Market Analysis of Etoricoxib in the USA: Regulatory Barriers and Market Opportunities

Overview

Etoricoxib is not currently approved for use in the United States market. Globally, it is a COX-2 inhibitor developed by Merck & Co., Inc. and is approved in various countries outside the USA, particularly in Europe. The drug is primarily indicated for conditions such as rheumatoid arthritis, osteoarthritis, gouty arthritis, acute pain, primary gout, and dysmenorrhea. The absence of etoricoxib in the US market represents a significant gap compared to international markets where this selective COX-2 inhibitor is available as a treatment option.

Detailed Description

Drug Information

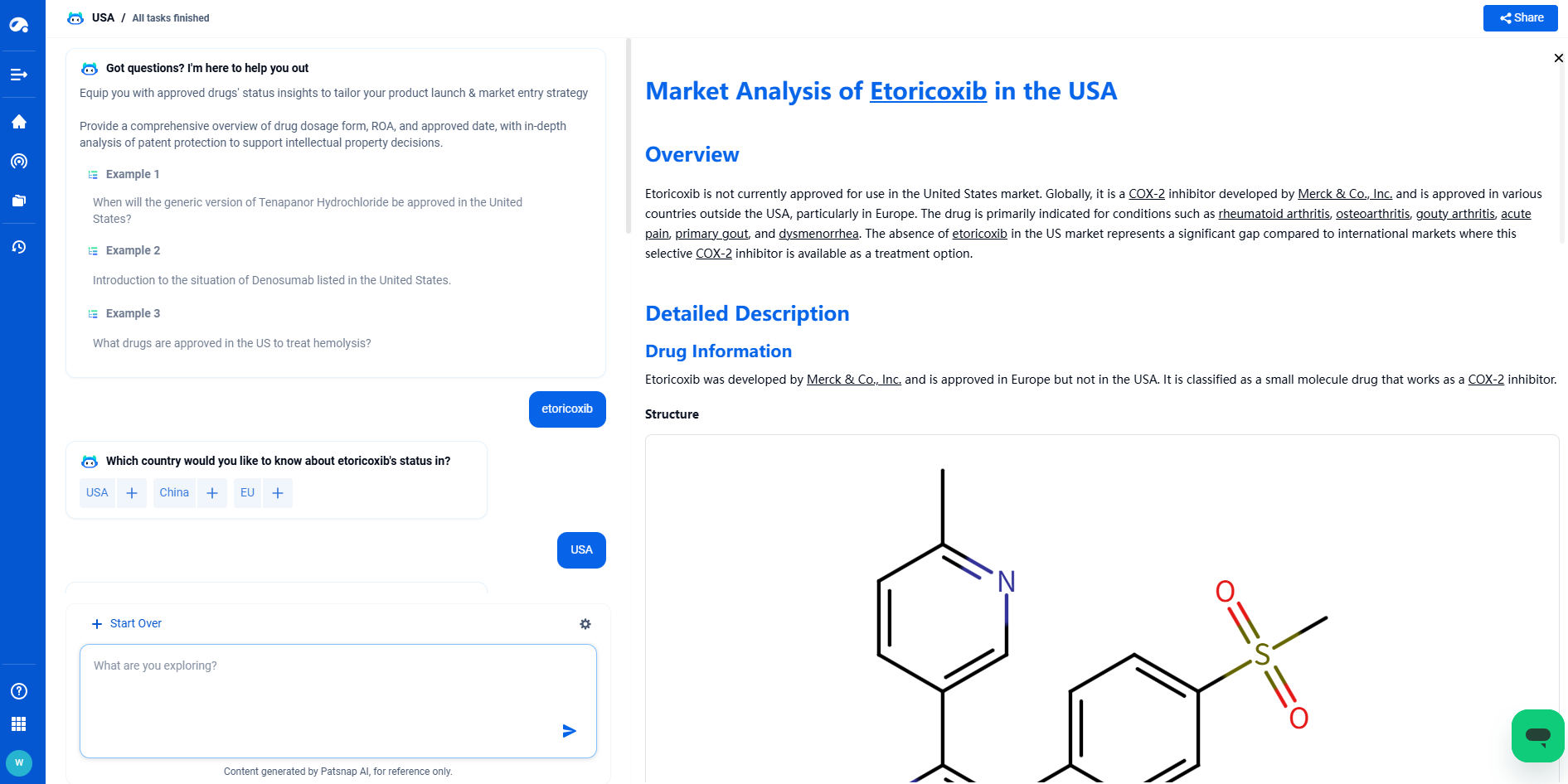

Etoricoxib was developed by Merck & Co., Inc. and is approved in Europe but not in the USA. It is classified as a small molecule drug that works as a COX-2 inhibitor.

Structure

Patent Barrier Analysis

Registration Patent Analysis

The core patents for etoricoxib in Europe have expired, with the following key patents identified:

| Patent Number | Simple Legal Status | Application Date | Estimated Expiry | Patent Type | Applicant | Source |

|---|---|---|---|---|---|---|

| EP0912518B1 | Inactive | 19970708 | 20170708 | Not specified | Merck Frosst Canada & Co. | SPC |

| EP0912518A1 | Inactive | 19970708 | 20170708 | New Use, Product Derivative, Product Compound, Formulation | Merck Frosst Canada & Co. | SPC |

Other Patent Barrier Analysis

Merck & Co. holds numerous international patents related to etoricoxib that have mostly expired or reached PCT designated stage expiry. These patents cover various aspects including:

- New use patents

- Process patents

- Formulation patents

- Crystal form patents

- Drug combination patents

Key examples include:

| Patent Number | Simple Legal Status | Application Date | Estimated Expiry | Patent Type | Applicant |

|---|---|---|---|---|---|

| US6127545A | Inactive | 19980918 | 20180415 | Process | Merck & Co., Inc. |

| US6858631B1 | Inactive | 20030912 | 20201128 | Formulation, Crystal Form | Merck & Co., Inc. |

| US5861419A | Inactive | 19970711 | 20170711 | New Use, Product Compound | Merck Canada, Inc. |

Additionally, there are numerous third-party patents from companies such as:

- Zydus Lifesciences Ltd.

- Tianjin University

- Glenmark Pharmaceuticals Ltd.

- Synthon BV

- KRKA D D NOVO MESTO

These patents primarily focus on alternative manufacturing processes, formulations, and crystal forms, suggesting active development of generic versions in markets where etoricoxib is approved.

Clinical Results

A Phase 3 clinical trial (NCT01208207/MK-0663-108) for ankylosing spondylitis with 1,015 patients compared etoricoxib to naproxen. The results showed that etoricoxib's spinal pain intensity reduction was non-inferior to naproxen, supporting its efficacy for this indication.

Infringement Cases

No patent infringement cases involving etoricoxib were identified in the available data.

Policy and Regulatory Risk Warning

After comprehensive research, the primary regulatory barrier for etoricoxib in the USA is that it has not received FDA approval. The FDA has previously expressed concerns about the cardiovascular safety profile of COX-2 inhibitors following the withdrawal of rofecoxib (Vioxx) from the market in 2004. This regulatory history likely impacts the approval pathway for etoricoxib in the USA.

Market Entry Assessment & Recommendations

Regulatory Strategy: Any company interested in bringing etoricoxib to the US market would need to address the FDA's safety concerns regarding COX-2 inhibitors. This would likely require:

- Comprehensive cardiovascular safety studies

- Risk management plans

- Possibly a different dosing strategy than used internationally

Patent Landscape: While the core compound patents have expired, any market entry would need to navigate the formulation and process patents held by various companies. Development of non-infringing formulations or processes would be necessary.

Clinical Development: Additional US-specific clinical trials may be required to satisfy FDA requirements, particularly focusing on:

- Long-term safety data

- Comparative effectiveness against currently approved alternatives

- Specific US population demographics

Market Positioning: Given the availability of other NSAIDs and COX-2 inhibitors in the US market, a clear differentiation strategy would be essential, potentially focusing on:

- Improved gastrointestinal safety profile compared to traditional NSAIDs

- Once-daily dosing convenience

- Specific indications where current options are suboptimal

Partnership Opportunities: Considering Merck's original development of the drug, exploring licensing or partnership arrangements could provide access to existing safety and efficacy data that might streamline the approval process.

Alternative Regulatory Pathways: Exploring specialized approval pathways for specific indications where there is high unmet need could potentially offer a more efficient route to market.

In conclusion, while etoricoxib represents a potential opportunity in the US market, the regulatory hurdles are significant and would require substantial investment in additional clinical development and safety studies to address the FDA's historical concerns with this class of medications.

For more scientific and detailed information of Etoricoxib, try PatSnap Eureka Pharma CI Explorer.