Request Demo

What are Richter Gedeon's recent drug deals?

20 March 2025

Overview of Richter Gedeon

Company Background

Richter Gedeon is a well‐established pharmaceutical company originating from Central Eastern Europe with a strong research, development, and commercialization track record. The company is headquartered in Budapest, Hungary, and has cultivated a reputation for its robust portfolio in women’s healthcare, biosimilars, and other therapeutic areas. Over the years, Richter Gedeon has progressively expanded its direct presence into Western Europe, China, Latin America, and beyond, growing to a market capitalization in the multi–billion USD range and generating consolidated sales that underscore its significance in the region. This geographic and product portfolio expansion reflects Richter’s commitment to innovation, and its ability to navigate diverse regulatory landscapes while preserving a focus on delivering high‐quality treatments to patients worldwide.

Business Strategy

Richter Gedeon’s business strategy is built on a multifaceted approach that includes active research and development, strategic licensing, and collaboration with global industry partners. The company leverages its expertise in steroid chemistry, biosimilar product development, and a wide range of therapeutic segments—including women’s healthcare, central nervous system disorders, and cardiovascular diseases—to create a strong competitive advantage. By engaging in selective licensing agreements and co-development partnerships, Richter Gedeon is able to share both risks and rewards with its collaborators while expanding its global reach. This strategic approach enables the company to maintain a healthy pipeline of innovative products and to respond proactively to shifting market demands in an increasingly competitive industry.

Recent Drug Deals

Recent Partnerships and Collaborations

Richter Gedeon has recently entered into a number of strategic collaborations that underscore its commitment to expanding its product portfolio and market reach.

- Myovant Sciences Collaboration for Relugolix Combination Tablet:

One of the most notable recent deals is the exclusive licensing agreement with Myovant Sciences regarding a relugolix combination tablet. This therapy, which combines relugolix with estradiol and norethindrone acetate, is aimed at treating uterine fibroids and endometriosis. Under the agreement, Richter Gedeon has secured the commercialization rights for this combination therapy in Europe, as well as in the Commonwealth of Independent States (CIS) including Russia, Latin America, Australia, and New Zealand.

The financial metrics of the deal are significant, with Myovant receiving an upfront payment of $40 million, along with additional potential milestone payments—up to $40 million in regulatory milestones and $107.5 million in sales-related milestones. This structured payment plan, which further includes tiered royalties on net sales post-regulatory approval, demonstrates the mutual commitment to success between the two companies.

From a strategic perspective, this collaboration allows Richter Gedeon to leverage its established networks in various international markets, particularly in regions where it traditionally holds a strong presence. For Myovant, the global reach and commercialization expertise of Richter Gedeon provide an accelerated path to market outside the U.S., complementing Myovant’s retention of rights within North America. This deal not only boosts Richter’s product portfolio in specialized women’s healthcare but also strengthens its role as a trusted partner for global commercialization across multiple geographies.

- Hikma Pharmaceuticals Collaboration for Denosumab Biosimilars:

Another critical recent deal involves Richter Gedeon’s exclusive license agreement with Hikma Pharmaceuticals aimed at the development and commercialization of denosumab biosimilars in the United States. Denosumab, referenced against established products such as Prolia® and Xgeva®, is used for the treatment of osteoporosis and for managing bone metastases-associated fractures.

Under this agreement, Richter Gedeon is in charge of developing the biosimilar products—conducting both Phase 1 and Phase 3 clinical studies—while Hikma manages the registration process with the U.S. Food and Drug Administration (FDA) and holds the exclusive rights to commercialize the products in the U.S. The financial framework of this deal includes an upfront payment for Richter Gedeon, supplemented by milestone payments that are triggered as the products reach defined clinical development and commercialization stages. Although the exact figures are not exhaustively disclosed, it is highlighted that the milestone payments are forecast to reach a double-digit million USD threshold.

This collaboration is strategically important because it positions Richter Gedeon in the competitive U.S. biosimilars market—a market that is viewed as an emergent area of interest both for its growth potential and for the advantages biosimilars provide in terms of cost competitiveness and broader patient access. The partnership with Hikma, a company with a solid footprint in the U.S. specialty therapeutics arena, reinforces Richter’s capacity to translate its extensive R&D capabilities into commercial successes in one of the world’s most challenging regulatory environments.

Recent Acquisitions

While recent announcements predominantly highlight licensing agreements and partnerships rather than outright acquisitions, Richter Gedeon has effectively utilized these collaborative models as a strategic substitute for traditional acquisitions.

- Strategic Inclusivity Without Direct Acquisitions:

Richter Gedeon has not recently reported major acquisition activities in the traditional sense based on the provided reference material. Instead, the company’s strategic focus appears to be on forming exclusive licensing partnerships that allow it to maintain its agile business model and focus on specific therapeutic areas without the complexities of full-scale mergers or acquisitions. These deals effectively function as quasi–acquisitions by providing Richter Gedeon with access to novel drug candidates and new markets, thereby achieving similar benefits to those realized through conventional M&A while mitigating associated risks.

Licensing Agreements

The backbone of Richter Gedeon’s recent drug deals is its robust pattern of licensing agreements, which serve as a conduit for expanding its portfolio and market footprint.

- Myovant and Relugolix Licensing Agreement:

In the deal with Myovant Sciences, the licensing agreement underlines a clear delineation of responsibilities where Myovant retains rights in the United States and in other therapeutic areas, while Richter Gedeon is entrusted with commercialization responsibilities in selected international territories. The upfront payment of $40 million, coupled with significant milestone and royalty arrangements, underscores a long-term revenue stream that is contingent upon the commercial success of the relugolix combination tablet. This arrangement reflects a modern and dynamic approach to licensing where the risk is shared and rewards are performance-based.

- Hikma and Denosumab Licensing Arrangement:

Similarly, the licensing agreement with Hikma Pharmaceuticals for the denosumab biosimilar is emblematic of Richter Gedeon’s strategy to harness collaborative innovation. Richter Gedeon provides its robust R&D and development capabilities, while Hikma navigates the intricate regulatory landscape and spearheads commercialization efforts in the U.S. This partnership not only diversifies Richter’s revenue streams but also exemplifies the shift toward a collaborative ecosystem in drug development where specialized roles are clearly allocated, thus optimizing efficiency and reducing time to market.

Impact of Recent Deals

Strategic Importance

The strategic importance of the recent drug deals for Richter Gedeon cannot be understated.

- Expansion of Therapeutic Portfolio:

The Myovant deal significantly leverages Richter Gedeon’s existing strengths in women’s healthcare. With uterine fibroids and endometriosis representing large, underserved markets in many regions, especially in Europe and emerging markets, the relugolix combination tablet positions Richter Gedeon to capture a sizeable share of a previously underexploited market segment. This not only expands their therapeutic portfolio but also enhances their competitive differentiation in terms of offering innovative combination treatments.

- Enhancement of Global Reach:

The collaboration with Hikma Pharmaceuticals is particularly strategic for penetrating the U.S. biosimilars market, which is among the most competitive yet lucrative sectors in the global pharmaceutical arena. Biosimilars represent a critical component of healthcare cost reduction strategies, and successful entry into this market can yield substantial long-term returns. Richter Gedeon’s expertise in biosimilar development, combined with Hikma’s established regulatory and sales infrastructure in the U.S., creates a synergistic relationship that is strategically aligned with global trends towards cost-effective medicines.

- Risk Mitigation Through Shared Responsibilities:

Both licensing agreements distribute the operational, regulatory, and financial risks between the collaborating parties. Such risk-sharing arrangements are vital in today’s complex pharmaceutical market where regulatory pathways can be unpredictable. By aligning with partners that have localized expertise and robust commercialization strategies, Richter Gedeon is effectively positioned to mitigate potential setbacks that could arise from individual market dynamics. This approach not only stabilizes their revenue projections but also offers a platform for sustained long-term growth.

Market Positioning

The recent deals have considerable implications for Richter Gedeon’s market positioning across various geographic and therapeutic landscapes.

- Strengthened Position in Women’s Health:

The licensing agreement with Myovant reinforces Richter Gedeon’s position as a leader in women’s healthcare. By commercializing a therapy specifically aimed at conditions such as uterine fibroids and endometriosis, the company can cater to a large and rapidly growing patient segment in international markets. Such positioning is likely to attract further partnerships and investments in the women’s health space, thereby enhancing their brand recognition and market influence in this domain.

- Entry into the U.S. Biosimilars Arena:

The deal with Hikma is instrumental in establishing Richter Gedeon as a key player in the U.S. biosimilar market—a market that is both high in volume and critical for addressing healthcare cost challenges. The U.S. market is known for stringent regulatory requirements and intense competition; however, partnering with an established entity like Hikma reduces market entry barriers and significantly increases the likelihood of success. This move is expected to position Richter not only as a regional leader but also as a global competitor capable of addressing the needs of developed markets.

- Diversification and Revenue Stability:

By securing multiple licensing deals, Richter Gedeon diversifies its revenue streams and reduces reliance on the outcomes of independent product launches. The structured payment models—comprising upfront payments, regulatory and sales milestones, and tiered royalties—create a stable and predictable financial environment that is less susceptible to the inherent volatility of drug development pipelines. Consequently, these deals serve as a financial buffer, enabling the company to invest in further R&D and strategic market expansions with greater confidence.

Challenges and Future Outlook

Challenges in the Pharmaceutical Industry

While the recent deals are a clear sign of Richter Gedeon’s innovative approach and strategic ambition, the broader pharmaceutical industry presents a range of challenges that must be navigated carefully.

- Regulatory Hurdles:

The complex regulatory frameworks governing drug approvals across different jurisdictions can pose significant challenges. Both the Myovant and Hikma deals are contingent upon successful regulatory filings and approvals, which could be impacted by shifting regulatory policies, unforeseen clinical data variations, or delays in clinical trial outcomes.

- Competitive Pressures:

The global pharmaceutical market is exceedingly competitive, with large multinational companies and agile biotech startups continually vying for market share. In particular, the biosimilars market in the United States is characterized by rapid innovation, pricing pressures, and high barriers to entry due to intellectual property and regulatory issues. Richter Gedeon must therefore not only maintain high levels of research and development efficiency but also strategically manage its collaborations to stay ahead of competitors.

- Integration of Cross-border Operations:

Operating across multiple markets—Europe, CIS, Latin America, Australia, New Zealand, and the U.S.—requires effective coordination and integration of localized commercial strategies. Differing market dynamics, cultural nuances, and regulatory requirements may create operational challenges that could impact the timely commercialization of products. Richter Gedeon will need to invest in robust management systems and cross-functional teams to mitigate these challenges effectively.

Future Prospects for Richter Gedeon

Despite these challenges, the future prospects for Richter Gedeon appear promising given its strategic initiatives and recent successful deals.

- Growth in Women’s Healthcare:

The global focus on women’s health is intensifying, especially as awareness grows around conditions like uterine fibroids and endometriosis. As healthcare systems worldwide strive to provide better, safer, and more effective treatments for women’s health issues, Richter Gedeon’s partnership with Myovant positions it well to capture a larger market share in this segment. Future prospects include potential expansion into additional women’s health therapies that could be integrated into their existing portfolio, further consolidating their leadership position in this field.

- Expansion of Biosimilar Portfolios:

The collaboration with Hikma serves as an important stepping stone into the biosimilars market, particularly in the U.S., where cost-containment pressures and the demand for affordable treatment alternatives continue to rise. Success in this market could lead to additional biosimilar partnerships or even the development of a broader biosimilar portfolio, positioning Richter Gedeon as a premier biosimilar provider on the global stage.

- Opportunities for Further Collaborations and Licensing:

Richter Gedeon’s agile business model and its track record of successful licensing deals make it an attractive partner for other global pharmaceutical companies. The company’s ability to structure financially attractive and risk–mitigated deals could pave the way for further collaborations in a variety of therapeutic areas. Such partnerships will likely boost its growth, not only through increased sales revenue and market penetration, but also by strengthening its reputation as a reliable and innovative player in the pharmaceutical industry.

- Innovation and Digital Transformation:

Looking ahead, Richter Gedeon is poised to capitalize on advancements in digital technologies and data analytics to enhance its R&D processes and streamline regulatory submissions. Investment in digital transformation can lead to more efficient clinical trial management, faster time-to-market, and more accurate forecasting of clinical outcomes, all of which are crucial for sustaining long-term growth in an increasingly competitive industry.

Conclusion

In summary, Richter Gedeon’s recent drug deals—most notably the exclusive licensing agreements with Myovant Sciences and Hikma Pharmaceuticals—are pivotal to the company’s strategic expansion and market diversification. The Myovant deal for the relugolix combination tablet provides Richter Gedeon with a significant opportunity to expand its presence in women’s healthcare across Europe, the CIS, Latin America, Australia, and New Zealand, underpinned by a robust financial structure that includes upfront payments, regulatory, and sales milestones. Meanwhile, the collaboration with Hikma Pharmaceuticals for the commercialization of denosumab biosimilars in the United States is a strategic move that leverages Richter’s R&D strengths while capitalizing on Hikma’s local regulatory and market expertise.

These deals not only enhance Richter Gedeon’s therapeutic portfolio and revenue stability but also bolster its market positioning by enabling entry into high-potential markets and diversifying income sources. While challenges related to regulatory complexities, competitive pressures, and the integration of cross-border operations persist, Richter Gedeon’s proactive approach to risk-sharing and innovation positions the company strongly for future growth. With a clear focus on both women’s healthcare and biosimilar development, alongside an overarching commitment to strategic alliances, the company is well-equipped to navigate the evolving landscape of the pharmaceutical industry.

Ultimately, Richter Gedeon’s recent drug deals exemplify a general-specific-general success model. They begin with broad strategic aims of global expansion and diversification, move through detailed, targeted initiatives in specific therapeutic areas via well-structured partnerships, and culminate in an overall strengthened market position and enhanced prospects for sustainable innovation and growth in the pharmaceutical industry. This holistic approach is likely to yield significant benefits in the long term, positioning Richter Gedeon as a key global player in both established and emerging market segments.

Company Background

Richter Gedeon is a well‐established pharmaceutical company originating from Central Eastern Europe with a strong research, development, and commercialization track record. The company is headquartered in Budapest, Hungary, and has cultivated a reputation for its robust portfolio in women’s healthcare, biosimilars, and other therapeutic areas. Over the years, Richter Gedeon has progressively expanded its direct presence into Western Europe, China, Latin America, and beyond, growing to a market capitalization in the multi–billion USD range and generating consolidated sales that underscore its significance in the region. This geographic and product portfolio expansion reflects Richter’s commitment to innovation, and its ability to navigate diverse regulatory landscapes while preserving a focus on delivering high‐quality treatments to patients worldwide.

Business Strategy

Richter Gedeon’s business strategy is built on a multifaceted approach that includes active research and development, strategic licensing, and collaboration with global industry partners. The company leverages its expertise in steroid chemistry, biosimilar product development, and a wide range of therapeutic segments—including women’s healthcare, central nervous system disorders, and cardiovascular diseases—to create a strong competitive advantage. By engaging in selective licensing agreements and co-development partnerships, Richter Gedeon is able to share both risks and rewards with its collaborators while expanding its global reach. This strategic approach enables the company to maintain a healthy pipeline of innovative products and to respond proactively to shifting market demands in an increasingly competitive industry.

Recent Drug Deals

Recent Partnerships and Collaborations

Richter Gedeon has recently entered into a number of strategic collaborations that underscore its commitment to expanding its product portfolio and market reach.

- Myovant Sciences Collaboration for Relugolix Combination Tablet:

One of the most notable recent deals is the exclusive licensing agreement with Myovant Sciences regarding a relugolix combination tablet. This therapy, which combines relugolix with estradiol and norethindrone acetate, is aimed at treating uterine fibroids and endometriosis. Under the agreement, Richter Gedeon has secured the commercialization rights for this combination therapy in Europe, as well as in the Commonwealth of Independent States (CIS) including Russia, Latin America, Australia, and New Zealand.

The financial metrics of the deal are significant, with Myovant receiving an upfront payment of $40 million, along with additional potential milestone payments—up to $40 million in regulatory milestones and $107.5 million in sales-related milestones. This structured payment plan, which further includes tiered royalties on net sales post-regulatory approval, demonstrates the mutual commitment to success between the two companies.

From a strategic perspective, this collaboration allows Richter Gedeon to leverage its established networks in various international markets, particularly in regions where it traditionally holds a strong presence. For Myovant, the global reach and commercialization expertise of Richter Gedeon provide an accelerated path to market outside the U.S., complementing Myovant’s retention of rights within North America. This deal not only boosts Richter’s product portfolio in specialized women’s healthcare but also strengthens its role as a trusted partner for global commercialization across multiple geographies.

- Hikma Pharmaceuticals Collaboration for Denosumab Biosimilars:

Another critical recent deal involves Richter Gedeon’s exclusive license agreement with Hikma Pharmaceuticals aimed at the development and commercialization of denosumab biosimilars in the United States. Denosumab, referenced against established products such as Prolia® and Xgeva®, is used for the treatment of osteoporosis and for managing bone metastases-associated fractures.

Under this agreement, Richter Gedeon is in charge of developing the biosimilar products—conducting both Phase 1 and Phase 3 clinical studies—while Hikma manages the registration process with the U.S. Food and Drug Administration (FDA) and holds the exclusive rights to commercialize the products in the U.S. The financial framework of this deal includes an upfront payment for Richter Gedeon, supplemented by milestone payments that are triggered as the products reach defined clinical development and commercialization stages. Although the exact figures are not exhaustively disclosed, it is highlighted that the milestone payments are forecast to reach a double-digit million USD threshold.

This collaboration is strategically important because it positions Richter Gedeon in the competitive U.S. biosimilars market—a market that is viewed as an emergent area of interest both for its growth potential and for the advantages biosimilars provide in terms of cost competitiveness and broader patient access. The partnership with Hikma, a company with a solid footprint in the U.S. specialty therapeutics arena, reinforces Richter’s capacity to translate its extensive R&D capabilities into commercial successes in one of the world’s most challenging regulatory environments.

Recent Acquisitions

While recent announcements predominantly highlight licensing agreements and partnerships rather than outright acquisitions, Richter Gedeon has effectively utilized these collaborative models as a strategic substitute for traditional acquisitions.

- Strategic Inclusivity Without Direct Acquisitions:

Richter Gedeon has not recently reported major acquisition activities in the traditional sense based on the provided reference material. Instead, the company’s strategic focus appears to be on forming exclusive licensing partnerships that allow it to maintain its agile business model and focus on specific therapeutic areas without the complexities of full-scale mergers or acquisitions. These deals effectively function as quasi–acquisitions by providing Richter Gedeon with access to novel drug candidates and new markets, thereby achieving similar benefits to those realized through conventional M&A while mitigating associated risks.

Licensing Agreements

The backbone of Richter Gedeon’s recent drug deals is its robust pattern of licensing agreements, which serve as a conduit for expanding its portfolio and market footprint.

- Myovant and Relugolix Licensing Agreement:

In the deal with Myovant Sciences, the licensing agreement underlines a clear delineation of responsibilities where Myovant retains rights in the United States and in other therapeutic areas, while Richter Gedeon is entrusted with commercialization responsibilities in selected international territories. The upfront payment of $40 million, coupled with significant milestone and royalty arrangements, underscores a long-term revenue stream that is contingent upon the commercial success of the relugolix combination tablet. This arrangement reflects a modern and dynamic approach to licensing where the risk is shared and rewards are performance-based.

- Hikma and Denosumab Licensing Arrangement:

Similarly, the licensing agreement with Hikma Pharmaceuticals for the denosumab biosimilar is emblematic of Richter Gedeon’s strategy to harness collaborative innovation. Richter Gedeon provides its robust R&D and development capabilities, while Hikma navigates the intricate regulatory landscape and spearheads commercialization efforts in the U.S. This partnership not only diversifies Richter’s revenue streams but also exemplifies the shift toward a collaborative ecosystem in drug development where specialized roles are clearly allocated, thus optimizing efficiency and reducing time to market.

Impact of Recent Deals

Strategic Importance

The strategic importance of the recent drug deals for Richter Gedeon cannot be understated.

- Expansion of Therapeutic Portfolio:

The Myovant deal significantly leverages Richter Gedeon’s existing strengths in women’s healthcare. With uterine fibroids and endometriosis representing large, underserved markets in many regions, especially in Europe and emerging markets, the relugolix combination tablet positions Richter Gedeon to capture a sizeable share of a previously underexploited market segment. This not only expands their therapeutic portfolio but also enhances their competitive differentiation in terms of offering innovative combination treatments.

- Enhancement of Global Reach:

The collaboration with Hikma Pharmaceuticals is particularly strategic for penetrating the U.S. biosimilars market, which is among the most competitive yet lucrative sectors in the global pharmaceutical arena. Biosimilars represent a critical component of healthcare cost reduction strategies, and successful entry into this market can yield substantial long-term returns. Richter Gedeon’s expertise in biosimilar development, combined with Hikma’s established regulatory and sales infrastructure in the U.S., creates a synergistic relationship that is strategically aligned with global trends towards cost-effective medicines.

- Risk Mitigation Through Shared Responsibilities:

Both licensing agreements distribute the operational, regulatory, and financial risks between the collaborating parties. Such risk-sharing arrangements are vital in today’s complex pharmaceutical market where regulatory pathways can be unpredictable. By aligning with partners that have localized expertise and robust commercialization strategies, Richter Gedeon is effectively positioned to mitigate potential setbacks that could arise from individual market dynamics. This approach not only stabilizes their revenue projections but also offers a platform for sustained long-term growth.

Market Positioning

The recent deals have considerable implications for Richter Gedeon’s market positioning across various geographic and therapeutic landscapes.

- Strengthened Position in Women’s Health:

The licensing agreement with Myovant reinforces Richter Gedeon’s position as a leader in women’s healthcare. By commercializing a therapy specifically aimed at conditions such as uterine fibroids and endometriosis, the company can cater to a large and rapidly growing patient segment in international markets. Such positioning is likely to attract further partnerships and investments in the women’s health space, thereby enhancing their brand recognition and market influence in this domain.

- Entry into the U.S. Biosimilars Arena:

The deal with Hikma is instrumental in establishing Richter Gedeon as a key player in the U.S. biosimilar market—a market that is both high in volume and critical for addressing healthcare cost challenges. The U.S. market is known for stringent regulatory requirements and intense competition; however, partnering with an established entity like Hikma reduces market entry barriers and significantly increases the likelihood of success. This move is expected to position Richter not only as a regional leader but also as a global competitor capable of addressing the needs of developed markets.

- Diversification and Revenue Stability:

By securing multiple licensing deals, Richter Gedeon diversifies its revenue streams and reduces reliance on the outcomes of independent product launches. The structured payment models—comprising upfront payments, regulatory and sales milestones, and tiered royalties—create a stable and predictable financial environment that is less susceptible to the inherent volatility of drug development pipelines. Consequently, these deals serve as a financial buffer, enabling the company to invest in further R&D and strategic market expansions with greater confidence.

Challenges and Future Outlook

Challenges in the Pharmaceutical Industry

While the recent deals are a clear sign of Richter Gedeon’s innovative approach and strategic ambition, the broader pharmaceutical industry presents a range of challenges that must be navigated carefully.

- Regulatory Hurdles:

The complex regulatory frameworks governing drug approvals across different jurisdictions can pose significant challenges. Both the Myovant and Hikma deals are contingent upon successful regulatory filings and approvals, which could be impacted by shifting regulatory policies, unforeseen clinical data variations, or delays in clinical trial outcomes.

- Competitive Pressures:

The global pharmaceutical market is exceedingly competitive, with large multinational companies and agile biotech startups continually vying for market share. In particular, the biosimilars market in the United States is characterized by rapid innovation, pricing pressures, and high barriers to entry due to intellectual property and regulatory issues. Richter Gedeon must therefore not only maintain high levels of research and development efficiency but also strategically manage its collaborations to stay ahead of competitors.

- Integration of Cross-border Operations:

Operating across multiple markets—Europe, CIS, Latin America, Australia, New Zealand, and the U.S.—requires effective coordination and integration of localized commercial strategies. Differing market dynamics, cultural nuances, and regulatory requirements may create operational challenges that could impact the timely commercialization of products. Richter Gedeon will need to invest in robust management systems and cross-functional teams to mitigate these challenges effectively.

Future Prospects for Richter Gedeon

Despite these challenges, the future prospects for Richter Gedeon appear promising given its strategic initiatives and recent successful deals.

- Growth in Women’s Healthcare:

The global focus on women’s health is intensifying, especially as awareness grows around conditions like uterine fibroids and endometriosis. As healthcare systems worldwide strive to provide better, safer, and more effective treatments for women’s health issues, Richter Gedeon’s partnership with Myovant positions it well to capture a larger market share in this segment. Future prospects include potential expansion into additional women’s health therapies that could be integrated into their existing portfolio, further consolidating their leadership position in this field.

- Expansion of Biosimilar Portfolios:

The collaboration with Hikma serves as an important stepping stone into the biosimilars market, particularly in the U.S., where cost-containment pressures and the demand for affordable treatment alternatives continue to rise. Success in this market could lead to additional biosimilar partnerships or even the development of a broader biosimilar portfolio, positioning Richter Gedeon as a premier biosimilar provider on the global stage.

- Opportunities for Further Collaborations and Licensing:

Richter Gedeon’s agile business model and its track record of successful licensing deals make it an attractive partner for other global pharmaceutical companies. The company’s ability to structure financially attractive and risk–mitigated deals could pave the way for further collaborations in a variety of therapeutic areas. Such partnerships will likely boost its growth, not only through increased sales revenue and market penetration, but also by strengthening its reputation as a reliable and innovative player in the pharmaceutical industry.

- Innovation and Digital Transformation:

Looking ahead, Richter Gedeon is poised to capitalize on advancements in digital technologies and data analytics to enhance its R&D processes and streamline regulatory submissions. Investment in digital transformation can lead to more efficient clinical trial management, faster time-to-market, and more accurate forecasting of clinical outcomes, all of which are crucial for sustaining long-term growth in an increasingly competitive industry.

Conclusion

In summary, Richter Gedeon’s recent drug deals—most notably the exclusive licensing agreements with Myovant Sciences and Hikma Pharmaceuticals—are pivotal to the company’s strategic expansion and market diversification. The Myovant deal for the relugolix combination tablet provides Richter Gedeon with a significant opportunity to expand its presence in women’s healthcare across Europe, the CIS, Latin America, Australia, and New Zealand, underpinned by a robust financial structure that includes upfront payments, regulatory, and sales milestones. Meanwhile, the collaboration with Hikma Pharmaceuticals for the commercialization of denosumab biosimilars in the United States is a strategic move that leverages Richter’s R&D strengths while capitalizing on Hikma’s local regulatory and market expertise.

These deals not only enhance Richter Gedeon’s therapeutic portfolio and revenue stability but also bolster its market positioning by enabling entry into high-potential markets and diversifying income sources. While challenges related to regulatory complexities, competitive pressures, and the integration of cross-border operations persist, Richter Gedeon’s proactive approach to risk-sharing and innovation positions the company strongly for future growth. With a clear focus on both women’s healthcare and biosimilar development, alongside an overarching commitment to strategic alliances, the company is well-equipped to navigate the evolving landscape of the pharmaceutical industry.

Ultimately, Richter Gedeon’s recent drug deals exemplify a general-specific-general success model. They begin with broad strategic aims of global expansion and diversification, move through detailed, targeted initiatives in specific therapeutic areas via well-structured partnerships, and culminate in an overall strengthened market position and enhanced prospects for sustainable innovation and growth in the pharmaceutical industry. This holistic approach is likely to yield significant benefits in the long term, positioning Richter Gedeon as a key global player in both established and emerging market segments.

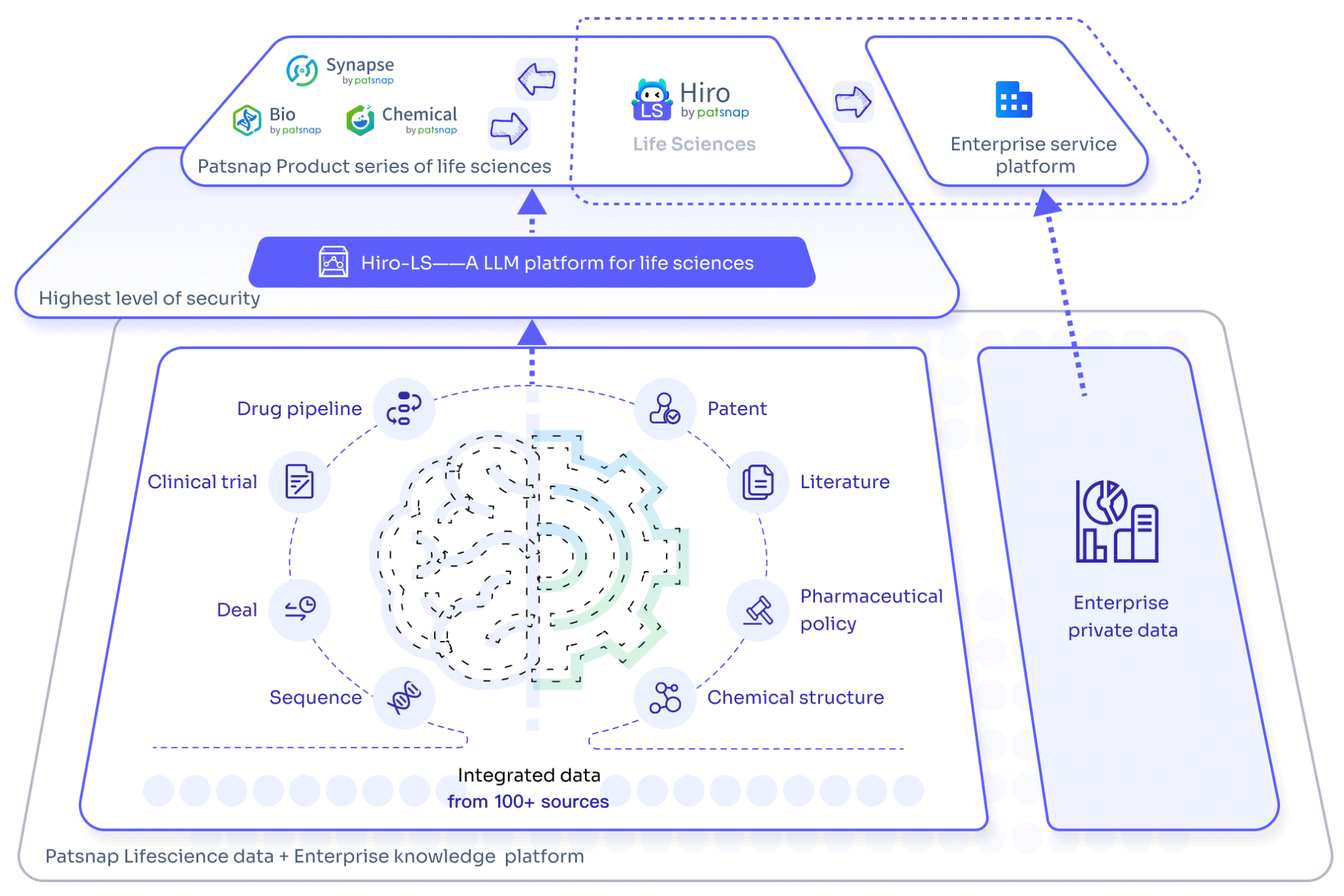

For an experience with the large-scale biopharmaceutical model Hiro-LS, please click here for a quick and free trial of its features!

Get started for free today!

Accelerate Strategic R&D decision making with Synapse, PatSnap’s AI-powered Connected Innovation Intelligence Platform Built for Life Sciences Professionals.

Start your data trial now!

Synapse data is also accessible to external entities via APIs or data packages. Empower better decisions with the latest in pharmaceutical intelligence.