Request Demo

Last update 08 May 2025

DGKζ

Last update 08 May 2025

Basic Info

Synonyms DAG kinase zeta, DAGK5, DAGK6 + [5] |

Introduction Diacylglycerol kinase that converts diacylglycerol/DAG into phosphatidic acid/phosphatidate/PA and regulates the respective levels of these two bioactive lipids (PubMed:15544348, PubMed:18004883, PubMed:19744926, PubMed:22108654, PubMed:22627129, PubMed:23949095, PubMed:9159104). Thereby, acts as a central switch between the signaling pathways activated by these second messengers with different cellular targets and opposite effects in numerous biological processes (PubMed:15544348, PubMed:18004883, PubMed:19744926, PubMed:22108654, PubMed:22627129, PubMed:23949095, PubMed:9159104). Also plays an important role in the biosynthesis of complex lipids (Probable). Does not exhibit an acyl chain-dependent substrate specificity among diacylglycerol species (PubMed:19744926, PubMed:22108654, PubMed:9159104). Can also phosphorylate 1-alkyl-2-acylglycerol in vitro but less efficiently and with a preference for alkylacylglycerols containing an arachidonoyl group (PubMed:15544348, PubMed:19744926, PubMed:22627129). The biological processes it is involved in include T cell activation since it negatively regulates T-cell receptor signaling which is in part mediated by diacylglycerol (By similarity). By generating phosphatidic acid, stimulates PIP5KIA activity which regulates actin polymerization (PubMed:15157668). Through the same mechanism could also positively regulate insulin-induced translocation of SLC2A4 to the cell membrane (By similarity).

Regulates RASGRP1 activity.

Does not regulate RASGRP1 activity. |

Related

8

Drugs associated with DGKζTarget |

Mechanism DGKζ inhibitors |

Active Org. |

Originator Org. |

Active Indication |

Inactive Indication- |

Drug Highest PhasePhase 1/2 |

First Approval Ctry. / Loc.- |

First Approval Date20 Jan 1800 |

Target |

Mechanism DGKA inhibitors [+1] |

Active Org. |

Originator Org. |

Active Indication |

Inactive Indication- |

Drug Highest PhasePhase 1/2 |

First Approval Ctry. / Loc.- |

First Approval Date20 Jan 1800 |

Target |

Mechanism DGKA inhibitors [+1] |

Active Org. |

Originator Org. |

Active Indication |

Inactive Indication- |

Drug Highest PhasePhase 1/2 |

First Approval Ctry. / Loc.- |

First Approval Date20 Jan 1800 |

7

Clinical Trials associated with DGKζNCT06873789

A Phase 1/2, Open-Label, Multicenter Study of INCB177054 in Participants With Select Advanced or Metastatic Solid Tumors

This study will be conducted to evaluate INCB177054 given as monotherapy or in combination with retifanlimab in participants with select advanced or metastatic solid Tumors.

Start Date24 Apr 2025 |

Sponsor / Collaborator |

CTR20242146

一项开放性、I 期、首次用于人体的剂量递增和剂量扩展,旨在评价二酰基甘油激酶 zeta 抑制剂 (DGKzi)BAY 2965501 单药治疗和联合治疗晚期实体瘤研究参与者的安全性、耐受性、最大耐受剂量或最大给药剂量、药代动力学、药效学和肿瘤缓解情况的研究

[Translation] An open-label, Phase I, first-in-human, dose-escalation and dose-expansion study to evaluate the safety, tolerability, maximum tolerated or maximum administered dose, pharmacokinetics, pharmacodynamics, and tumor response of the diacylglycerol kinase zeta inhibitor (DGKzi) BAY 2965501 as monotherapy and in combination with sera in participants with advanced solid tumors

研究人员正在寻找治疗晚期实体瘤患者的更好方法。晚期实体瘤是指可能已扩散到附近组织、淋巴结和/或身体远处部位的癌症类型,目前可用的治疗方法不太可能治愈或控制这些癌症。这项研究主要针对某些类型的皮肤癌、肾癌、胃癌和肺癌。研究治疗药物 BAY2965501 目前正在开发中,可作为单一疗法或与一种名为 pembrolizumab 的药物联合使用,用于治疗晚期实体瘤患者。BAY2965501 可阻断 T 细胞中的一种酶,从而激活 T 细胞。T 细胞是一种已知具有抗癌作用的免疫细胞,而 BAY2965501 是一种潜在的新型免疫疗法。这项首次人体试验的主要目的是了解 - 不同剂量的 BAY2965501 在单药或联合用药时的安全性如何; - BAY2965501 在单药或联合用药时引起的医疗问题的耐受程度(也称为耐受性); - 单药或联合用药的最大用量是多少; - 单药或联合用药如何进入、通过和排出体外。中国患者暂不参与联合用药组。

[Translation]

Researchers are looking for better ways to treat people with advanced solid tumors. Advanced solid tumors are types of cancer that may have spread to nearby tissues, lymph nodes, and/or distant parts of the body, and are unlikely to be cured or controlled by currently available treatments. This research is focusing on certain types of skin cancer, kidney cancer, stomach cancer, and lung cancer. The investigational treatment BAY2965501 is currently in development as a monotherapy or in combination with a drug called pembrolizumab for the treatment of people with advanced solid tumors. BAY2965501 blocks an enzyme in T cells, which activates them. T cells are a type of immune cell known to have anti-cancer effects, and BAY2965501 is a potential new type of immunotherapy. The main objectives of this first-in-human trial are to understand - How safe different doses of BAY2965501 are when used alone or in combination; - How well tolerated (also called tolerability) the medical problems caused by BAY2965501 when used alone or in combination; - What is the maximum dose of a single drug or combination; - How a single drug or combination enters, passes through, and is eliminated from the body. Chinese patients are not currently participating in the combination group.

Start Date26 Aug 2024 |

Sponsor / Collaborator  Bayer AG Bayer AG [+2] |

CTIS2023-503996-38-00

- BGB-A317-30813-101

Start Date17 Oct 2023 |

Sponsor / Collaborator |

100 Clinical Results associated with DGKζ

Login to view more data

100 Translational Medicine associated with DGKζ

Login to view more data

0 Patents (Medical) associated with DGKζ

Login to view more data

189

Literatures (Medical) associated with DGKζ07 Jan 2025·Journal of the American Heart Association

Diacylglycerol Kinase ζ Attenuates Doxorubicin‐Induced Cardiotoxicity Through p53 Degradation

Article

Author: Sato, Junya ; Watanabe, Masafumi ; Yamaguchi, Ryuhei ; Watanabe, Tetsu ; Takahashi, Hiroki ; Arimoto, Takanori ; Ono, Hiroe ; Ochi, Haruki ; Goto, Jun ; Tanaka, Toshiaki ; Tachibana, Shingo ; Otaki, Yoichiro ; Goto, Kaoru

01 Jan 2025·Biochemical and Biophysical Research Communications

Diacylglycerol kinase ζ is a positive insulin secretion regulator in pancreatic β-cell line MIN6

Article

Author: Ishikawa, Tomohisa ; Yoshinari, Kouichi ; Kaneko, Yukiko K ; Shizu, Ryota ; Kimura, Toshihide ; Watanabe, Naoya ; Yamaguchi, Momoka ; Ishihara, Hisamitsu

01 Jan 2025·Advances in Biological Regulation

Upstream and downstream pathways of diacylglycerol kinase : Novel phosphatidylinositol turnover-independent signal transduction pathways

Review

Author: Murakami, Chiaki ; Sakai, Hiromichi ; Sakane, Fumio

2

News (Medical) associated with DGKζ27 Jun 2024

According to the recent announcement on the CDE (China's Center for Drug Evaluation) website, Bayer has successfully obtained clinical trial approvals for two of its novel Class 1 drugs, which are aimed at addressing the treatment needs of patients with late-stage solid tumors and acute ischemic stroke.

Based on Bayer's public information, one of the new drugs is a DGKα inhibitor, and the other is a protein-based drug targeting α2AP. These two candidates are currently in Phase 1 and Phase 2 clinical development stages, respectively, at the international level.

BAY 2862789 oral solution, a small-molecule DGKα inhibitor co-developed by Bayer and the German Cancer Research Center (DKFZ), is now undergoing the first-in-human Phase 1 clinical trial globally. Its research and development target is the treatment of solid tumors. The diacylglycerol kinase (DGK) family plays a crucial role in the development, differentiation, and functional regulation of T cells and NK cells, with DGKα and DGKζ being the predominant isoforms. Studies have shown that DGKα is significantly expressed in various refractory cancers, promoting cell proliferation and inhibiting apoptosis. Its high expression is closely related to T-cell exhaustion, which is a key factor in the evasion of immune surveillance by late-stage cancers. Therefore, the specific inhibition of DGKα holds great potential in the field of cancer therapy, as it can effectively suppress cancer cell proliferation and activate T-cell functions, achieving a dual anti-cancer effect. Furthermore, the synergistic effect of this inhibitor with PD-1/PD-L1 inhibitors offers new hope for the treatment of refractory cancers.

The other new drug, BAY 3018250, is a protein-based drug targeting α2AP, which is part of Bayer's cardiovascular disease research and development pipeline. It aims to treat acute ischemic stroke and pulmonary embolism. Currently, this drug has made significant progress in the international Phase 2 clinical trial for the treatment of deep vein thrombosis (DVT). DVT is a serious health issue that can lead to life-threatening blockage of blood flow in the lungs. BAY 3018250 exerts its therapeutic effect by dissolving blood clots. Thrombotic vascular occlusion is a key factor in the development of ischemic stroke, and α2-antiplasmin (α2AP), a member of the serine protease inhibitor family, is closely associated with an increased risk of ischemic stroke and the failure of recombinant tissue plasminogen activator (rt-PA) treatment. Research has shown that anti-α2AP therapy can significantly reduce the formation of microvascular thrombosis, ischemic brain injury, brain edema, intracerebral hemorrhage, and mortality after ischemic stroke, suggesting that the temporary inactivation of α2AP may have potential therapeutic value for ischemic stroke. With the approval for clinical trials in China, BAY 3018250 will now be evaluated for the specific indication of acute ischemic stroke, bringing new hope for the treatment of this condition.

Phase 1Phase 2

10 Apr 2023

Bayer to present latest research across its advancing oncology portfolio at AACR 2023 Annual Meeting

Abstracts:

ND04, 5047, CT276, 2116, 4035, 433, CT126, 1964, 925, CT228, 311, 5043, CT082

Berlin, April 11, 2023

– Bayer will present latest research across its oncology portfolio at the

American Association for Cancer Research (AACR) 2023 Annual Meeting

, taking place from April 14-19 in Orlando (FL), USA. Bayer is advancing its oncology R&D efforts in three scientific areas that have the potential to address unmet needs in cancer patients: next-generation Immuno-Oncology, Targeted Radionuclide Therapies and Precision Molecular Oncology. Data from all three areas of scientific focus will be showcased during this year’s meeting.

Bayer is progressing novel research around its prostate cancer treatment darolutamide. The presentation highlights the synergistic anti-cancer effects of a PSMA (prostate-specific membrane antigen)-actinium-225 conjugate in combination with darolutamide in preclinical prostate cancer models. Darolutamide, which is jointly developed by Bayer and Orion Corporation, is an oral androgen receptor inhibitor indicated for the treatment of men with non-metastatic castration-resistant prostate cancer (nmCRPC), who are at high risk of developing metastatic disease and for the treatment of men with metastatic hormone-sensitive prostate cancer (mHSPC).

Bayer will present the first clinical Phase 1 results on aryl hydrocarbon receptor (AhR) inhibitor BAY 2416964, the company’s most advanced Immuno-Oncology program. A focus of the presentation will be on the target engagement results and pharmacokinetics from its ongoing monotherapy dose-escalation study to explore a potential optimal dose and schedule to effectively inhibit AhR. These results, along with a mathematical model-informed approach have supported the currently ongoing dose expansion for BAY 2416964.

In the New Drugs on the Horizon session at AACR, Bayer will present preclinical data on its novel selective diacylglycerol kinase (DGK) zeta inhibitor BAY 2965501, which is under Phase 1 clinical evaluation. The enzyme DGKzeta is a lipid kinase that can down-modulate T-cell activation by catalyzing the conversion of diacylglycerol to phosphatidic acid, thus acting as a ligand-independent, intracellular immune checkpoint. An inhibition of DGKzeta has been demonstrated to enhance T-cell priming against suboptimal tumor antigens and has the potential to overcome multiple immune-suppressive mechanisms in the tumor microenvironment. Based on these data, a first-in-human trial with BAY 2965501 in patients with advanced solid tumors was initiated and is currently enrolling patients.

Both small molecule inhibitors in Immuno-Oncology are being jointly developed in a strategic research alliance with the German Cancer Research Center (DKFZ) in Heidelberg, Germany.

From its focus area Precision Molecular Oncology, Bayer will show new preclinical data on its mutEGFR/HER2 inhibitor, which was developed in collaboration with the Broad Institute of MIT and Harvard in Cambridge (MA), USA. BAY 2927088 is a reversible small molecule inhibitor that is currently being evaluated in a first-in-human, Phase 1 clinical trial in non-small cell lung cancer (NSCLC) patients with mutations in epidermal growth factor receptors (EGFR & HER2) including exon20 insertions and point mutations. For the first time, Bayer will present the design of the clinical trial and the preclinical activity profile of the inhibitor in human epidermal growth factor receptor 2

(

HER2) mutant NSCLC.

Bayer will also report new data looking at larotrectinib, a highly selective and central nervous system (CNS)-active tropomyosin receptor kinase (TRK) inhibitor, approved for the treatment of patients with TRK fusion solid tumors, exploring the concordance between tissue and circulating tumor DNA (ctDNA) testing for neurotrophic tyrosine receptor kinase (NTRK) gene fusions from samples in larotrectinib clinical trials.

Additional research to be presented from Bayer’s Targeted Alpha Therapy program evaluates the antitumor efficacy and potential benefit of the combination of radium-223 with 177Lu-PSMA-617 in a preclinical model of bone metastatic prostate cancer. The combination of radium-223 and 177Lu PSMA imaging and therapy (I&T) is currently being investigated in patients with metastatic castration-resistant prostate cancer (mCRPC) in a phase 1/2 trial (AlphaBet, NCT05383079).

Key presentations on Bayer research to be presented at AACR 2023 are listed below:

Oral presentation:

BAY 2965501: A highly selective DGKzeta inhibitor for cancer immuno-therapy with first-in-class potential

Abstract ND04, Session DDT001 – New Drugs on the Horizon: Part 1

Sunday, April 16, 2:05 PM – 2:20 PM (EDT), Tangerine Ballroom 2 (WF2) - Convention Center

Poster presentations:

PSMA-targeted actinium-225 conjugate (225Ac-pelgifatamab) potentiates the antitumor efficacy of darolutamide in hormone-dependent and -independent prostate cancer models

Abstract #5047 / 14, Session PO.ET08.02 - Theranostics and Radionuclides/Pharmacologic Approaches

Tuesday, April 18, 1:30 PM - 5:00 PM (EDT), Section 19, Convention Center

Preliminary analysis of pharmacokinetic (PK) and target engagement biomarkers from a first-in-human Phase I study of immunomodulatory aryl hydrocarbon receptor (AhR) inhibitor BAY2416964

Abstract #CT276 / 16, Session PO.CT01.04 - Phase I Clinical Trials 2

Tuesday, April 18, 1:30 PM - 5:00 PM (EDT), Section 47, Convention Center

Phosphorylated extracellular signal-regulated kinase (pERK) activation in T effector cells as a target engagement biomarker for the DGKζ inhibitor BAY 2965501 in clinical trials

Abstract #2116 / 19, Session PO.CL01.11 - Biomarkers for Elucidation of Tumor Biology and Metastasis

Monday, April 17, 9:00 AM – 12:30 PM (EDT), Section 38, Convention Center

Preclinical activity of BAY 2927088 in HER2 mutant non-small cell lung cancer

Abstract #4035 / 9, Session PO.ET09.08 - Tyrosine Kinase and Phosphatase Inhibitors 2

Tuesday, April 18, 9:00 AM - 12:30 PM (EDT), Section 21, Convention Center

Mechanisms of resistance to BAY 2927088, the first reversible inhibitor targeting EGFR exon 20 insertion mutations in non-small cell lung cancer

Abstract #433 / 28, Session PO.ET03.02 - Drug Resistance in Molecular Targeted Therapies 2

Sunday, April 16, 1:30 PM - 5:00 PM (EDT), Section 15, Convention Center

An open-label, first-in-human study of BAY2927088 in patients with advanced non-small cell lung cancer (NSCLC) harboring an EGFR and/or HER2 mutation

Abstract #CT126 / 14, Session PO.CTP01.02 - Phase I Clinical Trials in Progress

Monday, April 17, 1:30 PM - 5:00 PM (EDT), Section 46, Convention Center

Racial and ethnic trends in next-generation sequencing (NGS) utilization among adult patients with selected advanced tumor types: a large commercial database analysis

Abstract #1964 / 5, Session PO.PR01.02 - Cancer Disparities Research

Monday, April 17, 9:00 AM - 12:30 PM (EDT), Section 28, Convention Center

NTRK gene fusion in adults and pediatrics with solid tumors: a record linkage study of expression frequency and patient characteristics using the Auria Biobank in Finland

Abstract #925 / 8, Session PO.CL11.01 - Analyses Using Clinical and Genomic Databases

Sunday, April 16, 1:30 PM – 5:00 PM (EDT), Section 38, Convention Center

Concordance between tissue and circulating tumor DNA (ctDNA) testing for neurotrophic tyrosine receptor kinase (NTRK) gene fusions in larotrectinib (laro) clinical trials

Abstract #CT228 / 18, Session PO.CT02.02 - Phase II Clinical Trials 2

Tuesday, April 18, 9:00 AM - 12:30 PM (EDT), Section 47, Convention Center

Optimization of treatment schedule for the combination therapy of ATR inhibitor elimusertib and PARP inhibitor niraparib in preclinical tumor models

Abstract #311 / 13, Session: Targeting Replication Stress and the Immune Microenvironment

Sunday, April 16, 1:30 PM - 5:00 PM (EDT), Section 11, Convention Center

Radium-223 demonstrates increased antitumor activity in combination with 177Lu-PSMA-617 in the intratibial LNCaP xenograft model of bone metastatic prostate cancer

Abstract #5043 / 10, Session PO.ET08.02 - Theranostics and Radionuclides/Pharmacologic Approaches

Tuesday, April 18, 1:30 PM - 5:00 PM (EDT), Section 19, Convention Center

Next-generation sequencing (NGS) and cytokine assessment from a Phase III study of copanlisib in combination with rituximab in patients with indolent non-Hodgkin lymphoma (iNHL) – associations with survival endpoints

Abstract #CT082 / 10, Session PO.CT03.01 - Phase III and Pediatric Clinical Trials

Monday, April 17, 9:00 AM - 12:30 PM (EDT), Section 47, Convention Center

About Oncology at Bayer

Bayer is committed to delivering science for a better life by advancing a portfolio of innovative treatments. The company has the passion and determination to develop innovative medicines that help improve and extend the lives of people living with cancer. The oncology franchise at Bayer includes six marketed products across various indications and several compounds in different stages of clinical development. Bayer focuses its research activities on first-in-class innovations across the following scientific platforms: Precision Molecular Oncology, Targeted Alpha Therapies, and Immuno-Oncology. Across the areas of focus, we have several prostate cancer treatments on the market or in development, with the goal of extending survival while limiting side effects of treatment throughout the different stages of the disease. Another key focus at Bayer is on innovative precision oncology treatments, with an approved TRK inhibitor exclusively designed to treat tumors that have an NTRK gene fusion, the oncogenic driver of tumor growth and spread. The company’s approach to research prioritizes targets and pathways with the potential to impact the way that cancer is treated.

About Bayer

Bayer is a global enterprise with core competencies in the life science fields of health care and nutrition. Its products and services are designed to help people and the planet thrive by supporting efforts to master the major challenges presented by a growing and aging global population. Bayer is committed to driving sustainable development and generating a positive impact with its businesses. At the same time, the Group aims to increase its earning power and create value through innovation and growth. The Bayer brand stands for trust, reliability and quality throughout the world. In fiscal 2022, the Group employed around 101,000 people and had sales of 50.7 billion euros. R&D expenses before special items amounted to 6.2 billion euros. For more information, go to

www.bayer.com

.

Find more information at

https://pharma.bayer.com

Follow us on Facebook:

http://www.facebook.com/bayer

Follow us on Twitter:

@BayerPharma

Forward-Looking Statements

This release may contain forward-looking statements based on current assumptions and forecasts made by Bayer management. Various known and unknown risks, uncertainties and other factors could lead to material differences between the actual future results, financial situation, development or performance of the company and the estimates given here. These factors include those discussed in Bayer’s public reports which are available on the Bayer website at

www.bayer.com

. The company assumes no liability whatsoever to update these forward-looking statements or to conform

them to future events or developments.

Phase 1Phase 3Phase 2Immunotherapy

Analysis

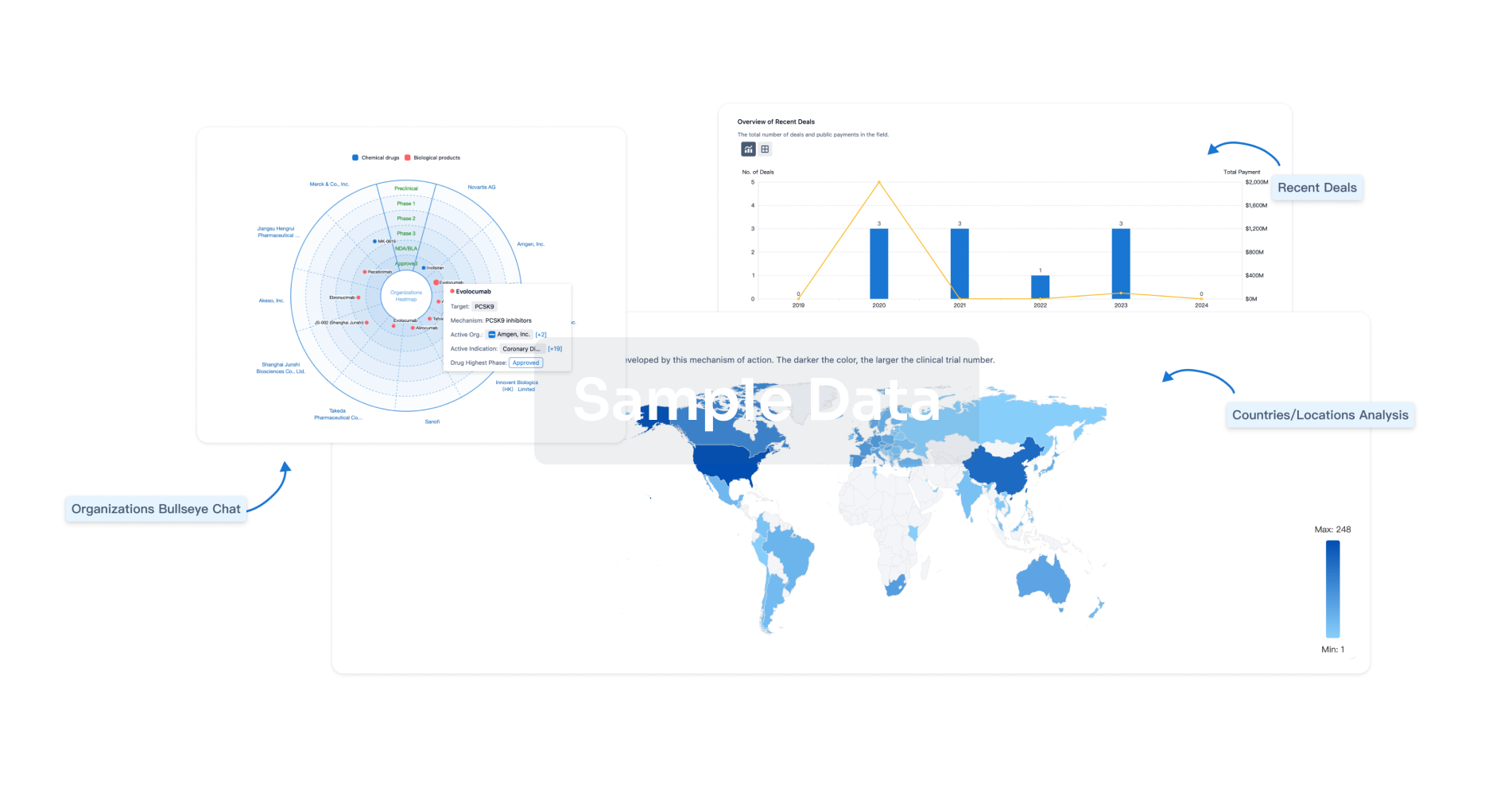

Perform a panoramic analysis of this field.

login

or

AI Agents Built for Biopharma Breakthroughs

Accelerate discovery. Empower decisions. Transform outcomes.

Get started for free today!

Accelerate Strategic R&D decision making with Synapse, PatSnap’s AI-powered Connected Innovation Intelligence Platform Built for Life Sciences Professionals.

Start your data trial now!

Synapse data is also accessible to external entities via APIs or data packages. Empower better decisions with the latest in pharmaceutical intelligence.

Bio

Bio Sequences Search & Analysis

Sign up for free

Chemical

Chemical Structures Search & Analysis

Sign up for free