Request Demo

Last update 16 Dec 2025

Vantictumab

Last update 16 Dec 2025

Overview

Basic Info

Drug Type Monoclonal antibody |

Synonyms Anti-frizzled receptor monoclonal antibody, Anti-Fzd receptor monoclonal antibody, Anti-Fzd7 receptor monoclonal antibody + [3] |

Target |

Action inhibitors |

Mechanism FZD7 inhibitors(frizzled class receptor 7 inhibitors) |

Therapeutic Areas |

Active Indication |

Originator Organization |

Active Organization |

Inactive Organization- |

License Organization |

Drug Highest PhasePhase 1 |

First Approval Date- |

Regulation- |

Login to view timeline

Structure/Sequence

Sequence Code 9645501L

Source: *****

Sequence Code 319372617H

Source: *****

Related

4

Clinical Trials associated with VantictumabNCT01957007

A Phase 1b Study of Vantictumab (OMP-18R5) in Combination With Docetaxel in Patients With Previously Treated Non-Small Cell Lung Cancer

This is an open-label Phase 1b dose-escalation study to assess the safety, tolerability, and PK of vantictumab when combined with docetaxel.

Start Date01 Sep 2013 |

Sponsor / Collaborator- |

NCT01973309

A Phase 1b Dose Escalation Study of Vantictumab (OMP-18R5) in Combination With Paclitaxel in Patients With Locally Recurrent or Metastatic Breast Cancer

This is an open-label Phase 1b dose-escalation study to assess the safety, tolerability, and PK of vantictumab when combined with paclitaxel.

Start Date01 Sep 2013 |

Sponsor / Collaborator- |

NCT02005315

A Phase 1b Dose Escalation Study of Vantictumab (OMP-18R5) in Combination With Nab-Paclitaxel and Gemcitabine in Patients With Previously Untreated Stage IV Pancreatic Cancer

This is an open-label Phase 1b dose-escalation study to assess the safety, tolerability, and PK of vantictumab when combined with nab-paclitaxel and gemcitabine.

Start Date01 Sep 2013 |

Sponsor / Collaborator- |

100 Clinical Results associated with Vantictumab

Login to view more data

100 Translational Medicine associated with Vantictumab

Login to view more data

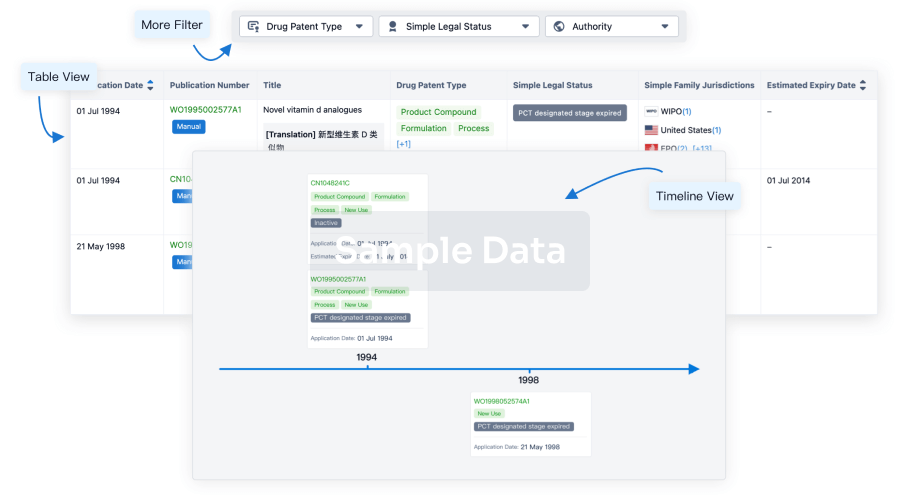

100 Patents (Medical) associated with Vantictumab

Login to view more data

14

Literatures (Medical) associated with Vantictumab02 Nov 2021·Expert opinion on therapeutic patentsQ2 · MEDICINE

Recent updates on Wnt signaling modulators: a patent review (2014-2020)

Q2 · MEDICINE

Review

Author: Patel, Bhumika D. ; Goswami, Vishalgiri G.

Introduction: Wnt signaling is a signal transduction pathway that plays a vital role in embryonic development and normal tissue preservation. Dysfunction of it gives rise to various diseases like cancer, Alzheimer's, metabolic and skeletal disorders, kidney and liver disease, etc. Thus, targeting Wnt pathway can be a potential approach to design and develop novel therapeutic classes.Areas covered: Authors provided an overview of Wnt modulators from 2014 to 2020. Different heterocyclic scaffolds and their pharmacology from a total of 104 PCT applications have been summarized.Expert opinion: The scientific community is working extensively to bring first in the class molecule to the market which targets Wnt pathway. Lorecivivint, Wnt inhibitor, for the treatment of knee Osteoarthritis and SM-04554, Wnt activator, for the treatment of androgenetic alopecia are currently under Phase III. Other molecules, LGK-974, RXC-004, ETC-159, CGX-1321, PRI-724, CWP-232291 and BC-2059 are also under different stages of clinical development for the treatment of cancer. Antibody based Wnt modulator, OTSA101-DTPA-90Y is currently under Phase I for the treatment of Relapsed or Refractory Synovial Sarcoma while OMP-18R5 is under Phase I for Metastatic Breast Cancer. Ongoing preclinical/clinical trials will define the role of the Wnt pathway in different therapeutic areas and open new opportunities.

01 Nov 2020·Breast cancer research and treatmentQ2 · MEDICINE

Phase Ib clinical trial of the anti-frizzled antibody vantictumab (OMP-18R5) plus paclitaxel in patients with locally advanced or metastatic HER2-negative breast cancer

Q2 · MEDICINE

Article

Author: Mita, Alain ; Xu, Lu ; O'Shaughnessy, Joyce ; Zhang, Chun ; Osborne, Cynthia ; Diamond, Jennifer R ; Brachmann, Rainer K ; Kapoun, Ann M ; Richards, Donald ; Stagg, Bob ; Becerra, Carlos ; Henner, Randall ; Farooki, Azeez ; Mita, Monica ; Uttamsingh, Shailaja

PURPOSE:

Vantictumab is a monoclonal antibody that binds to frizzled (FZD) receptors and inhibits canonical WNT signaling. This phase Ib dose escalation study enrolled patients with locally recurrent or metastatic HER2-negative breast cancer who were treated with weekly paclitaxel in combination with escalating doses of vantictumab.

METHODS:

Patients were enrolled in dose escalation cohorts treated with weekly paclitaxel 90 mg/m2 on days 1, 8 and 15 in combination with vantictumab 3.5-14 mg/kg days 1 and 15 or 3-8 mg/kg day 1 of every 28-day cycle. Primary endpoints were safety, dose-limiting toxicities (DLTs). Secondary endpoints included pharmacokinetics, efficacy and an exploratory biomarker analysis.

RESULTS:

Forty-eight female patients with a mean age of 54 were enrolled. The majority (66.6%) received prior chemotherapy for recurrent or metastatic disease; 45.8% were hormone receptor (HR)-positive, HER2-negative and 54.2% triple-negative. The most frequent adverse events related to any study treatment were nausea (54.2%), alopecia (52.1%), fatigue (47.9%), and peripheral neuropathy (43.8%). No DLTs occurred; however, 6 patients experienced fractures outside of the DLT window. The overall response rate was 31.3% and the clinical benefit rate was 68.8%. A 6-gene WNT pathway signature showed significant association with progression-free survival (PFS) and overall survival (OS) for the biomarker high versus biomarker low groups (PFS: p = 0.029 and OS: p = 0.00045, respectively).

CONCLUSIONS:

The combination of vantictumab and weekly paclitaxel was generally well tolerated with promising efficacy; however, the incidence of fractures limits future clinical development of this particular WNT inhibitor in metastatic breast cancer.

CLINICAL TRIAL REGISTRATION:

ClinicalTrials.gov registration: NCT01973309.

01 Jun 2020·Investigational new drugsQ3 · MEDICINE

A phase 1b dose escalation study of Wnt pathway inhibitor vantictumab in combination with nab-paclitaxel and gemcitabine in patients with previously untreated metastatic pancreatic cancer

Q3 · MEDICINE

Article

Author: O'Neil, Bert H ; Berlin, Jordan ; Dotan, Efrat ; Cardin, Dana B ; Shahda, Safi ; Lenz, Heinz-Josef ; Davis, S Lindsey ; Kapoun, Ann M ; Cohen, Steven J ; Stagg, Robert J ; Messersmith, Wells A

Summary:

Vantictumab is a fully human monoclonal antibody that inhibits Wnt pathway signaling through binding FZD1, 2, 5, 7, and 8 receptors. This phase Ib study evaluated vantictumab in combination with nab-paclitaxel and gemcitabine in patients with untreated metastatic pancreatic adenocarcinoma. Patients received vantictumab at escalating doses in combination with standard dosing of nab-paclitaxel and gemcitabine according to a 3 + 3 design. A total of 31 patients were treated in 5 dosing cohorts. Fragility fractures attributed to vantictumab occurred in 2 patients in Cohort 2 (7 mg/kg every 2 weeks), and this maximum administered dose (MAD) on study was considered unsafe. The dosing schedule was revised to every 4 weeks for Cohorts 3 through 5, with additional bone safety parameters added. Sequential dosing of vantictumab followed by nab-paclitaxel and gemcitabine was also explored. No fragility fractures attributed to vantictumab occurred in these cohorts; pathologic fracture not attributed to vantictumab was documented in 2 patients. The study was ultimately terminated due to concerns around bone-related safety, and thus the maximum tolerated dose (MTD) of the combination was not determined. The MAD of vantictumab according to the revised dosing schedule was 5 mg/kg (n = 16).

5

News (Medical) associated with Vantictumab10 Nov 2025

Data from Phase 3 Orbit and Cosmic studies of setrusumab in osteogenesis imperfecta on-track for around the end of 2025

Cash of $48.7 million as of September 30, 2025, expected to support operations into 2027

London, November 10, 2025– Mereo BioPharma Group plc (NASDAQ: MREO) (“Mereo” or the “Company”), a clinical-stage biopharmaceutical company focused on rare diseases, today announced its financial results for the third quarter ended September 30, 2025, and provided recent corporate highlights.

“We are rapidly approaching a major transition period in our corporate evolution, with the Phase 3 Orbit and Cosmic studies of setrusumab in osteogenesis imperfecta on track to read out around the end of the year. Based on the data from prior studies, we remain confident in the potential of setrusumab to reduce fractures and improve quality of life for people with OI. We continue to invest in commercial readiness activities to ensure Mereo is well positioned for a potential launch in our European territories,” said Dr. Denise Scots-Knight, Chief Executive Officer of Mereo. “Alongside the progress of the setrusumab program, we are continuing to advance partnering discussions for alvelestat. In addition, we are excited to have retained European commercial rights in our recent partnership deal with āshibio for vantictumab, which is being investigated in autosomal dominant osteopetrosis type 2, another rare bone disease for which promising preclinical data were presented at this year’s ASBMR Annual Meeting. With $48.7 million of cash at the end of the third quarter, we remain well-capitalized to continue executing through these important milestones.”

Third Quarter 2025 Highlights, Recent Developments, and Anticipated Milestones

Setrusumab (UX143) for osteogenesis imperfecta (OI)

The Phase 3 Orbit and Cosmic studies, led by our partner Ultragenyx, evaluating setrusumab in pediatric and young adult patients and young pediatric patients with OI, are progressing towards final analyses at which time patients will have been on therapy for at least 18 months. The data from both Orbit and Cosmic are expected around the end of 2025. The threshold for the Phase 3 Orbit final analysis is p<0.039 and the threshold for the Phase 3 Cosmic final analysis is p<0.05. Pre-commercial efforts continue in Europe where Mereo holds commercial rights. These include continuation of the SATURN program and an expansion of the activities to determine the potential addressable market and identify treatment centers beyond the five major countries in Europe to the Nordic and Benelux regions.

Alvelestat (MPH-966) for alpha-1-anti-trypsin deficiency lung disease (AATD-LD)

Activities to support initiation of the planned single, global Phase 3 pivotal study are ongoing. The Company continues to be actively engaged with multiple potential partners regarding development and commercialization of alvelestat.

Vantictumab for automsomal dominant osteopetrosis type 2 (ADO2)

Vantictumab is a fully-human monoclonal antibody that binds to certain frizzled receptors and inhibits Wnt signaling pathways, which was previously being developed in oncology settings. Mereo granted āshibio, Inc. an exclusive license to develop vantictumab in ADO2. Under the agreement, announced in August 2025, Mereo has retained European commercial rights, and has granted āshibio the right to commercialize in the U.S. and rest of the world.

Third Quarter 2025 Financial Results

Total research and development (“R&D”) expenses increased by $1.1 million, from $3.2 million in the third quarter of 2024 to $4.3 million in the three months ended September 30, 2025. The increase was primarily due to increases of $0.9 million in R&D expenses for setrusumab and $0.5 million for alvelestat, partially offset by a reduction of $0.2 million in R&D expenses for etigilimab. The increase in program expenses for setrusumab was primarily driven by amounts due under the manufacturing and supply agreement with our partner, Ultragenyx, as well as ongoing activities related to real-world evidence programs and medical affairs activities in Europe. This is in addition to costs we incur in relation to our collaboration with Ultragenyx, who fund the global development of the program, including input into development, regulatory and manufacturing plans. The increase in program expenses for alvelestat was primarily due to activities undertaken in preparation for the Phase 3 study, including drug product and packaging, in the three months ended September 30, 2025.

General and administrative (“G&A”) expenses decreased by $0.2 million, from $6.2 million in the third quarter of 2024 to $6.0 million in the third quarter of 2025. The decrease was primarily due to lower professional fees. Net loss for the third quarter of 2025 was $7.0 million compared to $15.0 million for the third quarter of 2024, primarily reflecting an operating loss of $10.0 million and a foreign currency transaction gain of $1.9 million. As of September 30, 2025, the Company had cash and cash equivalents of $48.7 million, compared to $69.8 million as of December 31, 2024. The Company’s guidance remains unchanged, and it continues to expect, based on current operational plans, that its existing cash and cash equivalents balance will enable it to fund its currently committed clinical trials, operating expenses, and capital expenditure requirements into 2027. This guidance does not include any payments associated with a potential partnership for alvelestat or business development activity around any of the Company’s non-core programs. Total ordinary shares issued as of September 30, 2025, were 795,484,404. Total ADS equivalents as of September 30, 2025, were 159,096,880, with each ADS representing five ordinary shares of the Company.

Forward-Looking StatementsThis press release contains “forward-looking statements” that involve substantial risks and uncertainties. All statements other than statements of historical fact contained herein are forward-looking statements within the meaning of Section 27A of the United States Securities Act of 1933, as amended, and Section 21E of the United States Securities Exchange Act of 1934, as amended. Forward-looking statements usually relate to future events and anticipated revenues, earnings, cash flows or other aspects of our operations or operating results. Forward-looking statements are often identified by the words “believe,” “expect,” “anticipate,” “plan,” “intend,” “foresee,” “should,” “would,” “could,” “may,” “estimate,” “outlook” and similar expressions, including the negative thereof. The absence of these words, however, does not mean that the statements are not forward-looking. These forward-looking statements are based on the Company’s current expectations, beliefs and assumptions concerning future developments and business conditions and their potential effect on the Company. While management believes that these forward-looking statements are reasonable as and when made, there can be no assurance that future developments affecting the Company will be those that it anticipates.

All of the Company’s forward-looking statements involve known and unknown risks and uncertainties some of which are significant or beyond its control and assumptions that could cause actual results to differ materially from the Company’s historical experience and its present expectations or projections. Such risks and uncertainties include, among others, the uncertainties inherent in the clinical development process; the Company’s reliance on third parties to conduct and provide funding for its clinical trials; the Company’s dependence on enrollment of patients in its clinical trials; and the Company’s dependence on its key executives. You should carefully consider the foregoing factors and the other risks and uncertainties that affect the Company’s business, including those described in the “Risk Factors” section of its Annual Report on Form 10-K, as well as discussions of potential risks, uncertainties, and other important factors in the Company’s subsequent filings with the Securities and Exchange Commission. The Company wishes to caution you not to place undue reliance on any forward-looking statements, which speak only as of the date hereof. The Company undertakes no obligation to publicly update or revise any of our forward-looking statements after the date they are made, whether as a result of new information, future events or otherwise, except to the extent required by law.

Mereo BioPharma Contacts:

Mereo

+44 (0)333 023 7300

Denise Scots-Knight, Chief Executive Officer Christine Fox, Chief Financial Officer

Burns McClellan (Investor Relations Adviser to Mereo)

+01 646 930 4406

Lee Roth

Investors

investors@mereobiopharma.com

MEREO BIOPHARMA GROUP PLCCONDENSED CONSOLIDATED BALANCE SHEETS(In thousands, except share and per share amounts)(Unaudited)

MEREO BIOPHARMA GROUP PLCCONDENSED CONSOLIDATED STATEMENTSOF OPERATIONS AND COMPREHENSIVE LOSS(In thousands, except per share amounts)(Unaudited)

Financial StatementLicense out/inPhase 3Phase 1

20 Aug 2025

– Company’s second clinical-stage asset licensed from Mereo Biopharma based on novel insights generated in a mouse model of osteopetrosis –

–

āshibio

has exclusive license to develop and commercialize vantictumab globally, excluding Europe, where Mereo retains commercial rights –

– Vantictumab development program is supported by safety and biomarker data generated in previous clinical trials –

BURLINGAME, CA, USA I August 19, 2025 I

āshibio

, a privately held, clinical-stage biotechnology company developing novel therapeutics for the treatment of bone and connective tissue disorders, today announced an exclusive licensing agreement with Mereo BioPharma (NASDAQ: MREO) for vantictumab for the treatment of autosomal dominant osteopetrosis type 2 (ADO2), a rare, debilitating bone disorder with no approved therapies. The licensing of vantictumab represents a strategic expansion of āshibio’s pipeline of clinical-stage assets that address high unmet needs and carry significant clinical and commercial potential.

ADO2, also known as Albers-Schönberg disease, is a genetic disorder caused by reduced function of osteoclasts. Impaired osteoclast function results in dense, brittle bone and leads to complications such as multiple fractures, poor bone healing, low blood counts (due to bone marrow sequestration), and painful nerve compression. The most common form of osteopetrosis, ADO2 results from a mutation in the chloride channel 7 (CLCN7) gene and has a reported incidence of 1 in 20,000 births.

1

“People living with autosomal dominant osteopetrosis type 2 face a lifetime of bone-related complications resulting in significant morbidity, multiple surgical procedures, chronic pain, and impaired quality of life – yet patients have no approved therapy to address the disease,” said āshibio Chief Executive Officer Pankaj Bhargava, MD. “Bringing vantictumab into our pipeline reflects our commitment to advancing therapies for rare skeletal conditions and improving the lives of those affected by serious bone disorders.”

Vantictumab is a monoclonal antibody that selectively binds to certain frizzled (Fzd) receptors and inhibits Wnt signaling pathways.

2

Originally intended for the treatment of cancer, vantictumab has been previously evaluated in oncology clinical trials, demonstrating a favorable safety and pharmacokinetic profile. Previous clinical trials have provided biomarker data that directly support the activity of vantictumab on osteoclast function. These data significantly derisk the clinical program and allow āshibio to rapidly advance vantictumab into clinical development for ADO2.

Preclinical data supporting the development of vantictumab in ADO2 will be presented at the upcoming American Society for Bone and Mineral Research (ASBMR) annual meeting, which takes place September 5-8, 2025 in Seattle, Wash.

Under the terms of the agreement, āshibio will lead global clinical development for vantictumab in adult and pediatric patients. Mereo has granted āshibio an exclusive license to develop and commercialize vantictumab in the US and the rest of the world, excluding Europe, where Mereo retains commercial rights.

About āshibio

āshibio is a privately held, clinical-stage biotechnology company developing a pipeline of novel therapeutics for the treatment of bone disorders. Founded in 2022, āshibio exited stealth mode in June 2024 with $40 million in seed and Series A financing. The company has initiated a Phase 2/3 trial of its lead asset, andecaliximab, in patients with fibrodysplasia ossificans progressiva (FOP), a rare genetic disorder characterized by progressive heterotopic ossification (HO), a pathological condition characterized by abnormal bone formation in muscle and soft tissues. āshibio has also initiated a development program in non-hereditary heterotopic ossification (NHHO), a severely disabling condition for which there are no approved therapies. The first study in the NHHO program is a Phase 1b trial of andecaliximab in patients with spinal cord injury at risk of HO. For more information, visit

www.ashibio.com

.

About Mereo BioPharma

Mereo BioPharma is a biopharmaceutical company focused on the development of innovative therapeutics for rare diseases. The Company has two rare disease product candidates: setrusumab for the treatment of osteogenesis imperfecta (OI); and alvelestat for the treatment of severe alpha-1 antitrypsin deficiency-associated lung disease (AATD-LD). Mereo’s partner, Ultragenyx Pharmaceutical, Inc., has completed enrollment in the Phase 3 portion of a pivotal Phase 2/3 study in pediatric patients and young adults (5 to 25 years old) for setrusumab in OI and in the Phase 3 study in pediatric patients (2 to <7 years old). The partnership with Ultragenyx includes potential additional milestone payments of up to $245 million and royalties to Mereo on commercial sales in Ultragenyx territories. Mereo has retained EU and UK commercial rights and will pay Ultragenyx royalties on commercial sales in those territories. Setrusumab has received Orphan Designation for osteogenesis imperfecta from the European Commission (“EC”) and the U.S. Food and Drug Administration (FDA), PRIME designation from the European Medicines Agency (EMA), and Breakthrough Therapy and Rare Pediatric Disease Designations from the FDA. Alvelestat has received Orphan Designation for AATD from the EC and the FDA, and Fast Track designation from the FDA for AATD-LD. Mereo has also entered into an exclusive global license agreement with ReproNovo SA, a reproductive medicine company, for the development and commercialization of leflutrozole, a non-steroidal aromatase inhibitor.

In addition to the rare disease programs, Mereo has two oncology product candidates, etigilimab, an anti-TIGIT; and navicixizumab for the potential treatment of late-line ovarian cancer. Navicixizumab has been partnered with Feng Biosciences, Inc. in a global licensing agreement that includes milestone payments and royalties. For more information, visit

www.mereobiopharma.com

.

1

Wu CC, Econs MJ, DiMeglio LA, et al. Diagnosis and management of osteopetrosis: consensus guidelines from the Osteopetrosis Working Group.

J Clin Endocrinol Metab

. 2017 Sep 1;102(9):3111-3123. doi: 10.1210/jc.2017-01127

2

Diamond JR, Becerra C, Richards D, et al. Phase Ib clinical trial of the anti-frizzled antibody vantictumab (OMP-18R5) plus paclitaxel in patients with locally advanced or metastatic HER2-negative breast cancer.

Breast Cancer Res Treat

. 2020 Aug 14;184(1):53–62. doi:

10.1007/s10549-020-05817-w

SOURCE:

āshibio

License out/inOrphan DrugPhase 1Phase 3Fast Track

20 Aug 2025

Autosomal dominant osteopetrosis type 2 is a rare bone condition that currently lacks approved therapies. Credit: PeopleImages.com – Yuri A/Shutterstock.com.

Biotechnology company āshibio has entered an exclusive licencing agreement with Mereo BioPharma for the monoclonal antibody, vantictumab, to treat a rare bone disorder.

The agreement aims to facilitate antibody development for the autosomal dominant osteopetrosis type 2 (ADO2) bone condition that currently lacks approved therapies.

āshibio will oversee clinical development of vantictumab globally for both adult and paediatric patients.

Mereo has granted exclusive rights to āshibio for the development and commercialisation in the US and other regions outside of Europe, where Mereo retains commercial rights.

ADO2, also referred to as Albers-Schönberg disease, is a genetic disorder characterised by reduced osteoclast function, leading to dense and brittle bones.

It is linked to mutations in the chloride channel 7 (CLCN7) gene, with an incidence rate of one in 20,000 births.

GlobalData Strategic Intelligence

US Tariffs are shifting - will you react or anticipate?

Don’t let policy changes catch you off guard. Stay proactive with real-time data and expert analysis.

By GlobalData

Learn more about Strategic Intelligence

Āshibio CEO Pankaj Bhargava stated: “People living with autosomal dominant osteopetrosis type 2 face a lifetime of bone-related complications resulting in significant morbidity, multiple surgical procedures, chronic pain and impaired quality of life – yet patients have no approved therapy to address the disease.

“Bringing vantictumab into our pipeline reflects our commitment to advancing therapies for rare skeletal conditions and improving the lives of those affected by serious bone disorders.”

Vantictumab functions by selectively binding to specific frizzled (Fzd) receptors and inhibiting Wnt (wingless-related integration) signalling pathways.

Initially developed for cancer treatment, it has undergone clinical trials in oncology showing a favourable safety and pharmacokinetic profile.

Previous studies have generated biomarker data that support the efficacy of vantictumab on osteoclast function, which aids in reducing risks associated with the clinical programme and allows āshibio to expedite the advancement of vantictumab into clinical trials for ADO2.

Pharmaceutical Technology Excellence Awards - The Benefits of Entering

Gain the recognition you deserve! The

Pharmaceutical Technology Excellence Awards

celebrate innovation, leadership, and impact. By entering, you showcase your achievements, elevate your industry profile, and position yourself among top leaders driving pharmaceutical advancements. Don’t miss your chance to stand out—submit your entry today!

Nominate Now

License out/in

100 Deals associated with Vantictumab

Login to view more data

External Link

| KEGG | Wiki | ATC | Drug Bank |

|---|---|---|---|

| D10410 | Vantictumab | - |

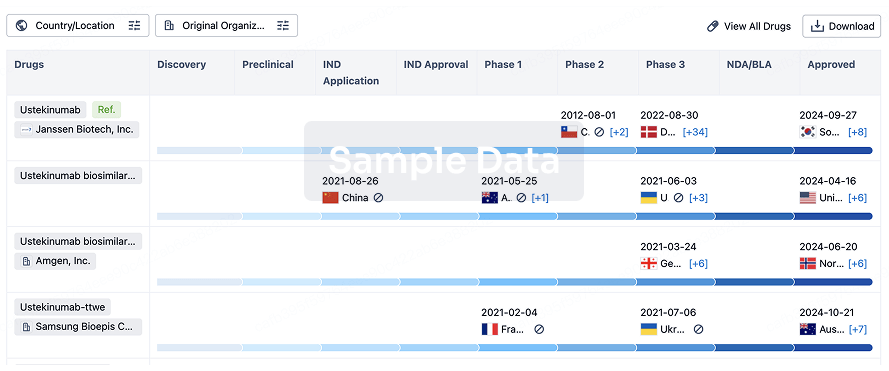

R&D Status

10 top R&D records. to view more data

Login

| Indication | Highest Phase | Country/Location | Organization | Date |

|---|---|---|---|---|

| Metastatic breast cancer | Phase 1 | United States | - | 01 Sep 2013 |

| Pancreatic Ductal Adenocarcinoma | Phase 1 | United States | - | 01 Sep 2013 |

| Recurrent Non-Small Cell Lung Cancer | Phase 1 | United States | - | 01 Sep 2013 |

| Breast Cancer | Phase 1 | - | - | |

| Non-Small Cell Lung Cancer | Phase 1 | - | - | |

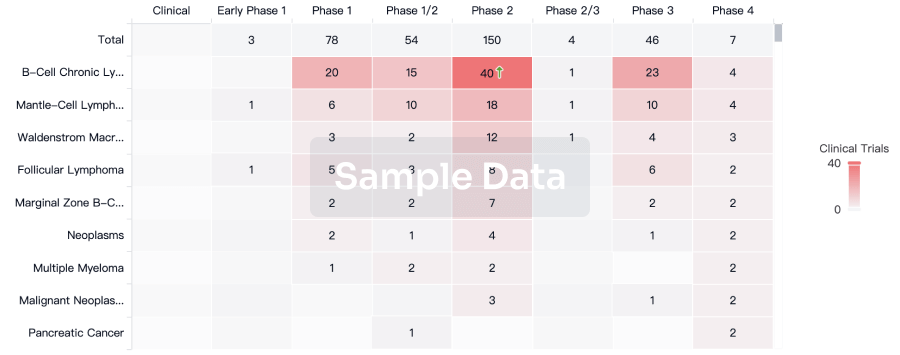

| Pancreatic Cancer | Phase 1 | - | - | |

| Osteopetrosis | Preclinical | United States | 01 Dec 2025 | |

| Neoplasms | Preclinical | United States | 02 Jul 2012 |

Login to view more data

Clinical Result

Clinical Result

Indication

Phase

Evaluation

View All Results

| Study | Phase | Population | Analyzed Enrollment | Group | Results | Evaluation | Publication Date |

|---|

Phase 1 | Metastatic HER2-Negative Breast Carcinoma HER2-negative | 48 | qnyupyrlcg(kyhgescyvo) = qnnccpalvc yuttcxemeg (xkjohwywve ) View more | Positive | 01 Nov 2020 | ||

Phase 1 | Metastatic Pancreatic Cancer First line | 31 | xhzrzjcyga(gezfsmtgqd) = not determined vaebiquwmi (gigzagyrfr ) View more | Negative | 01 Jun 2020 | ||

Phase 1 | 31 | Vantictumab + Nab-P + G | kbprcjobmd(gtmbbhrpft) = grade 3 dehydration in 1 of 9 patients in cohort 4 (5 mg/kg q4w) tovplrgcui (keexszfvcd ) View more | Negative | 29 Jan 2019 | ||

Phase 1 | 23 | fxxyxhbdry(ynwnicdvhl) = n = 3 llcrbyocnw (fiawwoawqw ) View more | - | 20 May 2016 |

Login to view more data

Translational Medicine

Boost your research with our translational medicine data.

login

or

Deal

Boost your decision using our deal data.

login

or

Core Patent

Boost your research with our Core Patent data.

login

or

Clinical Trial

Identify the latest clinical trials across global registries.

login

or

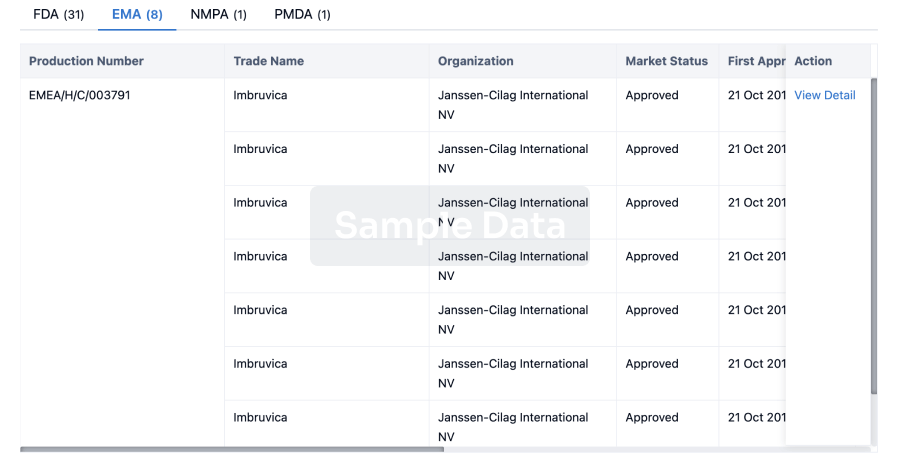

Approval

Accelerate your research with the latest regulatory approval information.

login

or

Biosimilar

Competitive landscape of biosimilars in different countries/locations. Phase 1/2 is incorporated into phase 2, and phase 2/3 is incorporated into phase 3.

login

or

Regulation

Understand key drug designations in just a few clicks with Synapse.

login

or

AI Agents Built for Biopharma Breakthroughs

Accelerate discovery. Empower decisions. Transform outcomes.

Get started for free today!

Accelerate Strategic R&D decision making with Synapse, PatSnap’s AI-powered Connected Innovation Intelligence Platform Built for Life Sciences Professionals.

Start your data trial now!

Synapse data is also accessible to external entities via APIs or data packages. Empower better decisions with the latest in pharmaceutical intelligence.

Bio

Bio Sequences Search & Analysis

Sign up for free

Chemical

Chemical Structures Search & Analysis

Sign up for free