Request Demo

Last update 23 Aug 2025

Petrelintide

Last update 23 Aug 2025

Overview

Basic Info

Drug Type Synthetic peptide |

Synonyms ZP 8396, ZP-8396, ZP8396 |

Target |

Action modulators |

Mechanism AMYR modulators(Amylin receptor modulators) |

Therapeutic Areas |

Active Indication |

Inactive Indication- |

Originator Organization |

Active Organization |

Inactive Organization- |

License Organization |

Drug Highest PhasePhase 2 |

First Approval Date- |

Regulation- |

Login to view timeline

Structure/Sequence

Sequence Code 1177483782

Source: *****

Related

7

Clinical Trials associated with PetrelintideNCT06926842

A Randomized, Double-Blind, Phase 2 Trial of Once-Weekly Petrelintide Compared With Placebo in Participants With Overweight or Obesity and Type 2 Diabetes

The main purpose of this study is to investigate efficacy and safety of three doses of petrelintide versus placebo in participants with overweight or obesity and type 2 diabetes.

Start Date22 Apr 2025 |

Sponsor / Collaborator  Zealand Pharma A/S Zealand Pharma A/S [+1] |

NCT07076030

Pharmacokinetics of Petrelintide Following Administration to Participants With Impaired Renal Function

This clinical research study is testing the study compound petrelintide that is being developed for the weight management in people with obesity or overweight with comorbidities or related diseases.

The aim of this clinical research study is to investigate whether the effects of petrelintide will be different in people with normal kidney function compared to people with impaired kidney function.

The aim of this clinical research study is to investigate whether the effects of petrelintide will be different in people with normal kidney function compared to people with impaired kidney function.

Start Date15 Apr 2025 |

Sponsor / Collaborator  Zealand Pharma A/S Zealand Pharma A/S [+1] |

CTIS2024-518124-77-00

- ZP8396-24059

Start Date26 Mar 2025 |

Sponsor / Collaborator |

100 Clinical Results associated with Petrelintide

Login to view more data

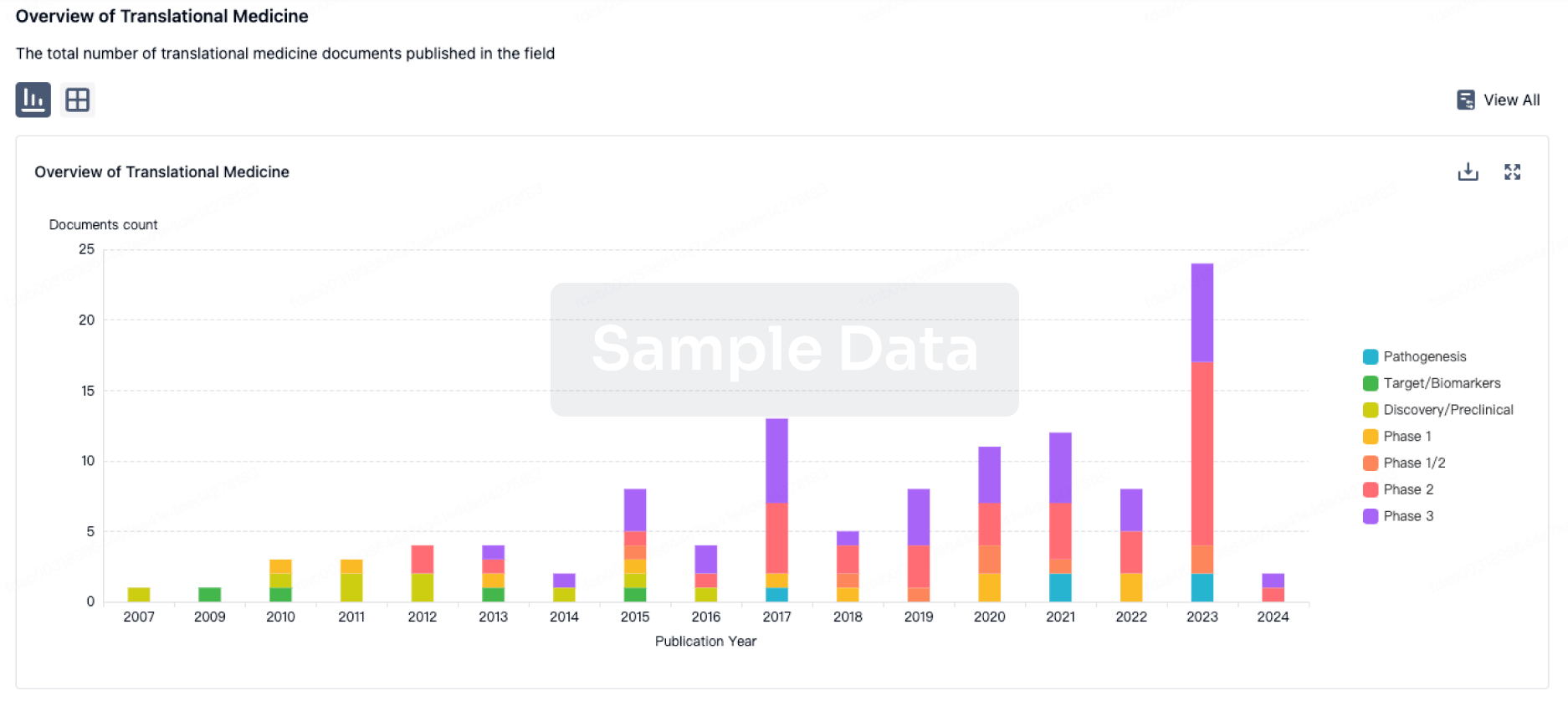

100 Translational Medicine associated with Petrelintide

Login to view more data

100 Patents (Medical) associated with Petrelintide

Login to view more data

1

Literatures (Medical) associated with Petrelintide24 Jul 2025·JOURNAL OF MEDICINAL CHEMISTRY

Discovery of BGM1812, a Novel Dual Amylin and Calcitonin Receptor Agonist for Obesity Treatment

Article

Author: Song, Yunsong ; Zheng, Zheng ; Yuan, Jiandong ; Ding, Haifeng ; Li, Xionghao ; Zhang, Zhoudong ; Huang, Yangqing ; Zong, Leilei ; Liu, Wenlang ; Li, Huanqiu ; Wang, Zitong ; Feng, Xiangyang ; Shen, Xinyi ; Jiang, Xiaohui ; Jia, Jie

Parallel activation of the calcitonin receptor (CTR) and amylin receptor (AMYR) is considered a more effective weight-loss strategy. Although the novel dual amylin and calcitonin receptor agonist (DACRA), petrelintide, is currently undergoing phase II clinical trials, its agonistic activity remains insufficient compared with natural agonists. Further optimization of the agonistic capabilities of petrelintide is an attractive strategy for developing DACRAs. Due to the lack of structure-activity relationship (SAR) and target binding information, a step-by-step process involving three rounds of modifications was performed guided by structure-based drug design and molecular dynamics (MD) simulations. Two successful methylation strategies led to the identification of the more efficient novel DACRA, BGM1812, with excellent performance in terms of half-life, stability, and solubility. In both in vivo and in vitro studies, BGM1812 showed significantly enhanced efficacy. This finding provides valuable insights into the SAR of petrelintide and highlights the potential of BGM1812 as a promising obesity drug candidate.

60

News (Medical) associated with Petrelintide25 Jul 2025

Roche Pharma CEO Teresa Graham spoke to Fierce Biotech on the sidelines of the company\'s first-half earnings event.\n The uncertainty around the future of Elevidys hasn’t destroyed Roche’s belief in the potential of gene therapies, the Swiss company’s head of pharma has told Fierce Biotech, as the pharma continues to expand its research reach outside of its traditional oncology focus.Roche and its partner Sarepta Therapeutics both paused trials of Elevidys back in April following the death of a 16-year-old patient in the U.S. Since then, Roche—which markets the drug outside of the U.S.—has stopped all ex-U.S. distribution of the drug in the commercial setting for non-ambulatory patients, while the FDA requested that Sarepta halt Elevidys shipments in the U.S. Earlier this week, Roche paused shipments in all patients in countries where Elevidys’ approvals referenced the FDA.But Roche Pharma CEO Teresa Graham denied Fierce’s suggestion that the issues around Elevidys have altered how the company views gene therapy as a modality.“It doesn’t, actually,” Graham told Fierce in an interview at Roche’s headquarters in Basel, Switzerland on Thursday.“The reality is that gene therapy will be an important modality in the treatment of human health,” Graham continued. “There is a lot of promise in gene therapy. I think what the entire industry is learning is that, scientifically, it\'s just a little harder than we might have thought.” Even before the latest difficulties with Elevidys, Roche had announced a “fundamental reorganization” of Spark Therapeutics, the gene therapy unit the Swiss pharma bought for $4.3 billion in 2019. That overhaul closely followed Roche’s decision to end work on a hemophilia A gene therapy candidate, which was a focus of the Spark acquisition.Roche’s move came against a backdrop of wider industry retreat from gene therapy, with Pfizer pulling its FDA-approved hemophilia B treatment Beqvez. Bluebird bio, a gene therapy pioneer once valued at $10 billion at its peak, was sold for just $49 million upfront to private equity firms.But Roche still sees potential in the modality, according to Graham.“I am firmly convicted that over time we will crack gene therapy and we will be able to deliver really meaningful treatments to patients,” she said.Graham spoke to Fierce on the sidelines of the company’s first-half earnings event, where Roche CEO Thomas Schinecker reminded journalists that 760 boys have successfully received Elevidys in the ambulatory setting.“I\'m really hopeful that we can find a path forward for this medicine,” Graham said in the interview on Thursday. “We clearly need to talk to regulators; we clearly need to have some good conversations about the safety—but we do firmly believe in the risk-benefit of this product.”Not all regulators sound ready to be convinced, with the European Medicines Agency (EMA) announcing Friday morning that it won\'t recommend Elevidys for approval in the ambulatory setting. Roche said in a statement that it “plans to continue to work with the EMA to explore a potential path forward.” Mixed results from emerging pipeline Another drug that Roche is keeping faith in is the Parkinson’s disease prospect prasinezumab. The future of the Prothena Biosciences–partnered asset looked in doubt after the anti-alpha-synuclein antibody failed a phase 2 study in December 2024.But Roche is giving prasinezumab a second chance, with plans to launch a phase 3 trial by the end of the year off the back of an analysis of data from the failed study. Specifically, the pharma pointed to longer-term follow-up data from an open-label portion of the study suggesting a clinical benefit on top of symptomatic treatment in early-stage Parkinson’s.“Given the dramatic unmet need in Parkinson\'s, it does feel like it would be a miss not to explore this,” Graham explained.“There\'s only really been minor improvements in treatments for these patients over the last 50 years, and, in every conversation I\'ve had with [key opinion leaders], they have really encouraged us to take this forward,” she said.“There\'s a little bit of a finger feel that there\'s something there, and we\'re only really ever going to be able to pull the signal out in a phase 3,” Graham added. Roche had less faith in CT-173, an early-stage obesity drug picked up as part of its $2.7 billion acquisition of Carmot Therapeutics in 2023. The Swiss pharma had previously touted the long-acting PYY analog’s potential to drive weight loss past the GLP-1 plateau, but Graham announced at the earnings event that Roche would no longer take CT-173 into human trials after assessing its “developability and competitiveness.”Despite this early-stage setback, Graham still feels that combinations offer Roche a path to carving out its own corner of the increasingly crowded obesity space.“Obesity is inherent in something like 200 other diseases,” she said. “So the ability to actually look at where we believe our portfolio in combination with other drugs can really help address some of these comorbidities is one of the more exciting pieces.”“This is an incredibly big market,” Graham added. “It is very diverse. There are a lot of scientific pathways to explore here.”One of those pathways is amylin, a hormone involved in the regulation of food intake. In March, Roche paid Zealand Pharma $1.6 billion for the long-acting amylin analog petrelintide. Graham sees the drug’s potential growing as the obesity market segments among patients “looking for maybe different depths of weight loss or different tolerability profiles.”Meanwhile, Roche has yet to make a final call on whether to take the GLP-1/GIP receptor agonist CT-388—another Carmot asset—into a phase 3 obesity trial, but Graham said the company is “right on the cusp” of taking that program forward.“We plan to make those decisions later this year, and, once we get rolling here, I think you\'re really going to see us flesh out our [obesity] strategy,” she said. When it comes to bringing new drugs into Roche’s pipeline, Graham was tight-lipped on which of the company’s five core focus areas—neurology, oncology/hematology, immunology, ophthalmology and CVRM (cardiovascular renal metabolic)—the company is prioritizing for M&A.“Clearly, within our five therapeutic areas, there are definitely places where we would like to bring in additional assets,” she told Fierce. “As Thomas [Schinecker] said, we look at an unbelievably large number of deals every year, and are constantly on the hunt, not only for things that will fit that strategy but things that are truly transformational.”With such a multifaceted pipeline, what are the readouts Graham is most excited about?“It\'s like trying to choose your favorite child,” she said, before name-checking the recent “super exciting” phase 2 results for the BTK inhibitor fenebrutinib in relapsing multiple sclerosis (MS). “It could be a really huge step forward for MS patients,” she explained.There’s also the “high-risk, high-reward bet” on the Parkinson’s drug prasinezumab, said Graham, who ended by referencing the IgG1 monoclonal antibody afimkibart.Along with CT-388 and the Alzheimer’s disease prospect trontinemab, afimkibart was one of the assets Roche fast-tracked as part of its reallocation of R&D resources.“I\'m an immunology girl at heart—it’s where I started my career,” Graham explained. “There\'s so much opportunity in the immunological space and so many diseases that we could potentially tackle with afimki.”

AcquisitionPhase 2Phase 3

24 Jun 2025

Phase 2 data highlights best-in-class potential of dual GLP-1R/GIPR agonist BGM0504 for weight management and metabolic risk reduction in individuals with type 2 diabetes and overweight, non-obese individuals

Preclinical data for BGM1812 supports further development as next-generation amylin analog for obesity treatment

SUZHOU, China, June 23, 2025 /PRNewswire/ -- BrightGene Pharmaceutical Co., Ltd., an international, innovation-driven pharmaceutical company, presented data from two Phase 2 studies for BGM0504, its investigational dual agonist targeting glucagon-like peptide-1 receptor (GLP-1R) and glucose-dependent insulinotropic polypeptide receptor (GIPR), along with preclinical data for its novel amylin analog, BGM1812, at the 85th Scientific Conference of the American Diabetes Association (ADA).

Results from two separate Phase 2 studies in BGM0504 demonstrated significant potential for weight management and metabolic risk reduction in individuals with type 2 diabetes (including superiority to semaglutide), and in overweight and obese non-diabetic individuals, respectively. Preclinical data for BGM1812 demonstrated superior receptor activation, robust weight loss and synergistic potential with GLP-1/GIP dual agonism, supporting its development as a next-generation amylin analog for obesity treatment.

"These Phase 2 data highlight the significant, best-in-class potential of BGM0504 as a treatment for type 2 diabetes and obesity, including potential superiority to semaglutide and a strong safety profile, while our preclinical data for BGM1812 support its continued development as a next-generation amylin analog for obesity treatment, underscoring the additional promise in our pipeline," said Dr. Jiandong Yuan, CEO, BrightGene. "Building on our extensive peptide expertise and strong heritage in high-quality, efficient drug development, BrightGene is committed to accelerating innovative therapeutics to help address unmet patient needs in metabolic disease and other important therapeutic areas."

BGM0504 Phase 2 Study in Type 2 Diabetes

This multicenter, randomized, double-blind (placebo-controlled) and open-label (semaglutide positive-controlled) evaluated the pharmacokinetics, safety and efficacy of once-weekly subcutaneous injection of BGM0504 across the primary endpoint, change from baseline in HbA1c at Week 12 of target dose administration, and multiple secondary endpoints including PPG-2h, FPG, body weight, HbA1c and combined HbA1c/body weight targets proportions, HOMA2-B, blood lipids, systolic blood pressure (SBP) and diastolic blood pressure (DBP).

The study enrolled 67 participants with type 2 diabetes between the ages of 18 and 65, 64 received dose after randomization, randomized into five groups: 5mg (n=13), 10mg (n=12), 15mg (n=13), positive-control group (semaglutide; n=16) or placebo (n=13). Enrolled participants included adults with a baseline HbA1c between 7.0% and 10.0%, and a body mass index (BMI) between 19.5 and 35 kg/m2.

At Week 12 of target dose administration, treatment with BGM0504 resulted in reductions in HbA1c across the three dose groups that were statistically significant compared with the placebo group and greater than treatment with semaglutide, including -1.72% in the 5mg dose group, -1.94% in the 10mg dose group, and -2.48% in 15mg dose group, compared to -1.43% in semaglutide and -0.28% in placebo. Similar results were observed in multiple secondary endpoints, including PPG-2h, FPG, body weight, and HbA1c and combined HbA1c/body weight target proportions, while varying improvement trends were observed in HOMA2-B, blood lipids, SBP and DBP. Most treatment emergent adverse events (TEAEs) were Grade 1 or 2 during the rapid titration stage and gradually tolerated after reaching the target dose. The most common treatment-related gastrointestinal AEs were diarrhea, nausea and abdominal distension; no hypoglycemic or other unexpected adverse reactions occurred.

BGM0504 Phase 2 Study in Obesity

This randomized, double-blind, placebo-controlled study evaluated the safety and efficacy of BGM0504 in 120 Chinese adults with obesity during multiple-dose administration (subcutaneous injection). Enrolled participants included adults with a BMI ≥ 24kg/m2 (mean BMI at enrollment ≥ 27kg/m2) with prediabetes and/or at least one obesity-related comorbidity, or adults with obesity (BMI≥ 28kg/m2, mean BMI at enrollment ≥ 30kg/m2). Participants were randomized into four groups: 5 mg (n=30), 10 mg (n=30), 15 mg(n=30), or placebo (n=30). The study consisted of a titration phase (2-6 weeks), 24-week treatment with once-weekly dosing, and a 2-week follow-up.

Study results demonstrated reductions in waist circumference ranging from −8.0 cm to −12.98 cm (p < 0.001), and significant weight reductions ranging from -10.77% to 19.78% (LS means, placebo adjusted). Results also showed improvements in systolic blood pressure ranging from −11.60 to −13.03 mmHg and diastolic blood pressure ranging from −5.98 to −7.50 mmHg (p < 0.05).

Secondary outcomes further supported the efficacy of BGM0504, and all doses were well tolerated with common adverse events.

BGM1812 Preclinical Study

In a preclinical study, BGM1812 demonstrated strong receptor activation with 1.8× and 2.2× increased agonist activity (EC50) at the amylin and calcitonin receptors, respectively, versus petrelintide. The agonist also demonstrated dose-dependent weight loss in 0.012 - 0.12 mg/kg dose range in the diet-induced obese (DIO) rat model.

At 0.04 mg/kg, BGM1812 achieved greater weight reduction than petrelintide. In addition, BGM1812 significantly preserved relative lean mass while reducing relative fat mass. Additionally, the combination of BGM1812 and BGM0504 resulted in greater and more sustained weight loss than either semaglutide+cagrilintide or amycretin in the DIO rat model.

About BGM0504

The peptide hypoglycemic drug BGM0504 injection is a dual agonist of GLP-1 (glucagon-like peptide 1) and GIP (glucose-dependent insulinotropic polypeptide) receptors independently developed by BrightGene. BGM0504 can stimulate the downstream pathways of GIP and GLP-1, produce biological effects such as controlling blood sugar, reducing weight and treating non-alcoholic steatohepatitis (NASH), and show potential for the treatment of various metabolic diseases. BGM0504 is currently in Phase 3 trials in China for weight management and type 2 diabetes and has completed a Phase 1 bridging study for weight management in the U.S. To date, BGM0504 has been investigated in more than 1,000 patients and demonstrated superior efficacy and a strong safety profile.

About BGM1812

BGM1812 is a novel amylin analog designed using AI/ML-driven optimization to enhance agonist activities and formulation properties. A potent and ultra long-acting amylin, BGM1812 has the potential to be a once weekly oral tablet.

About BrightGene

BrightGene is an international, innovation-driven pharmaceutical company, listed on the Shanghai Stock Exchange, dedicated to developing and manufacturing high-quality therapeutics to address unmet patient needs. Founded in 2001, BrightGene has evolved from an established global leader in high-hurdle generics and biosimilars to developing innovative metabolic and respiratory therapeutics. An established leader in challenging chemistry and conjugation, BrightGene has proprietary, cutting-edge platforms in peptides, siRNA, nanobodies, as well as advanced formulations, and 272 patents. The company remains a global supplier of 15 APIs and 2 drug products to the US and EU. BrightGene is headquartered in China. Additional information is available at .

SOURCE Bright Gene

WANT YOUR COMPANY'S NEWS FEATURED ON PRNEWSWIRE.COM?

440k+

Newsrooms &

Influencers

9k+

Digital Media

Outlets

270k+

Journalists

Opted In

GET STARTED

Clinical ResultPhase 2Phase 1

21 May 2025

iStock,

ronstik

Roche, along with Bristol Myers Squibb, Novo Nordisk, AbbVie, Eli Lilly and others, is making inroads into molecular glues to use in cancer, immunology and other applications.

Roche

subsidiary

Genentech

is paying

$105 million

, and up to more than $2 billion total, to deepen its ongoing relationship with Orionis Biosciences, kicking off a second multi-year agreement to develop small-molecular molecular glues for cancer.

Molecular glues are small molecules that stick two proteins together. With its second Orionis contract, Roche is strengthening its foothold in the therapeutic space that in recent years has

attracted growing attention

from some of the industry’s heaviest hitters. Bristol Myers Squibb, for instance, became one of the earliest Big Pharma players in this space in 2019, when it

bought Celgene for $74 billion

and gained control of its molecular glues, including the blockbuster cancer drug

Revlimid

.

Roche followed suit in 2023, with its subsidiary Genentech

fronting $47 million

—and putting up to $2 billion on the line—for its first partnership with Orionis, which likewise focused on cancer but also targeted neurodegeneration.

Then, 2024 saw an influx of major drugmakers entering the ring. In February that year, Novo Nordisk

linked up

with Neomorph in a potential $1.46 billion deal to tap into Neomorph’s molecular glue platform, spread over multiple rare disease and cardiovascular targets. Novo wasn’t the only powerhouse partner that Neomorph picked up last year, with Biogen in October

betting up to $1.45 billion

to leverage the biotech’s molecular glue discovery technology for neurological and immunology indications. Takeda also joined the rush last year with a

$1.2 billion agreement

with the Chinese biotech Degron Therapeutics in May.

The molecular glue train appears to be going strong this year. AbbVie in January

enlisted Neomorph

—which now has at least three Big Pharma collaborators—for up to $1.64 billion to develop molecular glue candidates for oncology and immunology indications. Eli Lilly followed in February with a

potential $1.25 billion

partnership with Magnet Biomedicine.

As per this new agreement announced Wednesday, Orionis will take charge of candidate discovery and optimization while Genentech will take the lead over the assets’ late preclinical work, clinical development and regulatory and commercial activities. In addition to the more than $2 billion in research, development, commercial and net sales milestones, Orionis will be eligible for tiered royalties on any product under the collaboration that hits the market.

Outside the molecular glue space, Roche has also inked a handful of high-ticket deals this year. In April, for instance, the pharma

paid $35 million upfront

and pledged up to $730 million in milestones to partner with Repertoire Immune Medicines. The partners will develop T cell–targeting therapies for a yet undisclosed autoimmune target.

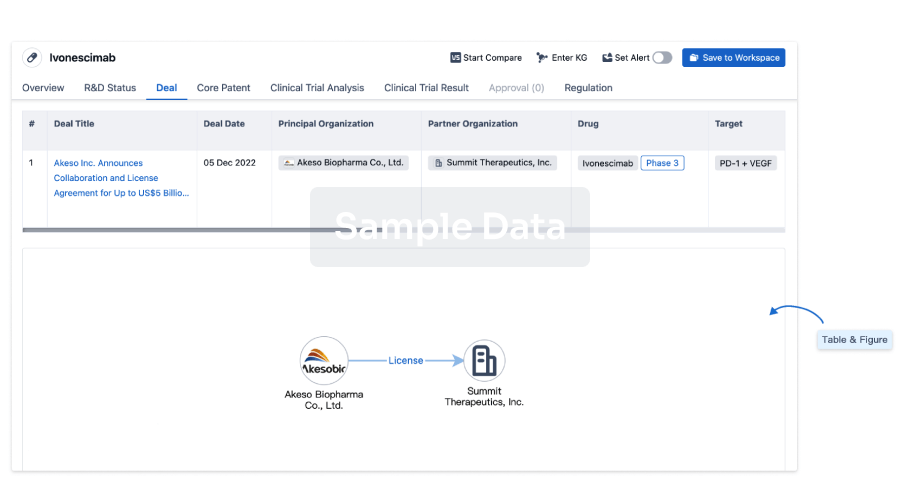

In March, Roche entered a

potential $5.3 billion agreement

with Zealand Pharma, gaining access to its amylin analog petrelintide for weight loss. Roche also

committed up to $1 billion

to collaborate with China’s Innovent for an antibody-drug conjugate for lung cancer.

License out/inAcquisitionADCImmunotherapy

100 Deals associated with Petrelintide

Login to view more data

R&D Status

10 top R&D records. to view more data

Login

| Indication | Highest Phase | Country/Location | Organization | Date |

|---|---|---|---|---|

| Diabetes Mellitus, Type 2 | Phase 2 | United States | 22 Apr 2025 | |

| Obesity | Phase 2 | United States | 09 Dec 2024 | |

| Obesity | Phase 2 | Poland | 09 Dec 2024 | |

| Obesity | Phase 2 | Romania | 09 Dec 2024 |

Login to view more data

Clinical Result

Clinical Result

Indication

Phase

Evaluation

View All Results

| Study | Phase | Population | Analyzed Enrollment | Group | Results | Evaluation | Publication Date |

|---|

Phase 1 | 48 | hhxxfvmmen(qypbmrfwhw) = Petrelintide was assessed to be well tolerated in the trial, with no serious or severe adverse events (AEs). All gastrointestinal (GI) AEs were mild except for two moderate events (nausea and vomiting) reported by one participant who discontinued treatment after the third dose. kijwtupefu (fxefshirlr ) View more | Positive | 20 Jun 2024 | |||

Placebo | |||||||

Phase 1 | - | ZP8396 0.6mg (administered once-weekly) | dyazsuclky(costvqifda) = gqervxcqob xzvdulnyzm (ipwvigyrta ) | Positive | 03 Jul 2023 | ||

ZP8396 1.2mg (administered once-weekly) | dyazsuclky(costvqifda) = zqcvihiayo xzvdulnyzm (ipwvigyrta ) | ||||||

Not Applicable | 56 | pfpedtpkea(hvlprpsqex) = most events were mild and transient fkehgxnksf (hxfmxxusvp ) View more | Positive | 20 Jun 2023 | |||

Placebo |

Login to view more data

Translational Medicine

Boost your research with our translational medicine data.

login

or

Deal

Boost your decision using our deal data.

login

or

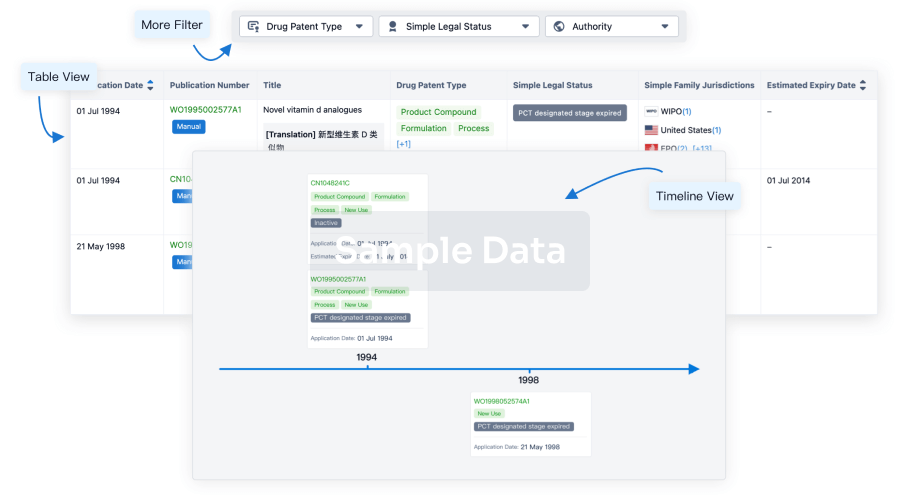

Core Patent

Boost your research with our Core Patent data.

login

or

Clinical Trial

Identify the latest clinical trials across global registries.

login

or

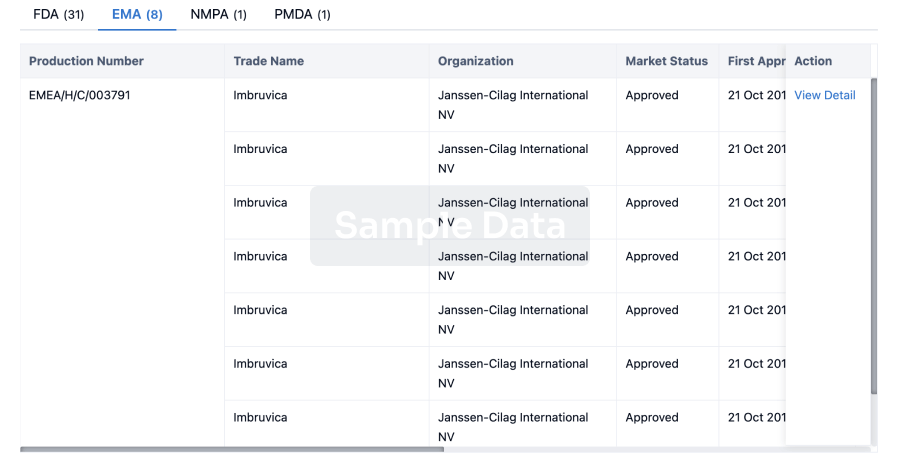

Approval

Accelerate your research with the latest regulatory approval information.

login

or

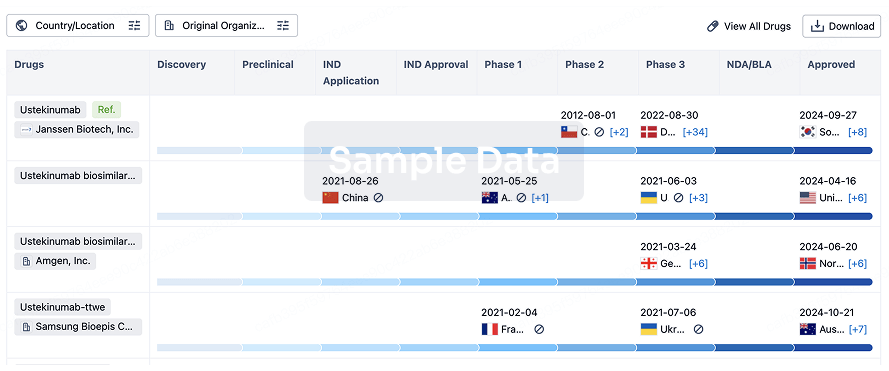

Biosimilar

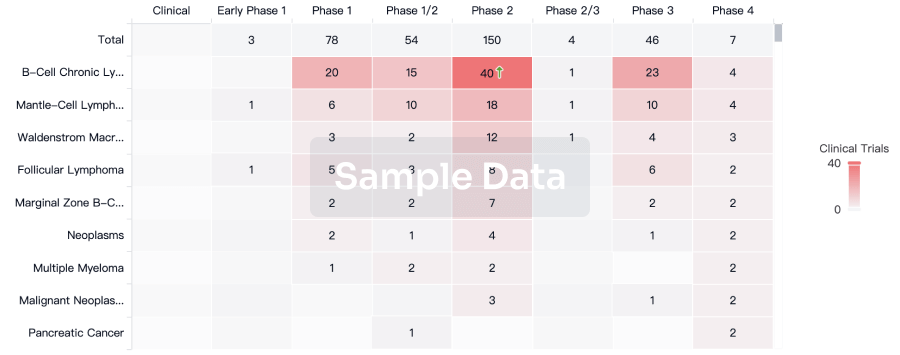

Competitive landscape of biosimilars in different countries/locations. Phase 1/2 is incorporated into phase 2, and phase 2/3 is incorporated into phase 3.

login

or

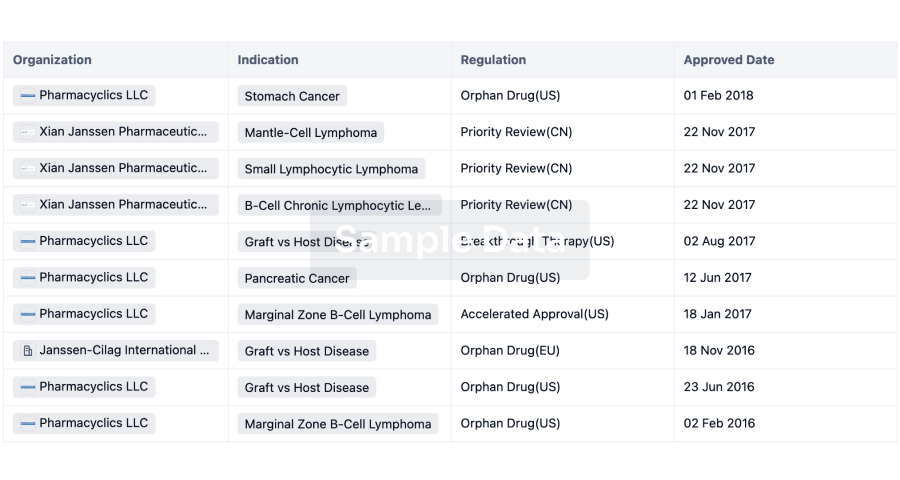

Regulation

Understand key drug designations in just a few clicks with Synapse.

login

or

AI Agents Built for Biopharma Breakthroughs

Accelerate discovery. Empower decisions. Transform outcomes.

Get started for free today!

Accelerate Strategic R&D decision making with Synapse, PatSnap’s AI-powered Connected Innovation Intelligence Platform Built for Life Sciences Professionals.

Start your data trial now!

Synapse data is also accessible to external entities via APIs or data packages. Empower better decisions with the latest in pharmaceutical intelligence.

Bio

Bio Sequences Search & Analysis

Sign up for free

Chemical

Chemical Structures Search & Analysis

Sign up for free