COVID-19 Pandemic Emphasized the Importance of In Vitro Diagnostics, More than $127 Billion Worth Market Opportunity in the IVD Market - Arizton

19 Jan 2023

Diagnostic Reagents

With More than USD 3 trillion Investment Opportunities Across Healthcare Services in North America Alone, the In-Vitro Diagnostics Market is Witnessing Huge Growth in North America.

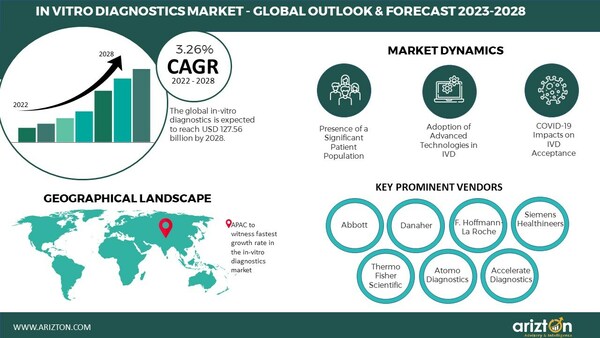

CHICAGO, Jan. 19, 2023 /PRNewswire/ -- According to Arizton's latest research report, the in-vitro diagnostics market will grow at a CAGR of 3.3% from 2022-2028. In recent years, IVD diagnostics has been one of the biggest industries that observed several product launches. The increasing demand for new diagnostics tests forced the development of new solutions. Currently, the IVD players are operating in a world that designs, develops, manufactures, and sells best-in-class solutions. COVID-19 is one of the best periods where several companies have come forward to develop rapid test kits to detect coronavirus. The leading market players are competing with rapidly emerging players in the market. Vendors in the market are increasing their share through inorganic growth. There is a constant product launch, helping the vendors acquire new customers in the market.

Continue Reading

Preview

Source: PRNewswire

In-Vitro Diagnostics Market

In 2022, North America accounted for the largest share of 40% of the global IVD market. The patient population with high healthcare expenditure is the major factor driving the in-vitro diagnostics market across North America. In addition, awareness about disease diagnosis, such as point-of-care, early detection, and preventive health check-ups, are some factors that positively impact the region's market growth. More than 60% to 80% of the regional population have any chronic condition, which led to demand for diagnostics services. The expenditure for healthcare services in the region is more than $3 trillion, indicating the potential growth of in-vitro diagnostics in the region. Moreover, the presence of market players and their market penetration in the region fuel access to IVD services.

The POC diagnostics market is growing faster than the traditional IVD industry. Over the few years, there has been a constant increase in the number of approved POC devices. In Canada's healthcare services, one of the emerging factors is point-of-care which is expected to drive the market in the future. The Canadian Standard Association has developed requirements that apply to POC (CAN.CSA-Z22870-07). The demand for POC for infectious diseases is increasing and becoming an important part of healthcare systems. In cancer and infectious disease diagnosis, point-of-care IVD solutions are commonly used.

Global In-Vitro Diagnostics Market Report Scope

Click Here to Download the Free Sample Report

Reagent & Consumables Market to Boom the Adoption Rate of In-Vitro Diagnostics Market

Faster adoption of concentrated reagents has enhanced vendors' competitiveness by improving customer satisfaction and reducing CO2 emissions and waste by decreasing the number of reagent shipments.

The global in-vitro diagnostics market by reagents & consumables has been growing rapidly in recent years. The COVID-19 pandemic has significantly boosted demand for reagents used in IVD procedures to run the COVID-19 sample for diagnosis. With the increasing demand for disease diagnosis and the rising number of clinical and research laboratories, the demand for IVD reagents is significantly increasing.

Innovation in consumables, especially reagents, is low compared to analyzers. Some companies do come up with new types of reagents for unique products. For instance, Sysmex, a Japanese company, developed a concentrated reagent for hematology analyzers. These concentrated reagents are gaining traction in the market, especially in developed countries. This is helping the company to gain market share.

COVID-19 Pandemic Positively Impacting the Market Growth

In the global IVD market, manufacturers played a vital role in enabling countries to broaden their COVID-19 testing capacity- certainly, molecular testing instruments usually dedicated to tuberculosis and HIV programs constitute major opportunities to be repurposed for COVID-19 response.

The COVID-19 pandemic has highlighted the importance of IVD solutions. According to "under Emergency Use Authorization" in the US and "under the in-vitro Diagnostics Directive" (IVDD) in Europe, the preference for self-testing solutions increased significantly, thus driving the market growth through rapid COVID-19 test kits. Several COVID-19 self-test kits were developed to drive the companies' revenue growth.

Click Here to Download the Free Sample Report

Key Company Profiles

Abbott

Danaher

Siemens Healthineers

ARKRAY

AccuBioTech

BD

Balio diagnostics

B&E BIO-TECHNOLOGY

BIOMÉRIEUX

Biohit Oyj

Biosystems

Cupid Limited

DIALAB

DiaSorin

Diagon

DIRUI

Hologic

High Technology

HORIBA

Linear Chemicals

INTEC

Nanjing Synthgene Medical Technology

NIHON KOHDEN

NOWDiagnostics

Perkin Elmer

Quidel

Salofa Oy

SEASUN BIOMATERIALS

SFRI

Shenzhen iCubio Biomedical Technology

SHENZHEN PROKAN ELECTRONICS

Shenzhen Landwind Medical

SPINREACT

Xiamen Biotime Biotechnology

Market Segmentation

Product & Services

Reagents and Consumables

Instruments/ Analyzers & Software

Services

Technology

Immuno and Clinical Chemistry

Hematology

Microbiology and Cytology

Others Technology

Application

Cardiology

Oncology

Nephrology

Drug Testing

Others

End-Users

Standard Reference Labs

Hospital-Affiliated Labs

Individuals

Clinics

Others

Geography

North America

US

Canada

Europe

Germany

France

Russia

Spain

Italy

UK

APAC

China

Japan

India

South Korea

Australia

Indonesia

Malaysia

Singapore

Latin America

Brazil

Mexico

Argentina

Middle East & Africa

Turkey

Saudi Arabia

South Africa

Check Out Some of the Top-Selling Related Research Reports:

HIV Rapid Test Kits Market - Global Outlook & Forecast 2023-2028: The global HIV rapid test kits market is expected to reach USD 1.68 billion by 2028. In the U.S., HIV testing is vital and integral to HIV prevention and management. The knowledge about HIV infection is increasing rapidly in the country, accelerating the high demand for HIV self-testing. In recent years, the significant patient population in the country has gone through routine medical check-ups, which includes HIV test. It increases the knowledge about HIV testing and care in the country and propels the market growth.

IVD Raw Materials Market - Global Outlook & Forecast 2022-2027: IVD raw materials market is expected to reach USD 34.25 billion by 2027. The Europe region is one of the matured markets for in-vitro diagnostics; the large laboratory instruments are highly automated compared to most point-of-care testing devices. Automation has increased the speed and ease of using the devices the workforce is thoroughly trained and adopted. Furthermore, the global IVD raw materials market is expected to witness an incremental growth of USD 9.91 billion and absolute growth of 40.73% by 2027.

COVID-19 Diagnostics Market - Global Outlook and Forecast 2021-2026: The global COVID-19 diagnostics market is expected to reach USD 7.4 billion by 2026. The RT-PCR testing segment constituted over 75% of the global COVID test market share. The market is growing because of the coronavirus (SARS CoV-2) pandemic outbreak, which has increased the demand for rapid testing worldwide. As the number of people suffering from viral infection increases, the demand for rapid testing, which allows quick detection of the virus, is growing. Adopting a population-wide testing approach, which includes household, and individual testing is one of the trends influencing the demand for covid-19 diagnostics kits. The shift from symptomatic testing to mass testing in developed countries is another major factor affecting the market.

Rapid Diagnostics Market - Global Outlook and Forecast 2020-2025: The global rapid diagnostics market size is to cross USD 43 billion by 2025. Abbott, F.Hoffman-La Roche, and Siemens Healthineers are the key players in the rapid diagnostics market. Global players focus on developing innovative products and expanding their product portfolio to remain competitive. They are investing extensively in R&D and product development activities to expand their product portfolio. Abbott, F. Hoffmann-La Roche, Danaher, Quidel, Luminex, and BD continuously focus on product development and offer new diagnostics technology to increase their market presence.

Table of Content

1 RESEARCH METHODOLOGY

2 RESEARCH OBJECTIVES

3 RESEARCH PROCESS

4 SCOPE & COVERAGE

4.1 MARKET DEFINITION

4.1.1 INCLUSIONS

4.1.2 EXCLUSIONS

4.1.3 MARKET ESTIMATION CAVEATS

4.2 BASE YEAR

4.3 SCOPE OF THE STUDY

4.3.1 MARKET BY PRODUCT & SERVICES:

4.3.2 MARKET BY TECHNOLOGY

4.3.3 MARKET BY APPLICATION

4.3.4 MARKET BY END-USERS

4.3.5 MARKET SEGMENTATION BY GEOGRAPHY

5 REPORT ASSUMPTIONS & CAVEATS

5.1 KEY CAVEATS

5.2 CURRENCY CONVERSION

5.3 MARKET DERIVATION

6 MARKET AT A GLANCE

7 PREMIUM INSIGHTS

7.1 OVERVIEW

8 INTRODUCTION

8.1 OVERVIEW

9 MARKET OPPORTUNITIES & TRENDS

9.1 ADVANCES IN MOLECULAR DIAGNOSTICS TRANSFORMING THE FUTURE OF HEALTHCARE

9.2 INCREASED DEMAND FOR COMPANION DIAGNOSTICS IN IVD

9.3 INCREASING PRODUCT LAUNCHES & MERGERS & ACQUISITIONS IN IVD

10 MARKET GROWTH ENABLERS

10.1 PRESENCE OF A SIGNIFICANT PATIENT POPULATION

10.2 ADOPTION OF ADVANCED TECHNOLOGIES IN IVD

10.3 COVID-19 IMPACT ON IVD MARKET

11 MARKET RESTRAINTS

11.1 STRINGENT REGULATIONS AND ASSOCIATED CHALLENGES

11.2 HIGH COST OF IVD

11.3 LACK OF ACCESS TO DIAGNOSTIC SERVICES AND ASSOCIATED CHALLENGES

12 MARKET LANDSCAPE

12.1 MARKET OVERVIEW

12.1.1 INSIGHT BY PRODUCT & SERVICES

12.1.2 INSIGHT BY TECHNOLOGY

12.1.3 INSIGHT BY APPLICATION

12.1.4 INSIGHT BY END-USERS

12.1.5 INSIGHT BY GEOGRAPHY

12.2 MARKET SIZE & FORECAST

12.3 FIVE FORCES ANALYSIS

12.3.1 THREAT OF NEW ENTRANTS

12.3.2 BARGAINING POWER OF SUPPLIERS

12.3.3 BARGAINING POWER OF BUYERS

12.3.4 THREAT OF SUBSTITUTES

12.3.5 COMPETITIVE RIVALRY

13 PRODUCT & SERVICES

13.1 MARKET SNAPSHOT & GROWTH ENGINE

13.2 MARKET OVERVIEW

13.3 REAGENTS AND CONSUMABLES

13.3.1 MARKET OVERVIEW

13.3.2 MARKET SIZE & FORECAST

13.3.3 MARKET BY GEOGRAPHY

13.4 INSTRUMENTS/ANALYZERS & SOFTWARE

13.4.1 MARKET OVERVIEW

13.4.2 MARKET SIZE & FORECAST

13.4.3 MARKET BY GEOGRAPHY

13.5 SERVICES

13.5.1 MARKET OVERVIEW

13.5.2 MARKET SIZE & FORECAST

13.5.3 MARKET BY GEOGRAPHY

14 TECHNOLOGY

14.1 MARKET SNAPSHOT & GROWTH ENGINE

14.2 MARKET OVERVIEW

14.3 IMMUNO & CLINICAL CHEMISTRY

14.3.1 MARKET OVERVIEW

14.3.2 MARKET SIZE & FORECAST

14.3.3 MARKET BY GEOGRAPHY

14.4 MOLECULAR DIAGNOSTICS

14.4.1 MARKET OVERVIEW

14.4.2 MARKET SIZE & FORECAST

14.4.3 MARKET BY GEOGRAPHY

14.5 HEMATOLOGY

14.5.1 MARKET OVERVIEW

14.5.2 MARKET SIZE & FORECAST

14.5.3 MARKET BY GEOGRAPHY

14.6 MICROBIOLOGY & CYTOLOGY

14.6.1 MARKET OVERVIEW

14.6.2 MARKET SIZE & FORECAST

14.6.3 MARKET BY GEOGRAPHY

14.7 OTHERS

14.7.1 MARKET OVERVIEW

14.7.2 MARKET SIZE & FORECAST

14.7.3 MARKET BY GEOGRAPHY

15 APPLICATION

15.1 MARKET SNAPSHOT & GROWTH ENGINE

15.2 MARKET OVERVIEW

15.3 INFECTIOUS DISEASES

15.3.1 MARKET OVERVIEW

15.3.2 MARKET SIZE & FORECAST

15.3.3 MARKET BY GEOGRAPHY

15.4 DIABETES

15.4.1 MARKET OVERVIEW

15.4.2 MARKET SIZE & FORECAST

15.4.3 MARKET BY GEOGRAPHY

15.5 CARDIOLOGY

15.5.1 MARKET OVERVIEW

15.5.2 MARKET SIZE & FORECAST

15.5.3 MARKET BY GEOGRAPHY

15.6 ONCOLOGY

15.6.1 MARKET OVERVIEW

15.6.2 MARKET SIZE & FORECAST

15.6.3 MARKET BY GEOGRAPHY

15.7 AUTOIMMUNE DISEASE

15.7.1 MARKET OVERVIEW

15.7.2 MARKET SIZE & FORECAST

15.7.3 MARKET BY GEOGRAPHY

15.8 NEPHROLOGY

15.8.1 MARKET OVERVIEW

15.8.2 MARKET SIZE & FORECAST

15.8.3 MARKET BY GEOGRAPHY

15.9 DRUG TESTING

15.9.1 MARKET OVERVIEW

15.9.2 MARKET SIZE & FORECAST

15.9.3 MARKET BY GEOGRAPHY

15.10 OTHERS

15.10.1 MARKET OVERVIEW

15.10.2 MARKET SIZE & FORECAST

15.10.3 MARKET BY GEOGRAPHY

16 END-USERS

16.1 MARKET SNAPSHOT & GROWTH ENGINE

16.2 MARKET OVERVIEW

16.3 STANDARD REFERENCE LABS

16.3.1 MARKET OVERVIEW

16.3.2 MARKET SIZE & FORECAST

16.3.3 MARKET BY GEOGRAPHY

16.4 HOSPITAL-AFFILIATED LABS

16.4.1 MARKET OVERVIEW

16.4.2 MARKET SIZE & FORECAST

16.4.3 MARKET BY GEOGRAPHY

16.5 INDIVIDUALS

16.5.1 MARKET OVERVIEW

16.5.2 MARKET SIZE & FORECAST

16.5.3 MARKET BY GEOGRAPHY

16.6 CLINICS

16.6.1 MARKET OVERVIEW

16.6.2 MARKET SIZE & FORECAST

16.6.3 MARKET BY GEOGRAPHY

16.7 OTHERS

16.7.1 MARKET OVERVIEW

16.7.2 MARKET SIZE & FORECAST

16.7.3 MARKET BY GEOGRAPHY

17 GEOGRAPHY

17.1 MARKET SNAPSHOT & GROWTH ENGINE

17.2 GEOGRAPHIC OVERVIEW

18 NORTH AMERICA

18.1 MARKET OVERVIEW

18.2 MARKET SIZE & FORECAST

18.3 PRODUCT & SERVICES

18.3.1 MARKET SIZE & FORECAST

18.4 TECHNOLOGY

18.4.1 MARKET SIZE & FORECAST

18.5 APPLICATION

18.5.1 MARKET SIZE & FORECAST

18.6 END-USER

18.6.1 MARKET SIZE & FORECAST

18.7 KEY COUNTRIES

18.7.1 US: MARKET SIZE & FORECAST

18.7.2 CANADA: MARKET SIZE & FORECAST

19 EUROPE

19.1 MARKET OVERVIEW

19.2 MARKET SIZE & FORECAST

19.3 PRODUCT & SERVICES

19.3.1 MARKET SIZE & FORECAST

19.4 TECHNOLOGY

19.4.1 MARKET SIZE & FORECAST

19.5 APPLICATION

19.5.1 MARKET SIZE & FORECAST

19.6 END-USER

19.6.1 MARKET SIZE & FORECAST

19.7 KEY COUNTRIES

19.7.1 GERMANY: MARKET SIZE & FORECAST

19.7.2 FRANCE: MARKET SIZE & FORECAST

19.7.3 RUSSIA: MARKET SIZE & FORECAST

19.7.4 SPAIN: MARKET SIZE & FORECAST

19.7.5 ITALY: MARKET SIZE & FORECAST

19.7.6 UK: MARKET SIZE & FORECAST

20 APAC

20.1 MARKET OVERVIEW

20.2 MARKET SIZE & FORECAST

20.3 PRODUCT & SERVICES

20.3.1 MARKET SIZE & FORECAST

20.4 TECHNOLOGY

20.4.1 MARKET SIZE & FORECAST

20.5 APPLICATION

20.5.1 MARKET SIZE & FORECAST

20.6 END-USER

20.6.1 MARKET SIZE & FORECAST

20.7 KEY COUNTRIES

20.7.1 CHINA: MARKET SIZE & FORECAST

20.7.2 JAPAN: MARKET SIZE & FORECAST

20.7.3 INDIA: MARKET SIZE & FORECAST

20.7.4 SOUTH KOREA: MARKET SIZE & FORECAST

20.7.5 AUSTRALIA: MARKET SIZE & FORECAST

20.7.6 INDONESIA: MARKET SIZE & FORECAST

20.7.7 MALAYSIA MARKET SIZE & FORECAST

20.7.8 SINGAPORE MARKET SIZE & FORECAST

21 LATIN AMERICA

21.1 MARKET OVERVIEW

21.2 MARKET SIZE & FORECAST

21.3 PRODUCT & SERVICES

21.3.1 MARKET SIZE & FORECAST

21.4 TECHNOLOGY

21.4.1 MARKET SIZE & FORECAST

21.5 APPLICATION

21.5.1 MARKET SIZE & FORECAST

21.6 END-USER

21.6.1 MARKET SIZE & FORECAST

21.7 KEY COUNTRIES

21.7.1 BRAZIL: MARKET SIZE & FORECAST

21.7.2 MEXICO: MARKET SIZE & FORECAST

21.7.3 ARGENTINA: MARKET SIZE & FORECAST

22 MIDDLE EAST & AFRICA

22.1 MARKET OVERVIEW

22.2 MARKET SIZE & FORECAST

22.3 PRODUCT & SERVICES

22.3.1 MARKET SIZE & FORECAST

22.4 TECHNOLOGY

22.4.1 MARKET SIZE & FORECAST

22.5 APPLICATION

22.5.1 MARKET SIZE & FORECAST

22.6 END-USER

22.6.1 MARKET SIZE & FORECAST

22.7 KEY COUNTRIES

22.7.1 TURKEY: MARKET SIZE & FORECAST

22.7.2 SAUDI ARABIA: MARKET SIZE & FORECAST

22.7.3 SOUTH AFRICA: MARKET SIZE & FORECAST

23 COMPETITIVE LANDSCAPE

23.1 COMPETITION OVERVIEW

23.2 MARKET SHARE ANALYSIS

23.2.1 ABBOTT

23.2.2 DANAHER

23.2.3 F. HOFFMANN-LA ROCHE

23.2.4 SIEMENS HEALTHINEERS

23.2.5 THERMO FISHER SCIENTIFIC

24 KEY COMPANY PROFILES

24.1 ABBOTT

24.1.1 BUSINESS OVERVIEW

24.1.2 PRODUCT OFFERINGS

24.1.3 KEY STRATEGIES

24.1.4 KEY STRENGTHS

24.1.5 KEY OPPORTUNITIES

24.2 DANAHER

24.3 F. HOFFMANN-LA ROCHE

24.4 SIEMENS HEALTHINEERS

24.5 THERMO FISHER SCIENTIFIC

25 OTHER PROMINENT VENDORS

25.1 ATOMO DIAGNOSTICS

25.1.1 BUSINESS OVERVIEW

25.1.2 PRODUCT OFFERINGS

25.2 ACCELERATE DIAGNOSTICS

25.3 AGILENT TECHNOLOGIES

25.4 ALTONA DIAGNOSTICS

25.5 AMOY DIAGNOSTICS

25.6 ARKRAY

25.7 ACCUBIOTECH

25.8 AGAPPE DIAGNOSTICS

25.9 BD

25.10 BIO-RAD LABORATORIES

25.11 BALIO DIAGNOSTICS

25.12 B&E BIO-TECHNOLOGY

25.13 BIOMÉRIEUX

25.14 BIOLYTICAL LABORATORIES

25.15 BIOSYNEX

25.16 BIOCARTIS

25.17 BIOCEPT

25.18 BIOHIT OYJ

25.19 BIOMERICA

25.20 BIOSYSTEM

25.21 BIOWAY BIOLOGICAL TECHNOLOGY

25.22 BOULE DIAGNOSTICS

25.23 CUPID LIMITED

25.24 CAREDX

25.25 CHEMBIO DIAGNOSTICS

25.26 CLINDIAG SYSTEMSA

25.27 CONTEC MEDICAL SYSTEMS

25.28 CONVERGENT TECHNOLOGIES

25.29 CPC DIAGNOSTICS

25.30 CPM SCIENTIFICA

25.31 CELLAVISION

25.32 DIALAB

25.33 DEXCOM

25.34 DIASORIN

25.35 DIAGON

25.36 DIATRON

25.37 DIRUI

25.38 DRUCKER DIAGNOSTICS

25.39 EDAN INSTRUMENTS

25.40 EKF DIAGNOSTICS HOLDING

25.41 ELITECHGROUP

25.42 ERBA DIAGNOSTICS

25.43 GENETRON HOLDINGS

25.44 GENRUI BIOTECH

25.45 HOLOGIC

25.46 HIGH TECHNOLOGY

25.47 HORIBA

25.48 LINEAR CHEMICALS

25.49 ILLUMINA

25.50 INTEC

25.51 J. MITRA & CO.

25.52 KILPEST INDIA LIMITED

25.53 MACCURA BIOTECHNOLOGY

25.54 MEDSOURCE OZONE BIOMEDICALS

25.55 MERIL LIFE SCIENCES

25.56 MP BIOMEDICALS

25.57 NANJING SYNTHGENE MEDICAL TECHNOLOGY

25.58 NIHON KOHDEN

25.59 NORMA INSTRUMENTS

25.60NOWDIAGNOSTICS

25.61 ORTHO CLINICAL DIAGNOSTICS

25.62 OPKO HEALTH (BIOREFERENCE HEALTH)

25.63 ORASURE TECHNOLOGIES

25.64 PERKIN ELMER

25.65 PRESTIGE DIAGNOSTICS

25.66 QIAGEN

25.67 QUIDEL

25.68 SYSMEX

25.69 SALOFA OY

25.70 SEASUN BIOMATERIALS

25.71 SEKISUI DIAGNOSTICS

25.72 SFRI

25.73 SHENZHEN DYMIND BIOTECHNOLOGY

25.74 SHENZHEN ICUBIO BIOMEDICAL TECHNOLOGY

25.75 SHENZHEN MINDRAY BIO-MEDICAL ELECTRONICS

25.76 SHENZHEN PROKAN ELECTRONICS

25.77 SHENZHEN LANDWIND MEDICAL

25.78 SINOCARE

25.79 SPINREACT

25.80 SURESCREEN DIAGNOSTICS

25.81 THE BINDING SITE GROUP

25.82 TRINITY BIOTECH

25.83 TRIVITRON HEALTHCARE

25.84 XIAMEN BIOTIME BIOTECHNOLOGY

25.85 ZHEJIANG ORIENT GENE BIOTECH

26 REPORT SUMMARY

26.1 KEY TAKEAWAYS

26.2 STRATEGIC RECOMMENDATIONS

27 QUANTITATIVE SUMMARY

27.1 MARKET BY GEOGRAPHY

27.2 MARKET BY PRODUCT & SERVICES

27.3 MARKET BY TECHNOLOGY

27.4 MARKET BY APPLICATION

27.5 MARKET BY END-USERS

27.6 PRODUCT & SERVICES: MARKET BY GEOGRAPHY

27.6.1 REAGENTS & CONSUMABLES: MARKET BY GEOGRAPHY

27.6.2 INSTRUMENTS/ANALYZERS & SOFTWARE: MARKET BY GEOGRAPHY

27.6.3 SERVICES: MARKET BY GEOGRAPHY

27.7 TECHNOLOGY: MARKET BY GEOGRAPHY

27.7.1 IMMUNO & CLINICAL CHEMISTRY: MARKET BY GEOGRAPHY

27.7.2 MOLECULAR DIAGNOSTICS: MARKET BY GEOGRAPHY

27.7.3 HEMATOLOGY: MARKET BY GEOGRAPHY

27.7.4 MICROBIOLOGY & CYTOLOGY: MARKET BY GEOGRAPHY

27.7.5 OTHER TECHNOLOGIES: MARKET BY GEOGRAPHY

27.8 APPLICATION: MARKET BY GEOGRAPHY

27.8.1 INFECTIOUS DISEASES: MARKET BY GEOGRAPHY

27.8.2 DIABETES: MARKET BY GEOGRAPHY

27.8.3 CARDIOLOGY: MARKET BY GEOGRAPHY

27.8.4 ONCOLOGY: MARKET BY GEOGRAPHY

27.8.5 AUTOIMMUNE DISEASES: MARKET BY GEOGRAPHY

27.8.6 NEPHROLOGY: MARKET BY GEOGRAPHY

27.8.7 DRUG TESTING: MARKET BY GEOGRAPHY

27.8.8 OTHER APPLICATIONS: MARKET BY GEOGRAPHY

27.9 END-USERS: MARKET BY GEOGRAPHY

27.9.1 STANDARD REFERENCE LABS: MARKET BY GEOGRAPHY

27.9.2 HOSPITAL AFFILIATED LABS: MARKET BY GEOGRAPHY

27.9.3 INDIVIDUALS: MARKET BY GEOGRAPHY

27.9.4 CLINICS: MARKET BY GEOGRAPHY

27.9.5 OTHER END-USERS: MARKET BY GEOGRAPHY

28 APPENDIX

28.1 ABBREVIATIONS

About

Us

:

Arizton Advisory and Intelligence is an innovative and quality-driven firm that offers cutting-edge research solutions to clients worldwide. We excel in providing comprehensive market intelligence reports and advisory and consulting services.

We offer comprehensive market research reports on consumer goods & retail technology, automotive and mobility, smart tech, healthcare, life sciences, industrial machinery, chemicals, materials, I.T. and media, logistics, and packaging. These reports contain detailed industry analysis, market size, share, growth drivers, and trend forecasts.

Arizton comprises a team of exuberant and well-experienced analysts who have mastered generating incisive reports. Our specialist analysts possess exemplary skills in market research. We train our team in advanced research practices, techniques, and ethics to outperform in fabricating impregnable research reports.

Click Here to Contact Us

Call: +1-312-235-2040

+1 302 469 0707

Mail: [email protected]

Photo: https://mma.prnewswire.com/media/1986749/In_Vitro_Diagnostics_Market.jpg

Logo: https://mma.prnewswire.com/media/818553/Arizton_Logo.jpg

SOURCE Arizton Advisory & Intelligence

For more details,please visit the original website

The content of the article does not represent any opinions of Synapse and its affiliated companies. If there is any copyright infringement or error, please contact us, and we will deal with it within 24 hours.

Organizations

Indications

Targets

-Drugs

-Hot reports

Get started for free today!

Accelerate Strategic R&D decision making with Synapse, PatSnap’s AI-powered Connected Innovation Intelligence Platform Built for Life Sciences Professionals.

Start your data trial now!

Synapse data is also accessible to external entities via APIs or data packages. Leverages most recent intelligence information, enabling fullest potential.