Highlights of February 2025: Biopharmaceutical Clinical-Stage Drug Investment, Financing, and Collaboration Deals (2)

Our analysis of February data reveals key trends in global clinical-stage biopharmaceutical financing. For contextual understanding, we recommend beginning with the following article.

11. Kyorin and Cyrano Therapeutics Enter into an Option Agreement for the Development and Commercialization of CYR-064 in Japan

On February 14, 2025, Kyorin Pharmaceutical Co., Ltd. and Cyrano Therapeutics, Inc. announced the signing of an option agreement for the novel drug CYR-064, which is designed to treat hyposmia following viral infections. Under the terms of this agreement, Kyorin has obtained the rights to develop and commercialize CYR-064 in Japan and will pay an option fee. Once the option is exercised and a licensing agreement is signed, Kyorin will also provide Cyrano with an upfront payment, milestone payments based on development and commercialization progress, and royalties calculated as a percentage of net sales after the product is launched.

CYR-064 is a patented intranasal formulation of theophylline, a broad-spectrum phosphodiesterase inhibitor (PDEi), which increases intracellular cAMP levels by inhibiting cAMP degradation, thereby enhancing the excitability of olfactory neurons. This provides a potential therapeutic pathway for treating hyposmia following viral infections and other olfactory disorders. Currently, CYR-064 is undergoing a Phase II clinical trial in the United States, with trial data expected in the second half of 2025.

Guided by its long-term vision "Vision 110," Kyorin Pharmaceutical is committed to creating high-value new drugs that meet medical needs. By actively leveraging open innovation strategies, Kyorin plans to continuously launch new drugs. This collaboration with Cyrano is part of its strategic implementation, aiming to accelerate the development and commercialization of CYR-064 in the Japanese market to address unmet medical needs.

For the fiscal year ending in March 2025, this agreement is not expected to have a significant impact on Kyorin's business performance. However, with further development of CYR-064 and its potential market success, Kyorin anticipates positive financial returns in the coming years. Meanwhile, this collaboration also opens up new prospects for finding effective treatments for hyposmia following viral infections on a global scale.

12. Royalty Pharma Invests $250 Million to Support Biogen's Lupus Drug Litifilimab Development

Royalty Pharma has entered into a $250 million agreement with Biogen to support the development of Biogen's late-stage experimental lupus drug litifilimab. Under the terms of the agreement, Biogen will receive this amount over the next six quarters. In return, if the drug achieves specific regulatory milestones, Royalty Pharma will receive undisclosed milestone payments and a mid-single-digit royalty on global sales. This transaction not only enhances Royalty Pharma's product portfolio but also brings more opportunities for potential revenue.

Litifilimab is an anti-BDCA2 antibody currently in Phase III trials for systemic lupus erythematosus (SLE) and cutaneous lupus erythematosus (CLE). The drug has demonstrated significant reduction in skin disease activity in the Phase II LILAC study, showing effective relief of skin symptoms in CLE patients compared to the placebo group at the primary endpoint. If approved by 2030, litifilimab is projected to achieve up to $750 million in global sales. This potential allows Biogen to use the funds to further advance its development process.

Currently, the SLE market is dominated by generic drugs, with only a few targeted biologics approved by the U.S. Food and Drug Administration (FDA) in the past fifty years, such as GSK's Benlysta (belimumab) and AstraZeneca's Saphnelo (anifrolumab). In contrast, the CLE market is even more innovation-starved, with this form of lupus primarily affecting the skin, causing inflammation, rashes, and lesions. The successful development of litifilimab could change this status quo and provide new treatment options for patients.

13. Tivic Health Acquires Statera Biopharma's TLR5 Agonist Entolimod™ to Expand Its Therapeutic Pipeline

Tivic Health Systems, Inc. has announced the acquisition of global exclusive rights to the late-stage Toll-like receptor 5 (TLR5) agonist Entolimod™ from Statera Biopharma for the treatment of acute radiation syndrome (ARS). In addition, Tivic has obtained exclusive options for five additional indications and clinical uses of Entolimod and its derivative Entalasta™. This extensive licensing agreement transforms Tivic into a diversified therapeutic company with complementary bioelectronic and biologic candidates in its clinical pipeline.

As the lead candidate in the licensed portfolio, Entolimod is a TLR5 agonist specifically designed for the treatment of ARS. According to data from market research firm CoherentMI, the global ARS market was valued at $5.2 billion in 2024 and is projected to grow at a compound annual growth rate of 5% from 2024 to 2031. Entolimod and its immune-optimized derivative Entalasta have undergone over forty animal and human trials and received approximately $140 million in investment. The FDA has granted Entolimod Fast Track and Orphan Drug designations for the prevention or treatment of ARS and to prevent death following a potentially lethal dose of total-body ionizing radiation after a radiological disaster.

Animal studies for ARS have shown that a single dose of Entolimod administered 25 hours after exposure to a lethal level of radiation can triple survival rates. The drug is effective without additional supportive care, demonstrating gastrointestinal protective properties and no dose-limiting toxicity even at the highest doses. Other studies have also shown its potential in applications such as immunosenescence, lymphocyte exhaustion, neutropenia, vaccine enhancement, and chronic radiation syndrome.

Under the agreement, Tivic will initially pay Statera $1.2 million in equity consideration and $300,000 in cash for the use of Entolimod in treating ARS. Tivic has the option to add one or more indications and expand its licensing scope to Entolimod's derivative Entalasta by exercising the exclusive options granted in the agreement. Future potential payments will be royalty and milestone-driven, ensuring alignment with the clinical and commercial success of Entolimod and subsequent Entalasta. The agreement structure allows Tivic to strategically manage its investment while maximizing shareholder returns.

To establish Tivic's biopharmaceutical capabilities and advance the product candidates toward commercialization, some members of Statera's team will join Tivic. The transaction also includes exclusive rights and options to over sixty patents and pending patents, related proprietary technology, and ownership of previously manufactured and tested materials. Craft Capital Management LLC served as the sole investment banking firm in this deal. With these resources integrated, Tivic is steadily moving toward becoming a leading biotherapeutic company.

14. Oramed Pharmaceuticals Announces Formation of OraTech Pharmaceuticals to Accelerate Development and Commercialization of Oral Insulin

Oramed Pharmaceuticals Inc., a clinical-stage pharmaceutical company focused on the development of oral drug delivery platforms, recently announced that it will transfer its proprietary Protein Oral Delivery (POD™) technology to a new joint venture, OraTech Pharmaceuticals Inc., through a definitive agreement. This move is aimed at accelerating the development and commercialization of Oramed's oral insulin ORMD-0801 and other innovative oral drug delivery technologies based on the POD™ platform.

In this transaction, Oramed will transfer its proprietary oral insulin and POD™ technology, along with other pipeline assets, to OraTech. Oramed shareholders will receive a majority stake in the new entity, allowing them to directly participate in its future success. Additionally, under the terms of the agreement, Oramed and HTIT will jointly invest $75 million, with Oramed contributing $15 million and HTIT contributing $60 million. This funding will provide OraTech with the necessary resources to advance product development, commercialization, and clinical progress.

OraTech will leverage HTIT's expertise in capsule manufacturing and cost-effective production capabilities to establish a robust, reliable, and scalable supply chain to support clinical trials and commercial efforts. HTIT will also provide a supply agreement for the oral insulin capsules. Furthermore, OraTech plans to relaunch the pivotal Phase III clinical trial in the United States and advance the registration of oral insulin in the U.S. and other countries. In China, OraTech will receive royalties from the sales of oral insulin, while HTIT will be responsible for submitting marketing authorization applications and preparing for commercialization.

15. AdvanCell and Eli Lilly Expand Collaboration to Advance Cancer Targeted Alpha Therapy

On February 10, 2025, AdvanCell announced that its strategic partnership with Eli Lilly and Company has been further expanded. This collaboration aims to research and develop innovative treatments for various types of cancer. The partnership not only recognizes AdvanCell's leadership in the field of Pb-212 targeted alpha therapy but also lays the foundation for a long-term collaboration between the two companies.

Under the new cooperation agreement, both parties will utilize AdvanCell's proprietary Pb-212 production technology and radiopharmaceutical development infrastructure, as well as Eli Lilly's drug candidates and extensive drug development experience, to jointly advance the development of more targeted alpha radiopharmaceutical therapies and accelerate their clinical progress. AdvanCell's technological advantages and its infrastructure established in Australia to expedite early clinical trials enable it to quickly move novel radiotherapeutic drugs containing Pb-212 from the discovery phase to clinical trials.

AdvanCell is currently conducting a Phase I/II trial for ADVC001, a potentially best-in-class targeted alpha therapy for metastatic prostate cancer. The trial aims to assess the safety and efficacy of the Pb-212-based radiopharmaceutical therapy. The core product ADVC001 is designed to bind to PSMA (a cell surface target highly expressed in prostate cancer) and has demonstrated potential best-in-class characteristics in preclinical studies. This collaboration is expected to accelerate the development of ADVC001, bringing new hope to patients with prostate cancer.

As the partnership between AdvanCell and Eli Lilly continues to deepen, both parties are committed to achieving new breakthroughs in cancer treatment. By integrating their respective strengths and technologies, the two companies will not only accelerate the clinical progress of existing projects but also potentially open up new therapeutic pathways. For cancer patients who do not respond well to traditional therapies, targeted alpha therapy offers a more precise and less side-effect-prone treatment option. In the future, with the emergence of more research results, it is expected that more patients will benefit from this innovative cancer treatment method.

16. OliX and Eli Lilly Reach Global Licensing Agreement to Develop New Therapies for MASH and Other Cardiometabolic Indications

On February 10, 2025, OliX Pharmaceuticals announced a global licensing agreement with Eli Lilly and Company. This cooperation aims to jointly develop and commercialize OliX's OLX75016, a Phase I candidate drug primarily targeting metabolic-associated fatty liver hepatitis (MASH) and other cardiometabolic indications. Under the terms of the agreement, OliX will receive an upfront payment from Eli Lilly to support the ongoing Phase I clinical trial in Australia.

OLX75016 originates from robust targets identified through genome-wide association studies (GWAS), a method that can identify genomic variations in large populations. In preclinical studies, OliX has demonstrated the efficacy of OLX75016 in treating MASH, liver fibrosis, and other cardiometabolic indications. Currently, OliX is developing OLX75016 as a novel therapy for MASH with liver fibrosis and other cardiometabolic conditions.

OliX Pharmaceuticals is a clinical-stage pharmaceutical company focused on developing treatments for various diseases using its proprietary RNAi technology. The company's core RNAi platform—Asymmetric siRNA (asiRNA)—is a unique gene-silencing technology based on RNA interference (RNAi) and is considered one of the most effective gene-silencing technologies currently available. Using this proprietary asiRNA technology, OliX has developed cell-penetrating asiRNA (cp-asiRNA), a therapeutic RNAi platform that effectively targets diseases such as proliferative scar formation, dry and wet age-related macular degeneration (AMD), and subretinal fibrosis.

In addition to cp-asiRNA, OliX has also developed another therapeutic RNAi platform, GalNAc-asiRNA, specifically for targeting various liver diseases. This collaboration with Eli Lilly not only advances the development of OLX75016 but also further solidifies OliX's position in the biopharmaceutical field, demonstrating its commitment to addressing unmet medical needs through innovative technologies. As research and development progresses, it is anticipated that more new therapies based on these advanced technologies will emerge, bringing hope to patients worldwide.

17. Kineta Restructures Portfolio Ahead of Merger with TuHURA

Ahead of its merger with TuHURA Biosciences, Kineta has made significant adjustments to its portfolio. To streamline its investments, Kineta decided to sell its collaboration deals with Genentech and Merck & Co. to an investment company and transferred its pain treatment candidate drug KCP506 to Pacira Pharmaceuticals, while also terminating its cooperation agreement with GigaGen. TuHURA purchased Kineta for $15 million, with $5 million allocated to secure the exclusivity agreement. This acquisition enabled TuHURA to acquire Kineta's Phase II checkpoint inhibitor.

In 2018, Genentech paid Kineta a $5 million upfront payment to obtain the rights to a small molecule modulator and set milestone payments of up to $96 million. The collaboration was expanded in 2020 to support the early development phase of a pain treatment candidate drug. On the other hand, Kineta inherited a collaboration with Merck from its merger with Yumanity Therapeutics, which obtained a preclinical drug candidate for amyotrophic lateral sclerosis (ALS) and frontotemporal dementia from Yumanity in 2020. In 2023, Kineta received a $5 million milestone payment from Merck, with up to $255 million still pending.

KCP506 is an α9α10 nicotinic acetylcholine receptor (nAChR) antagonist that Kineta is developing for the treatment of chronic neuropathic pain. Kineta initiated a Phase II trial for this drug. Subsequently, Kineta agreed to sell KCP506 to Pacira Pharmaceuticals for $450,000, marking the end of Kineta's further development of KCP506.

A subsidiary of HealthCare Royalty Partners, HCRX Investments Holdco, reached an agreement with Kineta covering Kineta's licensing deals with Genentech and Merck, as well as its role in an agreement with Fair Therapeutics related to cystic fibrosis. This move will help Kineta focus its resources on the development of other key projects.

Finally, Kineta decided to terminate its option and licensing agreement with GigaGen, which originally granted Kineta the rights to a CD27 drug program. By terminating this agreement, Kineta not only returned all rights to GigaGen but also waived its obligation to pay a $180,000 fee. This strategic retreat allows Kineta to concentrate more on the upcoming merger and the development of its core business.

18. Fosun Pharma and Dr. Reddy's Reach Licensing Agreement for HLX15 in Europe and the U.S.

On February 6, 2025, Fosun Pharma announced a licensing agreement with Dr. Reddy's Laboratories for HLX15, a biosimilar to daratumumab, an anti-CD38 monoclonal antibody under development. HLX15 is a recombinant human anti-CD38 monoclonal antibody injection intended for the treatment of multiple myeloma and other hematologic malignancies. Under the agreement, Dr. Reddy's will obtain exclusive commercialization rights to the drug in 43 countries and regions, including 42 European countries and the United States. The collaboration aims to expand the drug's market coverage and provide advanced biologics to more patients.

According to the terms of the agreement, Fosun Pharma will be responsible for the development, production, and commercial supply of HLX15 and may receive up to $131.6 million in funding from Dr. Reddy's, including a $33 million upfront payment and additional milestone payments. Additionally, Fosun Pharma will receive royalties based on annual net sales. This arrangement not only provides Fosun Pharma with the necessary cash flow to support its ongoing research and development but also enhances its competitiveness in the global market.

HLX15, as a biosimilar, primarily works by targeting and inhibiting the function of the CD38 protein to combat multiple myeloma. CD38 is a protein highly expressed on the surface of certain cancer cells, and monoclonal antibodies targeting it can effectively identify and destroy these cells while minimizing impact on normal tissues. Therefore, HLX15 is expected to become an important option for treating such diseases.

19. Relmada Therapeutics Acquires Potential Tourette Syndrome Therapy Sepranolone from Asarina Pharma AB

On February 6, 2025, Relmada Therapeutics announced the acquisition of Sepranolone from Asarina Pharma AB, a therapeutic asset for Tourette Syndrome (TS) and other compulsive-related disorders, ready to enter Phase IIb clinical trials. Sepranolone (isoallopregnanolone) is a first-in-class GABAA modulatory steroid antagonist (GAMSA) that selectively acts on the GABAA pathway, aiming to counteract the effects of allopregnanolone on TS and other compulsive disorders.

An open-label Phase IIa randomized study showed that Sepranolone has the potential to improve TS symptoms, as measured by changes in the Yale Global Tic Severity Scale (YGTSS). In the 12-week study, Sepranolone not only reduced the primary clinical endpoint of tic severity by 28% (p=0.051) compared to standard care alone but also achieved positive results in four key secondary endpoints, including a 69% improvement in quality of life, a 50% reduction in functional impairment, and a 44% reduction in premonitory urges. Additionally, the drug did not exhibit off-target central nervous system effects or systemic adverse effects, which is a significant advantage for central nervous system disorders requiring long-term use and potentially severe side effects.

Under the terms of the agreement, Relmada acquired global ownership of Sepranolone from Asarina Pharma AB for €3 million, completing the transaction through an asset purchase agreement. This acquisition reflects Relmada's mission to find solutions for refractory central nervous system diseases and its strategic goal of enhancing shareholder value by identifying and developing innovative compounds.

Relmada will continue to evaluate additional products and strategic opportunities and expects to update investors on the next steps for Sepranolone's development later in 2025. With further clinical data support, if Sepranolone successfully transitions to later-stage clinical trials and ultimately receives approval, it is expected to become one of the first-line treatments for Tourette Syndrome, bringing new hope to patients.

20. Acelyrin Terminates Izokibep Program, Affibody Regains Drug Development Rights

In 2021, Acelyrin acquired the license for izokibep with a $25 million upfront payment and committed to milestone payments of up to $280 million. Izokibep is an IL-17A inhibitor with a molecular weight only about one-eighth that of a typical antibody, exhibiting extremely high affinity for IL-17A and capable of specifically binding to both subunits of IL-17A as well as albumin in the serum. However, less than two years later, despite raising $540 million through an initial public offering to fund the late-stage trials of izokibep across multiple indications, Acelyrin ultimately decided to cease investment in the drug.

Izokibep achieved the primary endpoint in a Phase III clinical trial for the treatment of hidradenitis suppurativa (HS), demonstrating a 33% reduction in abscesses and inflammatory nodules by 75% or more in patients, compared to 21% in the placebo group. Despite these positive results, Acelyrin chose to discontinue investment in this indication. Additionally, after achieving success in psoriatic arthritis (PsA), Acelyrin also withdrew its investment, retaining only uveitis as the final active development area for izokibep. However, the Phase IIb/III trial in this area failed to meet its primary and secondary endpoints.

With Inmagene Biopharmaceuticals terminating the agreement covering Asian countries, including China and South Korea, the responsibility for izokibep will now fall entirely on Affibody in Sweden. Affibody's CEO, David Bejker, stated that he believes his company can better capitalize on the potential of izokibep than its former partner, particularly in the field of dermatology and for patients severely affected by hidradenitis suppurativa. This indicates Affibody's confidence in the potential of its product and its determination to regain control of the project.

21. Vanda Pharmaceuticals and AnaptysBio Reach Global Exclusive Licensing Agreement for IL-36R Antagonist Imsidolimab

On February 3, 2025, Vanda Pharmaceuticals and AnaptysBio announced a global exclusive licensing agreement for imsidolimab, an IL-36R antagonist monoclonal antibody. Imsidolimab has completed two pivotal global Phase III clinical trials for generalized pustular psoriasis (GPP) - GEMINI-1 and GEMINI-2, demonstrating good safety and efficacy. This drug balances the inflammatory response by inhibiting the function of the IL-36 receptor, which is particularly important for GPP patients caused by mutations in the IL36RN gene.

Under the terms of the agreement, Vanda will pay AnaptysBio a $10 million upfront payment and $5 million for existing drug supplies. Additionally, AnaptysBio will be eligible for up to $35 million in future regulatory approval and sales milestone payments, as well as a 10% royalty on global net sales. In this transaction, Vanda has obtained the global exclusive rights to develop, produce, and commercialize imsidolimab. These funds will support further research and development efforts to ensure that imsidolimab can reach the market as soon as possible.

In the Phase III clinical trial of GEMINI-1, 53% of patients receiving a 750 mg intravenous injection of imsidolimab achieved a GPP Physician's Global Assessment (GPPPGA) score of 0/1 (skin almost or completely clear) at week 4, compared to only 13% in the placebo group (p=0.0131). In the subsequent GEMINI-2 trial, all patients in the maintenance dose treatment group maintained a GPPPGA score of 0/1 without relapse, while 63% of patients in the placebo group experienced disease worsening. These results indicate that imsidolimab has significant efficacy for GPP.

Summary

The clinical-stage drug investment, financing, and collaboration transactions in February 2025 revealed several trends: First, capital continues to be optimistic about innovative drugs, especially those with breakthrough therapeutic potential, and is willing to invest substantial funds to support research and development. Second, antibody-drug conjugates (ADCs) have become one of the key areas of collaboration, demonstrating the global popularity of this technology platform. Lastly, Chinese pharmaceutical companies are not only seeking growth opportunities in the domestic market but also actively expanding into international markets, accelerating the global layout and commercialization of new drugs through licensing deals and other means. These dynamics indicate that, despite the many challenges facing the pharmaceutical industry, companies are actively exploring new development paths through capital injection and technological collaboration, aiming to gain a favorable position in global competition.

How to get the latest progress on drug deals?

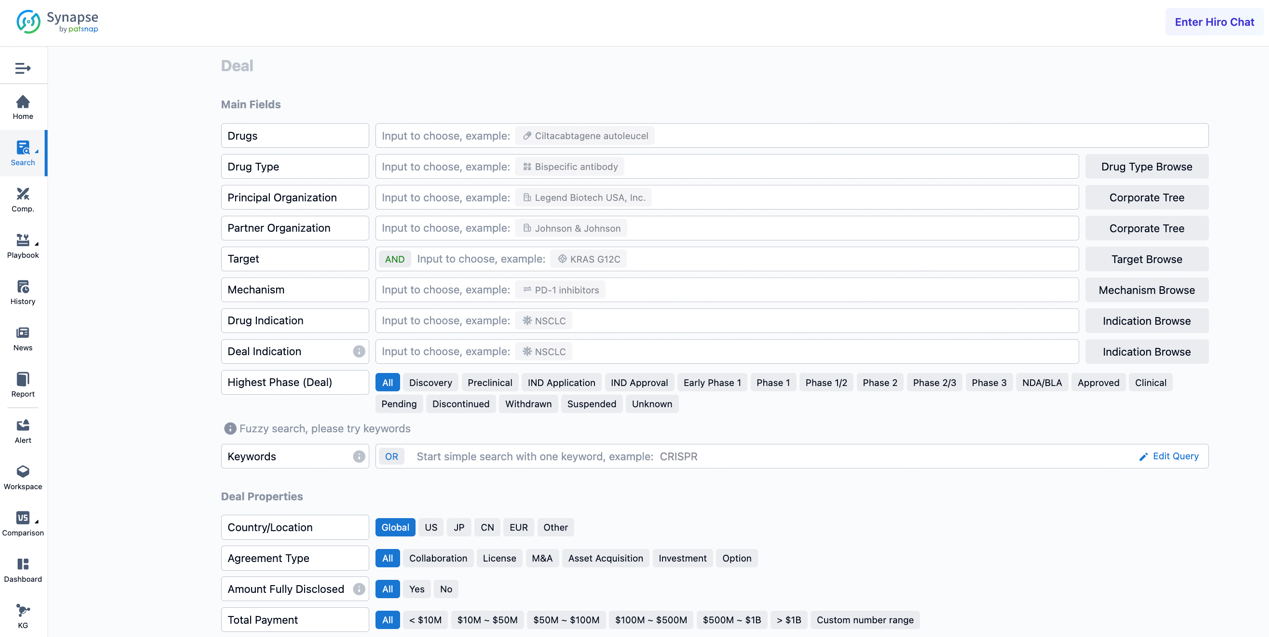

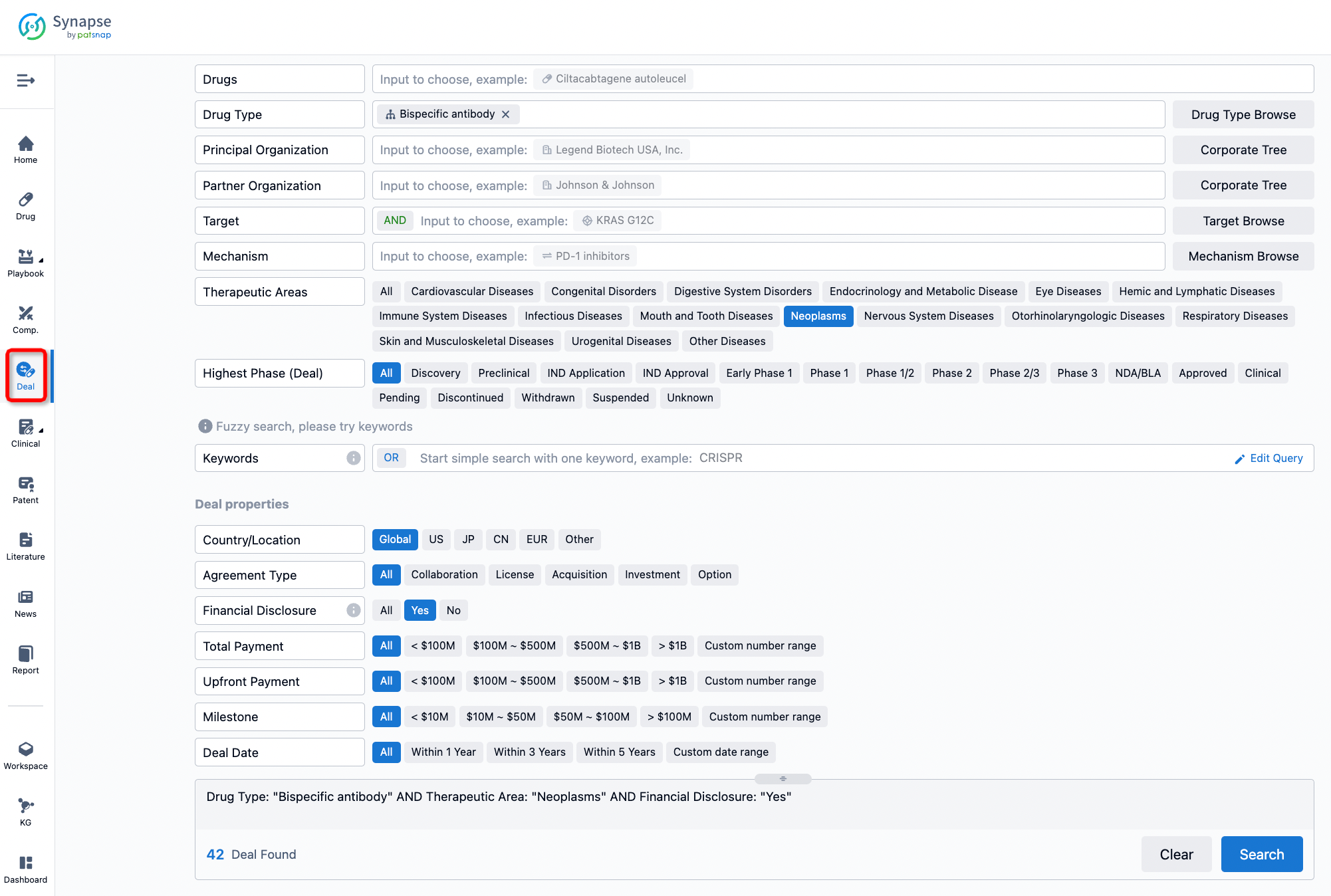

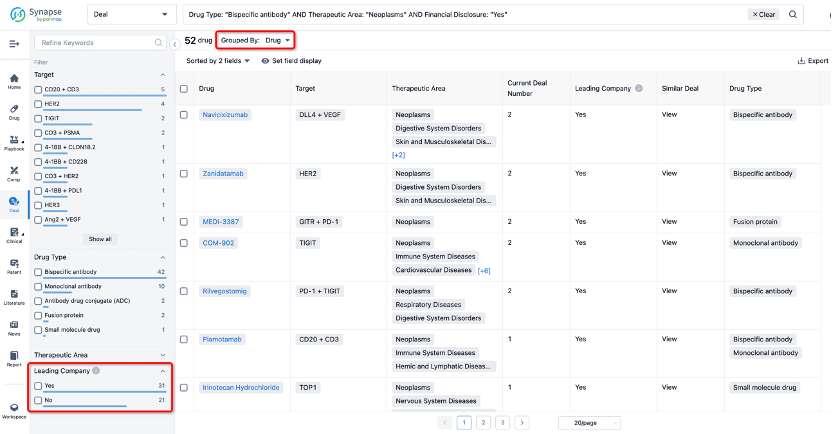

If you would like to access the latest transaction event information, you can click on the 'Deal' module from the homepage of the Synapse database. Within the Deal module, you can search for global pharmaceutical transaction information using labels such as Drugs, Organization, Target, Drug Type, Deal Date.

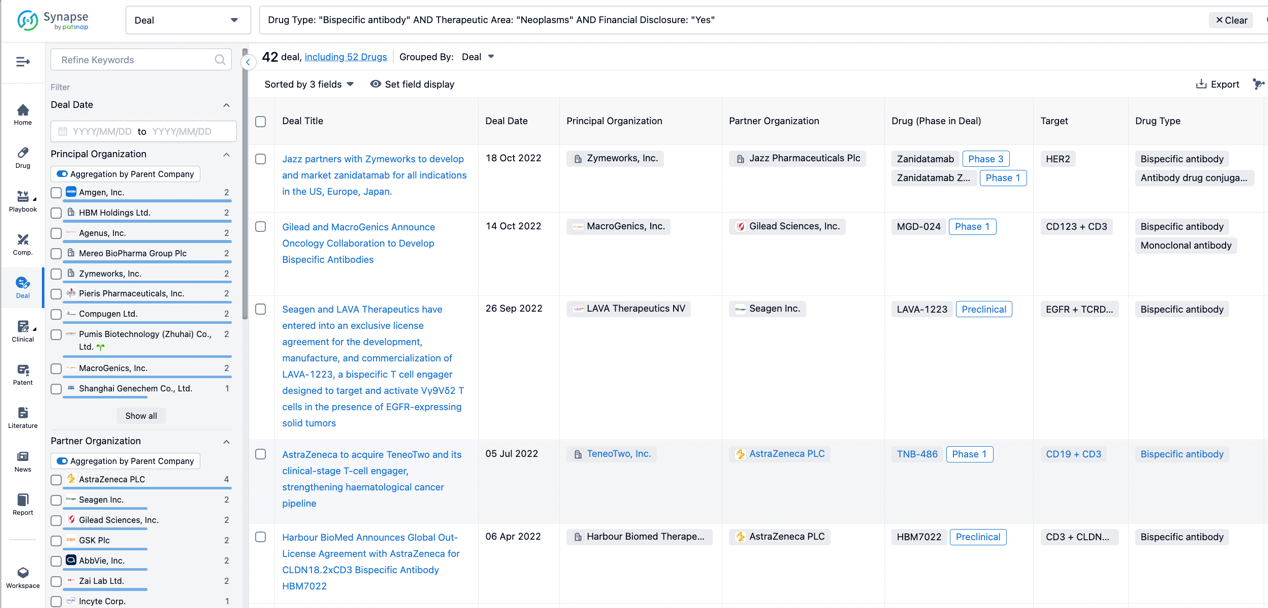

Furthermore, you can obtain the original link to the transaction coverage by clicking on the "Deal Name."

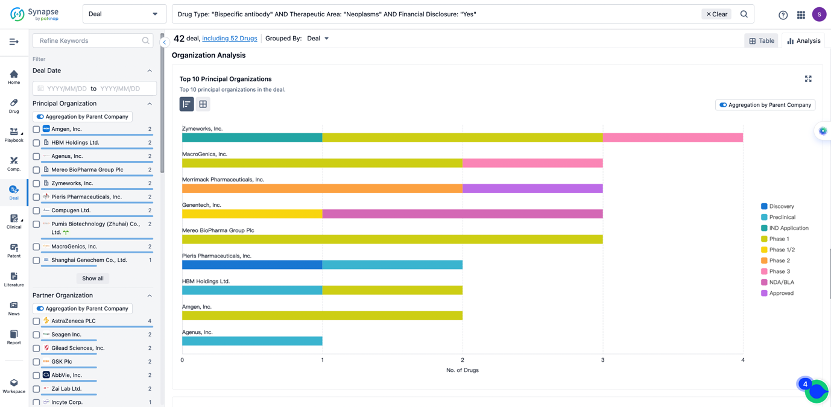

In the analysis view, you can see the most active assignors, assignees, popular targets, and other dimensions of analysis, as well as the distribution of research and development statuses at the time of the transaction, to help you better understand the search results.

The Synapse database also supports the ability to view current transactions from the dimension of "drugs" (by selecting "drugs" from the "Adjust Dimension" dropdown menu above). Targeting transactions involving renowned pharmaceutical companies that are of interest to the industry, such as Merck, Roche, etc., Synapse has identified a group of "leading companies" through drugs that have achieved global sales exceeding 1 billion US dollars in 2022. Transactions involving drugs from these leading companies can be filtered by clicking on the "Leading Company" tag on the left-hand side.

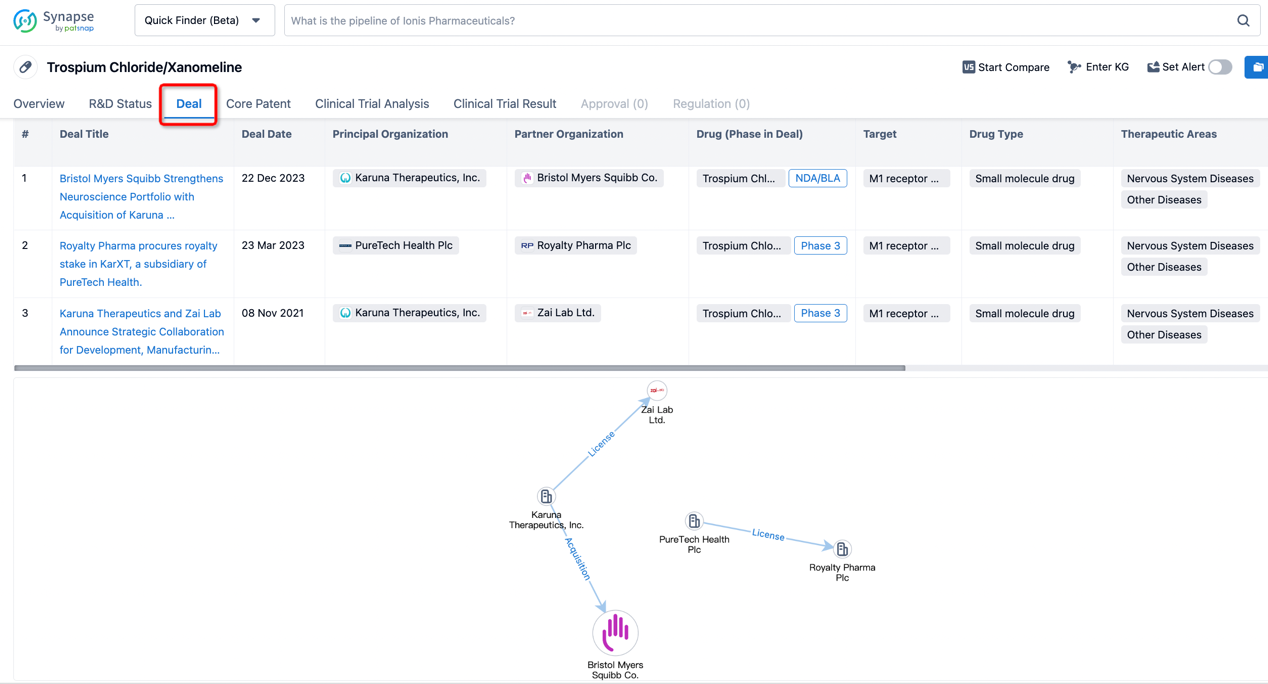

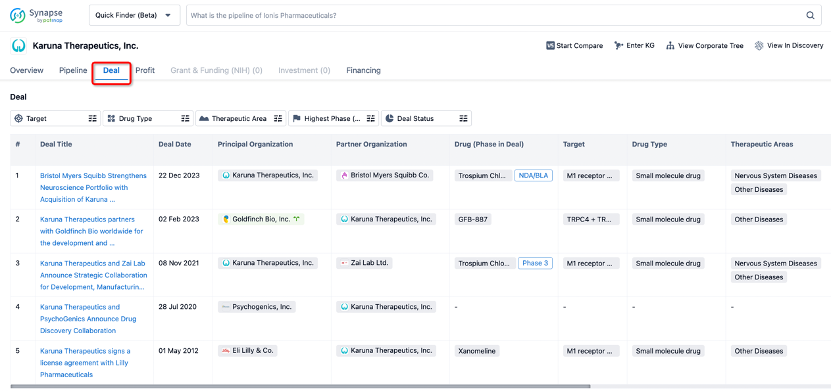

In addition to the drug transaction module, you can also view related transaction history on the drug detail page and the institution detail page.

Click on the image below to explore new pharmaceutical funding transactions!