Breaking the "Undruggable" Curse: A Discussion on KRAS Inhibitors

As one of the three major types of genes in the RAS family, the KRAS mutation is one of the most common oncogenic mutations in cancer patients. It has been dubbed an “undruggable” target and is considered by industry insiders to be the most difficult target to treat in history! This is partly because KRAS has a very strong binding force with the substrate GTP, with an affinity coefficient reaching the picomolar concentration level, making it difficult to develop competitive inhibitors that directly target the GTP pocket. On the other hand, the surface of KRAS protein lacks ideal small molecule binding pockets, making it difficult to design high-affinity conformational inhibitors.

Not until 2013, there was a significant progress in the research of small molecule inhibitors for KRAS mutations, when the first small molecule covalent targeting strategy of KRAS G12C was published on Nature. Studies have shown that even in cancer cells, KRAS protein can switch between the activated and inactivated states by binding to both GTP and GDP molecules. Due to the tight binding of KRAS and GTP, it is very difficult to directly inhibit the KRAS protein that is in an activated state and bound to GTP. However, when the KRAS G12C protein binds to GDP, the inactivated KRAS protein reveals a site where drugs can bind. Taking advantage of this, if target drugs are used, there is hope to lock the KRAS protein in the "inactivated state", thereby blocking the signaling pathway and the survival ability of the cancer cells that rely on this protein.

In the genetic mutations of KRAS, 97% are mutations of the 12th or 13th amino acid residues. The main ones are G12D, G12V, G13D, G12C, etc. Structural studies have shown that these gene mutations mainly interfere with KRAS's ability to hydrolyze GTP. The two drugs currently on the market, as well as most drugs under development, all target the G12C.

KRAS Competitive Landscape

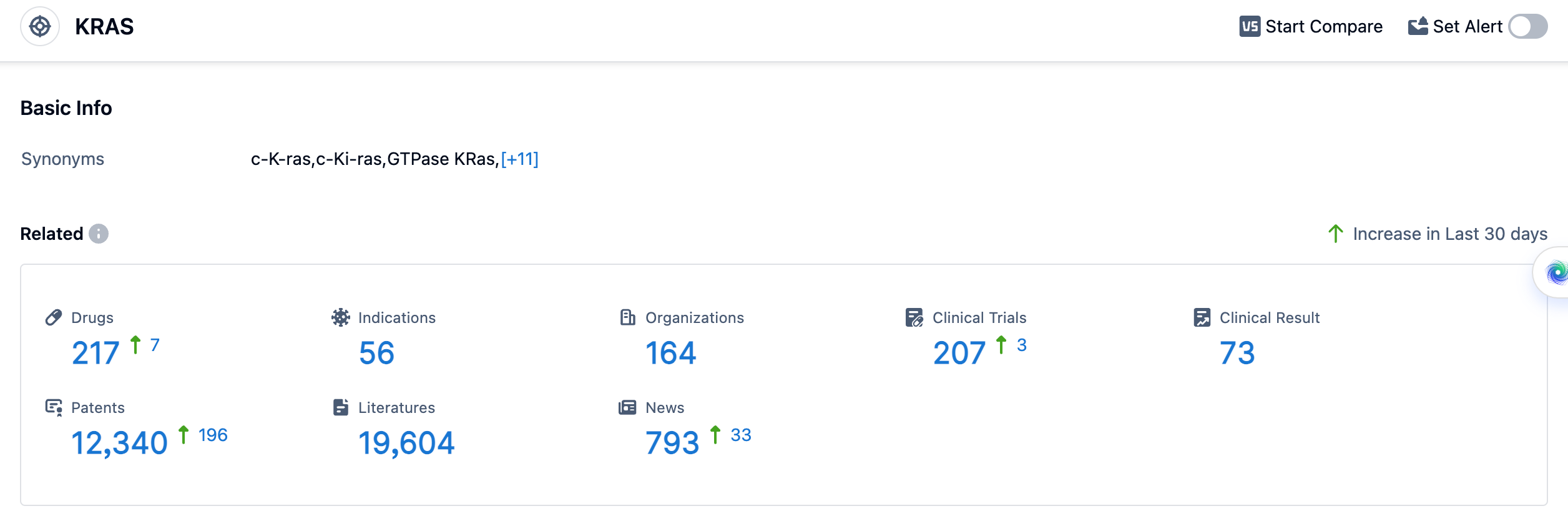

According to the data provided by Patsnap Synapse-Global Drug Intelligence Database: the following figure shows that as of 18 Sep 2023, there are a total of 217 KRAS drugs worldwide, from 164 organizations, covering 56 indications, and conducting 207 clinical trials.

👇Please click on the picture link below for free registration or login directly if you have freemium accounts, you can browse the latest research progress on drugs , indications, organizations, clinical trials, clinical results, and drug patents related to this target.

The highest phase drugs are mainly focused on Non-Small Cell Lung Cancer, Colorectal Cancer, Pancreatic Cancer, and Solid Tumors. These indications have drugs in various phases of development, including Approved, NDA/BLA, Phase 3, Phase 2, Phase 1, Preclinical, and Inactive.

The analysis of the current competitive landscape and future development of target KRAS reveals that multiple companies are actively involved in the research and development of drugs targeting KRAS. Mirati Therapeutics, Inc., Amgen, Inc., and Novartis AG are among the companies with the highest stage of development on this target. The indications with approved drugs include Non-Small Cell Lung Cancer, Colorectal Cancer, Pancreatic Cancer, and Solid Tumors. Small molecule drugs, TCR therapy, and Small interfering RNA are progressing rapidly under the current targets. The United States and China are the leading countries in the development of drugs targeting KRAS, with China showing significant progress. The competitive landscape is intense, with biosimilars and various drug types indicating competition and innovation in the field. The future development of target KRAS holds promise for the treatment of various cancers, with ongoing research and development efforts worldwide.

The first approved KRAS inhibitor for market launch -Lumakras

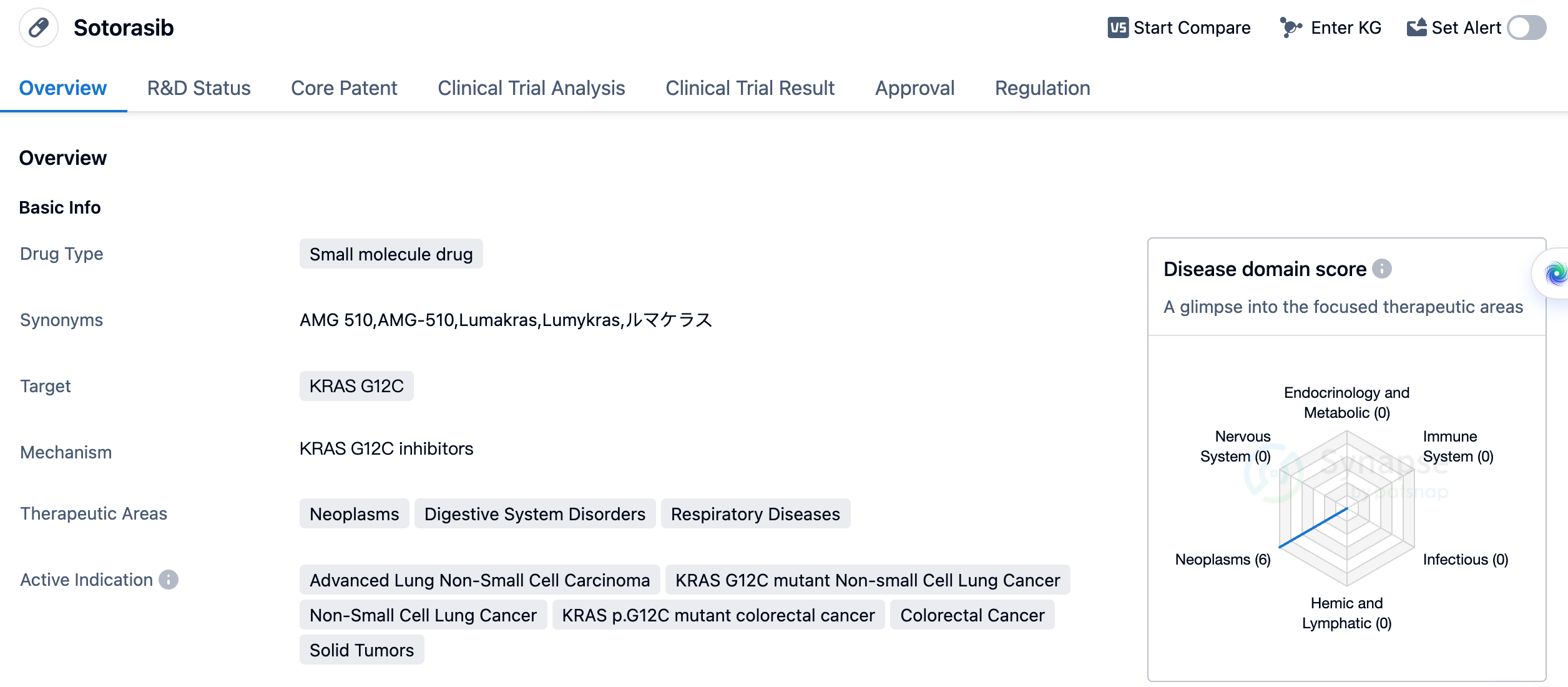

Lumakras becomes the first approved KRAS inhibitor, breaking the curse of KRAS being "undruggable". In recent years, it has also actively promoted combination therapy, targeting diseases such as lung cancer and colorectal cancer. In May 2021, based on the results provided by the open label phase I/II clinical trial CodeBreaK100, which include a 36% overall response rate, 81% disease control rate, and a median duration of response of 10 months, the FDA accelerated the approval of Amgen's KRAS G12C inhibitor Lumakras (Sotorasib, AM510), used to treat locally advanced or metastatic NSCLC patients carrying the KRAS G12C mutation who have previously undergone at least one systemic treatment. On July 14, 2022, Amgen announced the clinical Phase Ib trial results of the combination therapy of Lumakras and SHP2 tyrosine kinase receptor (RTK) inhibitor in NSCLC, colorectal cancer and other solid tumor patients. This suggests that KRAS targeted drugs will aim for a variety of intractable tumors not limited to NSCLC, entering another important stage.

👇Please click on the image below to directly access the latest data (R&D Status | Core Patent | Clinical Trial | Approval status in Global countries) of this drug.

Sotorasib has been indicated for the treatment of advanced lung non-small cell carcinoma, KRAS G12C mutant non-small cell lung cancer, non-small cell lung cancer, KRAS p.G12C mutant colorectal cancer, colorectal cancer, and solid tumors. This wide range of indications suggests that the drug may have a broad spectrum of activity against different types of cancer. In China, Sotorasib is currently in phase 3 of development, indicating that it is undergoing advanced clinical trials to assess its safety and efficacy in the Chinese population. This suggests that the drug may soon be available for patients in China, pending regulatory approval. Sotorasib has been granted several regulatory designations, including fast track, breakthrough therapy, accelerated approval, and orphan drug status. These designations highlight the potential of the drug to address unmet medical needs and expedite its development and approval process.

In summary, Sotorasib is a small molecule drug developed by Amgen, Inc. that targets the KRAS G12C mutation. It has shown promise in the treatment of various types of cancer, including advanced lung non-small cell carcinoma and colorectal cancer. The drug has received regulatory approval in the United States and is currently in phase 3 development in China. Its regulatory designations further emphasize its potential as a breakthrough therapy for patients with limited treatment options.

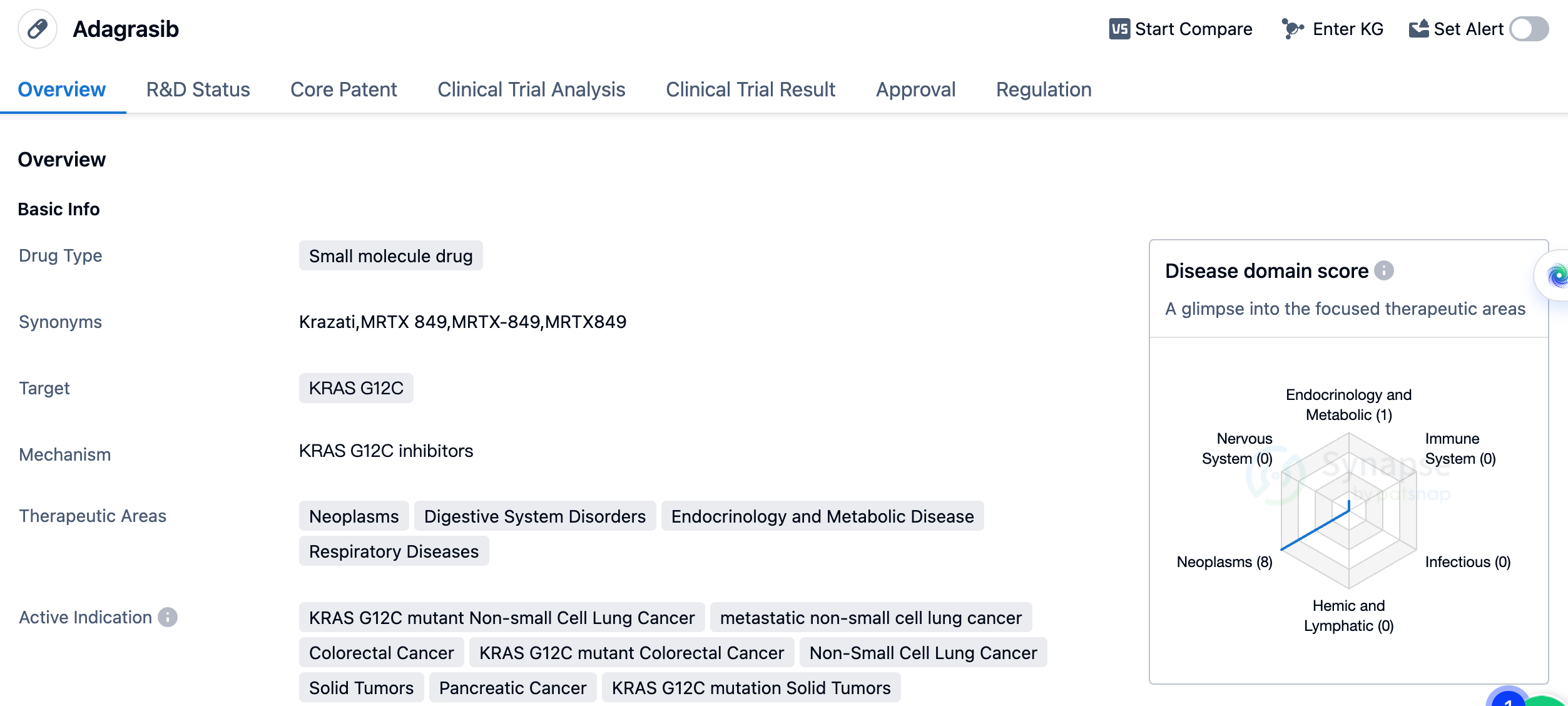

Adagrasib

In December 2022, Krazati (Adagrasib, MRTX849) developed by Mirati Therapeutics was approved by the FDA for marketing, for the treatment of patients with metastatic NSCLC. This makes it the second KRAS G12C inhibitor approved for marketing by the FDA, demonstrating good efficacy in the treatment of NSCLC and colorectal cancer, among other solid tumors. Mirati recently announced plans to initiate a Phase III trial to test the combination of Krazati and Keytruda in patients newly diagnosed with KRAS G12C mutated NSCLC. It is reported that these patients' tumors have high PD-L1 expression, with a tumor proportion score (TPS) of at least 50%. In recent early data released by Mirati, in an analysis targeting high PD-1 expressing patients, the combination of Krazati and Keytruda ("K-drug") showed an overall response rate of 63%. This indicated an improvement compared to the range of 39% to 45% observed with the "K-drug" alone.

👇Please click on the image below to directly access the latest data (R&D Status | Core Patent | Clinical Trial | Approval status in Global countries) of this drug.

The approval of Adagrasib is significant in the field of biomedicine, particularly in the treatment of cancers associated with the KRAS G12C mutation. This mutation is found in various types of cancer and has been challenging to target effectively. Adagrasib's approval offers new hope for patients with KRAS G12C mutant non-small cell lung cancer, colorectal cancer, and other solid tumors. As a small molecule drug, Adagrasib has the potential for oral administration, which may provide convenience for patients compared to other treatment options. The drug's approval in the United States and ongoing phase 3 trials in China indicate its potential for global availability and impact. In conclusion, Adagrasib is a small molecule drug developed by Array BioPharma, Inc. and Mirati Therapeutics, Inc. Its approval offers new treatment options for patients with KRAS G12C mutant cancers and represents a significant development in the field of biomedicine.