Request Demo

Last update 08 May 2025

EBV Protein x CD19

Last update 08 May 2025

Basic Info

Related Targets |

Related

1

Drugs associated with EBV Protein x CD19Target |

Mechanism CD19 inhibitors [+3] |

Active Org. |

Originator Org. |

Active Indication |

Inactive Indication- |

Drug Highest PhasePhase 1 |

First Approval Ctry. / Loc.- |

First Approval Date20 Jan 1800 |

1

Clinical Trials associated with EBV Protein x CD19NCT01430390

A Phase I Trial Using In Vitro Expanded Allogeneic Epstein-Barr Virus Specific Cytotoxic T-Lymphocytes (EBV-CTLs) Genetically Targeted to the CD19 Antigen in B-cell Malignancies

The purpose of this study is to test the safety of giving the patient special cells from a donor called "Modified T-cells". The goal is to assess the toxicities of T-cells for patients with relapsed B cell leukemia or lymphoma after a blood SCT organ SCT or for patients who are at high risk for relapse of their B cell leukemia or lymphoma.

Start Date01 Sep 2011 |

Sponsor / Collaborator |

100 Clinical Results associated with EBV Protein x CD19

Login to view more data

100 Translational Medicine associated with EBV Protein x CD19

Login to view more data

0 Patents (Medical) associated with EBV Protein x CD19

Login to view more data

6

Literatures (Medical) associated with EBV Protein x CD1914 Nov 2024·Zhonghua xue ye xue za zhi = Zhonghua xueyexue zazhi

[Early cellular immune exhaustion in patients with Epstein-Barr virus activation following haploidentical hematopoietic stem cell transplantation].

Article

Author: Huang, F ; He, J B ; Xu, N ; Xue, R T ; Lin, R ; Zhou, Y ; Liu, Q F ; Zhang, S Y ; Fan, Z P ; Huang, Y F ; Sun, J

23 Dec 2021·BloodQ1 · MEDICINE

EBV+ ALK+ large B-cell lymphoma

Q1 · MEDICINE

Article

Author: Hu, Shimin ; Liu, Hui

01 May 2018·International Journal of Surgical PathologyQ4 · MEDICINE

De Novo Unclassifiable CD20-Negative Diffuse Large B-Cell Lymphoma: A Diagnostic and Therapeutic Challenge

Q4 · MEDICINE

Article

Author: AbdullGaffar, Badr ; Seliem, Rania M.

2

News (Medical) associated with EBV Protein x CD1920 Dec 2023

THOUSAND OAKS, Calif.--(BUSINESS WIRE)-- Atara Biotherapeutics, Inc. (Nasdaq: ATRA), a leader in T-cell immunotherapy, leveraging its novel allogeneic Epstein-Barr virus (EBV) T-cell platform to develop transformative therapies for patients with cancer and autoimmune diseases, today announced the closing of the expanded global partnership with Pierre Fabre Laboratories for tabelecleucel (tab-cel® or EBVALLOTM). Building on the earlier partnership announced in October 2021 to commercialize tab-cel in Europe, this transaction provides Pierre Fabre Laboratories with the development, manufacturing, and commercialization rights for tab-cel in the United States and all remaining markets.

“We are pleased to announce the closing of the transaction with Pierre Fabre Laboratories who are committed to expanding the reach of tab-cel to patients in the U.S. and across the globe,” said Pascal Touchon, President and Chief Executive Officer of Atara. “Atara’s priority is to now submit the tab-cel BLA filing package, while initiating our first clinical study with ATA3219, a potential best-in-class allogeneic off-the-shelf CD19 CAR T with unique features.”

With the closing of the transaction, Atara will receive approximately USD 27 million in cash upfront and initial inventory purchase. Under the agreement, Atara has the potential to receive up to a total of USD 640 million and significant double-digit tiered royalties on net sales, including up to USD 100 million in potential regulatory milestones through BLA approval. In addition, Pierre Fabre Laboratories will reimburse Atara for expected tab-cel global development costs through the Biologics License Application (BLA) transfer, and purchase future tab-cel inventory through the manufacturing transfer date.

Substantially all tab-cel manufacturing, clinical, and regulatory activities are planned to transition from Atara to Pierre Fabre Laboratories at the time of BLA transfer.

Atara plans to submit the BLA to the U.S. Food and Drug Administration (FDA) for tab-cel for the treatment of post-transplant lymphoproliferative disease (PTLD) in the second quarter of 2024.

About Atara Biotherapeutics, Inc.

Atara is harnessing the natural power of the immune system to develop off-the-shelf cell therapies for difficult-to-treat cancers and autoimmune conditions, that can be rapidly delivered to patients within days. With cutting-edge science and differentiated approach, Atara is the first company in the world to receive regulatory approval of an allogeneic T-cell immunotherapy. Our advanced and versatile Epstein-Barr virus (EBV) T-cell platform does not require T-cell receptor or HLA gene editing and forms the basis of a diverse portfolio of investigational therapies that target EBV, the root cause of certain diseases, in addition to next-generation AlloCAR-Ts designed for best-in-class opportunities across a broad range of non-EBV-associated liquid and solid tumors. Atara is headquartered in Southern California. For more information, visit atarabio.com and follow @Atarabio on X (formerly known as Twitter) and LinkedIn.

Forward-Looking Statements

This press release contains or may imply "forward-looking statements" within the meaning of Section 27A of the Securities Act of 1933 and Section 21E of the Securities Exchange Act of 1934. For example, forward-looking statements include statements regarding: (1) the development, timing and progress of tab-cel®, including a potential BLA, the potential characteristics and benefits of tab-cel®, and the progress and results of, prospects for, and closing of the expanded global partnership with Pierre Fabre Laboratories involving tab-cel®, and the potential financial benefits to Atara as a result of the expanded global partnership with Pierre Fabre Laboratories; (2) the development, timing and progress of Atara’s AlloCAR-T programs, including ATA3219; (3) Atara’s cash runway; and (4) Pierre Fabre Laboratories’ activities relating to tab-cel and the timing thereof. Because such statements deal with future events and are based on Atara’s current expectations, they are subject to various risks and uncertainties and actual results, performance or achievements of Atara could differ materially from those described in or implied by the statements in this press release. These forward-looking statements are subject to risks and uncertainties, including, without limitation, risks and uncertainties associated with the costly and time-consuming pharmaceutical product development process and the uncertainty of clinical success; the COVID-19 pandemic and the wars in Ukraine and the Middle East, which may significantly impact (i) our business, research, clinical development plans and operations, including our operations in Southern California and Denver and at our clinical trial sites, as well as the business or operations of our third-party manufacturer, contract research organizations or other third parties with whom we conduct business, (ii) our ability to access capital, and (iii) the value of our common stock; the sufficiency of Atara’s cash resources and need for additional capital; and other risks and uncertainties affecting Atara’s and its development programs, including those discussed in Atara’s filings with the Securities and Exchange Commission , including in the “Risk Factors” and “Management’s Discussion and Analysis of Financial Condition and Results of Operations” sections of the Company’s most recently filed periodic reports on Form 10-K and Form 10-Q and subsequent filings and in the documents incorporated by reference therein. Except as otherwise required by law, Atara disclaims any intention or obligation to update or revise any forward-looking statements, which speak only as of the date hereof, whether as a result of new information, future events or circumstances or otherwise.

ImmunotherapyLicense out/in

01 Nov 2023

Pierre Fabre Laboratories to License Commercialization Rights to Tab-cel®, including Regulatory, Manufacturing and Development Activities, in the United States and All Remaining Markets

Atara to Receive Additional Payments of up to USD 640 Million, Significant Double-digit Tiered Royalties as a Percentage of Net Sales, and Funding of Tab-cel Global Development Costs

Tab-cel Global Partnership and Associated Strategic Restructuring Extends Atara Cash Runway into Q3 2025

ATA188 Phase 2 EMBOLD Study Primary Analysis and Communication on Track for Early November

Atara to Host Conference Call and Webcast today at 6:00 a.m. PDT / 9:00 a.m. EDT

THOUSAND OAKS, Calif.--(BUSINESS WIRE)-- Atara Biotherapeutics, Inc. (Nasdaq: ATRA), a leader in T-cell immunotherapy, leveraging its novel allogeneic Epstein-Barr virus (EBV) T-cell platform to develop transformative therapies for patients with cancer and autoimmune diseases, today reported recent business highlights including an expanded global partnership with Pierre Fabre Laboratories for tabelecleucel (tab-cel®), financial results for the third quarter 2023, and key upcoming catalysts.

“We are proud to expand our global tab-cel partnership with Pierre Fabre Laboratories, who is committed to delivering this first-of-its-kind treatment to patients in need across the globe,” said Pascal Touchon, President and Chief Executive Officer of Atara. “In light of our expanded tab-cel partnership and to strategically position the company going forward, we are also restructuring our operations to significantly reduce expenses, meaningfully extend our cash runway to nearly two years, and enable organizational focus on generating the greatest value from our transformative pipeline: ATA188 and our differentiated allogeneic CAR-T assets. I wish to personally thank the talented colleagues who will be departing Atara for their essential contributions in getting us to this critical point in our journey.”

Expanded Global Partnership for Tabelecleucel (tab-cel® or EBVALLO™)

Atara has entered into an expanded partnership with Pierre Fabre Laboratories for the U.S. and remaining global commercial markets for tab-cel for up to USD 640 million and significant double-digit tiered royalties on net sales. In addition, Pierre Fabre Laboratories has agreed to reimburse Atara for expected tab-cel global development costs through Biologics License Application (BLA) transfer, and purchase current and future tab-cel inventory through the BLA transfer date. Near-term payments to Atara include:

Approximately USD 30 million in cash upfront and initial inventory purchase at closing

USD 100 million in potential regulatory milestones through BLA approval

Substantially all tab-cel manufacturing, clinical, and regulatory activities are planned to transition from Atara to Pierre Fabre Laboratories at the time of BLA transfer

Atara expects to submit the tab-cel post-transplant lymphoproliferative disease (PTLD) BLA in Q2 2024

“We are eager to progress tabelecleucel toward approval in the U.S. so that American patients can access this innovative treatment already approved and commercialized in Europe,” said Eric Ducournau, CEO of Pierre Fabre Laboratories.

The closing of the transaction, subject to expiration of the waiting period under the Hart-Scott-Rodino Antitrust Improvements Act and other customary closing conditions, is expected to occur in December 2023. PJT Partners served as the exclusive financial advisor to Atara and Fenwick & West LLP served as legal counsel to Atara.

Strategic Restructure and Financial Impacts

Concurrent with the execution of the global tab-cel partnership, Atara is undertaking a strategic restructuring and is reducing its current workforce by approximately 30 percent. This will enable Atara to execute its remaining responsibilities under the tab-cel collaboration with Pierre Fabre Laboratories, while focusing on the advancement of ATA188 and its differentiated allogeneic CAR T (AlloCAR-T) programs

The strategic restructuring, combined with certain anticipated payments from the expanded global partnership and the Company’s existing cash, cash equivalents and short-term investments as of September 30, 2023, is expected to fund the Company’s planned operations into Q3 2025

Pipeline Focus Moving Forward

The ATA188 Phase 2 EMBOLD study primary analysis and communication remains on track for early November with more than 90 patients to be included

To create the greatest value from its potentially transformative pipeline, Atara will focus capital resources on ATA188 development and to unlock the full promise of its growing and potential best-in-class oncology and autoimmune targeted AlloCAR-T portfolio

Atara will leverage its EBV T-cell biology expertise and novel CAR-T technologies for areas of significant unmet medical need by overcoming limitations of current or investigational autologous or allogeneic CAR-T approaches:

Initiation of Phase 1 study in relapsed/refractory B-cell non-Hodgkin’s lymphoma (NHL) for ATA3219—an allogeneic CD19-1XX CAR+ EBV T cell immunotherapy—expected in the coming months with preliminary clinical data anticipated H2 2024

Progressing efforts toward a potential clinical study evaluating ATA3219 in autoimmune disease in parallel with NHL development

Continued advancement of promising early AlloCAR-T development programs including ATA3431, an allogeneic, bispecific tandem CAR directed against both CD19 and CD20 built on the EBV T-cell platform with a 1XX costimulatory signaling domain. ATA3431 preclinical data has been accepted for poster presentation at the upcoming American Society of Hematology (ASH) meeting in December 2023

Third Quarter 2023 Financial Results (prior to Pierre Fabre Laboratories partnership expansion in October 2023)

Cash, cash equivalents and short-term investments as of September 30, 2023, totaled $102.4 million, as compared to $153.6 million as of June 30, 2023

Net cash used in operating activities was $51.3 million for the third quarter 2023, as compared to $65.1 million in the same period in 2022

Atara reported a net loss of $69.8 million, or $0.66 per share for the third quarter 2023, as compared to a net loss of $84.1 million, or $0.82 per share for the same period in 2022.

Total costs and operating expenses include non-cash stock-based compensation, depreciation and amortization expenses of $12.4 million for the third quarter 2023, as compared to $15.4 million for the same period in 2022

Research and development expenses were $56.9 million for the third quarter 2023, as compared to $70.2 million for the same period in 2022

Research and development expenses include $6.8 million of non-cash stock-based compensation expenses for the third quarter 2023 as compared to $8.0 million for the same period in 2022

General and administrative expenses were $12.2 million for the third quarter 2023, as compared to $18.9 million for the same period in 2022

General and administrative expenses include $4.4 million of non-cash stock-based compensation expenses for the third quarter 2023, as compared to $6.0 million for the same period in 2022

Conference Call and Webcast Details

Atara will host a live conference call and webcast today, Wednesday, November 1, 2023, at 9:00 a.m. EDT. Analysts and investors can participate in the conference call by dialing 877-407-8291 for domestic callers and 201-689-8345 for international callers. A live audio webcast can be accessed by visiting the Investors & Media – News & Events section of atarabio.com. An archived replay will be available on the Company's website for 30 days following the live webcast.

About Atara Biotherapeutics, Inc.

Atara is harnessing the natural power of the immune system to develop off-the-shelf cell therapies for difficult-to-treat cancers and autoimmune conditions, including multiple sclerosis, that can be rapidly delivered to patients within days. With cutting-edge science and differentiated approach, Atara is the first company in the world to receive regulatory approval of an allogeneic T-cell immunotherapy. Our advanced and versatile Epstein-Barr virus (EBV) T-cell platform does not require T-cell receptor or HLA gene editing and forms the basis of a diverse portfolio of investigational therapies that target EBV, the root cause of certain diseases, in addition to next-generation AlloCAR-Ts designed for best-in-class opportunities across a broad range of non-EBV-associated liquid and solid tumors. Atara is headquartered in Southern California. For more information, visit atarabio.com and follow @Atarabio on X (formerly known as Twitter) and LinkedIn.

Forward-Looking Statements

This press release contains or may imply "forward-looking statements" within the meaning of Section 27A of the Securities Act of 1933 and Section 21E of the Securities Exchange Act of 1934. For example, forward-looking statements include statements regarding: (1) the development, timing and progress of tab-cel®, including a potential BLA, the potential characteristics and benefits of tab-cel®, and the progress and results of, and prospects for, the expanded global partnership with Pierre Fabre Laboratories involving tab-cel®, and the potential financial benefits to Atara as a result of the expanded global partnership with Pierre Fabre Laboratories; (2) the Company’s strategic restructure, including the staff reduction; (3) the development, timing and progress of ATA188, including data and analyses from the EMBOLD study and the timing of when such data will be received and communicated; (4) the development, timing and progress of Atara’s AlloCAR-T programs, including the timing of the start of any clinical trials, and the safety and efficacy of product candidates emerging from such programs, including ATA3219 and ATA3431; (5) Atara’s cash runway; and (6) Pierre Fabre Laboratories’ activities relating to tab-cel and the timing thereof. Because such statements deal with future events and are based on Atara’s current expectations, they are subject to various risks and uncertainties and actual results, performance or achievements of Atara could differ materially from those described in or implied by the statements in this press release. These forward-looking statements are subject to risks and uncertainties, including, without limitation, risks and uncertainties associated with the costly and time-consuming pharmaceutical product development process and the uncertainty of clinical success; the COVID-19 pandemic and the wars in Ukraine and the Middle East, which may significantly impact (i) our business, research, clinical development plans and operations, including our operations in Southern California and Denver and at our clinical trial sites, as well as the business or operations of our third-party manufacturer, contract research organizations or other third parties with whom we conduct business, (ii) our ability to access capital, and (iii) the value of our common stock; the sufficiency of Atara’s cash resources and need for additional capital; and other risks and uncertainties affecting Atara’s and its development programs, including those discussed in Atara’s filings with the Securities and Exchange Commission , including in the “Risk Factors” and “Management’s Discussion and Analysis of Financial Condition and Results of Operations” sections of the Company’s most recently filed periodic reports on Form 10-K and Form 10-Q and subsequent filings and in the documents incorporated by reference therein. Except as otherwise required by law, Atara disclaims any intention or obligation to update or revise any forward-looking statements, which speak only as of the date hereof, whether as a result of new information, future events or circumstances or otherwise.

Financials

ATARA BIOTHERAPEUTICS, INC.

Condensed Consolidated Balance Sheets

(Unaudited)

(In thousands)

September 30,

December 31,

2023

2022

Assets

Current assets:

Cash and cash equivalents

$

64,791

$

92,942

Short-term investments

37,617

149,877

Restricted cash

146

146

Accounts receivable

163

40,221

Inventories

6,591

1,586

Other current assets

9,388

10,308

Total current assets

118,696

295,080

Property and equipment, net

4,628

6,300

Operating lease assets

59,175

68,022

Other assets

6,289

7,018

Total assets

$

188,788

$

376,420

Liabilities and stockholders’ equity (deficit)

Current liabilities:

Accounts payable

$

6,511

$

6,871

Accrued compensation

14,430

17,659

Accrued research and development expenses

23,968

24,992

Deferred revenue

11,611

8,000

Other current liabilities

22,569

21,394

Total current liabilities

79,089

78,916

Deferred revenue - long-term

73,929

77,000

Operating lease liabilities - long-term

48,508

58,064

Liability related to the sale of future revenues - long-term

33,252

30,236

Other long-term liabilities

4,848

5,564

Total liabilities

$

239,626

$

249,780

Stockholders’ equity (deficit):

Common stock

10

10

Additional paid-in capital

1,858,423

1,821,721

Accumulated other comprehensive (loss) income

(571

)

(2,067

)

Accumulated deficit

(1,908,700

)

(1,693,024

)

Total stockholders’ equity (deficit)

(50,838

)

126,640

Total liabilities and stockholders’ equity (deficit)

$

188,788

$

376,420

ATARA BIOTHERAPEUTICS, INC.

Condensed Consolidated Statements of Operations and Comprehensive Income (Loss)

(Unaudited)

(In thousands, except per share amounts)

Three Months Ended

September 30,

Nine Months Ended

September 30,

2023

2022

2023

2022

Commercialization revenue

$

2,020

$

—

$

3,697

$

—

License and collaboration revenue

118

4,459

624

63,352

Total revenue

2,138

4,459

4,321

63,352

Costs and operating expenses:

Cost of commercialization revenue

2,615

—

5,726

—

Research and development expenses

56,888

70,157

175,185

210,018

General and administrative expenses

12,247

18,924

39,454

58,308

Total costs and operating expenses

71,750

89,081

220,365

268,326

Loss from operations

(69,612

)

(84,622

)

(216,044

)

(204,974

)

Gain on sale of ATOM Facility

—

—

—

50,237

Interest and other income (expense), net

(204

)

541

372

1,017

Total other income (expense), net

(204

)

541

372

51,254

Loss before provision for (benefit from) income taxes

(69,816

)

(84,081

)

(215,672

)

(153,720

)

Provision for (benefit from) income taxes

(19

)

10

4

10

Net loss

$

(69,797

)

$

(84,091

)

$

(215,676

)

$

(153,730

)

Other comprehensive gain (loss):

Unrealized gain (loss) on available-for-sale securities

362

(341

)

1,496

(2,591

)

Comprehensive loss

$

(69,435

)

$

(84,432

)

$

(214,180

)

$

(156,321

)

Basic and diluted loss per common share

$

(0.66

)

$

(0.82

)

$

(2.05

)

$

(1.51

)

Basic and diluted weighted-average shares outstanding

106,401

102,423

105,163

101,590

ImmunotherapyLicense out/inFinancial StatementASH

Analysis

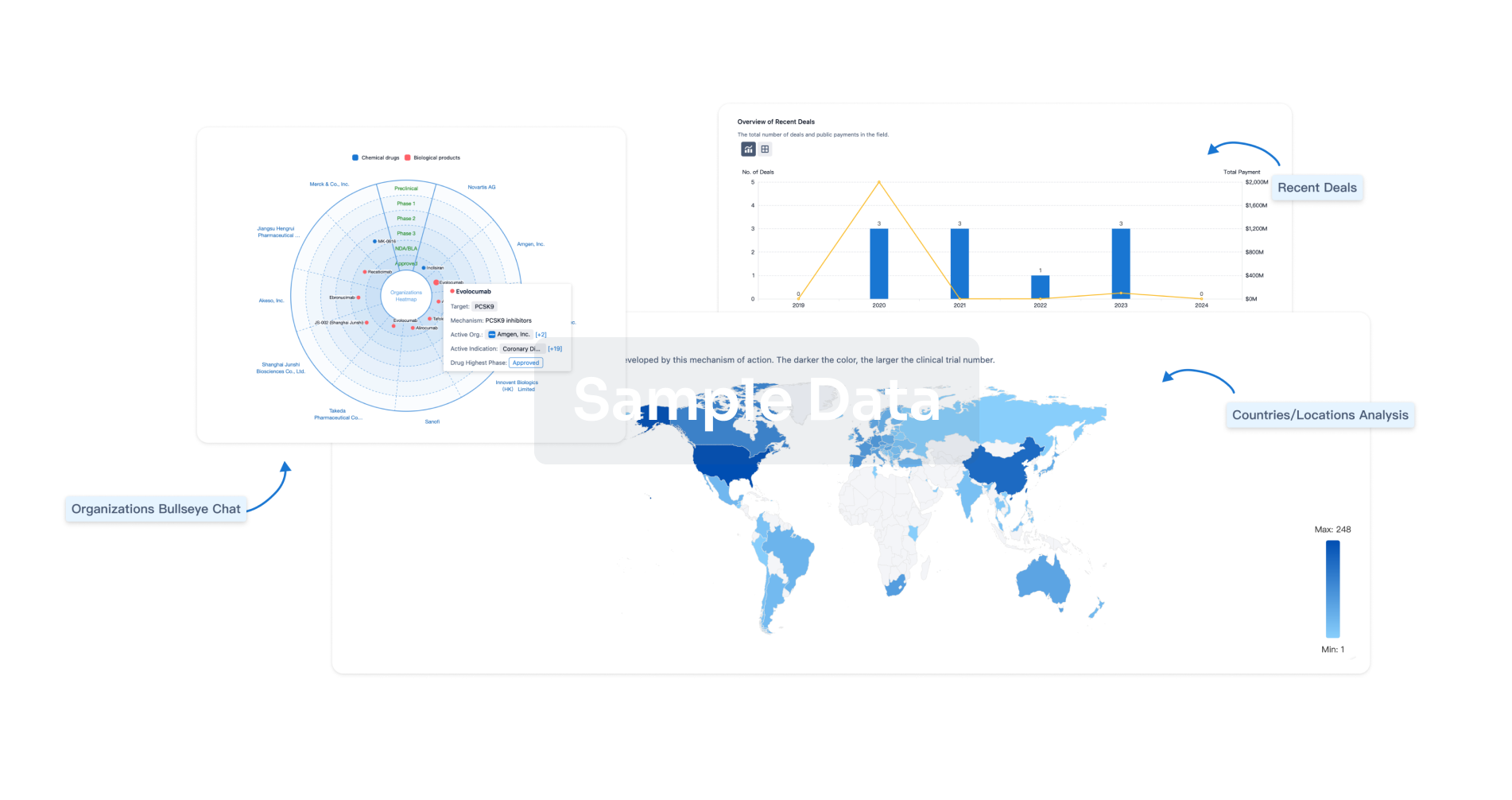

Perform a panoramic analysis of this field.

login

or

AI Agents Built for Biopharma Breakthroughs

Accelerate discovery. Empower decisions. Transform outcomes.

Get started for free today!

Accelerate Strategic R&D decision making with Synapse, PatSnap’s AI-powered Connected Innovation Intelligence Platform Built for Life Sciences Professionals.

Start your data trial now!

Synapse data is also accessible to external entities via APIs or data packages. Empower better decisions with the latest in pharmaceutical intelligence.

Bio

Bio Sequences Search & Analysis

Sign up for free

Chemical

Chemical Structures Search & Analysis

Sign up for free