Request Demo

Last update 08 May 2025

EIF4E x CCND1

Last update 08 May 2025

Related

1

Drugs associated with EIF4E x CCND1Target |

Mechanism CCND1 inhibitors [+2] |

Active Org.- |

Originator Org. |

Active Indication- |

Inactive Indication |

Drug Highest PhaseDiscontinued |

First Approval Ctry. / Loc.- |

First Approval Date20 Jan 1800 |

2

Clinical Trials associated with EIF4E x CCND1NCT02168725

A Phase I, Dose-escalation Study of the Safety, Pharmacokinetics and Efficacy of Weekly Intravenous Briciclib in Patients With Advanced Solid Tumors

The main objectives of this study are to determine the safety profile of briciclib, an experimental anti-cancer drug, as it is administered intravenously once weekly as escalating doses in adult patients with advanced cancer and solid tumors, and to determine the highest dose of briciclib that can be safely given. Secondary objectives are to determine how the amount of briciclib in circulation changes over time and how much briciclib gets into the urine for excretion, and to document potential anti-tumor effects of briciclib.

Start Date01 Jun 2014 |

Sponsor / Collaborator |

NCT01049113

Phase 1, Dose Escalation Study To Assess the Safety, Pharmacokinetics and Activity of 2-Hour Continuous Intravenous Dosing of ON 013105 Administered Weekly in Patients With Relapsed/Refractory Lymphoma and Acute Lymphoid Leukemia

This is an open-label, dose-escalation Phase 1 study of the investigational agent, ON 013105. In laboratory animal studies, ON 013105 has demonstrated anti-cancer activity. The purpose of this study is to determine the highest dose of ON 013105 that can be given safely in patients with relapsed/refractory Lymphoma or B-cell Acute Lymphocytic Leukemia (Philadelphia chromosome negative). Patients will receive weekly 2-hour IV infusions of ON 013105 at higher and higher doses until intolerable side effects are observed. It is important to know the highest safe dose so additional studies can be done.

Start Date01 Nov 2009 |

Sponsor / Collaborator |

100 Clinical Results associated with EIF4E x CCND1

Login to view more data

100 Translational Medicine associated with EIF4E x CCND1

Login to view more data

0 Patents (Medical) associated with EIF4E x CCND1

Login to view more data

132

Literatures (Medical) associated with EIF4E x CCND101 Jan 2024·Experimental Dermatology

eIF4E plays the role of a pathogenic gene in psoriasis, and the inhibition of eIF4E phosphorylation ameliorates psoriasis‐like skin damage

Article

Author: Huang, Shan ; Zhen, Yunyue ; Wen, He ; Yang, Luan ; Sun, Qing ; Wang, Ruijie ; Li, Xueqing

01 Jun 2023·iScience

Mechanism underlying follicular hyperproliferation and oncogenesis in hidradenitis suppurativa

Article

Author: Jin, Lin ; Atigadda, Venkatram ; Chen, Jari Q ; Sinha, Rajesh ; Mayo, Tiffany ; Chen, Yunjia ; Khan, Jasim ; Raman, Chander ; Deshane, Jessy S ; Lee, Madison B ; Elston, Carly ; Kashyap, Mahendra P ; Elewski, Boni E ; Elmets, Craig A ; Athar, Mohammad ; Guo, Yuanyuan ; Oak, Allen ; Weng, Zhiping ; Patcha, Prasanth ; Mukhtar, Shahid M

01 Sep 2022·Experimental Cell Research

Nuclear-targeted 4E-BP1 is dephosphorylated, induces nuclear translocation of eIF4E, and alters mRNA translation

Article

Author: Shibutani, Shusaku ; Takahashi, Sho ; Iwata, Hiroyuki

5

News (Medical) associated with EIF4E x CCND111 Apr 2023

The Company’s eIF4A inhibitor, zotatifin, will be tested in specific genomically-defined subgroups, including standard risk patients as well as high-risk patients carrying specific markers predictive of relapseSOLANA BEACH, Calif. and REDWOOD CITY, Calif., April 11, 2023 (GLOBE NEWSWIRE) -- eFFECTOR Therapeutics, Inc. (NASDAQ: EFTR), a leader in the development of selective translation regulator inhibitors (STRIs) for the treatment of cancer, today announced a clinical collaboration with Jennifer Caswell-Jin, M.D., Assistant Professor of Medicine at Stanford Medicine, who will serve as principal investigator in an investigator-initiated trial evaluating zotatifin in patients with estrogen receptor-positive (ER+), human epidermal growth factor receptor 2-negative (HER2-) breast cancer in a pre-operative setting. This trial will bring to the clinic the science of integrative subgroups of breast cancer, building on work done by Christina Curtis, Ph.D., Professor of Medicine, Genetics, and Biomedical Data Science, and Director of Artificial Intelligence and Cancer Genomics at Stanford Medicine. “ER+ breast cancer carries a significant, long-term risk of distant relapse, which is further increased in patients with high-risk genomic profiles,” said Dr. Caswell-Jin. “Professor Curtis and her colleagues previously identified eight subtypes of ER+ breast cancer, four of which are at high risk of distant relapse1. Two of these high-risk subtypes present an increase in genes encoding the proteins that zotatifin has been demonstrated to selectively downregulate in preclinical studies. This clinical trial will investigate how zotatifin might affect tumor growth, compared to standard of care, in patients with these specific high-risk genomic profiles, as well as in patients with standard risk. The goal is to develop precision approaches to improve breast cancer outcomes.” “This investigator-led study presents a unique opportunity to complement eFFECTOR’s existing development strategy with cutting-edge expertise in next-generation genomic predictive technologies to continue exploring the clinical potential of zotatifin for treating breast cancer,” said Doug Warner, M.D., chief medical officer of eFFECTOR Therapeutics. “These efforts complement eFFECTOR’s growing body of evidence of zotatifin’s activity in metastatic ER+ breast cancer. Our aim in the Stanford collaboration is to explore the potential to improve early targeted cancer therapy with zotatifin, to potentially delay or prevent future relapse. This approach is in contrast to a single genetic marker to predict an immediate response to therapy. Current targeted therapies fail too many patients, and we hope this collaboration will help identify better treatment regimens with improved clinical benefit for patients.” Dr. Curtis and Dr. Caswell-Jin’s research applies genomic data to define specific subgroups of breast cancer that predict higher risk of relapse after treatment with endocrine therapy, with or without chemotherapy. These subgroups at high risk of relapse are identified through analysis of molecular data from approximately 2,000 breast cancer patients with up to 20 years of clinical follow-up. To identify therapies that might provide clinical benefit to these particularly high-risk patients, Dr. Caswell-Jin will direct an umbrella, randomized pre-operative trial testing integrative subtype-targeted therapeutics in ER+/HER2- breast cancer. Zotatifin will be investigated in a cohort of patients at high risk of relapse, including a group with overexpression of cyclin D1 and fibroblast growth factor 3, proteins that promote cancer growth and survival, and a separate group with overexpression of fibroblast growth factor receptor 1, as well as in a cohort of patients at standard risk for relapse. In both cohorts, patients will be randomized to receive a single dose of zotatifin plus fulvestrant, or fulvestrant alone, 14 days before surgery. The primary objective of the study is to assess change in tumor proliferative status, as measured by Ki67 staining, from baseline to 14 days after preoperative treatment with either regimen. 1https://www.nature.com/articles/s41586-019-1007-8 About Zotatifin Zotatifin is a potent and sequence-selective small molecule inhibitor of eIF4A that is designed to suppress expression of a network of cancer driving proteins, including Cyclins D and E, CDKs 2, 4 and 6 and select RTKs as well as KRAS. We are currently investigating zotatifin in ongoing clinical trials for solid tumors. About eFFECTOR TherapeuticseFFECTOR is a clinical-stage biopharmaceutical company pioneering the development of a new class of oncology drugs referred to as STRIs. eFFECTOR’s STRI product candidates target the eIF4F complex and its activating kinase, mitogen-activated protein kinase interacting kinase (MNK). The eIF4F complex is a central node where two of the most frequently mutated signaling pathways in cancer, the PI3K-AKT and RAS-MEK pathways, converge to activate the translation of select mRNA into proteins that are frequent culprits in key disease-driving processes. Each of eFFECTOR’s product candidates is designed to act on a single protein that drives the expression of a network of functionally related proteins, including oncoproteins and immunosuppressive proteins in T cells, that together control tumor growth, survival and immune evasion. eFFECTOR’s lead product candidate, tomivosertib, is a MNK inhibitor currently being evaluated in KICKSTART, a randomized, double-blind, placebo-controlled Phase 2b trial of tomivosertib in combination with pembrolizumab in patients with metastatic non-small cell lung cancer (NSCLC). Zotatifin, eFFECTOR’s inhibitor of eIF4A, is currently being evaluated in Phase 2a expansion cohorts in certain biomarker-positive solid tumors, including ER+ breast cancer and KRAS-mutant NSCLC. eFFECTOR has a global collaboration with Pfizer to develop inhibitors of a third target, eIF4E. Forward-Looking StatementseFFECTOR cautions you that statements contained in this press release regarding matters that are not historical facts are forward-looking statements. The forward-looking statements are based on our current beliefs and expectations and include, but are not limited to: the clinical development of zotatifin; the potential benefits of the collaboration; and the potential therapeutic benefits of zotatifin. Actual results may differ from those set forth in this press release due to the risks and uncertainties inherent in our business, including, without limitation: we are dependent on Stanford to conduct the investigator-initiated clinical program; potential delays in the commencement, enrollment and completion of clinical trials; the success of our clinical trials and preclinical studies for our product candidates is uncertain; the inability to realize any benefits from the collaboration; regulatory developments in the United States and foreign countries; unexpected adverse side effects or inadequate efficacy of our product candidates that may limit their development, regulatory approval and/or commercialization, or may result in recalls or product liability claims; and other risks described in our prior filings with the Securities and Exchange Commission. You are cautioned not to place undue reliance on these forward-looking statements, which speak only as of the date hereof, and we undertake no obligation to update such statements to reflect events that occur or circumstances that exist after the date hereof. All forward-looking statements are qualified in their entirety by this cautionary statement, which is made under the safe harbor provisions of the Private Securities Litigation Reform Act of 1995. Contacts: Investors: Media:Christopher M. Calabrese Managing Director LifeSci Advisors917-680-5608ccalabrese@lifesciadvisors.comKevin GardnerManaging DirectorLifeSci Advisors617-283-2856kgardner@lifesciadvisors.comMike TattoryAccount SupervisorLifeSci Communications609-802-6265mtattory@lifescicomms.com

Phase 2

05 Jan 2023

Zotatifin continues to show favorable activity profile, including two confirmed partial responses (PR) among seven heavily pretreated subjects who received zotatifin, fulvestrant and abemaciclib (ECBF+A), with good tolerability

eFFECTOR to focus on front-line PD-L1 ≥ 50% cohort of KICKSTART trial with tomivosertib in non-small cell lung cancer

Management to present results and provide full pipeline update in investor call on January 5, 2023 at 4:30 p.m. ET

SOLANA BEACH, Calif. and REDWOOD CITY, Calif., Jan. 05, 2023 (GLOBE NEWSWIRE) -- eFFECTOR Therapeutics, Inc. (NASDAQ: EFTR), a leader in the development of selective translation regulator inhibitors (STRIs) for the treatment of cancer, today provided an update on its ongoing clinical development programs for both zotatifin, in Phase 2 expansion cohorts for the treatment of estrogen receptor positive breast cancer (ER+ BC) and KRAS non-small cell lung cancer (KRAS NSCLC) as well as Phase 1 development for SARS-CoV-2 (COVID-19), and tomivosertib, in a Phase 2b trial for the treatment of non-small cell lung cancer (NSCLC) in combination with pembrolizumab, an established anti-immune checkpoint inhibitor used to treat various types of cancer.

“We are making steady headway across all our clinical programs and look forward to a number of key data milestones in 2023 for both the zotatifin and tomivosertib programs,” remarked Steve Worland, Ph.D., president and chief executive officer of eFFECTOR. “With zotatifin, we continue to see activity across both ER+ BC expansion cohorts, and the drug continues to be generally well-tolerated. The safety results to date have led us to believe that we may be able to increase the dose of zotatifin, which may achieve greater anti-tumor activity. Therefore, we have resumed dose escalation and plan to wait for dose escalation data as well as data from the ongoing ECBF+A cohort before pursuing additional expansion cohorts. We have also completed enrollment in the third and final cohort in our Phase 1b study with zotatifin in COVID-19 and anticipate providing top-line data from this trial in the first half of 2023.”

Zotatifin program update as of December 15, 2022:

In the cohort (n=7) receiving zotatifin, fulvestrant and abemaciclib (ECBF+A), two patients experienced confirmed PRs, and a third patient had stable disease continuing beyond 24 weeks, for an objective response rate (ORR) of 29% (2/7) and a clinical benefit rate (CBR) of 43% (3/7). Zotatifin was generally safe and well-tolerated in this triplet combination. ORR and CBR data for the remaining 11 patients is anticipated to be available in the first half of 2023.In the ECBF cohort (n=18) receiving zotatifin and fulvestrant, one patient experienced a confirmed PR and one patient had stable disease continuing beyond 24 weeks. Zotatifin was generally safe and well-tolerated in this doublet combination.Dose-dependent target engagement was observed by two independent methods, without obvious signs of target saturation. Therefore, the company has resumed dose escalation with topline data anticipated in the second half of 2023.The company is deferring initiation of the Cyclin D1 amplified cohort in ER+ BC and pausing enrollment in the KRAS G12C lung cancer cohort until completion of dose escalation.Enrollment has completed in the third and final cohort in the Phase 1b COVID study.

“With regard to our tomivosertib program, clinical trial enrollment has been challenging across the entire industry and in particular in lung cancer, which impacted our KICKSTART trial,” continued Dr. Worland. “We believe that generating a strong signal indicating tomivosertib is an active agent is of the utmost importance for the program and for eFFECTOR at this juncture, and this could be accomplished through the readout of one randomized, placebo-controlled cohort. Therefore, we are focusing on completing enrollment in the PD-L1 ≥50% front-line cohort and are suspending further enrollment in the PD-L1 ≥1% maintenance cohort. We anticipate top-line results for the PD-L1 ≥50% front-line cohort in the second half of 2023.”

Tomivosertib Program Update:

Enrollment challenges have persisted across both cohorts resulting from staffing issues across clinical sites and competition from other trials, and topline data from the frontline PD-L1>50% cohort is now anticipated to readout in the second half of 2023.The company is discontinuing further enrollment of the PD-L1>1% maintenance cohort.

“Overall, we are pleased with the progress we are making in our clinical programs, and we continue to act thoughtfully and deliberately to direct our attention and resources to where we believe clinical safety and efficacy can most quickly and effectively be demonstrated for both therapeutic candidates,” remarked Michael Byrnes, chief financial officer of eFFECTOR. “Concentrating our efforts selectively also allows us to manage our existing cash resources efficiently, which we believe will now carry us into the first quarter of 2024.”

Conference Call

eFFECTOR management will host a conference call to provide additional details and discuss upcoming milestones. Call details are as follows:

Date: January 5, 2023Time: 4:30 p.m. ET | 3:30 p.m. CT | 1:30 p.m. PTWebcast Registration URL: https://onlinexperiences.com/Launch/QReg/ShowUUID=05FFAFE1-2C84-4055-8AC5-4F793B325365Audio Conference Registration URL: https://register.vevent.com/register/BI6cdb48c163b348bc9876364f6295a6fb

The webcast can be accessed on the “Investors” section of eFFECTOR’s website. The webcast will be archived and available for replay on the company’s website for 30 days following the call. Please log on approximately 5 to 10 minutes prior to scheduled start time to download and install any audio software if needed.

About Zotatifin

Zotatifin is a potent and sequence-selective small molecule inhibitor of eIF4A that is designed to suppress expression of a network of cancer driving proteins, including Cyclins D and E, CDKs 2, 4 and 6 and select RTKs as well as KRAS. We are currently investigating zotatifin in ongoing clinical trials for solid tumors and as a potential host-directed antiviral therapy in patients with mild to moderate COVID-19 in collaboration with UCSF.

About the Zotatifin Phase 1/2 Trial

The open label study had enrolled a total of 37 patients with advanced solid tumors in the Phase 1 dose escalation portion of the trial. In the expansion portion of the trial, a total of 18 patients with breast cancer were enrolled in the ECBF cohort, which evaluates zotatifin in combination with fulvestrant after progression on CDK treatment, and enrollment is ongoing in the ECBF+A cohort, which evaluates zotatifin in combination with fulvestrant and abemaciclib. The primary objectives of part one of the trial are to evaluate the safety and tolerability of zotatifin as a monotherapy in patients with defined, advanced solid tumors, determine the recommended Phase 2 dose for zotatifin as a monotherapy and to evaluate the PK profile. In part two, the primary objective is to evaluate the preliminary antitumor activity of zotatifin as a monotherapy and as combination therapy in patients with defined, advanced solid tumors.

About Tomivosertib

Tomivosertib is eFFECTOR’s wholly-owned, highly selective translation regulation inhibitor that targets mitogen-activated protein kinase interacting kinase (MNK). The oral, small molecule drug candidate has been shown to enhance killing of tumor cells by T cells, delay T-cell exhaustion/dysfunction and enhance the T-cell central memory pool, in part by down-regulating multiple checkpoint proteins including PD-1, PD-L1, TIM-3 and LAG-3. Tomivosertib is being evaluated in KICKSTART, eFFECTOR’s randomized, double-blind, placebo-controlled Phase 2b study in NSCLC in combination with pembrolizumab. The KICKSTART trial builds on results obtained in an earlier study of tomivosertib as an extension of checkpoint inhibitor treatment in patients experiencing insufficient response to a U.S. Food and Drug Administration (FDA)-approved checkpoint inhibitor alone.

About the Tomivosertib Phase 2b KICKSTART trial in NSCLC

KICKSTART is a randomized, double-blind, placebo-controlled clinical trial assessing the efficacy and safety of tomivosertib in combination with pembrolizumab, an FDA-approved PD-1 inhibitor, as frontline combination therapy. Patients enrolled in this trial will have demonstrated biomarker expression of PD-L1 >50% assessed by an FDA-approved diagnostic test. These NSCLC patients are generally the most responsive patient population to immunotherapy and most often receive checkpoint inhibitors as a monotherapy as standard of care.

About eFFECTOR Therapeutics

eFFECTOR is a clinical-stage biopharmaceutical company pioneering the development of a new class of oncology drugs referred to as STRIs. eFFECTOR’s STRI product candidates target the eIF4F complex and its activating kinase, MNK. The eIF4F complex is a central node where two of the most frequently mutated signaling pathways in cancer, the PI3K-AKT and RAS-MEK pathways, converge to activate the translation of select mRNA into proteins that are frequent culprits in key disease-driving processes. Each of eFFECTOR’s product candidates is designed to act on a single protein that drives the expression of a network of functionally related proteins, including oncoproteins and immunosuppressive proteins in T cells, that together control tumor growth, survival and immune evasion. eFFECTOR’s lead product candidate, tomivosertib, is a MNK inhibitor currently being evaluated in KICKSTART, a randomized, double-blind, placebo-controlled Phase 2b trial of tomivosertib in combination with pembrolizumab in patients with metastatic NSCLC. Zotatifin, eFFECTOR’s inhibitor of eIF4A, is currently being evaluated in Phase 2a expansion cohorts in certain biomarker-positive solid tumors, including ER+ breast cancer and KRAS-mutant NSCLC. eFFECTOR has a global collaboration with Pfizer to develop inhibitors of a third target, eIF4E. In addition to the company’s oncology focus, zotatifin is being evaluated as a potential host-directed antiviral therapy in patients with mild to moderate COVID-19 in collaboration with UCSF, which holds a $5 million cooperative agreement sponsored by the Defense Advanced Research Projects Agency.

Forward-Looking Statements

eFFECTOR cautions you that statements contained in this press release regarding matters that are not historical facts are forward-looking statements. The forward-looking statements are based on our current beliefs and expectations and include, but are not limited to: the future clinical development of our product candidates, including expectations on enrollment and the timing of reporting data from ongoing clinical trials; the planned update on expanded development of zotatifin and the timing thereof; the potential therapeutic benefits of our product candidates; the potential market opportunity for our product candidates; and our expected cash runway and the sufficiency of our capital resources to allow clinical trial data readouts and the expansion of our clinical development programs; and the potential to raise any capital under the LPC facility and the use of proceeds from any capital raised. Actual results may differ from those set forth in this press release due to the risks and uncertainties inherent in our business, including, without limitation: the risk that interim results of a clinical trial are not necessarily indicative of final results and one or more of the clinical outcomes may materially change as patient enrollment continues, following more comprehensive reviews of the data and more patient data become available; potential delays in the commencement, enrollment and completion of clinical trials; additional disruptions to our operations from the COVID-19 pandemic, including clinical trial and manufacturing delays; our dependence on third parties in connection with product manufacturing, research and preclinical and clinical testing; the results of preclinical studies and early clinical trials are not necessarily predictive of future results; the success of our clinical trials and preclinical studies for our product candidates is uncertain; we may use our capital resources sooner than expected and they may be insufficient to allow clinical trial readouts; regulatory developments in the United States and foreign countries; unexpected adverse side effects or inadequate efficacy of our product candidates that may limit their development, regulatory approval and/or commercialization, or may result in recalls or product liability claims; our ability to obtain and maintain intellectual property protection for our product candidates; any future impacts to our business resulting from the conflict between Russia and Ukraine and other risks described in our prior filings with the Securities and Exchange Commission. You are cautioned not to place undue reliance on these forward-looking statements, which speak only as of the date hereof, and we undertake no obligation to update such statements to reflect events that occur or circumstances that exist after the date hereof. All forward-looking statements are qualified in their entirety by this cautionary statement, which is made under the safe harbor provisions of the Private Securities Litigation Reform Act of 1995.

Contacts: Investors: Media:Christopher M. Calabrese Managing Director LifeSci Advisors917-680-5608ccalabrese@lifesciadvisors.comKevin GardnerManaging DirectorLifeSci Advisors617-283-2856kgardner@lifesciadvisors.comHeidi Chokeir, Ph.D.Managing DirectorEvoke Canale619-203-5391Heidi.chokeir@evokegroup.com

Phase 2Clinical ResultPhase 1Immunotherapy

07 Nov 2022

- Key executive appointments: Douglas Warner, M.D., as CMO & Mayank Gandhi, M.D., as CBO –

- Cohort treating ER+ breast cancer with combination of zotatifin, fulvestrant and abemaciclib has been expanded from 7 patients to 18 patients -

- Initiated dosing and completed enrollment in second cohort of Phase 1b clinical trial of zotatifin for the treatment of COVID-19 -

SOLANA BEACH, Calif. and REDWOOD CITY, Calif., Nov. 07, 2022 (GLOBE NEWSWIRE) -- eFFECTOR Therapeutics, Inc. (NASDAQ: EFTR), a leader in the development of selective translation regulator inhibitors (STRIs) for the treatment of cancer, today reported financial results for the third quarter ended September 30, 2022 and provided a corporate update.

“We continue to make progress on all fronts, most visibly this quarter with the expansion of a second zotatifin cohort in patients with ER+ breast cancer and completion of the second cohort testing zotatifin in patients with COVID-19,” remarked Steve Worland, Ph.D., president and chief executive officer of eFFECTOR. “We also continue to build out our executive team with key strategic additions including the previously announced appointment of Doug Warner, M.D., as CMO and the recent addition of Mayank Gandhi, M.D., as CBO. With momentum from positive interim data, we are confident we have the operational team necessary to effectively execute on our clinical development and strategic plans.”

Pipeline Highlights

Tomivosertib (eFT508): eFFECTOR’s wholly-owned, highly selective MNK inhibitor designed to enhance anti-tumor immune activity by activating T cells, delaying their exhaustion, and expanding the pool of central memory T cells.

Enrollment continues in Phase 2b KICKSTART trial in NSCLC. KICKSTART trial includes patients in two cohorts: (1) “PD-L1 ≥50% cohort” for patients with PD-L1 expression ≥50% who will receive tomivosertib or placebo in combination with pembrolizumab as their initial therapy; and (2) “PD-L1 ≥1% cohort” for patients with PD-L1 expression ≥1% who will receive tomivosertib or placebo in combination with pembrolizumab as maintenance therapy immediately after completing the platinum-based chemotherapy doublet phase of their frontline treatment without disease progression. The company plans to enroll approximately 60 patients in each cohort. Topline data readouts from both cohorts are anticipated in the first half of 2023.

Zotatifin (eFT226): eFFECTOR’s wholly-owned potent and selective inhibitor of mRNA helicase eIF4A, designed to downregulate expression of key oncoproteins and cell cycle proteins that drive tumor growth and resistance.

Further expansion in Part 2 of ongoing trial in ER+ breast cancer. The cohort evaluating zotatifin in combination with fulvestrant and abemaciclib (ECBF+A) has been expanded from the previously disclosed 7 patients to 18 patients. This builds on the previously announced expansion of the cohort evaluating zotatifin plus fulvestrant (ECBF) from 7 to 18 patients, and the planning for a new cohort evaluating zotatifin in combination with fulvestrant in ER+ breast cancer patients with Cyclin D1 amplification.On track to report topline data by end of 2022. Topline data from the expanded ECBF cohort (n=18) and from the initially planned 7 patients in the ECBF+A cohort are anticipated by the end of 2022. Initial overall response rate data from the Cyclin D1 amplified ER+ breast cancer cohort is expected in the first half of 2023.

COVID-19 program progresses with topline data from Phase 1b clinical trial expected in the first half of 2023. Enrollment completed in the first two cohorts of a three cohort Phase 1b clinical trial of zotatifin in non-hospitalized adults with confirmed COVID-19 infection. The study is a double-blind, randomized, placebo-controlled trial evaluating the safety and antiviral activity of a single dose of zotatifin. The company anticipates opening enrollment in the third cohort by the end of 2022, and expects to report topline data for all three cohorts in the first half of 2023.

Business Highlights:

Appointment of Mayank Gandhi, M.D., as chief business officer: In addition to the previously announced appointment of Doug Warner, M.D., as chief medical officer, in this last fiscal quarter eFFECTOR also welcomed Mayank Gandhi, M.D., as chief business officer. Dr. Gandhi brings over 15 years of experience in biopharmaceutical corporate development, partnering, product development and commercialization. Dr. Gandhi most recently served as vice president of corporate development & strategy of Jiya Acquisition Group, where he helped raise over $100 million towards an IPO, prior to which he held several senior business development, commercial operations and medical affairs roles at Genentech. Earlier in his career, he was an equity research analyst at Citigroup, Cowen and Avet Capital. Dr. Gandhi received his medical degree from the University of Mumbai and an M.B.A., with a concentration in healthcare management and finance, from Case Western Reserve University.

Third Quarter 2022 Financial Results

Cash Position and Guidance: The company had cash and cash equivalents, and short-term investments totaling $33.0 million as of September 30, 2022, compared to $41.0 million in cash and cash equivalents, and short-term investments as of June 30, 2022. Current cash is anticipated to be sufficient to fund readouts of topline data from Phase 2b KICKSTART trial evaluating tomivosertib in combination with pembrolizumab in patients with NSCLC in the first half of 2023, topline data from Phase 2a dose expansion cohorts evaluating zotatifin in patients with certain biomarker-positive solid tumors, including ER+ breast cancer, in the second half of 2022, initial overall response rate data from the Cyclin D1 amplified ER+ cohort in the first half of 2023 and topline data from Phase 1b clinical trial of zotatifin in non-hospitalized adults with confirmed COVID-19 infections in the first half of 2023.

Research and Development (R&D) Expenses: R&D expenses were $6.6 million for the quarter ended September 30, 2022, compared to $5.0 million for the same quarter of 2021. This increase for the quarter was due to higher external development expenses primarily associated with clinical trial costs for both the tomivosertib and zotatifin programs, partially offset by a decrease in license fees due to a one-time license payment made in the third quarter of 2021 as a result of the consummation of the business combination with Locust Walk Acquisition Corporation. R&D expenses included approximately $0.8 million and $0.9 million of non-cash stock compensation expense in the quarters ended September 30, 2022 and 2021, respectively.

General and Administrative (G&A) Expenses: G&A expenses were $3.5 million for the quarter ended September 30, 2022, compared to $4.1 million for the same quarter of 2021. This decrease for the quarter was primarily due to a decrease in non-cash stock compensation expense, partially offset by an increase in amortization related to D&O insurance. G&A expenses included approximately $0.8 million and $1.5 million of non-cash stock compensation expense in the quarters ended September 30, 2022 and 2021, respectively.

Other Income (Expense): Other expense was $0.3 million for the quarter ended September 30, 2022 and other income for the quarter ended September 30, 2021 was $17.6 million. Other expense in the quarter ended September 30, 2022 consisted primarily of interest expense associated with the company’s term loan. Other income for the quarter ended September 30, 2021 primarily consisted of income related to the change in fair value of the company’s earn-out liability for the period. The fair value of the share earn-out liability of $61.0 million at the closing date of the business combination, was remeasured at $43.3 million as of September 30, 2021.

Net Income (Loss): Net loss was $9.6 million, or $0.23 per basic and diluted share, for the quarter ended September 30, 2022, as compared to net income of $8.9 million, or a net income of $0.53 and $0.42 per basic and diluted share, respectively, for the same quarter of 2021.

About eFFECTOR TherapeuticseFFECTOR is a clinical-stage biopharmaceutical company pioneering the development of a new class of oncology drugs referred to as STRIs. eFFECTOR’s STRI product candidates target the eIF4F complex and its activating kinase, mitogen-activated protein kinase interacting kinase (MNK). The eIF4F complex is a central node where two of the most frequently mutated signaling pathways in cancer, the PI3K-AKT and RAS-MEK pathways, converge to activate the translation of select mRNA into proteins that are frequent culprits in key disease-driving processes. Each of eFFECTOR’s product candidates is designed to act on a single protein that drives the expression of a network of functionally related proteins, including oncoproteins and immunosuppressive proteins in T cells, that together control tumor growth, survival and immune evasion. eFFECTOR’s lead product candidate, tomivosertib, is a MNK inhibitor currently being evaluated in KICKSTART, a randomized, double-blind, placebo-controlled Phase 2b trial of tomivosertib in combination with pembrolizumab in patients with metastatic non-small cell lung cancer (NSCLC). Zotatifin, eFFECTOR’s inhibitor of eIF4A, is currently being evaluated in Phase 2a expansion cohorts in certain biomarker-positive solid tumors, including ER+ breast cancer and KRAS-mutant NSCLC. eFFECTOR has a global collaboration with Pfizer to develop inhibitors of a third target, eIF4E. In addition to the company’s oncology focus, zotatifin is being evaluated as a potential host-directed anti-viral therapy in patients with mild to moderate COVID-19 in collaboration with the University of California, San Francisco, which holds a $5 million cooperative agreement sponsored by the Defense Advanced Research Projects Agency.

Forward-Looking StatementseFFECTOR cautions you that statements contained in this press release regarding matters that are not historical facts are forward-looking statements. The forward-looking statements are based on our current beliefs and expectations and include, but are not limited to: the future clinical development of our product candidates, including expectations on enrollment and the timing of reporting data from ongoing clinical trials; the planned expanded development of zotatifin and the timing thereof; the potential therapeutic benefits of our product candidates; and the sufficiency of our capital resources to allow clinical data readouts and the expansion of our clinical development programs. Actual results may differ from those set forth in this press release due to the risks and uncertainties inherent in our business, including, without limitation: interim results of a clinical trial are not necessarily indicative of final results and one or more of the clinical outcomes may materially change as patient enrollment continues, following more comprehensive reviews of the data and more patient data become available; potential delays in the commencement, enrollment and completion of clinical trials; additional disruptions to our operations from the COVID-19 pandemic, including clinical trial and manufacturing delays; our dependence on third parties in connection with product manufacturing, research and preclinical and clinical testing; the results of preclinical studies and early clinical trials are not necessarily predictive of future results; the success of our clinical trials and preclinical studies for our product candidates is uncertain; we may use our capital resources sooner than expected and they may be insufficient to allow clinical trial readouts; regulatory developments in the United States and foreign countries; unexpected adverse side effects or inadequate efficacy of our product candidates that may limit their development, regulatory approval and/or commercialization, or may result in recalls or product liability claims; our ability to obtain and maintain intellectual property protection for our product candidates; any future impacts to our business resulting from inflation or the conflict between Russia and Ukraine or other geopolitical developments outside our control; and other risks described in our prior filings with the Securities and Exchange Commission. You are cautioned not to place undue reliance on these forward-looking statements, which speak only as of the date hereof, and we undertake no obligation to update such statements to reflect events that occur or circumstances that exist after the date hereof. All forward-looking statements are qualified in their entirety by this cautionary statement, which is made under the safe harbor provisions of the Private Securities Litigation Reform Act of 1995.

eFFECTOR Therapeutics, Inc.Condensed Consolidated Balance Sheets(in thousands)

September 30, 2022 December 31, 2021 (Unaudited) Assets Current assets: Cash and cash equivalents$11,903 $49,702 Short-term investments 21,053 — Prepaid expenses and other current assets 2,565 3,194 Total current assets 35,521 52,896 Property and equipment, net 246 91 Operating lease right-of-use assets 125 166 Other assets 759 903 Total assets$36,651 $54,056 Liabilities and stockholders' equity Current liabilities: Accounts payable$1,214 $516 Accrued expenses 3,615 3,418 Current term loans, net 18,985 — Accrued final payment on term loans, current 1,100 — Lease liabilities, current portion 54 44 Total current liabilities 24,968 3,978 Earn-out liability, non-current 6 12,130 Non-current term loans, net — 18,760 Accrued final payment on term loans — 1,100 Non-current warrant liability 40 678 Non-current lease liabilities 77 126 Total liabilities 25,091 36,772 Stockholders' equity: Common stock 4 4 Additional paid-in capital 145,931 138,181 Accumulated other comprehensive loss (69) — Accumulated deficit (134,306) (120,901) Total stockholders' equity 11,560 17,284 Total liabilities and stockholders' equity$36,651 $54,056

eFFECTOR Therapeutics, Inc.Condensed Consolidated Statement of Operations and Comprehensive Income (Loss)(Unaudited)(in thousands, except share and per share data)

Three Months Ended September 30, Nine Months Ended September 30, 2022 2021 2022 2021 Grant revenue$867 $427 $2,878 $1,119 Operating expenses:

Research and development 6,632 5,022 16,663 13,562 General and administrative 3,486 4,119 9,895 7,052 Total operating expenses 10,118 9,141 26,558 20,614 Operating loss (9,251) (8,714) (23,680) (19,495)Other income (expense) (308) 17,593 10,275 16,244 Net income (loss) (9,559) 8,879 (13,405) (3,251)Other comprehensive income (loss) 13 — (69) — Comprehensive income (loss)$(9,546) $8,879 $(13,474) $(3,251)

Net income (loss) per share, basic$(0.23) $0.53 $(0.33) $(0.49)Net income (loss) per share, diluted$(0.23) $0.42 $(0.33) $(0.49)

Weighted-average common shares outstanding, basic 41,171,990 16,701,967 41,047,533 6,588,282 Weighted-average common shares outstanding, diluted 41,171,990 20,067,715 41,047,533 6,588,282

Contacts:

Investors: Media:Christopher M. Calabrese Managing Director LifeSci Advisors917-680-5608ccalabrese@lifesciadvisors.comKevin GardnerManaging DirectorLifeSci Advisors617-283-2856kgardner@lifesciadvisors.comHeidi Chokeir, Ph.D.Managing DirectorEvoke Canale619-203-5391Heidi.chokeir@evokegroup.com

Financial StatementAcquisitionIPOmRNA

Analysis

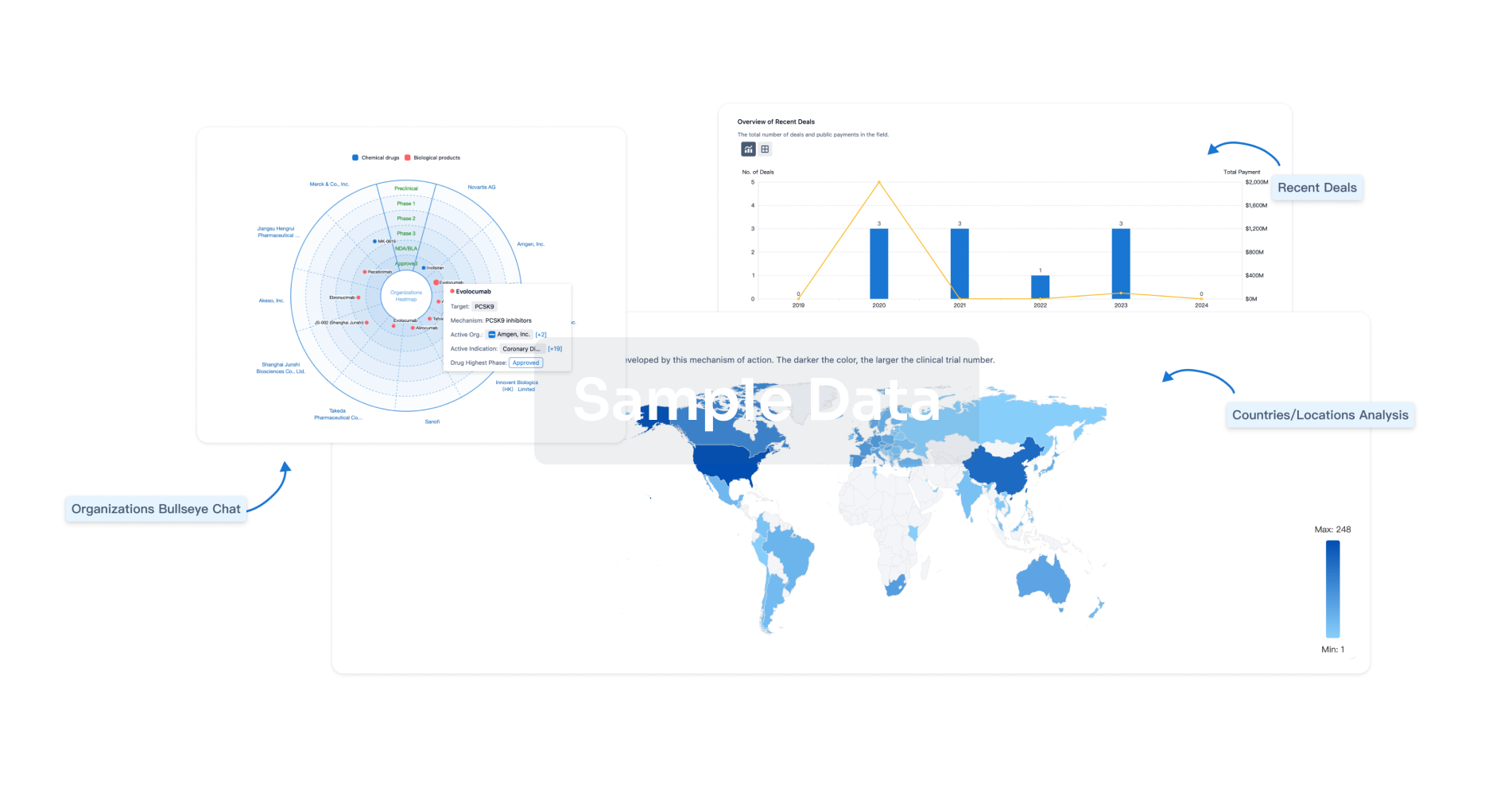

Perform a panoramic analysis of this field.

login

or

AI Agents Built for Biopharma Breakthroughs

Accelerate discovery. Empower decisions. Transform outcomes.

Get started for free today!

Accelerate Strategic R&D decision making with Synapse, PatSnap’s AI-powered Connected Innovation Intelligence Platform Built for Life Sciences Professionals.

Start your data trial now!

Synapse data is also accessible to external entities via APIs or data packages. Empower better decisions with the latest in pharmaceutical intelligence.

Bio

Bio Sequences Search & Analysis

Sign up for free

Chemical

Chemical Structures Search & Analysis

Sign up for free