Request Demo

Last update 08 May 2025

Trophos SA

Last update 08 May 2025

Overview

Related

2

Drugs associated with Trophos SATarget |

Mechanism mGluRs antagonists |

Active Org.- |

Originator Org. |

Active Indication- |

Inactive Indication |

Drug Highest PhasePending |

First Approval Ctry. / Loc.- |

First Approval Date- |

Target |

Mechanism TSPO inhibitors [+1] |

Active Org.- |

Originator Org. |

Active Indication- |

Inactive Indication |

Drug Highest PhasePending |

First Approval Ctry. / Loc.- |

First Approval Date- |

5

Clinical Trials associated with Trophos SANCT02835976

A Single-Center, Open-Label, Single Oral Dose Phase I Study to Determine the Excretion Balance of Radiocarbon (i.e., the Sum of 14C-Labeled TRO19622 and Its 14C-Metabolites) and to Investigate the Pharmacokinetics and Metabolic Profile of TRO19622

This Phase I study is designed to determine the excretion balance of radiocarbon, as the sum of carbon-14 (14C)-labeled TRO19622 and its 14C-metabolites, and to investigate the pharmacokinetics and metabolic profile of TRO19622 (olesoxime) in healthy participants.

Start Date01 Jul 2014 |

Sponsor / Collaborator |

EUCTR2010-024616-33-DK

Phase II, multicenter, randomized, double-blind, placebo controlled study to assess safety and efficacy of TRO40303 for reduction of reperfusion injury in patients undergoing Percutaneous Coronary Intervention for acute myocardial infarction

Start Date04 Aug 2011 |

Sponsor / Collaborator |

EUCTR2010-021179-10-BE

An Open-Label Safety Extension Study of TRO19622 in Amyotrophic Lateral Sclerosis (ALS) patients treated with riluzole.

Start Date28 Jan 2011 |

Sponsor / Collaborator |

100 Clinical Results associated with Trophos SA

Login to view more data

0 Patents (Medical) associated with Trophos SA

Login to view more data

5

News (Medical) associated with Trophos SA04 Sep 2024

Press Release Nicox Appoints Christine Placet to Board of Directors; Michele Garufi steps down from Board Christine Placet is CFO of Theranexus, and was formerly CEO of Horama and TrophosMichele Garufi, former Chairman and CEO of Nicox, hands over his Board position after over more than 25 years at the company he co-foundedThe Nicox Board has now been entirely renewed to bring in the expertise to support the Company’s strategic direction going forward September 4th, 2024 – release at 7:30 am CET Sophia Antipolis, FranceNicox SA (Euronext Paris: FR0013018124, ALCOX), an international ophthalmology company, today announced that Michele Garufi is stepping down as a member of the Board of Directors. The Board has appointed Christine Placet, a deeply experienced CEO and financial leader in the biotech industry, as a new Board member. The renewal of the Nicox Board brings the appropriate expertise to support the Company’s strategic direction going forward.“I am delighted to welcome Christine Placet to Nicox as a new Board member. I had the pleasure of working with Christine during our time at Trophos, where she played a pivotal role as CFO. Her expertise, strategic vision, and leadership in biotech are invaluable assets to Nicox. I look forward to working closely with her again as we continue to drive the business forward, with the focus on our de-risked compound NCX 470, moving towards topline results from the second pivotal Phase 3 trial, Denali, in H2 2025,” said Damian Marron, Chairman of Nicox.“On behalf of the Board and of Nicox, past and present, I would like to express my heartfelt gratitude to Michele Garufi for his dedicated and unstinting service to the company. Nicox has benefited from Michele’s vision, business acumen, scientific expertise and leadership for nearly 30 years, as we have sought to develop innovative solutions to help maintain vision and improve ocular health. We all wish Michele the very best for the future.” Michele Garufi, Co-Founder of Nicox, who served as CEO and Chairman until 2022 commented: “After many years of service at Nicox, this is the right time to hand over to a new generation of leadership. With Damian Marron appointed Chairman and Gavin Spencer as CEO earlier this year, we have a talented and dynamic leadership team in place who have led companies through critical phases of development and executed major financial transactions. I am therefore confident that Nicox is in very capable hands. I wish them every further success as they aim to deliver on the potential of NCX 470 to improve treatment of glaucoma.” Christine Placet joins Nicox with a distinguished career in the biotech industry. She started as an auditor at Ernst & Young and then built up extensive experience of financial leadership in small- and medium- sized companies. In 2004, she joined the biotech company Trophos as Chief Financial Officer, later becoming Chief Executive Officer. Under her leadership, Trophos was acquired by Roche for €470 million in 2015. She then became CEO of Horama (now Coave Therapeutics) in 2016, successfully leading funding rounds and advancing a key product into development. In 2021, she transitioned into consulting and joined Theranexus as CFO in April 2024. She is a graduate of Kedge Business School.About NicoxNicox SA is an international ophthalmology company developing innovative solutions to help maintain vision and improve ocular health. Nicox’s lead program in clinical development is NCX 470 (bimatoprost grenod), a novel nitric oxide-donating bimatoprost eye drop, for lowering intraocular pressure in patients with open-angle glaucoma or ocular hypertension. Nicox generates revenue from VYZULTA® in glaucoma, licensed exclusively worldwide to Bausch + Lomb, and ZERVIATE® in allergic conjunctivitis, licensed in multiple geographies, including to Harrow, Inc. in the U.S., and Ocumension Therapeutics in the Chinese and in the majority of Southeast Asian markets. Nicox, headquartered in Sophia Antipolis, France, is listed on Euronext Growth Paris (Ticker symbol: ALCOX) and is part of the CAC Healthcare index. For more information www.nicox.comAnalyst coverageH.C. Wainwright & Co Yi Chen New York, U.S. The views expressed by analysts in their coverage of Nicox are those of the author and do not reflect the views of Nicox. Additionally, the information contained in their reports may not be correct or current. Nicox disavows any obligation to correct or to update the information contained in analyst reports.Contacts NicoxGavin SpencerChief Executive OfficerT +33 (0)4 97 24 53 00communications@nicox.com Media / Investors Sophie Baumont Cohesion Bureau +33 6 27 74 74 49 sophie.baumont@cohesionbureau.comDisclaimerThe information contained in this document may be modified without prior notice. This information includes forward-looking statements. Such forward-looking statements are not guarantees of future performance. These statements are based on current expectations or beliefs of the management of Nicox S.A. and are subject to a number of factors and uncertainties that could cause actual results to differ materially from those described in the forward-looking statements. Nicox S.A. and its affiliates, directors, officers, employees, advisers or agents, do not undertake, nor do they have any obligation, to provide updates or to revise any forward-looking statements.Risks factors which are likely to have a material effect on Nicox’s business are presented in section 3 of the “Rapport Annuel 2023” which is available on Nicox’s website (www.nicox.com).Finally, this press release may be drafted in the French and English languages. If both versions are interpreted differently, the French language version shall prevail.Nicox S.A.Sundesk Sophia Antipolis, Bâtiment C, Emerald Square, Rue Evariste Galois, 06410 Biot, FranceT +33 (0)4 97 24 53 00

Attachment

EN_NewBoardMemberChristinePlacet_PR_FINAL

Executive ChangeAcquisitionPhase 3

07 Aug 2023

Company Adds Proven Product Development and Commercial Leader as it Accelerates Launch of Flowfect® Cell Engineering Technology

CAMBRIDGE, Mass., Aug. 7, 2023 /PRNewswire/ -- Kytopen, a biotechnology company that develops and markets advanced cell engineering solutions, today announced the appointment of Michael Chiu, Ph.D., as Chief Executive Officer. An entrepreneurial leader with extensive experience in building and commercializing new technologies, he brings to Kytopen a proven track record in fundraising, product development, and marketing launches. Dr. Chiu succeeds Paulo A. Garcia, Ph.D., one of the company's co-founders, who will continue as an advisor.

Continue Reading

Michael Chiu, Ph.D. appointed to Kytopen CEO.

Dr. Chiu joins Kytopen at the time of its accelerated roll-out of the Flowfect® technology to high-profile academic medical centers in the U.S. Prior to this, he was the Chief Executive Officer of Erbi Biosystems, Inc., which was acquired by Merck KGaA, Darmstadt Germany (MilliporeSigma in US), last year. Earlier in his career, he was a chief technology officer and senior executive with several high-tech companies, including Automation Engineering Inc. (acquired by Mycronic AB), Trophos Energy, and Teradyne. Dr. Chiu earned a B.S. in mechanical engineering from the University of Minnesota and an M.S. and Ph.D. from MIT. He subsequently received an M.B.A. through the Sloan Fellows program at MIT.

Paul K. Wotton, Ph.D., the company's Chairman, said, "Kytopen's suite of genome engineering tools has demonstrated exceptional performance, prompting the expansion and delivery of this transformative technology for wider adoption. Dr. Chiu's record of accomplishment in successfully commercializing life science instrumentation is a perfect fit for Kytopen's next stage of growth. The board appreciates Dr. Garcia's pioneering efforts in transforming the Kytopen technology from its origins in the MIT lab to a proven platform. We share his vision and unwavering passion for this disruptive technology poised to revolutionize the landscape of cell therapy development and manufacturing for the benefit of patients worldwide."

Dr. Garcia said, "It has been an extraordinary journey translating Kytopen's innovative Flowfect® technology from the MIT lab to deploying systems to leading researchers and biotech partners worldwide. I am fully confident Dr. Chiu will successfully guide the company through its next phase of accelerated commercial expansion."

Dr. Chiu added, "Kytopen's platform and products have transformative potential to redefine the discovery and manufacture of the next generation of living medicines. As global demand for these life-saving cell therapies grows, cost, labor, and time-to-market challenges must be addressed. The growing number of Flowfect Discover™ systems at leading academic medical centers and industry partners will accelerate work at the leading edges of this exciting field. I'm excited to work with Kytopen's talented team to expand the access and impact of our scalable, non-viral gene delivery platform for discovering, developing, and manufacturing new therapies."

About Kytopen

Kytopen is focused on the development and commercialization of groundbreaking genome engineering platforms for expediting the discovery, development, and manufacture of gene-modified cell therapies. Developed at MIT, the Flowfect® platform, harmonizing microfluidics and automation, revolutionizes the delivery of genome engineering materials to cells of therapeutic interest in an expeditious, scalable, and economically advantageous manner compared to current alternatives. In May 2023, Kytopen unveiled the Flowfect Discover™, an automated high-throughput genome engineering platform, and disclosed strategic partnerships with industry-leading Contract Development and Manufacturing Organizations (CDMOs) and translational academic medical centers. By combining Flowfect Discover™ with the Flowfect Tx™ large-scale delivery device in process development workflows, developers can now surmount manufacturing challenges during the discovery stage, fostering swifter and more cost-effective innovation.

SOURCE Kytopen

Executive ChangeAcquisition

30 Jun 2015

June 30, 2015

By

Alex Keown

, BioSpace.com Breaking News Staff

BASEL, Switzerland --

Roche Holding AG

investors hoping the Swiss pharmaceutical giant will dump its sluggish diabetes- diagnostics unit may be in for a long wait,

Bloomberg reported

this morning.

The company’s diabetes unit, which is valued at approximately $6.4 billion, lead the market in blood glucose meters and insulin pumps, but growth has slowed considerably since price cuts in 2013 sent sales tumbling in the U.S.,

Bloomberg

noted. That year the company floated the idea of selling its blood glucose meter business, but opted to scrap that plan in large part due to reimbursements on diabetes test supplies,

Reuters reported

.

Investors were hoping the company would follow the lead of

Bayer AG

, which sold its diabetes business to

KKR & Co.

and

Panasonic Corp.

for $1.1 billion earlier this month. However, there may not be an available buyer for the company’s diabetes unit.

Michael Leuchten

, an analyst at

Barclays Plc

in London, told Bloomberg there “aren’t enough natural buyers out there for two people selling a lemon at a good price.”

Leuchten added that he doesn’t believe

Roche

is looking to sell, but if a pharmaceutical company made a reasonable offer, the company would likely take a serious look because the division hasn’t been a big money-maker for the company over the past two years. Sales at

Roche

’s diabetes unit fell 17 percent in the U.S. in 2013 and 8.3 percent last year after cuts to reimbursement rates,

Bloomberg

noted.

A

Roche

spokesperson told

Bloomberg

the company is committed to diabetes care and added that the demand for products will continue to grow.

Diagnoses of diabetes are on the rise throughout the United States as well as around the world. There were approximately 30 million people in the United States diagnosed with Type2 diabetes in 2015, according to the

American Diabetes Association

. It is expected up to 9 million more Americans are undiagnosed. If the present trends continue, as many as one in three American adults are expected to have type 2 diabetes by 2050. More than 200,000 people die each year from diabetic complications, according to data compiled by the association. With the increase in diabetes rates, the market has been saturated with lower cost product, which is one reason

Bayer

sold off its unit and one reason

Roche

could consider making a move for the right offer.

Bayer

had been looking to sell its diabetes unit since 2012, although the next year

Bayer HealthCare

’s then chief executive officer

Joerg Reinhardt

said the company was planning on keeping the unit. Earlier this month

Bayer

completed the sale as part of its efforts to shed assets as part of its restructuring to focus on life sciences.

The deal

, which is expected to be completed in 2016, includes

Bayer

’s Contour portfolio, including Contour Next, Contour Plus, Contour and Contour TS. It also encompasses the sale of Breeze2, Brio, Entrust, Elite and Microlet lancing devices.

Bayer

’s diabetes unit earned $€909 million in sales in 2014, however the division has been hobbled by a product line that has been hindered by lack of innovation.

While

Roche

may or may not be looking to sell its diabetes care business,

Roche has been linked

to rumors the company is one contender to acquire pharma giant

GlaxoSmithKline

for approximately $143 billion. That news came only a few months after

Severin Schwan

,

Roche

’s chief executive officer, said the company is still interested in acquiring new products and technologies, but it not interested in a “

megamerger

.”

Over the past year

Roche

has made several large acquisitions to bolster its cancer treatments, including the 1.7 billion purchase of San Diego-based

Seragon

, the

$8.3 billion acquisition of InterMune, Inc.

, focused on therapies in pulmonology and fibrotic diseases and the

February acquisition of Germany-based Signature Diagnostics AG

, which specializes in oncology and genomics.

In April

Roche

nabbed a majority stake in U.S.-based

Foundation Medicine, Inc.

, spending more than $1 billion to acquire 56.3 percent of the company that specializes in molecular and genomic analysis.

Roche

also acquired

Capp Medical

, a genomics research company focusing on DNA sequencing to provide early cancer testing, earlier this month. In January

Roche

also spent $545 million to acquire French-based

Trophos

, which is developing drugs for neuromuscular diseases.

After Bristol-Myers Squibb Wonder Drug Meets Endpoints, Will FDA Process Be Up to Snuff?

Our

most popular story last week

was about a new wonder drug that wowed the

FDA

. An experimental anticoagulant drug under joint development between

Portola Pharmaceuticals, Inc.

,

Bristol-Myers Squibb Company

and

Pfizer Inc.

met all primary and secondary endpoints in a Phase III study determining safety and efficacy—and our readers responded. The hope now is it will be sped to patients as fast as possible.

That’s lead

BioSpace

to ask, what do you think about the drug approval process in this country? Let us know your ideas.

var _polldaddy = [] || _polldaddy; _polldaddy.push( { type: "iframe", auto: "1", domain: "biospace.polldaddy.com/s/", id: "after-bristol-myers-wonder-drug-meets-endpoints-will-fda-process-be-up-to-snuff", placeholder: "pd_1435601218" } ); (function(d,c,j){if(!document.getElementById(j)){var pd=d.createElement(c),s;pd.id=j;pd.src=(' '==document.location.protocol)?' ':' ';s=document.getElementsByTagName(c)[0];s.parentNode.insertBefore(pd,s);}}(document,'script','pd-embed'));

AcquisitionPhase 3Clinical Result

100 Deals associated with Trophos SA

Login to view more data

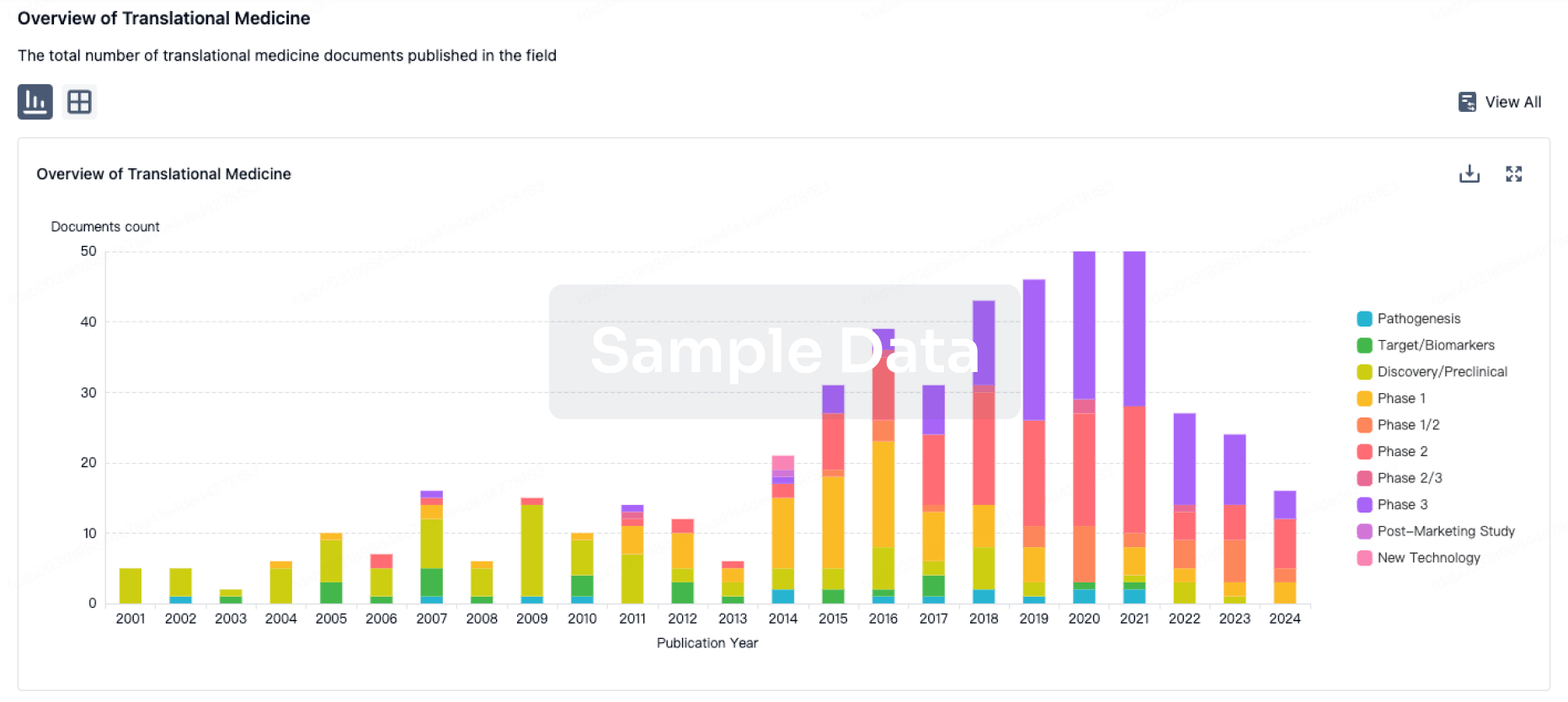

100 Translational Medicine associated with Trophos SA

Login to view more data

Corporation Tree

Boost your research with our corporation tree data.

login

or

Pipeline

Pipeline Snapshot as of 15 Dec 2025

The statistics for drugs in the Pipeline is the current organization and its subsidiaries are counted as organizations,Early Phase 1 is incorporated into Phase 1, Phase 1/2 is incorporated into phase 2, and phase 2/3 is incorporated into phase 3

Other

2

Login to view more data

Current Projects

| Drug(Targets) | Indications | Global Highest Phase |

|---|---|---|

TRO-17416 ( mGluRs ) | Motor Neuron Disease More | Pending |

TRO-40303 ( TSPO x mPTP ) | Myocardial Reperfusion Injury More | Pending |

Login to view more data

Deal

Boost your decision using our deal data.

login

or

Translational Medicine

Boost your research with our translational medicine data.

login

or

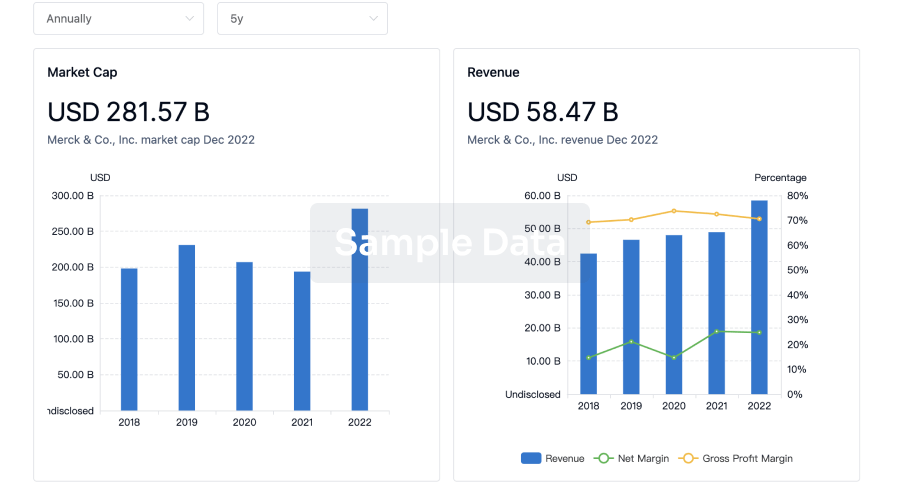

Profit

Explore the financial positions of over 360K organizations with Synapse.

login

or

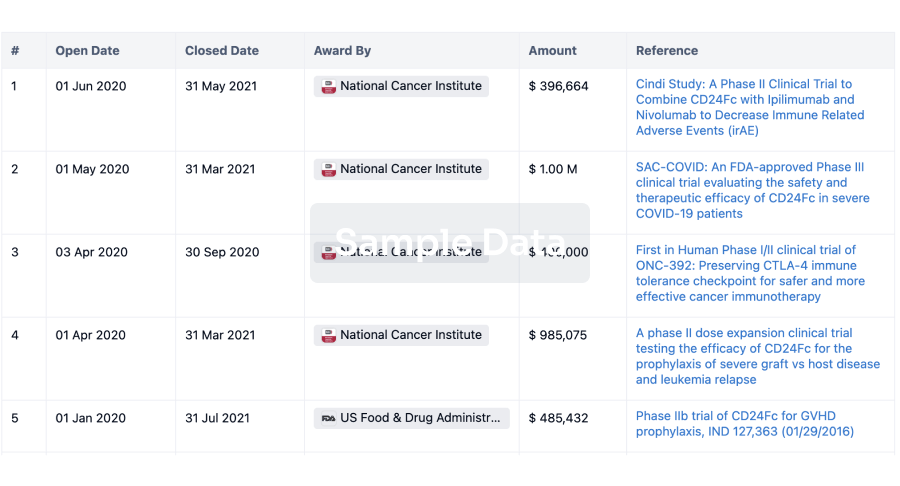

Grant & Funding(NIH)

Access more than 2 million grant and funding information to elevate your research journey.

login

or

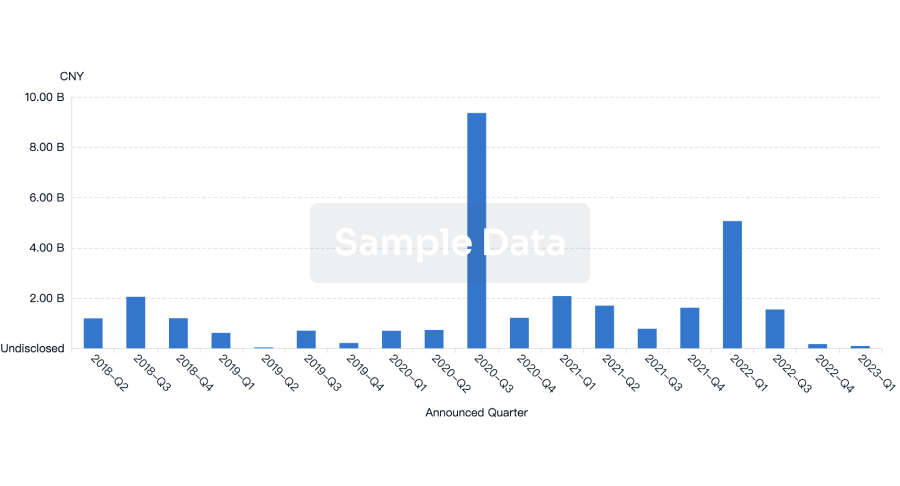

Investment

Gain insights on the latest company investments from start-ups to established corporations.

login

or

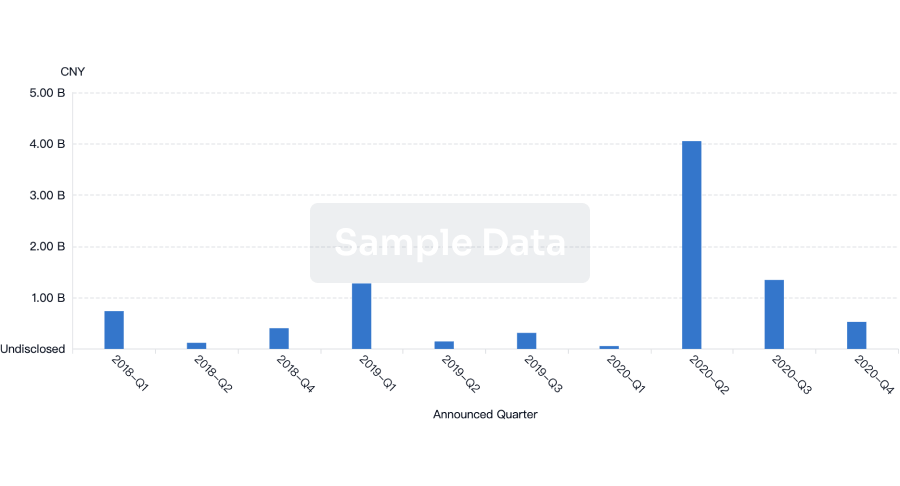

Financing

Unearth financing trends to validate and advance investment opportunities.

login

or

AI Agents Built for Biopharma Breakthroughs

Accelerate discovery. Empower decisions. Transform outcomes.

Get started for free today!

Accelerate Strategic R&D decision making with Synapse, PatSnap’s AI-powered Connected Innovation Intelligence Platform Built for Life Sciences Professionals.

Start your data trial now!

Synapse data is also accessible to external entities via APIs or data packages. Empower better decisions with the latest in pharmaceutical intelligence.

Bio

Bio Sequences Search & Analysis

Sign up for free

Chemical

Chemical Structures Search & Analysis

Sign up for free