you can identify forward-looking statements because they contain words such as “anticipate,” “believe,” “contemplate,” “continue,” “could,” “estimate,” “expect,” “intend,” “may,” “plan,” “potential,” “predict,” “project,” “should,” “target,” “will,” or “would” or the negative of these words or other similar terms or expressions. Forward-looking statements are based on Acrivon’s current expectations and are subject to inherent uncertainties, risks and assumptions that are difficult to predict. Factors that could cause actual results to differ include, but are not limited to, risks and uncertainties that are described more fully in the section titled “Risk Factors” in our reports filed with the Securities and Exchange Commission. Forward-looking statements contained in this press release are made as of this date, and Acrivon undertakes no duty to update such information except as required under applicable law.

Investor and Media Contacts: Adam D. Levy, Ph.D., M.B.A.alevy@acrivon.com

Alexandra Santos asantos@wheelhouselsa.com

Clinical ResultPhase 1Phase 2Fast TrackFinancial Statement

26 Mar 2025

Acrivon Therapeutics\' OncoSignature test proved less useful when it came to recruiting bladder cancer patients for ACR-368.\n Acrivon Therapeutics is halting work on developing its lead drug for ovarian and bladder cancers, instead focusing the Eli Lilly castoff solely on endometrial cancer.The Watertown, Massachusetts-based biotech had been evaluating the CHK1/2 inhibitor, called prexasertib or ACR-368, in a phase 2b trial of patients with endometrial cancer. These patients were split between 20 individuals who had tested positive for Acrivon’s OncoSignature biomarker test and 38 who tested negative.Based on an interim data extract, Acrivon was able to show that the OncoSignature “accurately identified patients whose tumors are sensitive to ACR-368,” with 80% of these individuals seeing their tumor shrink to some extent, according to Acrivon. This cohort saw a confirmed overall response rate of 35%, the biotech said in a Securities and Exchange Commission filing March 25.“Overall, these results demonstrate significant anti-tumor activity and disease control in BM+ patients with aggressive, refractory tumors that did not respond at all to the last line of prior therapy, and with a confirmed ORR more than double the best ORR observed in the last prior line of therapy for all BM+ patients,” Acrivon said in the filing.The company had already made endometrial cancer its top priority but used yesterday\'s filing to announce that it had now “officially deprioritized ovarian and bladder cancers” as targets for ACR-368.“Due to increased competition and a smaller market opportunity, the company set a high internal clinical bar for ovarian cancer, which preliminary data suggests is unlikely to be met,” Acrivon explained. In addition, the OncoSignature had been less useful recruiting bladder cancer patients with a suitable biomarker for ACR-368, meaning less than 10 individuals had been enrolled for this indication, the company added.The clinical resources for these two indications will be redirected to testing ACR-368 in endometrial cancer as well as toward Acrivon’s other clinical-stage candidate, ACR-2316. The WEE1/PKMYT1 inhibitor is currently in a phase 1 trial for patients with advanced solid tumors.ACR-368’s story dates back to the late 1990s, when it was discovered by Array BioPharma. Lilly had later picked up the CHK1/2 inhibitor before discarding it in 2019 after phase 2 studies didn\'t show enough promise. In 2021, Acrivon launched with a mission to reignite development of the drug and touted the therapy’s potential when it organized a $99 million IPO the following year.

Phase 1Phase 2Clinical ResultIPOAcquisition

05 Feb 2025

The ACR-368-tailored OncoSignature assay is being used to predict patients most likely to respond to ACR-368 in Acrivon’s ongoing, registrational-intent, multicenter Phase 2b trial of ACR-368 in patients with endometrial cancer and other tumor types

Clinical data presented at ESMO 2024 demonstrates statistically significant segregation of patient responders in biomarker-positive versus biomarker-negative subgroups based on prospective OncoSignature patient selection (p-value = 0.009)

Drug-tailored, proprietary OncoSignature biomarker assays are developed using the generative AI-driven Acrivon Predictive Precision Proteomics (AP3) platform, which is also used for streamlined, biologically rational drug design and indication finding

WATERTOWN, Mass., Feb. 05, 2025 (GLOBE NEWSWIRE) -- Acrivon Therapeutics, Inc. (“Acrivon” or “Acrivon Therapeutics”) (Nasdaq: ACRV), a clinical stage precision medicine company utilizing its Acrivon Predictive Precision Proteomics (AP3) platform for the discovery, design, and development of drug candidates through a mechanistic match to patients whose disease is predicted sensitive to the specific treatment, announced the U.S. Food and Drug Administration (FDA) has granted Breakthrough Device designation for the ACR-368 OncoSignature assay, a multiplex immunofluorescence assay for the identification of endometrial cancer patients who may benefit from ACR-368 treatment. The designation reflects the FDA’s determination that the device is reasonably expected to provide for more effective treatment or diagnosis of life-threatening or irreversibly debilitating human disease or conditions.

“We are pleased that the FDA has designated our ACR-368 OncoSignature assay, developed specifically to prospectively predict tumor sensitivity to ACR-368 and used in our advancing registrational-intent clinical study, as a Breakthrough Device for patients with endometrial cancer,” said Peter Blume-Jensen, M.D., Ph.D., chief executive officer, president, and founder of Acrivon Therapeutics. “This is the second such designation for our ACR-368 OncoSignature assay and represents yet another powerful validation of our generative AI-driven AP3 platform. The enrollment and dosing continues for both ACR-368 in our ongoing Phase 2b trials, as well as for ACR-2316, our internally-developed Phase 1 asset, which is a novel, differentiated WEE1/PKMYT1 inhibitor uniquely enabled by AP3. We have now completed enrollment in the first two dose-escalation cohorts of the ACR-2316 Phase 1 trial and initiated dosing in the third cohort.”

A company-sponsored, blinded, third-party KOL market research study showed strong interest in the emerging clinical profile of ACR-368. There is an estimated ~30,000 (and growing) new cases of high-grade, locally advanced or metastatic, recurrent (progressed on anti-PD-1 and chemotherapy) endometrial cancer per year in the U.S. The company presented positive clinical data at ESMO 2024 demonstrating a confirmed overall response rate (ORR) of 62.5% (95% CI, 30.4-86.5), as well as prospective ACR-368 OncoSignature patient selection (p = 0.009) in endometrial cancer.

The Breakthrough Devices Program is intended to provide patients and health care providers with timely access to medical devices by speeding up development, assessment, and review for premarket approval, 510(k) clearance, and marketing authorization.

About Acrivon Therapeutics Acrivon is a clinical stage biopharmaceutical company developing precision oncology medicines that it matches to patients whose tumors are predicted to be sensitive to each specific medicine by utilizing Acrivon’s proprietary proteomics-based patient responder identification platform, Acrivon Predictive Precision Proteomics, or AP3. The generative AI-driven AP3 platform is engineered to measure compound-specific effects on the entire tumor cell protein signaling network and drug-induced resistance mechanisms in an unbiased manner yielding terabytes of high resolution proprietary quantitative data for pathway-based drug design, indication finding, and response prediction. These distinctive capabilities enable AP3’s direct application for streamlined rational drug discovery for monotherapy activity, the identification of rational drug combinations, and the creation of drug-specific proprietary OncoSignature companion diagnostics that are used to identify the patients most likely to benefit from Acrivon’s drug candidates. Acrivon is currently advancing its lead candidate, ACR-368 (also known as prexasertib), a selective small molecule inhibitor targeting CHK1 and CHK2 in a potentially registrational Phase 2 trial across multiple tumor types. The company has received Fast Track designation from the Food and Drug Administration, or FDA, for the investigation of ACR-368 as monotherapy based on OncoSignature-predicted sensitivity in patients with platinum-resistant ovarian or endometrial cancer. Acrivon’s ACR-368 OncoSignature test, which has not yet obtained regulatory approval, has been extensively evaluated in preclinical studies, including in two separate, blinded, prospectively-designed studies on pretreatment tumor biopsies collected from past third-party Phase 2 trials in patients with ovarian cancer treated with ACR-368. The FDA has granted Breakthrough Device designations for the ACR-368 OncoSignature assay for the identification of patients with endometrial cancer or for patients with ovarian cancer, who may benefit from ACR-368 treatment. The company reported positive clinical data for ovarian and endometrial cancers in April 2024, and in September 2024 it reported additional positive clinical data for endometrial cancer, including a confirmed overall response rate of 62.5% (95% CI, 30.4 - 86.5) and further validation of its prospective OncoSignature selection of patients predicted sensitive to ACR-368 by showing segregation of responders in OncoSignature-positive versus OncoSignature-negative patients (p = 0.009). The median duration of treatment was not yet reached, but the duration on study was 6 months at the time of the data cut.

In addition to ACR-368, Acrivon is also leveraging its proprietary AP3 precision medicine platform for developing its co-crystallography-driven, internally-discovered pipeline programs. These include ACR-2316, the company’s second clinical stage asset, a novel, potent, selective WEE1/PKMYT1 inhibitor designed for superior single-agent activity through strong activation of not only CDK1 and CDK2, but also of PLK1 to drive pro-apoptotic cell death, as demonstrated in preclinical studies against benchmark inhibitors. In addition, the company has a preclinical cell cycle program with an undisclosed target.

Acrivon has developed AP3 Interactome, a proprietary, computational analytics platform driven by machine learning for integrated comprehensive analyses across all large, in-house AP3 phosphoproteomic drug profiling data sets to advance its in-house research programs.

Forward-Looking Statements This press release includes certain disclosures that contain “forward-looking statements” within the meaning of the Private Securities Litigation Reform Act of 1995 about us and our industry that involve substantial risks and uncertainties. All statements other than statements of historical facts contained in this press release, including statements regarding our future results of operations or financial condition, preclinical and clinical results, business strategy and plans and objectives of management for future operations, are forward-looking statements. In some cases, you can identify forward-looking statements because they contain words such as “anticipate,” “believe,” “contemplate,” “continue,” “could,” “estimate,” “expect,” “intend,” “may,” “plan,” “potential,” “predict,” “project,” “should,” “target,” “will,” or “would” or the negative of these words or other similar terms or expressions. Forward-looking statements are based on Acrivon’s current expectations and are subject to inherent uncertainties, risks and assumptions that are difficult to predict. Factors that could cause actual results to differ include, but are not limited to, risks and uncertainties that are described more fully in the section titled “Risk Factors” in our reports filed with the Securities and Exchange Commission. Forward-looking statements contained in this press release are made as of this date, and Acrivon undertakes no duty to update such information except as required under applicable law.

Investor and Media Contacts: Adam D. Levy, Ph.D., M.B.A. alevy@acrivon.com

Alexandra Santos asantos@wheelhouselsa.com

Clinical ResultFast TrackPhase 2Phase 1Immunotherapy

Analysis

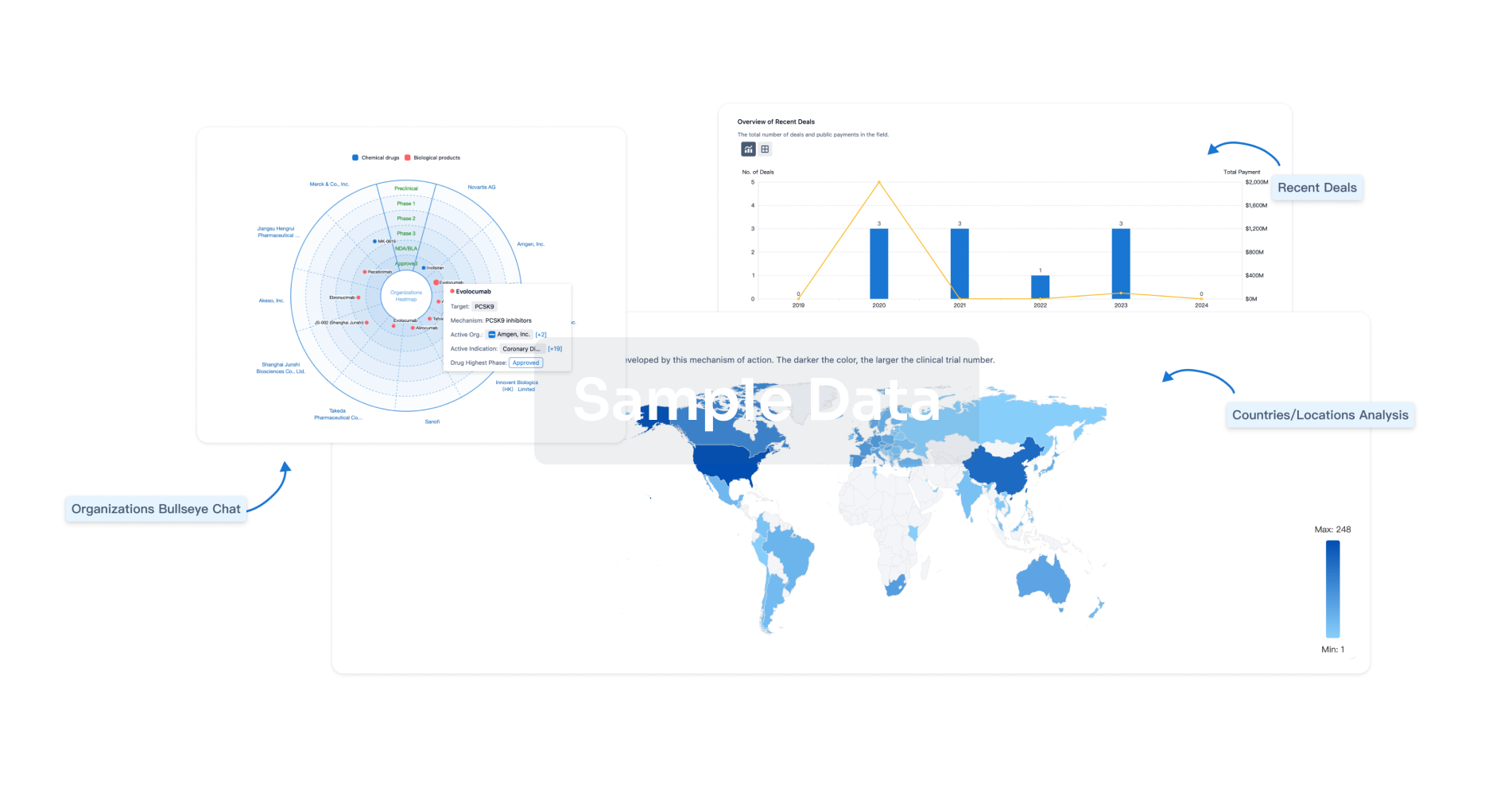

Perform a panoramic analysis of this field.

login

or

AI Agents Built for Biopharma Breakthroughs

Accelerate discovery. Empower decisions. Transform outcomes.

Get started for free today!

Accelerate Strategic R&D decision making with Synapse, PatSnap’s AI-powered Connected Innovation Intelligence Platform Built for Life Sciences Professionals.

Start your data trial now!

Synapse data is also accessible to external entities via APIs or data packages. Empower better decisions with the latest in pharmaceutical intelligence.

Bio

Bio Sequences Search & Analysis

Sign up for free

Chemical

Chemical Structures Search & Analysis

Sign up for free