Request Demo

Last update 08 May 2025

LRRC15

Last update 08 May 2025

Basic Info

Synonyms hLib, leucine rich repeat containing 15, Leucine-rich repeat protein induced by beta-amyloid homolog + [3] |

Introduction (Microbial infection) Modulates the ability of SARS-CoV-2 to infect host cells through interaction with the spike protein (PubMed:36228039, PubMed:36735681, PubMed:36757924). Does not act as a SARS-CoV-2 entry receptor but sequesters virions and antagonizes in trans SARS-CoV-2 infection of ACE2(+) cells when expressed on nearby cells (PubMed:36228039, PubMed:36757924). |

Related

14

Drugs associated with LRRC15Target |

Mechanism LRRC15 inhibitors [+1] |

Active Org. |

Originator Org. |

Active Indication |

Inactive Indication- |

Drug Highest PhasePreclinical |

First Approval Ctry. / Loc.- |

First Approval Date20 Jan 1800 |

Target |

Mechanism LRRC15 inhibitors [+1] |

Active Org. |

Originator Org. |

Active Indication |

Inactive Indication- |

Drug Highest PhasePreclinical |

First Approval Ctry. / Loc.- |

First Approval Date20 Jan 1800 |

Target |

Mechanism LRRC15 inhibitors |

Active Org. |

Originator Org. |

Active Indication |

Inactive Indication- |

Drug Highest PhasePreclinical |

First Approval Ctry. / Loc.- |

First Approval Date20 Jan 1800 |

1

Clinical Trials associated with LRRC15NCT02565758

A Multicenter, Phase 1, Open-Label, Dose-Escalation Study of ABBV-085, an Antibody Drug Conjugate, in Subjects With Advanced Solid Tumors

This is an open-label dose escalation study designed to evaluate the safety and pharmacokinetics of ABBV-085 and determine the recommended Phase 2 dose (as monotherapy or in combination with standard therapies) in subjects with advanced solid tumors.

Start Date18 Sep 2015 |

Sponsor / Collaborator |

100 Clinical Results associated with LRRC15

Login to view more data

100 Translational Medicine associated with LRRC15

Login to view more data

0 Patents (Medical) associated with LRRC15

Login to view more data

107

Literatures (Medical) associated with LRRC1501 Apr 2025·Digestive Diseases and Sciences

LRRC25 Is a Potential Biomarker for Predicting Immunotherapy Response in Patients with Gastric Cancer

Article

Author: Hu, Jinchen ; Yang, Zhensong ; Jian, Mi ; Jiang, Lixin ; Yu, Bin

01 Apr 2025·Modern Pathology

Spatial mapping of gene signatures in H&E-stained images: a proof of concept for interpretable predictions using additive multiple instance learning

Article

Author: Pagidela, Harshith ; Taylor-Weiner, Amaro ; Rahsepar, Bahar ; Brosnan-Cashman, Jacqueline ; Gerardin, Ylaine ; Markey, Miles ; Goldstein, Zvi ; Juyal, Dinkar ; Parmar, Chintan ; Abel, John ; Hennek, Stephanie ; Khosla, Archit ; Kim, Juhyun ; Yu, Limin ; Javed, Syed Ashar

01 Mar 2025·Laboratory Investigation

Comprehensive RNA Sequencing Analysis Identifies Network Hub Genes and Biomarkers Differentiating Desmoid-type Fibromatosis From Reactive Fibrosis

Article

Author: Jeong, Eunjin ; Na, Ji Min ; Kim, Seok-Hyung ; Sung, Chang Ohk ; Ku, Jamin ; Kim, Wonkyung

11

News (Medical) associated with LRRC1530 Apr 2025

PRAGUE, Czech Republic & BASEL, Switzerland & BOSTON, MA, USA I April 29, 2025 I

SOTIO Biotech

, a clinical-stage biopharmaceutical company owned by PPF Group, this week presented preclinical data on two of its leading antibody-drug conjugate (ADC) candidates, SOT109 and SOT106, at the American Association for Cancer Research (AACR) Annual Meeting in Chicago, IL.

Preclinical data on SOT109 (anti-CDH17 ADC) and SOT106 (anti-LRRC15 ADC) demonstrate strong anti-tumor activity and favorable tolerability profiles across multiple tumor models, supporting their potential as groundbreaking ADC therapies for various solid tumor types.

SOT109 is tailored to be a best-in-class ADC exploiting the highly promising target of CDH17 for treatment of gastrointestinal cancers including colorectal cancer (CRC), where unmet need remains very high. ADCs have shown limited clinical success in CRC to date largely due to a lack of ideal target antigens. CDH17 is a highly promising target antigen homogenously overexpressed in more than 90% of CRC and abundantly expressed in other GI cancers. Its expression in normal adult tissues is largely restricted to the GI tract, reducing the risk of off-target toxicity. SOT109 utilizes a proprietary, highly internalizing and fully human antibody combined with Synaffix B.V.’s leading ADC technology platform. Both the antibody and the epitope it is targeting, as well as the linker/payload design, have been selected to maximize its efficacy and safety.

SOTIO’s poster presentation on SOT109 showed the following:

SOT106, leveraging LigaChem Biosciences’ clinically validated ConjuAll™ ADC platform for tumor-specific MMAE release, is a potentially best-in-class ADC for the clinically-validated target LRRC15. SOTIO’s oral presentation on SOT106 showed the following:

“The data we presented at AACR this week highlights the strength of our next-generation ADCs by addressing areas of high unmet need in oncology,” said Martin Steegmaier, Ph.D., chief scientific officer at SOTIO. “SOT109 continues to show excellent tolerability and strong anti-tumor activity across multiple preclinical models of colorectal cancer, while SOT106 offers a novel precision approach with broad applicability in LRRC15

+

sarcomas and other solid tumors. These findings mark important progress in our pipeline and reinforce our commitment to developing highly differentiated ADCs for difficult to treat solid tumors.”

Presentation materials will be available

here

after the presentation concludes.

About SOTIO Biotech

SOTIO Biotech (SOTIO) is shaping the future of cancer immunotherapies by translating compelling science into patient benefit. The company is advancing an innovative pipeline of mono- and bispecific solid tumor ADC programs at various stages of preclinical development. The SOTIO pipeline also includes two clinical-stage programs: BOXR1030, a metabolically-enhanced CAR-T cell therapy targeting GPC3-expressing tumors; and SOT201, a next-generation PD-1-targeting immunocytokine. SOTIO is a member of the PPF Group. For more information, please visit the company’s website at

www.sotio.com

.

SOURCE:

SOTIO Biotech

ImmunotherapyAACRADCCell Therapy

25 Apr 2025

- Findings support advancement of ZL-6201 into Investigational New Drug (IND)-enabling studies in 2025 as a potential first-in-class and best-in-class antibody-drug conjugate (ADC) treatment for patients with leucine-rich repeat-containing protein 15 (LRRC15)-positive solid tumors

- Data from preclinical studies suggest ZL-1222, a novel anti-PD-1/interleukin-12 (IL-12) immunocytokine, induces potent anti-tumor activity through cis-activation of T cells in the tumor microenvironment and efficiently blocks PD-1/PD-L1 signaling pathway with improved systemic safety

SHANGHAI & CAMBRIDGE, Mass.--(BUSINESS WIRE)--Apr. 25, 2025-- Zai Lab Limited (NASDAQ: ZLAB; HKEX: 9688) will present new data from studies evaluating two of its internally developed, next-generation, investigational oncology therapies that it has global rights to, ZL-6201, a novel leucine-rich repeat-containing protein 15 (LRRC15) antibody-drug conjugate (ADC) targeting multiple solid tumors, and ZL-1222, an innovative anti-PD-1/ interleukin-12 (IL-12) immunocytokine for cancer immunotherapy, during poster sessions at the American Association for Cancer Research (AACR) Annual Meeting 2025 in Chicago, Illinois this week. The data provide strong evidence supporting continued evaluation of both investigational therapies.

“The latest findings that will be presented at AACR 2025 demonstrate impressive potential for the continued advancement of these next-generation oncology therapies,” said Linda Liu, Ph.D., Senior Vice President, Biologics Discovery, Zai Lab. “We look forward to continuing our evaluation of these therapies that may provide the opportunity to broaden treatment options for patients who have been unresponsive or resistant to current treatments across a broad range of cancer types.”

ZL-6201 is a potential first- and best-in-class ADC with high affinity and specificity for LRRC15, an appealing target for cancer therapy due to its overexpression in multiple solid tumor types such as sarcoma, glioblastoma and melanoma. The compound was designed with a novel ADC technology platform called TMALIN®, which leverages the tumor microenvironment to overcome challenges associated with first-generation ADC therapies, including off-target payload toxicity.

Findings to be presented at AACR 2025 on Tuesday, April 29, demonstrate that ZL-6201 efficiently internalizes within and kills tumor cells, while also exhibiting a strong bystander killing effect in the tumor microenvironment where the target is often expressed. In multiple in vitro and in vivo pre-clinical studies, treatment with ZL-6201 effectively suppressed the growth of established tumors. Based on these findings, Zai Lab plans to initiate Investigational New Drug (IND)-enabling studies of ZL-6201 as a potential treatment for patients with sarcoma and other LRRC15-positive solid tumors, such as breast cancer and other malignancies, in 2025.

ZL-1222 is a PD-1 targeted, next-generation IL-12 immunocytokine designed to leverage the anti-tumor potential of IL-12 while lowering the associated systemic toxicity. Previous preclinical studies have demonstrated that IL-12 can have dramatic anti-tumor activity. However, in clinical investigations, systemic administration of IL-12 has been associated with a narrow therapeutic index with severe adverse events.

Findings from preclinical studies to be presented Monday, April 28, at AACR 2025 suggest that ZL-1222, through precisely tailored IL-12 activity and PD-1 targeting, demonstrate potent anti-tumor activity in both anti-PD-1 sensitive and resistant tumor models, with improved systemic safety. These results indicate its potential to benefit patients who are unresponsive or resistant to the current immuno-oncology therapies.

“At Zai Lab we are building a robust portfolio of potential first- and best-in-class oncology therapies to expand treatment options for patients around the world,” said Rafael G. Amado, M.D., President, Head of Global Research and Development, Zai Lab. “Findings from our preclinical studies of ZL-6201 and ZL-1222 demonstrate our commitment to identifying innovative approaches that address limitations associated with first-generation therapies. These include the ability to deliver higher concentrations of cytotoxic agents and limit off-target toxicity, in order to deliver meaningful treatment options for patients with a range of cancer types.”

Details regarding the Zai Lab poster presentations at AACR 2025 are as follows:

Title: Discovery and characterization of a novel LRRC15-targeting antibody-drug conjugate (ADC) for the treatment of solid tumors Presenter: Bing Wan, Ph.D., Executive Director, Biology, Zai Lab Session Title: New and Emerging Cancer Drug Targets Date/Time: Tuesday, April 29, 2025, from 9:00 a.m. - 12:00 p.m. CT Location: McCormick Place Convention Center, Poster Section 17 Poster Board Number: 23 Published Abstract Number: 4266

Title: Cis-delivery of a potency-reduced IL-12 via an anti-PD-1 single-chain antibody exhibits potent anti-tumor activity Presenter: Linda Liu, Ph.D., Senior Vice President, Biologics Discovery, Zai Lab Session Title: Late-Breaking Research: Clinical Research 1 Date/Time: Monday, April 28, 2025, from 2:00 p.m. - 5:00 p.m. CT Location: McCormick Place Convention Center, Poster Section 53 Poster Board Number: 1 Published Abstract Number: LB204

About Zai Lab

Zai Lab Limited (NASDAQ: ZLAB; HKEX: 9688) is an innovative, research-based, commercial-stage biopharmaceutical company based in China and the United States. We are focused on discovering, developing, and commercializing innovative products that address medical conditions with significant unmet needs in the areas of oncology, immunology, neuroscience, and infectious diseases. Our goal is to leverage our competencies and resources to positively impact human health worldwide.

For additional information about Zai Lab, please visit www.zailaboratory.com or follow us at https://x.com/ZaiLab_Global.

Zai Lab Forward-Looking Statements

This press release contains forward-looking statements relating to our future expectations, plans, and prospects, for Zai Lab, including, without limitation, statements relating to our prospects and plans for developing and commercializing ZL-6201 and ZL-1222, the potential benefits of ZL-6201 and ZL-1222, and the potential treatment of solid tumors. All statements, other than statements of historical fact, included in this press release are forward-looking statements, and can be identified by words such as “aim,” “anticipate,” “believe,” “could,” “estimate,” “expect,” “forecast,” “goal,” “intend,” “may,” “plan,” “possible,” “potential,” “will,” “would,” and other similar expressions. Such statements constitute forward-looking statements within the meaning of the Private Securities Litigation Reform Act of 1995. Forward-looking statements are not guarantees or assurances of future performance. Forward-looking statements are based on our expectations and assumptions as of the date of this press release and are subject to inherent uncertainties, risks and changes in circumstances that may differ materially from those contemplated by the forward-looking statements. We may not actually achieve the plans, carry out the intentions or meet the expectations or projections disclosed in our forward-looking statements, and you should not place undue reliance on these forward-looking statements. Actual results may differ materially from those indicated by forward-looking statements as a result of various important factors, including but not limited to (1) our ability to successfully commercialize and generate revenue from our approved products, (2) our ability to obtain funding for our operations and business initiatives, (3) the results of our clinical and pre-clinical development of our product candidates, (4) the content and timing of decisions made by the relevant regulatory authorities regarding regulatory approvals of our product candidates, (5) risks related to doing business in China, and (6) other factors identified in our most recent annual and quarterly reports and in other reports we have filed with the U.S. Securities and Exchange Commission (SEC). We anticipate that subsequent events and developments will cause our expectations and assumptions to change, and we undertake no obligation to update or revise any forward-looking statements, whether as a result of new information, future events, or otherwise, except as may be required by law. These forward-looking statements should not be relied upon as representing our views as of any date subsequent to the date of this press release.

Our SEC filings can be found on our website at www.zailaboratory.com and on the SEC’s website at www.SEC.gov.

View source version on businesswire.com: https://www.businesswire.com/news/home/20250424710413/en/

Investor Relations: Christine Chiou / Lina Zhang +1 (917) 886-6929 / +86 136 8257 6943 christine.chiou1@zailaboratory.com / lina.zhang@zailaboratory.com Media: Shaun Maccoun / Xiaoyu Chen +1 (857) 270-8854 / +86 185 0015 5011 shaun.maccoun@zailaboratory.com / xiaoyu.chen@zailaboratory.com

Source: Zai Lab Limited

AACRImmunotherapyADC

26 Mar 2025

LigaChemBio (141080KS, hereinafter 'LigaChemBio') announced on the 26th that it will present preclinical research results for five programs, including the STING agonist ‘LCB39’ under development as an immuno-oncology agent, and the LRRC15 ADC ‘SOT106’ and CA242 ADC ‘IKS04’ candidates derived through its ADC platform technology licensing, at the American Association for Cancer Research (AACR 2025) Annual Meeting.

These research findings will be presented through oral presentations and posters by LigaChemBio and its partners during the AACR 2025, scheduled to be held in Chicago from April 25 to 30 (local time). The abstracts related to these presentations were made available on the conference website on the 25th.

LCB39 is a next-generation immuno-oncology candidate, proprietarily developed by LigaChemBio. It targets the STING (Stimulator of Interferon Genes) protein to activate innate immune cells. STING agonists have gained attention as a promising mechanism to overcome the limitations of existing immuno-oncology drugs. However, despite numerous attempts by global pharmaceutical companies, most have failed to develop due to issues with efficacy and side effects. LigaChemBio’s LCB39 is distinctive in that it uses proprietary technology to reduce cell permeability compared to competing STING agonists, while enhancing penetration into tumor tissues and prolonging exposure. This unique approach is expected to maintain the potent efficacy of existing STING agonists while ensuring safety, increasing the likelihood of success when LCB39 enters clinical trials in early 2026, overcoming the failures of previous competitors. LigaChemBio will unveil additional data from SITC 2024, showcasing the synergistic effects of LCB39 when used in combination with various cancer treatments, including ADCs and immune checkpoint inhibitors. This data is anticipated to boost the product’s market potential given its compatibility.

Furthermore, Preclinical results for 2 ADCs derived through the ADC platform licensing deals and Platform research result will also be presented. These results will be showcased by partners IKSUDA and SOTIO, which entered into ADC platform technology licensing agreements with LigaChemBio in 2020 and 2021, respectively. As these candidates are planned to enter global clinical trials, the value of the platform technology licensing is expected to be further highlighted.

SOT106, currently under development by Sotio, is an ADC targeting LRRC15 (Leucine-rich repeat containing protein 15) with a monoclonal antibody and LigaChemBio’s ADC platform, 'ConjuALL', combined with an MMAE payload. It is a candidate derived from a 2021 technology licensing agreement between LigaChemBio and Sotio. LRRC15, the target of SOT106, is minimally expressed in normal tissues, but is known to be overexpressed in malignant tumors such as sarcoma, glioblastoma, head and neck squamous cell carcinoma, non-small cell lung cancer, and triple-negative breast cancer, which are cancers with high unmet medical needs. LRRC15 is considered one of the promising targets for ADC therapy development. According to the published abstract, SOT106 has demonstrated strong and sustained dose-dependent tumor growth inhibition effects in various disease-related mouse models. Complete responses were also observed at a clinically relevant dose of 1mg/kg. Notably, SOT106 showed higher efficacy with lower doses and fewer administrations compared to comparator drugs, further validating LigaChemBio’s linker technology. In addition, Sotio announced that it has developed a diagnostic antibody, which will help patient populations most likely to benefit from SOT106 treatment. This development is expected to increase the likelihood of success in the upcoming Phase 1/2 clinical trials.

IKS04, currently under development by IKSUDA Therapeutics (IKSUDA), is an antibody-drug conjugate (ADC) that targets CA242 (a cancer-specific carbohydrate antigen).

IKS04 combines IKSUDAs proprietary antibody with LigaChem Biosciences (LCB)'s ADC platform ConjuALL, and LCB’s proprietary payload, a PBD prodrug (Pyrrolobenzodiazepine prodrug). LCBs platforms were accessed by IKSUDA through a license agreement with LCB in 2020 for use in the development of ADCs to numerous targets.

CA242, the target for IKS04, is known to be highly expressed in colorectal, pancreatic, and gastric cancers, while its expression in normal tissues is limited. Previous clinical studies, though unsuccessful, demonstrated the potential of CA242 as a druggable and potentially promising ADC target. However, these studies revealed the limitations of microtubule inhibitor-based payloads in gastric tumors due to their modest clinical efficacy. Therefore IKS04, which employs a potent DNA-damaging payload, such as a PBD, may provide significant improvement in clinical activity and offer an effective therapeutic option for patients with gastric cancers. LCBs prodrug approach enables tumor-ive release and activation of this potent payload for added safety.

According to IKSUDAs published abstract, CA242 has inordinately high expression abundance in high-expressing colon and gastric models, resulting in an antigen barrier which precludes tumor penetration of the ADC. Leveraging an ‘ultra-low DAR approach through co-administration of naked antibody with the ADC, IKSUDA has demonstrated an enhancement in tumor penetration, enabling consistently low minimally effective doses of <0.5mg/kg across all CA242-expression models. As a reference, the benchmark compound cantuzumab ravtansine was inactive even at doses of 2mg/kg in these models, validating the design hypothesis for payload mechanism ion.

Importantly, the ultra-low DAR approach does not negatively impact toxicity and IKS04 is also associated with a favorable preclinical therapeutic index (TI), which is significantly higher than all PBD-based ADC programs that have been assessed for solid tumors to date.

In conclusion, IKS04 has demonstrated strong and consistent anti-tumor efficacy across a range of GI tumor models, including those of the stomach and colon, alongside a favorable TI. This ADC program adds further evidence of the potential clinical benefit of LCB’s proprietary PBD prodrug approach for use in ADCs to ed tumor indications. Based on these positive results, IKSUDA plans to initiate clinical trials of IKS04 using the ultra-low DAR dosage regimen in the near future. IKS04 potentially offers a new treatment option for cancers which are notoriously difficult to treat.

Iksuda also presented research results that demonstrate the superiority of the linker technology introduced by LigaChemBio. According to the published abstract, Iksuda compared an FRα (Folate-Receptor Alpha) ADC using Iksuda's proprietary 'Permalink' conjugation method with LigaChemBio’s linker and MMAE payload, maintaining the antibody, conjugation method, and payload, while applying the valine-citrulline (vc) linker, which is commonly used by most global ADC companies after the expiration of its patent. Preclinical experiments showed that the ADC using LigaChemBio’s linker exhibited superior tolerability and stability in the bloodstream compared to the ADC using the vc linker. This research result is significant as it reaffirms the superiority of LigaChemBio’s proprietary linker technology over existing linker technologies

License out/inAACRADCImmunotherapy

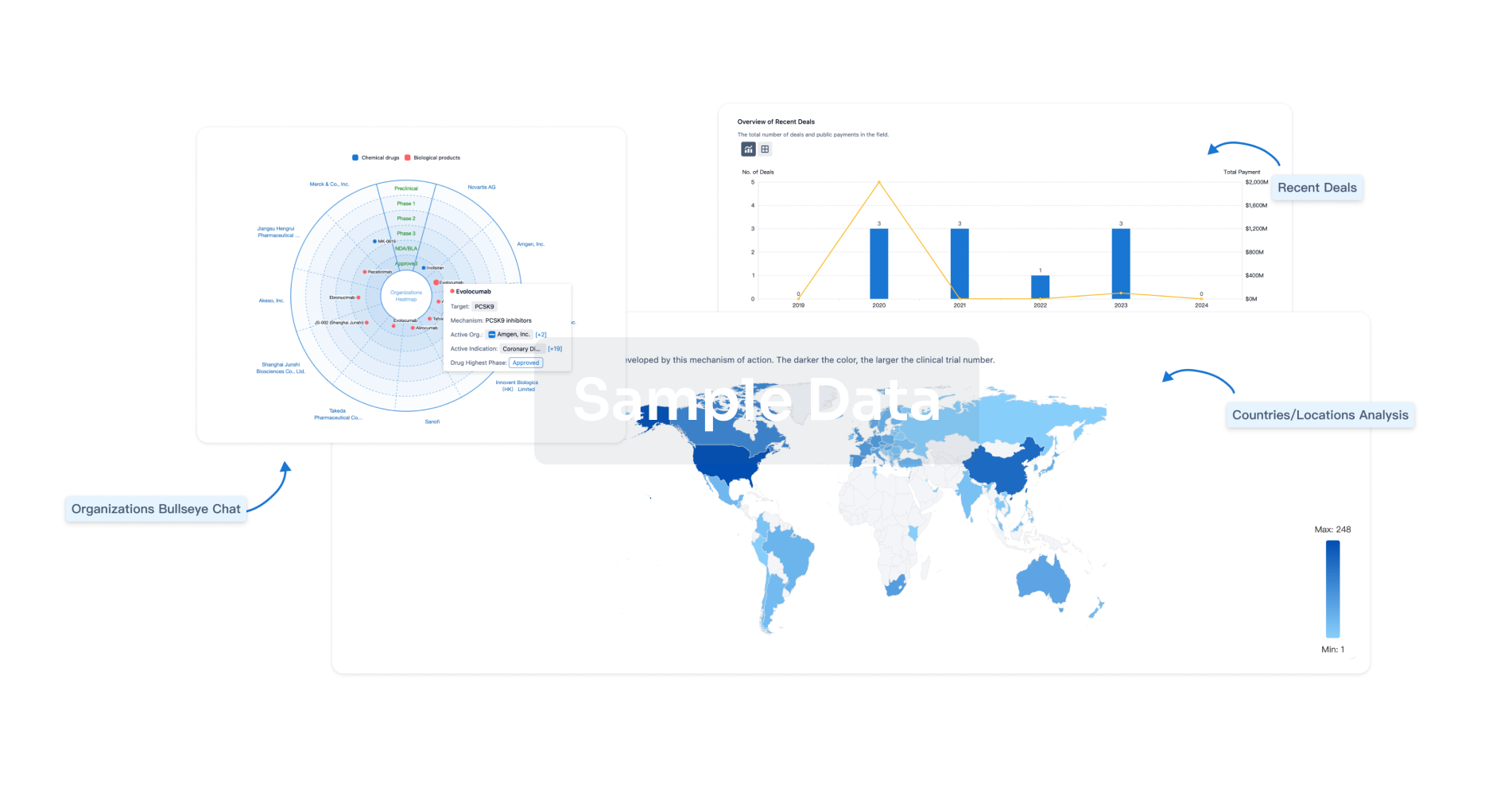

Analysis

Perform a panoramic analysis of this field.

login

or

AI Agents Built for Biopharma Breakthroughs

Accelerate discovery. Empower decisions. Transform outcomes.

Get started for free today!

Accelerate Strategic R&D decision making with Synapse, PatSnap’s AI-powered Connected Innovation Intelligence Platform Built for Life Sciences Professionals.

Start your data trial now!

Synapse data is also accessible to external entities via APIs or data packages. Empower better decisions with the latest in pharmaceutical intelligence.

Bio

Bio Sequences Search & Analysis

Sign up for free

Chemical

Chemical Structures Search & Analysis

Sign up for free