CMS spent more than $18B in four years on accelerated approvals with incomplete confirmatory trials, inspector general finds

29 Sep 2022

Accelerated Approval

The battle over whether and how to reform the FDA’s accelerated approval pathway is heating up again, just as the Senate punted any talks until the lame duck session just before the end of the year.

On Thursday, HHS’ inspector general released a new report reiterating concerns, also noted recently by the FDA’s Oncology Center of Excellence, about delayed or slowed confirmatory trials that are necessary to prove that the accelerated approvals were worth their salt in the first place.

The OIG estimates that Medicare and Medicaid spent more than $18 billion from 2018 to 2021 for 18 drugs (or 35 drug applications granted accelerated approval) with incomplete confirmatory trials that are past their original planned completion dates as of May 5.

Of the total 278 drug applications granted accelerated approval, OIG finds that 104 (37%) have incomplete confirmatory trials currently, and 34% of AAs with incomplete confirmatory trials (35 of 104) have at least one trial past its original planned completion date.

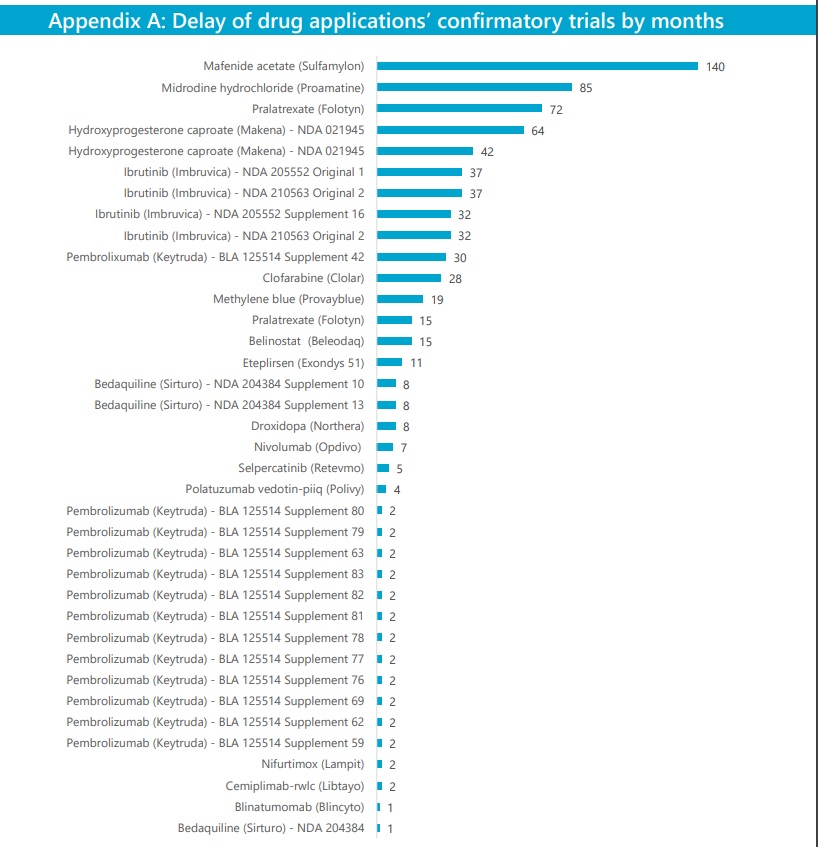

“Four drug applications granted accelerated approval each have confirmatory trials significantly past their original planned completion dates, overdue by at least 64 months or about 5 years. One trial for mafenide acetate ([Viatris’] Sulfamylon) is overdue by 140 months, or nearly 12 years. Trials for two other drug applications, midodrine hydrochloride ([Takeda’s] Proamatine) and pralatrexate ([Acrotech Biopharma’s] Folotyn), are 85 months and 72 months late, respectively,” the report notes.

Preview

Source: Endpts

In the case of Sulfamylon, FDA staff acknowledged to OIG that there’s a lack of trial milestones, which undermined their ability to hold the sponsor accountable. For Proamatine, which Medicare Part D spent about $142 million over four years, OIG noted that generic versions are already marketed, and in the time since its approval, the drug’s owner shifted between three different sponsors, slowing the pace of confirmatory trials.

And in Folotyn’s case, OIG says that changes in the standard of care for T cell lymphoma rendered the original confirmatory trial plan infeasible, but the FDA and Acrotech agreed to two new trials, the first of which finished in 2021 after a delay, and it submitted to the FDA its protocol for the second trial.

The report’s release comes as the FDA’s oncology adcomm recently evaluated one dangling accelerated approval, Oncopeptides’ Pepaxto, and one full approval, Secura Bio’s PI3K inhibitor Copiktra (duvelisib)PI3K inhibitor Copiktra (duvelisib), which won approval in September 2018 as a third-line treatment for relapsed or refractory CLL or SLL, but updated pivotal trial results raised safety questions.

The outside experts voted against keeping either drug on the market, although both sponsors have since made clear that they won’t pull their drugs without a fight. The FDA is also engaged in an ongoing fight that will culminate in another adcomm next month over Covis Pharma’s accelerated approval for the preterm birth drug Makena, which failed a confirmatory trial. Medicaid spent almost $700 million on Makena from 2018-2021, OIG said.

Makena's accelerated approval withdrawal hearing set for October as Covis wants to do more research

In the spring of 2021, the FDA also openly challenged six dangling accelerated approvals, three of which were later pulled by the companies. But perhaps the biggest moment for the accelerated pathway in recent memory came when the FDA pulled it out, seemingly out of nowhere and without mention of it at the adcomm, to sign off on Biogen’s controversial Alzheimer’s drug Aduhelm.

For more details,please visit the original website

The content of the article does not represent any opinions of Synapse and its affiliated companies. If there is any copyright infringement or error, please contact us, and we will deal with it within 24 hours.

Organizations

Indications

Targets

Hot reports

Get started for free today!

Accelerate Strategic R&D decision making with Synapse, PatSnap’s AI-powered Connected Innovation Intelligence Platform Built for Life Sciences Professionals.

Start your data trial now!

Synapse data is also accessible to external entities via APIs or data packages. Leverages most recent intelligence information, enabling fullest potential.