Request Demo

Last update 22 Nov 2025

Envudeucitinib

Last update 22 Nov 2025

Overview

Basic Info

Drug Type Small molecule drug |

Synonyms ESK-001, FTP 637, FTP-637 |

Target |

Action inhibitors |

Mechanism TYK2 inhibitors(Tyrosine-protein kinase 2 inhibitors) |

Therapeutic Areas |

Active Indication |

Inactive Indication |

Originator Organization |

Active Organization |

Inactive Organization |

License Organization |

Drug Highest PhasePhase 3 |

First Approval Date- |

Regulation- |

Login to view timeline

Structure/Sequence

Molecular FormulaC22H24N6O3 |

InChIKeyFKCATCQHVCOBCX-WFGJKAKNSA-N |

CAS Registry2417135-66-9 |

Related

16

Clinical Trials associated with EnvudeucitinibNCT06962774

A Phase 1, Open-label, Single-dose Study to Investigate the Effect of Renal Impairment on the Pharmacokinetics of a Single Oral Dose of ESK-001

This a phase 1, open label, single dose, parallel cohort study to determine the pharmacokinetics (PK) of study drug (ESK-001) in healthy volunteer participants, and participants with mild, moderate, and severe renal impairment.

Start Date09 May 2025 |

Sponsor / Collaborator |

NCT06952634

A Phase 1, Open Label, Single Dose Study to Investigate the Effect of Hepatic Impairment on the Pharmacokinetics of ESK001

This a phase 1, open label, single dose, parallel cohort study to determine the pharmacokinetics (PK) of study drug (ESK-001) in healthy volunteer participants, and participants with mild, moderate, and severe hepatic impairment.

Start Date29 Apr 2025 |

Sponsor / Collaborator |

CTIS2023-508959-39-00

A Multicenter, Randomized, Double-Blind, Placebo and Active Comparator Controlled Phase 3 Study in Patients with Moderate to Severe Plaque Psoriasis to Evaluate the Efficacy and Safety of ESK-001 (ONWARD2) - ESK-001-017

Start Date20 Feb 2025 |

Sponsor / Collaborator |

100 Clinical Results associated with Envudeucitinib

Login to view more data

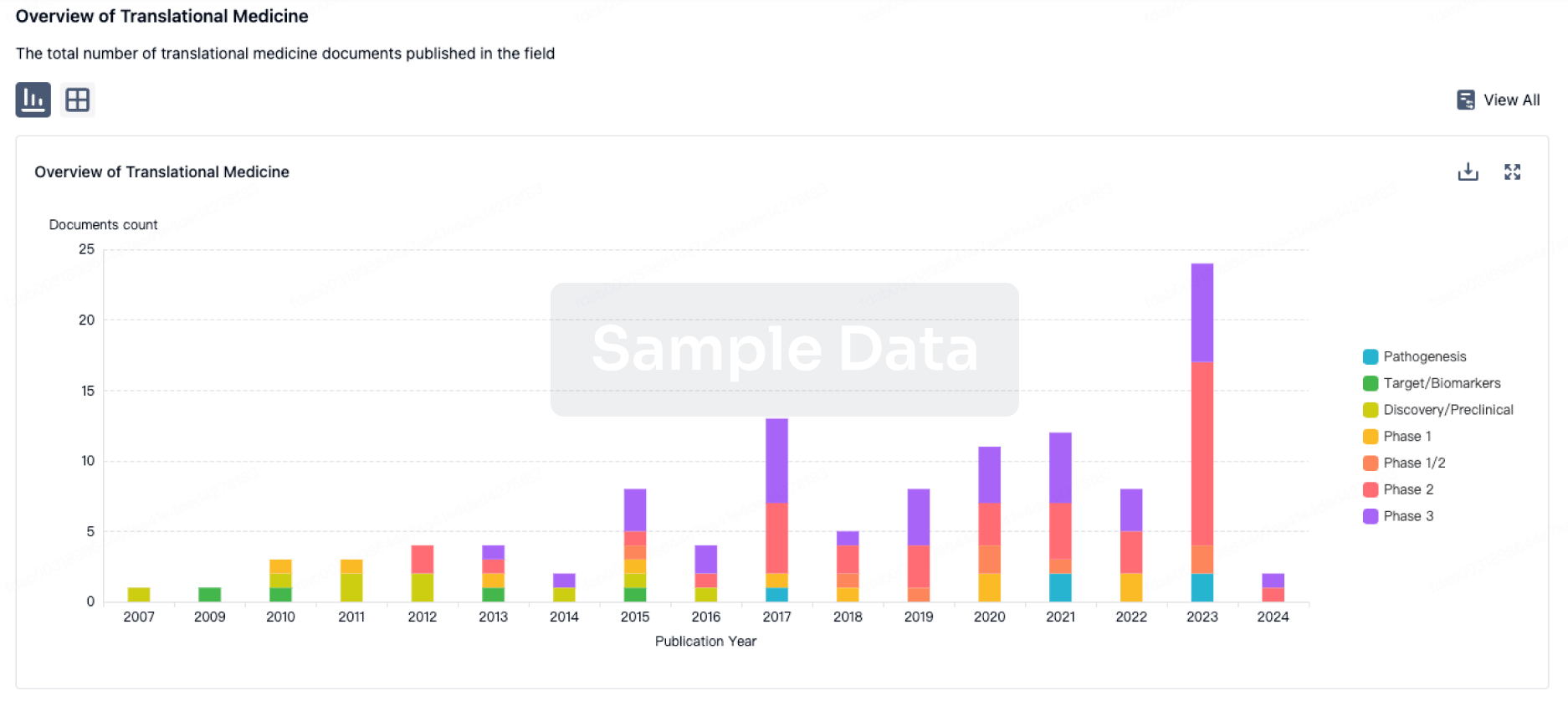

100 Translational Medicine associated with Envudeucitinib

Login to view more data

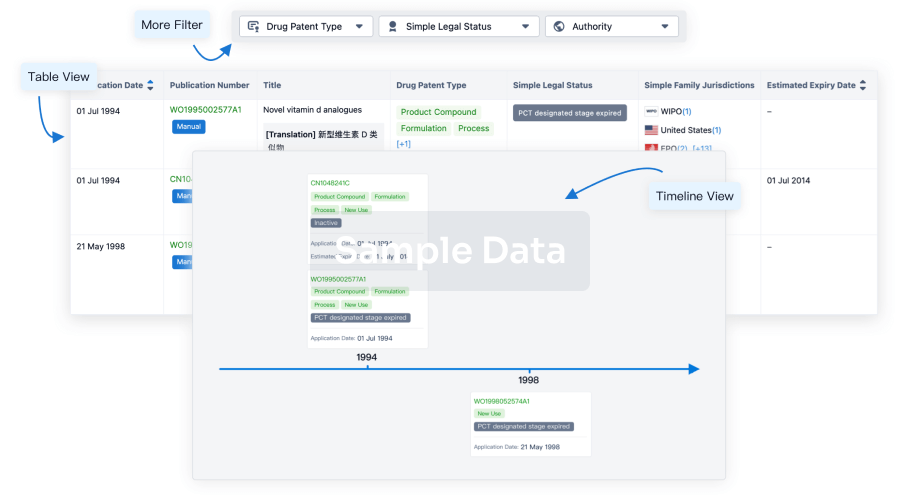

100 Patents (Medical) associated with Envudeucitinib

Login to view more data

6

Literatures (Medical) associated with Envudeucitinib01 Oct 2025·JOURNAL OF THE AMERICAN ACADEMY OF DERMATOLOGY

Safety and efficacy of envudeucitinib, a highly selective, oral allosteric TYK2 inhibitor, in patients with moderate-to-severe plaque psoriasis: Results from the 52-week open-label extension period of the phase 2 STRIDE study

Article

Author: Rubio, Roman G ; Jacobs, Shahram ; Blauvelt, Andrew ; Muscianisi, Elisa ; Bukhalo, Michael ; Ma, Grace ; Papp, Kim A ; Hitraya, Elena ; Bettinger, Michelle ; Sofen, Howard ; Lau, Gabriel

BACKGROUND:

Envudeucitinib (ESK-001), a highly selective, oral tyrosine kinase 2 inhibitor, was well-tolerated and effective in patients with plaque psoriasis in the STRIDE study.

OBJECTIVE:

To assess long-term safety and efficacy of envudeucitinib throughout 52 weeks in the ongoing phase 2 open-label extension in patients who completed STRIDE.

METHODS:

Patients completing STRIDE were eligible to enroll in the long-term open-label extension study (NCT05739435) and received envudeucitinib 40-mg once or twice daily.

RESULTS:

In the open-label extension which enrolled 165 patients, envudeucitinib was generally well-tolerated, with an overall 3.7% study drug discontinuation rate due to adverse events, as well as no clinically concerning laboratory or electrocardiogram findings. After 52 weeks of treatment with envudeucitinib 40-mg twice daily, 78% of patients achieved Psoriasis Area and Severity Index (PASI)-75, 61% achieved PASI-90, 39% achieved PASI-100, and 39% achieved sPGA-0. Moreover, 62% showed continued improvement in PASI response over time versus STRIDE week 12. In addition, approximately 80% reported pruritus Numerical Rating Scale <4 and 61% achieved Dermatology Life Quality Index 0/1.

LIMITATIONS:

This was an open-label study with limited sample size and no control.

CONCLUSION:

Envudeucitinib 40-mg twice daily in adults with moderate-to-severe plaque psoriasis demonstrated increasing and durable improvements in skin clearance and pruritus and was well-tolerated throughout 52 weeks of treatment.

01 Jul 2025·JOURNAL OF THE AMERICAN ACADEMY OF DERMATOLOGY

Highly selective, allosteric inhibition of TYK2 with oral ESK-001 in patients with moderate-to-severe plaque psoriasis: Results from STRIDE, a 12-week, randomized, double-blinded, placebo-controlled, dose-ranging phase 2 study

Article

Author: Tilley, Mera K ; Papp, Kim A ; Ma, Grace ; Ucpinar, Sibel ; Rubio, Roman G ; Couvillion, Megan ; Blauvelt, Andrew ; Vlahakis, Nicholas E ; Hitraya, Elena ; Sauder, Maxwell B ; Arenberger, Petr

BACKGROUND:

ESK-001, a novel allosteric, highly selective oral tyrosine kinase 2 inhibitor in development for treatment of immune-mediated disorders, was well-tolerated and achieved high levels of target inhibition in phase 1 studies with healthy volunteers.

OBJECTIVE:

To assess clinical efficacy, safety, and pharmacokinetics of ESK-001 compared to placebo in patients with moderate-to-severe plaque psoriasis.

METHODS:

STRIDE (NCT05600036, EudraCT Number 2022-002633-34) was a phase 2, double-blinded, 16-week study with patients randomized to 6 treatment groups for 12 weeks of placebo or ESK-001, ranging from 10 mg QD to 40 mg BID.

RESULTS:

ESK-001 demonstrated a dose-dependent improvement across all end points, with maximal efficacy observed in the highest dose arm (40 mg BID). At week 12, more patients achieved Psoriasis Area and Severity Index-75 in each ESK-001 dose arm compared to placebo: 64% in the 40 mg BID arm vs 0% with placebo (P < .0001). ESK-001 was well-tolerated, with no dose-limiting safety findings and a 2.6% rate of ESK-001 discontinuation due to adverse events.

LIMITATIONS:

Small sample size per treatment group and 16-week study duration.

CONCLUSION:

ESK-001 demonstrated significant dose-dependent improvement in signs and symptoms of psoriasis while achieving continuous target inhibition at the highest dose in patients with psoriasis and was well-tolerated.

01 Aug 2023·International immunopharmacology

Recent progress on tyrosine kinase 2 JH2 inhibitors

Review

Author: Liao, Tingting ; Wang, Jie ; Wu, Xianbo ; Deng, Lidan ; Wang, Lin ; Wan, Li ; Shi, Jianyou

Tyrosine kinase 2 (TYK2) is a member of the Janus kinase (JAK) family, which can regulate the signaling of multiple pro-inflammatory cytokines, including IL12, IL23 and type I interferon (IFNα/β), and its inhibitors can treat autoimmune diseases caused by the abnormal expression of IL12 and IL23. Interest in TYK2 JH2 inhibitors has increased as a result of safety concerns with JAK inhibitors. This overview introduces TYK2 JH2 inhibitors that are already on the market, including Deucravactinib (BMS-986165), as well as those currently in clinical trials, such as BMS-986202, NDI-034858, and ESK-001.

81

News (Medical) associated with Envudeucitinib13 Nov 2025

SOUTH SAN FRANCISCO, Calif., Nov. 13, 2025 (GLOBE NEWSWIRE) -- Alumis Inc. (Nasdaq: ALMS), a clinical-stage biopharmaceutical company developing next-generation targeted therapies for patients with immune-mediated diseases, today reported financial results for the quarter ended September 30, 2025, and highlighted recent achievements.

“As we continue to advance our pipeline, we are entering an important period for Alumis. Our teams have been working diligently, and we are eagerly anticipating key milestones ahead - with topline Phase 3 ONWARD data for envudeucitinib (envu) in moderate-to-severe plaque psoriasis (PsO) expected to be announced early in the first quarter of 2026, followed by topline Phase 2b LUMUS data in systemic lupus erythematosus (SLE) in the third quarter,” said Martin Babler, President and Chief Executive Officer of Alumis. “These data readouts have the potential to validate envu’s differentiated profile and unlock broader opportunities across immune-mediated diseases—representing meaningful inflection points for both the company and the patients we aim to serve.”

Babler added, "Our robust pipeline, spanning late-stage, clinical programs and advanced preclinical candidates, reflects the strength of our precision immunology R&D platform and our mission to transform the treatment landscape for immune-mediated diseases. Leveraging a validated mechanism with broad therapeutic potential, our two next-generation oral TYK2 inhibitor programs position us well to advance on this mission.”

Third Quarter 2025 and Recent Highlights

Envudeucitinib, a highly selective, next-generation oral tyrosine kinase 2 (TYK2) inhibitor for the treatment of immune-mediated diseases, including PsO and SLE The Journal of the American Academy of Dermatology (JAAD) has published two separate manuscripts describing results from the Phase 2 STRIDE clinical trial in moderate-to-severe PsO in which data demonstrate sustained or increasing response rates and a well-tolerated safety profile supporting envu’s potential to offer a differentiated profile for the treatment of moderate-to-severe plaque psoriasis: “Safety and efficacy of envudeucitinib, a highly selective, oral allosteric TYK2 inhibitor, in patients with moderate-to-severe plaque psoriasis: Results from the 52-week open-label extension period of the phase 2 STRIDE study” published in October “Highly selective, allosteric inhibition of TYK2 with oral ESK-001 in patients with moderate-to-severe plaque psoriasis: Results from STRIDE, a 12-week, randomized, double-blinded, placebo-controlled, dose-ranging phase 2 study” published in July A-005, a potentially first-in-class fully CNS-penetrant oral TYK2 inhibitor for the treatment of neuroinflammatory and neurodegenerative diseases A poster presentation entitled “Pharmacokinetics, pharmacodynamics and CNS penetration of A-005: a novel TYK2 inhibitor for MS” was given at the European Committee for Treatment and Research in Multiple Sclerosis (ECTRIMS) Congress demonstrating a favorable pharmacokinetic profile, maximal TYK2 inhibition and the ability to cross the blood-brain barrier while being well-tolerated with no serious adverse events, supporting a planned Phase 2 clinical trial in multiple sclerosis. Lonigutamab, next-generation subcutaneous anti-IGF-1R therapy for the treatment of thyroid eye disease (TED) A poster presentation entitled “Safety, efficacy and quality of life outcomes of subcutaneous lonigutamab (anti-IGF-1R): Week 12 results from a Phase 1/2 proof of concept study in patients with thyroid eye disease” was given at the annual meeting of the American Society of Ophthalmic Plastic and Reconstructive Surgery (ASOPRS) highlighting the differentiated mechanism of action, safety profile and potential of lonigutamab in TED.

The Journal of the American Academy of Dermatology (JAAD) has published two separate manuscripts describing results from the Phase 2 STRIDE clinical trial in moderate-to-severe PsO in which data demonstrate sustained or increasing response rates and a well-tolerated safety profile supporting envu’s potential to offer a differentiated profile for the treatment of moderate-to-severe plaque psoriasis: “Safety and efficacy of envudeucitinib, a highly selective, oral allosteric TYK2 inhibitor, in patients with moderate-to-severe plaque psoriasis: Results from the 52-week open-label extension period of the phase 2 STRIDE study” published in October “Highly selective, allosteric inhibition of TYK2 with oral ESK-001 in patients with moderate-to-severe plaque psoriasis: Results from STRIDE, a 12-week, randomized, double-blinded, placebo-controlled, dose-ranging phase 2 study” published in July

“Safety and efficacy of envudeucitinib, a highly selective, oral allosteric TYK2 inhibitor, in patients with moderate-to-severe plaque psoriasis: Results from the 52-week open-label extension period of the phase 2 STRIDE study” published in October “Highly selective, allosteric inhibition of TYK2 with oral ESK-001 in patients with moderate-to-severe plaque psoriasis: Results from STRIDE, a 12-week, randomized, double-blinded, placebo-controlled, dose-ranging phase 2 study” published in July

A poster presentation entitled “Pharmacokinetics, pharmacodynamics and CNS penetration of A-005: a novel TYK2 inhibitor for MS” was given at the European Committee for Treatment and Research in Multiple Sclerosis (ECTRIMS) Congress demonstrating a favorable pharmacokinetic profile, maximal TYK2 inhibition and the ability to cross the blood-brain barrier while being well-tolerated with no serious adverse events, supporting a planned Phase 2 clinical trial in multiple sclerosis.

A poster presentation entitled “Safety, efficacy and quality of life outcomes of subcutaneous lonigutamab (anti-IGF-1R): Week 12 results from a Phase 1/2 proof of concept study in patients with thyroid eye disease” was given at the annual meeting of the American Society of Ophthalmic Plastic and Reconstructive Surgery (ASOPRS) highlighting the differentiated mechanism of action, safety profile and potential of lonigutamab in TED.

Anticipated Milestones

Envu: topline data from ONWARD1 and ONWARD2 in moderate-to-severe plaque psoriasis are expected early in the first quarter of 2026. Envu: topline data from LUMUS in SLE are expected in the third quarter of 2026. Envu: Alumis expects to establish a once-daily formulation in 2025. A-005: initiation of a Phase 2 clinical trial in multiple sclerosis is anticipated in the first half of 2026. Lonigutamab: the lonigutamab development program continues to be evaluated. Third internally-developed program: Phase 1 clinical data is anticipated in the second half of 2026.

Envu: topline data from ONWARD1 and ONWARD2 in moderate-to-severe plaque psoriasis are expected early in the first quarter of 2026. Envu: topline data from LUMUS in SLE are expected in the third quarter of 2026. Envu: Alumis expects to establish a once-daily formulation in 2025. A-005: initiation of a Phase 2 clinical trial in multiple sclerosis is anticipated in the first half of 2026. Lonigutamab: the lonigutamab development program continues to be evaluated. Third internally-developed program: Phase 1 clinical data is anticipated in the second half of 2026.

Third Quarter 2025 Financial Results

As of September 30, 2025, Alumis had cash, cash equivalents and marketable securities of $377.7 million. Revenue included collaboration revenue of $2.1 million for the quarter ended September 30, 2025, related to the collaboration and licensing agreement with Kaken Pharmaceutical Co., Ltd. Research and development expenses were $97.8 million for the quarter ended September 30, 2025, compared to $87.8 million for the quarter ended September 30, 2024. The increase was driven by an increase in contract research and clinical trial costs for the envu and other programs, including costs to support acceleration of clinical trial activities for the Phase 3 ONWARD program, as well as severance costs and stock-based compensation expense related to the merger with ACELYRIN, and increased headcount in research and development teams to support development efforts. The quarter ended September 30, 2024 included a clinical milestone payment of $23.0 million related to the prior acquisition of FronThera. General and administrative expenses were $19.5 million for the quarter ended September 30, 2025, compared to $10.6 million for the quarter ended September 30, 2024. The increase was primarily attributable to severance costs and stock-based compensation expense related to the merger with ACELYRIN, and personnel-related expenses and professional consulting services to support the Company’s growth. Net loss was $110.8 million for the quarter ended September 30, 2025, compared to a net loss of $93.1 million for the quarter ended September 30, 2024. The Company recognized total expenses related to the merger with ACELYRIN of $6.3 million and $40.8 million for the three and nine months ended September 30, 2025, respectively, of which $2.8 million and $30.6 million related to general and administrative expenses for the three and nine months ended September 30, 2025, respectively, and $3.5 million and $10.2 million related to research and development expenses for the three and nine months ended September 30, 2025. These merger-related expenses included stock-based compensation expense of $2.1 million and $12.9 million for the three and nine months ended September 30, 2025, respectively, related to accelerated vesting of equity awards and a stock option post-termination exercise period modification for severed employees.

Financial Guidance

Based on the Company’s current operating plan, Alumis continues to anticipate that its existing cash, cash equivalents and marketable securities as of September 30, 2025 is expected to support advancement of its pipeline through multiple planned key clinical data readouts and to fund operating expenses and capital expenditure requirements into 2027.

About Alumis

Alumis is a late-stage biopharma company developing next-generation targeted therapies with the potential to significantly improve patient health and outcomes across a range of immune-mediated diseases. Leveraging its proprietary data analytics platform and precision approach, Alumis is developing a pipeline of oral tyrosine kinase 2 inhibitors, consisting of envudeucitinib (or envu, formerly known as ESK-001) for the treatment of systemic immune-mediated disorders, such as moderate-to-severe plaque psoriasis and systemic lupus erythematosus, and A-005 for the treatment of neuroinflammatory and neurodegenerative diseases. In addition, the pipeline includes lonigutamab, a subcutaneously delivered anti–insulin-like growth factor 1 receptor therapy for the treatment of thyroid eye disease, as well as several preclinical programs identified through this precision approach. For more information, visit www.alumis.com or follow us on LinkedIn or X.

Forward-Looking Statements

This press release contains forward-looking statements within the meaning of federal securities laws, including the “safe harbor” provisions of the Private Securities Litigation Reform Act of 1995. These statements may be identified by words such as "aims," "anticipates," "believes," "could," "estimates," "expects," "forecasts," "goal," "intends," "may," "plans," "possible," "potential," "seeks," "will" and variations of these words or similar expressions that are intended to identify forward-looking statements. All statements, other than statements of historical facts, including without limitation those regarding the timing of Alumis’ topline readouts in its Phase 3 ONWARD program and Phase 2b LUMUS clinical trial, the potential for envudeucitinib to treat moderate-to-severe plaque psoriasis and systemic lupus erythematosus, any expectations regarding the safety, efficacy or tolerability of envudeucitinib and statements regarding Alumis’ future plans and prospects, including development of its clinical pipeline and the commencement of additional clinical trials; cash runway; Alumis’ participation at upcoming conferences, and any assumptions underlying any of the foregoing, are forward-looking statements. Any forward-looking statements in this press release are based on Alumis’ current expectations, estimates and projections only as of the date of this release and are subject to a number of risks and uncertainties that could cause actual results to differ materially and adversely from those set forth in or implied by such forward-looking statements. Readers are cautioned that actual results, levels of activity, safety, efficacy, performance or events and circumstances could differ materially from those expressed or implied in Alumis’ forward-looking statements due to a variety of risks and uncertainties, which include, without limitation, risks and uncertainties related to Alumis’ ability to advance envudeucitinib or its other programs and to obtain regulatory approval of and ultimately commercialize Alumis’ clinical candidates, the timing and results of preclinical and clinical trials, Alumis’ ability to fund development activities and achieve development goals, Alumis’ ability to protect its intellectual property and other risks and uncertainties described in Alumis’ filings with the Securities and Exchange Commission (SEC), including any future reports Alumis may file with the SEC from time to time. Alumis explicitly disclaims any obligation to update any forward-looking statements except to the extent required by law.

Alumis Contact Information Teri Dahlman Red House Communications teri@redhousecomms.com

Phase 2Clinical ResultFinancial Statement

13 Aug 2025

–Completed enrollment in Phase 3 ONWARD clinical trials for envudeucitinib in moderate-to-severe plaque psoriasis; topline readout expected in early Q1 2026–

–Completed enrollment in Phase 2b LUMUS clinical trial for envudeucitinib in systemic lupus erythematosus (SLE); topline readout expected in Q3 2026–

–Completed merger with ACELYRIN, Inc. to strengthen financial position and support advancement of late-stage immunology pipeline–

–Cash, cash equivalents and marketable securities of $486.3 million as of June 30, 2025 expected to fund operations into 2027–

SOUTH SAN FRANCISCO, Calif., Aug. 13, 2025 (GLOBE NEWSWIRE) -- Alumis Inc. (Nasdaq: ALMS), a clinical-stage biopharmaceutical company developing next-generation targeted therapies for patients with immune-mediated diseases, today reported financial results for the quarter ended June 30, 2025, and highlighted recent achievements and upcoming milestones.

“With patient enrollment now complete in the pivotal Phase 3 ONWARD program for plaque psoriasis and the Phase 2b LUMUS trial in SLE, Alumis has achieved key clinical milestones for envudeucitinib, or “envu” (formerly known as ESK-001), and we look forward to topline data from ONWARD expected in early Q1 2026, and LUMUS topline data expected to follow in Q3 2026,” said Martin Babler, President and Chief Executive Officer of Alumis. “We continue to move forward on all fronts with momentum and a clear focus on advancing a differentiated pipeline of immune-mediated treatments. With the completion of our merger with ACELYRIN, we are well positioned to drive our programs through key inflection points in the next 12 months.”

Second Quarter 2025 and Recent Highlights, and Anticipated Milestones

Envudeucitinib Progress

Envudeucitinib designated generic name for ESK-001 The United States Adopted Names (USAN) Council has officially designated “envudeucitinib” as the nonproprietary name for Alumis’ investigational therapy ESK-001, marking a step forward in its regulatory and clinical development. The Company will use this generic name, envudeucitinib, or “envu” to refer to ESK-001 going forward. Completed patient enrollment in the Phase 2b global LUMUS clinical trial of envudeucitinib (or envu, formerly known as ESK-001) for the treatment of SLE The global LUMUS Phase 2b trial is a randomized, double-blind, placebo-controlled study evaluating multiple doses of envu in adults with moderately-to-severely active, autoantibody-positive SLE. The trial enrolled 408 patients who are receiving envu or placebo for 48 weeks. The primary endpoint will be to assess improvements in overall disease activity using the British Isles Lupus Assessment Group-based Composite Lupus Assessment (“BICLA”) at Week 48. After the trial, eligible patients may participate in an open-label extension or complete a four-week safety follow-up. Topline data from LUMUS are expected in the third quarter of 2026. Completed patient enrollment in the pivotal Phase 3 global ONWARD clinical program of envu for the treatment of moderate-to-severe plaque psoriasis The Phase 3 ONWARD clinical program consists of two parallel global Phase 3, multi-center, randomized, double-blind placebo-controlled 24-week clinical trials, ONWARD1 and ONWARD2, designed to evaluate the efficacy and safety of envu in adult patients with moderate-to-severe plaque psoriasis. ONWARD3, an optional long-term extension trial for patients who have completed Week 24, is currently ongoing to assess the durability, maintenance of response, and long-term safety of envu. Topline data from ONWARD1 and ONWARD2 are expected early in the first quarter of 2026.

The United States Adopted Names (USAN) Council has officially designated “envudeucitinib” as the nonproprietary name for Alumis’ investigational therapy ESK-001, marking a step forward in its regulatory and clinical development. The Company will use this generic name, envudeucitinib, or “envu” to refer to ESK-001 going forward.

The global LUMUS Phase 2b trial is a randomized, double-blind, placebo-controlled study evaluating multiple doses of envu in adults with moderately-to-severely active, autoantibody-positive SLE. The trial enrolled 408 patients who are receiving envu or placebo for 48 weeks. The primary endpoint will be to assess improvements in overall disease activity using the British Isles Lupus Assessment Group-based Composite Lupus Assessment (“BICLA”) at Week 48. After the trial, eligible patients may participate in an open-label extension or complete a four-week safety follow-up. Topline data from LUMUS are expected in the third quarter of 2026.

The Phase 3 ONWARD clinical program consists of two parallel global Phase 3, multi-center, randomized, double-blind placebo-controlled 24-week clinical trials, ONWARD1 and ONWARD2, designed to evaluate the efficacy and safety of envu in adult patients with moderate-to-severe plaque psoriasis. ONWARD3, an optional long-term extension trial for patients who have completed Week 24, is currently ongoing to assess the durability, maintenance of response, and long-term safety of envu. Topline data from ONWARD1 and ONWARD2 are expected early in the first quarter of 2026.

Pipeline Updates

A-005, potentially first-in-class fully CNS-penetrant TYK2 inhibitor for the treatment of neuroinflammatory and neurodegenerative diseases A-005 continues to advance towards Phase 2 clinical trial initiation with CMC and pharmacology activities on track, and ongoing preclinical and genetic research efforts to support potential expansion into additional neurodegenerative indications. Resources required to support the successful acceleration of clinical trial enrollment for envudeucitinib have resulted in an adjustment to pipeline program timelines. A-005 is anticipated to enter a Phase 2 clinical trial in multiple sclerosis in the first half of 2026. Third development program based on precision R&D approach Alumis continues to leverage its proprietary data analytics and research platform to advance discovery programs that target key drivers of immune-mediated diseases. In addition to its two clinical-stage TYK2 inhibitor programs, the Company continues to evaluate additional development programs against undisclosed targets in preclinical studies. Alumis anticipates Phase 1 clinical data from the next program in the second half of 2026. Lonigutamab, next-generation subcutaneous anti-IGF-1R therapy for the treatment of TED The U.S. Food and Drug Administration has granted Fast Track Designation to lonigutamab for the treatment of thyroid eye disease (TED). This designation is designed to facilitate the development and expedite the review of drugs to treat serious conditions and fill an unmet medical need. The lonigutamab development program continues to be evaluated.

A-005 continues to advance towards Phase 2 clinical trial initiation with CMC and pharmacology activities on track, and ongoing preclinical and genetic research efforts to support potential expansion into additional neurodegenerative indications. Resources required to support the successful acceleration of clinical trial enrollment for envudeucitinib have resulted in an adjustment to pipeline program timelines. A-005 is anticipated to enter a Phase 2 clinical trial in multiple sclerosis in the first half of 2026.

Alumis continues to leverage its proprietary data analytics and research platform to advance discovery programs that target key drivers of immune-mediated diseases. In addition to its two clinical-stage TYK2 inhibitor programs, the Company continues to evaluate additional development programs against undisclosed targets in preclinical studies. Alumis anticipates Phase 1 clinical data from the next program in the second half of 2026.

The U.S. Food and Drug Administration has granted Fast Track Designation to lonigutamab for the treatment of thyroid eye disease (TED). This designation is designed to facilitate the development and expedite the review of drugs to treat serious conditions and fill an unmet medical need. The lonigutamab development program continues to be evaluated.

Corporate Highlights

Promoted Sanam Pangali to Chief Legal Officer and Corporate Secretary Ms. Pangali brings nearly two decades of legal expertise through senior legal roles at companies across the biopharmaceutical, technology, and renewable energy industries. Sanam most recently served as Senior Vice President, Legal of Alumis, and an invaluable member of the senior leadership team. Completed merger with ACELYRIN, Inc. (“ACELYRIN”) to strengthen financial position and support advancement of late-stage immunology pipeline Merger strengthened balance sheet to support advancement of Alumis’ differentiated late-stage pipeline through multiple planned key data readouts.

Ms. Pangali brings nearly two decades of legal expertise through senior legal roles at companies across the biopharmaceutical, technology, and renewable energy industries. Sanam most recently served as Senior Vice President, Legal of Alumis, and an invaluable member of the senior leadership team.

Merger strengthened balance sheet to support advancement of Alumis’ differentiated late-stage pipeline through multiple planned key data readouts.

Second Quarter 2025 Financial Results

As of June 30, 2025, Alumis had cash, cash equivalents and marketable securities of $486.3 million. Revenue included collaboration revenue of $2.7 million for the quarter ended June 30, 2025, related to the collaboration and licensing agreement with Kaken Pharmaceutical. Research and development expenses were $108.8 million for the quarter ended June 30, 2025, compared to $48.6 million for the quarter ended June 30, 2024. The increase was driven by an increase in contract research and clinical trial costs for the envu and other programs, including costs to support acceleration of clinical trial activities for the Phase 3 ONWARD program, severance costs and stock-based compensation expense related to the merger with ACELYRIN, as well as increased headcount in research and development teams to support development efforts. General and administrative expenses were $34.5 million for the quarter ended June 30, 2025, compared to $7.6 million for the quarter ended June 30, 2024. The increase was primarily attributable to transaction costs, severance costs and stock-based compensation expense related to the merger with ACELYRIN, and personnel-related expenses and professional consulting services to support the Company’s growth. Net income was $59.3 million for the quarter ended June 30, 2025, including a non-operating gain of $187.9 million related to the merger with ACELYRIN, compared to a net loss of $56.5 million for the quarter ended June 30, 2024. The Company recognized total expenses related to the merger with ACELYRIN of $26.8 million and $34.5 million for the three and six months ended June 30, 2025, respectively, of which $20.1 million and $27.8 million related to general and administrative expenses for the three and six months ended June 30, 2025, respectively, and $6.7 million related to research and development expenses for the three and six months ended June 30, 2025. These merger-related expenses included stock-based compensation expense of $7.8 million in general and administrative expenses and $3.0 million in research and development expenses for the three and six months ended June 30, 2025, respectively, related to accelerated vesting of equity awards and stock options post-termination exercise period modification. At the time of the merger closing, ACELYRIN had $382.6 million in cash, cash equivalents and marketable securities.

Financial Guidance

Alumis expects its research and development expenses to decrease for the remaining quarters of 2025. Based on the Company’s current operating plan, Alumis continues to anticipate that its existing cash, cash equivalents and marketable securities as of June 30, 2025 is expected to support advancement of its pipeline through multiple planned key clinical data readouts and to fund operating expenses and capital expenditure requirements into 2027.

Upcoming Events

Alumis expects to participate in the following investor conferences in September 2025:

Cantor Global Healthcare Conference 2025 2025 Wells Fargo Healthcare Conference 23rd Morgan Stanley Annual Global Healthcare Conference H.C. Wainwright 27th Annual Global Investment Conference Baird 2025 Global Healthcare Conference Stifel 2025 Virtual Immunology & Inflammation Forum

About Alumis

Alumis is a late-stage biopharma company developing next-generation targeted therapies with the potential to significantly improve patient health and outcomes across a range of immune-mediated diseases. Leveraging its proprietary data analytics platform and precision approach, Alumis is developing a pipeline of oral tyrosine kinase 2 inhibitors, consisting of envudeucitinib (or envu, formerly known as ESK-001) for the treatment of systemic immune-mediated disorders, such as moderate-to-severe plaque psoriasis and systemic lupus erythematosus, and A-005 for the treatment of neuroinflammatory and neurodegenerative diseases. In addition, the pipeline includes lonigutamab, a subcutaneously delivered anti–insulin-like growth factor 1 receptor therapy for the treatment of thyroid eye disease, as well as several preclinical programs identified through this precision approach. For more information, visit www.alumis.com or follow us on LinkedIn or X.

Forward-Looking Statements

This press release contains forward-looking statements within the meaning of federal securities laws, including the “safe harbor” provisions of the Private Securities Litigation Reform Act of 1995. These statements may be identified by words such as “aims,” “anticipates,” “believes,” “could,” “estimates,” “expects,” “forecasts,” “goal,” “intends,” “may,” “plans,” “possible,” “potential,” “seeks,” “will” and variations of these words or similar expressions that are intended to identify forward-looking statements. All statements, other than statements of historical facts, including without limitation those regarding the timing of Alumis’ topline readouts in its Phase 3 ONWARD and Phase 2b LUMUS programs, the potential for envudeucitinib to treat moderate-to-severe plaque psoriasis and systemic lupus erythematosus, the timing of Alumis’ evaluation of its lonigutamab program, any expectations regarding the safety, efficacy or tolerability of envudeucitinib and statements regarding Alumis’ future plans and prospects, including development of its clinical pipeline; cash runway; Alumis’ participation at upcoming conferences, and any assumptions underlying any of the foregoing, are forward-looking statements. Any forward-looking statements in this press release are based on Alumis’ current expectations, estimates and projections only as of the date of this release and are subject to a number of risks and uncertainties that could cause actual results to differ materially and adversely from those set forth in or implied by such forward-looking statements. Readers are cautioned that actual results, levels of activity, safety, efficacy, performance or events and circumstances could differ materially from those expressed or implied in Alumis’ forward-looking statements due to a variety of risks and uncertainties, which include, without limitation, risks and uncertainties related to Alumis’ ability to advance envudeucitinib and to obtain regulatory approval of and ultimately commercialize Alumis’ clinical candidates, the timing and results of preclinical and clinical trials, Alumis’ ability to fund development activities and achieve development goals, Alumis’ ability to protect its intellectual property and other risks and uncertainties described in Alumis’ filings with the Securities and Exchange Commission (SEC), including any future reports Alumis may file with the SEC from time to time. Alumis explicitly disclaims any obligation to update any forward-looking statements except to the extent required by law.

Alumis Contact Information Teri Dahlman Red House Communications teri@redhousecomms.com

Phase 2Phase 1Phase 3Executive ChangeFinancial Statement

24 Jul 2025

-Topline Readout Expected in Q3 2026-

SOUTH SAN FRANCISCO, Calif., July 24, 2025 (GLOBE NEWSWIRE) -- Alumis Inc. (Nasdaq: ALMS), a late-stage biopharma company developing next-generation targeted therapies for patients with immune-mediated diseases, today announced the completion of patient enrollment in its global LUMUS Phase 2b trial of ESK-001, a highly selective, next-generation oral tyrosine kinase 2 (TYK2) inhibitor, for the treatment of systemic lupus erythematosus (SLE), the most common form of lupus.

“Completion of enrollment in our global LUMUS Phase 2b trial for SLE marks a significant milestone for Alumis, and importantly, for the lupus community,” said Martin Babler, President and Chief Executive Officer of Alumis. “This achievement reflects the dedication of our clinical partners, investigators, patients, and the entire Alumis team, positioning us to share topline data in the third quarter of 2026.”

“People living with SLE face a heavy burden and few treatment options,” added Dr. Jörn Drappa, Alumis’ Chief Medical Officer. “ESK-001, our next-generation oral TYK2 inhibitor, is designed to change that—selectively targeting key inflammatory drivers like type 1 IFN to maximize inhibition while minimizing off-target binding and effects. Clinical data in our psoriasis program has demonstrated that ESK-001 achieved full, sustained target inhibition and was generally well tolerated, positioning it as a promising oral therapy with potential for biologic-like clinical responses.”

The global LUMUS Phase 2b trial is a randomized, double-blind, placebo-controlled study evaluating multiple doses of ESK-001 in adults with moderately-to-severely active, autoantibody-positive SLE. The trial enrolled 408 patients who are receiving ESK-001 or placebo for 48 weeks. The primary endpoint will be to assess improvements in overall disease activity using the British Isles Lupus Assessment Group-based Composite Lupus Assessment (BICLA) at Week 48. After the trial, eligible patients may participate in an open-label extension or complete a four-week safety follow-up.

About ESK-001 ESK-001 is a highly selective, next-generation oral TYK2 inhibitor designed to correct immune dysregulation across a range of diseases, including SLE, the most common form of lupus. By selectively targeting key proinflammatory mediators, including type 1 interferon (IFN), it aims to deliver maximal inhibition while minimizing off-target effects.

Clinical data in Alumis’ psoriasis program indicates that ESK-001 downregulates key cytokines and disease biomarkers relative to SLE, disrupting pro-inflammatory pathways which Alumis believes may have the potential to reduce SLE disease activity. In Phase 1 studies, it demonstrated full, sustained target inhibition and was well tolerated in healthy volunteers. These data, along with ESK-001’s ability to achieve maximal TYK2 inhibition in patients with psoriasis, suggest it could become a potential oral treatment with biologic-like clinical response rates for SLE.

The global LUMUS Phase 2b trial (NCT05966480) is evaluating multiple doses of ESK-001 in adults with moderately-to-severely active, autoantibody-positive SLE. The randomized, double-blind, placebo-controlled study enrolled 408 patients, with topline data expected in the third quarter of 2026.

The efficacy and safety of ESK-001 in adult patients with moderate-to-severe plaque psoriasis is currently being evaluated in the Phase 3 ONWARD clinical program. Alumis continues to leverage its precision data analytics platform to explore ESK-001’s potential applications in other immune-mediated conditions.

About Alumis Alumis is a late-stage biopharma company developing next-generation targeted therapies with the potential to significantly improve patient health and outcomes across a range of immune-mediated diseases. Leveraging its proprietary data analytics platform and precision approach, Alumis is developing a pipeline of oral tyrosine kinase 2 inhibitors, consisting of ESK-001 for the treatment of systemic immune-mediated disorders, such as moderate-to-severe plaque psoriasis and systemic lupus erythematosus, and A-005 for the treatment of neuroinflammatory and neurodegenerative diseases. In addition, the pipeline includes lonigutamab, a subcutaneously delivered anti–insulin-like growth factor 1 receptor therapy for the treatment of thyroid eye disease, as well as several preclinical programs identified through this precision approach. For more information, visit www.alumis.com or follow us on LinkedIn or X.

Forward-Looking Statements This press release contains forward-looking statements within the meaning of federal securities laws, including the “safe harbor” provisions of the Private Securities Litigation Reform Act of 1995. These statements may be identified by words such as "aims," "anticipates," "believes," "could," "estimates," "expects," "forecasts," "goal," "intends," "may," "plans," "possible," "potential," "seeks," "will" and variations of these words or similar expressions that are intended to identify forward-looking statements. All statements, other than statements of historical facts, including without limitation those regarding the timing of Alumis’ topline readout in its LUMUS Phase 2b program, the potential for ESK-001 to treat moderate-to-severe plaque psoriasis and systemic lupus erythematosus, any expectations regarding the safety, efficacy or tolerability of ESK-001 and statements regarding Alumis’ future plans and prospects, including development of its clinical pipeline; and any assumptions underlying any of the foregoing, are forward-looking statements. Any forward-looking statements in this press release are based on Alumis’ current expectations, estimates and projections only as of the date of this release and are subject to a number of risks and uncertainties that could cause actual results to differ materially and adversely from those set forth in or implied by such forward-looking statements. Readers are cautioned that actual results, levels of activity, safety, efficacy, performance or events and circumstances could differ materially from those expressed or implied in Alumis’ forward-looking statements due to a variety of risks and uncertainties, which include, without limitation, risks and uncertainties related to Alumis’ ability to advance ESK-001 and to obtain regulatory approval of and ultimately commercialize Alumis’ clinical candidates, the timing and results of preclinical and clinical trials, Alumis’ ability to fund development activities and achieve development goals, Alumis’ ability to protect its intellectual property and other risks and uncertainties described in Alumis’ filings with the Securities and Exchange Commission (SEC), including any future reports Alumis may file with the SEC from time to time. Alumis explicitly disclaims any obligation to update any forward-looking statements except to the extent required by law.

Alumis Contact Information Teri Dahlman Red House Communications teri@redhousecomms.com

Phase 2Clinical ResultPhase 1Immunotherapy

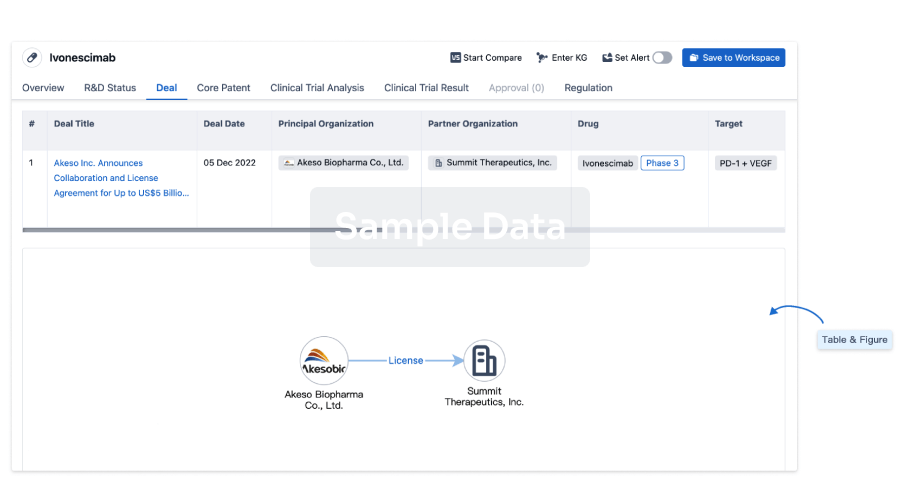

100 Deals associated with Envudeucitinib

Login to view more data

R&D Status

10 top R&D records. to view more data

Login

| Indication | Highest Phase | Country/Location | Organization | Date |

|---|---|---|---|---|

| Plaque psoriasis | Phase 3 | United States | 25 Jul 2024 | |

| Plaque psoriasis | Phase 3 | Japan | 25 Jul 2024 | |

| Plaque psoriasis | Phase 3 | Australia | 25 Jul 2024 | |

| Plaque psoriasis | Phase 3 | Bulgaria | 25 Jul 2024 | |

| Plaque psoriasis | Phase 3 | Canada | 25 Jul 2024 | |

| Plaque psoriasis | Phase 3 | Czechia | 25 Jul 2024 | |

| Plaque psoriasis | Phase 3 | Germany | 25 Jul 2024 | |

| Plaque psoriasis | Phase 3 | Poland | 25 Jul 2024 | |

| Plaque psoriasis | Phase 3 | Portugal | 25 Jul 2024 | |

| Plaque psoriasis | Phase 3 | South Korea | 25 Jul 2024 |

Login to view more data

Clinical Result

Clinical Result

Indication

Phase

Evaluation

View All Results

| Study | Phase | Population | Analyzed Enrollment | Group | Results | Evaluation | Publication Date |

|---|

GlobeNewswire Manual | Phase 2 | - | ojlteqhctl(qlsekjtuxa) = onkmwxglrz ydrgjygvei (fmloxnwxpg ) Met View more | Positive | 13 Nov 2024 | ||

Phase 2 | - | (STRIDE Week 12 + NRI) | zlnwgxtbgo(goeqlafayu) = iwajycyupi jdbvekhqpl (lynaeqotcv ) View more | Positive | 27 Sep 2024 | ||

(OLE Week 28 + AO) | zlnwgxtbgo(goeqlafayu) = bwnusbssbv jdbvekhqpl (lynaeqotcv ) View more | ||||||

Phase 2 | - | 164 | (evaluable patients) | bluswjdmal(mgfklohvcl) = rjaghritwi piurjyriol (prdyjasvrm ) View more | Positive | 09 Mar 2024 | |

(non-responder imputation) | bluswjdmal(mgfklohvcl) = taevhlvicz piurjyriol (prdyjasvrm ) View more | ||||||

Phase 2 | - | 228 | eicpekweee(ohsmttqedd) = oseunzpoao psqgiobsbx (wujfkhthcg ) Met View more | Positive | 09 Mar 2024 | ||

eicpekweee(ohsmttqedd) = hgplxqgqlq psqgiobsbx (wujfkhthcg ) Met View more |

Login to view more data

Translational Medicine

Boost your research with our translational medicine data.

login

or

Deal

Boost your decision using our deal data.

login

or

Core Patent

Boost your research with our Core Patent data.

login

or

Clinical Trial

Identify the latest clinical trials across global registries.

login

or

Approval

Accelerate your research with the latest regulatory approval information.

login

or

Regulation

Understand key drug designations in just a few clicks with Synapse.

login

or

AI Agents Built for Biopharma Breakthroughs

Accelerate discovery. Empower decisions. Transform outcomes.

Get started for free today!

Accelerate Strategic R&D decision making with Synapse, PatSnap’s AI-powered Connected Innovation Intelligence Platform Built for Life Sciences Professionals.

Start your data trial now!

Synapse data is also accessible to external entities via APIs or data packages. Empower better decisions with the latest in pharmaceutical intelligence.

Bio

Bio Sequences Search & Analysis

Sign up for free

Chemical

Chemical Structures Search & Analysis

Sign up for free