Analysis of Collaborations and Transactions in the Pharmaceutical Industry in January 2025

In January 2025, the pharmaceutical collaborations and transactions showcased a diversified trend of development, ranging from multinational pharmaceutical corporations to startup biotech enterprises. Each party is actively exploring new partnership models and technological platforms. Initially, the collaboration between Simcere Zaiming and AbbVie marks their dedication to combating the complex disease of multiple myeloma. The SIM0500 project, based on T-cell engaging bispecific antibody technology, not only demonstrates the application potential of cutting-edge scientific research but also brings new hope for patients. Moreover, Daiichi Sankyo's acquisition of the TA-MUC1 antibody gatipotuzumab from Glycotope highlights the focus on antibody-drug conjugate (ADC) therapy, providing more effective solutions for cancer treatment.

Concurrently, the strategic cooperation between Gilead Sciences and LEO Pharma focuses on the development of STAT6 inhibitors, indicating that the field of inflammatory diseases is becoming the next hot spot for research. By developing oral STAT6 inhibitors, the partners aim to overcome the limitations of current treatments reliant on injectable biologics, offering a more convenient therapeutic option. Additionally, the partnership agreement between Harbour BioMed and Windward Bio on HBM9378/SKB378 further reflects the high level of global attention to unmet medical needs in inflammatory diseases such as asthma, as well as the rise of Chinese biopharmaceutical firms in the international market.

1.Simcere Zaiming and AbbVie Jointly Develop New Trispecific Antibody SIM0500

On January 13, 2025, Simcere Pharmaceutical Group Limited (HKEX code: 2096) through its subsidiary Simcere Zaiming, together with AbbVie Inc. (NYSE code: ABBV), announced a licensing agreement choice to co-develop a novel trispecific candidate antibody named SIM0500. This drug is intended for patients with relapsed or refractory multiple myeloma (MM), currently undergoing Phase I clinical trials in China and the USA.

SIM0500 is a humanized trispecific antibody specially targeting GPRC5D, BCMA, and CD3, independently developed by Simcere Zaiming using its T-cell engager bispecific antibody technology platform. The uniqueness of this antibody lies in its low affinity/high-targeting activation CD3 engagement arm and binding sites targeting two tumor antigens, GPRC5D and BCMA, capable of generating potent T-cell cytotoxicity against multiple myeloma cells through various anti-tumor mechanisms. The objective of this collaboration is to jointly advance the research and development of SIM0500, providing new therapeutic options for patients with multiple myeloma.

As per the terms of the agreement, Simcere Zaiming will receive an upfront payment from AbbVie and is eligible to receive option fees and milestone payments totaling up to $1.055 billion, in addition to tiered royalties on net sales outside of Greater China. AbbVie will receive tiered royalties on net sales in Greater China. This collaboration not only strengthens both parties' capabilities in research and treatment of hematologic malignancies but also offers potential solutions for the significant unmet medical needs of multiple myeloma patients. Through this partnership, the two companies will share resources and technology to accelerate the clinical development process of SIM0500.

2.Daiichi Sankyo Acquires Glycotope’s TA-MUC1 Antibody for $132.5 Million, Accelerating Development of DS-3939 ADC Therapy

On January 13, 2025, Daiichi Sankyo Company announced that it would pay Glycotope GmbH $132.5 million to acquire the full intellectual property rights to the tumor-associated mucin-1 (TA-MUC1) antibody gatipotuzumab. This transaction is based on a licensing agreement signed by both parties in 2018, which granted Daiichi Sankyo the exclusive rights to develop and commercialize gatipotuzumab as an antibody-drug conjugate (ADC) globally. The transaction involves DS-3939, an ADC under development by Daiichi Sankyo, which utilizes the company's proprietary DXd ADC technology. DS-3939 comprises a humanized anti-TA-MUC1 antibody linked to a topoisomerase I inhibitor payload (exatecan derivative DXd) via a tetrapeptide cleavable linker. DS-3939 is currently in Phase 1/2 clinical trials for the treatment of various advanced solid tumors, including non-small cell lung cancer, breast cancer, urothelial cancer, ovarian cancer, biliary cancer, and pancreatic cancer. As a tumor-specific transmembrane glycoprotein overexpressed in most human epithelial cancers, TA-MUC1 represents an attractive target for cancer therapy. The purpose of this acquisition is to strengthen Daiichi Sankyo's leadership position in the ADC field and to further enrich its product line. With the complete intellectual property of gatipotuzumab, Daiichi Sankyo can more freely advance the development of DS-3939, offering new therapeutic options for cancer patients with unmet medical needs. This transaction not only signifies Daiichi Sankyo's continued commitment to investing in innovative cancer therapies but also lays the groundwork for potential future market breakthroughs.

3.Gilead and LEO Pharma Partner to Expedite Development of Oral STAT6 Inhibitor

On January 11, 2025, Gilead Sciences and LEO Pharma announced the establishment of a strategic partnership to expedite the development of LEO Pharma’s small molecule oral STAT6 program, which holds potential for treating inflammatory diseases. STAT6, a transcription factor required for signaling by the IL-4 and IL-13 cytokines, plays a crucial role in Th2-mediated inflammation such as atopic dermatitis, asthma, and chronic obstructive pulmonary disease (COPD). The aim of the collaboration is to provide an oral alternative to patients currently requiring injectable biologic treatments. According to the terms of the partnership agreement, Gilead will acquire development rights to LEO Pharma's comprehensive preclinical oral STAT6 small molecule inhibitors and targeted protein degraders, and will be responsible for further development of these oral projects. Concurrently, LEO Pharma will focus on developing topical formulations of potential STAT6 inhibitors and retain exclusive global rights to them. Additionally, LEO Pharma will have rights to co-commercialize oral medications for dermatological treatments outside the United States. The transaction involves up to $1.7 billion, including an upfront payment of $250 million, along with tiered royalties based on product sales. This partnership not only strengthens Gilead's position in the field of inflammatory disease treatment but also reflects LEO Pharma’s commitment to propelling innovation in dermatology through scientific research. The collaboration is expected to provide new treatment options for patients with chronic inflammatory diseases, especially those seeking more convenient treatment modalities. Gilead hopes to explore the potential of the STAT6 pathway through this collaboration, while LEO Pharma aims to accelerate the development of the STAT6 program and maximize its application potential.

4.Harbour BioMed has reached an agreement with Windward Bio to jointly advance the fully human anti-TSLP antibody HBM9378/SKB378

On January 10, 2025, Harbour BioMed, a global biopharmaceutical company specializing in innovative antibody therapies in oncology and immunology, together with Kelun-Botai, announced that they have entered into a licensing agreement with Windward Bio AG for the co-developed anti-TSLP (thymic stromal lymphopoietin) fully human monoclonal antibody HBM9378/SKB378. According to the terms of the agreement, Windward Bio has secured exclusive rights to research, develop, manufacture, and commercialize HBM9378/SKB378 globally, excluding Greater China, certain Southeast Asian, and Western Asian countries.

The deal is valued up to $970 million, including an upfront payment and near-term milestone payments totaling $45 million that incorporate both cash and a share in the equity of Windward Bio's parent company. Additionally, Harbour BioMed and Kelun-Botai will be entitled to receive further payments if Windward Bio undergoes a change of control or enters into re-licensing agreements with other third parties. This partnership provides significant financial backing and is hoped to expedite the development process of HBM9378/SKB378 in meeting the underserved medical needs on a global scale.

Through this collaboration, Harbour BioMed and Kelun-Botai aim to leverage Windward Bio's expertise and resources to further advance HBM9378/SKB378, which promises new treatment options for patients with inflammatory diseases such as asthma and chronic obstructive pulmonary disease. The uniquely designed trispecific antibody provides an extended half-life, significantly reducing the dosing frequency, improving patient compliance, and is administered subcutaneously enhancing convenience for patients. This cooperation not only demonstrates the innovative capabilities of the companies in the biopharmaceutical field but also marks a significant step in their international strategy, laying a solid foundation for long-term strategic growth.

5.Eternal Immunotherapies Enters into Strategic Collaboration with Dropshot Therapeutics

On January 9, 2025, Ethernal Immunotherapies NV (“Ethernal”), a leader in mRNA and lipid nanoparticle (LNP) technology, announced a strategic multitarget collaboration with Dropshot Therapeutics (“Dropshot”), a biotechnology company focused on the treatment of cardiac and renal diseases. The partnership accelerates the development of RNA-based therapeutic approaches through the joint exploration of new drug candidates for multiple indications. Under the terms of the agreement, Ethernal will receive an upfront payment and research funding, with the potential for milestone payments during development and tiered royalties following commercialization, potentially totaling $950 million.

The core of this collaboration leverages Ethernal's proprietary mRNA and LNP technology platforms, which enable precise RNA therapy delivery and expression to targeted organs and cell types. Dropshot contributes its deep expertise and technical know-how in the cardiac and renal disease arena, particularly in the cutting-edge exploration of delivering RNA payloads using LNPs. This collaboration not only propels the progression from pre-clinical animal studies to human clinical trials but also reflects the companies’ shared vision and commitment to developing innovative therapies.

For Ethernal, this partnership forges its position as a leader in nucleic acid-based drug development technologies and offers an opportunity to apply its technology in new therapeutic areas, improving patient quality of life. For Dropshot, working with Ethernal enables it to better address significant unmet medical needs in cardiac and renal diseases, advancing the development of innovative therapies. As emphasized by Ethernal's CEO, Bernard Sagaert, and Dropshot's CEO, Marijn Dekkers, the collaboration marks a concerted effort by both companies to develop transformative treatments for complex and challenging health conditions.

6.Mabworks Biotech has licensed its preclinical product MIL116 to Climb Bio, strengthening its layout in the field of immune kidney diseases

Mabworks Biotech announced a collaboration agreement with Climb Bio on January 10, 2025, and signed related contracts. According to the agreement, Mabworks will grant Climb Bio the rights to use its patents and proprietary technologies related to MIL116, an innovative APRIL antibody in preclinical development, granting the latter development, manufacturing, and sales rights globally, excluding Greater China. This collaboration involves a substantial amount, with the total potential payments reaching up to $893 million, including an upfront payment of $9 million, cumulative development milestone payments of up to $51.75 million, and sales milestone payments of up to $832 million. Additionally, Mabworks will receive a percentage of the net sales globally as royalties and other potential licensing payments.

For Mabworks, this partnership not only brings significant capital inflow but also marks an important milestone in its overseas collaborations for in-house developed products, showcasing the company's strong R&D capabilities and global vision in the treatment of immune-mediated kidney diseases. Through cooperation with Climb Bio, Mabworks can further advance the development process of MIL116, accelerate the drug's entry into clinical trials, and ultimately benefit a broad patient population with IgA nephropathy.

For Climb Bio, acquiring MIL116 (referred to as CLYM116 in its pipeline) represents a significant step towards becoming a leader in innovative therapies for immune-mediated diseases. Given that IgA nephropathy is a major cause of global glomerulonephritis and there is a substantial unmet medical need, research on the APRIL pathway inhibition mechanism is expected to bring revolutionary treatment methods for this disease.

7.Alpha Cognition and CMS secure a $44 million agreement to advance Zrevyl® in the Asian market for the treatment of mild to moderate Alzheimer's disease

On January 8, 2025, Alpha Cognition, Inc., a biopharmaceutical company focused on developing new therapies for debilitating neurodegenerative diseases, announced an exclusive licensing agreement with CMS. The agreement pertains to Alpha Cognition’s next-generation acetylcholinesterase inhibitor, ZUNVEYL (benzgalantamine), an orally administered drug approved by the FDA for the treatment of mild to moderate Alzheimer’s disease.

According to the terms of the agreement, the total amount is $44 million, including an upfront payment of $6 million and subsequent installment payments, development, and commercial milestones. Additionally, Alpha Cognition is eligible to receive royalties on the net sales of ZUNVEYL in Asia (excluding Japan), Australia, and New Zealand. CMS will take on the full responsibilities for regulatory approval, development, manufacturing, and commercialization of ZUNVEYL in these regions. This collaboration leverages CMS’s expertise and resources in the Chinese market to accelerate the launch of ZUNVEYL in the specified regions, meeting the substantial demand for Alzheimer’s treatment medications in those areas.

8.Candid Therapeutics Reaches Collaboration Agreement with WuXi Biologics on Tri-specific T Cell Engagers

Candid Therapeutics, Inc., a clinical-stage biotechnology company focused on the development of T cell engagers for treating autoimmune and inflammatory diseases, has announced a significant agreement with WuXi Biologics. Under this agreement, Candid will obtain exclusive global rights to a preclinical tri-specific T cell activator discovered using WuXi Biologics' proprietary WuXiBodyTM platform. This collaboration will accelerate Candid's development in the B-cell depletion therapy area, specifically for T cell engagers (TCEs) targeting BCMA, CD20, and CD19. Candid plans to complete the IND-enabling studies by the first half of 2026, setting the stage for the first human trials. Additionally, the agreement includes an upfront payment to WuXi Biologics and eligibility for up to $925 million in developmental and sales milestone payments, plus royalties on post-commercialization sales. For Candid, this agreement not only strengthens its leadership in the T cell engager field but also provides robust resource support to advance the development of novel therapies. For WuXi Biologics, this collaboration showcases the powerful capabilities of its WuXiBodyTM platform, especially in discovering complex tri-specific antibodies, and further establishes it as a preferred partner for next-generation biologic drug development.

9.Merck Acquires WuXi Biologics' Dundalk Vaccine Facility for €500 Million, Boosting Global Vaccine Production Capacity

On January 6, 2025, WuXi Biologics’ indirect wholly-owned subsidiary, Yaoming Haide Ireland, reached an agreement with Merck (known as MSD outside the USA and Canada) to sell its vaccine facility in Ireland. Valued at approximately €500 million, this transaction is part of Merck's long-term development strategy in Ireland and significantly expands its local presence. The objective of this transaction is to bolster Merck's position in global vaccine production and to meet the growing market demand by increasing production capacity. Notably, this deal follows Merck's previously announced investment of €1 billion in its facilities in Carlow and Dunboyne, demonstrating the company's commitment to the Irish market. The entire handover process is expected to be completed in the first half of 2025, at which point Merck will formally take over the operations of the Dundalk facility and begin integrating this new capacity into its global network.

Summary

The pharmaceutical collaborations and transactions in January 2025 showed several significant characteristics: First, there was a diversification of cooperation forms, covering multiple aspects from early-stage R&D tech licensing to market expansion of mature products. Second, the targets of these collaborations were clear, whether aiming for innovative therapies for specific diseases or enhancing the efficacy of existing treatments, all parties were committed to addressing unmet medical needs. Third, there was a noticeable globalization trend, with frequent cross-national collaborations highlighting the importance of resource sharing and collaborative innovation on a global scale.

In terms of trends, anti-cancer drugs remained a focal point for investment and collaboration, particularly with advances in immunotherapies, bispecific antibodies, and Antibody-Drug Conjugate (ADC) technologies, which provided new treatment directions for refractory diseases such as multiple myeloma. Additionally, more attention started to be paid to inflammatory diseases such as asthma and atopic dermatitis, indicating that besides traditional oncology, chronic disease management was gradually becoming another crucial research and development focus. Moreover, the strengthening of vaccine production was an unignorable trend, especially critical in enhancing production capabilities in the face of global public health challenges.

Looking ahead, the goals of these collaborations and transactions were not only to accelerate the development process of new drugs but also to optimize the entire industry chain, including all aspects from basic research to clinical trials, and through to production and commercialization. By establishing extensive and in-depth cooperative relationships, companies could fully leverage their respective strengths, achieving mutually beneficial outcomes. Additionally, this also indicated that the future pharmaceutical market would increasingly focus on the development of personalized treatment plans and ongoing improvements in patient experiences, thereby truly implementing a patient-centered value orientation.

How to get the latest progress on drug deals?

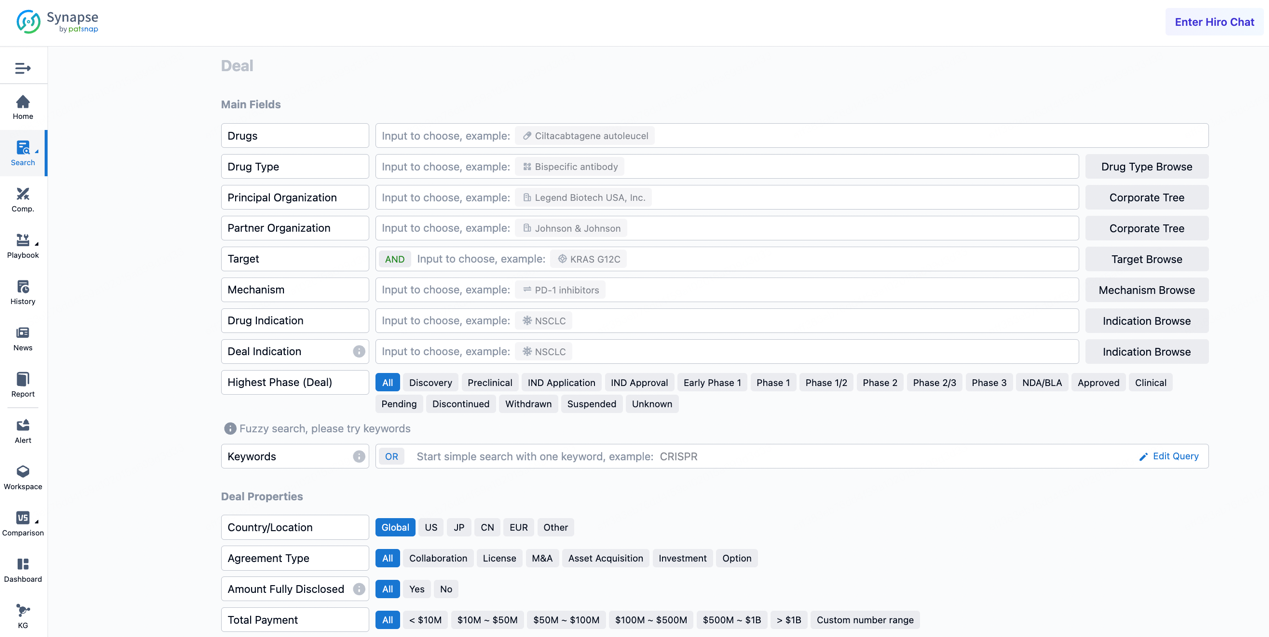

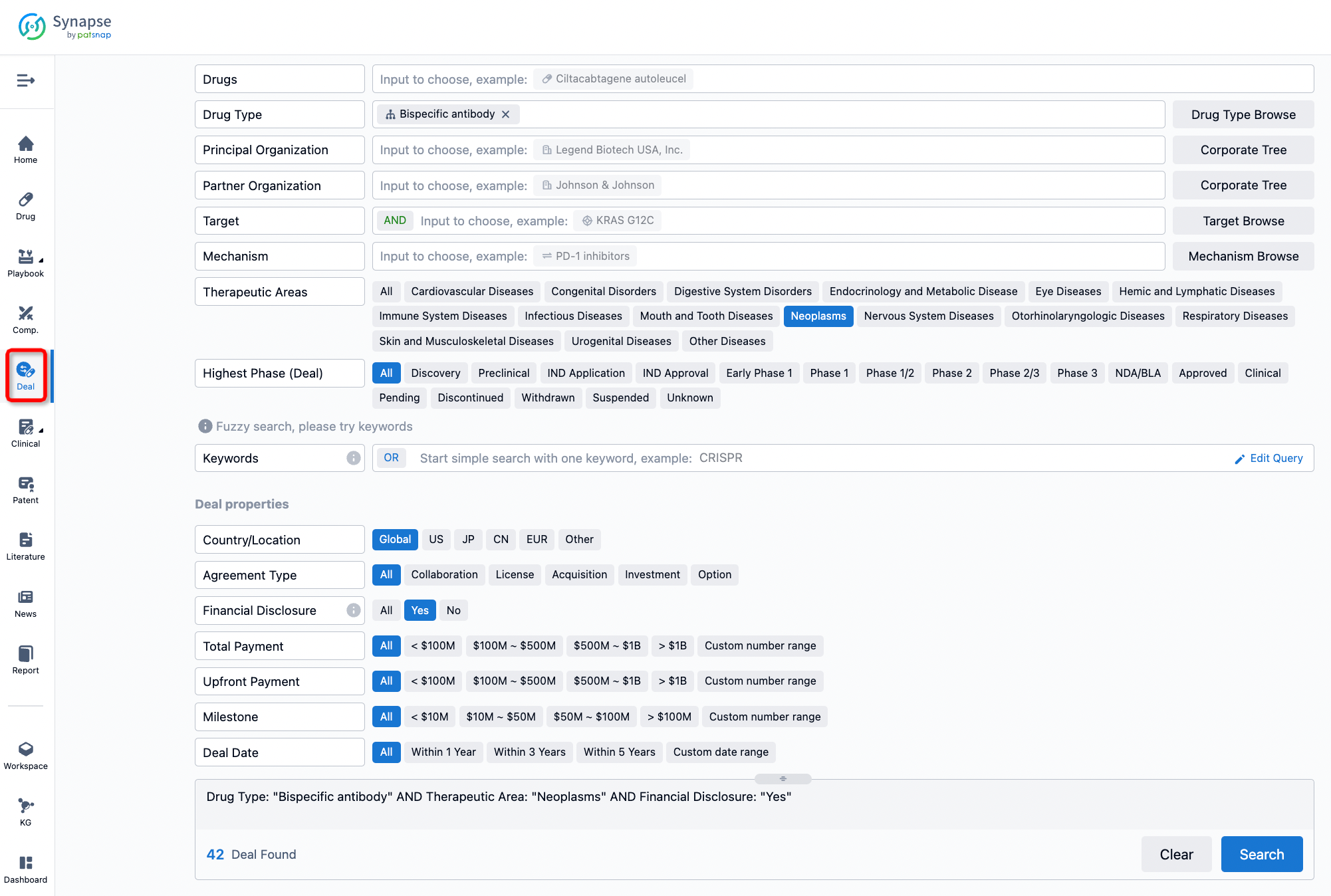

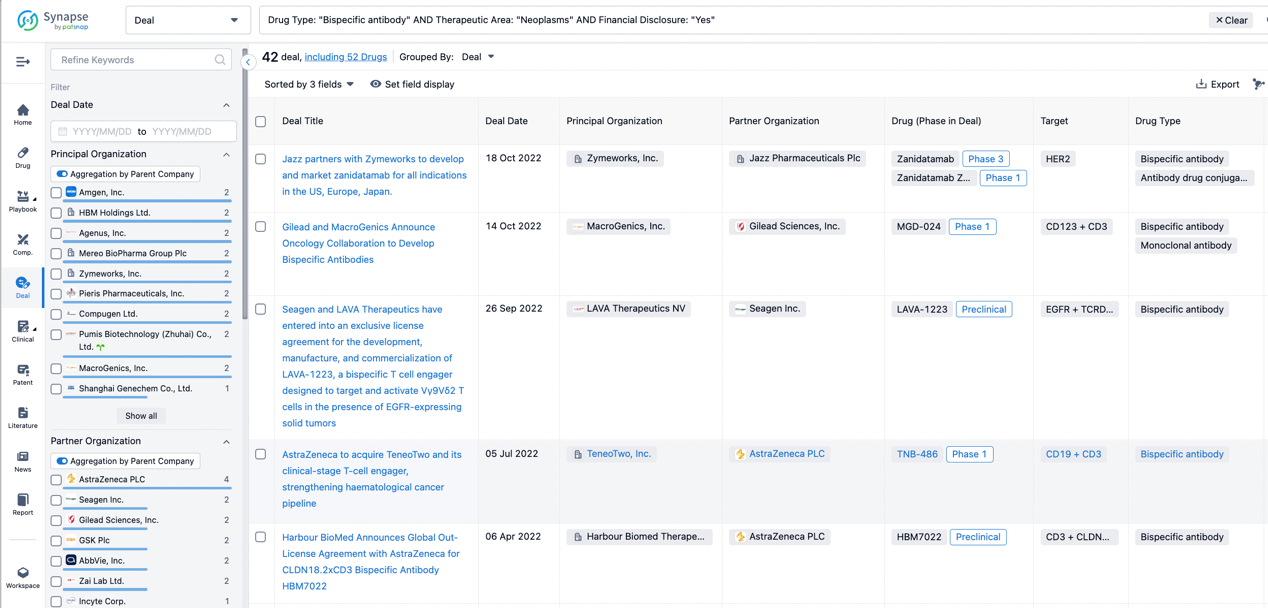

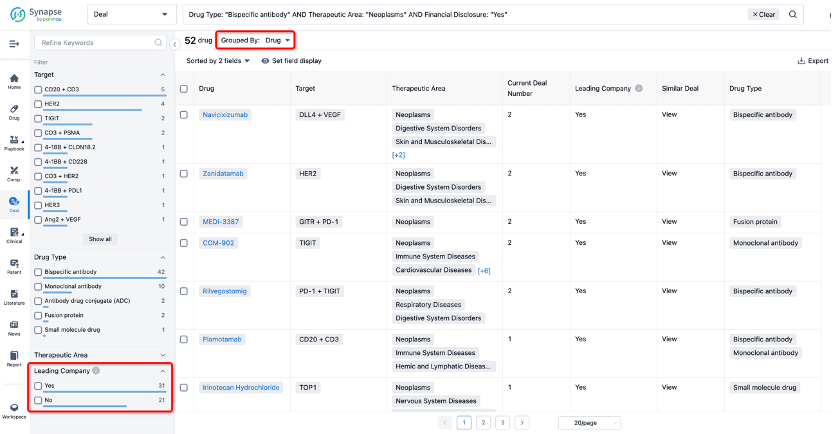

If you would like to access the latest transaction event information, you can click on the 'Deal' module from the homepage of the Synapse database. Within the Deal module, you can search for global pharmaceutical transaction information using labels such as Drugs, Organization, Target, Drug Type, Deal Date.

Furthermore, you can obtain the original link to the transaction coverage by clicking on the "Deal Name."

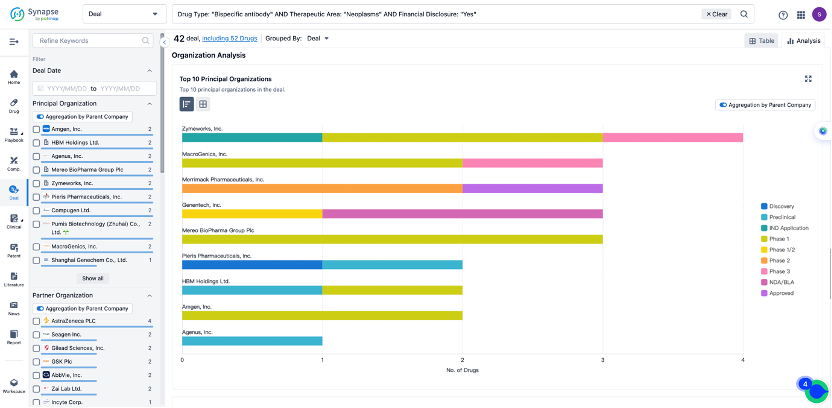

In the analysis view, you can see the most active assignors, assignees, popular targets, and other dimensions of analysis, as well as the distribution of research and development statuses at the time of the transaction, to help you better understand the search results.

The Synapse database also supports the ability to view current transactions from the dimension of "drugs" (by selecting "drugs" from the "Adjust Dimension" dropdown menu above). Targeting transactions involving renowned pharmaceutical companies that are of interest to the industry, such as Merck, Roche, etc., Synapse has identified a group of "leading companies" through drugs that have achieved global sales exceeding 1 billion US dollars in 2022. Transactions involving drugs from these leading companies can be filtered by clicking on the "Leading Company" tag on the left-hand side.

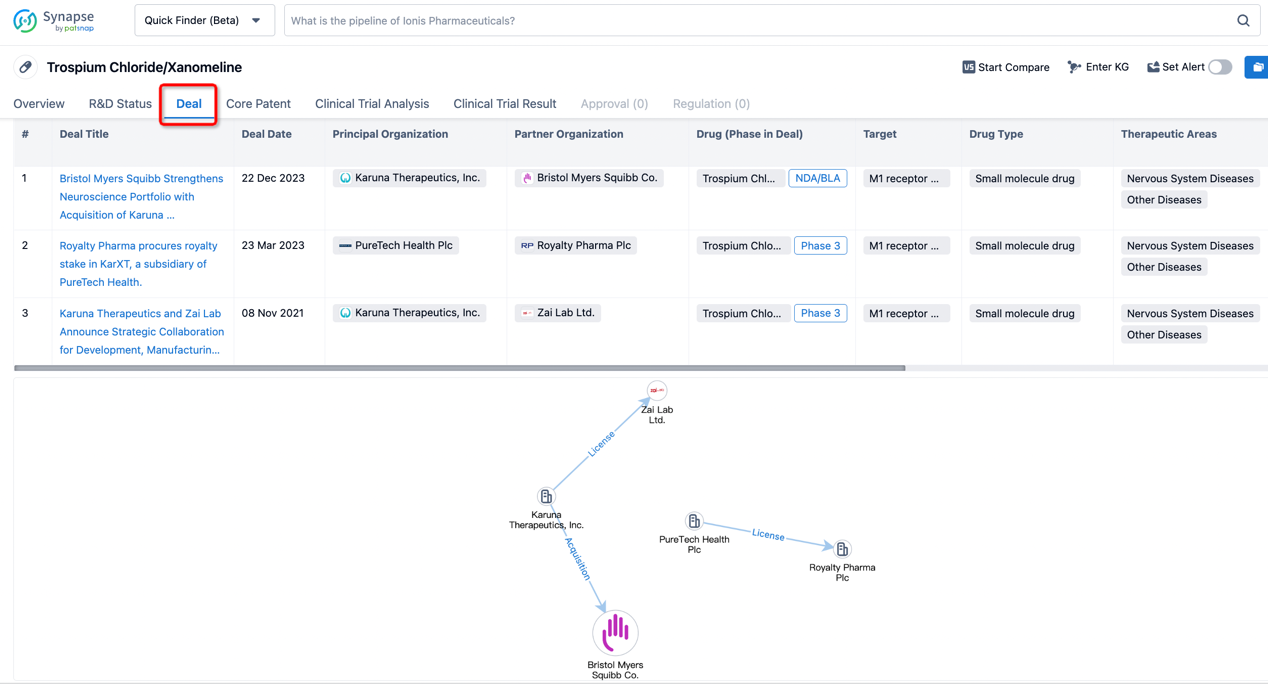

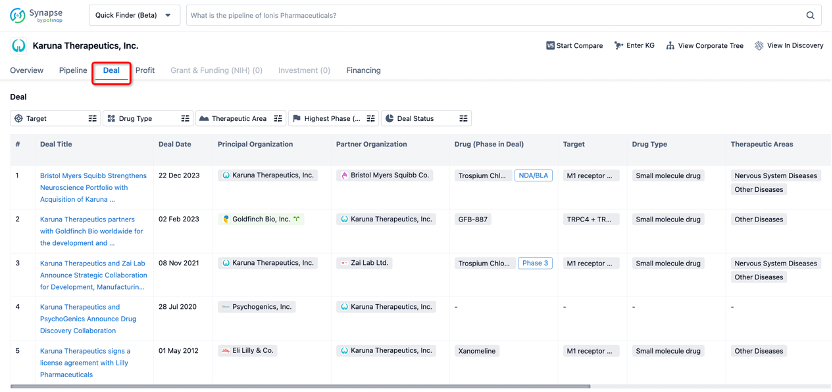

In addition to the drug transaction module, you can also view related transaction history on the drug detail page and the institution detail page.

Click on the image below to explore new pharmaceutical funding transactions!