Pfizer's Oral Weight Loss Drug Development Encounters Challenges - Who Will Be the Next 'Drug King' in the GLP-1 Race?

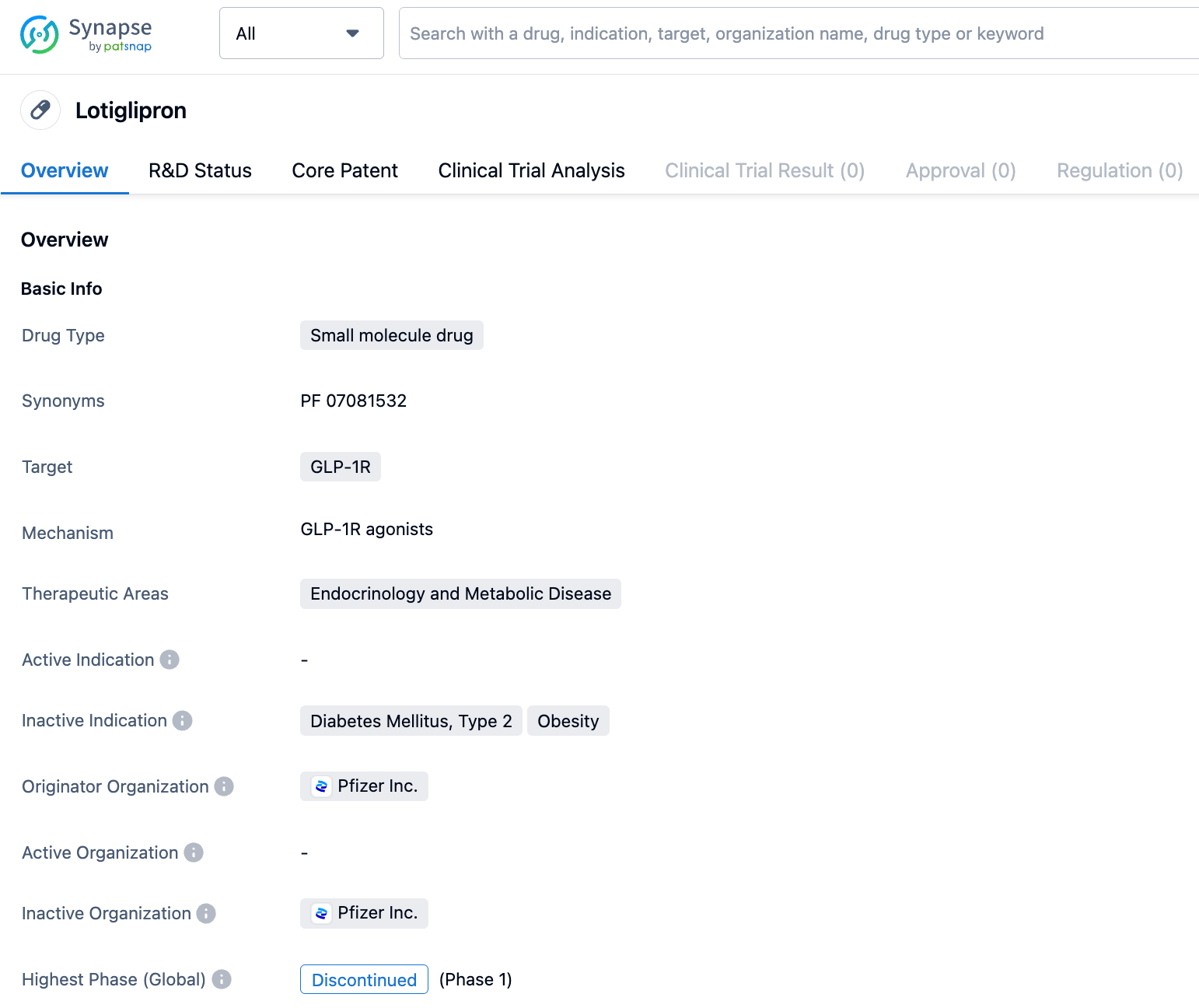

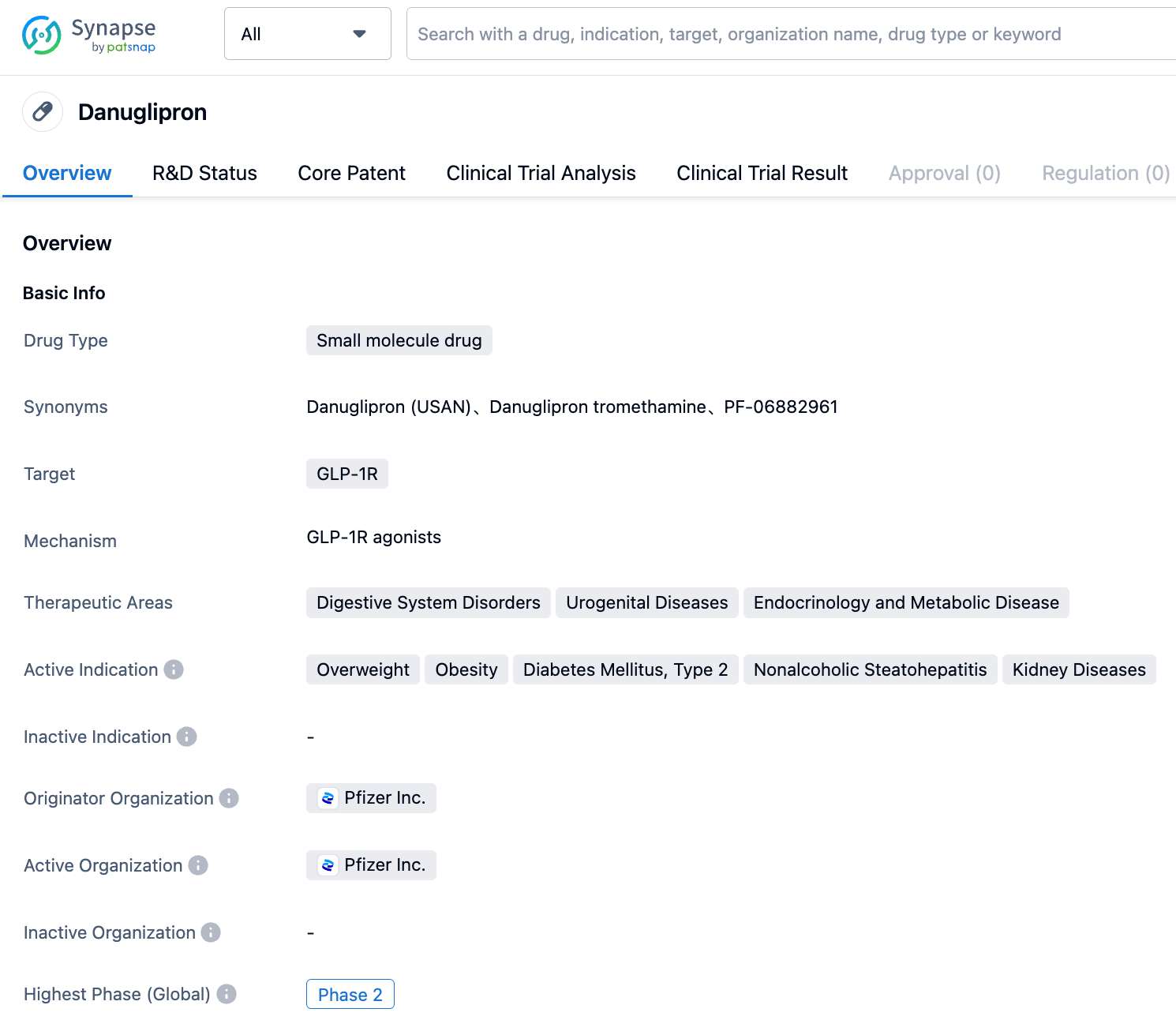

In June 2023, Pfizer announced that it will halt the development of its obesity and diabetes drug, Lotiglipron, which is currently in clinical trials, and shift its focus onto another oral weight loss drug, Danuglipron. The reason is the elevation of transaminase in patients who took Lotiglipron during the mid-stage clinical research.

The elevation of transaminase is a sensitive indicator of hepatocyte damage. Many BTK inhibitors used in treat autoimmune diseases are troubled by this indicator. The appearance of this phenomenon in Lotiglipron's clinical trials may mean that some patients' hepatocytes and liver function are impaired. However, Pfizer also stated that "no patients exhibited liver-related symptoms or side effects, and no patients experienced liver failure or needed treatment."

Expected to become the "Largest-Scale Drug Market"

According to Novo Nordisk's 2022 annual financial report, the GLP-1 drug market, led by Semaglutide, surpassed insulin for the first time last year, becoming the biggest driver in the diabetes market.

Today, a new "obesity revolution" is sweeping across the world. The aforementioned concerns clearly can't prevent the frenzied advance of GLP-1 class weight loss drugs in clinical and commercial development.

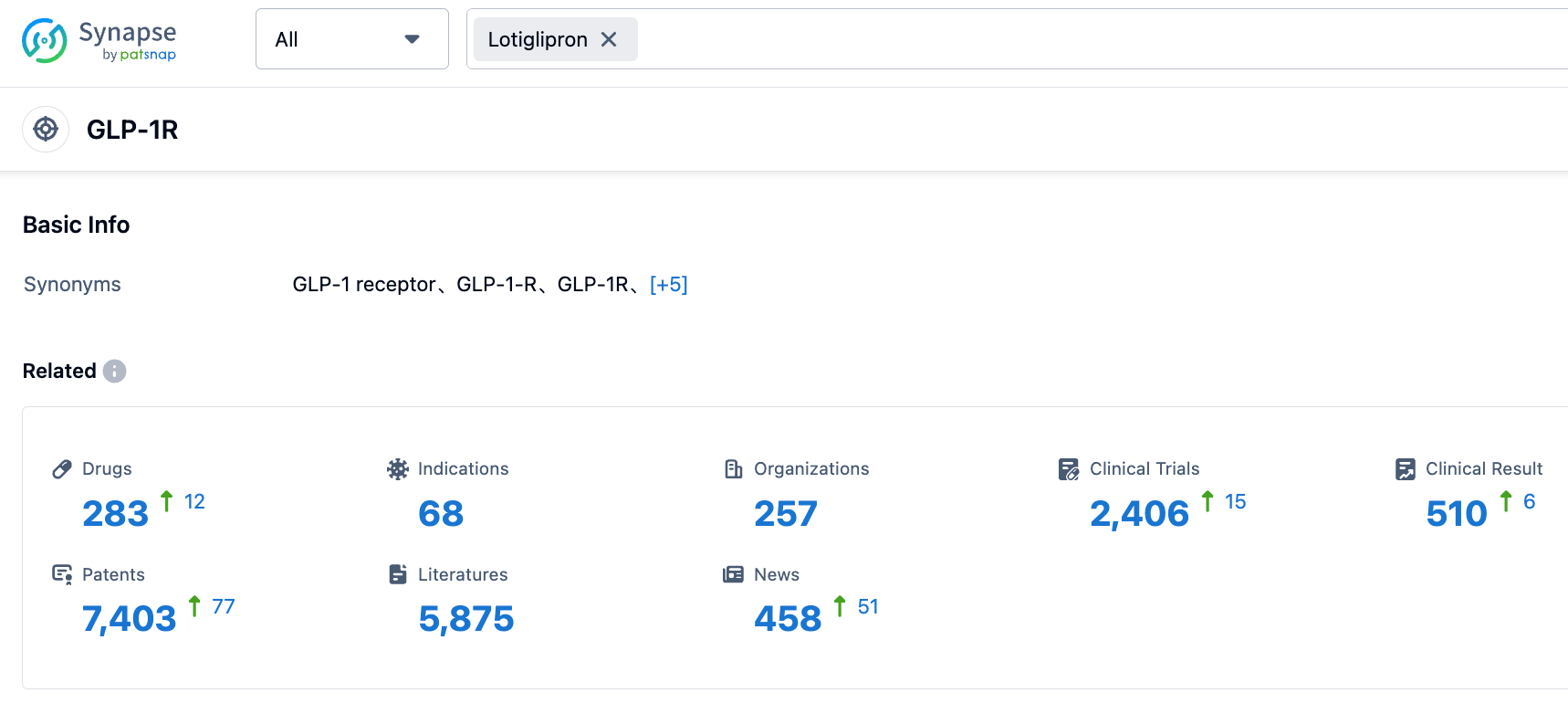

GLP-1 is a class of incretin hormones. As the name suggests, it is a type of peptide hormone synthesized and released by endocrine cells in the intestines into the body's circulation. Its main target is GLP-1R, which is distributed in tissues such as the small intestine, pancreas, cardiovascular system, brain, and salivary glands. GLP-1R belongs to GPCR (G-protein coupled receptor), which can activate various G-proteins (such as Gas, Gi/o, Gq, etc.) to trigger downstream biological signals.

The toxicity of Pfizer's small molecule GLP-1R has not been clearly supported by mechanistic data yet. In the past, small molecule GLP-1R has always been regarded as a "highly effective, low toxicity" optimal solution in the industry.

GLP-1R drugs currently on the global market are almost all large-molecule peptide drugs that require subcutaneous injection, which have limitations such as poor medication adherence, low production capacity, and high treatment costs. On the other hand, small molecule drugs, with their advantages of convenient oral administration, easy production, and low prices, can undoubtedly compensate for the disadvantages of peptide drugs. For this reason, small molecule GLP-1R drugs have become a target for early action by major pharmaceutical giants.

According to PatSnap Synapse, as of 24 Aug 2023, there are a total of 283 GLP-1R drugs worldwide, from 257 organizations, covering 68 indications, and conducting 2406 clinical trials.

Safety Concerns, Intensifying Competition in the GLP-1 Race

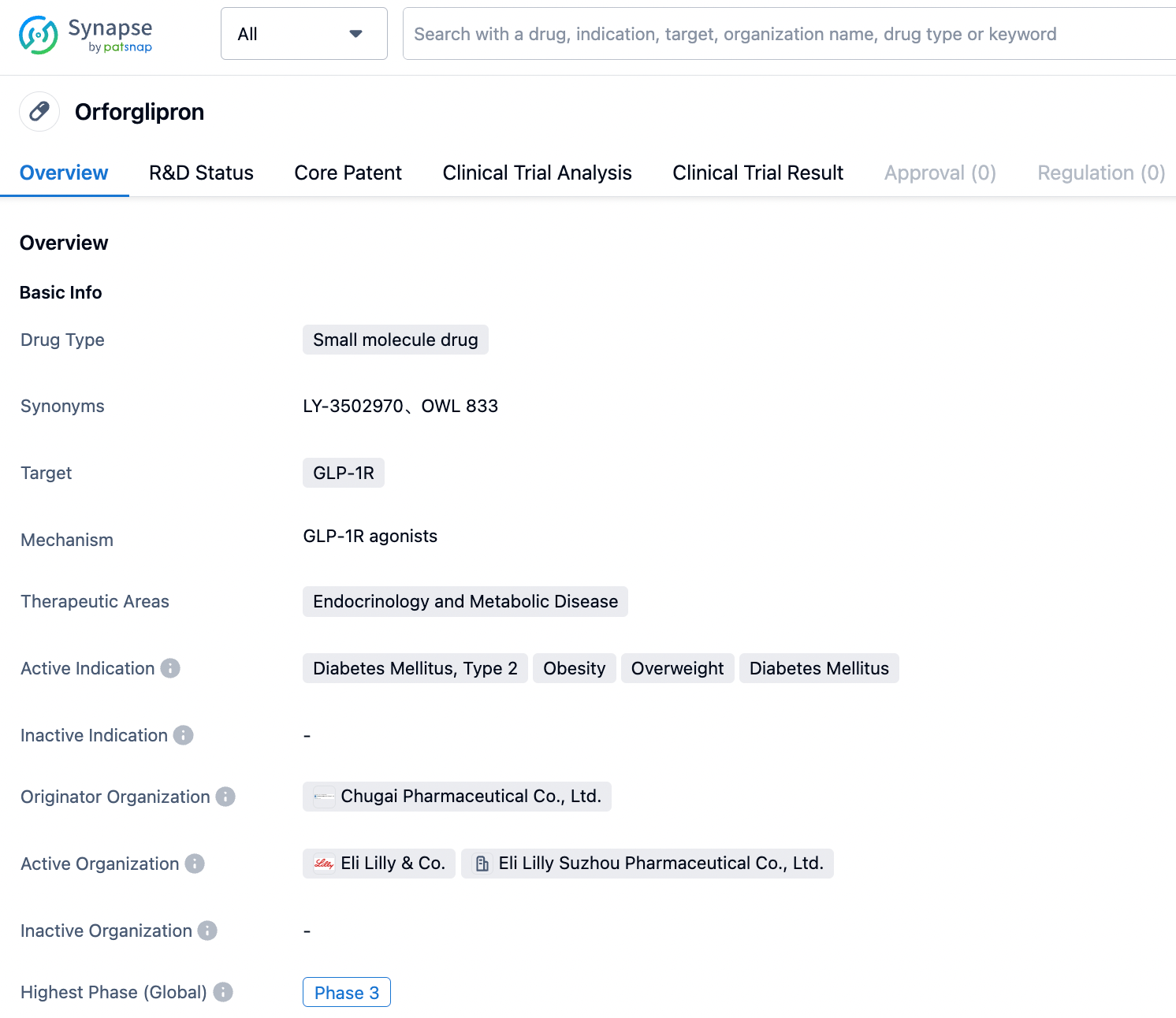

Currently, setting aside the orally administered semaglutide from the listed Novo Nordisk, the global leaders in the field of small molecule GLP-1R are primarily those from Eli Lilly and Pfizer. Vtv Therapeutics is also closely following clinical progress. In April 2023, Eli Lilly's GLP-1R oral agonist LY3502970 launched phase III, while Pfizer plans to wait for the results of phase II clinical trials of Lotiglipron and Danuglipron, and then choose the best one to advance to phase III.

It is reported that Lotiglipron (PF-07081532) is a molecule optimized based on Danuglipron, it has a longer half-life, and patients only need to take it orally once a day, while the latter needs to be taken orally twice a day.

In May 2023, Danuglipron was the first to announce impressive data: a phase II clinical trial involving 411 adult patients with type 2 diabetes revealed that all doses of Danuglipron significantly reduced patients' HbA1c and fasting blood sugar levels. Patients who took 120mg of Danuglipron lost about 10 pounds in 16 weeks.

In contrast, the phase III clinical results of semaglutide showed that adults who received a 1mg injection lost an average of about 9.9 pounds over 30 weeks. This could imply that Danuglipron's weight-loss effect is comparable to semaglutide, and its onset of action is faster.

However, it is important to note that although Danuglipron performed better than semaglutide in terms of weight loss; in terms of reducing blood sugar, there was not a single dose of Danuglipron that could match up to the high-dose group (14mg) of semaglutide tablets.

There are also safety concerns about Danuglipron, whether in diabetes or obesity indications, phase II data showed considerable safety risks. Under the high dose treatment of 80mg-200mg, 29% and 22% of patients respectively experienced vomiting and diarrhea in the phase 2a trial for diabetes. Since this dosage window is the only one that can compare with the effect of the Semaglutide tablet, the choice of treatment window will be tested. Meanwhile, in the obesity indication, 46% of people experienced vomiting after receiving 200mg of treatment.

In addition, among the three existing phase II clinical data, Danuglipron has a trend of increasing the patient's diastolic pressure and also a tendency to increase transaminase.

Eli Lilly's GLP-1R oral agonist LY3502970 is not without its concerns. In the phase I results published by Eli Lilly in October 2022, the most commonly reported adverse events during treatment with the LY3502970 group were nausea (47.1%), loss of appetite (45.1%), and vomiting (43.1%). However, these occurred in the early stages of treatment and diminished over time, with no related liver abnormalities or serious adverse events.

With such a crowded field, in addition to product efficacy and safety data, these companies will also face significant tests in commercialization. We wait to see who will become the next drug king in the GLP-1 race.