Request Demo

Last update 05 Feb 2026

Izalontamab Brengitecan

Last update 05 Feb 2026

Overview

Basic Info

Drug Type Antibody drug conjugate (ADC) |

Synonyms Iza-bren, Zalontamab brengitecan, 伊扎洛他单抗 - 布林吉替康 + [4] |

Target |

Action antagonists, inhibitors |

Mechanism EGFR antagonists(Epidermal growth factor receptor erbB1 antagonists), HER3 antagonists(Receptor tyrosine-protein kinase erbB-3 antagonists), TOP1 inhibitors(DNA topoisomerase I inhibitors) |

Therapeutic Areas |

Inactive Indication- |

Originator Organization |

Active Organization |

Inactive Organization- |

Drug Highest PhaseNDA/BLA |

First Approval Date- |

RegulationBreakthrough Therapy (China), Priority Review (China), Breakthrough Therapy (United States) |

Login to view timeline

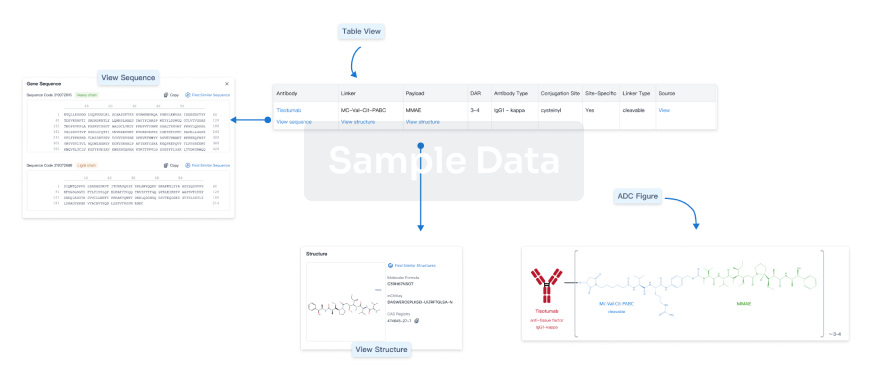

Structure/Sequence

Boost your research with our ADC technology data.

login

or

Sequence Code 43254

Source: *****

Sequence Code 10172664

Source: *****

R&D Status

10 top R&D records. to view more data

Login

| Indication | Highest Phase | Country/Location | Organization | Date |

|---|---|---|---|---|

| Metastatic Esophageal Squamous Cell Carcinoma | NDA/BLA | China | 20 Jan 2026 | |

| Oesophageal squamous cell carcinoma recurrent | NDA/BLA | China | 20 Jan 2026 | |

| Nasopharyngeal Carcinoma | NDA/BLA | China | 21 Nov 2025 | |

| Advanced Urothelial Carcinoma | Phase 3 | United States | 30 Sep 2025 | |

| Advanced Urothelial Carcinoma | Phase 3 | China | 30 Sep 2025 | |

| Advanced Urothelial Carcinoma | Phase 3 | Japan | 30 Sep 2025 | |

| Advanced Urothelial Carcinoma | Phase 3 | Argentina | 30 Sep 2025 | |

| Advanced Urothelial Carcinoma | Phase 3 | Australia | 30 Sep 2025 | |

| Advanced Urothelial Carcinoma | Phase 3 | Austria | 30 Sep 2025 | |

| Advanced Urothelial Carcinoma | Phase 3 | Belgium | 30 Sep 2025 |

Login to view more data

Clinical Result

Clinical Result

Indication

Phase

Evaluation

View All Results

Phase 3 | - | yapdbmpvsq(nixiduneze) = 经独立数据监查委员会(iDMC)判断,iza-bren在预设的期中分析中达到无进展生存期(PFS)和总生存期(OS)双主要终点。 fhvhgosnab (byorzqrfmr ) View more | Positive | 24 Nov 2025 | |||

Phase 3 | 386 | lpscytrswj(qodqrnrdwz) = gauwmdahgb laanmeurbr (bzopijcypn ) View more | Positive | 17 Oct 2025 | |||

lpscytrswj(qodqrnrdwz) = eqgosohqjk laanmeurbr (bzopijcypn ) View more | |||||||

Phase 1 | 113 | (all doses) | kcnpekqzac(ivvxeyyxle) = ceswgugocw jvutrzwgjo (lazajanwrv ) View more | Positive | 13 Oct 2025 | ||

(1.5 mg/kg D1D8 Q3W) | kcnpekqzac(ivvxeyyxle) = ezleierhvs jvutrzwgjo (lazajanwrv ) View more | ||||||

Phase 1/2 | 96 | sqwswanljp(tsvzkfrcqt) = fszcfykhii gcdodwdutb (zhxulwgmjg ) View more | Positive | 13 Oct 2025 | |||

(2.0 mg/kg Q3W) | sqwswanljp(tsvzkfrcqt) = lssopxvucv gcdodwdutb (zhxulwgmjg ) View more | ||||||

Phase 2 | 41 | BL-B01D1 2.2 mg/kg | jxcmjapklt(yjlfxdpxpr) = qwkkncfwed lksgstncxb (miysvjgkiz, 27.2 - 62.1) View more | Positive | 08 Oct 2025 | ||

BL-B01D1 2.5 mg/kg | - | ||||||

NEWS Manual | Phase 2 | 40 | calqqndfyp(nsmbtpczgk) = bibtdackdt ykosqyqdxg (qikalcemtg ) View more | Positive | 11 Sep 2025 | ||

WCLC2025 Manual | Phase 1/2 | 172 | mhpdurrcmr(gktzrruftd) = yovusdbxma fcldzvhfuf (qpnopzlzeh, 5.5 - 9.6) View more | Positive | 09 Sep 2025 | ||

(2.5 mg/kg D1D8 Q3W) | mhpdurrcmr(gktzrruftd) = buggbwarxv fcldzvhfuf (qpnopzlzeh, 5.5 - 9.7) View more | ||||||

NEWS Manual | Phase 1/2 | EGFR-mutated non-small Cell Lung Cancer EGFR Mutation | 50 | (既往接受过EGFR-TKI但未接受过化疗) | iralftcply(vniygmqtia) = spulkbfgtu iuddaksgtt (vvuskcatmk ) View more | Positive | 08 Sep 2025 |

(19 缺失突变组) | iralftcply(vniygmqtia) = hegoprdurb iuddaksgtt (vvuskcatmk ) | ||||||

NCT05880706 (WCLC2025) Manual | Phase 2 | 154 | mmmxlokcsp(rrszkvgagt) = svlvttkbqr yuloifzrza (asqfjjssya ) View more | Positive | 08 Sep 2025 | ||

(2.2 mg/kg (D1D8 Q3W)) | mmmxlokcsp(rrszkvgagt) = tmhmbrtoaz yuloifzrza (asqfjjssya ) View more | ||||||

NEWS Manual | Phase 2 | EGFR-mutated non-small Cell Lung Cancer EGFR Mutation | 40 | jzgymorxnc(dssbcgbkip) = kgxtnsvklf zuinnokqsr (lruaeyoptw ) View more | Positive | 08 Sep 2025 |

Login to view more data

Translational Medicine

Boost your research with our translational medicine data.

login

or

Deal

Boost your decision using our deal data.

login

or

Core Patent

Boost your research with our Core Patent data.

login

or

Clinical Trial

Identify the latest clinical trials across global registries.

login

or

Approval

Accelerate your research with the latest regulatory approval information.

login

or

Biosimilar

Competitive landscape of biosimilars in different countries/locations. Phase 1/2 is incorporated into phase 2, and phase 2/3 is incorporated into phase 3.

login

or

Regulation

Understand key drug designations in just a few clicks with Synapse.

login

or

AI Agents Built for Biopharma Breakthroughs

Accelerate discovery. Empower decisions. Transform outcomes.

Get started for free today!

Accelerate Strategic R&D decision making with Synapse, PatSnap’s AI-powered Connected Innovation Intelligence Platform Built for Life Sciences Professionals.

Start your data trial now!

Synapse data is also accessible to external entities via APIs or data packages. Empower better decisions with the latest in pharmaceutical intelligence.

Bio

Bio Sequences Search & Analysis

Sign up for free

Chemical

Chemical Structures Search & Analysis

Sign up for free