Bromhidrosis Disease Treatment Market Size to Grow by 362.76 Mn, Increasing Number of M&A by Vendors to be a Key Trend - Technavio

09 Nov 2022

AcquisitionCollaborate

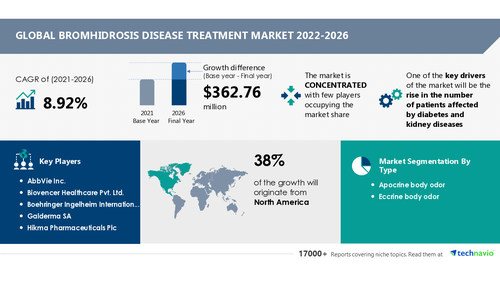

NEW YORK, Nov. 9, 2022 /PRNewswire/ -- The bromhidrosis disease treatment market size is expected to grow by USD 362.76 million from 2021 to 2026. In addition, the growth momentum of the market will accelerate at a CAGR of 8.92% during the forecast period, according to Technavio. The market has been segmented by type geography (North America, Europe, Asia, and Rest of World (ROW) and (apocrine body odor and eccrine body odor). Get a comprehensive report summary that describes the market size and forecast along with research methodology. The FREE sample report is available in PDF format

Continue Reading

Preview

Source: PRNewswire

Technavio has announced its latest market research report titled Global Bromhidrosis Disease Treatment Market 2022-2026

The rise in the number of patients affected by diabetes and kidney diseases, government awareness programs about the disease, and an increase in healthcare affordability in the US are some of the major factors propelling the market growth. However, factors such as the high cost of treatment, rise in the cost of R&D activities, and lack of knowledge of the disease will hamper the market growth.

More details: https://www.technavio.com/report/bromhidrosis-disease-treatment-market-industry-analysis

Bromhidrosis Disease Treatment Market: Trend

The

increasing M&As is a key trend shaping the bromhidrosis disease treatment market. The key vendors are acquiring small vendors to gain access to new products and technologies at low costs. For instance, in February 2022, Ipsen Pharma partnered with Mayoly Spindler to sell its global consumer healthcare business. In May 2022, Pfizer Inc. announced the acquisition of Biohaven Pharmaceutical Holding Company Ltd. In January 2022, Novartis AG partnered with AlnylamAlnylam to work on targeted therapy to restore liver function. Thus, the rise in the number of M&A will support the growth of the market in the coming years.

Technavio has identified key trends, drivers, and challenges in the market, which will help vendors improve their strategies to stay ahead of their competitors. Buy Now for detailed information about market dynamics

Bromhidrosis Disease Treatment Market: Type Landscape

By type, the

apocrine body odor segment will be a significant contributor to market growth during the forecast period. Apocrine sweat, when discharged, is colorless and odorless. In apocrine bromhidrosis, body odor is caused due to the combination of lipid-rich apocrine gland perspiration with microorganisms on the skin. This leads to the formation of thioalcohol. Thus, the increase in the number of people with apocrine bromhidrosis will drive the growth of the segment during the forecast period.

Bromhidrosis Disease Treatment Market: Geographic Landscape

By geography,

North America is going to have lucrative growth during the forecast period. About 38% of the market's overall growth is expected to originate from the region. The US and Canada are the key markets for bromhidrosis disease treatment in North America. The growth of the market in the region is attributed to factors such as rising healthcare expenditures, a well-developed healthcare sector, a large patient population, and government backing for R&D.

Learn about the contribution of each segment summarized in concise infographics and thorough descriptions. View a PDF Sample Report

Bromhidrosis Disease Treatment Market: Companies Covered

AbbVie Inc. - The company offers bromhidrosis disease treatment, namely Botox.

Galderma SA - The company offers bromhidrosis disease treatment, namely Alluzience.

Hikma Pharmaceuticals Plc - The company offers bromhidrosis disease treatment, namely Glycopyrrolate injection.

Ipsen Pharma - The company offers bromhidrosis disease treatment, namely Dysport.

Biovencer Healthcare Pvt. Ltd.

Johnson & Johnson - The company offers bromhidrosis disease treatment, namely Ditropan XLDitropan XL, through its subsidiary Janssen.

Merz Pharma GmbH & Co. KGaA

Bromhidrosis Disease Treatment Market: What our reports offer

Market share assessments for the regional and country-level segments

Strategic recommendations for the new entrants

Covers market data from 2021 to 2026

Market trends (threats, challenges, drivers, investment opportunities, and recommendations)

Strategic recommendations in key business segments based on the market estimations

Competitive landscaping recording the key common trends

Company profiling with financials, detailed strategies, and recent developments

Supply chain trends mapping the latest technological advancements

Get lifetime access to our Technavio Insights! Subscribe to our Basic Plan billed annually at USD 5000

Related Reports

Gastrointestinal Diseases Therapeutics Market by Drug Class and Geography - Forecast and Analysis 2022-2026: The increasing incidence of gastrointestinal diseases is driving market growth. Gastrointestinal diseases have increased significantly across the globe. Improper diet, inactive lifestyle, stress, food sensitivity, and bacterial or viral infection are the major factors contributing to the increasing incidence of chronic and acute gastrointestinal diseases.

Celiac Diseases Drugs Market by Therapy Type and Geography - Forecast and Analysis 2022-2026: Higher consumption of gluten-containing food is driving the market growth. Celiac disease is characterized by an increase in gluten deposition in the body due to the high consumption of food containing gluten. Pizza, cake, soups, beer, bread, cookies, pasta, and burgers are some of the widely consumed food that contains gluten.

Browse Health Care Market Reports

Table of Contents

1 Executive Summary

1.1 Market overview

Exhibit 01: Executive Summary – Chart on Market Overview

Exhibit 02: Executive Summary – Data Table on Market Overview

Exhibit 03: Executive Summary – Chart on Global Market Characteristics

Exhibit 04: Executive Summary – Chart on Market by Geography

Exhibit 05: Executive Summary – Chart on Market Segmentation by Type

Exhibit 06: Executive Summary – Chart on Incremental Growth

Exhibit 07: Executive Summary – Data Table on Incremental Growth

Exhibit 08: Executive Summary – Chart on Vendor Market Positioning

2 Market Landscape

2.1 Market ecosystem

Exhibit 09: Parent market

Exhibit 10: Market Characteristics

3 Market Sizing

3.1 Market definition

Exhibit 11: Offerings of vendors included in the market definition

3.2 Market segment analysis

Exhibit 12: Market segments

3.3 Market size 2021

3.4 Market outlook: Forecast for 2021-2026

Exhibit 13: Chart on Global - Market size and forecast 2021-2026 ($ million)

Exhibit 14: Data Table on Global - Market size and forecast 2021-2026 ($ million)

Exhibit 15: Chart on Global Market: Year-over-year growth 2021-2026 (%)

Exhibit 16: Data Table on Global Market: Year-over-year growth 2021-2026 (%)

4 Five Forces Analysis

4.1 Five forces summary

Exhibit 17: Five forces analysis - Comparison between 2021 and 2026

4.2 Bargaining power of buyers

Exhibit 18: Chart on Bargaining power of buyers – Impact of key factors 2021 and 2026

4.3 Bargaining power of suppliers

Exhibit 19: Bargaining power of suppliers – Impact of key factors in 2021 and 2026

4.4 Threat of new entrants

Exhibit 20: Threat of new entrants – Impact of key factors in 2021 and 2026

4.5 Threat of substitutes

Exhibit 21: Threat of substitutes – Impact of key factors in 2021 and 2026

4.6 Threat of rivalry

Exhibit 22: Threat of rivalry – Impact of key factors in 2021 and 2026

4.7 Market condition

Exhibit 23: Chart on Market condition - Five forces 2021 and 2026

5 Market Segmentation by Type

5.1 Market segments

Exhibit 24: Chart on Type - Market share 2021-2026 (%)

Exhibit 25: Data Table on Type - Market share 2021-2026 (%)

5.2 Comparison by Type

Exhibit 26: Chart on Comparison by Type

Exhibit 27: Data Table on Comparison by Type

5.3 Apocrine body odor - Market size and forecast 2021-2026

Exhibit 28: Chart on Apocrine body odor - Market size and forecast 2021-2026 ($ million)

Exhibit 29: Data Table on Apocrine body odor - Market size and forecast 2021-2026 ($ million)

Exhibit 30: Chart on Apocrine body odor - Year-over-year growth 2021-2026 (%)

Exhibit 31: Data Table on Apocrine body odor - Year-over-year growth 2021-2026 (%)

5.4 Eccrine body odor - Market size and forecast 2021-2026

Exhibit 32: Chart on Eccrine body odor - Market size and forecast 2021-2026 ($ million)

Exhibit 33: Data Table on Eccrine body odor - Market size and forecast 2021-2026 ($ million)

Exhibit 34: Chart on Eccrine body odor - Year-over-year growth 2021-2026 (%)

Exhibit 35: Data Table on Eccrine body odor - Year-over-year growth 2021-2026 (%)

5.5 Market opportunity by Type

Exhibit 36: Market opportunity by Type ($ million)

6 Customer Landscape

6.1 Customer landscape overview

Exhibit 37: Analysis of price sensitivity, lifecycle, customer purchase basket, adoption rates, and purchase criteria

7 Geographic Landscape

7.1 Geographic segmentation

Exhibit 38: Chart on Market share by geography 2021-2026 (%)

Exhibit 39: Data Table on Market share by geography 2021-2026 (%)

7.2 Geographic comparison

Exhibit 40: Chart on Geographic comparison

Exhibit 41: Data Table on Geographic comparison

7.3 North America - Market size and forecast 2021-2026

Exhibit 42: Chart on North America - Market size and forecast 2021-2026 ($ million)

Exhibit 43: Data Table on North America - Market size and forecast 2021-2026 ($ million)

Exhibit 44: Chart on North America - Year-over-year growth 2021-2026 (%)

Exhibit 45: Data Table on North America - Year-over-year growth 2021-2026 (%)

7.4 Europe - Market size and forecast 2021-2026

Exhibit 46: Chart on Europe - Market size and forecast 2021-2026 ($ million)

Exhibit 47: Data Table on Europe - Market size and forecast 2021-2026 ($ million)

Exhibit 48: Chart on Europe - Year-over-year growth 2021-2026 (%)

Exhibit 49: Data Table on Europe - Year-over-year growth 2021-2026 (%)

7.5 Asia - Market size and forecast 2021-2026

Exhibit 50: Chart on Asia - Market size and forecast 2021-2026 ($ million)

Exhibit 51: Data Table on Asia - Market size and forecast 2021-2026 ($ million)

Exhibit 52: Chart on Asia - Year-over-year growth 2021-2026 (%)

Exhibit 53: Data Table on Asia - Year-over-year growth 2021-2026 (%)

7.6 Rest of World (ROW) - Market size and forecast 2021-2026

Exhibit 54: Chart on Rest of World (ROW) - Market size and forecast 2021-2026 ($ million)

Exhibit 55: Data Table on Rest of World (ROW) - Market size and forecast 2021-2026 ($ million)

Exhibit 56: Chart on Rest of World (ROW) - Year-over-year growth 2021-2026 (%)

Exhibit 57: Data Table on Rest of World (ROW) - Year-over-year growth 2021-2026 (%)

7.7 US - Market size and forecast 2021-2026

Exhibit 58: Chart on US - Market size and forecast 2021-2026 ($ million)

Exhibit 59: Data Table on US - Market size and forecast 2021-2026 ($ million)

Exhibit 60: Chart on US - Year-over-year growth 2021-2026 (%)

Exhibit 61: Data Table on US - Year-over-year growth 2021-2026 (%)

7.8 Canada - Market size and forecast 2021-2026

Exhibit 62: Chart on Canada - Market size and forecast 2021-2026 ($ million)

Exhibit 63: Data Table on Canada - Market size and forecast 2021-2026 ($ million)

Exhibit 64: Chart on Canada - Year-over-year growth 2021-2026 (%)

Exhibit 65: Data Table on Canada - Year-over-year growth 2021-2026 (%)

7.9 Germany - Market size and forecast 2021-2026

Exhibit 66: Chart on Germany - Market size and forecast 2021-2026 ($ million)

Exhibit 67: Data Table on Germany - Market size and forecast 2021-2026 ($ million)

Exhibit 68: Chart on Germany - Year-over-year growth 2021-2026 (%)

Exhibit 69: Data Table on Germany - Year-over-year growth 2021-2026 (%)

7.10 China - Market size and forecast 2021-2026

Exhibit 70: Chart on China - Market size and forecast 2021-2026 ($ million)

Exhibit 71: Data Table on China - Market size and forecast 2021-2026 ($ million)

Exhibit 72: Chart on China - Year-over-year growth 2021-2026 (%)

Exhibit 73: Data Table on China - Year-over-year growth 2021-2026 (%)

7.11 UK - Market size and forecast 2021-2026

Exhibit 74: Chart on UK - Market size and forecast 2021-2026 ($ million)

Exhibit 75: Data Table on UK - Market size and forecast 2021-2026 ($ million)

Exhibit 76: Chart on UK - Year-over-year growth 2021-2026 (%)

Exhibit 77: Data Table on UK - Year-over-year growth 2021-2026 (%)

7.12 Market opportunity by geography

Exhibit 78: Market opportunity by geography ($ million)

8 Drivers, Challenges, and Trends

8.1 Market drivers

8.2 Market challenges

8.3 Impact of drivers and challenges

Exhibit 79: Impact of drivers and challenges in 2021 and 2026

8.4 Market trends

9 Vendor Landscape

9.1 Overview

9.2 Vendor landscape

Exhibit 80: Overview on Criticality of inputs and Factors of differentiation

9.3 Landscape disruption

Exhibit 81: Overview on factors of disruption

9.4 Industry risks

Exhibit 82: Impact of key risks on business

10 Vendor Analysis

10.1 Vendors covered

Exhibit 83: Vendors covered

10.2 Market positioning of vendors

Exhibit 84: Matrix on vendor position and classification

10.3 AbbVie Inc.

Exhibit 85: AbbVie Inc. - Overview

Exhibit 86: AbbVie Inc. - Product / Service

Exhibit 87: AbbVie Inc. - Key offerings

Exhibit 88: Boehringer Ingelheim International GmbH - Overview

Exhibit 89: Boehringer Ingelheim International GmbH - Business segments

Exhibit 90: Boehringer Ingelheim International GmbH - Key news

Exhibit 91: Boehringer Ingelheim International GmbH - Key offerings

Exhibit 92: Boehringer Ingelheim International GmbH - Segment focus

10.5 Galderma SA

Exhibit 93: Galderma SA - Overview

Exhibit 94: Galderma SA - Product / Service

Exhibit 95: Galderma SA - Key news

Exhibit 96: Galderma SA - Key offerings

Exhibit 97: Hikma Pharmaceuticals Plc - Overview

Exhibit 98: Hikma Pharmaceuticals Plc - Business segments

Exhibit 99: Hikma Pharmaceuticals Plc - Key offerings

Exhibit 100: Hikma Pharmaceuticals Plc - Segment focus

10.7 Ipsen Pharma

Exhibit 101: Ipsen Pharma - Overview

Exhibit 102: Ipsen Pharma - Business segments

Exhibit 103: Ipsen Pharma - Key offerings

Exhibit 104: Ipsen Pharma - Segment focus

10.8 Johnson and Johnson

Exhibit 105: Johnson and Johnson - Overview

Exhibit 106: Johnson and Johnson - Business segments

Exhibit 107: Johnson and Johnson - Key news

Exhibit 108: Johnson and Johnson - Key offerings

Exhibit 109: Johnson and Johnson - Segment focus

10.9 Medytox Inc.

Exhibit 110: Medytox Inc. - Overview

Exhibit 111: Medytox Inc. - Product / Service

Exhibit 112: Medytox Inc. - Key offerings

10.10 Merz Pharma GmbH and Co. KGaA

Exhibit 113: Merz Pharma GmbH and Co. KGaA - Overview

Exhibit 114: Merz Pharma GmbH and Co. KGaA - Product / Service

Exhibit 115: Merz Pharma GmbH and Co. KGaA - Key offerings

10.11 Novartis AG

Exhibit 116: Novartis AG - Overview

Exhibit 117: Novartis AG - Business segments

Exhibit 118: Novartis AG - Key offerings

Exhibit 119: Novartis AG - Segment focus

10.12 Pfizer Inc.

Exhibit 120: Pfizer Inc. - Overview

Exhibit 121: Pfizer Inc. - Product / Service

Exhibit 122: Pfizer Inc. - Key news

Exhibit 123: Pfizer Inc. - Key offerings

11.1 Scope of the report

11.2 Inclusions and exclusions checklist

Exhibit 124: Inclusions checklist

Exhibit 125: Exclusions checklist

11.3 Currency conversion rates for US$

Exhibit 126: Currency conversion rates for US$

11.4 Research methodology

Exhibit 127: Research methodology

Exhibit 128: Validation techniques employed for market sizing

Exhibit 129: Information sources

11.5 List of abbreviations

Exhibit 130: List of abbreviations

About Us

Technavio is a leading global technology research and advisory company. Their research and analysis focus on emerging market trends and provide actionable insights to help businesses identify market opportunities and develop effective strategies to optimize their market positions. With over 500 specialized analysts, Technavio's report library consists of more than 17,000 reports and counting, covering 800 technologies, spanning across 50 countries. Their client base consists of enterprises of all sizes, including more than 100 Fortune 500 companies. This growing client base relies on Technavio's comprehensive coverage, extensive research, and actionable market insights to identify opportunities in existing and potential markets and assess their competitive positions within changing market scenarios.

Contact

Technavio Research

Jesse Maida

US: +1 844 364 1100

UK: +44 203 893 3200

Email: [email protected]

Website: www.technavio.com/

SOURCE Technavio

For more details,please visit the original website

The content of the article does not represent any opinions of Synapse and its affiliated companies. If there is any copyright infringement or error, please contact us, and we will deal with it within 24 hours.

Organizations

Indications

Targets

-Hot reports

Get started for free today!

Accelerate Strategic R&D decision making with Synapse, PatSnap’s AI-powered Connected Innovation Intelligence Platform Built for Life Sciences Professionals.

Start your data trial now!

Synapse data is also accessible to external entities via APIs or data packages. Leverages most recent intelligence information, enabling fullest potential.