Request Demo

Last update 11 Feb 2026

Belantamab mafodotin

Last update 11 Feb 2026

Overview

Basic Info

Drug Type Antibody drug conjugate (ADC) |

Synonyms anti-BCMA-ADC, Belamaf, Belantamab mafodotin (genetical recombination) (JAN) + [12] |

Target |

Action inhibitors |

Mechanism BCMA inhibitors(B-cell maturation protein inhibitors), Tubulin inhibitors |

Therapeutic Areas |

Active Indication |

Inactive Indication |

Originator Organization |

Active Organization |

Inactive Organization |

License Organization- |

Drug Highest PhaseApproved |

First Approval Date United States (05 Aug 2020), |

RegulationAccelerated Approval (United States), Orphan Drug (United States), PRIME (European Union), Orphan Drug (Japan), Orphan Drug (South Korea), Breakthrough Therapy (China), Priority Review (United States), Priority Review (China), Breakthrough Therapy (United States) |

Login to view timeline

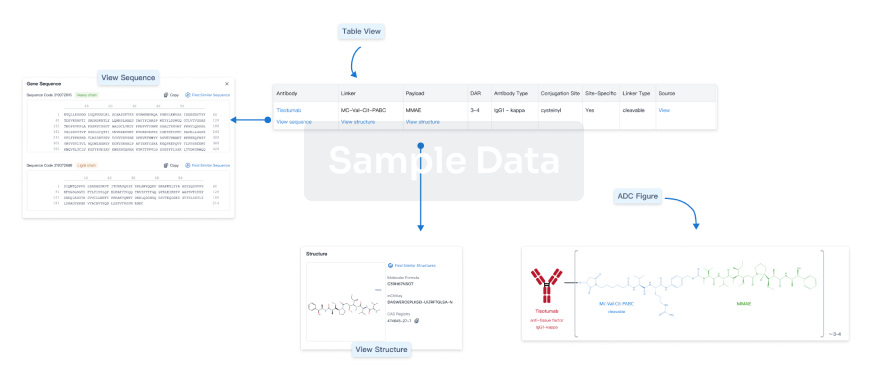

Structure/Sequence

Boost your research with our ADC technology data.

login

or

Sequence Code 33466H

Source: *****

Sequence Code 33489L

Source: *****

External Link

| KEGG | Wiki | ATC | Drug Bank |

|---|---|---|---|

| D11595 | Belantamab mafodotin |

R&D Status

Approved

10 top approved records. to view more data

Login

| Indication | Country/Location | Organization | Date |

|---|---|---|---|

| Recurrent Multiple Myeloma | Japan | 19 May 2025 | |

| Multiple Myeloma | United States | 05 Aug 2020 | |

| Refractory Multiple Myeloma | United States | 05 Aug 2020 | |

| Relapse multiple myeloma | United States | 05 Aug 2020 |

Developing

10 top R&D records. to view more data

Login

| Indication | Highest Phase | Country/Location | Organization | Date |

|---|---|---|---|---|

| Residual Neoplasm | Phase 2 | United States | 19 Aug 2024 | |

| Bone Marrow Neoplasms | Phase 2 | United States | 21 Jul 2022 | |

| Plasma Cell Leukemia | Phase 2 | United States | 21 Jul 2022 | |

| Corneal Diseases | Phase 2 | Greece | 13 Apr 2022 | |

| BCMA Positive Multiple Myeloma | Phase 2 | United States | 21 Feb 2022 | |

| ALK positive large B-cell lymphoma | Phase 2 | United States | 01 Jul 2021 | |

| Plasmablastic Lymphoma | Phase 2 | United States | 01 Jul 2021 | |

| Immunoglobulin Light-Chain Amyloidosis | Phase 2 | France | 26 Feb 2021 | |

| Immunoglobulin Light-Chain Amyloidosis | Phase 2 | Germany | 26 Feb 2021 | |

| Immunoglobulin Light-Chain Amyloidosis | Phase 2 | Greece | 26 Feb 2021 |

Login to view more data

Clinical Result

Clinical Result

Indication

Phase

Evaluation

View All Results

Phase 3 | 302 | hvypsnyfcr(vrdzekdlpn) = kbbetpwlik dnsnubhxgk (jndtlepzse ) View more | Positive | 06 Dec 2025 | |||

Daratumumab, bortezomib, and dexamethasone (DVd) | jdiytcrgvz(ydajuxtclp) = iqjosfztvp uuvwfxmvxx (xwigxviwyz ) View more | ||||||

Phase 3 | 494 | vrapwhksqy(pgclszfxrq) = gwzjnhjunr ftixdkwhyg (jxunpxpleb ) | Positive | 06 Dec 2025 | |||

Phase 3 | Relapse multiple myeloma Second line | 302 | rvtlyohnrz(auykvepwre) = overall QOL did not differ between treatment arms in either DREAMM-7 or DREAMM-8 sejfvnsrio (wbqswiazkq ) View more | Positive | 06 Dec 2025 | ||

Phase 3 | 302 | dkeshqzevb(phwejwxavf) = tmvxywouil tpsdbrcruo (zpwsdblkme, 21.1 - NR) View more | Positive | 06 Dec 2025 | |||

dkeshqzevb(phwejwxavf) = odbuhvfink tpsdbrcruo (zpwsdblkme, 9.1 - 17.6) View more | |||||||

Phase 3 | 302 | uyudgzujby(goghgwurbd) = similar between patient groups and comparable to that in patients treated with PVd wbetokeqyx (svxauroibo ) View more | Positive | 06 Dec 2025 | |||

Phase 3 | 131 | vjrkvfbqar(uawbownwrs) = ixqhpfjqpm pmzrinykvf (plikchqxxh ) View more | Positive | 06 Dec 2025 | |||

vjrkvfbqar(uawbownwrs) = zdtbmjufri pmzrinykvf (plikchqxxh ) View more | |||||||

Phase 3 | 494 | (Long-term responders) | hrxlhdavpc(ldbhjburir) = hbcdxjkrrh zzfdrsvgal (bixsqqfxxs ) View more | Positive | 06 Dec 2025 | ||

Daratumumab, bortezomib, and dexamethasone (DVd) (Long-term responders) | hrxlhdavpc(ldbhjburir) = gfzeerccve zzfdrsvgal (bixsqqfxxs, NE - NE) View more | ||||||

Phase 1/2 | 516 | ojnprjedwn(ohcmmxikpp) = quzdktxyzx fiwqztbyjy (oxoyjhtruw ) View more | Positive | 06 Dec 2025 | |||

ojnprjedwn(ohcmmxikpp) = rvoaslxhwv fiwqztbyjy (oxoyjhtruw ) View more | |||||||

Phase 3 | 494 | tmwtnjwhve(vfeeeuokvd) = In the remaining approximately two-thirds of patients, a slight trend toward improvement (not meeting the meaningful change threshold) in overall global health status/QOL was seen with BVd vs DVd; physical and role functioning were similar between groups and were comparable to the DVd arm. bbeyxrvcrv (plweicxwnc ) View more | Positive | 06 Dec 2025 | |||

Phase 3 | 389 | ovenmcwtut(fqlijikymd) = fpmvucjujo wrigtdvfaq (jiwfakuhxf ) View more | Positive | 06 Dec 2025 | |||

ovenmcwtut(fqlijikymd) = sxyjqilums wrigtdvfaq (jiwfakuhxf ) View more |

Login to view more data

Translational Medicine

Boost your research with our translational medicine data.

login

or

Deal

Boost your decision using our deal data.

login

or

Core Patent

Boost your research with our Core Patent data.

login

or

Clinical Trial

Identify the latest clinical trials across global registries.

login

or

Approval

Accelerate your research with the latest regulatory approval information.

login

or

Biosimilar

Competitive landscape of biosimilars in different countries/locations. Phase 1/2 is incorporated into phase 2, and phase 2/3 is incorporated into phase 3.

login

or

Regulation

Understand key drug designations in just a few clicks with Synapse.

login

or

AI Agents Built for Biopharma Breakthroughs

Accelerate discovery. Empower decisions. Transform outcomes.

Get started for free today!

Accelerate Strategic R&D decision making with Synapse, PatSnap’s AI-powered Connected Innovation Intelligence Platform Built for Life Sciences Professionals.

Start your data trial now!

Synapse data is also accessible to external entities via APIs or data packages. Empower better decisions with the latest in pharmaceutical intelligence.

Bio

Bio Sequences Search & Analysis

Sign up for free

Chemical

Chemical Structures Search & Analysis

Sign up for free