Request Demo

Last update 08 May 2025

Adenosine

Last update 08 May 2025

Basic Info

Synonyms 腺苷 |

Introduction- |

Related

4

Drugs associated with AdenosineTarget |

Mechanism Adenosine deaminase replacements |

Active Org. |

Originator Org. |

Active Indication |

Inactive Indication- |

Drug Highest PhaseApproved |

First Approval Ctry. / Loc. United States |

First Approval Date05 Oct 2018 |

Target |

Mechanism Adenosine inhibitors |

Active Org. |

Originator Org. |

Active Indication |

Inactive Indication- |

Drug Highest PhasePreclinical |

First Approval Ctry. / Loc.- |

First Approval Date20 Jan 1800 |

Target |

Mechanism Adenosine inhibitors |

Active Org.- |

Originator Org. |

Active Indication- |

Inactive Indication |

Drug Highest PhaseWithdrawn |

First Approval Ctry. / Loc. United States |

First Approval Date21 Mar 1990 |

7

Clinical Trials associated with AdenosineNCT03878069

Single Arm, Open-Label, Multicenter, Registry Study of Revcovi (Elapegademase-lvlr) Treatment in ADA-SCID Patients Requiring Enzyme Replacement Therapy

This registry study is being conducted in patients with adenosine deaminase severe combined immune deficiency (ADA-SCID) who require enzyme replacement therapy (ERT) treatment with Revcovi. Data on safety and on measures of efficacy are collected.

Start Date30 Sep 2019 |

Sponsor / Collaborator |

NCT02999984

Efficacy and Safety of Cryopreserved Formulation of Autologous CD34+ Hematopoietic Stem Cells Transduced Ex Vivo With Elongation Factor 1 Alpha Shortened (EFS) Lentiviral Vector Encoding for Human ADA Gene in Subjects With Severe Combined Immunodeficiency Due to ADA Deficiency

This is a prospective, non-randomized, single-cohort, longitudinal, single-center, clinical study designed to assess the efficacy and safety of a cryopreserved formulation of OTL-101 (autologous CD34+ hematopoietic stem/progenitor cells transduced ex vivo with EFS (Elongation Factor 1α Short form) Lentiviral Vector (LV) encoding for the human ADA gene) administered to ADA-SCID subjects between the ages of 30 days and 17 years of age, who are not eligible for an Human Leukocyte Antigen (HLA) matched sibling/family donor and meeting the inclusion/exclusion criteria. The OTL-101 product is infused after a minimal interval of at least 24 hours following the completion of reduced intensity conditioning. For subjects who successfully receive the OTL-101 product, pegademase bovine (PEG-ADA) Enzyme Replacement Therapy (ERT) is discontinued at Day+30 (-3/+15) after the transplant. After their discharge from hospital, the subjects will be seen at regular intervals to review their history, perform examinations and draw blood samples to assess immunity and safety.

Start Date16 Dec 2016 |

Sponsor / Collaborator |

JPRN-JapicCTI-163204

Multicenter, open-label, uncontrolled clinical study of STM-279 in patients with adenosine deaminase (ADA) deficiency (Phase III clinical study)

Start Date02 Mar 2016 |

Sponsor / Collaborator |

100 Clinical Results associated with Adenosine

Login to view more data

100 Translational Medicine associated with Adenosine

Login to view more data

0 Patents (Medical) associated with Adenosine

Login to view more data

1,618

Literatures (Medical) associated with Adenosine01 Dec 2025·Inflammation Research

Inflammatory pain and electroacupuncture: how the P2X3 receptor can help modulate inflammation—a review of current literature

Review

Author: Soares, Adinei Abadio ; da Silva, Keroli Eloiza Tessaro ; Ecco, Jardel Cristiano ; Resende E Silva, Débora Tavares ; Sousa Silva, Guilherme Vinício ; Ansolin, Vinicius

01 Aug 2025·Biomaterials

Immunity/metabolism dual-regulation via an acidity-triggered bioorthogonal assembly nanoplatform enhances glioblastoma immunotherapy by targeting CXCL12/CXCR4 and adenosine-A2AR pathways

Article

Author: Jiang, Xinqing ; Lin, Wanxian ; Wei, Xinhua ; Li, Tao ; Yang, Ruimeng ; Zhao, Yandong ; Lai, Shengsheng ; Xie, Kunfeng ; Yuan, Youyong ; Wei, Ruili ; Li, Jiamin

01 Jul 2025·Neural Regeneration Research

Prolonged intermittent theta burst stimulation restores the balance between A2AR- and A1R-mediated adenosine signaling in the 6-hydroxidopamine model of Parkinson’s disease

Article

Author: Ninkovic, Milica ; Jovanovic, Milica Zeljkovic ; Nedeljkovic, Nadezda ; Stevanovic, Ivana ; Ilic, Tihomir V. ; Stanojevic, Jelena ; Dragic, Milorad

4

News (Medical) associated with Adenosine12 Apr 2024

Portage Biotech said in January that it was halting development of its iNKT programs.

Portage Biotech is putting the clamps on existing work to save cash as it prioritizes a hunt for strategic alternatives.

The company said Friday that after a review of the financing market and the amount of spending necessary to advance its pipeline, the search for strategic alternatives would commence. In the meantime, Portage is halting enrollment in a clinical trial testing both its adenosine 2A inhibitor PORT-6 and its adenosine 2B inhibitor PORT-7. Portage bought both assets from Tarus Therapeutics less than two years ago.

Portage is considering anything from securing partners for its assets to a merger, sale or a full wind-down of the company. The biotech has no timetable for finding a path forward.

About three months ago, Portage said it was all in on prioritizing development of its adenosine inhibitors, electing to pause further development of an iNKT program. The biotech had been expecting to provide interim data from a phase 1a trial testing PORT-6 in patients with solid tumors at this year’s American Society of Clinical Oncology annual meeting in June, with final data teased for November.

But the company had little money to work with, entering 2024 with just $5.3 million in cash on hand, according to a full-year earnings report from February. Still, Portage affirmed at the time that it intended to press ahead with its adenosine work.

Those assets were acquired from Tarus back in July 2022, with Portage handing over 2.4 million shares and taking on $3 million in liabilities. In addition to PORT-6 and PORT-7, Portage took hold of a dual adenosine inhibitor, PORT-8, and a preclinical candidate to treat gastrointestinal tumors, dubbed PORT-9. But neither PORT-8 or PORT-9 are still in development, according to Portage’s pipeline.

AcquisitionPhase 1ASCO

01 Mar 2023

- Enrollment ongoing in IMPORT-201 Phase 1/2 trial of PORT-2 in Melanoma and Non-Small Cell Lung Cancer - Company on track to initiate Phase 1 portion of ADPORT-601 trial by end of 2Q23 - Company to Host a Key Opinion Leader Event on Targeting Adenosine Pathway in Cancer WESTPORT, Conn., March 01, 2023 (GLOBE NEWSWIRE) -- Portage Biotech Inc. (NASDAQ: PRTG), a clinical-stage immuno-oncology company advancing novel multi-targeted therapies for use as single agents and in combination, today announced financial results for the fiscal quarter ended December 31, 2022. “During the quarter and in recent weeks we continued to progress our clinical programs. Building on the favorable data presented from our lead program – invariant natural killer T cell (iNKT) agonist, PORT-2 – at the 2022 annual meeting of the Society of Immunotherapy of Cancer (SITC), we announced a new clinical collaboration agreement with Merck to evaluate PORT-2 in combination with KEYTRUDA® (pembrolizumab),” said Dr. Ian Waters, Chief Executive Officer and Chairman of Portage Biotech. “We are expanding this trial internationally and are pleased to announce that our Investigational New Drug application is approved in the U.S., and we are activating U.S. sites. We anticipate establishing the recommended Phase 2 dose shortly and commencing the Phase 2 portion of the IMPORT-201 trial in the second quarter of 2023. “We also are continuing to advance our company-sponsored ADPORT-601 adenosine trial for PORT-6 and PORT-7 in the U.S.,” continued Dr. Walters. “This trial is designed to adapt over time and include safety and efficacy cohorts for these two agents alone and with other immune activating agents, including others from Portage’s internal pipeline. The potential of our unique approach of enhancing immune response with next-generation small molecule adenosine inhibitors will be discussed in the Key Opinion Leader event we will be hosting on March 9. We look forward to building on the progress made during this past quarter, advancing our clinical programs, and presenting trial data at multiple congresses later this year.” Pipeline & Clinical Program Highlights for Fiscal Quarter Ended December 31, 2022 and Recent Weeks Presented updates from ongoing Phase 1/2 clinical trial of PORT-2 (IMM60) iNKT agonist for patients with non-small cell lung cancer (NSCLC) and advanced melanoma at SITC 37th Annual Meeting The poster presentation included updated data from the IMPORT-201 clinical trial, a multi-arm Phase 1/2 trial evaluating PORT-2 in multiple settings including first-line and refractory NSCLC and refractory melanoma, both as a monotherapy and in combination with Merck’s anti-PD-1 therapy (programmed death receptor-1), KEYTRUDA® (pembrolizumab)Data built on previous results shared at the 2022 American Society of Clinical Oncology (ASCO) meeting in June 2022 and presented additional safety and tolerability of PORT-2, along with the mechanistic potential to activate both the adaptive and innate immune systems and reduce the suppressive cells in the tumor microenvironment.The presented data are available here. Entered into a clinical collaboration agreement with Merck for the evaluation of Portage’s lead iNKT agonist, PORT-2, in combination with KEYTRUDA® (pembrolizumab), Merck’s anti-PD-1 therapy, for patients with first-line as well as PD-1 refractory NSCLC.The Company will host a key opinion leader webinar on targeting the adenosine pathway in cancer on Thursday, March 9, 2023 at 10:30 am Eastern Time. Featuring Lawrence Fong, M.D., from The University of California, San Francisco (UCSF) Helen Diller Family Comprehensive Cancer Center, and Sumit Subudhi, M.D., Ph.D., from MD Anderson Cancer Center, this event will cover the immunologic rationale and current clinical landscape that set the foundation for Portage’s development approach. A live question and answer session will follow the formal presentations. To register for the event, please click here. Financial Results from Quarter Ended December 31, 2022 The Company generated a net loss of approximately $7.5 million and other comprehensive loss of approximately $11.5 million during the three months ended December 31, 2022 (the “Fiscal 2023 Quarter”), compared to a net loss and other comprehensive loss of approximately $4.2 million during the three months ended December 31, 2021 (the “Fiscal 2022 Quarter”), an increase in net loss of $3.3 million and an increase in other comprehensive loss of $7.3 million. Operating expenses, which include research and development (“R&D”) and general and administrative (“G&A”) expenses, were $4.8 million in the Fiscal 2023 Quarter, compared to $4.2 million in the Fiscal 2022 Quarter, an increase of $0.6 million, which is discussed more fully below. R&D costs increased by approximately $0.6 million, or approximately 32%, from approximately $1.9 million in the Fiscal 2022 Quarter, to approximately $2.5 million in the Fiscal 2023 Quarter. The increase was primarily attributable to clinical trial costs of $0.6 million associated with the iNKT clinical trial and the start-up and manufacturing costs associated with the adenosine assets (PORT-6 and PORT-7) acquired in the Tarus acquisition of $0.8 million. There were no such costs incurred in the Fiscal 2022 Quarter. The Fiscal 2023 Quarter also included $0.1 million in other R&D costs relating to outside services and an increase in compensation of $0.1 million for consultants involved in R&D activities. The Fiscal 2022 Quarter included $0.6 million for bonuses to employees and consultants, reflected in payroll-related expenses, which was approved and paid in the Fiscal 2022 Quarter. There was no such amount in the Fiscal 2023 Quarter. Additionally, the Fiscal 2022 Quarter included a higher amount of non-cash share-based compensation expense of $0.4 million, which was primarily attributable to (a) the continued vesting over time of grants; and (b) the decrease in the fair value of grants made after the Fiscal 2022 Quarter. G&A expenses were substantially the same in the year-over-year periods, as they decreased by approximately $0.02 million, or approximately 0.9%, from approximately $2.24 million in the Fiscal 2022 Quarter, to approximately $2.22 million in the Fiscal 2023 Quarter. Professional fees increased by $0.2 million due to legal fees and audit related fees associated with the updating of public filings and payroll-related expenses increased by $0.3 million due to the continued build-up of the Company’s infrastructure. The Fiscal 2023 Quarter also included director’s fees of $0.1 million (director’s fees were approved and commenced January 2022). These increases were partially offset by a decrease in non-cash share-based compensation expense of $0.5 million attributable to the vesting of certain options granted in prior years and lower fair value associated with more recent grants and the decrease of $0.1 million associated with directors and officers (“D&O”) insurance due to a decrease in the D&O premium market year-over-year. The other principal components of the change in net loss and total comprehensive loss were as follows: Other items of income and expense - Other items were substantially non-cash in nature and aggregated approximately $0.54 million net loss in the Fiscal 2023 Quarter, compared to approximately $0.08 million net income in the Fiscal 2022 Quarter, a change in other items of income and expense of approximately $0.62 million, quarter-over-quarter. The primary reason for the quarter-over-quarter difference in other items of income and expense was the difference in the fair value of warrants outstanding recognized in the quarter-over-quarter period, which expired in October 2022, and a loss from the change (increase) in fair value of the deferred purchase price payable – Tarus and deferred obligation – iOx milestone. Net deferred income tax expense – Additionally, the Company reflected a net deferred income tax expense of $2.2 million in the Fiscal 2023 Quarter, compared to a net deferred income tax expense of $0.1 million in the Fiscal 2022 Quarter. The Fiscal 2023 Quarter includes the foreign currency effect on deferred tax liability balance settleable in British pound sterling of $2.5 million partially offset by the recognition of current period losses in the U.K. of $0.2 million and the related tax rate change effect of $0.1 million. Fair value analysis – At December 31, 2022, the Company performed a fair value analysis of its investment in Intensity Therapeutics, Inc. (“Intensity”) and determined the fair value was less than the its carrying value. Accordingly, the Company recognized an unrealized loss in value in Intensity of $4.046 million through other comprehensive income in the Fiscal 2023 Quarter. As of December 31, 2022, the Company had cash and cash equivalents of approximately $13.1 million. KEYTRUDA® is a registered trademark of Merck Sharp & Dohme Corp., a subsidiary of Merck & Co. LLC., Rahway, N.J., USA. About Portage Biotech Inc.

Portage is a clinical-stage immuno-oncology company advancing multi-targeted therapies to extend survival and significantly improve the lives of patients with cancer. Lead programs in the Portage portfolio include first-in-class invariant natural killer T cell (iNKT) small molecule engagers and best-in-class adenosine antagonists. These programs are being advanced using innovative trial designs and translational data to identify the patient populations most likely to benefit from treatment. The Company’s unique business model leverages a strong network of academic experts and large pharma partners to rapidly and efficiently advance multiple products. For more information, please visit www.portagebiotech.com, follow us on Twitter at @PortageBiotech or find us on LinkedIn at Portage Biotech Inc. Forward-Looking Statements All statements in this news release, other than statements of historical facts, including without limitation, statements regarding about the Company’s information that are forward-looking in nature and, business strategy, plans and objectives of management for future operations and those statements preceded by, followed by or that otherwise include the words "believe," "expects," "anticipates," "intends," "estimates," “will,” “may,” “plan,” “potential,” “continue,” or similar expressions or variations on such expressions are forward-looking statements. For example, statements regarding the Company's plans to advance first-in-class therapies to improve long-term treatment response and quality of life in patients with evasive cancers; the Company’s plan to commence the Phase 2 portion of the IMPORT-201 trial in the second quarter of 2023; the Company’s plan to augment an immune response with its next-generation small molecule adenosine 2A and adenosine 2B inhibitors; the Company's plans to identify the most promising clinical therapies and product development strategies that accelerate these medicines through innovative trial designs and the translational pipeline; the Company's plans to report multiple clinical readouts through the end of 2024; the safety and tolerability profile of PORT-2; the Company's collaboration agreement with Merck to evaluate PORT-2 in combination with KEYTRUDA® (pembrolizumab) for the treatment of patients with front-line and refractory NSCLC; the Company's preparations to launch of ADPORT-601 adenosine trial for PORT-6 and PORT-7 in the U.S.; advancing the Company's broader strategy of de-risked clinical development; and the Company's ability to deliver on multiple catalysts in the coming months and forward-looking statements. As a result, forward-looking statements are subject to certain risks and uncertainties, including , but are not limited to: the Company's plans and ability to develop and commercialize product candidates and the timing of these development programs; the Company's clinical development of its product candidates, including the results of current and future clinical trials; the benefits and risks of the Company's product candidates as compared to others; the Company's maintenance and establishment of intellectual property rights in its product candidates; the Company's need for financing and its estimates regarding its capital requirements and future revenues and profitability; the Company's estimates of the size of the potential markets for its product candidates; its selection and licensing of product candidates; and other factors set forth in “Item 3 - Key Information-Risk Factors” in the Company’s Annual Report on Form 20-F for the year ended March 31, 2022. Although the Company believes that the expectations reflected in these forward-looking statements are reasonable, undue reliance should not be placed on them as actual results may differ materially from these forward-looking statements. The forward-looking statements contained in this news release are made as of the date hereof, and the Company undertakes no obligation to update publicly or revise any forward-looking statements or information, except as required by law. FOR MORE INFORMATION, PLEASE CONTACT: Investor RelationsChuck Padala chuck@lifesciadvisors.com Media RelationsGwendolyn Schankergschanker@lifescicomms.com

---tables to follow---

Portage Biotech Inc.Condensed Consolidated Interim Statements of Operations and Other Comprehensive Income (Loss)(U.S. Dollars in thousands, except per share amounts)(Unaudited – see Notice to Reader dated February 28, 2023)

Three months endedDecember 31, Nine months endedDecember 31, 2022 2021 2022 2021 In 000’$ In 000’$ In 000’$ In 000’$ Expenses

Research and development $2,535 $1,928 $5,976 $4,804 General and administrative expenses 2,224 2,241 6,523 6,288 Loss from operations (4,759) (4,169) (12,499) (11,092)Change in fair value of deferred purchase price payable - Tarus and deferred obligation - iOx milestone (498) – (428) – Share of loss in associate accounted for using equity method (152) (261) (268) (363)Change in fair value of warrant liability 8 342 33 726 Foreign exchange transaction gain (loss) 50 – (60) – Depreciation expense (1) – (1) – Interest income 50 – 115 – Interest expense – (1) (9) (42)Loss before provision for income taxes (5,302) (4,089) (13,117) (10,771)Income tax (expense) benefit (2,199) (117) 2,906 465 Net loss (7,501) (4,206) (10,211) (10,306)Other comprehensive income (loss)

Net unrealized loss on investments (4,017) – (4,017) – Total comprehensive loss for period $(11,518) $(4,206) $(14,228) $(10,306)

Net loss attributable to:

Owners of the Company $(7,485) $(3,512) $(10,163) $(9,553)Non-controlling interest (16) (694) (48) (753)Net loss $(7,501) $(4,206) $(10,211) $(10,306)

Comprehensive loss attributable to:

Owners of the Company $(11,502) $(3,512) $(14,180) $(9,553)Non-controlling interest (16) (694) (48) (753)Total comprehensive loss for period $(11,518) $(4,206) $(14,228) $(10,306)

Loss per share

Basic and diluted $(0.44) $(0.26) $(0.65) $(0.74)

Weighted average shares outstanding

Basic and diluted 17,039 13,344 15,719 12,966 Portage Biotech Inc.Condensed Consolidated Interim Statements of Financial Position(U.S. Dollars in thousands)(Unaudited – see Notice to Reader dated February 28, 2023) As of, December 31,2022 March 31,2022

(Audited) Assets

Current assets

Cash and cash equivalents $13,104 $23,352 Prepaid expenses and other receivables 1,786 1,480 Convertible note receivable 642 – Total current assets 15,532 24,832 Long-term assets

Investment in associate 1,405 1,673 Investment in private company 3,363 7,409 Goodwill 43,862 43,324 In-process research and development 145,588 117,388 Deferred commitment fee 894 – Other assets, including equipment, net 39 36 Total long-term assets 195,151 169,830 Total assets $210,683 $194,662 Total assets

Liabilities and Equity

Current liabilities

Accounts payable and accrued liabilities $2,422 $750 Warrant liability – 33 Total current liabilities 2,422 783 Non-current liabilities

Deferred tax liability 25,515 28,445 Deferred purchase price payable - Tarus 8,876 – Deferred obligation - iOx milestone 5,568 – Total non-current liabilities 39,959 28,445 Total liabilities 42,381 29,228

Shareholders’ Equity

Capital stock 216,630 158,324 Stock option reserve 20,542 16,928 Accumulated other comprehensive (loss) income (3,059) 958 Accumulated deficit (65,168) (55,005)Total equity attributable to owners of the Company 168,945 121,205 Non-controlling interest (643) 44,229 Total equity 168,302 165,434 Total liabilities and equity $210,683 $194,662

ImmunotherapyFinancial StatementASCOClinical ResultPhase 2

19 Sep 2022

Bugworks - a US, India and Australia based start-up with globally recognized expertise in drug discovery, has set up a dedicated

Immuno-oncology ex vivo research lab at the Bengaluru-based hospital, Cytecare.

The lab bridges the translation from discovery to development, addressing several hard-to-treat cancers such as gastric, colorectal, renal cell, breast, head and neck, non-small cell lung cancers.

This partnership between leading drug discovery start-up and leading cancer hospital paves way for the development of novel Immuno-oncology drugs that can be effective in wider patient populations.

The outcome of this translational research will guide the first-in-human trials, expected to commence in early 2024.

BENGALURU, India, Sept. 19, 2022 /PRNewswire/ -- Bugworks Research Inc., a clinical stage biopharmaceutical company, and Cytecare Cancer Hospitals today announced the launch of a first-of-its-kind collaboration. Bugworks develops best-in-class, novel therapies for cancer and infectious diseases & has set up a dedicated research center within Cytecare, which is committed to excellence in treating cancer patients.

Continue Reading

Cytecare Logo

The coming together of a leading innovator in drug discovery and a state-of-the-art cancer hospital promises to be a game changer in saving countless human lives. Bugworks' drug discovery engine coupled with Cytecare's excellence in delivering optimal clinical outcomes will offer differentiated solutions to patients all over the world.

Commenting on the significance of this strategic collaboration,

Suresh Ramu, Co-Founder & CEO, Cytecare Cancer Hospitals, said, "We are excited to partner with Bugworks Research, in this inspiring endeavor to discover novel treatments for different types of cancers. In 2016, we started with the vision of building the country's best institution for cancer care, supported by India-specific research data. At Cytecare, we are committed to provide the best possible treatment to patients and support cutting-edge research. We strongly believe that affordable and accessible immuno-oncology therapies can come from India and be made accessible to all patients. This collaboration heralds a brave new beginning to a healthier future."

Bugworks' current research in immuno-oncology centers around modulating the tumour microenvironment that includes adenosine antagonism - an area of research with applications across many solid tumours. The drug candidates from this research will undergo translational testing on patient-derived tumours in the ex vivo laboratories at Cytecare, prior to progressing to first-in-human clinical studies.

Dr. V. Balasubramanian, Co-Founder and COO, Bugworks, noted, "We are discovering highly differentiated, novel small molecule immunotherapeutic agents that target the immunosuppressive and tumour-promoting microenvironment. The ex vivo laboratories at Cytecare Cancer Hospitals, as part of our collaboration, will greatly aid the translation of our research to high percentage successful clinical outcomes."

At present, immunotherapy is an important pillar in the armamentarium of cancer care. The currently approved agents are indeed life-saving, albeit only for a small segment of patients. Bugworks' approach, in collaboration with Cytecare Hospitals, offers new avenues to increase the percentage of patients who would benefit from these life-saving immunotherapies. The current collaboration is a small, yet significant step in helping India become a biotech powerhouse.

About Bugworks Research ()

Bugworks Research is a clinical-stage biopharmaceutical company, developing novel therapeutic assets to combat Antimicrobial Resistance (AMR) and immunotherapies to treat cancer patients using innovative structure-guided medicinal chemistry. Its AMR asset, BWC0977, currently in Phase 1 human studies will address serious hospital, community and biothreat bacterial infections. Its immuno-oncology pipeline is in pre-clinical development and has the potential to target multiple cancers.

About Cytecare Cancer Hospitals ()

Cytecare launched its flagship center, Cytecare Cancer Hospitals, a 150-bed organ-site focused cancer hospital, in November 2016 at Yelahanka, Bengaluru. Founded on the principle of 'Fighting Cancer the Right Way', Cytecare houses some of the finest surgeons, physicians, medical oncologists, radiation oncologists, and other clinical experts in the country within its world-class facility. Patient-centricity is a hallmark of treatment at Cytecare and today their comprehensive clinical team delivers holistic healing across a range of medical specialties. Cytecare is also a part of multiple global clinical research studies, which ensures continuous learning & improvement in clinical outcomes for their patients. Cytecare delivers a consistently high-level of specialized care for thousands of cancer patients, from more than 40 countries.

For enquiries contact:

Pradeep Fernandes

[email protected]

Logo:

Logo:

SOURCE Bugworks

CollaborateImmunotherapySmall molecular drug

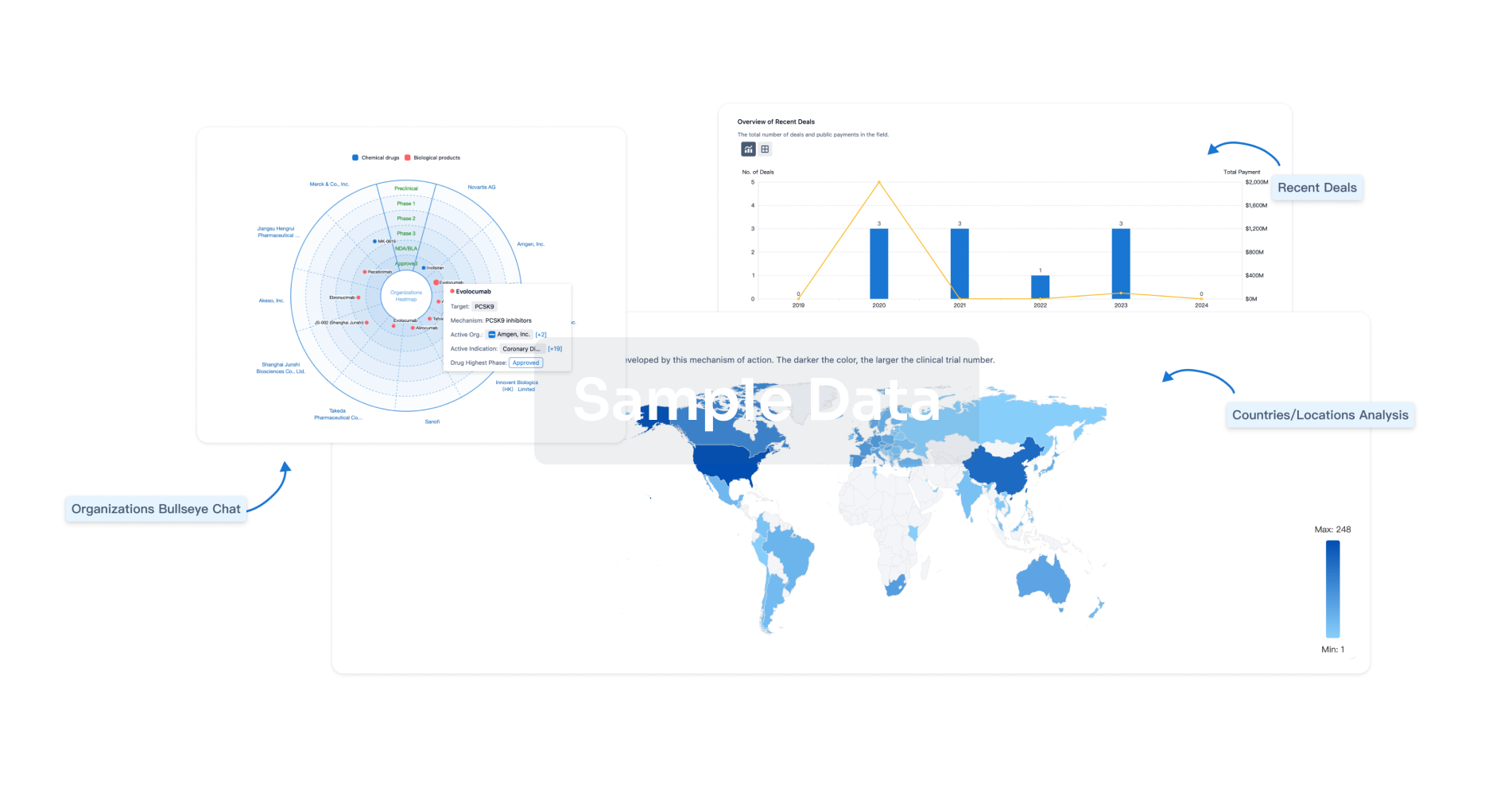

Analysis

Perform a panoramic analysis of this field.

login

or

AI Agents Built for Biopharma Breakthroughs

Accelerate discovery. Empower decisions. Transform outcomes.

Get started for free today!

Accelerate Strategic R&D decision making with Synapse, PatSnap’s AI-powered Connected Innovation Intelligence Platform Built for Life Sciences Professionals.

Start your data trial now!

Synapse data is also accessible to external entities via APIs or data packages. Empower better decisions with the latest in pharmaceutical intelligence.

Bio

Bio Sequences Search & Analysis

Sign up for free

Chemical

Chemical Structures Search & Analysis

Sign up for free