Request Demo

Last update 04 Dec 2025

Celyad Oncology SA

Last update 04 Dec 2025

Overview

Tags

Neoplasms

Hemic and Lymphatic Diseases

Immune System Diseases

Universal CAR-T

Autologous CAR-T

CAR-T

Disease domain score

A glimpse into the focused therapeutic areas

No Data

Technology Platform

Most used technologies in drug development

No Data

Targets

Most frequently developed targets

No Data

| Disease Domain | Count |

|---|---|

| Neoplasms | 7 |

| Hemic and Lymphatic Diseases | 4 |

| Immune System Diseases | 2 |

| Top 5 Drug Type | Count |

|---|---|

| Universal CAR-T | 4 |

| CAR-T | 2 |

| Autologous CAR-T | 1 |

Related

7

Drugs associated with Celyad Oncology SATarget |

Mechanism NKG2D antagonists |

Active Org. |

Originator Org. |

Active Indication |

Inactive Indication- |

Drug Highest PhasePhase 1 |

First Approval Ctry. / Loc.- |

First Approval Date- |

Target |

Mechanism NKG2D antagonists |

Active Org. |

Originator Org. |

Active Indication |

Inactive Indication- |

Drug Highest PhasePhase 1 |

First Approval Ctry. / Loc.- |

First Approval Date- |

Target |

Mechanism BCMA inhibitors |

Active Org. |

Originator Org. |

Active Indication |

Inactive Indication- |

Drug Highest PhasePhase 1 |

First Approval Ctry. / Loc.- |

First Approval Date- |

13

Clinical Trials associated with Celyad Oncology SANCT04991948

An Open-label, Phase Ib Study to Assess the Safety and Clinical Activity of CYAD-101 Administered Concurrently With FOLFOX Chemotherapy, Followed by Pembrolizumab Treatment, in Patients With Metastatic Colorectal Cancer

The purpose of the CYAD-101-002 study is to assess the safety and clinical activity of CYAD-101 in patients with unresectable metastatic colorectal cancer administered concurrently with FOLFOX chemotherapy, followed by pembrolizumab treatment.

Start Date22 Nov 2021 |

Sponsor / Collaborator  Celyad Oncology SA Celyad Oncology SA [+1] |

NCT04613557

Open-label Phase I, Multi-center Study to Determine the Recommended Dose of CYAD-211 After a Non-myeloablative Preconditioning Chemotherapy in Multiple Myeloma Patients With Relapsed or Refractory Disease

The purpose of the IMMUNICY-1 study is to assess the safety, activity and cell kinetics of CYAD-211 in adults with relapsed or refractory multiple myeloma after a lymphodepletion regimen with fludarabine and/or cyclophosphamide

Start Date16 Nov 2020 |

Sponsor / Collaborator |

NCT04167696

Open-label, Phase I, Multi-center Study to Determine in Relapsed/Refractory Acute Myeloid Leukemia or Myelodysplastic Syndrome Patients the Recommended Dose of CYAD-02 After a Non-myeloablative Preconditioning Chemotherapy Followed by a Potential Consolidation Cycle

An open-label, phase I, multi-center study to determine in relapsed/refractory (r/r) acute myeloid leukemia (AML) or myelodysplastic syndrome (MDS) patients the recommended dose of CYAD-02 after a non-myeloablative preconditioning chemotherapy followed by a potential CYAD-02 consolidation cycle for non-progressive patient. A maximum of 27 r/r AML/MDS patients will be evaluated in this study in case of no dose limiting toxicity (DLT) and no replacement of patients.

Start Date25 Nov 2019 |

Sponsor / Collaborator |

100 Clinical Results associated with Celyad Oncology SA

Login to view more data

0 Patents (Medical) associated with Celyad Oncology SA

Login to view more data

103

News (Medical) associated with Celyad Oncology SA29 Sep 2025

Mont-Saint-Guibert, Belgium; September 29, 2025, 6:30 pm CET; regulated information / inside information – Celyad Oncology (Euronext: CYAD) (the “Company”), today announces the divestment of the Company’s research facility.

Under the terms of an asset purchase agreement, the Company shall sell its research facility’s equipment and office furniture in Mont-Saint-Guibert, Belgium, for a total consideration of €3 million. The transaction is subject to a number of customary conditions precedent and is anticipated to close in the fourth quarter of this year. Management currently anticipates that this transaction will extend the cash runway of the Company by approximatively three quarters, i.e. into Q3-2026.

Acquisition

25 Sep 2025

Mont-Saint-Guibert, Belgium; September 25, 2025, 6:30 pm CET; regulated information – Celyad Oncology (Euronext: CYAD) (the “Company”), today announced its financial results for the first half year 2025 ended June 30, 2025.

First Half 2025 financial review

As of June 30, 2025, the Company’s Treasury position amounted to €0.8 million.

After due consideration of detailed budgets and estimated cash flow forecasts for the years 2025 and 2026, the Company projects that its existing cash and cash equivalents will be sufficient to fund its estimated operating and capital expenditures into the fourth quarter of 2025.

Key financial figures for first half 2025, compared with the first half of 2024 and full year 2024, are summarized below:

Research and Development (R&D) expenses were €2.1 million in June 2025 as compared to €1.5 million during the same period in 2024, an increase of €0.6 million. The increase in the Company’s R&D expenses was primarily driven by the increase of the IP costs related to the licensing activities as well as the increase of the expenses linked to the redevelopment of the catheter.

General and Administrative (G&A) expenses remained stable with €1.7 million in June 2025 as in June 2024.

Net loss for the first half of 2025, was €3.7 million, or €(0.09) per share, compared to a net loss of €3.0 million, or €(0.07) per share, for the same period in 2024.

Net cash used in operations was €3.3 million for the first half of 2025 compared to €2.8 million for the first half of 2024. The increase of €0.5 million was primarily driven by the global increase of IP activities and catheter development costs.

As of June 30, 2025, the Company had cash and cash equivalents of €0.8 million. No capital increase occurred in the first half of 2025. The total number of basic shares outstanding was 41.4 million like in December 31, 2024.

The interim financial report for first half 2025 of the Company can be found on our website: https://celyad.com/investors/

Financial Calendar 2025

May 20th 2026 : Annual shareholders meeting September 24th 2026 : First Half 2026 Interim results

The financial calendar is communicated on an indicative basis and may be subject to change.

The Company continues to bolster its intellectual property estate and to pursue options to monetize it The Company’s two main research and development platforms have delivered proof-of-concept and are ready to be incorporated into clinical candidates and/or to be further explored and exploited via potential partnerships The Company actively participated at several key international scientific conferences and published in well-renowned peer-reviewed journals which have raised the interest for the Company’s technologies and developments Operational expenses according to Budget allowing cash runway until third quarter 2025

Mont-Saint-Guibert, Belgium; September 13, 2024, 7:00 am CET; regulated information – Celyad Oncology (Euronext: CYAD) (the “Company”), today announces its financial results for the first half year 2024 ended June 30, 2024, and provides a business update.

Michel Lussier, interim Chief Executive Officer of Celyad Oncology, commented: “Celyad Oncology continues to make remarkable progress in developing cutting-edge technologies for chimeric antigen receptor (CAR) T-cell therapy. Our groundbreaking multiplex platform is revolutionizing the potential of CAR T-cells, while our pioneering NKG2D-based multispecific CAR T-cell platform is further paving the way to conquer current limitations of this transformative class of immunotherapy”

The Company is pursuing a strategy of continued research and development, with a particular focus on intellectual property (IP). Monetization of its innovative approaches and technologies is a key objective. Celyad Oncology is progressing in this regard and is currently in discussion with potential partners for out-licensing deals; With its research focus, the Company has made concrete progress by providing proof-of-concept of the multiplex short hairpin RNAs (shRNAs) non-gene edited technology platform and the multispecific NKG2D-based CAR T-cell platform, which provide unique options to tackle the major current limitations of CAR T-cell therapies. Options to further explore or validate these data through strategic partnerships, and/or to incorporate these technologies into clinical CAR-T candidates are actively pursued by the Company; The Company continues to share and discuss its latest advances at international scientific conferences throughout the first half of 2024 with updated results provided at the 27th ASGCT [1] Annual Meeting and the Recent insights into Immuno-Oncology VIB conference [2]. The Company is also focusing on sharing data and views with the scientific community and has published a review highlighting the interest of non-gene editing technologies for allogeneic CAR T-cell therapies in Cells [3] and another review providing an overview of all engineering strategies to safely drive CAR T-cells into the future in Frontiers in Immunology [4], two well-renowned peer-reviewed scientific journals; In response to the request expressed by several companies and academic institutions engaged in gene and cell therapies for cardiac applications, the Company has re-initiated the manufacturing and commercialization of C-Cath®, an intra-myocardial injection catheter developed and owned by the Company.

Multiplex shRNA non-gene edited technology – The Company developed a chimeric micro-RNA (miRNA) cluster to enable multiplexing of shRNAs, designed for easy, efficient, and tunable downregulation of up to four target genes simultaneously in CAR T-cells. Data successfully demonstrated the feasibility and effectiveness of the multiplex approach to improve allogeneic CAR T-cell viability by avoiding graft-versus-host disease (GvHD) via knocking down of CD3ζ, avoiding host-versus-graft (HvG) reaction and promoting cell persistence via knocking-down of β2M and CIITA, and avoiding CD95L-induced autophagy via knocking-down of CD95; Another multiplex cassette focusing on the knock-down of co-inhibitory receptors (PD-1, LAG-3, TIM-3 and CD95) was also developed to decrease the expression of exhaustion markers at the surface of CAR T-cells. Multispecific NKG2D-based CAR T-cell platform – Different NKG2D-based multispecific CAR T-cells were developed to provide the proof-of-concept that NKG2D ligands (NKG2DL) are valuable targets in a multispecific CAR approach to counteract relapses due to antigen loss or antigen heterogeneity.PSMA/NKG2DL tandem CAR T-cells, that encompass the extracellular domain of the natural NKG2D receptor fused to an anti-PSMA CAR to overcome antigen heterogeneity and improve anti-tumor efficacy against prostate cancer were developed and demonstrated functionality in vitro against prostate cancer cell lines expressing or not the tumor-associated antigen PSMA; In vivo proof-of-concept of the company’s CD19/NKG2DL tandem CAR T-cell candidate was also provided in a B-ALL relapse model, showing that this multi-specific CAR T-cell candidate has an enhanced anti-tumor efficacy against heterogeneous lymphoma tumors, or to counteract antigen loss, as compared to currently existing treatment options.

Data successfully demonstrated the feasibility and effectiveness of the multiplex approach to improve allogeneic CAR T-cell viability by avoiding graft-versus-host disease (GvHD) via knocking down of CD3ζ, avoiding host-versus-graft (HvG) reaction and promoting cell persistence via knocking-down of β2M and CIITA, and avoiding CD95L-induced autophagy via knocking-down of CD95;

Another multiplex cassette focusing on the knock-down of co-inhibitory receptors (PD-1, LAG-3, TIM-3 and CD95) was also developed to decrease the expression of exhaustion markers at the surface of CAR T-cells.

PSMA/NKG2DL tandem CAR T-cells, that encompass the extracellular domain of the natural NKG2D receptor fused to an anti-PSMA CAR to overcome antigen heterogeneity and improve anti-tumor efficacy against prostate cancer were developed and demonstrated functionality in vitro against prostate cancer cell lines expressing or not the tumor-associated antigen PSMA;

In vivo proof-of-concept of the company’s CD19/NKG2DL tandem CAR T-cell candidate was also provided in a B-ALL relapse model, showing that this multi-specific CAR T-cell candidate has an enhanced anti-tumor efficacy against heterogeneous lymphoma tumors, or to counteract antigen loss, as compared to currently existing treatment options.

As of June 30, 2024, the Company’s Treasury position amounts to €6.2 million.

After due consideration of detailed budgets and estimated cash flow forecasts for the years 2024 and 2025, the Company projects that its existing cash and cash equivalents will be sufficient to fund its estimated operating and capital expenditures into the third quarter of 2025.

Key financial figures for first half 2024, compared with the first half of 2023 and full year 2023, are summarized below:

Research and Development (R&D) expenses were €1.5 million in June 2024 as compared to €2.1 million during the same period in 2023, a decrease of €0.6 million. The decrease in the Company’s R&D expenses is primarily driven by the Company’s strategic decision in 2022 and beginning of 2023 to discontinue clinical development and prioritization of most promising research programs.

General and Administrative (G&A) expenses were €1.7 million in June 2024 as compared to €3.7 million during the same period in 2023, a decrease of €2.0 million. This decrease is mainly related to the decrease in employee expenses related to headcount reduction and management changes to support the Company’s reorganization (notably resulting from Nasdaq delisting and SEC deregistration of the Company) and to a decrease in insurance costs and consulting fees.

As of June 30, 2024, Management has determined that there has been no event (such as a firm sublicense or collaboration contract) that led to a change in fair value of the contingent consideration and other financial liabilities. The Company’s other income is mainly associated with grants received and some insurance compensations.

Net loss for the first half of 2024, was €3.0 million, or € (0.07) per share, compared to a net loss of €3.7 million, or € (0.17) per share, for the same period in 2023. As noted above, the decrease in net loss between periods was primarily due to the decrease of R&D and General and administrative expenses in 2024 partly compensated by lower amounts of grants revenues from public institutions.

Net cash used in operations was €2.8 million for the first half of 2024 compared to €8.3 million for the first half of 2023. The decrease of €5.5 million is primarily driven by the global decrease in preclinical and clinical activities, insurance costs and headcount. In 2023 the deviation between Net cash used in operations and Loss of the period was mainly explained by the change in the working capital (Trade payables and other liabilities decrease). The decrease of these costs is in line with the Company’s decision to adopt and implement over the last few months of the year 2022 the new business strategy to focus on early-stage discovery research in areas of expertise where it can leverage the differentiated nature of its platforms.

More data and evidence in the context of the multispecific CAR and shRNA multiplex platforms, with the possibility of a clinical evaluation of assets and initiation of clinical trials either by the Company and/or through strategic partnerships afterwards; Celyad Oncology will attend and present updated data on its programs at the 9th CAR-TCR Summit in Boston, US (Sep. 17-20), the Advanced Therapies Europe in Estoril (Sep. 10-12) and present two posters at the 39th Annual Meeting of the Society for Immunotherapy of Cancer (SITC) in Houston (Nov. 6-10); The Company anticipates the appointment of a new CEO in the second half of 2024.

April 2nd 2025 : Full Year 2024 Financial Statements May 5th 2025 : Annual shareholders meeting September 25th 2025 : First Half 2025 Interim results

The financial calendar is communicated on an indicative basis and may be subject to change.

[1] American Society of Gene & Cell Therapy Annual meeting, Baltimore, US (May 7-11, 2024)

[2] Recent insights into Immuno-Oncology VIB (Flemish Institute for Biotechnology) conference, Antwerp (May 30-31, 2024)

[3] Cells 2024;13(2):146

[4] Front Immunol. 2024:15:1411393

Georges Rawadi was appointed Chief Executive Officer as from April 27, 2023 Celyad Oncology has received approximately EUR 9.8m in private placement commitments from historical shareholders Encouraging progress in multiplex shRNA platform development, which allows now targeting of up to four genes simultaneously, were presented at international meetings In vitro validation of NKG2D-based multi-specific CAR T-cell platform with a first candidate targeting both NKG2D ligands and CD19was also presented

Mont-Saint-Guibert, Belgium; September 4, 2023, 10:00 pm CET; regulated information – Celyad Oncology (Euronext: CYAD) (the “Company” or “Celyad Oncology”), today announces its financial results and recent business developments for the first half year, ended June 30, 2023.

“Celyad Oncology is now fully focused on maximizing the potential of its proprietary technology platforms and intellectual property, enabling the Company to be at the forefront of developing next-generation CAR T-cell therapies. We are eager to see the impact of our research efforts on the future of CAR T-cell treatments, with the goal to broaden the range of cancer indications and tackle the main limitations of current CAR T-cell therapies” commented Georges Rawadi, Celyad Oncology’s Chief Executive Officer.

First Half 2023 and recent corporate highlights:

Georges Rawadi was appointed Chief Executive Officer of the Company as from April 27, 2023. Georges Rawadi is a seasoned executive with over 20 years of experience in pharma/biotech, as research director, business developer, CEO, and board member. He also has insightful knowledge of both the company and the CAR-T space as he spent four years at Celyad Oncology (2014-2018) as Vice-President Business Development & Intellectual Property (“BD & IP”). Georges Rawadi has a genuine passion for seeking and creating new business opportunities. On May 5th, 2023, the Company announced voluntary delisting of its American Depositary Shares representing ordinary shares (“ADSs”) from the Nasdaq Global Market. Delisting was effective as of July 20, 2023. The Company continues to be listed on Euronext Brussels and Euronext Paris. On August 24, 2023, the Company announced that it has obtained commitments from Fortress, Tolefi and other longstanding existing shareholders to subscribe to a capital increase of up to €9.8 million in 2 tranches:A first tranche of 2.0 million was disbursed in the context of authorized capital as of September 4, 2023; and A second tranche to be subscribed by Fortress is subject to the approval by the extraordinary shareholders’ meeting. Following this private placement, the Company believes that its existing cash and cash equivalents should be sufficient, based on the current scope of activities, to fund operating expenses and capital expenditure requirements into the end of the fourth quarter of 2024.

A first tranche of 2.0 million was disbursed in the context of authorized capital as of September 4, 2023; and

A second tranche to be subscribed by Fortress is subject to the approval by the extraordinary shareholders’ meeting. Following this private placement, the Company believes that its existing cash and cash equivalents should be sufficient, based on the current scope of activities, to fund operating expenses and capital expenditure requirements into the end of the fourth quarter of 2024.

First Half 2023 and recent operational highlights:

Short hairpin ribonucleic acid (shRNA) non-gene edited technology – During this first half of 2023, we have collected and presented data validating our shRNA multiplexing approach:We developed a micro-RNA (miRNA)-based multiplex shRNA platform designed for easy, efficient, and tunable downregulation of up to four target genes simultaneously; We showed that the downregulation of each target gene could be fine-tuned, from a moderate downregulation up to a functional knock-out, without the need of gene editing thereby avoiding associated potential safety issues; The plug-and-play design of our platform is designed to allow swapping of each target sequence without affecting the performance of the technology and streamlining of the generation of engineered adoptive T-cell therapies; To demonstrate the effectiveness of our approach, we have been able to simultaneous knock-down in CAR T-cells several genes involved in different cellular processes such as alloreactivity (CD3ζ), cell persistence (β2M, CIITA), T-cell exhaustion (PD-1, LAG-3), or ligand-induced apoptosis (CD95); Data were presented at the World Oncology Cell Therapy Congress in Boston, US (April 25-26, 2023) and at the CAR-TCR Summit in Boston, US (August 29 – September 1). NKG2D-based CAR T-cells and multi-specific CAR T-cell platform – During this first half of 2023, we have published data validating our NKG2D-based CAR T-cell approach and presented data from our multi-specific CAR T-cell platform:Results from 16 patients treated in the dose-escalation segment of the hematological arm of the Phase I THINK trial were published in The Lancet Haematology Journal (Lancet Haematol. 2023 Mar;10(3):e191-e202) and provided proof-of-concept for targeting NKG2D ligands (NKG2DL) with CAR T-cell therapy; We have developed different CD19/NKG2DL multi-specific CAR T-cells, utilizing both tandem and dual NKG2D-based CARs that encompass the extracellular domain of the natural NKG2D receptor fused to an anti-CD19 scFv, or co-expressed with an anti-CD19 CAR, respectively; The majority of our CD19/NKG2DL multi-specific CAR T-cell candidates were able to secrete cytokines, proliferate, and eliminate acute lymphoblastic leukemia tumor cells lacking the CD19 antigen in vitro. Interestingly, some of these multi-specific CAR T-cells displayed a better in vitro functionality against wild-type leukemia tumor cells expressing the CD19 antigen as compared to CD19-specific single targeting CAR T-cells, highlighting the potential of our approach against both CD19 positive and CD19 negative cancer cells; First in vivo data suggest that our CD19/NKG2DL multi-specific CAR T-cell candidates have an enhanced anti-tumor efficacy against heterogeneous lymphoma tumors as compared to currently existing treatment options; We are currently developing several NKG2D-based multi-specific CAR T-cells for the treatment of diverse solid cancers where there is a high heterogeneity in antigen expression; Data were presented at the Immuno-Oncology Summit Europe 2023 held in London, UK (June 20-22, 2023).

We developed a micro-RNA (miRNA)-based multiplex shRNA platform designed for easy, efficient, and tunable downregulation of up to four target genes simultaneously;

We showed that the downregulation of each target gene could be fine-tuned, from a moderate downregulation up to a functional knock-out, without the need of gene editing thereby avoiding associated potential safety issues;

The plug-and-play design of our platform is designed to allow swapping of each target sequence without affecting the performance of the technology and streamlining of the generation of engineered adoptive T-cell therapies;

To demonstrate the effectiveness of our approach, we have been able to simultaneous knock-down in CAR T-cells several genes involved in different cellular processes such as alloreactivity (CD3ζ), cell persistence (β2M, CIITA), T-cell exhaustion (PD-1, LAG-3), or ligand-induced apoptosis (CD95);

Data were presented at the World Oncology Cell Therapy Congress in Boston, US (April 25-26, 2023) and at the CAR-TCR Summit in Boston, US (August 29 – September 1).

Results from 16 patients treated in the dose-escalation segment of the hematological arm of the Phase I THINK trial were published in The Lancet Haematology Journal (Lancet Haematol. 2023 Mar;10(3):e191-e202) and provided proof-of-concept for targeting NKG2D ligands (NKG2DL) with CAR T-cell therapy;

We have developed different CD19/NKG2DL multi-specific CAR T-cells, utilizing both tandem and dual NKG2D-based CARs that encompass the extracellular domain of the natural NKG2D receptor fused to an anti-CD19 scFv, or co-expressed with an anti-CD19 CAR, respectively;

The majority of our CD19/NKG2DL multi-specific CAR T-cell candidates were able to secrete cytokines, proliferate, and eliminate acute lymphoblastic leukemia tumor cells lacking the CD19 antigen in vitro. Interestingly, some of these multi-specific CAR T-cells displayed a better in vitro functionality against wild-type leukemia tumor cells expressing the CD19 antigen as compared to CD19-specific single targeting CAR T-cells, highlighting the potential of our approach against both CD19 positive and CD19 negative cancer cells;

First in vivo data suggest that our CD19/NKG2DL multi-specific CAR T-cell candidates have an enhanced anti-tumor efficacy against heterogeneous lymphoma tumors as compared to currently existing treatment options;

We are currently developing several NKG2D-based multi-specific CAR T-cells for the treatment of diverse solid cancers where there is a high heterogeneity in antigen expression;

Data were presented at the Immuno-Oncology Summit Europe 2023 held in London, UK (June 20-22, 2023).

Upcoming anticipated milestones

More data and evidence in the context of the multi-specific CAR platform and shRNA multiplexing approach in H2 2023, with the aim of a clinical evaluation of assets and initiation of clinical trials either by the Company and/or through strategic partnerships afterwards; Relocation, in H2 2023, into a new research facility which fits better its current needs after the strategic shift. The Company will remain headquartered at the Axis Parc, Mont-Saint-Guibert, Belgium but with its new business location at Dumont 9.

Upcoming Conferences

The Company will take part in the 4th International Conference on Lymphocyte Engineering (ICLE) in Munich (September 12-14) and the annual congress of the Society for Immunotherapy of Cancer (SITC) in San Diego (November 1-5), as well at several business conferences in the second half of 2023.

First Half 2023 Financial Results

Key financial figures for the first half of 2023, compared with the first half of 2022 and full year 2022, are summarized below:

The Company’s license and collaboration agreements generated no revenue in the first half of 2023 similar to the first half of 2022.

The Research and Development (R&D) expenses have decreased primarily due to the Company’s decision to discontinue some of preclinical programs and manufacturing and clinical study activities after the Company’s decision to adopt and implement a new business strategy. Furthermore, there has been a decrease of employee expenses and related travel costs which is mainly related to headcount reduction through 2022, to support the Group’s reorganization around preclinical and clinical programs, as well as a decrease of the expenses associated with share-based payments (non-cash expenses) related to the warrant plan offered to the Company’s employees, managers and directors.

General and Administrative (G&A) expenses were €3.7 million in 2023 as compared to €6.2 million in 2022. This decrease is primarily related to lower insurances costs, the decrease of employee expenses due to headcount reduction and management changes through 2022 to support the Company’s reorganization and the decrease of the expenses associated with the share-based payments (non-cash expenses) related to the warrants plan offered to the Company’s employees, managers and directors.

As of June 30, 2023, there was no change in fair value of the contingent consideration and other financial liabilities as Management has determined that there have been no event (such as a firm sublicense or collaboration contract) that increases the probability of the projected future cash outflow due to Celdara Medical, LLC and Dartmouth College, indicating that the probability is remote, similar to December 31, 2022.

Regarding the other income/other expenses, the Company recorded €2.1 million in net other income for the first half of 2023 compared to a net other income of €1.6 million for the first half of 2022. The net other income for the first half of 2023 is primarily due to the gain on the sale of certain fixed assets to Cellistic for €1.1 million and grant income from the Walloon Region of €0.8 million.

Net loss was €3.7 million, or €(0.17) per share, for the first half of 2023 compared to a net loss of €14.1 million, or €(0.62) per share, for the same period of 2022.

Net cash used in operations, was €8.3 million for the first half of 2023 compared to €16.3 million for the first half of 2022. The decrease of €8.0 million is primarily driven by the sale of the manufacturing activities in 2022 combined with global decrease on preclinical and clinical activities, insurance costs, headcount, management changes costs and associated impact on the change in working capital.

As of June 30, 2023, the Company had cash and cash equivalents of €5.0 million. No capital increase has occurred in the first half of 2023.

As of June 30, 2023, the total number of basic shares outstanding were 22.6 million similar to December 31, 2022.

Conference Call and Webcast Details

A conference call will be held on Tuesday 5th of September at 1:00 p.m. CET / 7:00 a.m. EDT discuss half year 2023 financial results and provide an update on the Company’s recent changes and upcoming milestones.

Participants may access the conference call by dialing +1-877-407-9716 or +1-201-493-6779 (United States, International), +32 (0) 800-73-904 (Belgium Fixed) or +32 (0) 800-73-566 (Belgium Mobile). Participants may ask for instant telephone access to the event via the “Call me” link or attend the conference live webcast.

Archived recording will be available in the “Events” section of the Celyad website after the event.

Financial Calendar 2023

The financial calendar is communicated on an indicative basis and may be subject to change.

Starting in 2023, Celyad Oncology is now entirely focused on its new business strategy with one clear objective: help to overcome the current limitations of CAR-T approaches. It plans to do this via (i) strengthening of its research focus centered around NKG2D, B7-H6 and shRNA platforms; (ii) maximizing the value of its IP estate and (iii) driving innovation through strategic collaborations.

Mont-Saint-Guibert, Belgium – Celyad Oncology (Euronext & Nasdaq: CYAD) (the “Company”), a biotechnology company focused on innovative technologies for chimeric antigen receptor (CAR) T-cell therapies, today announces its financial results for the fiscal year 2022 ended December 31, 2022 and provides a business update.

Michel Lussier, Interim Chief Executive Officer of Celyad Oncology, said: “2022 was a crossroad year for Celyad Oncology, with important changes and turning points. We strongly believe all those changes, together with our prior accomplishments, significantly strengthened our position. Having dealt with the 2022 challenges, Celyad has now positively reinvented itself as a leaner, more agile organization. We believe that Celyad is well prepared and has the relevant unique assets and know how to create significant shareholder value in the next few years.”

Operational highlights

Since late 2022, the Company has implemented a differentiated and innovative strategy, increasing its R&D efforts in areas of expertise where it believes it can leverage the differentiated nature of its platform technology and continue to bolster its intellectual property (IP) estate; and The Company will continue to explore options to tackle the major current limitations of CAR T-cell therapies through development of its dual targeting CARs with NKG2D capabilities, B7-H6 targeting immunotherapies and multiplexing approach of short hairpin RNAs (shRNAs).

Upcoming Anticipated Milestones

The Company will provide an update on its shRNA multiplexing and dual CAR platforms and business development in the first half of 2023; The Company will take part in the World Oncology Cell Therapy Congress in Boston, US (25-26 April 2023), as well as in the Immuno-Oncology summit in London (20-22 June 2023); The Company anticipates the arrival of a new CEO in the first half of 2023; and We anticipate fundraising in the first half of 2023.

Full Year 2022 Financial Review

As of December 31, 2022, the Company had cash and cash equivalents of €12.4 million ($13.3 million).

The Company projects that its existing cash and cash equivalents should be sufficient to fund operating expenses and capital expenditure requirements into the fourth quarter of 2023.

After due consideration of detailed budgets and estimated cash flow forecasts for the years 2023 and 2024, the Company projects that its existing cash and cash equivalents will not be sufficient to fund its estimated operating and capital expenditures over at least the next 12 months from the date that the financial statements are issued.

The Company is currently evaluating different financing options to obtain the required funding to extend the Company’s cash runway beyond 12 months from the date the financial statements are issued.

Key financial figures for full-year 2022, compared with full-year 2021, are summarized below:

(1) “Treasury position” is an alternative performance measure determined by adding Short-term investments and Cash and cash equivalents from the statement of financial position prepared in accordance with IFRS. The purpose of this measure by Management is to identify the level of cash available internally (excluding external sources of financing) within 12 months.

The Company’s license and collaboration agreements generated no revenue in 2022 and in 2021.

Research and Development (R&D) expenses were €18.9 million in 2022 as compared to €20.8 million in 2021, a year-over-year decrease of €1.8 million. The decrease in the Company’s R&D expenses is primarily driven by the Company’s decision to discontinue some of preclinical and in process development costs after the Company’s decision to adopt and implement a new business strategy over the last few months of 2022, as well as a decrease of the expenses associated with share-based payments (non-cash expenses) related to the warrant plan offered to our employees and directors.

General and Administrative (G&A) expenses were €10.5 million in 2022 as compared to €9.9 million in 2021, an increase of €0.6 million. This increase is primarily related to higher insurances costs and consulting fees partially compensated by the decrease of the expenses associated with the share-based payments (non-cash expenses) related to the warrants plan offered to our employees and directors.

The fair value adjustment (€14.7 million) relating to the contingent consideration and other financial liabilities as of December 31, 2022, is mainly driven by the full reversal of the liability. This liability is a result of business combination accounting (IFRS3) which requires the liability to be recorded unless the possibility of any outflow is remote.

This impairment comes as a result of the Company’s strategic shift in focus away from clinical development and the early stage nature of the implementation of the Celyad 2.0 strategy, which involves shifting from an organization focused on clinical development to one prioritizing R&D discovery and the monetization of its intellectual property (IP) portfolio through partnerships, collaborations and license agreements. To date, no effective sublicence contract nor collaboration contract has been entered into, and as a result there is uncertainty as to the timing and amount of associated short, medium and long term revenues.

Given this uncertainty, and per accounting standards, the Company recognizes a full impairment loss on the remaining value of goodwill, In Process Research and Development, and Horizon Discovery’s shRNA platform, resulting in a non-cash impairment of €35.1 million on a consolidated basis for the financial year ended December 31, 2022.

This accounting conclusion, which reflects the Company’s financial situation as of December 31, 2022, does not affect Management’s commitment to continue in its efforts to pursue the potential monetization of the Company’s IP. If and when such a firm sublicense or collaboration contract occurs and hence increases the probability of revenue, the Management will estimate the reversal of the impairment which will be limited so that the carrying amount of the asset does not exceed its recoverable amount along with the remeasurement of the related contingent liability.

The Company’s other income is principally associated with grants received from the Walloon Region mainly in the form of recoverable cash advances (RCAs) and R&D tax credit income as well as the gain on sale of the CTMU activities:

Net loss for the year ended December 31, 2022 was €40.9 million, or €1.81 per share, compared to a net loss of €26.5 million, or €1.70 per share, for the same period in 2021. As noted above, the increase in net loss between periods was primarily due to the non-cash impairment adjustment on the Oncology intangible assets.

Net cash used in operations for the year ended December 31, 2022, which excludes non-cash effects, amounted to €28.0 million, which is in line with net cash used in operations of €26.6 million for the year ended December 31, 2021.

The net assets of the Company as of December 31, 2022, on a BE-GAAP non-consolidated basis, have fallen below half of the Company’s capital. As a result, in accordance with Article 7:228 of the Belgian Code for Companies and Associations, the Board of Directors plans to submit for a vote, at its May 5, 2023 shareholders’ meeting, its business plan including a proposal to continue the Company’s activities. The Board of Directors will publish a detailed report regarding this proposal on or around April 3, 2023, together with the convocation with proposed resolutions for the shareholders’ meeting.

Annual Report 2022

The Annual Report for the year ended December 31, 2022 will be published on March 23, 2023, and will be available on the Company’s website, www.celyad.com. The Company’s statutory auditor, EY Bedrijfsrevisoren/Réviseurs d’Entreprises BV/SRL (EY), has confirmed that the completed audit has not revealed any material misstatement in the consolidated financial statements. EY also confirmed that the accounting data reported in the press release are consistent, in all material respects, with the consolidated financial statements from which it has been derived.

Conference Call and Webcast Details

A conference call will be held on Friday, March 24th at 1:00 p.m. CET / 8:00 a.m. EDT to review the financial and operating results for full year 2022. Please dial into the call five to ten minutes prior to start time using the appropriate number below and ask to join the “Celyad Oncology SA call”:

United States / International: +1-877-407-9716 or +1-201-493-6779 Belgium: +32 (0) 800-73-904 (Fixed) or +32 (0) 800-73-566 (Mobile)

Participants may also access to the live webcast link for instant telephone access to the event. Archived recording will be available in the “Events” section of the Celyad website after the event.

Financial Calendar 2023

The financial calendar is communicated on an indicative basis and may be subject to change.

Celyad Oncology has implemented a strategic shift from an organization focused on clinical development to one fully harnessing the true potential of its proprietary technology platforms and intellectual property

The company is now prioritizing internal discovery endeavors to tackle the major current limitations of CAR T-cell therapies As of December 31, 2022, the Company ended the year with an unaudited treasury position of €12.4 million ($13.3 million)

Mont-Saint-Guibert, Belgium – Celyad Oncology (Euronext & Nasdaq: CYAD) (the “Company”), a biotechnology company focused on the discovery and development of innovative technologies for chimeric antigen receptor (CAR) T-cell therapies, today provides a fourth quarter 2022 business update and an outlook for 2023.

Michel Lussier, interim Chief Executive Officer of Celyad Oncology, said: “The second half of 2022 has been a pivotal time for the Company as we have engaged in a new Celyad 2.0 strategy to leverage our innovative technologies and R&D platforms and focus on IP partnering transactions. We’ve stretched our cash runway by divesting our manufacturing business unit, and discontinued our clinical programs to focus on selected, critical R&D efforts to mitigate the current limitations of CAR T-cell therapy. We believe we are now well-positioned to unleash the power of our IP estate and to help making the cell therapy approach a success.”

Operational highlights

The Company announced a strategic shift in October 2022 to prioritize discovery research in areas of expertise where it can leverage the differentiated nature of its platforms. The Company has implemented a differentiated and innovative strategy, which it believes has the potential to tackle the major current limitations of CAR T-cell therapies. This strategy includes a multiplexing approach of the short hairpin RNA (shRNA) platform, a dual CAR development of a next-generation NKG2D-based CAR, and the development of B7-H6-targeting immunotherapies. In October 2022, the Company decided to discontinue the development of CYAD-101, the allogeneic TIM-based, NKG2D-based CAR T-cell candidate for metastatic colorectal cancer (mCRC), based on a strategic, financial and medical review, taking into account the costs associated with the pursuit of the program. There were no new safety concerns leading to this decision. The clinical hold announced in March 2022 on the CYAD-101-002 Phase 1b trial had been lifted in July 2022 by the FDA. Data collected in the IMMUNICY-1 trial of the clinical program CYAD-211, the allogeneic shRNA-based, anti-BCMA CAR T candidate for relapsed or refractory multiple myeloma (r/r MM), which was developed to validate shRNA technology in the clinic, have shown a favorable safety profile for CYAD-211 across all dose-levels and cohorts, with 19 patients treated in total. The lack of observed graft-versus-host disease (GvHD) despite engraftment of CYAD-211 provided proof-of-concept for the use of shRNA as a technology to control GvHD of allogeneic CAR T-cells. In December 2022, the Company decided to discontinue the development of its remaining clinical program CYAD-211 based on a strategic and financial review. There were no safety concerns leading to this decision and all patients previously treated with CYAD-211 still continue to receive their protocol-defined follow-up.

Corporate highlights

In September 2022, the Company entered into a €6 million asset purchase agreement with Cellistic, the cell therapy development and manufacturing business of Ncardia BV, whereby Cellistic acquired Celyad Oncology’s Good Manufacturing Practice (GMP) grade cell therapy manufacturing business unit. Since October 2022, the Company has implemented a strategic shift from an organization focused on clinical development to one prioritizing R&D discovery and leveraging its IP estate through partnerships, collaborations and license agreements. The Company has compiled a foundational and broad IP estate that controls key aspects of developing therapies in the allogeneic cell therapy space. The patents around allogeneic CAR T-cell therapies and NKG2D-based therapies provide an avenue to develop intellectual property programs and to partner with outside parties around the licensing of these patents.

Financial highlights

As of December 31, 2022, the Company had cash and cash equivalents of €12.4 million ($13.3 million). Net cash burn during the fourth quarter of 2022 amounted to €1.0 million, in line with expectations. The Company projects that its existing cash and cash equivalents should be sufficient to fund operating expenses and capital expenditure requirements into the fourth quarter of 2023.

After due consideration of detailed budgets and estimated cash flow forecasts for the year 2023, which reflect the new strategy of the Company and include expenses and cash outflows estimations in relation to the development of its proprietary technology platforms and intellectual property, the Company continues to project that its existing cash and cash equivalents will not be sufficient to fund its estimated operating and capital expenditures over at least the next 12 months from the date that this release is issued.

Outlook for 2023

Celyad Oncology is increasing its R&D efforts on areas of expertise where it believes it can leverage the differentiated nature of its platform technology and continue to bolster its IP estate. The Company will continue to leverage the dynamic potential of the shRNA platform, and to explore options to tackle the major current limitations of CAR T-cell therapies through its dual targeting CARs with NKG2D capabilities and B7-H6 targeting cell therapies. The Company will provide updates on the potential proof-of-concept of the dual CAR and multiplexing research programs and on business development in the course of 2023 and will take part in several conferences to share these data.

Financial Calendar 2023

The financial calendar is communicated on an indicative basis and may be subject to change.

Company continues to transition business focus to monetizing unique cell therapy intellectual property and prioritizing R&D discovery Clinical updates expected by end of year for the Phase 1 dose-escalation IMMUNICY-1 trial for lead shRNA-based allogeneic CAR T candidate, CYAD-211, for relapsed/refractory multiple myeloma (r/r MM)

Mont-Saint-Guibert, Belgium – Celyad Oncology SA (Euronext & Nasdaq: CYAD) (the “Company”), a biotechnology company focused on the discovery and development of chimeric antigen receptor T cell (CAR T) therapies for cancer, today provided an update on its financial results and recent business developments for the fiscal quarter ended September 30, 2022.

“This past quarter has been a pivotal moment for the Company as we focus on a new Celyad 2.0 strategy as we seek to monetize our valuable IP estate and leverage our dynamic shRNA technology for our R&D programs. We’ve bolstered our cash runway with an asset purchase agreement for our manufacturing business unit and we believe we are well-positioned to unleash the power of our IP estate and potentially redefine the cell therapy space,” said Michel Lussier, interim Chief Executive Officer of the Company.

Recent Highlights

The Company entered into a €6 million asset purchase agreement with Cellistic whereby Cellistic acquired Celyad Oncology’s Good Manufacturing Practice (GMP) grade cell therapy manufacturing facility Based on a strategic, financial and medical review, taking into account the costs associated with the pursuit of the program and the delays to reach key medical milestones following the resolution of the previously announced clinical hold, the Company has decided to discontinue the development of CYAD-101

Update on Business Model and Research Programs

As previously announced, with Celyad 2.0, Celyad Oncology is implementing a strategic shift from an organization focused on clinical development to one prioritizing R&D discovery and the monetization of its IP estate through partnerships, collaborations and license agreements. The Company intends to focus its R&D efforts on areas of expertise where it believes it can leverage the differentiated nature of its platform technology and continue to bolster its IP estate.

The Company possesses key technology and controls IP which covers the potential development of next-generation therapies, including those using short hairpin RNA (shRNA) and T cell receptor Inhibitor Molecule (TIM). Celyad Oncology has expanded the IP estate in-licensed from Dartmouth College with additional patents to broadly cover aspects of allogeneic cell therapy.Current discovery programs have the potential to create additional independent IP. The Company is developing a potential next-generation NKG2D Type I receptor CAR T candidate and a technology to potentially utilize this receptor as a basis for dual CAR technology. The Company is also considering the potential to focus R&D efforts on either B7-H6 CAR T or bispecific antibody candidates for a powerful new antigenic target in the oncology field.

In addition, the Company is seeking to advance its shRNA platform through multiplexing technology that allows it to modulate multiple genes simultaneously. This technology is potentially complementary to the Company’s All-in-One Vector approach, which allows for the expression of multiple shRNAs in a single construct within a single transduction step. Combining multiplexed shRNAs with CARs and additional genes of choice provides potential for broad therapeutic functionality.

Update on Clinical Programs

CYAD-211 – Allogeneic shRNA-based, anti-BCMA CAR T candidate for r/r MM

The dose-escalation Phase 1 IMMUNICY-1 trial is evaluating the tolerability and clinical activity of a single infusion of CYAD-211 following preconditioning with CyFlu (cyclophosphamide and fludarabine) in patients with relapsed / refractory multiple myeloma (r/r MM). CYAD-211 was developed to demonstrate potential proof of concept of shRNA technology in the clinic. Our other clinical studies of shRNA disclosed to date have demonstrated encouraging safety and bioactivity signals, and its use as a technology to avoid Graft-versus-Host disease of allogeneic CAR Ts could be a viable approach Clinical updates are expected by year end

CYAD-211 was developed to demonstrate potential proof of concept of shRNA technology in the clinic. Our other clinical studies of shRNA disclosed to date have demonstrated encouraging safety and bioactivity signals, and its use as a technology to avoid Graft-versus-Host disease of allogeneic CAR Ts could be a viable approach Clinical updates are expected by year end

Third Quarter 2022 Financial Review

As of September 30, 2022, the Company had cash and cash equivalents of €13.4 million ($13.1 million). Net cash burn during the first quarter of 2022 amounted to €1.0 million ($1.0 million), in line with expectations. The Company confirms its previous guidance that its existing cash and cash equivalents should be sufficient to fund operating expenses and capital expenditure requirements up to mid-2023. This guidance does not include any potential proceeds from the equity purchase agreement established with Lincoln Park Capital Fund, LLC.

After due consideration of detailed budgets and estimated cash flow forecasts for the years 2022 and 2023 which reflect the current strategy of the Company and include expenses and cash outflows estimations in relation to the development of discretionary research programs and pipeline of products candidates, the Company continues to project that its existing cash and cash equivalents will not be sufficient to fund its estimated operating and capital expenditures over at least the next 12 months from the date that the release is issued.

Executive ChangeCell TherapyFinancial StatementImmunotherapyPhase 1

11 Sep 2025

Mont-Saint-Guibert, Belgium, September 11, 2025, 06:30 pm CET – regulated information – Celyad Oncology SA (Euronext: CYAD) (“Celyad Oncology” or the “Company”) today announced, in accordance with Article 14 of the Belgian Law of 2 May 2007 regarding the publication of major shareholdings in issuers whose securities are admitted to trading on a regulated market (the “Transparency Law”), that it received a notification of transparency dated September 08, 2025, indicating that CFIP CLYD (UK) Limited, an affiliate of Fortress Investment Group LLC, has passively crossed below the 60% threshold, holding 34,146,795 voting rights, i.e. 59.41% of Celyad Oncology’s voting rights.

Content of the Notification:

Reason of the Notification:

Passive crossing of a threshold

Notification by:

A parent undertaking or a controlling person

Persons subject to the notification requirement:

Fortress Investment Group LLC – 1345 Avenue of the Americas, New York, NY 10105 United States

CFIP CLYD (UK) Limited – 7 Clarges Street, 4th Floor, London W1J 8AE, United Kingdom

Date on which the threshold is crossed:

September 04, 2025

Threshold that is crossed (in %):

60

Denominator:

57,479,320

Notified details:

Full chain of controlled undertakings through which the holdings is effectively held: CFIP CLYD (UK) Limited (“CFIP UK”), a UK limited liability company directly holds 34,146,795 voting rights in the issuer. CFIP CLYD LLC, a Delaware limited liability company (“CFIP”), is the parent of CFIP UK. FIP II UB Investments LP, a Delaware limited partnership (“FIP II”), holds 50% of the membership interests in CFIP. FIP Fund II GP LLC, a Delaware limited liability company (“FIP II GP”), is the general partner of FIP II. Hybrid GP Holdings LLC, a Delaware limited liability company (“Hybrid GP”), is the parent of FIP II GP and indirectly controls the general partners of certain investment funds that hold membership interests in CFIP. FIG LLC, a Delaware limited liability company (“FIG LLC”), is an investment advisor registered with the US Securities and Exchange Commission and indirectly controls the investment advisers to certain investment funds that hold membership interests in CFIP. Fortress Operating Entity I LP, a Delaware limited partnership (“FOE I”), is (i) the sole owner of FIG LLC and (ii) the managing member of, and holds the majority of equity interest in, Hybrid GP. FIG Blue LLC (formerly known as FIG Corp.), a Delaware limited liability company (“FIG Blue”) is the general partner of FOE I. Fortress Investment Group LLC, a Delaware limited liability company (“Fortress”) is the sole owner of FIG Blue. Fortress, acting through the investment advisers owned and controlled by FIG LLC, holds discretionary authority over the funds that indirectly hold the membership interests in CFIP, and can exercise the voting rights associated therewith without any instruction from its clients. Additional information:

CFIP CLYD (UK) Limited (“CFIP UK”), a UK limited liability company directly holds 34,146,795 voting rights in the issuer.

CFIP CLYD LLC, a Delaware limited liability company (“CFIP”), is the parent of CFIP UK.

FIP II UB Investments LP, a Delaware limited partnership (“FIP II”), holds 50% of the membership interests in CFIP.

FIP Fund II GP LLC, a Delaware limited liability company (“FIP II GP”), is the general partner of FIP II.

Hybrid GP Holdings LLC, a Delaware limited liability company (“Hybrid GP”), is the parent of FIP II GP and indirectly controls the general partners of certain investment funds that hold membership interests in CFIP.

FIG LLC, a Delaware limited liability company (“FIG LLC”), is an investment advisor registered with the US Securities and Exchange Commission and indirectly controls the investment advisers to certain investment funds that hold membership interests in CFIP.

Fortress Operating Entity I LP, a Delaware limited partnership (“FOE I”), is (i) the sole owner of FIG LLC and (ii) the managing member of, and holds the majority of equity interest in, Hybrid GP.

FIG Blue LLC (formerly known as FIG Corp.), a Delaware limited liability company (“FIG Blue”) is the general partner of FOE I.

Fortress Investment Group LLC, a Delaware limited liability company (“Fortress”) is the sole owner of FIG Blue. Fortress, acting through the investment advisers owned and controlled by FIG LLC, holds discretionary authority over the funds that indirectly hold the membership interests in CFIP, and can exercise the voting rights associated therewith without any instruction from its clients.

This transparency notification relates to the passive downward crossing of the 60% threshold. This results from the fact that the shares that were issued by Celyad Oncology on 4 September 2023 in the context of a private placement (the “2023 Private Placement”) bear double voting rights as from 4 September 2025.

CFIP CLYD (UK) Limited had on 4 September 2023 subscribed to 1,454,808 new shares in Celyad Oncology and these shares now bear double voting rights, bringing the total number of shares with double voting right in Celyad Oncology held by CFIP CLYD (UK) Limited to 7,954,808 and the total number of voting rights held by CFIP CLYD (UK) Limited to 34,146,795. As another shareholder of Celyad Oncology had subscribed to a larger stake in the 2023 Private Placement and because all such shares equally bear double voting rights as from 4 September 2025, CFIP CLYD (UK) Limited’s overall percentage of voting rights in Celyad Oncology has decreased to 59.41%.

100 Deals associated with Celyad Oncology SA

Login to view more data

100 Translational Medicine associated with Celyad Oncology SA

Login to view more data

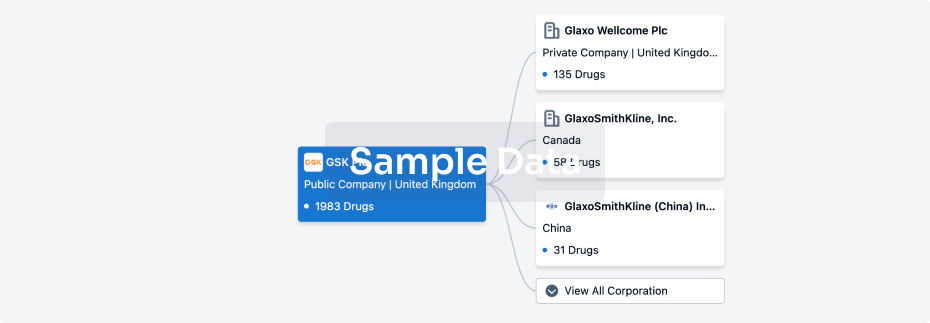

Corporation Tree

Boost your research with our corporation tree data.

login

or

Pipeline

Pipeline Snapshot as of 08 Dec 2025

The statistics for drugs in the Pipeline is the current organization and its subsidiaries are counted as organizations,Early Phase 1 is incorporated into Phase 1, Phase 1/2 is incorporated into phase 2, and phase 2/3 is incorporated into phase 3

Preclinical

4

3

Phase 1

Other

12

Login to view more data

Current Projects

| Drug(Targets) | Indications | Global Highest Phase |

|---|---|---|

CYAD-211 ( BCMA ) | Refractory Multiple Myeloma More | Phase 1 |

CYAD-02 ( NKG2D ) | Myelodysplastic Syndromes More | Phase 1 |

CYAD-101 ( NKG2D ) | Rectal Cancer More | Phase 1 |

CYAD-221 ( CD19 ) | B-Cell Leukemia More | Preclinical |

PSMA/NKG2DL Tandem CAR T-Cells(Celyad Oncology) ( NKG2D x PSMA ) | Prostatic Cancer More | Preclinical |

Login to view more data

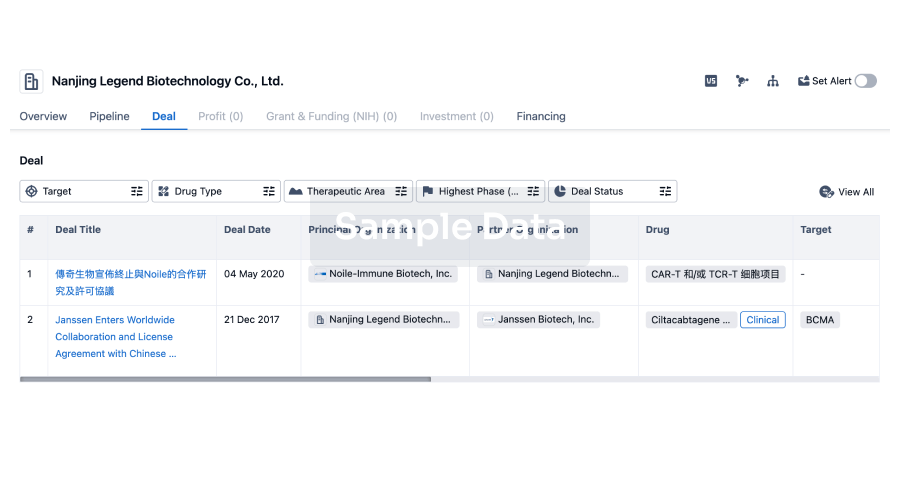

Deal

Boost your decision using our deal data.

login

or

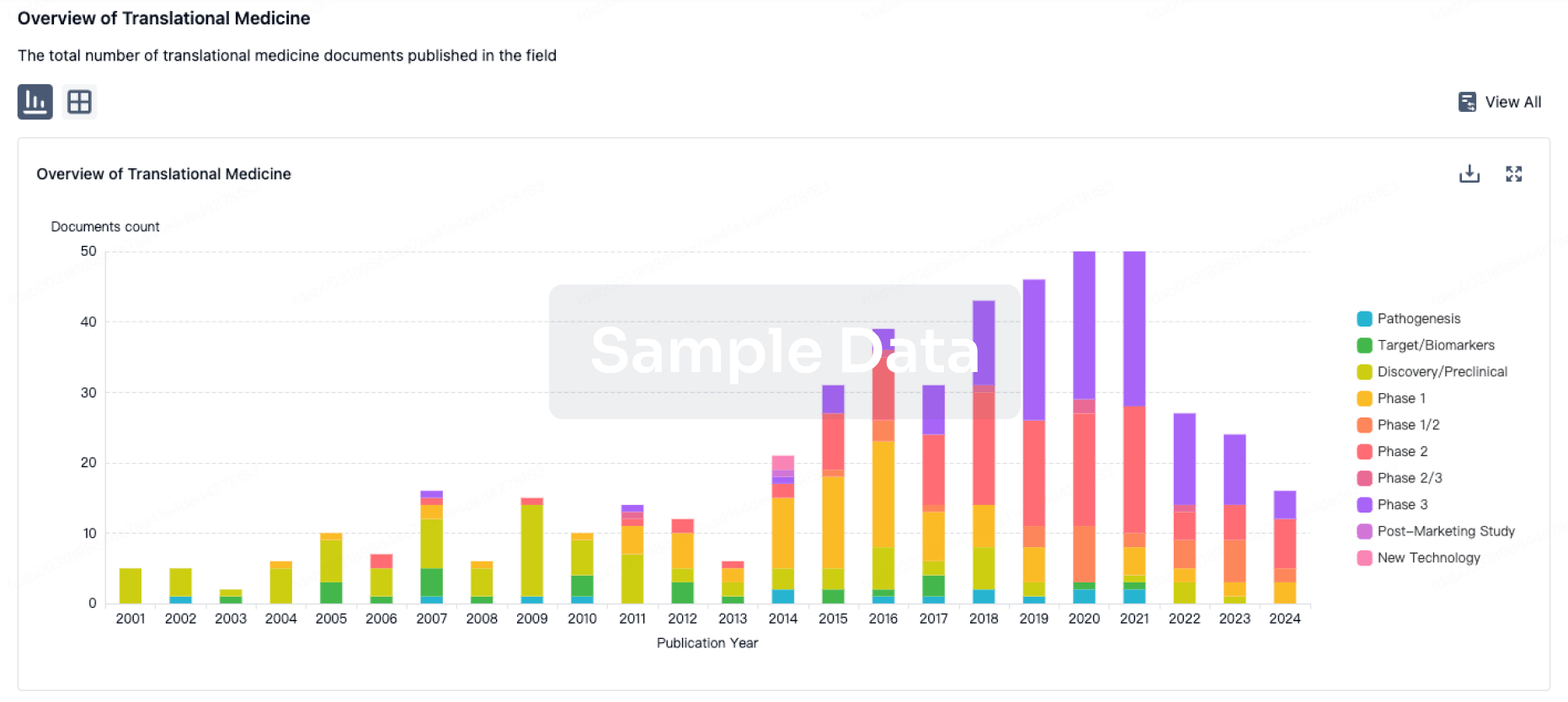

Translational Medicine

Boost your research with our translational medicine data.

login

or

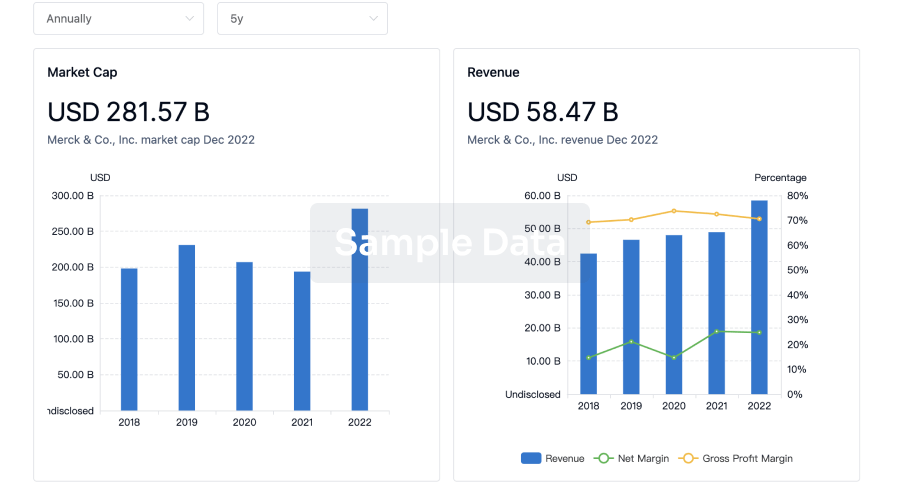

Profit

Explore the financial positions of over 360K organizations with Synapse.

login

or

Grant & Funding(NIH)

Access more than 2 million grant and funding information to elevate your research journey.

login

or

Investment

Gain insights on the latest company investments from start-ups to established corporations.

login

or

Financing

Unearth financing trends to validate and advance investment opportunities.

login

or

AI Agents Built for Biopharma Breakthroughs

Accelerate discovery. Empower decisions. Transform outcomes.

Get started for free today!

Accelerate Strategic R&D decision making with Synapse, PatSnap’s AI-powered Connected Innovation Intelligence Platform Built for Life Sciences Professionals.

Start your data trial now!

Synapse data is also accessible to external entities via APIs or data packages. Empower better decisions with the latest in pharmaceutical intelligence.

Bio

Bio Sequences Search & Analysis

Sign up for free

Chemical

Chemical Structures Search & Analysis

Sign up for free