Request Demo

Last update 08 May 2025

SORD

Last update 08 May 2025

Basic Info

Synonyms (R,R)-butanediol dehydrogenase, L-iditol 2-dehydrogenase, Polyol dehydrogenase + [7] |

Introduction Polyol dehydrogenase that catalyzes the reversible NAD(+)-dependent oxidation of various sugar alcohols. Is mostly active with D-sorbitol (D-glucitol), L-threitol, xylitol and ribitol as substrates, leading to the C2-oxidized products D-fructose, L-erythrulose, D-xylulose, and D-ribulose, respectively (PubMed:3365415). Is a key enzyme in the polyol pathway that interconverts glucose and fructose via sorbitol, which constitutes an important alternate route for glucose metabolism. The polyol pathway is believed to be involved in the etiology of diabetic complications, such as diabetic neuropathy and retinopathy, induced by hyperglycemia (PubMed:12962626, PubMed:25105142, PubMed:29966615). May play a role in sperm motility by using sorbitol as an alternative energy source for sperm motility (PubMed:16278369). May have a more general function in the metabolism of secondary alcohols since it also catalyzes the stereospecific oxidation of (2R,3R)-2,3-butanediol. To a lesser extent, can also oxidize L-arabinitol, galactitol and D-mannitol and glycerol in vitro. Oxidizes neither ethanol nor other primary alcohols. Cannot use NADP(+) as the electron acceptor (PubMed:3365415). |

Related

4

Drugs associated with SORDTarget |

Mechanism SORD inhibitors |

Active Org.- |

Originator Org. |

Active Indication- |

Inactive Indication |

Drug Highest PhaseDiscontinued |

First Approval Ctry. / Loc.- |

First Approval Date20 Jan 1800 |

Target |

Mechanism SORD inhibitors |

Active Org.- |

Originator Org. |

Active Indication- |

Inactive Indication |

Drug Highest PhasePending |

First Approval Ctry. / Loc.- |

First Approval Date20 Jan 1800 |

Target |

Mechanism SORD inhibitors |

Active Org.- |

Originator Org. |

Active Indication- |

Inactive Indication |

Drug Highest PhasePending |

First Approval Ctry. / Loc.- |

First Approval Date20 Jan 1800 |

100 Clinical Results associated with SORD

Login to view more data

100 Translational Medicine associated with SORD

Login to view more data

0 Patents (Medical) associated with SORD

Login to view more data

1,592

Literatures (Medical) associated with SORD01 Apr 2025·Experimental Eye Research

Genetic association of MIR-449B, GCLC, eNOS, SORD, and ENPP1 with diabetic retinopathy

Article

Author: Rong, Shisong ; Fan, Lin ; Yang, Zhenglin ; Gong, Bo ; Liu, Yijun ; Li, Huan ; Wang, Kaifang ; Hao, Fang ; Yuan, Ye ; Luo, Huaichao ; Xu, Huijuan ; Zhang, Ruifan ; Zhou, Yu ; Xiao, Jialing ; Shi, Yi ; Ju, Xueming ; Zou, Rong

21 Mar 2025·ACS Chemical Biology

Structural and Mechanistic Characterization of the Flavin-Dependent Monooxygenase and Oxidase Involved in Sorbicillinoid Biosynthesis

Article

Author: Tjallinks, Gwen ; Nguyen, Quoc-Thai ; Mattevi, Andrea ; Fraaije, Marco W. ; Angeleri, Nicolò ; Ram, Arthur F. J. ; Mannucci, Barbara ; Visser, Jaap ; Arentshorst, Mark

01 Feb 2025·Food Chemistry

Improving sugar and respiratory metabolism in pear wounds by postharvest dipping with chitosan and chitooligosaccharide

Article

Author: Liang, Wei ; Su, Tingting ; Romanazzi, Gianfranco ; Yu, Lirong ; Xie, Pengdong ; Wang, Yi ; Bi, Yang ; Prusky, Dov ; Zhang, Xuemei

25

News (Medical) associated with SORD20 Dec 2024

A recent lawsuit alleges Applied misled investors into thinking govorestat had a higher chance of approval than it actually did.\n A turbulent month at Applied Therapeutics is being capped off with the departure of CEO and chair Shoshana Shendelman, Ph.D., mere days after she and the company were named in a proposed class action lawsuit.Applied’s chief financial officer Les Funtleyder has been named interim CEO, according to a Dec. 20 release, while biopharma vet John Johnson has been named executive chairman. Funtleyder will continue his role as CFO while filling in for Shendelman.The company’s share price has plunged by about 90% since Thanksgiving, which is when an FDA rejection for its drug candidate govorestat began a chain reaction.The rejection was paired with a warning letter from the FDA, in which the agency chastised Applied’s conduct during its 47-patient trial of govorestat in kids with classic galactosemia.The agency took issue with the deletion of electronic data by a third-party vendor and the mishandling of a dosing error that caused some patients to receive lower levels of govorestat than intended. Applied has now withdrawn its marketing authorization application to the European Medicines Agency for govorestat in classic galactosemia, the company said in the Dec. 20 release, in order to gather more data to support EU approval.After learning of the warning letter, an investor accused Applied of knowing about these trial issues but not disclosing them in a proposed class action lawsuit. The Dec. 17 lawsuit names the company, Shendelman and chief medical officer Riccardo Perfetti, M.D., Ph.D., as defendants.According to the lawsuit, Applied kept the trial’s problems to itself while continuing to share positive news about govorestat and discuss plans for its potential approval and commercialization. This made investors think the drug had a higher chance of approval than it actually did, the lawsuit alleges, leading them to suffer losses when the drug was rejected and Applied’s stock tumbled.In the wake of the warning letter, lawsuit and Shendelman’s departure, Applied is delaying its submission of govorestat for approval in treating sorbitol dehydrogenase deficiency. The firm had originally planned to seek approval early in the first quarter of 2025 but now says it will shoot for after the first quarter, according to the Dec. 20 release.

Executive Change

20 Dec 2024

Shoshana Shendelman Steps Down as CEO; Les Funtleyder Appointed Interim Chief Executive Officer

Announces Business Updates

NEW YORK, Dec. 20, 2024 (GLOBE NEWSWIRE) -- Applied Therapeutics, Inc. (Nasdaq: APLT), a biopharmaceutical company dedicated to creating transformative treatments for rare disease, today announced the following leadership changes, effective immediately:

John H. Johnson, a recognized leader in the pharmaceutical and biotechnology industry, has been named Executive Chairman;Dr. Shoshana Shendelman has stepped down as Chair and CEO; andLes Funtleyder, Applied Therapeutics’ Chief Financial Officer, has been named Interim Chief Executive Officer.

Mr. Johnson is a biopharmaceutical industry veteran with 40 years of transformational leadership experience at global healthcare organizations, including Johnson & Johnson, Eli Lilly & Company, ImClone, and Pfizer, Inc. He brings to Applied Therapeutics a multi-decade track record of implementing turnaround plans that enable growth and value creation for shareholders. He has served as the CEO of Reaction Biology and before that served as CEO of Strongbridge Biopharma plc prior to its acquisition by Xeris Biopharma Holdings. He is also an experienced Director having served on numerous boards across biotech and biopharmaceutical services companies.

Dr. Teena Lerner, Applied Therapeutics’ Lead Independent Director, said, “On behalf of the Board, we strongly believe that John will be a tremendous addition to Applied Therapeutics. His experience leading pre-commercial businesses, deep knowledge of rare diseases and the commercialization process, along with his commitment to culture, are deeply aligned with Applied Therapeutics’ priorities. We believe this change in leadership is the right next step for our Company, our shareholders and the patients we aim to serve.”

Dr. Lerner continued, “Les has a strong understanding of our business and operations and has fostered relationships across our industry and the Applied Therapeutics team since resuming the role of CFO last year. Having served as a member of the Board since June 2016 and previously served as our interim CFO in 2018 and 2019, he brings to the interim CEO role deep knowledge of our company and extensive experience managing and investing in the healthcare industry. We are confident in Les and John’s ability to drive the Company forward and will continue to support them and the leadership team while we work to identify a permanent CEO.”

Mr. Johnson said, “I look forward to leveraging my background and years of biopharmaceutical experience to help write the next chapter for Applied Therapeutics. My top priority will be to ensure we have the right groundwork in place to work toward our regulatory and clinical milestones. I look forward to working closely with the Board, management and team to drive value creation.”

“I am honored to assume the role of Interim CEO and lead the Company forward,” said Mr. Funtleyder, “We have a deep bench of talent throughout the organization and a promising clinical pipeline. Utilizing our unique multifaceted approach to drug development, I am confident in our potential to bring the candidates in our pipeline to the patients who need them.”

“We thank Shoshana for her leadership and vision, which have been pivotal to developing Applied Therapeutics’ portfolio of highly specific and selective product candidates. We wish her the very best in her future endeavors,” concluded Dr. Lerner.

Dr. Shendelman said, “Founding and leading Applied Therapeutics for the last eight years has been an incredible journey. Together, we completed multiple successful clinical trials, built commercial infrastructure and advanced the Company’s Aldose Reductase Inhibitor (ARI) franchise across multiple disease areas.”

With the support of the Company's finance organization, Mr. Funtleyder will continue to serve as CFO while serving as Interim CEO.

Business Updates

As previously disclosed, in November 2024, the Company received a Complete Response Letter (“CRL”) for the New Drug Application (NDA) for govorestat for the treatment of Classic Galactosemia. Given the leadership changes announced today, the Company continues to evaluate its response to the CRL, including any meeting request to discuss appropriate next steps with FDA.

Following receipt of the CRL, the Company also today announced the withdrawal of the Marketing Authorization Application (MAA) to the European Medicines Agency (EMA) for govorestat (AT-007) for the treatment of Classic Galactosemia, as more time is needed to acquire further data to support a European MAA.

In light of recent regulatory developments, the Company will be closely examining the ongoing Sorbitol Dehydrogenase (SORD) Deficiency clinical development program and will continue to work with the FDA on the data needed to support an appropriate regulatory pathway for the drug, including ongoing work to provide the FDA with support for the potential use of the accelerated approval pathway for govorestat for the treatment of SORD Deficiency. To accommodate these ongoing workstreams, the Company currently expects to submit an NDA for govorestat for the treatment of SORD after the first quarter of 2025.

Mr. Funtleyder continued, “While we complete the important work to best position govorestat, we are focused on execution and ensuring the highest standards of integrity and quality. SORD Deficiency is a rare neuromuscular disease with no FDA-approved drugs, and it remains highly attractive in terms of unmet need, key opinion leader support and commercial potential. We continue to believe in the clinical value of govorestat and remain committed to the prospect of providing patients with a treatment option that has the potential to slow disease progression.”

Additionally, the Company announced that the Compensation Committee of the Board of Directors of the Company approved inducement awards to Mr. Johnson under Nasdaq Listing Rule 5635(c)(4) consisting of a stock option award to acquire 2,000,000 shares of our common stock and a restricted stock unit award with respect to 1,000,000 shares of our common stock. Fifty percent of each of these inducement awards will vest upon the earlier to occur of a change in control or the approval by the United States Food and Drug Administration (FDA) of the Company’s proposed new drug application relating to the treatment of Sorbitol Dehydrogenase Deficiency, with the remaining fifty percent of the inducement awards vesting in equal annual installments on each of the first two anniversaries of the grant date. Mr. Johnson must generally remain continuously employed through each vesting date.

About John H. Johnson

John H. Johnson, 66, is a recognized leader in the pharmaceutical and biotechnology industry, with more than four decades of experience. Currently, he serves as a member of the Board of Directors, member of the Compensation Committee and Chair of the Nominating and Corporate Governance Committee of Verastem, Inc. (Nasdaq: VSTM) since April of 2020. He has served as Chief Executive Officer and Board Director of Reaction Biology, since March of 2022, and a member of the Board of Directors of Xeris Biopharma Holdings, Inc. serving on the Nominating and Corporate Governance Committee and Axogen, Inc. serving on the compensation committee and chair of the Quality, Compliance, and Portfolio committee. He served from 2005-2007 as the Company Group Chairman of Biopharmaceuticals within Johnson & Johnson, responsible for the Biotechnology, Immunology, and Oncology commercial businesses. Previously, Mr. Johnson served from September 2009 to January 2011 as president of Eli Lilly & Company’s Worldwide Oncology Unit, following the company’s 2008 acquisition of ImClone Systems, Inc., where he served as Chief Executive Officer and a member of ImClone’s Board of Directors from August 2007 until October 2008. He has served as a member of the Board of Directors of Pharmaceutical Research and Manufacturers of America (PhRMA), from January 2013 until August 2014, and as a member of the Health Section Governing Board of biotechnology Industry Organization (BIO), from January 2013 to August 2014. Mr. Johnson also served as CEO of Strongbridge Biopharma plc, a rare disease company, from July 2020 until its acquisition by Xeris Biopharma Holding Inc. in October 2021.

About Les Funtleyder

Les Funtleyder, 55, has served as a member of our board of directors since June 2016 and since November 2023 has served as our Chief Financial Officer. Mr. Funtleyder has served as a healthcare portfolio manager at E Squared Capital Management, LLC since January 2014, a role from which he is currently taking a sabbatical, as a senior external advisor with McKinsey and Co. since June 2017, and as a consulting partner at Bluecloud Health, a private equity healthcare fund, from December 2013 to April 2020. Mr. Funtleyder previously served as the director of strategic investments and communications of OPKO Health Inc., a publicly traded healthcare company. Mr. Funtleyder currently serves on the board of directors of several private healthcare companies and foundations while also serving on the board of directors of Nasdaq-listed Reviva Pharmaceuticals (Nasdaq: RVPH) and as an advisor at Zentynel Frontier Investments. Mr. Funtleyder is an adjunct professor at Columbia University Medical Center and an adjunct professor of healthcare investors at the Columbia University School of Public Health. Mr. Funtleyder received his B.A. from Tulane University and MPH from Columbia University Mailman School of Public Health.

About Applied Therapeutics

Applied Therapeutics is a clinical-stage biopharmaceutical company committed to the development of novel drug candidates against validated molecular targets in rare diseases. The Company’s lead drug candidate, govorestat, is a novel central nervous system penetrant Aldose Reductase Inhibitor (ARI) for the treatment of CNS rare metabolic diseases, including Classic Galactosemia, Sorbitol Dehydrogenase (SORD) Deficiency and PMM2-congenital disorder glycosylation (CDG).

To learn more, please visit www.appliedtherapeutics.com.

Forward-Looking Statements

This press release contains “forward-looking statements” that involve substantial risks and uncertainties for purposes of the safe harbor provided by the Private Securities Litigation Reform Act of 1995. Any statements, other than statements of historical fact, included in this press release regarding the strategy, future operations, prospects, plans and objectives of management, including words such as “may,” “will,” “expect,” “anticipate,” “plan,” “intend,” “predicts” and similar expressions (as well as other words or expressions referencing future events, conditions or circumstances) are forward-looking statements. These include, without limitation, statements regarding the timing to submit an NDA for govorestat for the treatment of SORD. Forward-looking statements in this release involve substantial risks and uncertainties that could cause actual results to differ materially from those expressed or implied by the forward-looking statements, and we, therefore cannot assure you that our plans, intentions, expectations or strategies will be attained or achieved.

Such risks and uncertainties include, without limitation, (i) our plans to develop, market and commercialize our product candidates, (ii) the initiation, timing, progress and results of our current and future preclinical studies and clinical trials and our research and development programs, (iii) our ability to take advantage of expedited regulatory pathways for any of our product candidates, (iv) our estimates regarding expenses, future revenue, capital requirements and needs for additional financing, (v) our ability to successfully acquire or license additional product candidates on reasonable terms and advance product candidates into, and successfully complete, clinical studies, (vi) our ability to maintain and establish collaborations or obtain additional funding, (vii) our ability to obtain and timing of regulatory approval of our current and future product candidates, (viii) the anticipated indications for our product candidates, if approved, (ix) our expectations regarding the potential market size and the rate and degree of market acceptance of such product candidates, (x) our ability to fund our working capital requirements and expectations regarding the sufficiency of our capital resources, (xi) the implementation of our business model and strategic plans for our business and product candidates, (xii) our intellectual property position and the duration of our patent rights, (xiii) developments or disputes concerning our intellectual property or other proprietary rights, (xiv) our expectations regarding government and third-party payor coverage and reimbursement, (xv) our ability to compete in the markets we serve, (xvi) the impact of government laws and regulations and liabilities thereunder, (xvii) developments relating to our competitors and our industry, (xviii) our ability to achieve the anticipated benefits from the agreements entered into in connection with our partnership with Advanz Pharma and (xiv) other factors that may impact our financial results. In light of the significant uncertainties in these forward-looking statements, you should not rely upon forward-looking statements as predictions of future events. Although we believe that we have a reasonable basis for each forward-looking statement contained in this press release, we cannot guarantee that the future results, levels of activity, performance or events and circumstances reflected in the forward-looking statements will be achieved or occur at all. Factors that may cause actual results to differ from those expressed or implied in the forward-looking statements in this press release are discussed in our filings with the U.S. Securities and Exchange Commission, including the “Risk Factors” contained therein. Except as otherwise required by law, we disclaim any intention or obligation to update or revise any forward-looking statements, which speak only as of the date they were made, whether as a result of new information, future events or circumstances or otherwise.

Contacts

Investors:Maeve Conneighton / Andrew Vulis212-600-1902appliedtherapeutics@argotpartners.com

Media:media@appliedtherapeutics.com

Executive ChangeAcquisitionNDA

11 Mar 2024

Shares in Applied Therapeutics were down as much as 10% on Monday after the company disclosed more details of a Phase III study in sorbitol dehydrogenase (SORD) deficiency revealing the extent to which its proposed treatment, govorestat (AT-007), fell short of functional endpoints.The aldose reductase inhibitor is already under priority review at the FDA as a treatment for classic galactosemia despite failing a Phase III paediatric study last year. At the time, CEO Shoshana Shendelman said the study had nevertheless demonstrated "compelling evidence" of clinical benefit. An FDA decision on that application is due on August 28, and the agency plans to convene an advisory panel to discuss the filing. Regulators in Europe have also accepted the drug for review for galactosemia.The latest study, called INSPIRE, randomised 56 patients with SORD deficiency to receive either govorestat or placebo. The condition, an autosomal recessive form of hereditary neuropathy, results when loss of SORD prevents the body from converting sorbitol to fructose, leading to high sorbitol levels accumulating in the tissues and causing nerve damage over time.At the moment, there are no FDA-approved therapies to reduce sorbitol levels in the nervous system. Govorestat works by inhibiting the conversion of glucose to sorbitol.Last month, Applied said an interim analysis of the INSPIRE study showed a significant correlation between sorbitol levels and the prespecified CMT-FOM endpoint which measures functional ability of patients with neuropathies. The composite endpoint consists of 10m walk-run test (10MWR), 4-stair climb, sit-to-stand test, 6-minute walk test (6MWT) and dorsiflexion.However, the company said at the time that there was no effect on the final primary endpoint of 10MWR at the 12-month interim readout, so the study would continue blinded through to 24 months. The company did not give any details, but Baird analysts noted that an initial read of the data looked "reviewable.""We think the initial results from the Phase III INPSIRE study look good enough to get an FDA review for a Subpart H approval," the analysts said, adding that "govorestat has repeatedly shown the ability to substantially reduce sorbitol, the only factor with bioplausability for causality."In the interim data analysis released Monday, Applied highlighted "trends" on CMT-FOM measures linked to walking ability, such as 10MWR (p=0.258), dorsiflexion (p=0.314) and 6MWT (p=0.606), although these were not significant. There was no substantial effect on stair climb or sit-to-stand test.

Phase 3Priority ReviewPhase 2NDA

Analysis

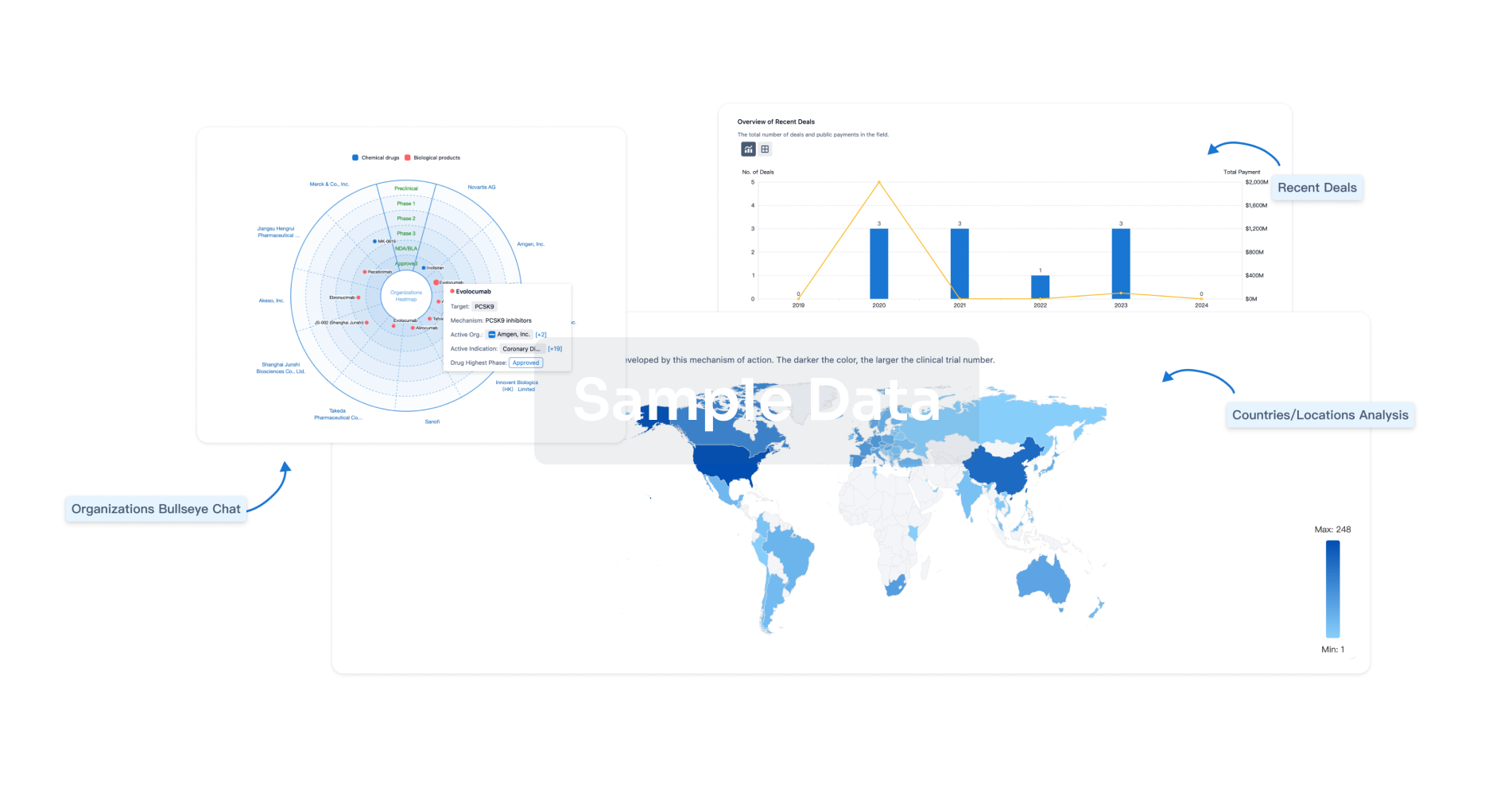

Perform a panoramic analysis of this field.

login

or

AI Agents Built for Biopharma Breakthroughs

Accelerate discovery. Empower decisions. Transform outcomes.

Get started for free today!

Accelerate Strategic R&D decision making with Synapse, PatSnap’s AI-powered Connected Innovation Intelligence Platform Built for Life Sciences Professionals.

Start your data trial now!

Synapse data is also accessible to external entities via APIs or data packages. Empower better decisions with the latest in pharmaceutical intelligence.

Bio

Bio Sequences Search & Analysis

Sign up for free

Chemical

Chemical Structures Search & Analysis

Sign up for free