Request Demo

Last update 15 Nov 2025

AstraZeneca PLC

Last update 15 Nov 2025

Overview

Tags

Neoplasms

Respiratory Diseases

Urogenital Diseases

Small molecule drug

Monoclonal antibody

Antibody drug conjugate (ADC)

Disease domain score

A glimpse into the focused therapeutic areas

No Data

Technology Platform

Most used technologies in drug development

No Data

Targets

Most frequently developed targets

No Data

| Disease Domain | Count |

|---|---|

| Neoplasms | 257 |

| Endocrinology and Metabolic Disease | 115 |

| Immune System Diseases | 110 |

| Nervous System Diseases | 96 |

| Infectious Diseases | 80 |

| Hemic and Lymphatic Diseases | 72 |

| Top 5 Drug Type | Count |

|---|---|

| Small molecule drug | 249 |

| Monoclonal antibody | 59 |

| Antibody drug conjugate (ADC) | 25 |

| Synthetic peptide | 18 |

| Diagnostic radiopharmaceuticals | 14 |

Related

516

Drugs associated with AstraZeneca PLCTarget |

Mechanism SARS-CoV-2 S protein inhibitors |

Active Org. |

Originator Org. |

Active Indication |

Inactive Indication- |

Drug Highest PhaseApproved |

First Approval Ctry. / Loc. Japan |

First Approval Date27 Dec 2024 |

Target |

Mechanism TOP1 inhibitors [+1] |

Active Org. |

Originator Org. |

Active Indication |

Inactive Indication |

Drug Highest PhaseApproved |

First Approval Ctry. / Loc. Japan |

First Approval Date27 Dec 2024 |

Target |

Mechanism TTR modulators |

Active Org. |

Originator Org. |

Active Indication |

Inactive Indication |

Drug Highest PhaseApproved |

First Approval Ctry. / Loc. United States |

First Approval Date22 Nov 2024 |

5,983

Clinical Trials associated with AstraZeneca PLCNCT07175415

ITCC-104: HEM-iSMART International Proof of Concept Therapeutic Stratification Trial of Molecular Anomalies in Relapsed or Refractory HEMatological Malignancies in Children, Sub-Protocol E: Capivasertib + Venetoclax + Dexamethasone in Pediatric Patients With Relapsed or Refractory Hematological Malignancies

HEM-iSMART is a master protocol which investigates multiple investigational medicinal products in children, adolescents and young adults (AYA) with relapsed/refractory (R/R) ALL and LBL. Sub-protocol E is a phase I/II trial evaluating the safety and efficacy of capivasertib + venetocolax in combination with dexamethasone in children and AYA with R/R ped ALL/LBL whose tumor present with alterations of the PAM pathway, or lacking any mutations.

Start Date01 Oct 2026 |

Sponsor / Collaborator |

NCT06015750

An Interventional, Prospective Open-Label Study of Immunosuppressive Therapies to Mitigate Immune-Mediated Loss of Therapeutic Response to Asfotase Alfa (STRENSIQ®) for Hypophosphatasia (RESTORE)

The primary objective of this study is to evaluate the effect of immunosuppressive therapy (IST) in participants treated with asfotase alfa who demonstrate immune-mediated loss of effectiveness (LoE).

Start Date29 Jul 2026 |

Sponsor / Collaborator |

NCT07162480

Phase II Trial of Puxitatug Samrotecan (AZD8205) in Advanced, Recurrent or Metastatic (R/M) Aggressive Adenoid Cystic Carcinoma Subtype I (ACC-I)

Phase II open label study designed to evaluate the efficacy and safety of P-Sam in patients with aggressive, solid, NOTCH mutant or p63 low (B7-H4 high) R/M ACC-I patients.

Start Date28 Feb 2026 |

Sponsor / Collaborator |

100 Clinical Results associated with AstraZeneca PLC

Login to view more data

0 Patents (Medical) associated with AstraZeneca PLC

Login to view more data

9,602

Literatures (Medical) associated with AstraZeneca PLC31 Dec 2025·Human Vaccines & Immunotherapeutics

Exploring nurses’ experiences with a school-located influenza vaccination program: A qualitative study in the region of Murcia, Spain

Article

Author: Perez Martin, Jaime ; Robles Mañueco, Marta ; Martínez Ruiz, Marina ; Zornoza Moreno, Matilde

A cross-sectional qualitative pilot study was designed to assess the nurses' perspectives regarding a school-located influenza vaccination pilot program. The program was developed during the 2022-2023 season in the Region of Murcia (an autonomous community of Spain) targeting the 3- to 4-year population in 24 public schools, using the intranasal Fluenz® Tetra vaccine. School nurses unanimously recognized their professional role not only in administering the vaccine, but also in the development and implementation of general aspects of the pilot program and reported that the experience was very positive. Nursing professionals should be fully involved in providing information to parents about the main aspects of influenza infection and benefits of having their children vaccinated against seasonal influenza. Nurses also advocated that the flu vaccination for children should begin at the same time as vaccination for adults, with vaccination planning completely integrated into the school schedule.Practice implications: The study results could guide healthcare authorities in facilitating the implementation of school-located influenza vaccination programs and increase immunization of preschool children against flu.

01 Dec 2025·LABORATORY INVESTIGATION

Validation and Prospective Testing of a High-Sensitivity, Quantitative Analytic Assay for HER2 on Histopathology Slides

Article

Author: Scott, Liam ; Fulton, Regan ; Rimm, David L ; Khaimova, Revekka ; Chan, Nay N N ; He, Mengni ; Liebler, Daniel C ; Robbins, Charles J ; Benanto, Julia ; Gaule, Patricia ; Bates, Katherine

The recent approval of antibody-drug conjugates targeting human epidermal growth factor receptor 2 (HER2) (such as trastuzumab deruxtecan [T-DXd]) has led to challenges for the immunohistochemical (IHC) companion diagnostic test because the test was optimized for gene-amplified levels of HER2. Here, we develop and validate an objective test for low-level HER2 expression toward more accurate selection of patients for T-DXd. We validated the high-sensitivity HER2 assay using a mix of the requirements for an IHC assay and that of a ligand-binding assay. Then, we prospectively tested it on 316 core biopsy specimens received by the Yale Pathology Laboratories from August 2022 to August 2023. Using a 40-case breast cancer tissue validation set, we find very high accuracy and precision with a coefficient of variation <10% and define a reportable range for the assay in attomoles per square millimeter. These prospective cases not only show the dynamic range of HER2 expression but also the discordance of Yale Pathology Labs staff pathologist scores with quantitative measurements, especially in the low range of HER2. We find that 6% of the cohort was below the limit of detection of this more sensitive assay, whereas 71% of the IHC 0 cases were above the limit of quantification. Efforts are underway to determine a possible threshold expression level required for T-DXd response. In summary, this assay validation study provides a method for accurate, objective measurement of HER2 and has the potential to improve selection of patients for T-DXd or similarly targeted antibody-drug conjugate therapies in future.

01 Oct 2025·Multiple Sclerosis and Related Disorders

ACT with NMOSD: A targeted, telehealth-delivered mental health intervention for patients & caregivers

Article

Author: Nurse, Chelsi N ; Wakschal, Emily ; Peppers, Charles L ; Deshpande, Ankita ; Esiason, Darcy C ; Andrews, Leigh ; Erler, Wendy ; Levy, Michael ; Hattrich, Tom ; O'Hayer, C Virginia ; Bruschwein, Heather ; Leist, Thomas ; Kushner, Hallie M ; Smith, Patrick J ; Drescher, Christopher F

PURPOSE:

The rare, unpredictable, debilitating nature of neuromyelitis optica spectrum disorder (NMOSD) constitutes a unique psychological burden. This single-arm, pilot clinical trial examined the effectiveness of Acceptance and Commitment Therapy (ACT) tailored to meet the psychological burden of NMOSD, a brief telehealth-delivered intervention, targeting this burden.

METHODS:

Forty-three adults with NMOSD (76 % aquaporin-4 seropositive (AQP4+)) in USA, with elevated anxiety and/or depression completed 6-weeks of an experiential talk therapy designed to increase psychological flexibility and valued action, specifically tailored to address the psychological burden of NMOSD: Acceptance and Commitment Therapy (ACT) w NMOSD. Patients attended via Zoom, along with 22 caregivers, providing baseline, posttreatment, and follow-up measures of depression, anxiety, cognitive fusion, psychological flexibility, valued living, disability, sleep, fatigue, and pain. Linear mixed effect models examined changes in repeated measures of all outcomes, controlling for age, sex, disability, AQP4 serostatus.

RESULTS:

Participants were mostly female (84 %) and Caucasian (56 %), with baseline mild depression (mean 15.4 [SD = 8.7]) and moderate anxiety (mean = 13.5 [SD = 9.3]). Most participants (93 %) completed all treatment sessions and study assessments. Pre-to-post treatment analysis showed clinically meaningful reductions in depression (15.4 (12.8, 19.0) to 11.1 (8.3, 13.8) P<.001;) and anxiety (13.5 (11.2, 15.7) to 10.0 (7.5, 12.4) P ≤.005). Parallel improvements in cognitive fusion (39.6 (35.6, 43.6) to 33.7 (29.6, 37.7) P<.001), psychological acceptance (20.0 (17.3, 22.8) to 17.0 (14.2, 19.8) P < 0.002), valued living (49.2 (43.2, 55.3) to 60.5 (54.4, 66.6) P<.001), and sleep quality (10.1 (9.0, 11.2) to 8.3 (7.1, 9.5), P<.001) support the overall benefit of ACT to mental health. Improvements remained at 3-month follow-up. Disability status, pain, fatigue, were unchanged, as expected.

CONCLUSIONS:

ACT with NMOSD is a promising innovative targeted mental health intervention for adults with NMOSD with lasting benefits.

CLINICALTRIALS:

gov ID # NCT05840055 Supported by Alexion Pharmaceuticals.

10,635

News (Medical) associated with AstraZeneca PLC14 Nov 2025

Created with Canva Dreamlab

†

Through substantial leadership turnover and workforce cuts, the FDA has continued to support the advanced therapy sector, actively working to remove obstacles to innovation.

The cell and gene therapy landscape has seen a mixed bag of headlines this year. Leadership changes at the FDA have attracted negative attention, but the current health administration is actually fueling positive momentum in some areas, particularly the cell and gene therapy space.

A bevy of changes have come down the pike, including last month’s

guidances

meant to streamline the path to market for these therapies and this week’s announcement of a new

regulatory mechanism

to support more

baby KJs

. The FDA is clearly showing its dedication to regulatory burdens for sponsors. This is a fundamental regulatory shift shaped by technological innovation and new political leadership.

News of positive change seems at odds with rocky personnel changes, but these kinds of actions are typical of a change in administration.

In a decade of leading several high-pro builds and the scale up of the first ever CGT manufacturing facilities, my consulting firm, Project Farma, has witnessed many shakeups among officials. The moves we’re seeing today affirm regulatory trust in the data and maturity of the CGT sector. The sentiment in the industry and amongst organizations like the Alliance for Regenerative Medicine, where I serve as a board member, is that this momentum is real. While no system is perfect, we are hopefully witnessing the beginnings of a regulatory framework that balances scientific rigor with the speed and flexibility patients deserve.

Cell and Gene Therapy

FDA’s New Cell and Gene Therapy Guidances Finally Go a ‘Click Further’ to ‘Game Changing’

Following up on previous, dimly received issuances, a new set of ideas published by the FDA to streamline regulatory pathways for cell and gene therapies ‘for small populations’ is receiving a warmer welcome—but experts warn it will take more to turn the tide for the fraught therapeutic space.

October 3, 2025

·

5 min read

·

Dan Samorodnitsky

Momentum with Modernization

At a

recent roundtable

, FDA Commissioner Marty Makary, CBER Director Vinay Prasad and HHS Secretary Robert F. Kennedy Jr. emphasized their commitment to streamlining regulation and cutting red tape. The intent with these changes is to reduce barriers, promote flexibility and retain U.S. leadership in biomedical innovation.

As panelists at a recent roundtable, including Carl June and Tom Cahill, warned

, China’s more permissive regulatory model has attracted early-stage cell and gene therapy development abroad. Without further action, the U.S. risks a brain drain and the erosion of its innovation advantage.

Nevertheless, the institutional direction and the industry’s biggest players remain supportive of and optimistic of the cell and gene therapy field, and these regulatory tailwinds are giving the market an unprecedented wave of momentum in strategic investment and dealmaking. This year alone,

Eli Lilly announced an agreement to acquire Verve Therapeutics

to expand its

in vivo

gene editing capabilities, while AstraZeneca added to its portfolio with the

$1B purchase of Esobiotec, completed in May

.

AbbVie announced plans to buy CAR T developer Capstan for up to $2.1B

, and

Roche completed the acquisition of Poseida Therapeutics

in a deal worth up to $1.5B.

These moves from the industry’s biggest players demonstrate that regardless of a challenging fundraising climate, major pharma companies are deepening their cell and gene pipelines through acquisitions, partnerships and platform investments.

Regulatory Action With Real Market Impact

In June 2025, the

FDA made a landmark move to eliminate Risk Evaluation and Mitigation Strategies (REMS)

across six approved

CAR T therapies

, citing extensive clinical experience and mature safety management protocols. This move broadens patient access, especially for rural and underserved populations, by allowing more community hospitals to administer CAR T treatments without the previously required certifications or proximity rules.

I expect that this decision is delivering immediate business impact for the sector, and that it represents a broader regulatory posture recognizing the clinical maturity of cell and gene therapies. The downstream impact of changes like this will be faster uptake, broader patient access and a clearer path to scale. Analysts suggest the strategic decision to remove REMS could signal a return to more permissive, patient-advocacy-driven approaches for rare disease approvals, potentially easing the path for certain cell and gene therapy programs.

Regulatory

‘Chaotic’ HHS Overhaul a Wrecking Ball Toward a Better FDA: Former CIO

The upheaval of the Health and Human Services workforce and leadership leaves much to be desired in terms of delivery, recently retired FDA Chief Information Officer Vid Desai tells

BioSpace

, but the regulatory agency is evolving to be more open to much needed change.

November 6, 2025

·

5 min read

·

Jef Akst

While deregulation is a recurring theme, the FDA remains intent on protecting its “gold standard” reputation and balancing innovation with safety. See, for instance, the actions the FDA took in July 2025, when the agency evaluated a potential market withdrawal of Sarepta’s gene therapy Elevidys following three patient deaths, two of which involved acute liver failure. Elevidys had been granted accelerated approval, and Sarepta had received the first ever platform designation for the AAVrh74 viral vector it uses in gene therapy products for multiple muscular dystrophy indications.

Following a rapid review, the FDA investigation of an 8-year-old boy’s death in Brazil was ultimately deemed unrelated to Elevidys. The FDA later recommended lifting the pause for ambulatory patients, and Sarepta resumed shipments for this population. Shipments for non-ambulatory patients remain on voluntary hold pending updated safety labeling and risk-mitigation plans, while FDA placed clinical holds on other AAVrh74-based programs and revoked the vector’s platform designation, after already having worked with Sarepta to add a boxed warning to Elevidys for acute liver injury.

The Elevidys case reminds us that even amid regulatory optimism, the stakes remain high, and the agency should remain committed to balancing innovation and speed of development with keeping patients safe. As novel AAV-based therapies, as well as other CGT modalities, reach wider patient populations, post-market surveillance, real-time data integration and adaptive risk management will be essential to maintaining both safety and trust.

Securing US Leadership in a Competitive Global Market

Without consistent regulatory clarity and follow-through, the U.S. risks ceding innovation to countries like China, which already have faster regulatory paths for early-stage cell and gene therapies. If early-stage development continues to migrate abroad, the result will not only be a loss of U.S. leadership but also delayed access for American patients.

As more personalized or modular therapies reach the market under accelerated or adaptive pathways, long-term safety monitoring and public trust in FDA oversight will become critical issues. Regulatory agility will need to be paired with robust post-market regulations and oversight.

The FDA’s recent moves reflect a dual commitment to unlock access where scientific maturity allows, and to intervene decisively when safety is at stake. The removal of REMS from CAR T therapies marks a leap forward in democratizing advanced cancer treatment. But the scrutiny around Elevidys shows the agency remains vigilant, offering credibility to its deregulatory efforts and underscoring the need for smart, scalable oversight as the CGT landscape continues to evolve.

Sustaining the sector’s momentum will demand a commitment to modernization that keeps pace with science. As other nations adopt faster, more flexible frameworks, the U.S. must ensure its own systems are equally adaptive, without compromising the rigor that underpins trust in our therapies. The stakes extend beyond today’s patient access and encompass the U.S.’ ability to define the next generation of advanced therapies, anchor innovation within our borders and remain the global leader in translating breakthrough science into real-world cures.

Acquisition

13 Nov 2025

The study will explore how wearables, smartphone-based functional tests, and ePROs could detect changes in disease trajectory in real-world conditions

The results will help lay the groundwork for larger trials and, ultimately, digital tools that could one day transform how neuromuscular disorders like Myasthenia Gravis are monitored and managed”

— Loïc Carment, PhD. Chief Scientific Officer of Ad Scientiam

PARIS, FRANCE, November 13, 2025 /

EINPresswire.com

/ -- Ad Scientiam today announced a collaboration with

Merck KGaA

, Darmstadt, Germany, a leading science and technology company, to launch a prospective, multi-center pilot study exploring the feasibility of an investigational software as a

medical device

designed to support the management of people living with generalized

Myasthenia Gravis

(gMG). The study will explore how wearable technologies, smartphone-based functional tests, and electronic patient-reported outcomes (ePROs) could detect changes in disease trajectory in real-world conditions.

Bridging gaps in disease monitoring:

Myasthenia Gravis is a rare autoimmune neuromuscular disease marked by fluctuating muscle weakness. Many patients remain insufficiently controlled despite available therapies, often struggling to detect or communicate subtle changes in their average state amid daily fluctuations in symptoms. At the same time, physicians lack more continuous, objective tools to complement traditional clinical assessments.

This investigational software as a medical device is being developed to address these gaps by uniting three digital health components in a single, patient-centered solution:

- Mobile application: enabling objective data collection through unsupervised active functional tests and electronic questionnaires.

- Wearable activity monitor: passive monitoring of physical activity, heart rate, breathing, and sleep.

- Cloud platforms: extracting digital biomarkers and building exploratory disease trajectory models.

Measuring what matters in daily life:

An exploratory study applying this software as a medical device is being prepared to be launched in selected European countries in 2026. Its primary goal is to explore the feasibility of using digital measures collected by this novel software as a medical device to detect changes in disease trajectory in adults with generalized Myasthenia Gravis over a 12-month period, under real-life, unsupervised conditions.

Patient-centric innovation:

By combining passive data, active functional tests, and ePROs, this software as a medical device aims to provide patients with gMG a more continuous and objective way of following their condition.

“This study is an important first step to explore the feasibility of such a digital platform in real-world, unsupervised conditions. By turning everyday digital measures into a clearer view of disease trajectory, we aim to provide clinicians with more continuous, objective data and give patients a simpler way to recognize and share subtle changes. The results will help lay the groundwork for larger trials and, ultimately, digital tools that could one day transform how neuromuscular disorders like Myasthenia Gravis are monitored and managed.” - Dr Loïc Carment, PhD. Chief Scientific Officer of Ad Scientiam.

About Ad Scientiam:

Ad Scientiam is committed to improving patient care by continuously monitoring the progression of severe and disabling diseases in real-life settings. This approach is essential for delivering more effective and personalized care.

The company develops and clinically validates digital biomarkers that capture subtle and often hard‑to‑detect fluctuations in disease activity. These biomarkers are derived from data collected through everyday digital tools such as smartphones and are processed with proprietary algorithms.

The company’s expertise is recognized by leading hospital institutions across Europe, the United States, and Canada, and by major pharmaceutical partners including Sanofi, Alexion, Kyowa Kirin, Vertex, Merck KGaA, Darmstadt, Germany, and Biogen. MSCopilot

®

, a CE‑marked Software as a Medical Device, is classified as Class IIa under the EU Medical Device Regulation (MDR). Beyond MS, Ad Scientiam is validating new medical devices across various fields, including neuroscience, rare diseases, and mental health.

Ad Scientiam’s Quality Management System is fully compliant with ISO 13485.

Contact: press@adscientiam.com

Saad Zinaï

Ad Scientiam

email us here

Visit us on social media:

LinkedIn

Instagram

Facebook

Legal Disclaimer:

EIN Presswire provides this news content "as is" without warranty of any kind. We do not accept any responsibility or liability

for the accuracy, content, images, videos, licenses, completeness, legality, or reliability of the information contained in this

article. If you have any complaints or copyright issues related to this article, kindly contact the author above.

Clinical Study

12 Nov 2025

NEWARK, Del. and ATLANTA, Nov. 12, 2025 /PRNewswire/ -- The National Institute for Innovation in Manufacturing Biopharmaceuticals (NIIMBL) and the Open Applications Group, Inc. (OAGi) are proud to announce the release of a groundbreaking set of ontologies designed to enhance data interoperability and analytics capabilities across the biopharmaceutical industry. These ontologies are the result of a collaborative effort within OAGi's Industrial Ontologies Foundry (IOF) among domain experts, standards developers, and leading organizations. They establish a semantic foundation for consistent data exchange, integration, and interpretation.

The newly released ontologies cover core biomanufacturing concepts, including process parameters, equipment, quality attributes, various types of recipes and their components, processing steps, and materials. They are intended to serve as a common reference framework for systems integration, data analytics, regulatory submissions, and digital transformation initiatives across the biopharmaceutical manufacturing value chain.

"Ontologies give us a shared language to structure and contextualize manufacturing data. With this release, we're one step closer to seamless interoperability across our systems, suppliers, and regulators. With this release, we see growing progress toward cross-consortia collaboration to create an interoperable ontology to serve the biopharmaceutical manufacturing industry," said Roger Hart, NIIMBL Senior Fellow and Big Data Program Lead.

"This joint initiative marks a significant milestone in our mission to bring a new, advanced data interoperability standard to bring new values to industries. The ontologies we've co-developed with OAGi and NIIMBL members will empower the industry to create smarter automations, better traceability, and more scalable and reliable analytics," said Boonserm Kulvatunyou, National Institute of Standards and Technology Process Engineering Group Leader and Semantics Interoperability Expert.

"This latest release of ontologies is a significant step forward in establishing industry-wide standards for biopharmaceutical manufacturing digitalization. The enhanced ontology features streamlined conceptual frameworks and refined semantic constructs that dramatically improve usability for ontology specialists and implementation teams," stated Elyse Easson, Director, Commercialization and Digital CMC Value Team, Digital MMD.

The biopharmaceutical manufacturing sector has expressed strong support for the availability of this ontology and the advantages it offers for leveraging data in manufacturing processes.

"This ontology will be beneficial to the development of biopharmaceuticals because it will facilitate communication amongst those with diverse backgrounds. The human-readable aspects of it provide a shared language and reference point for effective communication between organizations. The machine-readable aspects will enable automated organization and visualization of data from disparate sources, a task that is frequently time consuming and performed manually," said Jan Kemper, Associate Principal Automation Engineer at AstraZeneca.

"This latest release of biopharmaceutical manufacturing ontologies is a significant step forward, establishing a shared language for data across the industry. By creating a standardized, streamlined framework, these ontologies provide the clean, well-structured data essential for analytics and AI to thrive. This unification of data from diverse sources not only ensures seamless interoperability but also accelerates insights that improve product quality, yield, and time to market," added Markus Hartmann, Global Product Lead for Data Semantics at MilliporeSigma.

The ontologies are now publicly available under an MIT-style license and are expected to be adopted by technology vendors, regulatory bodies, and biomanufacturing organizations seeking to modernize their data infrastructure and promote digital maturity.

For access to the ontologies and technical documentation, visit .

For more information about NIIMBL, visit NIIMBL.org.

About NIIMBL

The National Institute for Innovation in Manufacturing Biopharmaceuticals (NIIMBL) is a public-private partnership whose mission is to accelerate biopharmaceutical innovation, support the development of standards that enable more efficient and rapid manufacturing capabilities, and educate and train a world-leading biopharmaceutical manufacturing workforce, fundamentally advancing U.S. competitiveness in this industry. NIIMBL is part of Manufacturing USA®, a diverse network of federally sponsored manufacturing innovation institutes, and is funded through a cooperative agreement with the National Institute of Standards and Technology (NIST) in the U.S. Department of Commerce with significant additional support from its members.

NIIMBL contact:

Daniel Maiese

Communications Manager

+1 302-831-3824

[email protected]

About OAGi and IOF

OAGi is a non-profit standards organization with the mission to improve data interoperability within and among enterprises by developing data standards, ontologies, and other resources. The IOF is an OAGi division.

OAGi contact:

Michelle Banks

+1 404-402-1962

[email protected]

SOURCE National Institute for Innovation in Manufacturing Biopharmaceuticals (NIIMBL)

21%

more press release views with

Request a Demo

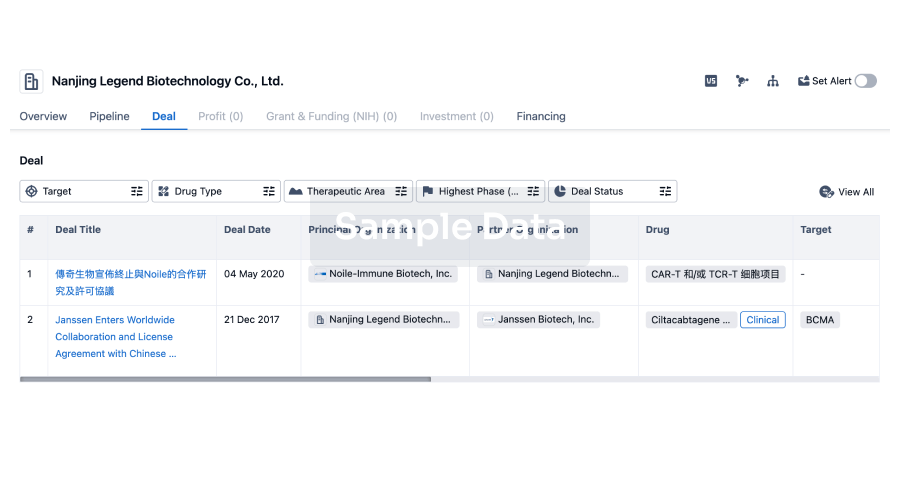

100 Deals associated with AstraZeneca PLC

Login to view more data

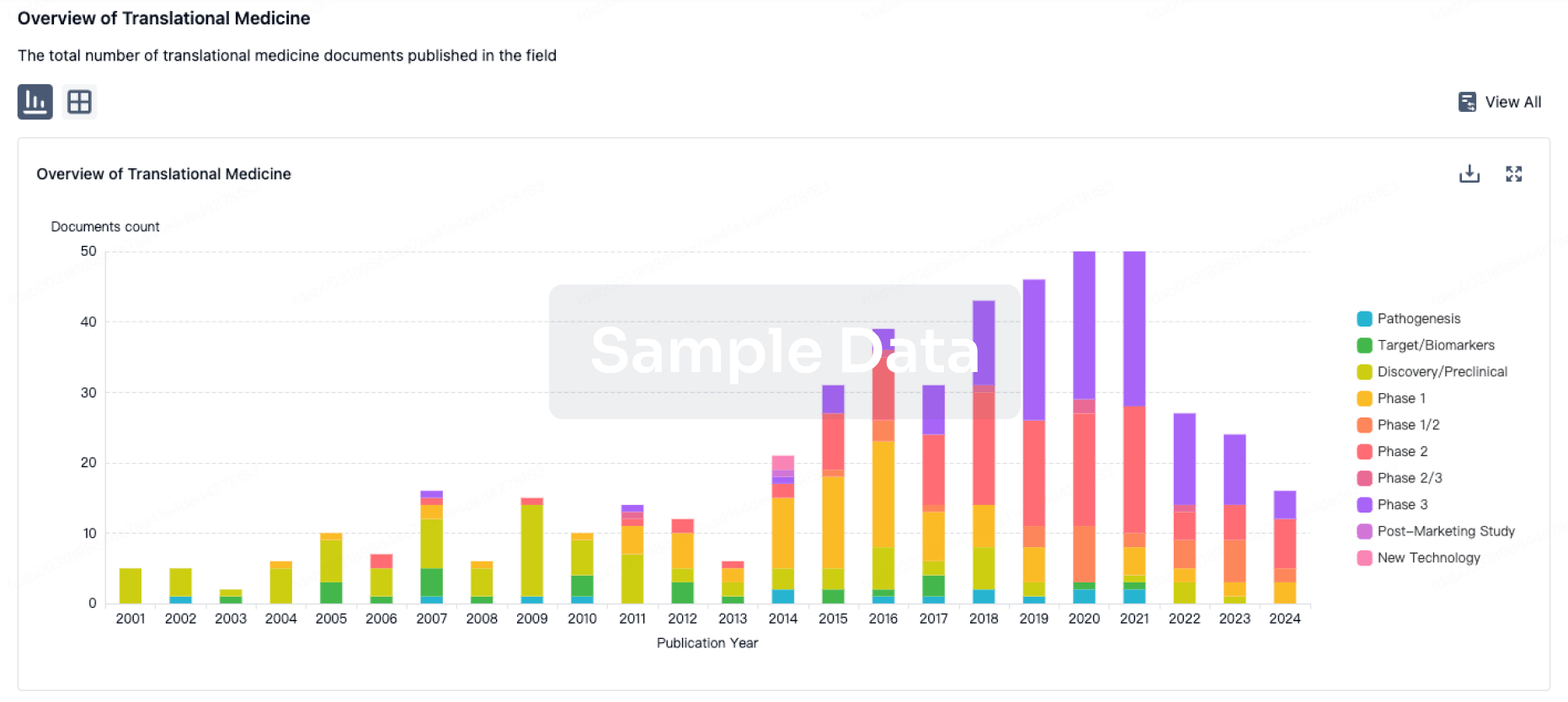

100 Translational Medicine associated with AstraZeneca PLC

Login to view more data

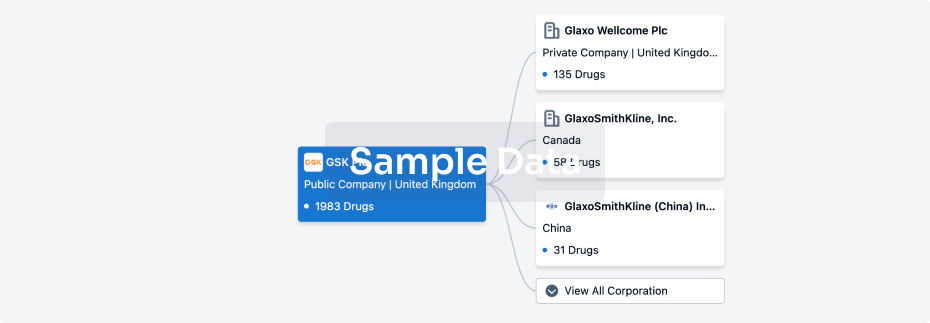

Corporation Tree

Boost your research with our corporation tree data.

login

or

Pipeline

Pipeline Snapshot as of 20 Dec 2025

The statistics for drugs in the Pipeline is the current organization and its subsidiaries are counted as organizations,Early Phase 1 is incorporated into Phase 1, Phase 1/2 is incorporated into phase 2, and phase 2/3 is incorporated into phase 3

Discovery

62

178

Preclinical

IND Application

1

58

Phase 1

Phase 2

94

38

Phase 3

NDA/BLA

3

81

Approved

Other

823

Login to view more data

Current Projects

| Drug(Targets) | Indications | Global Highest Phase |

|---|---|---|

Tremelimumab ( CTLA4 ) | Advanced Lung Non-Small Cell Carcinoma More | Approved |

Ticagrelor ( P2Y12 receptor ) | Myocardial Infarction More | Approved |

Acalabrutinib ( BTK ) | Chronic Lymphocytic Leukemia More | Approved |

Esomeprazole Magnesium ( Proton pump ) | Gastroesophageal Reflux More | Approved |

Fulvestrant ( ER ) | Hormone receptor positive breast cancer More | Approved |

Login to view more data

Deal

Boost your decision using our deal data.

login

or

Translational Medicine

Boost your research with our translational medicine data.

login

or

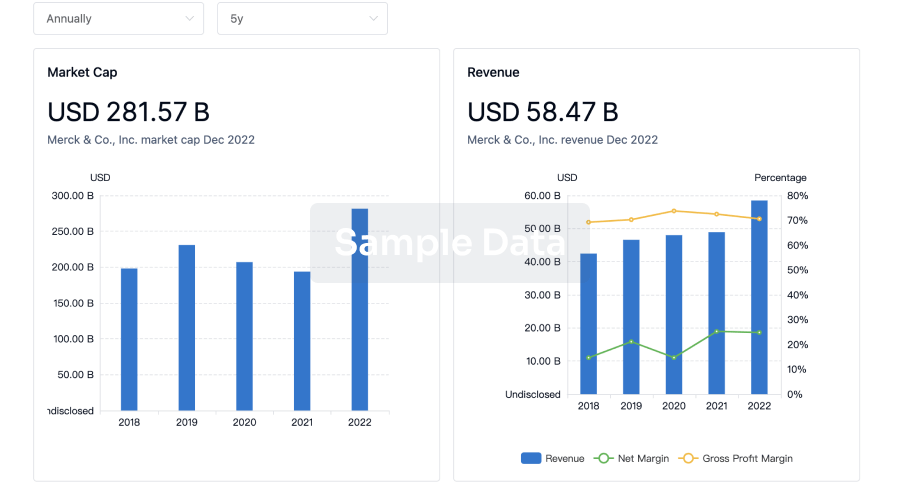

Profit

Explore the financial positions of over 360K organizations with Synapse.

login

or

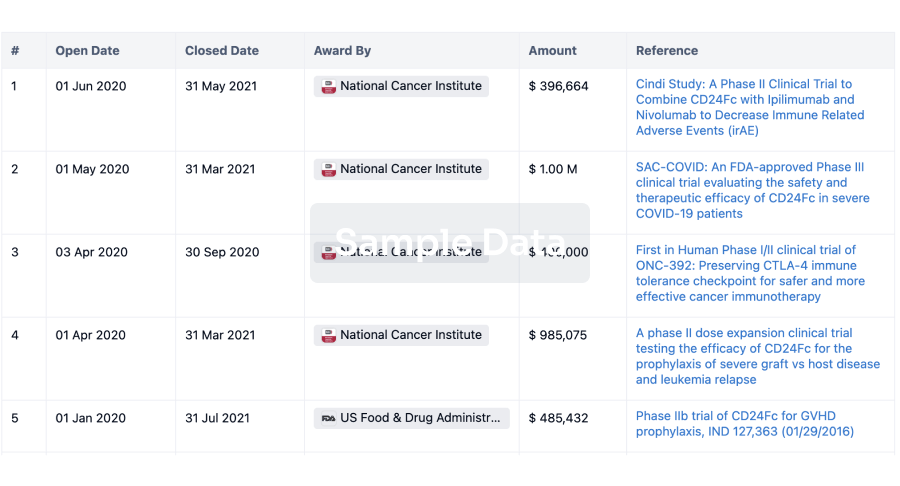

Grant & Funding(NIH)

Access more than 2 million grant and funding information to elevate your research journey.

login

or

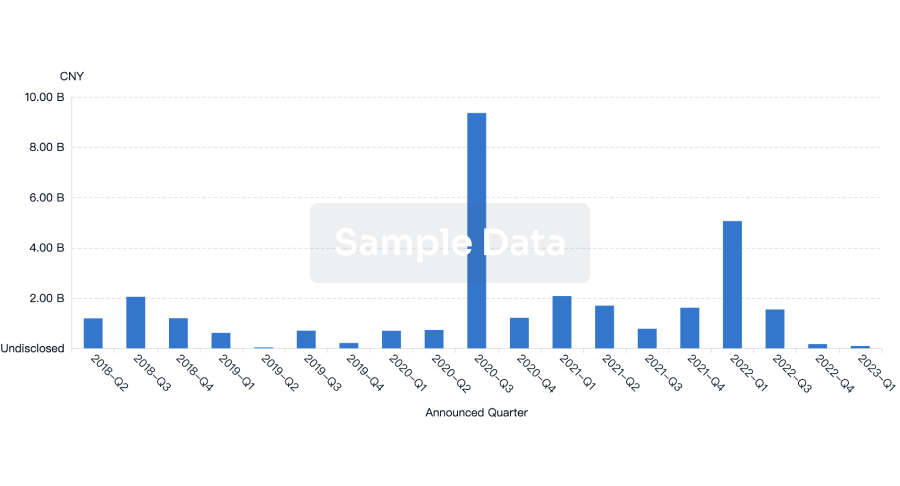

Investment

Gain insights on the latest company investments from start-ups to established corporations.

login

or

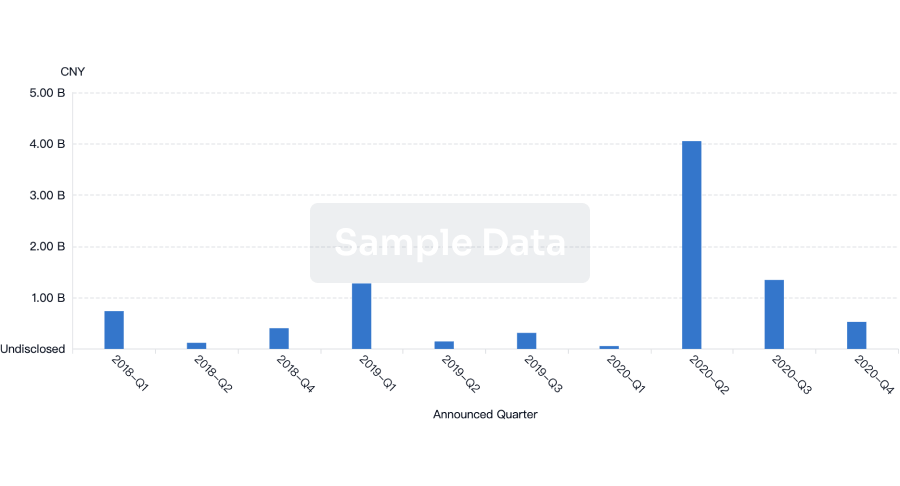

Financing

Unearth financing trends to validate and advance investment opportunities.

login

or

AI Agents Built for Biopharma Breakthroughs

Accelerate discovery. Empower decisions. Transform outcomes.

Get started for free today!

Accelerate Strategic R&D decision making with Synapse, PatSnap’s AI-powered Connected Innovation Intelligence Platform Built for Life Sciences Professionals.

Start your data trial now!

Synapse data is also accessible to external entities via APIs or data packages. Empower better decisions with the latest in pharmaceutical intelligence.

Bio

Bio Sequences Search & Analysis

Sign up for free

Chemical

Chemical Structures Search & Analysis

Sign up for free