Request Demo

Last update 08 May 2025

INI1

Last update 08 May 2025

Basic Info

Synonyms BAF47, BRG1-associated factor 47, hSNF5 + [14] |

Introduction Core component of the BAF (hSWI/SNF) complex. This ATP-dependent chromatin-remodeling complex plays important roles in cell proliferation and differentiation, in cellular antiviral activities and inhibition of tumor formation. The BAF complex is able to create a stable, altered form of chromatin that constrains fewer negative supercoils than normal. This change in supercoiling would be due to the conversion of up to one-half of the nucleosomes on polynucleosomal arrays into asymmetric structures, termed altosomes, each composed of 2 histones octamers. Stimulates in vitro the remodeling activity of SMARCA4/BRG1/BAF190A. Involved in activation of CSF1 promoter. Belongs to the neural progenitors-specific chromatin remodeling complex (npBAF complex) and the neuron-specific chromatin remodeling complex (nBAF complex). During neural development a switch from a stem/progenitor to a postmitotic chromatin remodeling mechanism occurs as neurons exit the cell cycle and become committed to their adult state. The transition from proliferating neural stem/progenitor cells to postmitotic neurons requires a switch in subunit composition of the npBAF and nBAF complexes. As neural progenitors exit mitosis and differentiate into neurons, npBAF complexes which contain ACTL6A/BAF53A and PHF10/BAF45A, are exchanged for homologous alternative ACTL6B/BAF53B and DPF1/BAF45B or DPF3/BAF45C subunits in neuron-specific complexes (nBAF). The npBAF complex is essential for the self-renewal/proliferative capacity of the multipotent neural stem cells. The nBAF complex along with CREST plays a role regulating the activity of genes essential for dendrite growth (By similarity). Plays a key role in cell-cycle control and causes cell cycle arrest in G0/G1. |

Related

1

Drugs associated with INI1Target |

Mechanism INI1 inhibitors |

Active Org. |

Originator Org. |

Active Indication |

Inactive Indication- |

Drug Highest PhaseDiscovery |

First Approval Ctry. / Loc.- |

First Approval Date20 Jan 1800 |

100 Clinical Results associated with INI1

Login to view more data

100 Translational Medicine associated with INI1

Login to view more data

0 Patents (Medical) associated with INI1

Login to view more data

6,218

Literatures (Medical) associated with INI101 Jul 2025·Journal of Hazardous Materials

Remediation strategy of biochar with different addition approaches on antibiotic resistance genes in riparian zones under dry wet alternation

Article

Author: Jiang, Runren ; Chen, Xi ; Lu, Guanghua ; Yuan, Saiyu ; Liu, Shiqi ; Su, Pengpeng ; Chen, Yufang ; Yan, Zhenhua

01 May 2025·International Journal of Biological Macromolecules

Fluorescent HIV-1 integrases for a suite of new user-friendly stability, nucleic acid binding and strand transfer activity assays

Article

Author: Sorenson, Alanna E ; Schaeffer, Patrick M ; Bourquin, Rebecca A

01 May 2025·Pathology - Research and Practice

Loss of SWI/SNF complex expression (SMARCA4, SMARCA2, SMARCB1, ARID1A) is associated with dMMR in primary adenocarcinoma of jejunum and ileum: A clinicopathological and molecular analysis based on the Chinese population

Article

Author: Jiang, Dongxian ; Deng, Minying ; Hou, Yingyong ; Niu, Zhiping ; Abuduwaili, Ayizimugu ; Xu, Chen ; Zhang, Xiaolei ; Zhang, Xinyi ; Su, Jieakesu ; Luo, Rongkui ; Wang, Huimei ; Xu, Lei

22

News (Medical) associated with INI112 Mar 2025

ViiV Healthcare, GSK's HIV-focused subsidiary, is pushing forward with a new long-acting treatment for patients with HIV. After positive results from a mid-stage study, the company says it will advance development of a six-month intravenous (IV) version of its experimental antibody-based therapy, N6LS (VH109), in combination with its long-acting HIV drug cabotegravir.The Phase IIb EMBRACE trial, presented Wednesday at the Conference on Retroviruses and Opportunistic Infections (CROI), showed that N6LS, given every four months along with monthly cabotegravir injections, successfully kept the virus under control in adults already stable on treatment.Primary endpoint data showed that after six months of treatment, 96% of patients given the IV formulation of N6LS maintained HIV-1 RNA levels below 50 copies/mL — exactly matching the success rate of current standard treatments. When given as a subcutaneous (SC) injection, 88% of patients maintained HIV-1 RNA levels below 50 copies/mL. Confirmed virologic failure was observed in two participants from each N6LS group.Meanwhile, the IV option stood out as better tolerated, with no infusion site reactions — unlike the SC group, where 14% of participants reported issues."We are building on the positive patient and physician experience we have with Cabenuva (cabotegravir/rilpivirine) and pioneering the next generation of long-acting treatment options," said Kimberly Smith, head of R&D at ViiV. Cabenuva was first approved by the FDA in 2021, with the product’s label updated the following year to include dosing every two months in virologically suppressed adults."We're looking forward to continuing the development of VH109 as a component of our future ultra long-acting regimens," Smith added.The N6LS presentation was part of a broader showcase of ViiV's long-acting portfolio at CROI, where the company also presented positive findings from two Phase IIa proof-of-concept trials. These additional studies evaluated VH184, a third-generation integrase inhibitor, and VH499, a capsid inhibitor.Specifically, ViiV said VH184 led to a "marked drop" in HIV-1 viral load across all tested doses — 10 mg, 50 mg, and 300 mg taken once every three days — during a 10-day monotherapy period, with the highest average viral load decline being -2.31 log10 copies/mL in the highest dose group. Similarly, VH499 showed decreases in HIV-1 viral load ranging from -1.8 to -2.2 log10 copies/mL across its dosing arms — 25 mg, 100 mg, and 250 mg — with the highest dose producing the greatest reduction.

Clinical ResultPhase 2Drug ApprovalPhase 3

12 Mar 2025

Merck & Co. is pushing forward with a simplified oral HIV treatment – a once-daily, two drug regimen that combines Pifeltro (doravirine) with its experimental nucleoside reverse transcriptase translocation inhibitor islatravir – aiming to file for regulatory approval by mid-2025.The announcement Wednesday follows positive data from two Phase III trials demonstrating that the regimen is just as effective as standard HIV therapies in maintaining viral suppression in adults with HIV-1. Merck first shared topline results in December and unveiled more detail at the Conference on Retroviruses and Opportunistic Infections (CROI) on Wednesday.In one of studies, called MK-8591A-052, the Pifeltro/islatravir combo was tested against Gilead Sciences' HIV treatment Biktarvy (bictegravir/emtricitabine/tenofovir alafenamide) in 513 HIV patients who had virologic suppression for at least three months while on Biktarvy. At 48 weeks, 91.5% of patients who switched to Merck's regimen kept their viral load under control, compared to 94.2% of those on Biktarvy, meeting the bar for non-inferiority. Although the regimen did not achieve superiority over the Gilead's drug.The second trial, dubbed MK-8591A-051, compared Pifeltro/islatravir to patients' existing antiretroviral therapy (bART). Here, 95.6% of patients on Pifeltro/islatravir maintained viral suppression at 48 weeks, versus 91.9% seen in the bART group.If approved, Merck's treatment would be the first two-drug HIV regimen that doesn't include an integrase inhibitor to demonstrate comparable efficacy and safety to the three-drug InSTI-based Biktarvy regimen in a Phase III trial, according to Eliav Barr, chief medical officer at Merck Research Laboratories."These data and our work on the longer-acting islatravir-based therapies in our pipeline show our continued commitment to help find new options that address the evolving needs of people living with HIV," Barr added.The regimen's safety profile was generally comparable to the comparator antiretroviral regimens across both trials. At week 48, the mean percent change in total lymphocyte and CD4 counts were similar between Pifeltro/islatravir and comparator treatments, an issue that had stalled the programme a few years ago. There was also no treatment-emergent resistance to Pifeltro or islatravir in either trial.Beyond this daily oral combination, Merck is also advancing a once-weekly combination of islatravir with Gilead's capsid inhibitor lenacapavir, which showed positive Phase II results in October.

Clinical ResultPhase 3Phase 2

27 Mar 2024

Scientists reversed an aggressive cancer, reverting malignant cells towards a more normal state. Rhabdoid tumors are an aggressive cancer which is missing a key tumor suppressor protein. Scientists discovered that removing a second protein from cancer cells already experiencing tumor suppressor loss can reverse cancer cell identity.

St. Jude Children's Research Hospital scientists reversed an aggressive cancer, reverting malignant cells towards a more normal state. Rhabdoid tumors are an aggressive cancer which is missing a key tumor suppressor protein. Findings showed that with the missing tumor suppressor, deleting or degrading the quality control protein DCAF5 reversed the cancer cell state. These results suggest a new approach to curing cancer -- returning cancerous cells to an earlier, more normal state rather than killing cancer cells with toxic therapies -- may be possible. The results were published today in Nature.

"Rather than making a toxic event that kills rhabdoid cancer, we were able to reverse the cancer state by returning the cells toward normal," said senior author Charles W.M. Roberts, MD, PhD, Executive Vice President and St. Jude Comprehensive Cancer Center director. "This approach would be ideal, especially if this paradigm could also be applied to other cancers."

"We found a dependency which actually reverses the cancer state," said first author Sandi Radko-Juettner, PhD, a former St. Jude Graduate School of Biomedical Sciences student, now a Research Program Manager for the Hematological Malignancies Program at St. Jude. "Standard cancer therapies work by causing toxicities that also damage healthy cells in the body. Here, it appears that we're instead fixing the problem caused by the loss of a tumor suppressor in this rhabdoid cancer."

Drugging the un-targetable

In many cancers, there is no easily druggable target. Often, these cancers are caused by a missing tumor suppressor protein, so there is nothing to target directly as the protein is missing. Loss of tumor suppressors is much more common than a protein gaining the ability to drive cancer. Consequently, finding a way to intervene therapeutically in these tumors is a high priority. The researchers were looking for a way to treat an aggressive set of cancers caused by the loss of the tumor suppressor protein SMARCB1 when they found a new approach to treatment.

The St. Jude group found a little-studied protein, DCAF5, was essential to rhabdoid tumors missing SMARCB1. Initially, they identified DCAF5 as a target, using the Dependency Map (DepMap) portal, a database of cancer cell lines and the genes critical for their growth. DCAF5 was a top dependency in rhabdoid tumors. After the initial finding, the scientists genetically deleted or chemically degraded DCAF5. The cancer cells reverted to a non-cancerous state, persisting even in a long-term mouse model.

"We saw a spectacular response," Roberts said. "The tumors melted away."

Removing quality control to reverse cancer

Normally, SMARCB1 is an essential component of a larger chromatin-regulating complex of proteins called the SWI/SNF complex. Unexpectedly, the study found that in the absence of SMARCB1, DCAF5 recognizes SWI/SNF as abnormal and destroys the complex. When DCAF5 degrades them, the researchers showed that SWI/SNF re-forms and maintains its ability to open chromatin and regulate gene expression. While the SWI/SNF activity level in the absence of SMARCB1 was to a lesser extent than usual, it was nonetheless sufficient to reverse the cancer state fully.

"DCAF5 is doing a quality control check to ensure that these chromatin machines are built well," Roberts said. "Think of a factory assembling a machine. You need quality checks to examine and find faults and to pull it off the line if it doesn't meet standards. DCAF5 is doing such quality assessments for the assembly of SWI/SNF complexes, telling the cell to get rid of complexes if SMARCB1 is absent."

"The mutation of SMARCB1 shuts off gene programs that prevent cancer. By targeting DCAF5, we're turning those gene programs back on," Radko-Juettner said. "We're reversing the cancer state because the cell is becoming more 'normal' when these complexes aren't targeted for destruction by DCAF5."

Future therapeutic opportunities to reverse cancer

"From a therapeutic perspective, our results are fascinating," Radko-Juettner said. "DCAF5 is part of a larger family of DCAF proteins that have been shown to be drug targetable. We showed that when DCAF5 is absent, mice had no discernable health effects, so we could potentially target DCAF5. This can kill the cancer cells but shouldn't affect healthy cells. Targeting DCAF5 thus has the potential to avoid the off-target toxicity of radiation or chemotherapy, making it a promising therapeutic avenue to pursue."

Beyond DCAF5, the findings could have implications for other cancers driven by the loss of a tumor suppressor.

"We have demonstrated a beautiful proof of principle," Roberts said. "Myriad types of cancers are caused by tumor suppressor loss. We hope we may have opened the door to thinking about new ways to approach targeting at least some of these by reversing, instead of killing, cancer."

Analysis

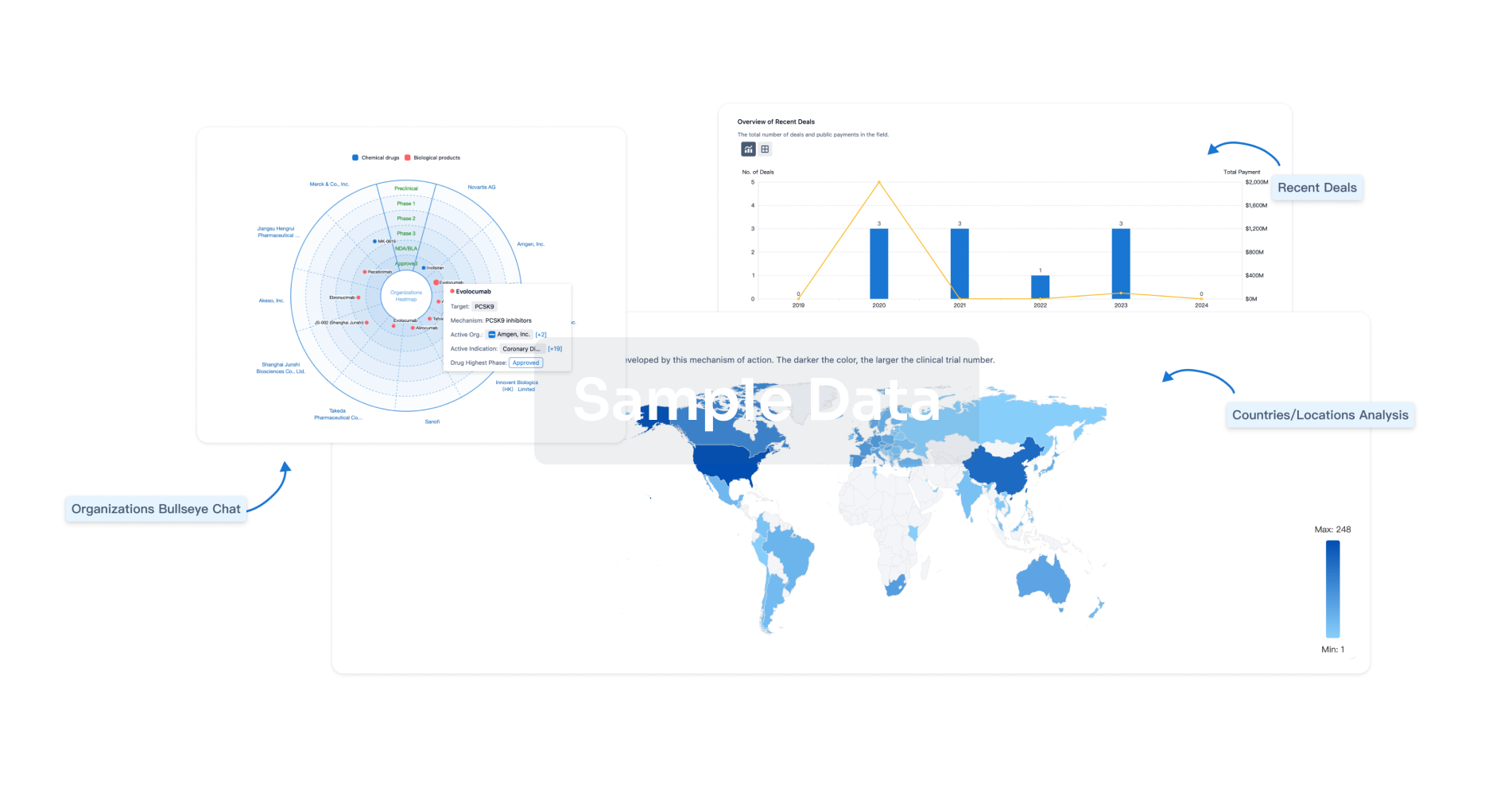

Perform a panoramic analysis of this field.

login

or

AI Agents Built for Biopharma Breakthroughs

Accelerate discovery. Empower decisions. Transform outcomes.

Get started for free today!

Accelerate Strategic R&D decision making with Synapse, PatSnap’s AI-powered Connected Innovation Intelligence Platform Built for Life Sciences Professionals.

Start your data trial now!

Synapse data is also accessible to external entities via APIs or data packages. Empower better decisions with the latest in pharmaceutical intelligence.

Bio

Bio Sequences Search & Analysis

Sign up for free

Chemical

Chemical Structures Search & Analysis

Sign up for free